Home » Inheritance » Inheritance of a privatized apartment after the death of the owner by law and will

21

After privatization, an apartment used on the basis of a social tenancy agreement becomes the personal property of the persons registered in it, and after their death can be transferred by inheritance to the successors specified in Chapter. 62 and 63 of the Civil Code of the Russian Federation, by will or by law.

The procedure for inheriting a privatized apartment

There are two methods of succession:

- Will.

- In law.

In the first case, a person has the opportunity to dispose of his property at his own discretion. The citizen himself decides who will get the privatized apartment and in what shares. Russian legislation does not provide for the full will of the citizen when deciding the fate of acquired values. There are a number of restrictions; for example, the norms highlight a category of persons whose interests in inheritance cases are protected by the state. We are talking about a mandatory share.

The opportunity to receive it is reserved for the following persons:

- Children under 18 years of age.

- Parents who are on old-age pensions and the testator's husband/wife who is unable to work due to illness.

- Citizens who were dependent on the deceased.

The specified group of persons receives at least half of the portion that they would have inherited without a will.

A privatized apartment is inherited by will and goes to the legal successors equally if the shares are not determined.

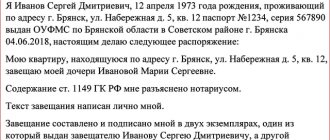

Will

Chapter is devoted to inheritance by will. 62 of the Civil Code of the Russian Federation. Despite the fact that lawyers recognize this mode of inheritance as more progressive than the order of inheritance, not all citizens use a will. This is explained by the fact that the law does not establish a mandatory rule obliging a specific person to draw up a will. If this document is not found after the person passes away, the law comes into play. In particular, the Civil Code of the Russian Federation, which clearly defines the order of inheritance.

Inheritance of a privatized apartment by law

Russian law divides heirs into queues; their number is eight. It is possible to enter into legal succession provided that there are no applicants from the previous line. This can happen on various grounds, for example, recognition of the heir as unworthy in court, and so on. The basis of the order is the principle of family relationships, both blood and property. The heirs of the first stage are the husband/wife, children and parents of the deceased.

A situation may arise when the legal successor died before the opening of the inheritance or on the same day as the testator. Who has the right to inheritance in this case? The legislator introduced the concept of the right of representation. In other words, the legal successors will be the descendants of the person who, due to death, did not enter into the inheritance. By way of transmission, citizens receive part of the property intended for the deceased ancestor. If the right of representation extends to several people, then the share of the deceased will be divided between them in equal parts.

For example:

After the death of the mother, the right to inherit the privatized apartment arises from her daughters A.G. Gromova and S.S. Svetikova. However, A.G. Gromova dies in an accident without having time to formalize the succession. Gromova was not married, but she was left with two sons, Ivan Nesterov and Andrei Nesterov, the only legal successors. How is a privatized apartment inherited and what to do in this case? This happens as follows: Gromova and Svetikova each own ½ of the room. This means that the children of A.G. Gromova can claim the mother's share in equal parts. After completing all the necessary actions, each of the Nesterov brothers should receive ¼ of the living space.

Inheriting a privatized apartment without a will can have negative consequences in the form of a burden. For example, to be the subject of collateral in a loan agreement. As a general rule, citizens inherit not only the property rights of a deceased person, but also his duties.

In the event that losses from debts exceed potential profits, the successor has the opportunity, as provided by law, to refuse the inheritance.

Deadlines

The general time period for accepting an inheritance is 6 months. For persons entering into legal succession due to the refusal of applicants in the previous queue, 3.

For a child born after the opening of the inheritance, an application is submitted by the legal representative within a 6-month period from the moment of his birth. Missed deadlines can be restored through legal proceedings or with the consent of those who have already accepted the inheritance.

We recommend that you read:

Inheritance of real estate after the death of a relative

In court, the case will be considered with the involvement of citizens who have entered into legal succession; the following circumstances are subject to proof:

- The person did not know and did not have the opportunity to obtain information that the inheritance had been opened or that he had valid reasons for missing the time period established by legal norms. These include illness, long business trips, and so on.

- An application for restoration of the temporary period for entering into legal succession should not be made later than 6 months from the moment the reasons for missing it no longer exist.

Ignorance of the legislation governing the time of entry into inheritance is not recognized by the court as a circumstance worthy of attention when making a decision on missing the statute of limitations.

Provided that a citizen who missed the time allotted for receiving an inheritance manages to obtain the written consent of other legal successors to include him in the circle of heirs, such a document obliges the notary to issue a certificate.

Sample documents

Sample application for registration of ownership of an apartment

Sample agreement on division of property

- Look

Sample application for registration of property rights

Sample application for renunciation of inheritance

- Look

Sample application for inheritance

- Look

Preemptive right

Inheritance of a share in a privatized apartment will be carried out according to the rules established by the norms, that is, in equal proportions between legal successors. So, if the property is privatized for 4, then ¼ shares are inherited. When there is no possibility of dividing residential premises in kind, the circle of those who have a priority right to receive ownership of it on account of their share when inheriting a privatized apartment is determined at the legislative level.

These are recognized as:

- Co-owners of the deceased citizen, while legal successors who lived with the testator together and used the premises, but do not have ownership rights to it, will not be taken into account.

- Heirs who were not co-owners of the property with the deceased, but used it on an ongoing basis and legally until the day of his death.

- Citizens who lived together with the testator until his death (provided they had no other living space).

A person who has received premises in the property on account of his share, and has used the pre-emptive right granted by the norms, is obliged to pay compensation to other heirs for their shares of the property.

If the apartment is privatized for two, then after the death of one of the owners, the second, provided that he is not an heir by law or will, does not have a preemptive right.

A will for a share in a privatized apartment helps to avoid disputes between legal successors, since it is the formalized will of the deceased citizen. Following entry into the inheritance, the share is registered with Rosrestr.

What is a mandatory share

Those who are already preparing to soon take possession of their inheritance may be in for an unpleasant surprise - the appearance of persons who, in any case, should receive part of the property. No matter how other heirs try to challenge this, according to the law, they will have to share with these people, and this cannot be avoided.

Such persons must be allocated a share, the size of which is not less than half of the share that they would have received if they had been specified in the will. It is impossible to reduce or limit it; their claim to part of the property is completely legal. This is called the “compulsory share”, and only people from a certain category can receive it.

Important! The right of compulsory share will be valid even if the shares of other legal heirs are reduced. They have no choice but to come to terms with it and share.

How is a privatized apartment divided after the death of a husband/wife?

Property acquired during marriage is considered joint property of the spouses. Otherwise may be established by agreement. Acquired material assets are considered the property of everyone until the relationship is formalized. The same rule applies to property given to a husband or wife, as well as property received by one of them as an inheritance. However, if it is proven that the value of the property of one of the parties to the marriage relationship has been increased due to common funds or investments of the other half, then it is recognized as jointly acquired.

Inheritance of a privatized apartment after the death of a spouse depends on who it is registered to. When privatizing residential premises, it is understood that the municipality will transfer the property it owns to citizens free of charge. Any person who is a party to a social rental agreement has the right to become a participant in this process or to refuse in favor of other persons.

We recommend that you read:

Inheritance of a share in a privatized apartment after death

Thus, if a wife at one time had the need to officially refuse to participate in privatization in favor of her husband, then she will not be a co-owner of the property. And since we are talking about the free acquisition of living space, jointly acquired property does not arise here. After the death of her husband, the apartment will be inherited by her along with other first-line applicants on an equal basis.

Example:

Citizen E.V. went to court in December 2021. Emelyanov with a request to allocate the marital share in jointly acquired property in the form of ¼ of the premises and exclude it from the inheritance mass.

From the circumstances of the case it followed:

- In 2012, a dwelling with an area of 70 square meters. m., in which E.V. Emelyanova and her other half Emelyanov S.A. lived under a social tenancy agreement, privatized. E.V. Emelyanova renounced her share in favor of the main tenant, her husband. The property was registered in the name of the husband.

- In 2013, the couple carried out a major renovation of the premises: they increased the living space due to the loggia, redesigned the corridor, which led to a larger kitchen, and replaced the cold and hot water supply risers. All work was legalized by the Department of Property Relations. The price of the premises has increased significantly after renovation.

- In May 2014, the marriage between E.V. was dissolved. Emelyanova and S.A. Emelyanov, the division of jointly acquired property was not carried out.

- The man died in November 2021. The deceased had a son from his first marriage, G.S. Emelyanov and daughter A.S. Emelyanov from the plaintiff.

G.S. Emelyanov, in a counterclaim, asks to divide the disputed apartment after the death of his father between him and his sister A.S. Emelyanova in equal parts. And citizen E.V. Emelyanova considers that after the death of her husband she lost the right to division of property, since several years had passed since the divorce.

The court decided to satisfy E.V.’s claim. Emelyanova for the following reasons:

- Housing is privatized at will by all persons included in the social tenancy agreement, but a person has the right to refuse his share in favor of someone else.

- After the death of the owner without a will, a privatized apartment is inherited in equal parts by the applicants of the corresponding order.

- The owner of the disputed property was the late S.A. Emelyanov, but the major repairs carried out at the expense of the spouses’ common funds significantly increased the cost of the living space, which is confirmed by the documents presented.

- The statute of limitations for the division of property acquired jointly by spouses is 3 years. In the situation under consideration, the time period when E.V. Emelyanova could apply for the division of material assets acquired in an official union, which began its course from the moment of divorce, that is, from May 2014, and ended in May 2021.

In accordance with the above arguments, the court decided to recognize the right to ¼ of the home for E.V. Emelyanova, the remaining area is transferred in equal shares to G.S. Emelyanov and A.S. Emelyanova.

Inheritance of a non-privatized apartment

Who will get a non-privatized apartment after the death of the owner? This issue is resolved through the court. To open an inheritance, the notary is presented with documentary evidence of ownership of the property. Failure to do so will result in refusal to perform notarial acts. If the apartment is not privatized, this means that the municipality is considered its owner after the death of the responsible tenant.

In order to inherit a non-privatized apartment, you will need to justify the following facts in court:

- An application was received from the tenant about the desire to register ownership of the apartment with the relevant authority.

- A package of documents for the procedure is presented.

- Until the day of his death, the citizen did not withdraw the submitted appeal.

If all the above requirements are met, then the court, by its decision, will include the disputed area in the inheritance estate. This is the only way to inherit a non-privatized apartment. However, housing legislation provides another opportunity to become a property owner in such a situation. If the legal successor lived in the same premises as the deceased and was registered there, he has the right to contact the municipality with a request to conclude a social tenancy agreement, and subsequently an agreement for the gratuitous transfer of property.

According to the inheritance agreement (Article 1140.1 of the Civil Code of the Russian Federation)

The testator may conclude such an agreement with any of the persons specified in Article 1116 of the Civil Code of the Russian Federation.

The document provides for the procedure for transferring the apartment, determines the circle of legal successors, and can appoint an executor. The consequences of an inheritance agreement depend on the circumstances that occurred before the opening of the inheritance. The agreement is certified by a notary. The testator may unilaterally refuse the inheritance agreement by notifying all parties of the refusal through a notary.

How to register an inheritance

Registration of inheritance, regardless of whether it occurs by will or by law, requires compliance with the established procedure.

The rules of law provide for the following actions:

- Applying to a notary office.

- Entering into actual possession of property, that is, the new owner takes measures to preserve and maintain material assets passing to him by inheritance. If a dispute arises, the expenses incurred by the citizen in carrying out the above actions will be confirmation of the inheritance of the apartment.

The papers provided to the notary both for inheriting a privatized apartment without a will, and with it, will be:

- A death certificate taken from the civil registry office (civil registry office).

- Documentary evidence of a family relationship with the deceased.

- Extracts from Rosreestr for privatized real estate and the management organization confirming the absence of debt for utility and housing services.

To establish the degree of relationship, you can present documents from the registry office, a court decision, extracts from birth or house registers.

State duty on inheritance

According to the previous legislation, upon entering into the rights of inheritance of a privatized apartment, the legal successors paid a tax. Currently, payment of a state fee is required instead. Its size depends on the presence of family relationships. Thus, for heirs of the first and second stages, the amount of the mandatory fee will be 0.3% of the value of the real estate that went to the successor, but not more than 100,000 rubles.

For all others, this amount is equal to 0.6% of the price of the property, but not more than 1,000,000 rubles.