If a spouse dies, then his husband or wife can take advantage of the property rights that are prescribed by law. They are considered the closest relatives, which gives them the opportunity to inherit certain material objects in the form of an apartment, dacha, car, garage and other things. The question of what rights a spouse has when inheriting in 2022 most often arises when, in addition to the wife or husband, other claimants to the inheritance also claim their rights.

It is advisable to consider the problem of marital rights in inheritance in two aspects. It all depends on the circumstances under which the property previously came into the possession of the deceased. For example, it could have been purchased before the wedding or after it.

The spouse has a share

If there is one, then in addition to the inheritance itself, the spouse can claim rights to half of everything acquired during the marriage. For example, if housing was purchased using joint financial assets, then both spouses have completely similar rights to it. The fact that official documents are issued for only one of them will not matter here.

When deciding on the issue of inheritance rights, the notary will first deal with the registration of the marital share and only after that - the allocation of shares for all heirs.

If you follow the law, then the shares of the spouses are equal, therefore exactly half will be given to the property of the surviving husband or wife. What remains after this allocation will be at the disposal of the heirs. Moreover, the spouse will also participate in this process.

To make the process of distribution of shares clear, it is better to illustrate this with an example.

A middle-aged man died. Some time passed after the funeral when the relatives decided to start filling out the paperwork. This is where a dispute arose about who has more rights. Relatives include his wife, teenage son and elderly parents. The object over which the conflict flared up was a three-room Khrushchev house. The couple bought it seven years after the official registration of the marriage. Obviously, half of this housing will go to the wife. The other part will be divided equally between the wife, son and parents.

Division of property upon the death of one of the spouses in kind

According to the law, all joint property of the spouses is divided between them in equal shares, which means that each of them owns half of the apartment, car, and TV. And in the case of inheritance of such half by several persons at once, the situation will worsen even more. The remaining wife can receive 3/5 or 9/11 of the total property. The notary will indicate in the certificate only the share in the inheritance after the death of the husband, and the heirs will be asked to try to decide on the allocation of their shares in kind. If they succeed, then the agreements reached can be enshrined in the agreement. If a dispute arises, then the right to divide property after the death of a spouse and allocate shares in kind goes to the court.

Can a spouse be left without an inheritance?

This result is quite possible if a will has been drawn up. Current legislation gives the sole owner the right to dispose of his belongings as he wishes. This principle also applies to the hereditary sphere.

In simple terms, the owner of the property has the right to name any citizen in the will. If this is done, the spouse may lose his inheritance rights. But there are some exemptions that allow him to receive part of the property in any case.

For example, if a husband or wife has reached the age of 65 or 60 years, respectively, then they receive the status of a compulsory heir and can count on a share, even if a complete stranger or another relative is called to inherit by will according to the will of the deceased.

True, it is no longer possible to talk about equal distribution in this case. The share of the obligatory heir will be less than what the citizen specified in the will will receive.

Division of property upon the death of one of the spouses

Common property acquired over the years of married life is divided according to the rules of inheritance (SC, CC), unless an agreement on the division of property was signed between the husband and wife.

What is considered common property and is subject to inheritance:

- joint income from business, work;

- financial receipts - pensions, financial assistance from the state, various payments;

- real estate and movable property purchased during the years of marriage - housing, cars, etc., regardless of whose name it was acquired;

- shares, shares, shares purchased during marriage.

What property is not considered common:

- securities, apartments, houses, cars inherited;

- property received under a gift agreement or deed of gift;

- things for personal use in accordance with Article 36 of the Family Code, with the exception of luxury items (precious items, precious stones are subject to inheritance).

Inheritance within marriage

Sometimes one of the spouses becomes an heir. For example, parents died and bequeathed a house to their son or daughter. In divorce proceedings, the question may arise: does the other person have the right to claim this property and demand a full division?

When it comes to the equal division of a property, it is understood that the husband and wife participated jointly and equally in its acquisition, that is, they allocated funds from their common budget to pay for the transaction.

Receiving a house by inheritance does not involve spending marital funds; the property is transferred to the heir free of charge. A simple conclusion follows: such real estate will not be classified as jointly acquired property. Its division will be impossible, with the exception of one case.

If the spouses decide to reconstruct the premises and invest joint finances in its renovation and expansion, then the situation may change radically. The other spouse has the legal right to claim part of the house.

Inheritance by law

After the death of one of the spouses, the joint property is first divided. The second spouse receives half of what belonged to both of them. And the remaining half is divided among all the heirs who have declared their rights. Since inheritance occurs in order of priority, and the spouse is the heir of the first priority, the inheritance after death will be divided only between representatives of the first priority. The law also includes parents and children. Thus, the remaining half of the deceased's property will be divided in equal parts among all first-degree who claimed their ashes.

Unworthy heirs may be excluded from inheritance, including:

- citizens who tried to obtain an inheritance by carrying out illegal actions;

- parents who have been deprived of parental rights in relation to the inheritance of their children’s property;

- citizens who evaded their obligations to support the testator.

In addition, persons who have committed a crime against the health and life of the testator are not allowed to inherit.

Conclusion

What rights does a spouse have when inheriting in 2022? The surviving husband or wife has legal property rights provided for by law, for example, to an apartment, car and other property. If it is necessary to divide residential premises acquired during the marriage, the notary will follow the following algorithm. First, he will allocate half to the surviving spouse, and after that he will deal with the distribution of the inheritance.

The right to the spousal share will be confirmed by a certificate issued at a notary's office. In addition, the surviving spouse has the right to claim a part of the inheritance, since the law gives him the rights of a first-priority heir.

If property is donated or received as a result of inheritance, the spouse has the right to inherit, and in priority order. But it happens that the spouse is left with nothing. For example, if during the marriage the spouses did not acquire anything, and the testator considered it necessary not to leave an inheritance to his relatives, including his own spouse. His will must be done.

Inheritance by will

The deceased could not fully dispose of the joint property, therefore, if the will states that the property belonging to both spouses passes in full, for example, to a child, it cannot be fulfilled in full. Here, as with inheritance by law, the share of each spouse is first allocated, and only half of the deceased spouse is inherited according to his will. The second half immediately goes to the surviving spouse.

The division of property upon the death of one of the spouses does not occur at all if, according to the will, all the property is already assigned to the wife or husband.

Refusal of spousal share

The owner has the right to refuse property that belonged to him by right of common joint ownership (Article 236 of the Civil Code of the Russian Federation). To renounce the marital share, you must submit a waiver application to a notary. In this case, the share will pass into the estate and will be divided along with the other property of the deceased.

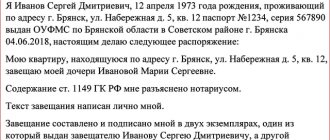

Sample application

Recommendations that will help

In conclusion, I would like to note a number of points that it is advisable to take into account in such situations. It is better to prevent possible negative consequences than to correct them later.

First of all, it is necessary:

- Determine whether a will was written by the deceased.

- If most of the things were acquired by the wife, and the husband has children from a previous relationship, a will should be written.

- When the parties are in an unequal financial situation, it is best to conclude a marriage contract.

- Do not enter into conflict throughout your family life with children from your first marriage, but rather show them attention and friendliness.

- First of all, the person (spouse) who lived with the deceased and used them will claim household items, furniture, and equipment.

Everything needs to be resolved through negotiations, including emerging issues related to the division of inheritance. You need to demand only what belongs by law.

Author: Oleg Vladimirovich Roslyakov, source.

What is considered the inheritance of a deceased person?

Inheritance can take place in two forms:

- in law;

- by will.

In the first case, the heirs have the right to receive their share in order of priority. There are eight queues, which is directly enshrined in law . In the second case, inheritance occurs according to the rules prescribed in the will. There is no relationship here; an outsider can also receive the property.

The hereditary mass is of particular importance. This includes all the property that the deceased managed to acquire and was in his possession at the time of death. The inheritance is considered open only from the date of death. It may include movable and immovable things, as well as property rights and obligations.

Property must be inherited in the place where it was opened. It can also be the place of permanent registration of the citizen, which existed at the time of death. If there is none, the place where the person’s real estate or movable property is located is taken into account. This provision is regulated in more detail in Article 1115 of the Civil Code of the Russian Federation.

The period for opening an inheritance is not regulated by law. There are only time frames established at the regulatory level for accepting the property of the deceased. This is due to the fact that the inheritance opens automatically after the death of a person. A child, parent, or other family member may waive their share, but this will not close the estate.

Design rules

Notaries are involved in registering inheritance rights. They open an inheritance case at the request of applicants for the inheritance and register it in a unified register. This ensures that more than one case will not be opened regarding the same inheritance. If, during registration, it turns out that the inheritance case has already been opened by another notary, the application will be attached to him.

Where to go

To complete the formalities, the heirs turn to the notary at the place of residence of the deceased - the place where the inheritance was opened.

Package of documents

The heir applies to the notary with an application to open the inheritance and attaches the following documents to it:

- original death certificate;

- a will (if any) with a notary’s note that it has not been changed or revoked;

- inheritance agreement (if any);

- documents certifying family ties (marriage, birth, adoption, etc.);

- a certificate of the testator’s last place of residence;

- an extract from the house register about deregistration at the place of residence;

- a copy of the financial and personal account from the last place of residence of the testator.

Based on the submitted documents, the notary opens an inheritance case. He will also issue a certificate of right to inheritance.

State duty and deadlines

Registration of the right to inheritance requires payment of a state fee in the amount of:

- 0.3% of the value of inherited property for close relatives (children, spouses, parents, full brothers and sisters), but not more than 100,000 rubles;

- 0.6% - for all other heirs, but not more than 1,000,000 rubles.

We wrote more about the state duty here.

Certain categories of federal beneficiaries, heirs living in houses and apartments that are part of the inheritance mass, do not pay the state duty. In addition, heirs of persons who died in the line of duty are exempt from paying the duty.

How to recognize an inheritance as jointly acquired?

In accordance with Art.

37 of the RF IC, an inheritance can be recognized as joint property if the value of the inherited property has increased significantly due to the money or labor of the second spouse. As judicial practice shows, this is not easy to do. The courts satisfy the applicant's demands only if there are results of a construction and technical examination, which indicate an increase in the cost of housing due to the improvements made. Otherwise, it will not be possible to prove that the changes increased the cost.

Example. Karina inherited an apartment during her marriage. The housing was old and needed renovation. The couple installed an electric boiler, installed a new front door and plastic windows. Cosmetic renovations were also carried out. As a result, the appearance of the room has changed greatly. Since Karina was on maternity leave, the costs of repairs were mainly borne by her husband. The man collected all the checks (for 200,000 rubles) and during the divorce asked to recognize the apartment as joint. But the court ruled that persons living in the apartment are required to bear the costs of maintaining the satisfactory technical condition of the apartment. The man did not provide evidence that the cost of the apartment had increased significantly, so the court refused to satisfy the demands.

Who is the direct heir after the death of a spouse if there is no will?

If the husband dies, who are the first priority heirs? It has been established that, according to the law, close relatives of the deceased are legal successors. The legislator divided all recipients into 8 (eight) queues depending on the degree of relationship.

The first heirs are those who were closest to the deceased. Article 1142 of the Civil Code of the Russian Federation provides a list of these persons.

First priority heirs after death without a will:

- wife;

- son or daughter;

- parents;

- grandchildren or granddaughters by right of representation.

An important condition for a woman to inherit is the registration of family relations with a man in the registry office. If she is absent, she cannot be an heir by law. The legal spouse must receive 50% of the acquired joint property in the process of family relations.

Children, whether natural, adopted or from a previous marriage, inherit equally. If a man has been deprived of parental rights, his children can also inherit.

In the case where the father abandoned the child who was later adopted by another person, then this child loses the opportunity to inherit the property of his biological father. An exception is the case when a daughter or son, after adoption, maintained a relationship with a parent, in accordance with a court decision (clause 3 of Article 1147 of the Civil Code of the Russian Federation).

Note! The spouse's children, unless adopted, do not legally inherit the property of their mother's husband. However, if they are disabled and were dependent on him for at least a year, then they are entitled to a share on an equal basis with the other heirs.

In addition, the husband’s unborn children conceived by him during his lifetime may inherit. If such a situation arises, the division of the inheritance is carried out only after the birth of the baby, with the participation of his legal representatives.

Parents are a separate category that inherits somewhat less frequently, due to the fact that the overwhelming majority of people die at an old age, when they are no longer alive. In this situation, it does not matter whether the parents are married or not.

Adoptive parents are also treated the same - they have the same rights as biological parents. Guardians and trustees cannot claim inheritance.