A deed of gift for a house, the pros and cons in 2021, which we will consider today, is one of the most common ways of transferring real estate both between relatives and between strangers. However, paying attention to such undoubted positive aspects of the transaction as the speed of registration and cost savings, many are later disappointed in this method of alienation of property, faced with the need to pay taxes, register property rights and some “pitfalls” that arise at different stages.

A practicing lawyer and author of the Legal Ambulance website, Oleg Ustinov, will help you understand how beneficial a deed of gift is for each of the parties.

You can check the relevance of the information provided on the Consultant website.

What is a deed of gift in 2021

From the point of view of the current legislation of the Russian Federation, a gift agreement or a deed of gift for a house is an agreement on the transfer (alienation) of real estate from one party to another free of charge, that is, without any benefit (money, things, services) for the donor of the property.

Today, the wide popularity of this method of transferring property is due to the short period of registration of ownership rights and financial savings. However, in order for the gift agreement not to be ultimately declared invalid, it is necessary to follow certain rules, having information about the “pitfalls” when concluding such a transaction.

For example, the grounds for canceling a deed of gift may include the completion of the transaction in question without the mutual consent of the parties or the presence of any conditions that imply that the current owner of the house receives a certain benefit after the execution of the contract.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

In such cases (if there are reciprocal obligations), according to the laws of the Russian Federation, the parties are obliged to enter into another transaction - an exchange. Otherwise, the legality of the contract can be challenged in court at any time.

Also, as we already mentioned in the article about donating a garage, real estate objects are directly related to the land plots on which they were built. Thus, the deed of gift will be considered invalid if the house is donated without ownership of the land. In this case, the plot of land on which the building (in this case, a house) is built is also subject to re-registration.

From the above we can conclude that:

- Registration of a deed of gift for a house is impossible without transferring into the ownership of the recipient not only the building, but also the plot.

- In some situations, a transaction is concluded with one contract for two objects at once.

For example, even when donating part of a house, the donor is obliged to transfer to the donee a certain part of the land, the size of which is calculated based on the general data of the building and the share.

Let us note that if the donor has a long-term lease on the property and, according to the law, he has the right to use it, he can transfer his right in full to the donee. At the same time, the former owner will continue to act as the owner.

Can the transaction be declared invalid?

In some cases, a deed of gift may be considered illegal. These include the following situations:

- The donor's physical condition deteriorated sharply after the conclusion of the contract. In this case, law enforcement agencies will investigate the attack on the health of the victim.

- After signing the document, the death of the donor occurred: the relatives will insist that he was incompetent or was not responsible for his actions, and the recipient will have to take over the rights through the court.

- If the donated property is lost or destroyed, the recipient may be deprived of his rights.

- If the recipient does not need the gift, a waiver of the property can be formalized: the gift transaction is voluntary, so no one has the right to force it to be received.

- If the donee works in the guardianship or social protection authorities, and is not a relative of the donor.

- If the contract is drawn up with errors, it will not be possible to enter into rights.

To challenge a deed of gift, Russian legislation provides for a period of 3 years: during this time, relatives can file a lawsuit and demand that the fact of the donation be declared unlawful. The period is counted from the moment of registration of the document or the time when interested parties received notification that their rights have been infringed.

It is important to remember that the total period during which it is possible to challenge a deed of gift does not exceed 10 years from the date of registration.

Pros and cons of registering a deed of gift for a house

Like any other legal transaction, a gift agreement, depending on the situation, contains both positive and negative sides. And only after studying all of them, experts recommend that citizens decide whether this real estate transaction is suitable for them or whether it would be better to use another method of transferring it to another person.

Lawyers include the main advantages of deeds of gift::

- There is no obligation to certify the authenticity of documents involved in a transaction with a notary.

- Determination of the conditions and timing of the transfer of the gift into ownership.

- No gift taxation for transactions between relatives.

- The fact that the donee becomes the legal owner of the property immediately after registration of ownership.

- After the official registration of the transaction, the new owner of the property has the right to dispose of it at his own discretion.

- Real estate can be donated during the donor's lifetime, which sometimes avoids conflicts between heirs that often arise when making a will.

- A house received by deed of gift is not part of the jointly acquired property, and therefore will not be divided during a divorce.

ARTICLE RECOMMENDED FOR YOU:

Voluntary donations to educational institutions: conditions of legality in 2021

As a rule, the disadvantages of the deal include::

- An incorrectly drawn up document can be easily challenged in court.

- A gift of a house, unlike, for example, a will, cannot be changed in favor of another person.

- Transactions in which parties are not relatives (strangers and persons not included in this category by law) are subject to income tax, the amount of which in 2021 is 13% of the total value of the transaction.

- Also, there is a list of persons who cannot act as recipients. But, more on that later.

Concept and parties to the gift agreement

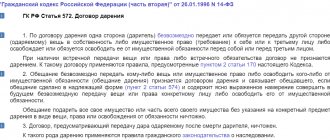

The donation of rights, things or the release of the donee from obligations is carried out free of charge . According to Art. 572 of the Civil Code of the Russian Federation, if the fact of a counter transfer (from the donee to the donor) of goods or services was discovered, the agreement is not considered a donation. The rules of Art. 170 Civil Code of the Russian Federation.

The donor has the right to assume the obligations of the donee to pay debts or provide him with the right of claim in relation to himself or third parties. restrictions apply to the gift agreement :

- a promise to make a gift in the future is recognized as a gift agreement only if it is drawn up in accordance with the rules of paragraph 2 of Art. 574 Civil Code of the Russian Federation;

- it is unacceptable to promise to donate all or part of the property without indicating specific items of donation;

- An agreement according to which the object of donation could be transferred to the donee only after the death of the donor is recognized as void. At the same time, the donor's heirs receive the obligation to transfer the gift, which the testator did not manage to fulfill during his lifetime. It is permissible to include in the contract a clause according to which, after the death of the donor, his heirs are exempt from the need to make a gift.

The gift agreement is multilateral and cannot be concluded by one person.

How to draw up a deed of gift for a house in 2021 so that it is not challenged

Before drawing up a donation agreement for a house, you should definitely familiarize yourself with the established procedure for this simple but very important procedure.

- At the first initial stage, the donee must prepare all the necessary documents that confirm his right of ownership of the housing and the land plot on which it is located.

- After this, it is necessary to draw up an agreement, conclude a transaction (sign a deed of gift), and then be sure to officially register the act of transfer of ownership from the donor to the donee.

Remember that in this case, only a transaction executed in writing, but not orally, will be considered legal. The agreement must be drawn up in 3 copies, and it must clearly state the object of the donation and its detailed characteristics (technical data, location, cadastral value, etc.). In addition, the document should indicate the conditions and actual period when the deed of gift comes into force.

It is worth noting that, although, according to the current legislation of the Russian Federation, in 2021 the act of donation may not be certified by a notary, experienced lawyers of the Legal Ambulance website recommend involving a specialist in the procedure. Otherwise, there is a possibility that in the future one of the donor’s heirs will try to cancel the deal.

After the parties have signed the deed of gift, the procedure for registering ownership takes place according to one of the following methods:

- The parties submit the package of necessary documents to the local branch of Rosreestr.

- Papers are sent there by registered mail.

- All files necessary for registration can also be uploaded to the personal account on the official website of Rosreestr.

Features of registering a deed of gift for a house between close relatives

Let us immediately note the fact that the procedure for registering and drawing up a deed of gift for a house between close relatives must take place in accordance with the scheme established by law, subject to the requirements of the Civil Code of the Russian Federation. However, in some cases, the content of the gift agreement in this case may differ from the standard one.

Lawyer's Note

At the same time, according to the results of a survey on our website, relatives rarely draw up a written act at all, basing the gift on a trusting relationship and an oral agreement. Unfortunately, in some cases, this approach leads to quarrels, conflicts and litigation with considerable time and financial costs.

Remember that an indication in the content of the agreement that the deed of gift will come into force only after the death of the donor and the current owner of the donated property leads to the recognition of the transaction as invalid! Such a document will 99.9% be challenged by a court decision.

Sample contracts (Word, .doc)

ARTICLE RECOMMENDED FOR YOU:

Agreement for the donation of an apartment between close relatives in 2021 - MFC form

Essential terms of the gift agreement

Article 432 of the Civil Code of the Russian Federation defines the main provisions for concluding an agreement. According to paragraph 1 of this article, the contract must include essential terms . These include conditions that are mandatory for the conclusion of a contract and defined in laws and other regulations. Each type of contract may include different essential terms.

For a gift agreement, an essential condition is information about the subject of the agreement . If they are not indicated, the agreement is considered to have no legal force. The characteristic features of the thing or the features of the rights that are the subject of the donation are described. If there are any shortcomings, they are also indicated .

Important

The term of the contract does not relate to the essential conditions, therefore the contract can be drawn up without specifying the period for the transfer of the gift.

From Art. 432 of the Civil Code of the Russian Federation it follows that an agreement can be concluded only after an agreement has been reached between the parties regarding each of the points contained in the document. Not only essential conditions are specified, but also additional and incidental ones (if any).

Documents required for registration of deed of gift

Now is the time to consider what documents are needed for a deed of gift for a house. Since the stage of collecting the documentation package is considered one of the most important, we recommend that you carefully study the lists and explanations below, because the absence of just one act or certificate may cause the registration of property rights to be rejected.

Of course, in each individual case, the package of required papers may vary. However, the list still remains unchanged:

- Passports of the parties involved in the transaction.

- A correctly drawn up application for registration of the transfer of ownership of the house, signed by both parties.

- Deed of gift (donation agreement) for a house.

- Documentation confirming the donor's ownership and the legality of his actions in donating this property.

- Papers that confirm the donor's ownership of the land plot on which the house is located.

- If the object of the transaction acts as joint property, you will need to obtain the written consent of your spouse.

For housing that was purchased after marriage, but which is not part of the jointly acquired property, you will also need to provide confirmation, which today, as a rule, is provided by deeds of gift or certificates of inheritance. Also, documents confirming the fact of purchasing a house with personal funds can serve as similar evidence.

However, the best option for you will be to seek a free consultation provided by the lawyers of our website! After all, only an experienced specialist can accurately indicate which papers will be needed in your case.

In 2021, in order to confirm your ownership of a house, the following documents are used:

- Home Book;

- a certificate confirming that there has been no refusal to transfer the property;

- technical passport of the house;

- other documentation that can confirm that the house and the land under it are the property of the donor.

As we already mentioned at the beginning of the article, according to the current legislation of the Russian Federation, the donor can dispose of a land plot only if this plot is his property. Moreover, if the plot is inherited for life or is in use, the donor does not have the right to dispose of it.

It is worth noting that for the donation of land plots, the legislation provides for its own package of documentation, the absence of part of which may nullify the donation agreement. This list includes:

- cadastral passport;

- title documents for property;

- certificates according to which the donor has no debt on this land plot;

- technical characteristics of all buildings erected on the territory of this site;

- papers authorizing the alienation;

- plan drawn up by cadastral service specialists.

Also, sometimes the person acting as the donor of the house may need other additional paperwork. This, for example, may be influenced by the marital status of the donors themselves and the age of the recipient. Such documents include:

- a court order confirming the deprivation of parental rights;

- power of attorney;

- consent of the trustee or guardian;

- also, in the case of donating property to a minor, the consent of the guardianship and trusteeship authorities or parents (adopted or relatives - it makes no difference) will be required.

Who can't give an apartment to?

There are several situations that prohibit issuing a deed of gift for an apartment:

- The donor may not be a person serving as an official at the local or federal level in connection with his position.

- The donor cannot be a minor or incapacitated person. Even if such a donor was able to draw up a deed of gift, it can easily be declared invalid.

- If the donor of an apartment is the owner of a commercial organization and tries to donate property to the same owner of another commercial organization, then such manipulations are prohibited.

- If the donor is a client of medical clinics, educational institutions and other social institutions, then issuing a gift deed for his living space is prohibited by law.

Sometimes, after registering a deed of gift for an apartment, relations with relatives may change, not for the better. Donating real estate is a very serious step for the donor. In this case, a will for inheriting an apartment protects the owner of the home more. Before you issue a deed of gift, you need to think several times. After all, it is almost impossible to cancel this step after the deed of gift is registered in Rosreestr, and the recipient is in no danger, even if he decides to drive his donor out onto the street.

Features of a deed of gift for a plot for a residential building

A deed of gift for a house between close relatives and strangers must be drawn up in triplicate. The presence of a notary is not mandatory, but an advisory factor that will act as a guarantor of the absence of claims from both parties in the future.

At the same time, in order for the gift agreement to have legal force, it must comply with the rules and regulations established by Russian legislation:

- The act must contain all important information about the building and the land on which it is built.

- Information from the parties' passports must be entered without blots or errors.

- The donee is obliged to express his consent to accept property from the donor.

- The agreement must define the conditions and timing of its entry into force.

- The content must indicate the actual cost of the house and land being transferred.

ARTICLE RECOMMENDED FOR YOU:

Invalidation of the gift agreement

Current questions and answers

- Question:

If a law firm formalizes a donation, and only then files for bankruptcy, can the deed of gift be challenged.

Answer:

Yes, the transaction can be challenged to prevent deliberate concealment of things, concealing property from creditors. Basis – art. 578 Civil Code.- Question:

Is there a state duty when re-issuing a deed of gift?

Answer:

Yes, the donor who decides to change the side of the contract is required to pay a state fee in the amount of 1000 rubles.- Question:

If I sell the donated apartment immediately, will there be a duty?

Answer:

The deadline for resolving the problem, in which you will have to pay 13% tax on the cost of the apartment, expires after three years. If you sell before this period, there will be a tax of 13%.

- home

- Donation

Article rating:

(no votes)

Share with friends:

Related publications

- Donation

Deed of gift for a house and land in 2021

- Donation

Cancellation of deed of gift for an apartment

- Donation

Cancellation of deed of gift for a house in 2021

- Donation

Gift or inheritance: which is better?

Popular material

Deed of gift for a residential building or part thereof

According to the legislation in force in the Russian Federation, residential property can be transferred by its owner to another person in whole or in parts. In jurisprudence, there are examples of donative shares of a residential building, as well as donation agreements for undivided property. In case of transfer of part of the house, certain conditions must be met:

- Make a separate kitchen and bathroom;

- arrange a separate entrance to the donated part of the house;

- provide separate communications, etc.

In addition, when separating part of such a property, the donor will need to undergo an appropriate examination at the BTI, whose specialists must provide an extract containing:

- Determining the possibility or impossibility of dividing the living space.

- Options for this section.

- Estimated cost, as well as a technical plan for redevelopment in case of division.

- Date of construction of the building.

- Plan of the entire housing.

- The actual amount of compensation for the party who received the smaller share (if it is impossible to divide the area into equal shares).

At the same time, in the donation agreement for a part of the house, the donor simply indicates certain rooms that will be donated to the recipient.

When can you sell donated real estate?

Subtleties and nuances You can specify additional points in the document: limit the validity period of the deed of gift or indicate who bears the costs when concluding the transaction. If this is not stated in the text, material costs in the form of state duties and taxes are paid by the donee. By agreement, they can be transferred or divided between the participants. In the text of the gift document when transferring real estate, it is often stated that the donor will live in the transferred living space. In this case, after his death, judicial confirmation of the rights of the donee is often required.

- Full name of the donor and recipient, passport details, residential addresses;

- Description of the property that will be donated;

- Date of conclusion of the act, signatures of the parties.

How much does it cost to register a deed of gift for a house in 2021?

It is also worth noting the fact that drawing up a donation agreement for a house, like most legal procedures, involves certain financial expenses. At the same time, having transferred all expenses to the donee, the donor may not pay anything at all, because, in fact, he does not receive any benefits as a result of the transaction.

The total cost of the costs of correctly registering a deed of gift directly depends on the methods of its execution and the individual characteristics of the transaction.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Thus, in the case of independently drawing up an act, the parties to the contract who are included in the category of relatives will only pay a fee established by the state. The price for registration of a deed of gift by an agency will vary, depending on the region of residence of the parties and the complexity of the situation. However, we remind you that each of our visitors has the opportunity to get a free consultation, which will allow you to save a lot!

Each of these offices has its own price list, which determines the pricing policy for each type of service. Therefore, if you decide to contact an agency, be sure to compare prices in 3-4 companies to choose the best one.

Since during the transaction only the recipient party benefits, it is he who will have to pay for the procedure for registering property rights. To date, the price for this has been set at 1,000 Russian rubles . Remember that without a corresponding receipt for successful payment for this service, employees of the registration authority do not have the right to carry out the operation of transferring ownership of the donated house.

So, in some cases, the best option would be to make a will. More about this in the video:

In addition, the new owner of the donated property will have to pay a fee for the plot and housing (350+2,000 Russian rubles). It is also worth talking about the tax paid.