Country real estate attracts city dwellers and allows them to escape from the hustle and bustle. However, the landlord, the owner of the house and land, has to think about how to legally secure the integrity of the property and draw up a competent house rental agreement. , which first caught my eye, and taking it as a model and basis would be a rash decision. The document must specify absolutely all possible risks borne by the tenant and the landlord, as well as establish financial responsibility for the property, furniture and equipment located in the cottage and in the local area.

Owners should know: when a house is rented out by a legal entity, a lease agreement for the house and the land plot is drawn up. If the rental of residential real estate occurs between individuals, a rental agreement form is required.

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

DEPOSIT AGREEMENT

__________________ “____”______________20__

Mr(f)________________________________________________________________________________

passport: series ________ No.________________ issued________________________________

_________________________________ date of issue ___________________ code __________,

hereinafter referred to as the “Depositor”, on the one hand,

and Mr. _____________________________________________________________________ passport: series__________ No. ____________ issued by ________________________________ _________________________________ date of issue _________________________________, residing at the address: _______________________________________________________

_____________________________________________________________________________,

hereinafter referred to as the “Designee”, on the other hand, have entered into this

agreement on the following:

Subject of the agreement

1.1. The Depositor received from the Depositor an amount in the amount of _______________________ (__________________________________________________________)

rubles as a guarantee of fulfillment of his obligation to conclude a rental agreement for residential premises, the monthly rental fee for which is __________________

(___________________________________________). The residential premises are located at: __________________________________________________________

_____________________________________________________________________________.

1.2. The amount specified in clause 1.1 is transferred by the Depositor to the Depositee on account

payment due for renting a Residential Premises and is included in the rental price

Residential premises.

1.3. The Lender is obliged to make payment for the Rental of Residential Premises during the term of this Agreement.

1.4. In the event of the Depositor’s refusal, the amount contributed as a guarantee for the fulfillment of his obligations to conclude the agreement remains with the Depositor.

1.5. If the Depositee refuses to rent out the Residential Premises described in clause 1.1, he shall pay the amount specified in clause 1.1 as a guarantee of its fulfillment

obligations to conclude an agreement is returned to the Depositor in double amount.

Duration of the Agreement

2.1. This Agreement comes into force on the year "_____"_________________ and is valid until the year "____"____________________.

Additional terms

3.1. This Agreement is drawn up in two copies - one for each of the Parties.

3.2. __________________________________________________________________________

____________________________________________________________________________.

Signatures of the parties

Depositor _________________________ Depositor ______________________

Download the document “Agreement on deposit when concluding a residential lease agreement”

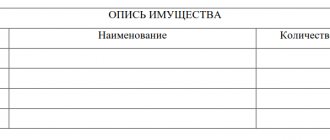

Who compiles the property inventory?

The initiator of the document can be either the owner of the property or the tenant. The paper must be drawn up by the owner in the presence of the tenant. This will help avoid possible misunderstandings in the future. The owner can also draw up the document himself. And then, when the tenant moves in, he checks the property listed in the document for its condition and availability.

The document is drawn up in 2 copies. One is for the owner, the second is for the tenant. If the transaction is made with the participation of a realtor, then a copy will be required for him. The inventory must contain signatures with a transcript of all participants in the transaction.

You can learn more about the inventory of property from the following video:

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Agreement on deposit when concluding a residential lease agreement”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Employment contract between individuals

Agreements regulating the provision by one individual of any services or performance of work to another are classified as civil contracts. However, as in the case of an employer who is a business entity, a customer who is an individual can enter into an employment contract with another individual.

It is worth saying that in practice, the conclusion of an employment contract between individuals is very rare, but the Labor Code contains a special chapter 48 that regulates the specifics of the labor of ordinary individuals.

An employment contract between individuals is concluded in writing, and it must contain such essential conditions as:

- Full name and passport details of the employer and employee;

- place and working conditions;

- start date of work and validity period of the employment contract (an individual employer does not require any grounds for concluding an employment contract for a certain period; such a requirement applies only to business entities);

- working hours, provision of days off and annual paid leave (which, although determined by agreement of the parties, must be no worse than the general provisions established by the Labor Code)

- description of the job function;

- terms of remuneration.

The individual employer is required to register such an employment contract with the local government administration. The fact of termination of the employment relationship in the event of termination of the employment contract must also be reported.

When concluding an employment contract between individuals, a work book is not created, and if the employee already has one, then entries are not made in it. The time spent working for an individual employer is confirmed only by an employment contract registered with the local authority. But even if the agreement was not registered, this does not make it invalid.

Documents found on the topic “apartment rental agreement with prepayment”

- Apartment rental agreement Residential rental agreement → Apartment rental agreement

apartment rental agreement in ………… .. “……………1993 we, gr. ……………………………….( full name ), referred to as… - Agreement rental apartments 2

Residential lease agreement → Apartment lease agreement 2apartment rental agreement "" 201 , hereinafter referred to as the lessor , on the one hand, and, on the other hand...

- Agreement rental parts of the living space (apartments)

Lease agreement for residential premises → Lease agreement for part of residential premises (apartment)lease agreement part of a residential premises ( apartment ) city "" 201g, hereinafter referred to as "ar...

- Agreement hiring (rental) apartments

Residential lease agreement → Apartment rental agreementapartment rental agreement "" 201, hereinafter referred to as the lessor, on the one hand, and, referred to on the further...

- Agreement rental apartments 1

Residential lease agreement → Apartment lease agreement 1apartment rental agreement "" 201 gr. (full name), hereinafter referred to as “lessor”,...

- Delivery certificate apartments to the tenant (To agreement rental residential premises)

Residential lease agreement → Certificate of delivery of an apartment to the tenant (to the residential lease agreement)act of renting out an apartment to a tenant, Moscow, June 10, 1992, we, the undersigned, the landlord , Valery Alekseevich Kuznetsov, and the tenant , Volchetsk...

- Agreement rental apartments with acceptance certificate

Residential rental agreement → Apartment rental agreement with acceptance certificateagreement for residential premises “” we, the undersigned: Mr./Ms., hereinafter referred to as “landlord...

- Agreement on deposit (daily rent apartments)

Agreement and agreement on deposit → Agreement on deposit (daily rent of an apartment)... 1. The landlord received from the tenant a deposit in an amount equivalent to guarantee his obligations to conclude daily rental agreement for residential premises, for a total amount of () rubles, located at the address: up to an hour. min. "" &...

- Agreement purchase and sale apartments. Transfer and Acceptance Certificate apartments

Real estate purchase and sale agreement → Apartment purchase and sale agreement. Apartment acceptance certificatecontract for the sale and purchase of an apartment "" 20, hereinafter referred to as "Party-1", on the one hand, and ...

- Sample. Application for installation, renaming, temporary renaming for a period rental apartments, rearranging the phone

Statements from citizens → Sample. Application for installation, renaming, temporary renaming for the duration of the apartment rental, telephone relocation...house) 4. right to an apartment (registration (registration), property without registration (registration), temporary registration, rent ) 5. request of the applicant (installation of a telephone, renaming, temporary renaming for the period of rent of the apartment , p...

- Sample. Agreement on the provision of a plot of land for use on the terms rental in Moscow (agreement rental land) (order of the Deputy Mayor of Moscow dated March 2, 1993 No. 110-rvm)

Lease agreement for land, land share, plot → Sample. Agreement on the provision of a plot of land for use on a lease basis in Moscow (land lease agreement) (Order of the Deputy Mayor of Moscow dated March 2, 1993 No. 110-rvm)appendix to the order of the vice-mayor of Moscow dated March 2, 1993 no. 110-rvm agreement on the provision of a plot of land for use on a lease ( lease agreement ) Moscow no. "" 20 year ruler...

- Claim for agreement repairs apartments

Statements of claim, complaints, petitions, claims → Claim under an apartment renovation agreement... the contractor and his address) from (indicate your last name, first name, patronymic and address) claim under the apartment renovation contract “” in 20, I entered into contract No. for the renovation of an apartment at the address: . the cost of repair work was...

- Agreement purchase and sale apartments

Real estate purchase and sale agreement → Apartment purchase and sale agreementcontract for the sale and purchase of an apartment in the city (village) "" 20 we, gr. (full full name), resident, and gr. (full full name), live...

- Agreement sublease apartments

Residential lease agreement → Apartment sublease agreementsublease agreement for apartment "" 201 we, the undersigned: passport series: No. issued...

- Return certificate apartments To agreement hiring

Residential lease agreement → Certificate of return of the apartment to the rental agreementact of returning the apartment to agreement No. dated ""20. ""20, hereinafter referred to as the lessor, on the one hand, and, we refer to...

Individual entrepreneur rents out an apartment/house: features of contractual relations

The existing legislative framework provides two opportunities for renting out housing:

- On behalf of an individual;

- On behalf of an individual entrepreneur (IP).

You can also transfer your housing to trust management, but we will leave this option out of the question for now. If you have many properties or you rent out an apartment by the day, then most likely the state will expect you to register in the form of an individual entrepreneur and conduct business activities.

In other cases, the landlord has a choice. How to make it? – Weigh the pros and cons.

| Individual entrepreneur | Individual |

| Pros: · 6% taxes instead of 13% is always nice · If you already have an IP, then you can “use it to benefit” | Pros: · No need to register anywhere · You can use all the benefits when selling an apartment (if you have owned it for more than 5 years) · One personal income tax return is submitted and tax is paid once (for the previous year) · You can use personal income tax benefits: for example, social deductions and property deductions - very useful if you recently bought a home and especially with a mortgage · No problems with receiving payment in cash or by card · If necessary, you can formalize the relationship in the form of “free use” - this is not prohibited for individuals · If you rent out an apartment to a company, it will pay the tax for you as a tax agent, and you do not need to file a declaration |

| Minuses: · The biggest disadvantage: you may lose tax benefits when selling an apartment if you rented it out on behalf of an individual entrepreneur, and the losses will be much greater than the gains from taxes. See here for more details. · Social payments will have to be paid even if there is no rental income · You cannot register for “free use” (free rent) - that’s why an entrepreneur is an entrepreneur, to earn income · Receiving payment in cash is not very convenient - you need to fill out additional documents · If you are not registered as an individual entrepreneur, you will have to register. This is not very difficult, but it will take 1-2 days “to do everything”, and the process will take up to 5 days · It is practically impossible to properly arrange a deposit for the last month · The volume of reporting and organizational tasks (such as reporting to Rosstat) is growing. You have already been exposed, so there may be checks, etc. · To receive payment by bank transfer, you may need to open an individual entrepreneur account in a bank, and these are the costs of banking services | Minuses: · 13% taxes instead of 6% is always unpleasant · If you already have an individual entrepreneur, then most likely you will have to submit two declarations - both for individual entrepreneurs and for personal income tax |

Important: personal income tax is paid for the previous year, but payments to individual entrepreneurs must be made throughout the year. So it won’t be possible to decide “in hindsight” who you were - an individual entrepreneur or just an individual. As you noticed, the main advantage of an individual entrepreneur is purely financial. For a more detailed analysis of the financial side of the matter, you can use the calculator developed by the “Correct Rent” project , which allows you to compare in detail the rent on behalf of an individual and an individual entrepreneur using the example of Moscow. For example, if you rent out an apartment for 15 thousand, then personal income tax will be more profitable than individual entrepreneurs.

So, if you decide to rent out an apartment as an individual entrepreneur and find a tenant, then you need to conclude an agreement. Where can I get the text? – There are many free versions of contracts on the Internet. Some of them are quite detailed, some are short and contain many “omissions”, and some are simply contrary to the law. However, examples of contracts on behalf of individual entrepreneurs are not easy to find.

It's good that there are two options.

Exit 1 – take the contract for an individual and slightly modify it. The main changes are:

- The type of contract does not change. If you rent to an individual, then this is hiring. If you rent to a legal entity, then this is a lease.

- Landlord/lessor details. For individual entrepreneurs, you must indicate the OGRNIP, INN, the date of registration of the individual entrepreneur, as well as bank details (if available);

- Accepting payments. It is carried out non-cash to an account or card or in cash, and is issued in accordance with the law (currently by check or using BSO);

- Taxes. It is necessary to indicate that the rental amount is indicated without VAT, and the lessor is not a VAT payer due to the fact that he uses the Simplified or Patent Taxation System (STS or PSN);

- Accordingly, the tenant-legal entity will not be a tax agent (for individual entrepreneurs); The individual entrepreneur pays taxes himself.

If you are not confident in your abilities, then Exit 2 is to use a contract template developed specifically for individual entrepreneurs. The “Correct Rent” project in the contract store offers contracts for individual entrepreneurs with comments , which allows you to use the contract as a basis and adapt it to your needs.

And finally, finally: if you took the exam as an individual and decided to take it as an individual entrepreneur, or, on the contrary, decided to “leave the individual entrepreneur,” then keep in mind:

- If within one year you have played two roles, you will have to submit two declarations - both personal income tax and simplified tax system (or pay for a patent for the simplified tax system).

- In any case, the contract will have to be concluded “again”, in a new capacity. It may be similar in content, but the features listed above must be taken into account.

Good luck in renting your home, and follow the real estate and rental news from the “Correct Rent” project.

Still have questions? – consult with a Portal lawyer

Are you renting or renting a home? We will help!

On our Portal you can:

- Absolutely free

- Buy rental and lease agreements for individual entrepreneurs for all occasions and additional items. agreements with comments from our lawyers in the agreements store (from 100 rubles)

- Is your case “more complex” and the standard contract template does not suit you? – our lawyer will draw up a lease agreement for you, tailored to all your needs.

- We can also register an individual entrepreneur for you, select the optimal form of taxation and take care of accounting issues. You can watch it here

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Agreement on a deposit when concluding a residential lease agreement” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!