When a driver candidate, who is also a driving school student, completes his training and passes all internal exams at the driving school, the most awaited moment comes. It's time for the traffic police exams. Now in 2021, one of the additional conditions for admission to the traffic police exams is a prepaid state fee for issuing a driver’s license or, as everyone used to say, for issuing a license.

Every driving school student, before exams at the traffic police, is faced with the question of how to pay the state fee to obtain a license. In general, there is nothing complicated about this; even an ordinary school student can easily pay the state fee to obtain a driver’s license on his own. In order to unfold this procedure in detail for you, let’s begin to consider it in order. There are several easiest ways to pay the state fee for obtaining a license:

- The state fee for obtaining a driver's license (driver's license) is paid through the State Services portal.

- The state fee for obtaining a license is paid through an ATM terminal (for example, Sberbank).

- The state fee for obtaining a license is paid through the cash desk of any Bank.

- Make a payment through the Sberbank Online mobile application.

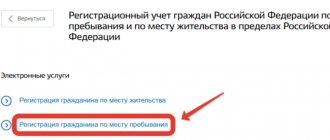

Let's look at method number 1. Now in 2021, 95% of students of all driving schools sign up for exams at the traffic police through government services, and it doesn’t matter whether they submit documents on their own or go to an organized exam with representatives of the driving school. When registering for exams at the State Traffic Inspectorate through the State Services portal, the very last step will be paying the state fee for issuing a driving license. Further on the link you can see our step-by-step instructions for registering for qualifying exams in the traffic police INSTRUCTIONS You can pay the state fee for obtaining a license with any bank card. By paying the state fee through State Services, you receive a discount of 600 rubles. Don’t forget, if you submit documents to the traffic police on your own, you need to print out the receipt for payment of the state fee for issuing a driving license and attach it to the set of documents issued by the driving school. If you submit documents to the traffic police yourself, by means of registration through State Services, this is the easiest way to do it. You don’t have to arrive 2-3 hours before the traffic police office opens, stand in line, take a ticket and wait for a call. You arrive at the examination department of the State Traffic Inspectorate, on the date and time of your choice, calmly, without waiting in line, go to the window designated for admission through State Services, and submit documents for the exam. Now let's get back to paying the state fee to obtain a driver's license.

In what cases is it necessary to pay a state fee for registering property?

The state fee for registering property is payable when making any transactions that are related to property (real estate):

- privatization;

- inheritance;

- barter agreement;

- registration of purchase and sale;

- rent;

- donation.

Depending on the situation in which you take ownership, a certain procedure and amount of state duty is established. For detailed information, please visit the portal. For this:

- Follow the link https://www.gosuslugi.ru.

- Log in to the system.

- On the main page, go to the “Authorities” section.

- Select "Rosreestr".

- Click on the item “State cadastral registration and (or) state registration of rights to real estate and transactions with it.”

- From the list that appears, select the desired category (registration of lease, registration of rights to a land plot, etc.).

- The next page will display information on how to obtain the service, the required package of documents, etc.

To register ownership of a property, you need to enter information about it into the Unified State Register of Real Estate (USRN) and pay a state fee. This can be done before and after filing an application for registration of ownership.

Procedure for paying state duty

A duty is a legally established fee that is paid for legally significant actions of government agencies. Both legal entities and individuals must pay the state fee for registering property rights. We are talking about the purchase and sale, mortgage, gift of real estate. Typically, the buyer pays the duty. If there are several buyers, they can split the costs. The state fee can be paid before and after filing an application for registration of property rights. If the application is submitted in paper form, then a receipt for payment of the fee is attached to the application for registration of the transfer of rights to real estate. In this case, the payer bears full responsibility for the correctness of the payment recipient’s details, noted Orzhoniya Koba, a member of the Russian Lawyers Association (RLA). “But if a number is incorrectly indicated in the recipient’s details, the payment simply will not go through. In this case, the risk that the money will go to the wrong place is minimal,” she added. If the application for registration of property and the documents attached to it are submitted in electronic form, the fee can be paid after they are submitted, but before they are accepted for consideration by the rights registration authority, explained the press service of Rosreestr. In this case, you do not need to attach a payment receipt to your application. Payment information is entered into the State Information System on state and municipal payments.

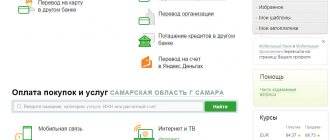

If, five days after submitting the application, the data on payment of the state duty is not in the information system, and the document on its payment is not submitted by the applicant, then the rights registration authority is obliged to return the application and documents without consideration, Rosreestr clarified. Amount of state duty The amount of state duty for registration of property rights depends on the type of registration actions, the property and on who pays the fee - an individual or a legal entity. For the latter, the rates are higher. When acquiring rights in common shared ownership, each owner pays a fee depending on the size of his share. The state fee for registration of ownership of real estate under a contract of sale, gift, exchange is: - for individuals - 2 thousand rubles; — for legal entities — 22 thousand rubles. State registration of mortgages, including making an entry in the Unified State Register of Real Estate: - for individuals - 1 thousand rubles; — for legal entities — 4 thousand rubles. State registration of an agreement for participation in shared construction: - for individuals - 350 rubles; — for legal entities — 6 thousand rubles. State registration of a share in the right of common ownership of common real estate in an apartment building - 200 rubles. State registration of an individual’s ownership of a land plot for personal subsidiary farming, individual garage or individual housing construction, or real estate on such a plot - 350 rubles. A complete list of state duty amounts for registering ownership of real estate can be found on the Rosreestr website. Methods of payment of the state duty The state duty for registration of property rights is paid at the place where the legally significant action was performed in cash or non-cash form. This can be done at any bank branch or at the MFC. Payment can be made either through ATMs and terminals, or at the cash desk of these institutions. When paying through a terminal or ATM, you will need to select the appropriate service in the menu and the service provider (Rosreestr), enter the payer’s full name and passport information, as well as the details specified in the receipt. Payment can be made online in your personal Internet banking accounts. For example, in the Sberbank application, for this you need to go to the “Payments” - “Home” - “Rosreestr” section and enter the details. You can also pay the state fee on the state services portal. To do this you need to: - submit an application for the service through the government services portal; — wait until the accrual is issued, and the payment button appears in the application; — you can pay the fee on the portal with a bank card, using an electronic wallet or mobile phone. The fact of payment of the state duty by the payer in cash is confirmed by a receipt from a bank or MFC, in non-cash form - by a payment order marked by the bank or the relevant territorial body. How to check payment You can check payment of the state duty online through your bank’s application, contact the bank branch directly, or check the data in the state information system about state and municipal payments. Typically, payment information enters the payment system within one day. If there is information about the payment of the state duty contained in the State Information System on state and municipal payments, additional confirmation of payment is not required. Payment details Payment details for paying state fees vary depending on the region in which the property is located. Details can be found when contacting the MFC. Also, current information is posted on the Rosreestr website. To find out the payment details, you must: - go to the Rosreestr website; — select the desired region in the site header; — go to the menu for individuals or legal entities; — select the “Register real estate” service; — on the side of the right window, select the “Cost, details, and sample documents” tab; — specify the region; — receive details for registering property rights. Beneficiaries There are preferential categories of citizens who are exempt from paying state duty. If the common property of several persons is registered and there is a beneficiary among them, then the beneficiary’s duty is deducted from the total amount. The remainder is divided among the remaining applicants according to general rules and paid. Beneficiaries include: low-income people (with the exception of state registration of restrictions / encumbrances on real estate rights); veterans and disabled people of the Great Patriotic War, prisoners of fascist concentration camps, prisoners of war during the Great Patriotic War; individuals who apply for state registration of ownership of residential premises provided to them in exchange for vacated housing under the Moscow renovation program. Overpayment If it is determined that the applicant has overpaid the fee, the excess amount will be refunded. The payer has three years to submit an application to the department, and the money is returned within a month. It should be taken into account that the fee paid for state registration of rights to real estate will not be refunded in the event of refusal of state registration. The basis for the return of overpaid duty is an application by the payer or his representative by proxy. Original payment documents must be attached to the refund application if the fee is refundable in full. If it is partially refundable, copies of payment documents. Innovations In 2021, changes came into force that relate to the payment of state duties. The new provisions abolished the payment of the fee for registration of ownership of real estate, the rights to which arose before the date of entry into force of the Federal Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with it” - “previously arose right " “Starting from the new year, it is possible to register a “previously arisen right” (for example, on the basis of a privatization agreement, a certificate of land ownership, a purchase and sale agreement certified by a notary and other documents executed before January 31, 1998. The changes also concern the establishment of a state duty in the amount 1 thousand rubles for registering the transfer of ownership of a property in connection with the reorganization of a legal entity in the form of transformation.

How to pay the state fee for registering property on State Services

There is no way to submit an application for property registration on State Services. On the portal this service is non-electronic. Due to this, you will not receive a receipt that is generated automatically after submitting your application. Try paying the state tax according to your UIN. For this:

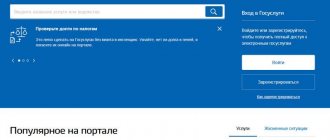

- Go to the website www.gosuslugi.ru.

- Go to your personal account.

- Enter your username and password for authorization.

- On the main page, select the “Payment” category. It's at the top of the screen.

- Select "By receipt".

- Enter the UIN in the empty column. You will receive it on the Rosreestr website.

- If the system finds the necessary data, then proceed to make the payment.

- Select the payment method for the state fee.

- Enter the required information.

- Confirm the payment with the code from SMS.

If the system does not find the necessary details, you will not be able to pay the state fee for property registration through State Services. Please use another available method.

Payment of state fees through the MFC

You can pay the fee to the MFC if you don’t want to figure everything out on your own. This can be done quite quickly, since special payment terminals are now installed there. In order to deposit money, you need to do the following:

- Contact the center employee and explain to him what you need to do.

- Follow his instructions and enter all the necessary data in the terminal. Be sure to take a document with the details with you.

- Insert the money and collect the check, which you will need when you hand in the title deeds.

State duty for property registration

New features are periodically added to the State Services portal. In this regard, functionality for paying state fees for registering property rights may soon appear. For now, check out the information about the amount to be paid:

- The state duty for purchasing a new apartment is 2,000 rubles;

- if you register a share in an apartment, then pay a state fee of 200 rubles;

- when registering a personal plot, which is located under a residential building, they charge 350 rubles;

- if you register ownership of real estate by right of inheritance from a close relative, then pay 0.3% of the cadastral value, but not more than 100,000 rubles. In other cases, the state duty will be 0.6%, but not more than 1 million rubles;

- When registering a mortgage and making an entry in the Unified State Register, they charge 1 thousand rubles.

More detailed information on the amount of state duty for registering property rights is available on the Rosreestr website.