Home / Real estate / Land / Taxes / Benefits

Back

Published: 04/01/2017

Reading time: 10 min

0

704

Disabled people are one of the most common categories of land tax payers, who are entitled to significant benefits in this area.

The features and conditions of their application are fixed at both the federal and regional levels, so specific requirements for people with disabilities can be very different.

It is worth considering in detail exactly what characteristics the payer must meet to receive the benefit, as well as what he needs to do for this.

- Legislation

- Preferential categories of disabled people

- Types of benefits

- Receipt procedure Writing an application

- Preparation of necessary documents

- Submitting an application and documents to the Federal Tax Service

- Waiting for a decision from the inspectorate

- Exercise of the right to benefit

Tax benefits for parents of disabled children under personal income tax (NDFL)

A tax deduction for personal income tax is issued by the employer, and when combining two specialties, the deduction will be provided only by one of the employers.

In relation to the payment of personal income tax on wages and other regular payments, only federal benefits - tax deductions - apply. The amount of the tax deduction will depend on the order in which children appear in the family and on the degree of relationship between the child and the parent:

- Tax deductions for the first child in a family are provided in the amount of 1.4 thousand rubles to biological parents, guardians, trustees, and adoptive parents.

- The tax deduction for the 2nd child for the same categories of recipients is 1.4 thousand rubles .

- The tax deduction for the 3rd child, regardless of the category of recipients, will be 3 thousand rubles .

- The tax deduction for a disabled minor child, for a disabled person studying full-time at a university (up to 24 years old), a graduate student, a resident, an intern, a student under 24 years old with a 1st or 2nd disability group is equal to:

- 12 thousand rubles for parents and adoptive parents;

- 6 thousand rubles for the child’s legal representatives.

Receipt procedure

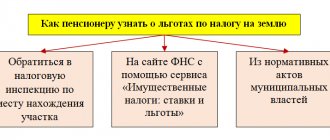

Before applying for a benefit, it is necessary to clarify whether the payer really has the right to receive it and in what exact amount it is provided. This information can be provided:

- employees of the local administration of the locality where the disabled person lives;

- employees of the Federal Tax Service Inspectorate office, to which the payer’s site is assigned in accordance with the territorial location.

After this, the algorithm for applying for benefits will be as follows:

Writing an application

It does not have a set form, but must be drawn up in accordance with basic requirements:

- the header indicates the details of the subject to whom the appeal is made (that is, the head of a specific Federal Tax Service and the full name of this body), as well as the payer’s data (his full name, contacts, etc.);

- the main part contains a request to provide a specific benefit, and also provides a reference to its legislative basis;

- The following is a list of all documents that are attached to the application;

- at the end there is the date, full name and signature of the subject on whose behalf the document is being drawn up.

Preparation of necessary documents

The availability of supporting documents is a mandatory requirement when applying for benefits, so the applicant will need to prepare:

- a copy of your passport or other identity document (must be certified or together with the original);

- cadastral document for the plot (extract from the Unified State Register or cadastral passport), which contains data on its value, exact area and some other necessary characteristics;

- title papers for land (certificate of ownership and a copy of the agreement or other document on the basis of which it was obtained);

- a certificate based on the results of the ITU on the establishment of a specific disability group in relation to the applicant;

- power of attorney (if the applicant’s interests are represented by his official authorized representative).

Depending on the specific situation, other additional papers may be required when applying. Their exact list should be clarified in advance with the tax authorities responsible for land tax.

Submitting an application and documents to the Federal Tax Service

The application is made to the department of the tax office in relation to which the disabled person has an obligation to pay tax (in accordance with his territorial location).

Waiting for a decision from the inspectorate

Typically, the processing time for submitted papers is up to 30 working days. After this, the applicant will receive a response (usually in writing) with a justified refusal to provide benefits or approval of the submitted application.

Tax benefits for parents of disabled children on transport tax

Passenger cars that are equipped to transport disabled people, and passenger cars with a power of less than 100 hp, purchased with the help of USZN, are not subject to transport tax in any region of Russia.

The tax rate and transport tax benefits are approved at the level of the constituent entity of the Russian Federation, and therefore everything depends on where the family of a disabled child lives. For example, in Moscow this tax is not paid (provided that the vehicle power does not exceed 200 hp):

- disabled people of groups 1 and 2 (one car);

- guardian of an incapacitated child who is a disabled child (one car);

- parent, adoptive parent, guardian, trustee of a child with a disability (for one car).

Legislation

Legislative regulation of land tax for disabled people is carried out at two levels:

- Federal. The main document in this case is the Tax Code of the Russian Federation, namely its Chapter 31. Among the preferential categories noted in Art. 395 of the Tax Code of the Russian Federation, disabled people are not listed, however, some benefits can be provided to them in accordance with Part 5 of Art. 391 Tax Code of the Russian Federation.

- Regional. Land tax as a local type of collection can be regulated by regional legislative acts, therefore, the specific conditions for its calculation and payment can be determined precisely by the laws of local authorities. Each subject of the Russian Federation annually fixes specific rates of this tax depending on the category of payer, and also establishes a list of beneficiaries additional to the Tax Code of the Russian Federation.

When determining specific benefits for people with disabilities, both of these levels are of great importance, since at each of them the types of assistance may be different. However, people with disabilities often must meet certain additional conditions to receive regional support.

Conditions for obtaining tax benefits for parents of a disabled child

Tax benefits are provided under the following conditions:

- the benefit will be issued only to one of the parents of a disabled child;

- tax deductions will be valid monthly until the child reaches the age of majority (or 24 years old if the child is a full-time student);

- the parent is provided with a tax deduction in the amount of 3 thousand rubles;

- if a disabled person is raised by a single parent, he has the right to receive a double tax deduction (until the parent remarries);

- the parent will also be entitled to a reduction in total earnings before taxation by 3 times the minimum wage.

Non-property tax deductions

In addition to the fact that children with disabilities have the benefits discussed earlier, they can also apply discounts and benefits on the income they receive in the form of additional payments.

The monthly standard deduction is 500 rubles. This benefit applies exclusively to people in groups 1 and 2. As before, tax deductions are not provided for disabled people of group 3.

Also, disabled people of the 1st and 2nd disability groups are exempt from paying any type of state duty.

List of documents for registration of tax benefits

To apply for tax benefits, a family raising a disabled child will need to prepare the following documents:

| Document | Where to get it |

| Parent's Russian passport | GUVM MIA |

| Pension certificate of a disabled child | Pension Fund |

| Child's birth certificate | Civil registry offices |

| Certificate of marriage or divorce | Civil registry offices |

| Conclusion of medical and social examination | ITU Bureau |

| Certificate of family composition | Passport Office |

| Court decision to transfer a child to a foster family (for adoptive parents, guardians, trustees) | Court Clerk |

| Certificate stating that the second father did not apply for similar preferences in relation to this child | At the place of work |

General provisions

Disabled children require special care.

In particular, the disease does not allow the child to care for himself, receive an education and take part in social activities. It is noteworthy, but the disability status must be documented: without a medical report, the child is not considered disabled, even if there are visible injuries and health problems. The decision to assign a child a disability is made by a medical and social expert commission (MSEC). It is this conclusion that gives the child and parents the right to receive benefits provided by the state.

Who are disabled children

It is immediately necessary to clarify that the status of a disabled child is assigned only to citizens under 18 years of age.

Disability is recognized as:

- significant health problems accompanied by disorders of body functions;

- loss (full or partial) of the ability to self-care, movement, orientation in space, communication with others;

- the need for constant care, rehabilitation and habilitation.

Important! To be assigned a disability, all of the above points must be met. For example, if a child has a congenital disease that does not prevent him from leading a full life, disability is not assigned.

Disabled children

This category has been formally abolished.

Until 2014, if a child was assigned a disability, then upon reaching adulthood, he automatically acquired the status of “Disabled Childhood”. This procedure has been revised. Now that a disabled child is 18 years old, he is sent to undergo a medical and social commission. Based on the examination, he is assigned a certain disability group, while the very fact that the person is disabled from childhood is not taken into account and is not mentioned in the conclusion.

We would like to add that those who previously received the status of a disabled child continue to enjoy the benefits provided by law in full.

Common mistakes

Error: A guardian of a disabled child claims an exemption from personal property taxes on the basis that he is raising a child with a disability.

Comment: Parents and legal representatives of disabled children are not exempt from property taxes.

Error: A woman who is a single mother of a disabled child claims to continue to receive a double tax deduction for personal income tax after remarriage.

Comment: In the event of remarriage, a single mother is deprived of the right to a double tax deduction for personal income tax.

Land tax

Land tax

– local tax, established by local authorities and regulated by Chapter 31 of the Tax Code.

Land tax is credited to the local budget at the location

land plot.

It is the municipal authorities that determine tax rates, payment procedures, and tax benefits.

Decisions of local authorities in cities where CBU offices are located:

- Decision of the City Duma of the municipality of Novorossiysk dated November 21, 2017 No. 241 (as amended on February 25, 2020)

- Decision of the Krasnodar City Duma dated November 24, 2005 No. 3 p.2 (as amended on November 19, 2020)

- Decision of the Council of Deputies of the Mineralovodsk City District dated November 20, 2020 No. 18

The amount of land tax does not depend on the financial results of the payer’s activities, but only on such characteristics as fertility, location of the plot, etc.

Who pays land tax?

Land owners.

Payers of land tax

are organizations, individual entrepreneurs and individuals who own land plots with the right:

- property, property

- permanent unlimited use,

- lifelong inheritable ownership.

Land tax is not paid for plots located under the right of free temporary use or under a lease agreement

Objects of taxation?

Plots of land located on the territory of the municipality in whose territory the tax is introduced are subject to land tax.

Not subject to taxation

:

- areas withdrawn from circulation or limited in circulation;

- areas from the forest fund lands;

- plots included in the common property of an apartment building, etc.

Land tax rate

Land tax rates

depend on the category of land.

The category of land

is its purpose.

To find out the tax rate you need:

- determine the category of land,

- in the decision of local authorities to find out the rate for the category of their site.

Land category

may be indicated in an extract from the Unified State Register of Real Estate, a certificate of land ownership, the state real estate cadastre, a purchase and sale agreement, etc.

Tax rate

is established by local authorities, but cannot exceed:

- 0,3%

in relation to the following land plots: - agricultural purposes;

- occupied; housing stock and communal complexes;

- for subsidiary or dacha farming, gardening, vegetable farming or livestock farming;

- limited in circulation to ensure defense, security and customs needs.

in relation to other areas.

If the local government has not decided on the rate, then the general rate applies - 1.5%, and for some categories of land - 0.3%

How to find out the cadastral value of land?

Cadastral value

plot is the tax base for land tax. It is approved by the authorities in relation to each land plot as of January 1 of the year for which the tax is paid. If the land plot is formed during the accounting year, then the cadastral value on the day of entry into the Unified State Registration Register is taken.

The cadastral value of land can be found out by sending a request to Rosreestr via the website (https://rosreestr.ru/wps/portal/p/cc_present/EGRN_2). You can make a request at the territorial office of the department. Then officials will issue a cadastral certificate.

If the cadastral value of the plot has not been established, but land tax does not need to be paid

The cadastral value can be changed during the year in the following cases:

- changes in the type of permitted use;

- transfer of a plot from one category of land to another;

- changes in the area of land.

Land tax calculation

Annual tax amount

calculated by the formula:

Amount of land tax for the year

=

Cadastral value of a land plot

X

Tax rate

If during the year the ownership of the land plot changed: it arose or ceased, then the tax amount is adjusted by a special coefficient.

Amount of land tax for less than a year

=

Amount of land tax for the year

X

Number of full months of land ownership per year

12

To determine complete months, the “15th” rule is used: a month is considered complete if a change in the land plot is registered after the 15th.

During the year, the cadastral value of the site may change: if the area, type of permitted use or category of land changes. Then the calculation is made taking into account the adjustment of the cadastral value and the date of registration of the new value in the Unified State Register.

Land tax benefits

The Tax Code provides benefits

on land tax for individuals and organizations. For example, indigenous peoples or areas used for public roads are completely exempt from land tax. For some beneficiaries, for example, disabled people, the tax base is reduced by 10,000 rubles.

Local laws may provide additional benefits.

If there is a tax benefit, we advise you to submit a corresponding application

. Otherwise, tax authorities may not have the necessary information, and they will calculate the tax without taking into account the benefit.

Along with the application, you can submit documents confirming your right to this benefit.

Term

filing an application for benefits

is not established

.

The benefit can be taken into account without an application if, at the time of calculating the tax, the inspectorate has information that the owner has the right to the benefit.

Tax calculation procedure for organizations and individuals

Land owners: organizations and citizens are taxpayers of land tax. Taxpayers are required to pay tax. Taxable period

- year.

However, tax calculations and payment deadlines differ for legal entities and individuals.

- Organizations

- Individuals and individual entrepreneurs

Organizations calculate land tax independently. In addition, the company must make advance payments and submit a declaration to the tax authority.

Calculation and payment of land tax

The organization must pay advance payments

based on the results of the 1st, 2nd and 3rd quarters, if in the local regulations:

- reporting periods

are established , - There is no exemption from paying advance payments.

The amount of the advance payment for the 1st, 2nd and 3rd quarters is calculated as ¼ of the amount of land tax.

Advance payment for land tax

=

Cadastral value of a land plot

X

Tax rate

4

Advance payments are paid no later than the last day of the month following the expired quarter

At the end of the year, you need to transfer the tax minus advance payments. In the case where the company does not have to pay advance payments, the entire annual tax amount is paid.

Amount of land tax payable for the year

=

Amount of land tax for the year

—

Amount of advance payments

Payment deadlines

The deadlines for paying taxes and advance payments are the same in all regions.

- For advance payments

- no later than

the last day of the month

following the expired quarter. - For tax

– no later than

March 1

of the next year.

If the deadline falls on a weekend, payment must be transferred no later than the next business day

Land tax declaration

Starting from the 2021 tax period, organizations no longer rent

declaration

to the tax authority .

The last time the declaration must be submitted is for 2021. The deadline for filing the declaration is no later than February 1

the year following the reporting year. For example, a declaration for 2021 must be submitted by February 1, 2021.

When submitting initial or updated declarations up to 2019 inclusive, the previous procedure applies - fill out the form that was in effect during the period being submitted.

Land tax return forms:

- for 2021,

- for 2021,

- for 2021,

- for other years.

New obligation for legal entities

From 2021, companies owning land plots that are subject to taxation must notify the tax authorities about them if:

- at the end of the year they will not receive a message from the tax office about the calculated amounts of land tax,

- did not declare benefits for these areas.

This must be done once before December 31 of the year following the reporting year.

For example, in 2021 the organization bought land that is taxed. In 2022, no message was received from the inspection. Then you need to inform the tax authorities about the purchase by December 31, 2022.

Related Topics

- Cancellation of land tax declaration

- How to pay land tax from 2021

Calculation of land tax for individuals and individual entrepreneurs is carried out by the tax office.

Officials are required to calculate the tax and send a tax notice

. The notification indicates the amount of tax, cadastral number and location of the site, payment deadline, etc.

The deadline for paying land tax is December 1

next year.

So, for 2021, land tax must be paid no later than December 1, 2021. For late payment, a penalty will be charged for each day of delay.

Tax officials may notify the employer and demand that the arrears be withheld from the debtor’s salary or impose restrictions on leaving the country. If the landowner has not received the notification, then it is necessary to take the initiative and report this to the tax office.

Related Topics

- When the tax notice did not arrive

- Obligation to report to the tax authority about unaccounted for items

In conclusion, it should be noted that the tax burden on land owners is increasing every year. This is due to an increase in the tax base - the cadastral value of land.

Is it possible to reduce land tax?

We recommend you give it a try!

- First, you need to check the owner’s eligibility for federal or local benefits. To receive a benefit, you must submit an application and supporting documents to the tax office.

- It is necessary to check the correspondence of the cadastral value of the land and the market value. If the difference is significant, then the cadastral value of the land can be reduced through the court.

- If land tax is paid by notification, you need to check the calculation of the amount. For example, is the tax rate determined correctly?

reference Information

- Land tax rates and benefits in other cities

Answers to common questions about tax benefits for parents of disabled children

Question No. 1: I am a single mother, can I receive a double tax deduction for personal income tax?

Answer: Yes, single parents have the right to claim a double personal income tax deduction until they enter into a new marriage.

Question No. 2: I filed a tax deduction in January, but in October of the same year they stopped taking it into account when paying my salary, what should I do?

Answer: Probably, by October, your total income, calculated on an accrual basis from the beginning of the year, turned out to be more than the maximum possible amount for accounting for a tax deduction - 350 thousand rubles.

What benefits are provided: federal and regional level

It was mentioned above that a child with disabilities is entitled to a wide range of social privileges.

Benefits are established by federal legislation and regional regulations. In general, a number of social benefits can be divided into the following categories:

- housing - discounts are offered on utility bills and landline telephone payments;

- transport - discounts on travel on public transport, including waterways and railways, the benefit applies to one accompanying person;

- education - priority rights when enrolling in preschool and general education institutions, this includes a set of measures for social adaptation, benefits for admission to higher educational institutions and home education programs;

- medical - providing free vouchers for resort and health treatment, prosthetics, provision of wheelchairs;

- social - benefit payments, priority services, priority rights to housing.

Important! Regional benefits are established at the discretion of the administration of the region or region, and therefore may change. Federal privileges apply to everyone, regardless of place of residence.

Basic concepts on the topic

Let's consider the basic concepts that you need to know when studying the issue of preferential land tax. Each concept has its own meaning.

| Concept | Description |

| Disabled person | A citizen who has limited opportunities in social and personal life activities associated with his inherent deviations. Deviations can manifest themselves in the physical, mental, sensory and mental spheres. |

| Group (category) of disability | Disorders are classified according to the degree of expression of impairments and limitations in human life. |

| Tax | A levy or payment to the government for services or items provided to citizens. Accrued to individuals and legal entities. |

| Benefit (privilege) | Benefits or additional rights. A benefit also means a partial or complete exemption from certain rules. |

The status of disability is assigned by a socio-medical examination. A citizen simultaneously receives the title of group 2 disabled person in medical and legal terms for one year. Then he needs to go through the commission again and confirm his status.

How to get tax breaks

To receive the required payments or discounts, you first need to clarify all the conditions with local governments. Then prepare and provide all the necessary papers to prove your status and legal right to a particular tax break.

The state provides a fairly wide range of benefits for disabled taxpayers. This was done for the social and financial protection of this category of citizens. The main thing is to know your rights and the possibility of receiving a discount on a particular tax.

Errors that occur when receiving benefits

Error No. 1. The opportunity to reduce tax when using a deduction arises after submitting a package of documents to the Federal Tax Service. If a benefit is provided based on the status of a disabled person, the package of documents includes an ITU certificate. Persons who previously included a certificate as part of another package of documents mistakenly believe that it is necessary to resubmit it. The package of documents is provided in full in the absence of previously submitted certificates. In addition, the Federal Tax Service Inspectorate is obliged to request documents that can be obtained from official bodies through interdepartmental exchange.

Error No. 2. Tax deduction is provided from the day when the person has the right to reduce the amount of the obligation. It is a mistake to think about receiving benefits for the entire year in which the tax was calculated. The deduction applies from the moment the right is acquired.

Disability groups

The degree of disability and severity of illness of each citizen applying for this status is determined by a medical examination and a specially convened medical commission based on the patient’s medical history and his condition at the time of the examination.

Group 1 is considered the heaviest. Assigned to people with irreparable injuries and diseases or congenital problems that pose serious limitations to the full functioning of a person. Group 2 implies that a person can basically take care of himself, but with certain actions he requires the help of strangers. Group 3 is considered the only working group. It includes people with dysfunctions that do not interfere with independent movement or self-care.

In other words, group 1 is considered completely incompetent. Disabled persons of the 2nd degree include people with health problems for which they need periodic assistance. If group 3 is assigned, the individual cannot work in his previous specialty, but is quite capable of serving himself independently.

The privileges offered by the state will also be different for each group. An individual with a disability is entitled to monthly pension benefits, free travel on public transport, compensation for utility bills, rehabilitation and treatment in sanatoriums, privileges when purchasing medications (for disabled disabled people, a number of medications are provided free of charge, for working people - a 50% discount on purchase) . In addition, there are tax privileges.

Application for entitlement to benefits and documents provided to receive a deduction

Group 1 disabled people will need to contact the territorial office of the Federal Tax Service to receive benefits. The statement states:

- Details of the government agency receiving the application.

- Complete information about the applicant.

- Document's name.

- A request for a deduction with justification of the right.

- List of attached documents.

The application is signed by the person indicating the date, surname, and initials. A free form of document preparation is used. You can submit an application with attachments in person, through a proxy or by mail, by registered mail with declared value and return receipt requested.

Documents that serve as the basis for the provision of benefits will need to be attached to the application.

| Document form | Explanation |

| Applicant's passport | If documents are presented by an authorized person, a passport of the representative of interests is presented |

| Land plot documents | Title documents – cadastral passport or extract from the register |

| Certificate of disability | ITU certificate provided |

| Power of attorney | Required if an application is submitted by a representative |

The tax is calculated by the territorial branch of the Federal Tax Service. Notifications are sent to individuals about the amount of accrued tax liability.