Legal basis of land tax

Land tax is a local tax payable in the respective regions.

The main provisions of land tax are determined by Ch. 31 Tax Code of the Russian Federation. At the same time, regions adopt their own laws in relation to it, by which they have the right to independently regulate a number of issues:

- establish and differentiate tax rates, provided that they do not exceed those given in the Tax Code of the Russian Federation;

- determine the procedure and deadlines for paying taxes by organizations, taking into account the restrictions existing in the Tax Code of the Russian Federation;

- introduce additional (in comparison with the Tax Code of the Russian Federation) tax benefits.

What other taxes need to be paid to the local budget, read the material “Federal, regional and local taxes in 2017.”

Who pays land tax?

The definition of land tax payers is very simple. According to paragraph 1 of Art. 388 of the Tax Code of the Russian Federation, payers of land tax are legal entities and individuals who have land recognized as an object of taxation and one of the following rights to this land:

- property, including joint or shared property;

- use without expiration date;

- lifelong ownership under inheritance conditions.

Persons who have the right to free use, as well as those using land under a lease agreement, are not required to pay land tax (clause 2 of Article 388 of the Tax Code of the Russian Federation).

If there is joint or shared ownership of a land plot, each owner pays tax according to his share (clause 2 of Article 391 and Article 392 of the Tax Code of the Russian Federation):

- in case of joint ownership, these shares are equal;

- in the case of shared ownership, they are proportional to the share of ownership of the land.

The definition of objects of taxation is given in Art. 389 Tax Code of the Russian Federation. This is all the land available in the regions that have adopted the land tax law, with the exception of:

- land withdrawn from circulation or limited in circulation;

- forest areas intended for logging;

- cultural heritage lands;

- land plots of the water fund that are state-owned;

- land under apartment buildings.

If a plot falls on the territory of several regions, then land tax payers pay it in each of these regions in accordance with local laws. At the same time, the tax base for each region is determined in proportion to the share of the area of the land plot located in this region (clause 1 of Article 391 of the Tax Code of the Russian Federation).

Cancellation of tax returns for transport and land taxes

Starting from 2021, the obligation for organizations to submit tax returns for transport and land taxes has been canceled (Clause 9, Article 3 of Federal Law No. 63-FZ of April 15, 2019). Thus, organizations no longer submit tax returns for the period 2021 and subsequent tax periods.

Tax authorities will continue to accept tax returns in the following cases (letter of the Federal Tax Service dated October 31, 2019 No. BS-4-21/ [email protected] ):

- when submitting updated tax returns for tax periods prior to 2021;

- when submitting updated tax returns, if the original tax returns were submitted during 2021 in case of reorganization of the organization.

In addition, tax returns for transport and land taxes must be filed in cases where an organization wants to claim tax benefits for tax periods before 2021, as well as for the period during 2021 in case of termination of the organization through liquidation or reorganization (clause 3 Article 55 of the Tax Code of the Russian Federation).

If an organization declares tax benefits for the periods preceding 2020 by submitting an application, the Federal Tax Service will simply not accept it, and the taxpayer will be asked to submit the appropriate tax return (letter of the Federal Tax Service dated September 12, 2019 No. BS-4-21 / [email protected] ).

In all of the above cases, organizations must submit tax returns for transport tax in the form approved. by order of the Federal Tax Service dated December 5, 2016 No. ММВ-7-21/ [email protected] , and for land tax - in the form approved. by order of the Federal Tax Service dated May 10, 2017 No. ММВ-7-21/ [email protected]

When taxpayers' rights to benefits are recognized

The list of benefits for land tax is established by Art. 395 Tax Code of the Russian Federation. The main conditions for their use are:

- provision of a site for certain purposes and its use for these purposes;

- documentary evidence of entitlement to benefits.

Organizations that are payers of land tax are exempt from paying tax on plots intended for the purpose of locating:

- institutions of the penal system;

- public roads;

- religious buildings;

- public organizations of disabled people;

- folk arts and crafts;

- special and free economic zones;

- innovative.

There are additional restrictions for public organizations of people with disabilities and organizations with their participation. Benefits apply to them if:

- in all-Russian public organizations the number of disabled people exceeds 80%;

- in organizations with authorized capital formed by contributions from all-Russian organizations of disabled people, the number of disabled workers is more than 50%, and the share of their salaries in the wage fund exceeds 25%, while the site is used for the production and sale of goods, work, services, but not for excisable or subject to mineral extraction tax goods, not for brokerage or other intermediary services;

- institutions, the property of which is fully owned by all-Russian public organizations of disabled people, are engaged in activities aimed at providing assistance to disabled people, their social protection and rehabilitation.

The terms of tax exemption for special and free economic zones are limited:

- 10 years from the date of registration as a resident - for shipbuilding organizations of a special zone;

- 5 years from the month of the emergence of the right to a land plot - for other residents of the special zone;

- 3 years from the month of the emergence of the right to a land plot - for participants in the free economic zone.

There is only one benefit for individuals. It can be used by the indigenous peoples of the Russian Federation who continue to lead a traditional way of life for them.

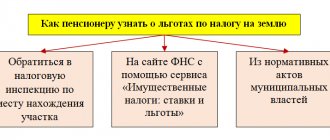

Regional laws may establish additional tax benefits for both organizations and individuals.

about the nuances of paying land tax for summer cottages here.

Introduced the need to submit applications for land and transport tax benefits

Declarations on transport and land were cancelled. Instead, companies were offered the option of submitting applications to receive benefits on these taxes (clause 3 of Article 361.1 of the Tax Code of the Russian Federation, clause 10 of Article 396 of the Tax Code of the Russian Federation). It turns out that in order to take advantage of the benefit, the taxpayer needs to submit a corresponding application to the Federal Tax Service. Its form is regulated by Order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected]

This application requires indicating the objects of taxation - specific plots of land and vehicles. In addition, it is necessary to indicate the benefits that are due, indicating the details of regulatory legal acts and information about documents that prove the right to benefits.

One application is drawn up for different objects (land and transport). In addition, the application may simultaneously indicate different checkpoints assigned at the location of the objects. The Federal Tax Service indicated this in Letter dated 02/03/2020 No. BS-4-21/ [email protected]

Taxpayers have the right to submit an application for benefits along with supporting documentation to any tax office. Documents can be submitted in person, through TKS, by mail or through the MFC. In addition, the law does not establish any time limits for submitting a package of documents. Thus, a taxpayer can apply for a deduction in any way convenient for him and at any time.

If the taxpayer does not submit an application, he is not deprived of the right to receive benefits. If the Federal Tax Service Inspectorate has information about the benefits that a taxpayer is entitled to, it calculates taxes on land and transport for 2021 taking into account these benefits.

However, if the taxpayer does not independently declare the receipt of the benefit, there is a possibility that the Federal Tax Service, even if the information is available, will not provide him with the benefit. The subject will then receive a notice of overpayment of tax. In this regard, tax authorities informed business entities in January 2021 that they would need to apply for tax breaks on transport and land during the 1st quarter of 2021.

Conditions for reducing the tax base for individuals

Some categories of individuals - land tax taxpayers are entitled to another benefit. It represents a direct reduction in the tax base by an amount that is not taxed. In this case, the tax (if the amount of the reduction is equal to it or exceeds it) may be reduced to zero (clause 7 of Article 391 of the Tax Code of the Russian Federation). According to the Tax Code of the Russian Federation, the amount of reduction is 10 thousand rubles. (Clause 5 of Article 391 of the Tax Code of the Russian Federation). However, regions can change both the amount of this amount and the list of taxpayers entitled to such a benefit (clause 2 of Article 387 of the Tax Code of the Russian Federation).

According to paragraph 5 of Art. 391 of the Tax Code of the Russian Federation, this benefit is applicable if the payer of land tax is:

- Hero of the USSR, Russian Federation or full holder of the Order of Glory;

- disabled person of the 1st or 2nd group, disabled since childhood;

- a veteran or disabled person of WWII or military operations;

- a person exposed to radiation as a result of accidents at civil and military facilities in the Russian Federation or during nuclear tests.

The right to such a benefit must be documented. The procedure and deadlines for submitting documents are established by regional laws. In this case, the confirmation period cannot be later than February 1 of the year following the settlement year (clause 6 of Article 391 of the Tax Code of the Russian Federation).

For information on how land tax is calculated for individual entrepreneurs, read the article “Land tax for individual entrepreneurs since 2015.”

What is the tax base

The tax base characterizes the item subject to taxation in terms of quantity, value, physical properties or other characteristics. In other words, the tax base defines the units in which the object of taxation can be “measured.” the object of taxation is .

The item on which the tax is levied is called its object. It can be represented by various assets and financial amounts, for example:

- income, receipts, profit;

- cost of goods sold;

- payment received for services rendered or work performed;

- total income of an individual;

- own property owned by organizations and citizens;

- hereditary mass;

- vehicles, etc.

NOTE! Most often, the name of the tax reflects precisely its object: “income tax”, “land tax”, etc.

So, we conclude: the item on which tax must be paid is considered an object of taxation, and the tax base is its significant characteristic.

Results

Payers of land tax are individuals and legal entities using land plots on the basis of ownership, the right of perpetual use or the right of inheritance of land. Tax legislation establishes a number of persons who have preferential conditions when calculating tax. At the same time, the laws of the constituent entities may expand the list of beneficiaries.

To understand all the nuances of calculating land tax, read our “Land Tax” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax Code of the Russian Federation, Article 396 of the Tax Code of the Russian Federation

1. The amount of tax is calculated at the end of the tax period as a percentage share of the tax base corresponding to the tax rate, unless otherwise provided by paragraphs 15 and 16 of this article.

2. Taxpaying organizations calculate the amount of tax (the amount of advance tax payments) independently.

The paragraph became invalid on January 1, 2015. — Federal Law of November 4, 2014 N 347-FZ.

3. The amount of tax payable to the budget by individual taxpayers is calculated by the tax authorities.

4. Lost force on January 1, 2011. — Federal Law of July 27, 2010 N 229-FZ.

5. The amount of tax payable to the budget at the end of the tax period is determined by taxpayer organizations as the difference between the amount of tax calculated in accordance with paragraph 1 of this article and the amounts of advance tax payments payable during the tax period.

6. Taxpayers for whom the reporting period is defined as a quarter shall calculate the amounts of advance tax payments at the end of the first, second and third quarters of the current tax period as one-fourth of the corresponding tax rate of the percentage of the cadastral value of the land plot as of January 1 of the year being tax period.

7. In the event that a taxpayer acquires (terminates) during the tax (reporting) period the right of ownership (permanent (perpetual) use, lifelong inheritable possession) to a land plot (its share), the calculation of the amount of tax (amount of advance tax payment) in relation to this of a land plot is carried out taking into account a coefficient defined as the ratio of the number of full months during which this land plot was in the ownership (permanent (perpetual) use, lifelong inheritable possession) of the taxpayer to the number of calendar months in the tax (reporting) period.

If the emergence of the right of ownership (permanent (perpetual) use, lifelong inheritable possession) to a land plot (its share) occurred before the 15th day of the corresponding month inclusive, or the termination of the specified right occurred after the 15th day of the corresponding month, the month of occurrence is taken as the full month (termination) of this right.

If the emergence of the right of ownership (permanent (perpetual) use, lifelong inheritable possession) to a land plot (its share) occurred after the 15th day of the corresponding month or the termination of the specified right occurred before the 15th day of the corresponding month inclusive, the month of occurrence (termination) of the specified rights are not taken into account when determining the coefficient specified in this paragraph.

8. In relation to a land plot (its share) inherited by an individual, the tax is calculated starting from the month of opening of the inheritance.

9. When establishing a tax, the representative body of a municipal formation (legislative (representative) government bodies of federal cities of Moscow, St. Petersburg and Sevastopol has the right to provide for certain categories of taxpayers the right not to calculate or pay advance tax payments during the tax period.

10. Taxpayers - individuals entitled to tax benefits, submit an application for benefits and documents confirming the taxpayer’s right to a tax benefit to the tax authority of their choice.

In the event of the emergence (termination) of taxpayers' right to a tax benefit during the tax (reporting) period, the calculation of the amount of tax (the amount of the advance tax payment) in relation to the land plot for which the right to a tax benefit is granted is carried out taking into account a coefficient defined as the ratio the number of full months during which there is no tax benefit to the number of calendar months in the tax (reporting) period. In this case, the month in which the right to a tax benefit arises, as well as the month in which this right is terminated, is taken to be a full month.

11 - 13. Lost power. — Federal Law of July 23, 2013 N 248-FZ.

14. Based on the results of the state cadastral valuation of land, information on the cadastral value of land plots is provided to taxpayers in the manner determined by the federal executive body authorized by the Government of the Russian Federation.

15. In relation to land plots acquired (provided) for ownership by individuals and legal entities on the terms of housing construction on them, with the exception of individual housing construction carried out by individuals, the calculation of the amount of tax (amount of advance tax payments) is carried out taking into account coefficient 2 during the three-year construction period, starting from the date of state registration of rights to these land plots until the state registration of rights to the constructed property. In the event of completion of such housing construction and state registration of rights to the constructed property before the expiration of the three-year construction period, the amount of tax paid for this period in excess of the amount of tax calculated taking into account coefficient 1 is recognized as the amount of overpaid tax and is subject to offset (refund) to the taxpayer in the generally established ok.

In relation to land plots acquired (provided) into ownership by individuals and legal entities on the terms of housing construction on them, with the exception of individual housing construction carried out by individuals, the calculation of the amount of tax (amount of advance tax payments) is carried out taking into account the coefficient 4 within a period exceeding the three-year construction period, up to the date of state registration of rights to the constructed property.

16. In relation to land plots acquired (provided) into ownership by individuals for individual housing construction, the calculation of the amount of tax (the amount of advance tax payments) is made taking into account coefficient 2 after 10 years from the date of state registration of rights to these land plots up to state registration of rights to a constructed property.