A contract for the provision of gratuitous services implies an agreement under which one party undertakes to perform certain actions and provide services to the other party without charging a fee for it.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

This type of agreement is not enshrined in the Civil Legislation, however, due to the principle of freedom of contract, the parties can enter into an agreement free of charge. This type of transaction is often used in the field of charity, when foundations or organizations provide services not related to making a profit. Or, the specified agreement may be some kind of trick in order to avoid taxation.

Subjects under a contract for the provision of services free of charge can be both individuals and legal entities.

Below we will go through step by step how to draw up such a document and what nuances you should pay attention to when drawing it up.

Agreement for the provision of free services

Kurgan

January 17, 2023

RRC "Scientific Center" represented by General Director Albert Albertovich Pavlov, acting on the basis of the Charter, hereinafter referred to as the Customer on the one hand, and Stroy LLC, represented by General Director Mikhail Stanislavovich Mikhailov, acting on the basis of the Charter, hereinafter referred to as the executor on the other hand We have entered into this agreement as follows:

The preamble of the document traditionally includes:

- name of the type of transaction;

- place and date of conclusion of the contract;

- names and roles of the parties to the agreement.

The essential terms of the contract for the provision of services free of charge are:

- subject of the agreement;

- term of provision of services;

- duties of the parties;

- responsibility of the parties.

Tax accounting

According to the letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated May 10, 2012 No. 03-07-07/49, the transfer of property rights free of charge within the framework of charitable activities to educational institutions is not subject to value added tax and corporate income tax.

In accordance with subparagraph 12 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the transfer of goods (performance of work, provision of services), transfer of property rights free of charge within the framework of charitable activities in accordance with Federal Law dated August 11, 1995 No. 135-FZ “ On charitable activities and charitable organizations", with the exception of excisable goods, is exempt from taxation with value added tax. It should be taken into account that, on the basis of paragraph 2 of Article 170 of the Code, amounts of value added tax on purchased materials and repair work performed by a contractor are not deductible.

Income in the form of work (services) gratuitously received by non-profit organizations, performed (rendered) on the basis of relevant contracts, subject to the conditions established in paragraph 2 of Article 251 of the Code, is not taken into account when determining the tax base for income tax.

The procedure for reflecting these transactions in the tax accounting accounts of the 1C: Public Institution Accounting 8 program is discussed in detail in the article Accounting for gratuitously provided services, published on ITS-Budget resources.

Item

Information about the subject appears in the initial paragraphs of this document. The subject in this case is the services themselves, which are provided free of charge. It will look like this:

The Contractor undertakes to provide the services specified in the contract, and the Customer undertakes to accept them. The Contractor provides the following services: Installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345), located at the address: Kurgan region, Kurgan city, Mashinostroiteley Avenue 333B. The contractor can provide services both personally and with the involvement of third parties. The period for installation of air conditioners is 2 (Two) calendar days from the date of signing this agreement. Carrying out the work does not entail payment, since the contract is concluded free of charge.

What must be included in the document?

Before signing an agreement, you must pay attention to whether it contains certain data that can fully characterize the property that is being transferred or given completely free of charge to another person.

Such information can perfectly serve as what this item consists of, where it is located (if it is a plot of land, a house, etc.). If the contract is drawn up to indicate free services, then it must contain data about these services that must be provided (list and implementation terms).

Since if such information is missing , then this agreement will not be considered valid. Once a document has been drawn up between people, the notary must formalize accordingly.

procedure :

- indicate number ;

- place of detention;

- by whom it is issued;

- who registers (first person I.O.F);

- passport details;

- who registers (data of the second);

- passport details;

- subject of the contract;

- customer responsibilities ;

- responsibilities of the performer ;

- period .

Duties of the parties

This section sets out the obligations between the Counterparties. Such a clause may indicate various obligations by mutual agreement of the parties, but we will focus on the basic wording. So this section looks like this:

The Contractor undertakes to: Perform the installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345). Provide air conditioner installation services properly. The criterion for the quality of work performed is the normal functioning of air conditioners in work rooms. Complete the work within 2 (Two) calendar days from the date of conclusion of this agreement. The Customer undertakes to: Provide assistance when the Contractor performs the work in the form of providing all necessary documentation related to the fulfillment of the obligation under the contract. Provide the necessary conditions for the Contractor to carry out the work. Upon completion of the work by the contractor, accept these works by drawing up an act of acceptance and transfer of completed work.

The work is qualified as repair of fixed assets

If installation work on assembling a sports surface on a sports ground is qualified as a repair, the cost of the fixed asset does not change.

However, the cost of the work should be reflected in the Inventory card for non-financial assets (f. 0504031).

| Excerpt from the document |

| “The result of work on the repair of a fixed asset object that does not change its value (including the replacement of elements in a complex fixed asset object (in a complex of structurally articulated objects that constitute a single whole) is subject to reflection in the accounting register - the Inventory card of the corresponding fixed asset object by making records of changes made, without being reflected in the accounting accounts.” |

| paragraph 27 of Instruction No. 157n |

To do this, you should use the document Overhaul, modernization of NFA with the operation Overhaul of fixed assets (Fig. 3).

Rice. 3

The document indicates the OS object that has been repaired and the cost of repair. When carrying out the document Overhaul, modernization of NFA, an entry is created in the Overhaul of OS register. This data will be reflected in the object's inventory card.

Accounting records should include entries on the acceptance of work (services) for installation of coatings, the accrual of non-operating income and the offset of mutual claims - see Table 1.

Table 1

| No. | Fact of economic life | Accounting records | BSU document | |

| Debit | Credit | |||

| 1. | Acceptance for accounting of works (services) for installation of coating | KRB 2 401 20 225 | KRB 2 302 25 730 | Services of third parties (with the operation “Purchase from supplier (ХХХ - 302.ХХ)”) |

| 2. | Accrual of non-operating income | KDB 2 205 80 560 | KDB 2 401 10 180 | Certificate of provision of services (with the operation Sales of services (205.ХХ - 401.10.1ХХ)) |

| 3. | Settlement of counterclaims of the same type | KRB 2 302 25 830 | KDB 2 205 80 660 | Operation (accounting) |

Considering that the procedure for reflecting gratuitously received work (services) in the accounting records of state (municipal) institutions is not defined by regulatory documents, the corresponding correspondence of the institution’s accounts must be determined in the Accounting Policy in agreement with the authorized body (the main manager of budget funds; the body exercising the functions and powers founder; financial body, treasury body to which the functions of external financial control are transferred).

Responsibility of the parties

The text of the document contains information about the circumstances in the event of which the parties bear mutual financial liability. This clause is an integral component of this type of agreement. These provisions are written as follows:

The parties bear financial responsibility for non-fulfillment or improper fulfillment of their obligations under this agreement. In the event of damage to the Customer, work rooms, air conditioners when performing the work specified in the paragraphs of this document, the contractor bears financial liability. In the event of equipment breakdown due to the fault of the Contractor, which arose during the installation process, the Customer has the right to demand compensation for damage.

Standard form and content of the transaction

There is no legally established form of the document. The parties have the right to agree on terms that do not contradict the general rules of law. In practice, an agreement for the provision of services between individuals is concluded in writing. Regardless of the subject composition, mandatory notarization is not required. The customer has the right to determine in the text whether the work is performed personally by the contractor or whether the involvement of third parties is permissible.

The structure of the transaction includes the following parts:

- Preamble (date and place of conclusion of the agreement, full name and details of the identity document, registration address).

- Subject (what actions the performer undertakes to do, time and place of performance).

- The order of delivery (compliance of the work result with the established standard, the sequence of delivery and acceptance).

- Price and payment procedure (payment procedure by the customer, cost of work).

- Responsibility (measures for non-compliance with the terms of the agreement, the claim procedure for considering appeals, the deadline for responding to a claim).

- Additional conditions (force majeure, duration of the transaction, procedure for early termination, list of attachments).

- Details of the parties (full name and identification document details, registration address, contact details, signature and transcript).

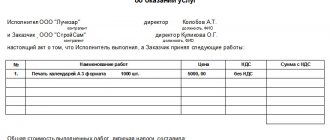

The document confirming the fulfillment of the terms of the transaction is the act of services rendered. It is drawn up in the same form as a standard contract for the provision of services, for example, a simple written one. The contractor indicates a list of work performed, the customer indicates acceptance and absence of claims. When drawing up a document, make a reference to the original document indicating its number and date of signing.

Here is an example of a service agreement between two individuals:

Final provisions

This section contains general information based on the content of the contract. Thus, the conditions for drawing up the contract may be indicated, that is, in how many copies it is drawn up. Also, from what moment does the contract begin to have legal force, and in what order can the transaction be terminated? The design of such a section looks like this:

This document is drawn up in 2 (two) copies, one copy for each party. This agreement has legal force from the moment it is signed by the Counterparties and terminates after the Parties fulfill their obligations under this agreement. This agreement may be terminated unilaterally at any time during its validity. In case of unilateral refusal to fulfill obligations, the party initiating the termination of the contract is obliged to notify the other party of its intentions no later than 1 (One) calendar day.

At the end of the document, the details of the parties are indicated and after signing the agreement, the contract is considered concluded.

Transfer conditions

Items transferred under the contract must be in good condition, suitable for the intended use and accompanied by all the required documentation and accessories. Otherwise, the borrower has the right to either request the attached documents and accessories, or terminate the transaction (with the lender paying the costs incurred by the other party).

If the lender refuses to provide the thing itself after the conclusion of the transaction, the other party has the right to demand termination of the contract and compensation for costs incurred as a result of this refusal.

If defects are detected in the transferred item, the borrower has the right:

- demand that defects be eliminated free of charge;

- eliminate it yourself and demand reimbursement of expenses incurred;

- demand early termination of the contract with reimbursement of expenses incurred.

The transfer of an item from the lender to the borrower is recorded by signing the transfer act.

Use and return

The person who has received the item for loan use is obliged to keep it in working order and pay for its maintenance. And not only carry out routine maintenance work, but carry out major repairs. Except in cases where the contract specifically specifies rules for the use of the transferred item that differ from the usual rules.

Risks associated with accidental destruction or damage to the transferred item are the responsibility of the owner, except for the following circumstances in which the item was destroyed or damaged, namely:

- the item was used for other purposes or in violation of the contract;

- the item was transferred to another person without the knowledge of the owner;

- there was an opportunity to prevent such consequences, but the borrower did not take advantage of it.

In what cases is it impossible to conclude?

Quite often, a gratuitous agreement is equated or confused, they do not know how to formulate it correctly, but, nevertheless, this peculiarity is observed due to the fact that in our law there are no certain conditions under which this type of agreement must be drawn up.

But what is known for certain is that not everyone can draw up such a “free” contract. This especially applies to this type of contract that provides for the donation of an item.

In addition, commercial organizations cannot and simply do not have the right to negotiate . Since it is believed that the purpose of this type of structure is primarily to make a profit .

Money the main and final goal of absolutely any activity of entrepreneurs. Consequently, transactions that are concluded between several organizations cannot be considered free of charge.

For other people, who are legal entities and individuals, there are no restrictions regarding the conclusion of an agreement.