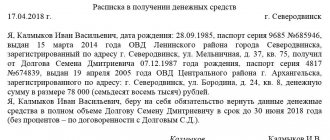

Money is a necessary attribute of the life of a modern person. Therefore, when they run out, many Russians turn to friends or relatives for help. Unfortunately, few people think about the safety of such a loan. It should be remembered that the transfer of large sums of money must be accompanied by a receipt. In most cases, this document is used in financial relations between individuals and when applying for a loan in microfinance organizations. Next, let's talk about what a receipt for receiving funds is and how to draw it up correctly.

What is a receipt and why document it?

A receipt is a written certification of the fact of transfer of funds from one person to another. In the event that financial disagreements arise between the lender and the borrower, this document will serve as proof of the transfer of money and will also confirm the terms of the loan.

The receipt is not a mandatory document. However, if the lender doubts the borrower’s integrity, it is recommended to document the transaction.

The receipt for the transfer of money does not have strictly established forms. Depending on the circumstances, the receipt may be:

- Subject - the text of the document indicates the purpose of the loan.

- Pointless - there is no clear goal (only the loan amount, conditions and repayment period are indicated).

- Notary certified.

- Handwritten or typed.

Experts recommend making a receipt in writing (by hand). Firstly, it is easier to identify the author of a document by handwriting. Secondly, if the parties to the transaction have a conflict regarding the return of the amount of money, the receipt will be excellent evidence in court.

In accordance with Art. 808 of the Civil Code of the Russian Federation, a loan agreement between individuals must be concluded in writing if its amount exceeds 1000 rubles. If the lender is a legal entity - regardless of the amount.

Important: in accordance with paragraph 2 of Art. 163 of the Civil Code of the Russian Federation, the receipt does not have to be certified by a notary. Only the loan agreement is subject to mandatory certification. In this case, the receipt comes as an attachment to it.

Nuances of registering a receipt

- For a minor child under 14 years of age who is the owner of an apartment, funds to pay for the cost of the property being sold are received by his representatives by law (parents or guardians). Their presence is required when transferring money; they also write a receipt. At the same time, they indicate their personal information and the child’s. The child does not have to be present during the transaction.

- A minor child who has already received a passport writes a receipt in his own hand indicating that he received the amount of money in the presence of one of the parents. The receipt is certified by the child’s personal signature. Legal representatives must also provide their details and sign.

- If there are several sellers, then each is required to write a receipt on his own behalf indicating his specific share of the transaction.

- The receipt does not require notarization. However, the parties, by mutual agreement, can contact a notary to confirm the fact of transfer of funds. Then the document will have stronger legal force.

The receipt has no statute of limitations and must be kept by the buyer. You should not submit its original to the tax authority or Rosreestr. Only the original is a legally significant document that can serve as evidence of the transfer of cash during legal proceedings, as well as when receiving a tax deduction.

Regulatory regulation of receipts for receipt of funds

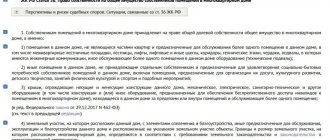

In accordance with paragraph 2 of Art. 808 of the Civil Code of the Russian Federation, a receipt confirms the loan agreement and its terms. This document can be drawn up as a supplement to the above agreement or be an independent element of the transaction.

The law does not provide for a clear form for drawing up a mortgage. No federal regulation regulates the contents of the receipt. Therefore, the parties to the transaction have the right to rely on their own beliefs.

It is not necessary to notarize the receipt. However, clause 1 of Article 163 of the Civil Code of the Russian Federation provides participants in a financial transaction with the opportunity to certify a document, thereby confirming the legality of the transfer and receipt of funds.

Important: a notary has the right to certify a receipt only if it is an attachment to the loan agreement.

Details of filling out the details

Each item must be described in detail and completed as required. He must respond to all requests as fully as possible.

The “Organization” attribute implies writing the full or abbreviated name of the organization that issued the receipt.

The “serial number of the power of attorney” is determined by the assigned number of this receipt, registered in the accounting department of the organization or private enterprise, by the person authorized to issue this type of documentation.

“Date of issue” displays the actual moment the document was completed. If you do not indicate the date on a document, it may be considered invalid. If such an error is made, the recipient will not have a legal basis for receiving the tangible property.

“The validity of the requisite is set until...” This field implies writing the period that the organization itself has determined. Basically, the validity of the receipt is established for a period of up to 15 working days. If the settlement is permanent, the validity period of the receipt will be extended to a month. If for some reason the person authorized to receive the property loses his rights, it is important to notify the supplier of the changes that have occurred. Previously issued and signed receipts lose their validity and are cancelled.

“Name of the consumer and his registration address.” This includes the business name and full address. Based on this data, the supplier issues the property.

“Name of the payer and its registration address” - the name of the private enterprise that will pay for the services of transferring one or another type of property.

“Personal account number and bank name” – the name of the bank branch where the personal account was opened. It is also important to indicate the details of the person for whom the bank account is opened.

“Power of attorney issued” - you need to write what position the authorized person holds, his full name. Property cannot be issued to a person who is not in the service of this organization. If the recipient of the property is a member of the organization’s management, then there is no need for a power of attorney. The manager is still required to comply with certain rules, for example, he must provide a document proving his identity, put a signature that corresponds to the passport and put the seal of the organization. If he transfers his powers to receive property to another person, he undertakes to draw up and transfer a power of attorney or a receipt.

“Passport” means indicating the serial number of the document of the employee who has the authority to receive tangible property.

“Name of supplier” is the name of the enterprise organizing the transfer of tangible property and from which the recipient will receive the specified goods using a receipt.

“Tangible assets or property” - the receipt ensures the transfer of tangible property that the supplier releases on the basis of a previously drawn up power of attorney, contract, along with, invoice, agreement or other document capable of confirming the partnership relationship between the parties. Sometimes the trustee undertakes to receive delivery of property under several agreements. In this case, he must be given one receipt, which will record all the numbers and dates of registration of each of the transfers. This rule applies only when the receipt occurs in one place, and not in different places. In the latter case, the number of receipts will correspond to the number of places where the property will be transferred.

This paragraph also implies a description of the tangible property itself that will be received from the supplier. In some forms, lists of property to be transferred may already be pre-typed. In this case, the necessary elements in the list need to be emphasized.

“Units of measurement” – you must write the amount of property to be transferred. Units of measurement can be calculated in pieces, sets, meters and other forms.

“Quantity in words” - the amount of property in suitable units of measurement must be written in numbers, and then in words in parentheses. This technique is used to avoid unreliable interpretation of one of the entries; in case of doubt, the entry made in words is taken as the truth.

“Signature of the person who received the receipt” - put a signature by an authorized person to whom the organization has given such rights to act in

as a representative.

“Manager and chief accountant” - the lines must contain the signatures of these authorized persons currently occupying the above positions. The signatures must match those indicated in the passport.

If necessary, the deputy manager or chief accountant can sign. A legal entity has the right to authorize any employee to receive property on a receipt by drawing up a power of attorney for him. All rights can be adjusted to the conditions of operation of each organization, at the discretion of its management. In order for the established set of laws to come into force, the management of the organization undertakes to draw up and sign an order. It is important to secure the order both with signatures and with the help of the organization’s personal seal.

“The position held by the recipient of the power of attorney receipt” is the full name of the employee authorized by the power of attorney and the job position that he currently occupies.

“Number, date of the document on the execution of the order” - one of the last columns is filled in when the authorized person has already received the property from the supplier and fulfilled his obligations.

The person who received the receipt for the goods undertakes, within one day after receiving the property, to provide documentation about the work done to the accounting department. If the receipt of property occurs in parts, then the provision of documents about the work done must also be provided each time, no later than one day.

If a receipt was drawn up for an employee, but was not used by him, such a document must be returned, and a person authorized by the organization will mark it “not used.” After this, a document with such a mark will be stored for a year by the party responsible for its storage. After this period, such documents are destroyed, about which a note is also written in the journal.

If the authorized person does not report on the work done upon receipt of the property, a new power of attorney will not be drawn up for him in the future.

Are witnesses needed?

Witnesses are not required to be present when the money is transferred and when the receipt is written. Their presence is an initiative of one of the parties. However, if the lender-borrower relationship progresses to litigation, witness testimony will become an important element of support.

If the lender decides to involve witnesses in the financial transaction, then only uninterested adults can act in their role. Personal data of witnesses (full name, passport data, actual residence address) are written down in the text of the document.

The receipt is signed by witnesses (in this case they act as persons who certify the transaction).

The difference between a promissory note and a cash note

Let's immediately define the concepts:

IOU

a document confirming the existence of a debt under a loan agreement.

Cash receipt

a document confirming the fact of transfer and receipt of money.

Thus, a promissory note implies more than just the transfer of funds. Things, securities and other expensive items can be transferred under this document.

In order to certify the existence of a debt to the borrower, it is necessary to draw up a promissory note. A cash receipt should be drawn up if you need to confirm the transfer of funds as repayment of debt under a loan agreement.

Sample receipt for receiving money for a car

It is quite simple to draw up a receipt for receipt of funds for any property being sold. First, we write who is transferring the money and to whom, the amount is also indicated, and then the subject of the transaction is indicated, it can be an apartment, a car, a plot of land, a garage, a boat, machinery, equipment, etc. it is necessary to indicate brief characteristics of the transferred property and information about the documents on the basis of which the transfer takes place.

Sample receipt for receiving cash for a car (Word)

Possible writing nuances

- The location/city in which the object of purchase is located is indicated as the place of completion.

- In the event of a change of surname in the period between the conclusion of the contract and receipt of money, the new surname is indicated, indicating the old one and the document according to which the change took place.

- If the place of registration changes during the same period, the new place of registration is indicated with the indication “previously registered at the address...” and an indication of the address specified in the agreement.

- In case of payment through a letter of credit, a receipt is not required by law. But if there is a mutual agreement, it can be written. In addition to the required items, it contains information that the money was received in a specific bank account. A receipt is given to the buyer after receiving the money. If he does not agree, the receipt can be written down in the terms of access to the letter of credit or placed in a safe deposit box, from which the buyer can pick it up by presenting an extract from the Unified State Register for the new owner.

- In the case of a sale by power of attorney, all details of the bearer of the power of attorney are indicated and then: “acting under a power of attorney from ... (full name of the buyer or several)”, then it is indicated when, where, by which notary the power of attorney was issued and its number in the register.

- If the sellers include minor children, the blood parent must sign on the receipt not only for himself, but also for the minor child. Even if the seller has three minor children, the mother or father must sign for each child separately.

- When there are several sellers, it is acceptable to write by one of them, but with the obligatory signature of all the others.

- If people are not members of the same family (for example, in a communal apartment), each owner writes a receipt separately for the amount that only he received.

- Any person authorized by a notarized power of attorney or a notary can sign for an owner who does not have the physical ability to sign.

- If the owner is only a minor, a receipt is drawn up and signed for him by his legal representative.

Important little things

To avoid further surprises challenging the authenticity of the receipt, it is written entirely by hand in the presence of the buyer. The correctness of all receipt data is checked. The number is not entered or the number is entered when the registration documents are expected to be received. If the number is not entered, the buyer will subsequently have to enter it in the same paste as the receipt was written.

Corrections are not permitted on the receipt. This is especially true for data in the amount received, last name, first name and patronymic!

This is why transaction receipts are sometimes rewritten several times. But this is extremely important. There should be no additional empty space between the main text and captions in which some information could be entered. When writing, you need to ensure that the signatures do not appear on the back of the receipt separately from the main text. It should go the other way with at least a few words.

Considering that writing a receipt takes a lot of time during a transaction, it is permissible to allow the seller to write the entire text in advance before specifying the amount. It is important that he continues writing the receipt for the transaction with the same paste that he wrote before.

After reading the text of the receipt by both parties, the buyer puts his signature in small handwriting in a corner so that the receipt cannot be forged.

Rules for drawing up a receipt for receiving funds

The legislation does not provide for a clear form of execution of this document. It is recommended to use a written form. A receipt, the text of which is printed on a computer, does not contradict legal norms. However, if in case of untimely repayment of borrowed funds it is necessary to perform a handwriting examination, this will not be possible.

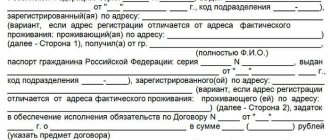

It is advisable to indicate the following information in the text of the receipt:

- Date and place of signing the document.

- Full name of the borrower, his passport details, registration address (if the place of actual residence does not coincide with the place of registration, it is advisable to indicate both addresses), current telephone number.

- Full name, passport and contact details of the person who is borrowing funds.

- Loan amount (indicated in numbers and words to avoid inaccuracies). If the receipt is issued in a foreign currency, you must indicate the current exchange rate, as well as specify the conditions for the return (at what rate, in what currency).

In addition, the text of the receipt should indicate the period and conditions for the return of money.

The interest rate, penalties for late payment, as well as additional debt repayment options should be specified as additional conditions

At the end of the text of the document, the signatures of the parties and witnesses (if they take part in the transaction) must be placed.

The receipt is drawn up in two identical copies . This is necessary to exclude the fact that one of the parties made changes to the text of the document. Each copy is signed by the parties to the transaction.

If the text of the mortgage note is typed electronically, it must be signed by the lender. Both printed copies are hand-signed by the parties (the use of facsimiles is prohibited).

Lending money is a responsible procedure that must be legally formalized. Therefore, before drawing up the text of the receipt, it is recommended that you familiarize yourself with a sample of this document.

It should be noted that the receipt is drawn up only by agreement of all parties to the transaction.

Responsibilities of the chief accountant

The chief accountant of the organization undertakes to fulfill a number of specific requirements, which determines the coherence of work and the accuracy of documents, which means their legal right to exist and the provision of protection of interests.

The responsibilities of an accountant include:

- control over document compliance with established rules;

- supervising used and unclaimed receipts and powers of attorney;

- receipt of receipt documents and statements by receipt, based on the work done.

Property cannot be transferred in several cases, for example:

- the receipt was issued in violation of the rules, it does not contain all the necessary details, or the data is incorrect;

- the document has errors, corrections or blots;

- the period within which the receipt had its legal effect has expired;

- the recipient notified the supplier that the receipt and power of attorney were canceled.

The person authorized to receive goods on receipt is required to provide an acceptable document capable of confirming his identity. An employee of an emergency organization or organization is obliged to compare the passport data with those included in the receipt. It is also important to pay attention to the validity period of the receipt; it may be that the document is already expired. If such a situation occurs, the document will be declared invalid, and the transfer of property on its basis will be impossible.

An employee of the supplier company or his representative receives a receipt upon receipt and transfer of property. If the transfer of goods or other property occurs in parts, then the procedure for drawing up a document with data, details, dates, and other individual information is repeated each time. The receipt is drawn up in two copies, and each of the transaction partners has the opportunity to use a personal copy. The receipt allows you to monitor the fulfillment of obligations by the parties, keep records and clearly see your rights and obligations to each party.

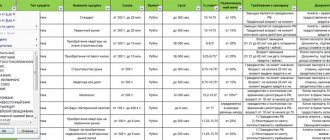

What types of receipts exist?

The following types of receipts exist:

- About borrowing money - relevant in the case of loans to unfamiliar people who do not inspire trust.

- About receiving money under the contract. The main difference: in the text of the document it is necessary to indicate that the purpose of the payment is to repay the debt under the agreement.

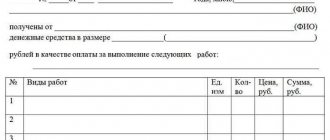

- About receiving an advance for work. The purpose of the loan is to receive an advance payment for work under the contract.

- About receiving wages. The text of the document must indicate for which specific period wages are paid.

- About the safety of property.

- About receiving documents.

Important: the loan receipt is solely an attachment to the loan agreement, which confirms its terms and also certifies the transfer of a sum of money. The loan agreement may include provisions for the accrual of interest for the use of the lender's funds. This item must be written down in the receipt.

A receipt for receipt of money is direct evidence of the transfer of funds. A cash receipt can be substantive or non-substantive.

The text of the subject receipt clearly states the borrower's goals regarding the further sale of funds. A non-objective mortgage does not have a clear wording. It specifies only the size of the loan, the terms and conditions of its repayment.

Regardless of what type of receipt will be issued, it must contain the main points: passport and contact information of the parties, purpose of the loan, amount, currency, conditions and repayment period of the debt.

Errors when drawing up a document

Making a receipt for receiving funds is quite simple. Many citizens use ready-made document samples. However, not all samples provided on the Internet exactly correspond to the legal requirements for drawing up a loan agreement. Most of the participants in the transaction make mistakes, which in the future may cause the borrower to fail to repay the debt.

Errors that affect the legitimacy of a document include:

- Inaccurate or incomplete data of the parties to the transaction.

- The loan amount is not written in block letters.

- There is no exact deadline for repayment of borrowed funds.

- Presence of blots and errors in personal data.

Unfortunately, the legal side of issuing a receipt is only the tip of the iceberg. Few people pay attention to the ethical and moral side of the process of fulfilling the terms of the contract.

Transferring the loan amount to the bank account of a relative of the lender is the most common mistake of the borrower. The text of the receipt should always indicate the bank details to which transfers will be made to repay the debt (only relevant in case of non-cash payments). If the lender asks the borrower to transfer money to an account that is not related to previous agreements, you should not comply with his requests - in most cases this is fraud.

Lenders unwittingly make a mistake that casts doubt on the fact of further debt collection from the borrower in court. Paragraph 1 of Article 807 of the Civil Code of the Russian Federation states that the loan agreement is considered concluded from the moment the money is transferred. This means that if, during a non-cash transfer of funds, the lender does not indicate the purpose of payment, the loan agreement may be considered not concluded.

You should not take the borrower’s word for it; always check his passport details, because they are his personal identifier.

Witnesses when calculating the deposit

The transfer of funds can take place in front of witnesses, which reduces the risk of challenging it. More often than not, the buyer is interested in this. The receipt must contain information that the process took place in the presence of witnesses and their personal data in strict accordance with personal documents.

To confirm the fact of transfer of money, two witnesses who have an opinion independent of the participants in the transaction are sufficient. Their presence is indicated in the receipt and certified by personal signatures with a transcript.

Sample deposit for an apartment

How to apply for debt repayment by receipt

It is not enough to simply place the money in the hands of the lender or transfer it to the agreed upon bank account. All actions of the parties must be documented.

When the debt is fully repaid, a corresponding receipt is drawn up, the author of which is the so-called creditor.

The document contains the following information:

- Passport and contact details of the parties to the transaction.

- Loan amount (in numbers and words).

- Date and amount of debt repaid.

- Purpose of debt.

The text must include a phrase stating that the debt has been repaid in full within the agreed time frame. The lender also informs in writing that it has no claims against the borrower.

At the request of the parties, the receipt for the return of funds can be certified by independent witnesses.

How to apply correctly? – instructions

A sample receipt for financial responsibility can be downloaded, but it is better to write everything by hand. To write a confirmation paper, the consumer should take a standard sheet of paper and a blue pen, indicate the name of the document, gradually entering the following information there:

- passport data of the parties to the relationship (if this is a working version of the receipt, then the employee needs to write information indicating his position, initials, surname);

- indication of the place of residence of the parties to the agreement;

- describe the transferred tangible property in detail;

- indicate what date and year the transfer was made, when the return of the material thing should be carried out (the period is set in digital value and in capital letters;

- The signature of the party who assumes the responsibilities is affixed.

The receipt of the financially responsible person before the inventory, the sample is almost the same as the previous version, only in this case, additional information about the enterprise and the initials of the authorized person receiving the paper are entered.

It should be noted that the form of the drawn up paper can be arbitrary, but such agreements must contain all the important nuances of the transaction and nothing can be omitted.

Document form

What to do if the debtor refuses to pay money

There are cases when the borrower, due to circumstances or his own reluctance, refuses to return the funds. In this situation, the lender has the right to go to court.

You must provide the court with a statement of claim, a passport or other document confirming your identity, as well as a receipt for receipt of funds.

There are two types of legal proceedings for the return of funds: easy (the borrower agrees with the debt and admits that he is unable to fulfill his obligations in a timely manner) and complex (the defendant does not recognize the debt, refuses his obligations and denies signing a receipt for receipt of funds) .

- In the first case, the court will be on the side of the plaintiff. In this situation, the lender can independently (without involving a lawyer) cope with all the complexities of the legal process.

- In the second case, it is better to seek the help of a lawyer. If the receipt was made in writing, the court will order a handwriting examination. All additional financial costs will be borne by the plaintiff. However, if the court makes a positive decision, the defendant will have to cover all costs.

You can get legal assistance on issues of drawing up a receipt for receipt of funds on our website.

Mandatory information on the receipt

Nominally, the buyer can contact the seller to request written confirmation of the transfer of money at any time. But in practice, it is better that this document is drawn up and presented to the buyer at the time of payment. This will be the most reliable insurance. First of all, the receipt will help the buyer protect his rights in the event of litigation.

In general, the structure of a receipt for receipt of funds for a land plot is similar to other similar documents in the procedures for the purchase and sale of real estate. However, it is important to remember that the land plot needs to be described in a little more detail than an apartment, dacha or house, especially in the absence of clearly verified boundaries (which is common due to numerous errors by cadastral service employees).

Mandatory components of the document content:

- Full name: “Receipt for receipt of funds for the land plot.”

- Date and place of compilation.

- Passport details of the parties to the real estate purchase and sale transaction: full name;

- citizenship;

- registration;

- civil status;

- passport ID;

- contact information (mobile phone number, residential address, email address).

- address of the house and buildings;

In the event that the documents for the property being sold are old, it is better to carry out the procedure for selling the land after the next measurement and amendment by the cadastral chamber. To do this, a cadastral engineer must come and measure the territory.

Popular questions about the article

✅ When do I require a receipt for receipt of funds for a land plot?

The buyer may require the seller to issue a receipt for the transfer of money at any time. But in practice, it is better that this document is drawn up and presented to the buyer at the time of payment. This will be the most reliable insurance.

✅ Why do you need a receipt?

The receipt will help the buyer protect his rights in the event of litigation.

✅ What information does a receipt for receiving money for a land plot contain?

The receipt contains the following information:

- Name of the document, date and place of preparation;

- Passport details of the parties to the transaction;

- Technical characteristics of the land plot - address, area, cadastral number;

- Seller's signature confirming receipt of money.

✅ Is it worth involving witnesses when drawing up a receipt?

The presence of witnesses when drawing up a receipt for the transfer of money is not necessary, but is acceptable. They can even put their signatures, provided that they are not relatives of the previous owner of the land.

✅ Is it necessary to have a document certified by a notary?

A receipt for receipt of money for a land plot does not require mandatory notarization. However, if large amounts are involved, it is recommended to have the document certified. The notary will also check the authenticity of the banknotes.