The sale of seized property by bailiffs is a completely common process. It does not raise any special questions among citizens. More precisely, when faced with the sale of confiscated or seized property, no one will worry too much. This process has its own procedure, as well as conditions and rules. All this is extremely important, moreover, it is all enshrined in law. Let's try to figure out exactly how bailiffs can sell this or that property that has been seized from the owner. What should you prepare for when dealing with this process?

Everything is according to the law

Let's start with the fact that the procedure for the sale of seized property by bailiffs is regulated by law. Moreover, there is a special article in Russian legislation that regulates the rules for the sale of seized property. The rules are attributed to the law “On Enforcement Proceedings”. We will need Article 87.

Here you can see many features prescribed for each type of property. It is important that, according to the laws, the debtor in some cases has the opportunity to independently implement it. For this, the “cost” of the process should not exceed 30,000 rubles; there is no dispute regarding this figure. The phenomenon is very rare. Otherwise, the seized property will be sold by bailiffs.

How they work

But what kind of process is this? What should you expect? How exactly will everything happen? A lot of questions arise regarding our topic today.

Everything here is extremely simple and easy if you understand it well. The procedure for selling property that has been seized or seized by a court is called a sale. That is, bailiffs and authorized bodies will conduct transactions for the purchase and sale of property by citizens. This process no longer arouses any suspicion or fear in anyone. After all, the system has been known to everyone for a long time. Moreover, citizens quite often turn to purchasing property confiscated or seized by the court. Especially when it comes to real estate. Why? More on this a little later. First you need to find out how the sale of seized property occurs. After all, everything has its own limitations and deadlines.

What does a buyer need to do to participate in the auction?

In order to win the bankruptcy auction, the buyer must complete a number of necessary procedures regarding registration on the electronic platform. To participate in the auction, a person is required to make a deposit, the amount of which is determined by the bankruptcy manager.

The deposit amount is transferred to the organizer’s bank details and is a kind of guarantee that the winner will buy the lot.

The regulations for conducting electronic bidding for the sale of property (enterprise) of debtors during the procedures applied in a bankruptcy case on an electronic platform are posted on the websites of electronic platforms on the Internet. The auctions are held in accordance with the order of the Ministry of Economic Development of the Russian Federation dated July 23, 2015 No. 495 “Conducting electronic auctions for the sale of property or enterprise of debtors during the procedures applied in bankruptcy cases” (hereinafter referred to as Order No. 495).

Important!

First of all, when working in an electronic system, the buyer must have an electronic signature. Registration of an electronic signature for participation in auctions is a paid procedure, its cost is about 5,000 - 6,000 rubles.

The buyer then needs to go through the registration process. Registration on the electronic platform is carried out, as a rule, without charging a fee.

Registering a buyer in the system consists of several steps that must be completed before starting to work on the electronic platform.

1 step. Account creation and user activation.

The buyer must read the text of the Regulations and accept its terms. The Regulations are an agreement of adhesion between the applicant organization and the Site Operator in accordance with Article 428 of the Civil Code of the Russian Federation. An email with a confirmation code will be sent to the email address provided by the buyer, which must be entered on the email address confirmation page.

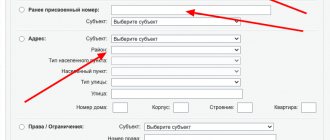

Step 2. Entering information about the counterparty.

After activation, the buyer must enter information about the counterparty on whose behalf this user will work in the system. That is, either a company, an individual entrepreneur, or an individual who plans to purchase property is indicated.

This information will be used in the future to create documents (forms) sent to the future buyer.

Step 3. Providing documents confirming the entered information.

To register on the electronic platform, the buyer submits an application for registration with the following documents and information attached:

- an extract or copy of an extract from the Unified State Register of Legal Entities (for legal entities), from the Unified State Register of Individual Entrepreneurs (for individual entrepreneurs), issued no earlier than thirty days before the date of submission of the application for registration;

- copies of constituent documents (for legal entities), copies of identity documents (for individuals who are applicants for registration on an electronic platform or representatives of applicants, including heads of legal entities that are applicants for registration on an electronic platform);

- information about TIN (for legal entities and individuals);

- information about the OGRN (OGRNIP) (for legal entities and individuals who are individual entrepreneurs), information about the insurance number of an individual personal account (for individuals who are not individual entrepreneurs);

- copies of a duly certified translation into Russian of documents issued in accordance with the legislation of the relevant state on state registration of a legal entity (for foreign legal entities), state registration of an individual as an individual entrepreneur and (or) identification documents of an individual (for foreign individuals);

- copies of documents confirming the authority of the applicant’s manager to register on the electronic platform (for legal entities) or the authority of another person to carry out actions on behalf of such an applicant (for legal entities and individuals);

- email addresses, telephone numbers in the Russian Federation and postal addresses in the Russian Federation of the applicant for registration on the electronic platform.

The specified application and the documents and information attached to it must be submitted in the form of an electronic message signed with an electronic signature.

These are the formalities that the buyer must complete in order to gain access to the auction.

However, the buyer must first check the desired object of purchase before the start of the auction. That is, inspect the object of sale, as well as familiarize yourself with the requirements for bidders in the notice of bidding.

Second chance

There is no need to rush into implementation. This process begins with the fact that a citizen’s property is confiscated for one reason or another. Bailiffs notify a person about his debt and send him the relevant documents that indicate the seizure of property. This process is perhaps the most important. After all, no one can just come and take away property. Everyone by law must be given a chance.

For what? To pay off debt. After all, the process of selling seized property by bailiffs begins when a citizen has a serious debt. This is exactly what practice shows. At the same time, the repayment period is also clearly established. A citizen has the right to cancel the debt within 30 days after notification of confiscation. If no action is taken, you can say goodbye to your property. It will be seized and then transferred for sale by bailiffs.

Grounds for arrest

The right of ownership of movable and immovable property may be limited only on the grounds expressly provided for by law. The possibility of forced alienation of assets belonging to citizens and legal entities is provided for by the provisions of Federal Law No. 127-FZ “On Bankruptcy” and Federal Law No. 229-FZ “On Enforcement Proceedings”.

The procedure and conditions for the sale of property have various bases:

- in case of bankruptcy of citizens or enterprises, the identification of property assets is carried out by the arbitration manager on the basis of a court order to initiate bankruptcy proceedings;

- In enforcement proceedings, FSSP officials are required to use their powers to search and sell property on the basis of a judicial act and an application from the claimant.

In the process of declaring the debtor's insolvency, the financial manager does not seize the property, since the prohibition on disposal is enshrined in law. For enforcement proceedings, a different procedure is applied - the disposal of property is limited by seizure in accordance with the order of the bailiff.

The sale of seized property in both cases will follow similar rules - the procedure and conditions for determining the initial price of the debtor's assets are of particular importance.

Grade

The first and very important stage that must be carried out before the sale begins is the assessment of the seized property. You can't do without it. By the way, you will have to invite an appraiser for this. He will quickly be able to establish the real value of the property at which he will have to sell it.

Everything is assessed: securities, real estate, and jewelry. True, most likely, the cost of these goods will unpleasantly surprise you. Practice shows that seized property is usually not valued too highly. Even if in reality it is of particular value.

What is needed for the sale of property by bailiffs to take place? The procedure, as we have already found out, begins with a property assessment. So, the citizen was sent a notice of seizure of property, 30 days have passed, and the debt has not been repaid. Now you need to evaluate the property and put it up for sale as soon as possible. The appraiser's call will have to be completed within one month. An inventory of property by bailiffs without an assessment is considered invalid.

At what price will this or that price be set? If the property does not have any special features, then its market value will be taken. After the bailiff receives the results, the actual implementation can begin. There is really nothing difficult about this. Especially for buyers.

How they sell

The sale of seized property by bailiffs, as we have already found out, occurs through the sale of property. This is a fairly common case. What has been seized is simply put up for sale by the bailiffs for a certain period, at the prices given by the appraiser.

True, there is one peculiarity here. The thing is that the sale of confiscated property by bailiffs, when it exceeds the value of 500,000 rubles, occurs through an auction. At the same time, it is worth paying attention to the fact that most often this process applies to real estate - apartments, houses, land plots. It turns out that the auction is the main way of implementation.

The seized property is put up for sale by the bailiff using special official resources. And the process is completely controlled by the authorities. That is, it is almost impossible to find seized property on some amateur sales site (for example, Avito). You will still be redirected to a special database that relates to a particular court in Russia.

Procedure and deadlines for implementation

The conditions for the sale of property seized by a bailiff during enforcement proceedings are regulated by Federal Law No. 229-FZ.

Where does property go after arrest? From the moment of seizure of things, objects and objects, the owner loses the right to freely dispose of them without the consent of FSSP officials. In this case, until the moment of actual sale, the property may be transferred for safekeeping to the debtor with the right of limited use.

The procedure for selling the debtor's assets consists of the following stages:

- issuing a seizure order;

- sending the debtor a notice of the upcoming seizure of items for sale at auction or through direct sale - the document is drawn up 30 days before the date of the announced auction so that the debtor has the opportunity to repay the debt;

- valuation of property to be sold;

- sale without an auction - if its value is less than 500,000 rubles;

- appointment and holding of a specialized auction - if the valuation exceeds 500,000 rubles.

How is the sale value of seized property determined? The determination of the price in an out-of-court procedure is carried out by bailiffs in relation to the assets seized by them. To do this, FSSP officials use an inventory of assets compiled during the seizure process. Based on the inventory, an agreement is concluded with a professional independent appraiser, who uses various assessment methods to prepare a final report.

Determination of the sale price in court occurs as a result of foreclosure on the mortgaged property. In this case, FSSP employees apply the assessment indicators recorded in the judicial act and writ of execution. If there is no such value indicator, the bailiffs are obliged to send the collector a notice of the need to go to court to establish the sale price.

In order to buy property seized and transferred for sale from bailiffs, it is necessary to monitor public notices of the FSSP service, which they are required to post on the website fssprus.ru/torgi. Sales without auctions are carried out under the control of the state, and the transaction price will be the estimated indicator recorded in the appraiser's report.

Deadlines

We will pay special attention to the duration of our action today. The deadlines for the sale of seized property by bailiffs are clearly established. They are not too big. How much is given for this process? Minus the notification of the owner, as well as the assessment, there are only 2 months left for bidding and auctions.

What happens if you don’t meet this time period? It's OK. It’s just that unsold property will begin to fall in price. Every 2 months of delay reduces the value of the property by 15%. It turns out that the longer they don’t buy, the lower the price will be in the end.

If we talk about holding auctions, the bailiffs on the Roismuschestvo website post possible product options, as well as the timing of the process. If by that time a certain number of participants is not recruited, the auction is considered failed. This means that now the property will be put up for a second process, but this time at a 15% price reduction. The price tag is reduced until a successful transaction takes place. There are no restrictions in this regard.

After the auction or purchase and sale transaction has taken place, the bailiff draws up a corresponding act. It must contain all information about the product. This procedure does not cause any problems, because citizens are not directly involved in it. All the buyer needs to know is simply information about what he is purchasing. It is mandatory to notify him of the features of the property. More precisely, to report that this is seized property. Some still don't trust such deals.

Responsibilities of the seller and auction organizer

An auction is a competitive form of sale of property assets, in which the buyer is determined based on the highest price offer. In the process of enforcement proceedings, the seller will be the FSSP service, which is entrusted with the following responsibilities:

- determining the organizer of the auction and the form of the auction (by conducting it in person or using a specialized electronic platform);

- concluding an agreement with the auction organizers and determining the auction commission;

- evaluation of the auction item and determination of the starting price of each object;

- determining the minimum auction step by which participants in the bidding procedure will make subsequent offers;

- conclusion of an agreement with the winner of a public auction.

The auction is carried out on the principles of openness and accessibility; any interested person has the right to participate. At the registration stage, participants are required to make a deposit, the amount of which is determined by the seller.

Conducting auctions is the responsibility of the organizer. The organizer of the auction can be a specialized enterprise or individual entrepreneur who has a permit. The responsibilities of the organizer, after concluding an agreement with the seller, will include:

- publishing notices of auctions and attracting potential buyers;

- accepting applications from participants and conducting bidding procedures, including on specialized electronic resources;

- summing up the results of the auction procedure and transferring information about the winners of the auction to the seller.

Since the auction can be held for each specific item or object from the total amount of seized property, several winners can be determined at the auction. A purchase and sale agreement will be concluded with each of them.

After completion of the bidding procedure, the proceeds are transferred by the bailiffs to pay off the debt under the writ of execution. If, after full repayment of debts, there are free funds remaining, they are subject to transfer to the debtor.

It's not always possible

The procedure for the sale of seized property by bailiffs is simple. As you can see, there is nothing special about this. Only drawing up numerous acts, reports and notifications. But there are some limitations here.

For example, you cannot seize property that has been pledged. In addition, this restriction applies when the amount of debt does not exceed 3,000 rubles. The phenomenon is rare, but it does occur. It turns out that it is not always possible and not in all cases to make an arrest. As a result, implementation is also not carried out.

For the collector

That's not all. If we rely on the data described in the laws of the Russian Federation, then if there is no sale of property within a month, bailiffs send a notice to the claimant with an offer to keep this property. Or rather, buy it back.

Here the citizen is not limited by anything. He must forward his response to the relevant authorities. You are given 5 days to think about it. This is precisely the period established by law. If the claimant agrees to keep the seized property, the redemption occurs at a discount. Which one? You need to subtract 25% from the indicated market value. It is at this price that claimants have the right to buy the property.

If no response was received or the citizen issued a refusal, the auction does not continue immediately. Instead, the right to return the property is transferred to the debtor. In this case, you will have to pay off the debt and also buy back your property. In practice, this phenomenon occurs extremely rarely. After all, conversations with debtors are usually short.

The procedure for the sale of seized property by a bailiff

The sale of the debtor's property in enforcement proceedings is a rather complex process consisting of several stages. In this article we will try to understand how the bailiff sells the seized property, what is guided by it and who else, besides him, is involved in this process.

The sale of the debtor's seized property is carried out in accordance with the general provisions of the Federal Law “On Enforcement Proceedings”, taking into account the joint Order of the Federal Bailiff Service (FSSP of Russia) No. 347, the Federal Agency for State Property Management No. 149 of July 25, 2008. The order establishes the procedure for interaction between the Federal Bailiff Service and the Federal Agency for State Property Management (Rosimushchestvo) regarding the organization of the sale of property seized in pursuance of court decisions or acts of bodies that have the right to make decisions on foreclosure on property.

The sale of the debtor's seized property occurs through its sale by the Federal Property Management Agency, represented by its territorial bodies and individuals and legal entities (specialized organizations) selected by it on a competitive basis. The process of selling such property begins with the bailiff making a decision to transfer the debtor's property for sale. Before the transfer of property, it must be assessed at market prices in accordance with Article 85 of the Federal Law “On Enforcement Proceedings” - independently or with the involvement of an appraiser. The services of an appraiser are required in cases where real estate, securities not traded on the organized securities market (except for investment units of open-end and interval mutual investment funds), property rights (except for receivables not sold at auction), precious metals and stones, products made from them, scrap of such products, collectible banknotes in rubles and foreign currency, items of historical or artistic value, an item whose preliminary value exceeds thirty thousand rubles. Also, the bailiff is obliged to involve an appraiser if the claimant does not agree with the assessment made by the bailiff independently.

The seized property must be transferred by a bailiff within ten days from the date of its assessment and is considered transferred from the date of signing the transfer and acceptance certificate.

The resolution on the transfer of the debtor's property for sale and the notification of readiness for such sale are sent by the bailiff to the Federal Property Management Agency, which, within five working days after the date of receipt of the listed documents, makes a decision on the independent sale of the seized property or on the involvement of specialized organizations for these purposes. The Federal Property Management Agency notifies the territorial body of the Federal Bailiff Service of its decision in writing.

Property is sold on a commission basis or at auction. No less than thirty days before the date of the auction, the Federal Property Management Agency or specialized organizations attracted by it must publish a notice in the print media, including those distributed at the location of the property being sold, and public information and telecommunication networks (the Internet). Within seven days, the Federal Property Management Agency or specialized organizations provide the territorial body of the Federal Bailiff Service in writing with a link to the website and print media in which the notice was published. The territorial body of the Federal Bailiff Service of Russia, in turn, posts this information on its official website.

The total period within which the seized property must be sold is two months from the date of its transfer. If the debtor's property has not been sold within one month from the date of its transfer on a commission basis or if the first auction is declared invalid, the Federal Property Management Agency or specialized organizations notify the bailiff, who issues a decision to reduce the price by fifteen percent. When the debtor's property has not been sold within one month after the price reduction, the bailiff sends the claimant an offer to keep this property.

If the claimant refuses to relinquish the debtor's property or does not receive notification from him of the decision to retain the unrealized property, the property is offered to other claimants. If there are none or there is no decision on their part to keep the unrealized property, it is returned to the debtor.

The date of completion of the process of sale of seized property is the date of transfer of funds to the appropriate account of the department of the territorial body of the Federal Bailiff Service, or the date of the act of acceptance and transfer (return) of the property, or, if the property is recalled and was not transferred for sale, the date of the decision on the revocation seized property from sale.

Thus, the sale of the debtor’s seized property is carried out in the manner and within the time limits established by law with the participation of not only the bailiff service, but also the Federal Agency for State Property Management, as well as specialized organizations.

In reality, the model for the sale of the debtor’s property is far from the ideal one prescribed by law. Often, the claimant has to take additional measures to quickly solve problems related to the sale of property, contact professional lawyers who, thanks to their experience and knowledge, organize and control the process of transferring property from the debtor and the process of its sale.

Kabanova Anastasia

Center for Legal Technologies "YURKOM"

Is it worth it

In principle, the procedure for selling seized property by bailiffs is clear. It is extremely simple. A notice is sent to the debtor, then he is given a month to close the debt. If this does not happen, then an inventory of the property will be carried out with the mandatory participation of an appraiser. Of course, this process involves drawing up an appropriate act. Next, the product is put up for sale, most often at auction. It is possible to reduce the value by 15% if the property is not sold within the time limits established by law. And so again and again. Nothing difficult.

But some buyers have a question: is it worth getting involved with the purchase of seized property? After all, some are afraid of deception and problems. Experience shows that there is no reason to be afraid. Moreover, at auctions you can often buy someone's property (especially real estate) at affordable prices. If you are used to being careful, ask the bailiffs for complete information about what you are going to buy. They must explain to you why the property was seized.

Enforcement proceedings for foreclosure

The law firm ZASCHITA quite often carries out orders for conducting enforcement proceedings . The most difficult is enforcement proceedings , during which it is necessary to foreclose on the mortgaged property under a mortgage agreement. A mortgage is a security against real estate. If the debtor took out a loan and mortgaged his apartment, the one who gave the loan has the right of mortgage (mortgage of real estate). If the debtor does not pay, the creditor can foreclose on the mortgaged property. at what the process of foreclosure on mortgaged property is in this article.

To begin with, let us outline the final goals of enforcement proceedings to foreclose on mortgaged property . Enforcement proceedings in this case can end in two ways:

1. The investor holds in his hands an extract from the Unified State Register of Real Estate on the state registration of the right to the subject of mortgage.

2. The investor holds in his hands the money received from the sale of the mortgaged property.

These are the goals of the work. Let's consider all the stages of achieving them.

Submitting a writ of execution

As a general rule, a writ of execution must be filed at the place of residence of the debtor. In most cases, it coincides with the subject of the mortgage. However, a situation is possible in which the subject of the mortgage is located in one area, and the place of residence of the debtor is in another. In this case, it should be submitted at the location of the subject of the mortgage, adding to the application a reference to clause 1 of Art. 33 of the Federal Law on Enforcement Proceedings, according to which “if the debtor is a citizen, then enforcement actions are carried out and enforcement measures are applied by the bailiff at his place of residence, place of stay or location of his property.”

Having determined the district department of the FSSP, you should prepare an application for acceptance of the writ of execution for enforcement.

The application must indicate

— Name of the district bailiff department

— Full name of the claimant and his address

— Full name of the debtor and his address

— Please accept the writ of execution and initiate enforcement proceedings

— Details of the writ of execution

— If the debtor has paid any amounts after the court decision, an indication of the fact of payment

— Bank details of the claimant

— Request to impose a temporary restriction on the debtor’s departure from the Russian Federation

— Request to seize the debtor’s property, indicating the subject of the mortgage. The attachment to this application must include

— Original writ of execution a (a copy must remain in our case files) — Copy of loan agreements — Copy of mortgage agreement

— A copy of the court decision or ruling

— A copy of the representative’s power of attorney (show the original upon submission)

This application for acceptance of the writ of execution for enforcement must be submitted in two copies. One must be handed over to the FSSP department. On the second, the office puts a mark of acceptance. This ends this stage.

Initiation of enforcement proceedings

After 5-7 working days from the date of filing the application, you must go to the office during the bailiff’s office hours and find out which bailiff your case has been transferred to. If it has not yet been transferred, clarify the transfer deadlines. If transferred, you should immediately go to an appointment with a bailiff and receive a decision to initiate enforcement proceedings .

First communication with the bailiff

During your first conversation, you should do the following:

— Check the direction of requests for property availability. Interested in Rosreestr, State Traffic Safety Inspectorate, Federal Tax Service regarding salaries, Pension Fund, if there is evidence that the debtor receives a pension.

— Check the direction of the request for voluntary execution of the court decision.

— Offer assistance in terms of providing transport, preparing documents, providing security and witnesses.

- Offer to include the request for receiving F7 and F9, as well as to deliver a response to this request (if it is possible to obtain F7 and F9 on your own, these documents should already be submitted by the first communication with the bailiff).

— Indicate that you are ready to provide a custodian for the seized property.

— Propose and agree on a plan for further action.

The first communication should end with an agreement on the next step. The next step should be to receive a response from Rosreestr about the debtor’s rights to real estate, as well as a request for F7 and F9 (if it is impossible to obtain independently).

Receiving a response from Rosreestr

The bailiff must send a request to Rosreestr to obtain information about the existence of the debtor's registered rights to real estate. A response must be received from Rosreestr indicating real estate objects and registered encumbrances, in particular mortgages. Next, you should negotiate with the bailiff about the inventory and seizure of the mortgaged property.

Obtaining F7 and F9 (if it is impossible to obtain independently)

The issue of obtaining Form 7 and Form 9 for the mortgage should be resolved with the bailiff. It is necessary to invite the bailiff to issue the corresponding request in hand and immediately receive these documents from the settlement and registration department at the location of the subject of the mortgage. If the bailiff indicated that he will do this himself, it is necessary to clarify the deadlines for completion.

Inventory and seizure of pledged property

At this stage, it is necessary to obtain agreement from the bailiff on the shortest possible time for drawing up the inventory and arrest. It is advisable to carry out this event without actually visiting the debtor’s site. If it is necessary to leave, the bailiff should be provided with the presence of witnesses and transport. The end of this stage is the receipt of an act of seizure (inventory of property).

Conclusion of a storage agreement free of charge

During subsequent meetings with the bailiff, it is necessary to indicate that we have a person who is ready to enter into an agreement for the storage of mortgaged property free of charge and to act as a custodian. The bailiff should provide the custodian’s passport details and clarify when he will be able to send them to the main department. The bailiff must send the custodian's data and information about the subject of the mortgage to the Main Directorate of the FSSP at the address: st. Bolshaya Morskaya, no. 59. (for the Leningrad Region Bolshoy pr. V.O., no. 80, lit. B). A specific employee is responsible for drawing up the storage agreement. 3 days after the district bailiff sends the data to the Main Directorate, it is necessary for our custodian to call a specific employee and coordinate the time of arrival to sign the storage agreement. The mortgage collector's representative must review the execution of the custodian's custody agreement.

Transfer of seized property to auction

It is necessary to obtain a resolution from the bailiff to transfer the seized property for auction, which is addressed to the FAUGI Territorial Administration of the Federal Property Management Agency in the Leningrad Region. A bid application must also be submitted. These documents must be sent to the Main Directorate. It is necessary to check the fact that the case was sent from the district department of the FSSP, since the issuance of a decision does not yet mean the actual transfer of the case. From the main department of the FSSP, the case should be sent to the Federal Property Management Agency. The result is a notification that the seized property is ready for sale.

Preparation of tenders

The Federal Property Management Agency must transfer the object for bidding to one of the commercial organizations. The result is the issuance of an Order for the provision of services for the sale of seized property at auction. Next, the selected commercial organization must publish a message about the auction on the website https://fssprus.ru/torgi/. Bidding information must be checked at least once every two weeks. The search is best done using the original sale price of the mortgaged property. When information about the date of the auction becomes available, the director and investor should be notified.

Bidding

After the end of the primary or secondary trading date, you should check their results on the website https://fssprus.ru/torgi/. If the information does not appear on the website for more than a week, it is necessary to visit the district bailiff to obtain information. As a rule, the first auction is considered invalid. In this case, it is necessary to track the date of secondary trading. Repeated auctions may also be declared invalid. However, they can happen. Let's consider options in both cases.

The auction took place. Receiving funds

In this case, you need to make sure that the bailiff has the details of the collector to send funds. However, it should be understood that after the buyer pays money to the auction organizer, these funds go to the accounting department of the Federal Bailiff Service. It may take about one month until the proceeds are transferred to the claimant. You should track the receipt of money into the creditor's account. If necessary, arrange access to the bailiff leading the enforcement proceedings .

The auction did not take place. Leaving property behind

If the repeated auction for the sale of the pledged property does not take place, it is extremely important to timely declare your consent to retain the property in the manner provided for in clause 4. Art. 58 Federal Law “On mortgage (real estate pledge)”. According to the norm of this law, the claimant-mortgagee may choose to acquire ownership of the mortgaged property. The price in this case will be determined by the formula: the price of real estate at the first auction - 25%. That is, if at the first auction the apartment was offered at a price of 4,000,000 rubles. At the second auction, the price is reduced by 15% (in this case, the price at the repeated auction will be RUB 3,400,000). And if the re-tender does not take place, the price at which the property can be retained will in this example be 3,000,000 rubles. At the same time, the claimant-mortgagor can use the offset to purchase this real estate. That is, if by the end of the repeated auction the total amount of the debtor’s debt (including all interest, fines, expenses) exceeded the amount of the initial sale price minus 25%, then the debtor does not need to pay anything through the bailiff service. You can simply declare that you retain the property, and the debtor will still owe the difference between the total amount of debt and the price of retaining the property. If the amount of the total debt is lower than the price of abandonment of the property by the mortgagee-collector, then the debtor will have to pay the difference between the price of abandonment and the total amount of the debt. When conducting enforcement proceedings to foreclose on the pledged property, it is necessary to calculate in advance what the amount of debt of the mortgagor-debtor will be by the end of the repeated auction. Ideally, the amount owed should be greater than the price of reserving. In this case, no additional payments will be required. When retaining mortgaged real estate, it is extremely important to comply with the deadlines established by law. In accordance with paragraph 5 of Art. 58 of the Federal Law “On Mortgage (Pledge of Real Estate)”, the claimant can retain the pledged property only within one month from the moment the repeated public auction is declared invalid. If this deadline is missed, the pledge of real estate is terminated. In fact, this will mean the impossibility of collecting the debt. In this case, it is extremely important to receive a notification from the bailiff as soon as possible after the repeated auction with a proposal to retain the property that was not sold at the auction. After receiving this document, you should immediately send to the bailiff and the auction organizer an application to reserve the mortgaged real estate. Also, the bailiff must submit a calculation of the debt of the debtor-mortgagor on the date of leaving the property behind. This is especially true if the writ of execution indicates an open amount of interest and penalties.

The text of the application to reserve the pledged property may be as follows:

STATEMENT

On the retention of the debtor’s property that was not sold during the execution of the writ of execution.

Based on the claim of the Claimant... dated 08/06/2015, enforcement proceedings were initiated No. 74835/15/78024-IP dated 08/14/2015, the bailiff was Alexandra Vladimirovna Fedorova. Initiated on the basis of the writ of execution No. FS No. 006079718 dated 08/05/2015, issued by the Primorsky District Court in case No. 2-4283/2015, which entered into force on 07/28/2015, subject of execution: foreclosure on mortgaged property 1/3 share, by selling it at public auction, the sales price upon its sale in the amount of 1,300,000 rubles, in relation to the debtor: ..., ... year of birth, debtor's address: ... St. Petersburg, Russia, 197374, in favor of the claimant: ..., address of the collector: ... St. Petersburg, Russia, 197341.

On 05/12/2016, during enforcement proceedings ... represented by a representative by proxy... Notification dated 05/11/2016 No. 16/4507427 was handed over with a proposal to leave for... the following property: 1/3 share of an apartment at the address:... for 975,000 rubles ., since the specified property was not sold at public auction. For the claimant, this property is of interest and value, based on the above

ASK:

1. Accept the consent of the claimant... to leave the debtor’s property..., within the framework of enforcement proceedings No. 74835/15/78024-IP dated August 14, 2015.

Application:

1. A copy of the representative’s power of attorney.

2. Calculation of debt as of the date of application

This application must be submitted to the bailiff and the executor, putting an acceptance mark on the copy. Similarly, this application must be submitted to the auction organizer. At the same time, submitting an application to retain the unrealized pledged property should be submitted by mail. It is necessary to send registered letters to the auction organizer and the bailiff with acknowledgment of delivery. It is mandatory to draw up an inventory of the postal item and save the receipt for sending the letters.

Receiving from the auction organizer a set of documents for registering ownership of the pledged property

To register ownership of the pledged property, you must obtain the following documents from the auction organizer:

1. An order for the provision of services for the sale of seized property at auction (taken from the auction organizer, such as a power of attorney from Rosimushchestvo);

2. Printout from a periodical about the start of the first auction;

3. Protocol on the first auction;

4. Printout from a periodical about the start of re-tendering;

5. Protocol on re-tendering;

6. Notification of the auction organizer about the retention of the debtor’s property that was not sold during the execution of the writ of execution.

Receiving from the bailiff a set of documents for registering ownership of the mortgaged property

After submitting an application to the bailiff to retain the pledged property, you must agree with him on a day to receive the registration kit. To register ownership of mortgaged real estate that was not sold at the repeated auction, we need the following set of documents from the bailiff:

1. Resolution of the bailiff on the transfer of property for sale;

2. The act of transferring seized property for sale;

3. Resolution of the bailiff to reduce the price of property transferred for sale by 15%;

4. Notification of failed tenders;

5. Act of return of property to bailiffs from the auction organizer;

6. An offer to the claimant of unrealized property to retain the property;

7. Application for retention of the debtor’s property that was not sold during the execution of the writ of execution;

8. Resolution on the abolition of measures banning registration actions in relation to property;

9. Resolution on the transfer of unrealized property of the debtor to the claimant;

10. Resolution to lift the seizure of property by a bailiff;

11. The act of transferring unrealized property to the claimant.

After receiving sets of documents from the bailiff and from the auction organizer, the next stage begins - registration of ownership in Rosreestr for the mortgaged real estate. And we will talk about it in the next article.

Kuznetsov Mikhail Vladimirovich - General Director

LLC "Legal

Agreement

In reality, everything is much simpler than it seems. The sale of seized property by bailiffs is a fairly common process. Moreover, it is in great demand among citizens. This has its own reasons. For example, property value.

However, there is no need to panic if your property is seized. In some cases, bailiffs may accommodate you. That is, when for some reason you were unable to repay the debt and prevent inventory. This rule applies to cases where the property is of particular value to the owner. In such a situation, you can try to come to an agreement. For example, about extending the debt repayment period. This is not entirely legal, but there is such a prospect. So if you are a victim of debt, don't panic. Try to come to an agreement, pay off the debt and regain your property. Or buy it back when the opportunity arises.