Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised September 22, 2021

Reading time 11 minutes

579

Becoming a debtor is not difficult - a wave of layoffs and rising prices are depriving people of the opportunity to pay loans and housing and communal services. Then the creditor wins the court, and the bailiffs begin to collect the debt. We tell you how to negotiate with bailiffs on the payment of debt in installments in order to pay in small installments and preserve property.

Obligations of the debtor

When an individual is served with a resolution to initiate enforcement proceedings, or he receives a notice from State Services, he has only 5 working days to repay the debt on his own.

But not every person has the resources to pay off debts. Execution of a court decision is the job of a bailiff (Bailiff), this civil servant is endowed with broad powers to collect debts. For example, failure to pay according to the writ of execution will result in the SPI introducing restrictions for the debtor:

- for trips abroad;

- for transport management;

- for the use of money in bank accounts - deposits, deposits.

The enforcement action also involves the sale of the defaulter's property in order to cover the obligations.

Is it possible to get an installment plan from the FSSP?

Defaulters are often interested in how to get an installment plan for a writ of execution from bailiffs if it is not possible to pay off the debt amount at once.

It is important to be aware of what is happening. If you do not receive mail, you will learn about the restrictions of the bailiffs when you try to fly abroad or when your car is stopped by traffic police officers. Or from a bank SMS about forced debiting of money from a bank card marked “ID debt.”

FSSP employees monitor the finances of defaulters and their property. Then the bailiff:

- sends documents to the bank to write off money to pay off the debt, and if a salary or pension comes to the card, then up to 50% monthly;

- seizes property - car, apartment, dacha. If a person does not pay, and the debt is commensurate in value, then the bailiff has the right to take and sell the car or real estate (except for the only home).

How not to pay bailiffs by court decisionRelated article

The debtor should act immediately after receiving the decision - ask for an installment plan according to the writ of execution.

In 2021, bailiffs are more loyal, and it is quite possible to reach an agreement so that half of your pension or salary is not written off. Installment plans are provided to citizens on the basis of Resolution of the Plenum of the Supreme Court No. 50 of November 17, 2015, to debtors who have documentary evidence of insolvency. A person needs to prove in court that there are circumstances that do not allow him to repay the debt within the legal time frame.

Security measures for the seller when leaving a receipt for an installment payment

Since the sale of household appliances, cars, digital innovations, real estate and other goods carries greater risk for the seller, it is he who must be aware of the possible risks and options for how he can protect himself.

To begin with, it is worth taking into account the fact that individuals do not have the legal right to sell goods in installments; a receipt in this case is not a guarantee of establishing correctness and fairness in favor of the seller. Of course, this does not mean that if someone decides to sell a TV to a neighbor in installments, he will be condemned for his actions. It is only important to remember that individuals do not have such a legal right, which means that in the event of a dishonest attitude of the buyer, they will be deprived of the protection of legal authorities.

For the installment receipt to be valid and protective for the seller, he must ensure that it displays the following information about the buyer:

- obtain guarantees of the buyer’s solvency;

- sell goods to the buyer where he has his actual place of residence;

- receive a down payment for the product in the amount of 25% of its total cost;

- indicate the amount of the minimum payment;

- fix the deadlines for making each individual payment and repaying the total cost of the goods;

- provide goods for purchase only if its cost does not exceed three months’ salary of the buyer;

- determine the deadline for making payment for goods for six months or a year, and in the case of the sale of a domestically produced vehicle, extend this period to five years.

If the seller changes the schedule for making payments, decides to charge interest or penalties, then these changes should first be discussed with your partner, and only then included in the contents of the receipt upon mutual agreement.

How installment plans are provided - a sample application to the court

To ask for payment of a debt in installments, an individual needs to go to court. The application is submitted to the court that made the decision, or to the district court at the place of execution (in the same area where the bailiffs department is). The debtor himself or the bailiff has the right to ask the court to pay in installments if he sees that the person has nothing to pay. There is no state fee for filing an application.

Sample application to the court for installment payment to the FSSP - 18 KB

- An application to the court for installment payment is drawn up in several copies: for the court, bailiffs, creditor and all interested parties (if there is, for example, a guarantor).

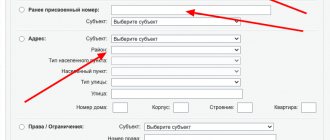

- The header of the document contains the details of the judicial authority, the applicant, information about the court decision and debt.

- The reasons that do not allow you to repay the debt are indicated: illness, presence of dependents and difficult financial situation, dismissal, reduction in income.

All circumstances are documented: attach medical certificates, birth/death certificate, loan agreements, document confirming disability, dismissal order. The legislation allows the involvement of witnesses who are able to confirm the financial problems of the debtor. - A request is indicated to allow the debt to be repaid in feasible payments, as well as the term and terms of the installment plan (number of months, exact amount of the monthly payment). You need to independently develop a schedule of mandatory payments and attach it to the application.

When considering the application, the court will assess the situation and take into account the evidence. After making a decision on installment payment, the bailiffs, when working with an individual, will be guided by the established schedule for repaying obligations. If the debtor follows the court decision, he will not have additional problems with the FSSP.

They arise when payment is received in a smaller amount than the payment amount fixed in the schedule, or when payment terms are violated. Then the bailiffs will be able to re-raise the issue of forced collection of the debt and will go to court to cancel the order on installment payments.

How to protect your property from seizure

To prevent such radical actions on the part of bailiffs as arrest, seizure and sale of property, the debtor should get in touch in a timely manner and maintain contact with the IRS. It is necessary to convince the FSSP of your positive intentions and show your desire to implement the court’s decision with all your might.

For this, lawyers recommend:

- Find out whether it is possible to agree with the creditor on a deferment and partial repayment of the debt. Perhaps the person or organization you owe will agree to work out a schedule and collect the debt slowly but surely.

- Transfer at least small amounts, but regularly, so that the bailiff can see the seriousness of your intentions.

- If there is money in bank accounts, information about it can be transferred to the FSSP to write off debt from them.

A popular question is: what will happen if you pay 100 rubles a week (or a month) according to a writ of execution, and will it be possible to protect property in this way?

Property is seized if the amount recovered exceeds 3,000 rubles. If the debt is less than 3 thousand, then nothing will be seized. With larger debts, the bailiff has the right to seize the property, but is obliged to take into account the principle of proportionality - the object that he is going to sell must be cheaper or equal in value to the amount of the debt. He cannot sell, for example, a dacha worth a million for a microloan debt of 50 thousand rubles. If the amount is significant, for example, 600 thousand rubles, then the bailiff has the right to seize the car, and 100 ruble monthly payments will not help.

Is it possible to reach an agreement with the bailiff and not pay debts?

No you can not. The bailiff has practically no powers to grant official installment plans, except for executive holidays and postponing the action for 10 days. All other issues must be resolved in court, through interaction with the creditor.

When communicating personally with a bailiff or during enforcement actions, the debtor is prohibited from:

- offer a bribe to a FSSP specialist in cash, property, or other benefits;

- use physical force, insult an FSSP employee, threaten him with violence;

- intentionally hide, damage or destroy property that is seized.

All illegal actions will necessarily entail criminal or administrative sanctions. It is better to use legal options for protection in enforcement proceedings, or write off the debt through bankruptcy.

How much should I pay to avoid having my property seized?

Material on the topic

The debtor’s only home - when can he lose it? What is a person’s only home, can he be taken away for debts. How does the court determine that housing is the only one. What kind of real estate cannot be considered the only home. Mortgage for a single residence.

Law No. 229-FZ states that seizure of assets is prohibited for debt amounts up to 3 thousand rubles. If the debt is greater, the FSSP specialist has the right to seize real estate, vehicles, jewelry, and movable property.

Even if you start paying several thousand rubles a month, this will not entail the removal of the arrest. Only full repayment of the debt guarantees that the bailiff will lift the prohibitions and restrictions.

Note that the bailiff can even seize assets that are not subject to sale. For example, the only home of a defaulter cannot be sold unless it is the subject of a mortgage.

But the arrest of such an apartment is allowed, since it is an interim measure. This is done so that the debtor cannot sell the home or re-register it to one of his relatives.

How to ask for a reduction in salary deductions

The duty of FSSP employees is to ensure compliance with the court decision. The faster the better. Having received the writ of execution, the bailiff issues a resolution to begin proceedings on the debt and hands a copy of the resolution to the debtor. If within 5 days the citizen voluntarily fulfills his obligations, the issue will be closed. In the absence of payment, the bailiff will carry out forced collection, for which he will charge an enforcement fee - 7% of the debt amount, but not less than 1000 rubles. This is payment for the work of bailiffs.

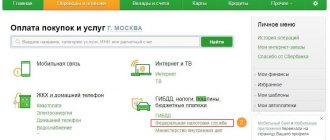

Bailiffs are executors, so it is difficult to negotiate deferments and installments with them - when money appears in the account, the bailiff is obliged to write it off. But if, as a result of deductions from your salary, you are left with less than the subsistence minimum, you can submit a petition to the bailiff to reduce the amount of deductions.

Sample application to the bailiff to reduce the amount of deductions - 15.2 KB

Resolution of December 31, 2021 No. 2406

The cost of living per capita will be 11,653 rubles, for the working population - 12,702 rubles, for children - 11,303 rubles, for pensioners - 10,022 rubles.

Starting from 2021, the cost of living is set for a year at once, and not for a quarter, as it was before. In addition, if previously its value was determined based on calculating the cost of products included in the consumer basket, now it depends on the median per capita income in the country.

Read completely

Source

If you have minor children to support, add a child minimum for each (see sample application). What should be included in the application to reduce the amount of deductions in the FSSP? Documents that will prove your income and expenses:

- 2-NDFL certificate or self-employed income certificate,

- notification of registration with the employment service,

- documents about illness (yours or your loved ones, if you took care leave and therefore did not receive income),

- Form 9 on family composition, birth certificates of children, marriage and divorce.

The bailiff will consider the application and make a decision - for example, to reduce the amount of write-offs, to withhold 25% from the debtor's salary every month.

If he refuses, you can complain to the senior SPI, but it’s easier to ask for an installment plan in court. The court will establish a collection schedule according to which the citizen will receive the minimum wage for himself and his dependents, or even provide a deferment for several months if the person is temporarily unable to pay.

Sample application to the court for a deferred payment to the FSSP - 18 KB

An individual against whom enforcement proceedings have been initiated must take the initiative and explain the situation. After making the payment, it is advisable to contact the bailiff and inform him about the payment. If problems occur that lead to a delay in the transfer of funds, you need to visit the FSSP branch in advance and notify the SPI about this.

Constant control over the progress of enforcement proceedings will allow you to avoid serious restrictions, forced collection of property, and seizure of money in bank accounts.

How can pensioners repay their debts?

Russian legislation was amended No. 215-FZ dated July 20, 2020, which protected pensioners with credit debts of less than 1 million rubles. They were allowed to pay off overdue obligations in installments without fear of the bailiffs blocking accounts and inventory of property.

Citizens who receive a pension for the loss of a breadwinner, disability or old age, the amount of which does not exceed 2 minimum wages, have the right to installment plans. There are also a number of conditions:

- The pensioner has no other source of income other than the monthly payment from the Pension Fund. If a self-employed pensioner who has officially received such status from the tax authority applies for an installment plan, he will be denied.

- The debtor owns only a single dwelling; there are no other residential properties.

- When studying the financial situation of a pensioner, bailiffs will not take into account the amount of existing savings, as well as movable property. The main thing is that his pension does not exceed 2 minimum wages.

- Enforcement proceedings were initiated until 10/01/2020.

Installment plans are assigned for bank loans and borrowings that have already been transferred to bailiffs for collection. If enforcement proceedings have not yet been initiated regarding the obligations, debtors can resolve problems with the bank peacefully. To pay off debt, you can ask for a credit holiday or participate in a restructuring program.

If a pensioner’s loan debt is more than a million rubles, he is not entitled to installment plans. But then he can officially write off the loans through bankruptcy of individuals. This is more profitable, because at the same time you can write off debts on microloans, taxes, housing and communal services, etc.

Bankruptcy of a pensioner in 2021Related article

To receive an installment plan, a pensioner must submit an application to the local FSSP branch. And here the debtor will need knowledge of how to negotiate with bailiffs.

A payment schedule is attached to the application - money will be debited from the pension according to the schedule. The maximum period for which installment plans can be provided does not exceed 2 years, and the law sets the deadline for such concessions - until 07/01/2022. The installment plan issued by the bailiff will be transferred to the bank, and the bank will not be able to involve collectors in the case.

It is quite logical to conclude about the advantages of installment payment, which protects:

- from enforcement of a court decision;

- from blocking accounts;

- from seizure of property (except for property held by third parties or in respect of which appropriate restrictive decisions have already been made);

- from threats and illegal actions of collectors.

Installment plans impose restrictions. A pensioner cannot dispose of personal property (sell a car, for example), or act as a guarantor. There is also a strict requirement to comply with the payment regime in accordance with the schedule. For one delay, the completed installment plan will be canceled and will not be provided again.

Form of the document and its design

When drawing up a receipt, the compiler has the responsibility to specify all the subtleties of the issue and write them down in writing. These features include the following details:

- payment of a partial amount, which will occur in stages;

- the number of payments that the payer plans to make in order to fully cover the purchase amount;

- the time intervals in which the payer will make the payment of each payment;

- established dates on which the buyer undertakes to make both staged payments and the full amount for the purchase;

- the amount of interest, if the seller provides for it under the contract;

- the type of currency in which the seller expects to receive the full amount of payment for the goods provided.

The form of writing a document has a free style and does not have rules defined by law for document execution.

However, in order to correctly draw up a receipt, certain rules must be followed. Such rules relate to maintaining the order of presentation of mandatory information and the necessary data themselves, without which the receipt will lose its legal force.

The receipt must contain correct information from both parties to the agreement. It should display the following information:

- document's name;

- Full name of each person;

- passport details and residence address of both parties;

- the day, month and year when the agreement was drawn up between the parties;

- the amount of money in figures and words to avoid misinterpretation;

- the day, month and year in which the receipt was drawn up;

- At the end, the party who compiled the receipt puts a signature, and next to it there is a transcript to it.

The differences between installment plans and loans are as follows. When it comes to a loan obligation, it should be remembered that in this case there are three parties involved: the buyer, the seller and the credit institution. It turns out that the buyer pays not only for the goods, but also pays for the services of the credit company, as a result of which he is faced with a significant overpayment. When it comes to installments, the buyer deals only with the seller and buys the product for a fixed amount without overpaying for it. However, the seller may impose certain conditions that the buyer undertakes to fulfill.