Who pays land tax

Land tax is paid by land owners and those whose land is in permanent (perpetual) use or lifelong inheritance.

There is no need to pay tax in the following cases:

- the use of land is registered free of charge, for a certain period;

- the plot is rented under a contract;

- the plot is exempt from taxation (in accordance with clause 2 of article 389 of the Tax Code of the Russian Federation).

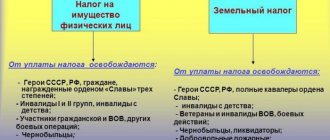

Benefits are provided for taxpayers:

- Federal. The list of organizations exempt from tax is given in Art. 395 Tax Code of the Russian Federation. Also, indigenous peoples do not pay the tax. And for the citizens listed in Art. 391 of the Tax Code of the Russian Federation, a reduction in the tax base is provided.

- Local. They are established by regulations of local governments and the laws of federal cities - Moscow, St. Petersburg and Sevastopol.

Thus, in the Trans-Baikal Territory, disabled people of groups 1 and 2, disabled people from childhood, veterans and disabled people of the Great Patriotic War, and persons affected by the disaster at the Chernobyl nuclear power plant are completely exempt from paying land tax.

In other regions, both individuals and legal entities may be exempt from tax. In addition, there is a decrease in the tax base.

In Moscow, a 30% discount is provided for sanatorium-resort organizations and healthcare institutions - according to the Moscow city law “On Land Tax” dated November 24, 2004 No. 74 (as amended on January 1, 2019). In Yekaterinburg, local authorities provide Heroes of the Soviet Union with a benefit in the amount of 100 thousand rubles. (decision of the Yekaterinburg City Duma dated November 22, 2005 No. 14/3).

Additional tax benefits for land

An additional benefit (deduction, reduced rate, exemption from payment) for land tax for pensioners in 2021, in addition to the federal one, can be provided by local authorities. Then the benefits are combined and provided together, but only within one specific municipality. How can a pensioner find out about this?

Methods for obtaining the necessary information are listed in the figure:

Both the geographical location of the land plot and the status of the pensioner can influence the amount of land tax, we will show with examples:

Example 1

Two retired friends - Stepanov P. A. and Trifonov A. G. (both veterans of the Great Patriotic War) - live several kilometers from each other. Their land plots are equal in area, but belong to different territories:

- P. A. Stepanov’s land plot is located on the territory of the Malopurginsky district of the Udmurt Republic;

- the land of A. G. Trifonov is located within the boundaries of the city of Agryz in the Republic of Tatarstan.

Although both plots are the same in area, pensioners pay land tax differently:

- Stepanov P.A. in 2021 pays land tax taking into account the federal benefit on a plot area of 9 acres (15 - 6). There are no additional local benefits for this category of pensioners.

- Trifonov A.G. does not pay tax on his land in 2021 - war veterans in this area are completely exempt from land tax.

Example 2

Let's change the conditions of the previous example. Let's say that the retired friends are not war veterans, but both have the status of honorary citizens in their municipal areas. In this case, the situation with the payment of land tax will change dramatically:

- Stepanov P.A. is exempt from payment - such a benefit is provided for honorary citizens of the Malopurginsky district;

- Trifonov P.A. will have to pay land tax - in his area there is no additional benefit for honorary citizens. Although he can take advantage of the federal benefit (in the form of a deduction for 600 sq. m.).

Examples show that nuances of local legislation can significantly adjust the tax obligations of pensioners. You just need to know about your rights to benefits and report this to the tax office in a timely manner. We'll tell you how to do this below.

A pensioner has the right to claim benefits for the previous 3 years. In this case, the Federal Tax Service will recalculate the tax amount for all 3 years.

Find out how to apply for a refund of overpayments for previous periods in ConsultantPlus. If you do not have access to the K+ system, sign up for a trial demo access for free.

Deadline for payment of land tax

Starting from 2021, it is not required to submit a land tax return (federal law dated April 15, 2019 No. 63-FZ). The tax payment deadline has become the same for everyone: it has been postponed to March 1 of the following reporting year (Federal Law No. 325-FZ dated September 29, 2019). That is, organizations must pay tax for 2021 no later than 03/01/2021.

Individuals and individual entrepreneurs equated to individuals are required to pay tax for 2021 by December 1, 2021 (Clause 1 of Article 397 of the Tax Code of the Russian Federation).

Also, during the tax period - a year - organizations can pay advance payments based on the results of the first, second and third quarters as ¼ of the annual tax amount (clause 6 of Article 396 of the Tax Code of the Russian Federation). Payment of advance payments is provided for by the laws of the municipality (clauses 2 and 3 of Article 397 of the Tax Code of the Russian Federation).

You can get acquainted with the deadlines in detail using the Federal Tax Service service. It is necessary to select the type of tax and the subject of the Russian Federation.

How can a pensioner apply for benefits in 2021?

To receive a land tax benefit, a pensioner must fill out an application once (KND form 1150063) and send it to the tax office (clause 10 of Article 396 of the Tax Code of the Russian Federation). This way he will inform the controllers that he retired in accordance with pension legislation and is entitled to land benefits. It is not necessary to attach documents confirming your right to benefits (pension certificate). Tax officials will request the necessary information from the relevant authorities.

If a pensioner has previously submitted an application for a benefit on another tax, for example transport, then there is no need to do this again. The Federal Tax Service already has information about the beneficiary, so the benefit will be provided based on the available data.

If a pensioner has several land plots, he has the right to choose which of them he wants to receive a deduction for. In clause 6.1 of Art. 391 of the Tax Code of the Russian Federation provides for a notification procedure by which a pensioner informs the tax authorities of his desire to take advantage of a deduction for a specific area:

- you need to fill out a notification (KND form 1150038) and

- send it to the tax authorities before December 31 of the year, which is the tax period from which the deduction is applied to the land plot.

If the pensioner has not yet decided which of his existing plots he wishes to receive a deduction for, controllers will provide a deduction for land with the maximum tax amount.

If a pensioner has only one plot of land or it does not matter to him which plot the deduction will be applied to, he is not required to notify the tax authorities (letter of the Federal Tax Service of Russia dated January 17, 2018 No. BS-4-21 / [email protected] ).

How land tax is calculated if the land has been owned for less than a year and its cadastral value has changed, find out from this material .

Land tax rates

Tax rates have not changed in 2021:

- 0.3% for agricultural lands, plots of personal subsidiary plots, summer cottages; lands for the needs of the state, housing stock and infrastructure; areas used for national defense, security and customs;

- 1.5% for other lands.

Subjects have the right to set their own rates, but not higher than those accepted at the federal level.

The table below shows examples of rates in Moscow and Yekaterinburg.

Do I need to apply for benefits?

To receive a benefit, you can contact any tax office. You can submit an application through the taxpayer’s personal account, at the MFC, by letter, or by coming to the tax office in person.

Some categories of citizens receive benefits without application. For example, pensioners, pre-retirees, disabled people, combat veterans, large families and owners of outbuildings with an area of up to 50 square meters. m may not contact the tax authorities on this issue: their benefits are taken into account automatically based on the data that tax authorities receive from the Pension Fund of Russia, Rosreestr, social protection authorities and other departments.

If you belong to preferential categories of citizens, but the benefit was not taken into account for you, you must independently declare it by contacting the Federal Tax Service.

Calculation of land tax

To calculate land tax, the formula is used:

Land tax = Tax base × Tax rate

The tax base is the cadastral value of the land plot as of 01/01/2020. This information is provided by Rosreestr upon request in person or on the official website of the department. For more information about the tax base, see Art. 391 Tax Code of the Russian Federation.

When a land plot has several owners and a purchase or sale of land was made in the reporting year, the formula will look like this:

Land tax = Kst × St × D × Kv,

Where:

Kst - cadastral value;

St - tax rate;

D - share in land ownership;

Kv - coefficient of land ownership in months.

Let's look at an example of calculating land tax:

Ivanov I.A. purchased a plot of land for gardening in the Moscow region on 04/09/2020. The property was registered in the name of I. A. Ivanov, his wife and two children in equal shares. The cadastral value of the plot is RUB 2,354,500.

The tax rate is 0.3%.

Land tax for I. A. Ivanov is equal to:

2,354,500 × 0.3% × 0.25 × 0.75=RUB 1,324.41,

where 0.25 is ¼ share in the property, 0.75 is the ownership coefficient (9 months / 12 months).

When calculating the number of months of ownership, the following feature is taken into account:

- if the plot was purchased before the 15th day of the current month inclusive, then this month is included in the calculation. If the property is registered after the 15th, the month is not taken into account;

- If the land is sold by the owner before the 15th day, then the month of sale is not taken into account for tax purposes. If after the 15th day, it is taken into account (clause 7 of Article 396 of the Tax Code of the Russian Federation).

Results

Upon retirement, citizens have the opportunity to reduce their land tax obligations.

They need to inform the tax authority about their right to the benefit once by submitting an application. Thanks to the federal incentive, pensioners are not required to pay tax for plots of 6 acres or less. If the land plot exceeds this limit, tax is paid on the remaining area. Municipal authorities have the right to establish additional tax preferences for land by their regulations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which budget receives land tax from organizations?

Land tax must be paid at the location of the land plot. Therefore, a very significant requisite is OKTMO - a code according to which the territorial affiliation of the land can be determined. Read about other important details that characterize land tax in this material.

The task of paying land tax is assigned not only to legal entities, but also to individuals, which means that all landowners need to understand the mechanism for calculating the tax. Land Tax section will help you understand all the tax intricacies .

Federal taxes and fees

Mandatory for payment throughout the country, fully described by the Tax Code of the Russian Federation. It doesn’t matter where the taxpayer is located, the rules are the same everywhere. Most federal taxes go directly to the federal budget, with crumbs from some going to the regions. Some federal taxes are paid by everyone (for example, VAT). Others - only to those engaged in certain types of activities (for example, mineral extraction tax). Federal taxes include:

- value added tax (VAT);

- excise taxes;

- personal income tax (NDFL);

- corporate income tax;

- fees for the use of objects of the animal world and for the use of objects of aquatic biological resources;

- water tax;

- National tax;

- tax on additional income from the production of hydrocarbons;

- Mineral extraction tax (MET).

What happens if you don't pay taxes on time?

If you are late in paying taxes, then, in addition to the tax itself, you will also have to pay a penalty - for each calendar day of delay at an interest rate equal to 1/300 of the current key rate of the Central Bank of Russia. Penalties will begin to accrue the next day, December 2.

If the total debt exceeds 10,000 rubles, the Federal Tax Service will collect the debt through the court. In this case, the debtor will have to pay all legal costs. Also, if there is a tax debt, an individual may face a ban on traveling abroad and seizure of bank accounts.

Legislation

Due to the fact that land tax is classified as local, its legislative regulation is carried out at two levels - federal and regional. Therefore, the main regulatory legal acts in force in this area will be:

- Tax Code of the Russian Federation. Chapter 31 of the Tax Code of the Russian Federation provides the basic rules and requirements regarding the calculation of land tax, its payment or the provision of certain benefits for it. When developing local legislative acts, the provisions of the Tax Code of the Russian Federation must be taken into account.

- “Law on Land Tax” of the locality where the site is located (hereinafter referred to as the Law). This document is already local and already establishes specific interest rates and possible benefits for payers.

As for the Moscow region, each individual administrative location has its own local law, the provisions and requirements of which may differ slightly. Therefore, the benefits provided to payers, as well as the conditions for receiving them, may also be different.

Types of benefits

The benefits used in the Moscow Region can be divided into the following groups:

- Reducing the tax base by a certain amount. Since the cost of land plots in the Moscow Region is often quite high, the size of the discount in this case is also quite large. Compared to the federal value (10 thousand rubles), this figure can be many times higher.

- Decrease in interest rate. The maximum rates limits (0.3 and 1.5%, depending on the type of site) are established in the Tax Code of the Russian Federation, however, local authorities can slightly reduce these indicators. Accordingly, the total amount payable will also be less.

- Full or partial cancellation of tax payment. For example, local law may provide a tax discount of 50 or 100%.

In each of these cases, the reduction in the final amount of tax payable is quite significant. This is especially true for situations where the cadastral value of the site is very high.