- Filling out a loan agreement between individuals

- Features of concluding agreements of this type

- The procedure for signing a loan agreement between individuals

- Obligations of the borrower to repay the loan amount

- Consequences of violation by the borrower of the terms of the agreement

- Dispute Resolution

- Conditions for changing and early termination of the loan agreement

Civil legislation allows citizens to privately borrow money - Article 807 of the Civil Code of the Russian Federation. Such agreements are concluded only in writing in a simple form.

Therefore, you need to know how to properly process these loans in order to protect your interests. A loan agreement between individuals is directly provided for by civil legislation - Article 807 of the Civil Code of the Russian Federation. However, the private procedure for concluding loan agreements between individuals does not prevent the transfer of money at interest.

In what cases is an act drawn up?

An act can be drawn up in a variety of situations:

- when executing a donation agreement, a service agreement, a purchase and sale agreement, a lease, a loan, etc.

- when transferring money within the company - from one accountant (or cashier) to another, for example, when turning over a shift.

If the act serves as an annex to the agreement, its presence, and even, if desired, the main aspects of the content can be written down directly in the main document (subsequently, a properly completed and certified act will become the basis for giving the agreement the status of a valid one).

The deed serves as evidence of the transfer of money between the parties, so its importance cannot be underestimated.

You should be careful when drawing up the act, writing down all the details and not forgetting that at some point this form may acquire the status of a legally significant document (for example, if disagreements arise between the parties and one of them decides to go to court) .

Dispute Resolution

Often, a loan agreement between individuals provokes many disputes arising on its basis. To avoid the most acute conflicts, it is advisable for the parties to agree in advance on all possible nuances, interpretations and conditions for the implementation of certain instructions.

If a dispute does arise, it is desirable that it be resolved peacefully. Thus, in case of dissatisfaction, the parties can simply send each other claims and close controversial issues without court intervention.

The lender and borrower must think through every nuance of cooperation and include it in the interest-bearing loan agreement between individuals or its interest-free analogue. This especially applies to the timing of when a response to a submitted claim should be received. You also need to discuss the procedure under what circumstances to go to court if the conflict cannot be resolved peacefully. Disputes of this type are resolved in the Arbitration Court at the place of residence of the defendant.

What to pay attention to when drawing up an act

There is no single form of the act of acceptance and transfer of funds that is mandatory for use, so representatives of the parties can form it based on their own presentation in free form or, if the organization has its own sample document developed and properly approved, using its template. It is only important that the form in its composition meets certain standards of office work, and in content includes some unchanged data.

Like any other official document, the act can be divided into three parts: the header, the main section and the conclusion.

- The following is entered in the header:

- the name of the document and its meaning briefly indicated;

- place and date of its compilation;

- if the document is an annex to an agreement, you must provide a reference to the number and date of the agreement.

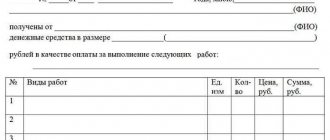

- After this comes the main part. You must enter here:

- subjects who draw up the act (names of organizations and full names of its representatives, full names of individual entrepreneurs or citizens of the Russian Federation and their passport details);

the amount that is transferred (necessarily in numbers and words);

- certify that the obligations are fulfilled in full and properly;

- indicate all other information that the parties consider necessary to include in this document (for example, about the form of transfer of money - bank transfer, online transfer, bills of exchange, “cash”, etc.).

- The final part of the act must contain the signatures of both parties (only “live” - the use of facsimile autographs, i.e. printed using various types of cliches is unacceptable), as well as seals, but only when their use is indicated in the local regulatory documents of the company .

If there are any attachments (checks, receipts and other documents), their originals or copies can also be attached to the act, noting their presence as a separate item.

How to correctly draw up a receipt for the transfer of money in debt?

In real life, there is hardly a person who would not be asked to borrow money. Despite the abundance of microfinance organizations and banks that issue loans based on just one or two documents, many seek to get money from their friends, who, perhaps, will not set high interest rates or provide flexible conditions for repaying the loan. Be that as it may, the transfer of funds is formalized either by a loan agreement or a promissory note. Legally, there is no difference between these documents. Both documents certify the transfer of funds from one person to another. Due to the fact that it is easier to draw up a promissory note than a loan agreement, we will analyze the main key points of its execution.

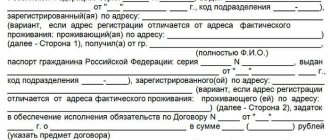

- It is better to entrust the writing of the receipt to the borrower himself. A handwritten receipt deprives the borrower of the opportunity to invalidate it, as is the case with a typewritten one. If the receipt was initially made on a computer and later the parties simply signed, then the debtor can declare in court that he did not sign the receipt and did not receive any money under this document. In this case, the lender has only one option - to conduct a handwriting examination. But here it is necessary to take into account that the result of the examination largely depends on the volume of material transferred for comparison.

- When issuing a receipt, you cannot limit yourself to only indicating your full name. sides The details of the lender and the borrower must be entered as in the passport, indicating the date of birth, series and number of the passport, the authority that issued the passport, department code and date of issue. It is mandatory to indicate the residential address of both the debtor and the creditor.

- The receipt should avoid wording such as “The Borrower receives (will receive) a loan in the amount of...” or “The Borrower is provided with funds in the amount of...”. These formulations are vague, as they do not reflect the specific fact of transfer of funds from one person to another. If the receipt is drawn up using such wording, the debtor may challenge the very fact of transfer of funds. This means that the creditor may lose the opportunity to collect the debt from such a debtor. To avoid this, we recommend using the following wording: “The funds have been received by the Borrower at the time of writing this receipt; the parties will not draw up an additional act of acceptance and transfer of money.”

- The receipt should indicate that the borrower was not acting under duress at the time the receipt was written. It is enough to indicate that the borrower does not act under the influence of deception, violence, threat or malicious agreement of the parties in order to deprive the debtor of the opportunity to invalidate the transaction under Art. 179 of the Civil Code of the Russian Federation."

- Particular attention should be paid to the terms of the agreement on the term and method of repayment of the loan amount, as well as interest for using the loan and interest for failure to repay the loan amount within the period specified in the receipt. It must be recognized that these conditions are not mandatory. The promissory note will be valid without them. However, the presence of these conditions greatly simplifies the collection of debt in court. Moreover, interest on the loan and penalties provided for in the receipt can significantly increase the amount recovered.

- There is also a risk that if the debt is forcibly collected, the borrower’s spouse will actively oppose the seizure of jointly acquired property and its subsequent sale at auction. To avoid this, the borrower’s spouse must make a handwritten entry in the promissory note indicating his awareness of the transfer of funds to the borrower for the needs of the family. Otherwise, the spouse may declare that the funds were spent by the borrower at his own discretion.

In conclusion, in order to improve the legal literacy of drawing up promissory notes, we consider it necessary to provide a sample of a correct promissory note:

Receipt

“__” _______ _____ city __________

I, (full full name), (date of birth), passport of a citizen of the Russian Federation (series, number, by whom and when issued, unit code), living at the address __________, hereby confirm that I have received funds in the amount of 500,000 ( five hundred thousand) rubles from (full full name) (date of birth), passport of a citizen of the Russian Federation (series, number, by whom and when issued, unit code), residing at the address ____________.

I undertake to return them on time before (date of repayment of the loan amount), personally transferring the funds to my full name. (lender). I also confirm that I am not acting under the influence of deception, violence, threat or malicious agreement of the parties, the essence of this receipt for the transfer of my full name. (borrower) funds on a reimbursable basis are clear.

Funds in the amount of 500,000 rubles were transferred by the time of writing this receipt, and an additional act of acceptance and transfer of money will not be drawn up.

For the use of the debt amount under this receipt, interest is accrued at a rate of 2% of the amount of 500,000 rubles per month.

I, (full full name), (date of birth) passport of a citizen of the Russian Federation (series, number, by whom and when issued, unit code), wife of a citizen (full full name of the borrower), hereby confirm that I know about the loan concluded between my husband and a citizen (full name of the lender), I agree with this transaction, since we need the loan amount to solve common family needs.

Signature of the borrower and his full name.

Signature of the borrower's spouse and her full name.

debt collection

Design nuances

Just like the text of the act, its design entirely depends on the vision of the document by the drafter. It can be done in handwritten form (like a receipt) or typed on a computer, on letterhead or on an ordinary blank sheet of paper.

The document is drawn up in at least two copies - one for each of the interested parties, but if necessary, certified copies can be made. If an act is formed between legal entities, information about it must be entered in the documentation journal.

Download the loan agreement between individuals

Before downloading a loan agreement, competent lawyers warn that all conditions of its execution (sections) and their compliance with the conditions must be checked:

- interest-free or interest-bearing loan (the moment of interest repayment is indicated: at the end of the term or they are included in payments during the term of the agreement);

- type of loan (targeted or non-targeted);

- method of receiving and returning funds (cash, bank transfer, other);

- time of receipt and return of funds (in parts, in a single amount, in tranches);

- liability of the parties, provision, return, grounds for termination (each condition is agreed upon by the parties or regulated by current legislation);

- use of the claims procedure for pre-trial settlement;

- places for consideration of claims (by law or by agreement of the parties).

Advice to Sravni.ru: Do not waste time drawing up a loan agreement with a notary or with witnesses. Prepare the required number of copies - according to the number of interested parties: this is enough for the official consideration of the document in controversial cases.

Features of drawing up an act

This document must necessarily contain the details of both parties (information from the organization’s registration papers or passport data of an individual) - without them, the document does not acquire legal status.

It is permissible to draw up an act not only personally, but also acting through a representative. However, in this case, it is important that the authorized person has a notarized power of attorney, a copy of which must be attached to the deed.

The act must necessarily satisfy the requirements of both parties. If any of them does not agree with any part of the act, it has the right to make its own adjustments, which must be approved by the counterparty.

Consequences of violation by the borrower of the terms of the agreement

You should not violate the terms of a loan repayment agreement between individuals, as this is fraught with various unpleasant consequences. If a person does not want to return the money within the prescribed time frame, additional interest is imposed on the debt, the amount of which is specified in the law (Clause 1 of Article 395 of the Civil Code of the Russian Federation). They will grow from the moment when the funds were supposed to arrive until the moment when the money does arrive.

Sometimes a money loan agreement between individuals provides for the condition of repaying the debt in installments. If a person fails to repay the next amount on time, the lender has every right to demand that the debtor return the entire remaining amount, including interest on the use of the loan that has accumulated during the period before its repayment.