18

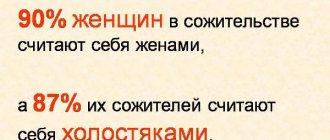

The practice of living together between a man and a woman without registering a marriage has long been rooted in society. Everyone has their own reasons for refusing to submit documents to the registry office. In this case, children of common-law spouses are usually registered in the name of both parents. Citizens realize the importance of a legal family union when one of the spouses dies and the question of inheritance arises. Let's try to figure out what rights a common-law spouse has after the death of her husband.

Can a common-law wife claim an inheritance or an apartment?

The transfer of property rights is carried out between legal spouses. But there are certain exceptions to the law. Much depends on the property regime, the presence/absence of a will, and the status of the common-law wife. For example, whether she is a disabled dependent or not.

If the property shared by cohabitants is their joint property, then after the death of the man, the woman owns half of the assets. But a woman cannot claim part of the property of her common-law spouse.

In accordance with the Civil Code, the inheritance mass is formed in full from the personal property of a citizen. He has the right to distribute it among legal successors under the will. Otherwise, the property will be transferred to the relatives of the deceased.

How to get an inheritance for a common-law wife

| No. | Option | A comment |

| 1 | Will | If we talk about the transfer of ownership of an apartment or a car, then the property can be sold or donated during the owner’s lifetime. It is enough for a man to draw up a gift deed and register it with a notary. After which the woman will become the full owner of the apartment, which she could inherit as the legal spouse of the testator. But the conclusion of such agreements does not relate to the issue of inheritance. Therefore, the only option is to draw up a will. |

| 2 | As a disabled dependent of the deceased | If a woman has reached retirement age at the time of the death of her common-law husband or has become disabled. If such spouses live together and the man supports the woman for more than a year, then she can claim a mandatory share of the inheritance. Even the presence of a will does not deprive her of this right. |

| 3 | As a legatee under a will | The owner can designate his common-law spouse both as an heir and as a legatee. Testamentary disclaimer implies obtaining rights to use property without the creation of ownership rights. A citizen may oblige the children to provide their cohabitant with an apartment for lifelong residence, or for a certain period. In case of refusal, the legal successors are deprived of their inheritance. |

Example. A family of 3 lived in a 2-room apartment. The owner of the property was a man. All family members were registered in the testator's apartment. Relations between common-law spouses were not legalized. The couple also had no children together. A man raised a woman's child. However, the testator had a son from a previous marriage. He lived separately from his father with his family. As a result of an industrial injury, the common-law spouse received disability. For about two years she was supported by her husband. Soon the man died. The only heir was his son. On the day of the testator’s death, the spouses had lived together for more than 10 years. The son and common-law wife of the testator turned to the notary. The cohabitant managed to prove her rights to the obligatory part of the inheritance. As a result, she was entitled to ¼ of the property. The direct heir was to inherit ¾ of the apartment.

✨ Results

In the event that inheritance occurs for a common-law spouse, the heir will be able to receive his part of the property if:

- the common-law spouse is recognized as a dependent of the testator;

- a will has been made to the heir;

- the inherited property was transferred during the life of the testator;

- an inheritance agreement has been drawn up.

To receive an inheritance, you will need to contact a notary and prove your right to receive the inheritance.

What can he claim?

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

A common-law spouse cannot, by law, rely on the inheritance left after the death of her partner. 1st line relatives are the legal husband/wife, parents of the deceased person and his children.

If a common child is registered in the name of the testator, then he is entitled to a share in the inheritance on a general basis, regardless of whether his parents were married. If the heir has not reached the age of majority, then the mother (the common-law spouse of the deceased citizen) acts in his interests.

What difficulties might there be?

The main difficulties are that the legal heirs may remain dissatisfied with their share prescribed in the will.

Or they will consider that the illegitimate wife does not deserve the share that the deceased assigned her. In this case, they can challenge the will in court.

If among the legal heirs there are minors, disabled people and elderly people, then this will be an additional obstacle to receiving an inheritance for a person who previously cohabited with the deceased.

Rights of a cohabitant

The opportunities of a woman who is not in a marital relationship with her common-law husband are significantly limited by law. However, her husband can change things during his lifetime. For example, a man categorically does not want to register a marriage, but decided to transfer his property to his child, parents or brother.

The owner can make a testamentary refusal in favor of his common-law spouse. For example, the heirs will have to provide the woman with the opportunity to live in the house for the rest of her life (Article 1137 of the Civil Code of the Russian Federation).

Example. A widower in adulthood decided to start a family again. However, he categorically refused to get married. The man had a house in the village. His brother lived nearby, who helped him all his life. As a result, the man decided to leave his house to his brother. He made a will accordingly. The former widower had no children from cohabitation with a woman. My own child died in a car accident. However, the woman had a son who lived in her personal home. But the young man, abusing alcohol, periodically caused trouble at home. It was unbearable to live in the house with him. Before his death, the testator fell ill. His common-law wife looked after him all the time. In order not to offend the woman and not to change his promise regarding his brother, the man made changes to his will. He executed a will in favor of his wife. As a result, the brother had to provide the opportunity for his common-law wife to live in the testator’s house.

However, this option greatly depends on the relationship between the heirs and the cohabitant. In the case of a negative relationship, living together will be impossible.

The legatee does not have the right to demand determination of the procedure for using the premises. Therefore, the heirs can rent out the free living space.

Can a common-law spouse waive her rights? Yes. If we take the example under consideration as a basis, then she is not obliged to live in the testator’s house if the living conditions in it are unacceptable. In addition, the woman can return to her own home.

Who monitors the execution of a will? Such a duty may be assigned to the executor of the will. Also, the supervisory function is performed by the notary who executed the will. If the heir is a minor citizen, then the guardianship authority acts in his interests.

Inheritance according to the next principle

Article 1142 of the Civil Code of the Russian Federation determines that divided inherited property is distributed among the heirs in order of priority. The legislation provides for eight queues, starting with the main one:

- Legal spouse, parents and children of the deceased.

- Sisters, brothers, grandparents. The concept of siblings includes both natural and step-relatives of this type.

- The deceased's aunts and uncles.

- Full-blooded sisters and brothers of grandparents (great-uncles and grandmothers of the deceased), children of full-blooded nephews (great-uncles and granddaughters).

- Parents and grandparents (great-grandparents).

- Direct descendants of grandparents' sisters and brothers, great-grandchildren. Great nieces or nephews.

- Stepmother, stepfather, stepsons and stepdaughters.

- Dependents of the deceased who are disabled persons.

In the absence of a will, all the property of the deceased will be divided in equal parts among all priority heirs. Inheritance of property by persons belonging to a lower priority order occurs only if there are no other heirs in a higher order.

None of the lists directly list cohabitants as options for heirs (except in cases of her incapacity while living with her cohabitant).

How to prove a civil marriage after the death of a spouse

In the absence of a will, the woman will have to prove:

- fact of cohabitation for a period of at least 1 year;

- disability;

- general housekeeping;

- the fact of being in custody.

How to prove a civil marriage? To do this, you must submit the relevant documents.

List of documentation

| No. | Title of the document | A comment |

| 1 | Certificate from the housing office, the Federal Migration Service, the passport office (about registration at the place of residence or place of stay at the place of registration of the deceased) | It can be taken at the place of registration of the testator. It will be clear from the document that the applicant lived with the deceased citizen. If a child was born to the spouses during their cohabitation, you can submit a birth certificate for the child. But, if the common-law spouse was not registered in the cohabitant’s apartment, then she will have to go to court. |

| 2 | ITU certificate or pension certificate | Only a disabled dependent is entitled to a share in the property. If the common-law wife lived with the deceased, did not work and was supported by him, but she is able to work, then she cannot be recognized as a dependent. In the case where a woman is disabled due to retirement age, it is enough to present a passport. |

| 3 | Evidence of personal relationship | Cohabitation implies actual marital relations. However, the testator and the woman could live together for other reasons. For example, a woman was hired as a live-in caregiver or rented a room. Therefore, it is necessary to provide proof of the marital relationship. Photographs, videos, and witness statements are suitable for this purpose. |

| 4 | Information about the income of a common-law wife | The important point is being contained. If the income of the cohabitant allows her to independently provide for her own needs, then she cannot be recognized as a dependent. |

It is necessary to prove the fact of being a dependent in court. The hearing of the case takes place within the framework of special proceedings. The application is submitted at the place of residence of the deceased citizen. The form of the document must comply with the requirements of the Code of Civil Procedure of the Russian Federation.

The application must be accompanied by:

- plaintiff's passport;

- death certificate of the partner;

- written evidence of cohabitation, disability and/or being dependent on the testator;

- evidence of pre-trial actions;

- certificate of income of the applicant;

- receipt of payment of state duty.

Additionally, witness testimony can be used. You can invite neighbors of the deceased citizen or mutual friends as witnesses.

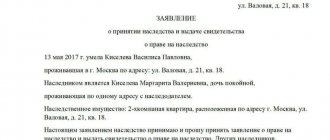

Sample statement of claim to establish the fact of being a dependent

How to enter into an inheritance for a common-law wife

The procedure for acquiring property rights is the same for all heirs. Documents must be submitted to the notary within 6 months .

Missing deadlines is fraught with loss of property rights. If the establishment of legal facts occurs in court, then it is necessary to take into account the circumstances of the case in which the applicant for the property finds himself.

However, you must go to court no later than 3 years (limitation period) after the death of the testator.

The application is submitted:

- to the notary's office at the place of registration of the testator;

- to a notary at the location of the property (if the inheritance includes real estate and the place of registration of the deceased is unknown);

- to the notary office at the place of storage of the most valuable property of the deceased (if the inheritance does not include real estate);

- at the place established by a court decision (if the issue of opening an inheritance was resolved in court).

The application must be accompanied by documents confirming the rights to the property of the testator:

- original will;

- death certificate;

- passport of common-law spouse;

- certificate of cohabitation with a deceased citizen;

- evidence of loss of ability to work and being dependent on the testator;

- title papers for an apartment/house;

- a judicial act confirming the cohabitation of common-law spouses and/or the fact that the plaintiff is dependent on the testator;

- assessment of inherited property;

- a statement about the absence of debt from the deceased subject;

- receipt of payment of the mandatory fee.

If the inheritance of the property of a deceased citizen occurs according to law, then a will is not required. If the heir is a young child, then you must additionally provide a certificate of his birth. The document is required to confirm the relationship between the baby and the deceased person.

Sample application for acceptance of inheritance

Where to contact

In order to register an inheritance in the absence of a will, you must first collect a list of documents. Then go to a notary to establish the existence of a will.

If there is no will, then you need to contact the notary office of the area where the testator lived.

The next step is to write an application for inheritance, and you must submit the necessary package of documents to the notary. Then the notary's services are paid, and the transfer of ownership is formalized.

Which authority carries out the division of property?

Only a court can allocate a share of the testator's property in favor of his wife.

In this case, all circumstances, documents, witness statements and other evidence confirming the actual existence of this family are taken into account.

Who is included in the circle of first-line heirs? The answer is presented in the article “How the division of property occurs between heirs of the first stage.” You can find out whether you need to pay inheritance tax to close relatives here.

Can a common-law husband claim an inheritance, an apartment of a common-law wife?

The above rules apply equally to both common-law spouses. Therefore, a man has the same rights and obligations as a common-law spouse.

To avoid misunderstandings, it is better for citizens to legalize their relations. You can also make a will so that the spouse is not left without property after the death of his common-law wife.

In addition, it is advisable to avoid registering joint property in the name of one of the cohabitants. Otherwise, the share of the common-law husband will be transferred to the heirs of the deceased.

Nuances

In order to avoid lengthy legal proceedings, it is recommended to take care in advance of registering relationships and property while both spouses are alive.

Is it possible to make a joint will?

On November 1, 2021, a law was passed according to which a husband and wife can jointly draw up a will.

The main condition for this must be an officially registered marriage. And the common-law wife cannot take part in the preparation of this document.

How to avoid difficulties

It is advisable to get married officially at the registry office. This will allow the common-law wife to become the legal heir even in the absence of a will.

If due to some circumstances this is not possible, then it is necessary to draw up a will. Do not neglect the opportunity to receive an inheritance provided by law. In addition, do not forget about collecting the necessary evidence of the existence of your family.