What is joint ownership

Citizens of the country can make any transactions not prohibited by law. This includes the purchase and sale, donation, exchange of movable or immovable property.

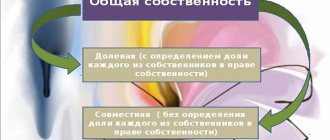

The number of owners of one object is not limited by law (Article 244 of the Civil Code of the Russian Federation). For example, one person can buy a house. Whereas a family of three has the right to privatize an apartment.

The main difference between joint ownership is the absence of fixed shares. Each participant is entitled to the same share of the property. Co-owners can change the established procedure for the distribution of parts by concluding an agreement (Article 245 of the Civil Code of the Russian Federation).

The rule on joint ownership applies not only when documents are executed for two or more citizens at the same time. Spouses are co-owners of the property, regardless of which of them the papers are issued for (Article 34 of the RF IC). An exception is property donated, inherited and acquired before the registration of marriage relations. The same applies to cases of privatization of an apartment by one of the spouses.

Additionally, spouses can change the property regime by concluding a marriage contract or an agreement on the allocation of shares in the joint property of the spouses.

Finding out the fact of drawing up a will

The fact is that the principle of freedom of inheritance allows the testator in his will, which must be certified by a notary, to distribute shares in jointly acquired property, guided only by his will (see Articles 1118 - 1119 of the Civil Code of the Russian Federation).

This principle is somewhat limited only by the rule on the obligatory share in the inheritance, according to which the testator cannot deprive the inheritance of his children who have not reached the age of majority or are deprived of the ability to work, as well as a disabled spouse, parents and dependents recognized as disabled.

The mandatory share rule applies to all persons who are dependent on the testator and implies that all dependents in any case will receive at least half of the share that is due to each of them by law, regardless of what is written in the will. This is the so-called “obligatory share”, which includes all the property that the heir receives from the inheritance if there are grounds for this (Article 149 of the Civil Code of the Russian Federation).

What restrictions apply to joint ownership?

Each co-owner is the owner exclusively of his part of the property. Such a person has no right to dispose of the share of another owner.

When one of the participants sells their part of the property, the priority right of redemption belongs to the co-owners (Article 250 of the Civil Code of the Russian Federation). The seller must make them a written offer.

are given 1 month to make a decision . If they refused or did not confirm their intention regarding joint property, then the seller can alienate the property to third parties.

Important! The conditions for the sale of housing should not differ from those specified in the written offer to the co-owners.

Is it possible to inherit joint property? The law does not prohibit the sale or inheritance of objects that are jointly owned by several citizens.

Moreover, if there is a restriction on the sale of property in the form of a priority right of redemption, then when transferring property by inheritance, such a rule does not apply. The testator can make a will or the property after his death will go to relatives within the framework of the law.

We take into account the rules of wills according to the law

Inheritance occurs by law if the deceased spouse did not leave a will.

There is a sequence of inheritance prescribed in Articles 1142-1145 and 1148 of the Civil Code of the Russian Federation. For more details, see Art. 1141 of the Civil Code of the Russian Federation. If several heirs are part of the same line of succession, their shares of inheritance must be equal, unless heirs by right of representation participate in the inheritance.

The first priority of inheritance includes the children, spouse and parents of the deceased (Article 1142 of the Civil Code of the Russian Federation).

If there are no heirs in the inheritance queue, they move on to the next inheritance queue.

In the simplest case, when there is no marriage contract or court decision on the division of property, and all issues have been resolved between the heirs and there is no dispute, then the inheritance mass, according to Article 39 of the RF IC, is exactly half of all jointly acquired property. That is, if the property is an apartment, then half of the apartment is included in the estate, and this half is inherited by the surviving spouse or by him and the remaining heirs from the first line of inheritance in equal shares.

If one of the heirs by law dies either simultaneously with the testator, or before the opening of the inheritance, then his share passes to his descendants, dividing in equal shares between them (Clause 1 of Article 1146 of the Civil Code of the Russian Federation). Example: a mother and her only son die. In this case, the son's children receive the entire inheritance in equal shares.

Who has the priority right to inherit joint property?

When registering an inheritance, the priority right of individual applicants is taken into account. One of them is the co-owner of the property.

What rights does the primary assignee have? An heir from among the co-owners has the right to expect to receive property that belonged to the testator in exchange for his share.

The priority right is valid regardless of the presence of applicants who used the property during the life of the deceased subject. Residents of the apartment/house will have to leave the premises at the first request of the owner.

The question of the possibility/impossibility of dividing a property or other property between heirs is decided in court.

Inheritance by will

If the owner has determined in the will the purpose of the shares of the property, then they are transferred to the designated recipients. The law does not give the notary the authority to redistribute property.

Example. Citizen R. executed a will. In the document, he assigned ½ share in a residential building to his eldest son. ½ share in this house belonged to his wife. He divided the rest of the property between his wife and youngest son. After his death, the woman turned to the notary with a demand to change the composition of the inheritance, due to the fact that she is a co-owner of the house. However, the notary refused to satisfy the requirements.

In such a situation, the inheriting co-owner has the following options:

- go to court to challenge the will;

- agree with the recipient of the share on exchange or redemption after inheritance.

Inheritance by law

In the absence of a will, inheritance takes place according to law. It provides for compliance with the order established by the Civil Code.

If the inheritance line includes a co-owner of the property, then he has the right to receive a share of the common property on account of the inheritance. To do this, you must submit an application to the notary for entry into the inheritance and indicate priority rights to the object.

The situation changes if the co-owner is not an heir. For example, if the co-owner is the ex-wife of a deceased man.

The priority right is given to the heirs who lived with the deceased owner and used the property at the time of his death. Heirs who did not use the indivisible object may receive the right to an apartment if the successor does not have other residential premises.

Common property of spouses

The following property is considered common:

- Any income of the spouses, including income from work, from entrepreneurship and the results of the intellectual activity of the spouses. Also, common property includes any payments received by spouses, for example: pensions, benefits, financial assistance - in general, any payments received by spouses that do not have a special purpose.

- Property in the form of real estate, movable property, securities and shares in capital contributed to any commercial institutions, for example, to credit organizations, if they were acquired at the expense of the income of both spouses, as well as shares and monetary contributions of spouses.

- Absolutely any property that was acquired by spouses during marriage. It does not matter to whom the ownership is registered and who exactly contributed the money when purchasing the property.

Now let’s find out what property does not belong to the category of jointly acquired property?

According to Art. 36 of the RF IC, property that one of the spouses received by inheritance or as a gift during marriage cannot be classified as jointly acquired property. Also, common property does not include personal items, except jewelry and luxury items.

The share of the surviving spouse in the jointly acquired property does not change with the death of the second spouse and the receipt of the share of the deceased spouse by will or by right of inheritance. According to Article 1150 of the Civil Code of the Russian Federation, the share in property jointly acquired by spouses that belonged to the deceased spouse is included in the inheritance and passes by law to the heirs. Usually, when determining shares in property jointly acquired by spouses, their shares are taken as equal.

Let's give an example: there is an apartment in the jointly acquired property of the spouses. If one spouse dies, his half of the apartment is included in the estate. The same half that belonged to the surviving spouse remains with him without changes. The surviving spouse can change this situation if he submits a statement that his share is absent in the property acquired during the marriage. With such a statement, the inheritance of the deceased spouse will include the entire apartment (see paragraph 33 of Resolution of the Plenum of the Armed Forces of the Russian Federation No. 9 of May 29, 2012).

To inherit jointly acquired property after the death of one of the spouses, you must follow the scheme below.

How to inherit an apartment that was jointly owned

The registration of inheritance is carried out by a notary. The case is opened at the request of the legal successor.

An application for acceptance of property is submitted at the place of registration of the copyright holder. In some cases, binding may occur to the location of real estate or the most significant property.

The deadline for submitting documents depends on the method of inheritance and the line of relationship with the deceased citizen (Article 1154 of the Civil Code of the Russian Federation).

An alternative way to enter into rights is to accept the inheritance after the fact. In this case, the applicant must take the necessary actions that confirm his intention to enter into the inheritance.

Procedure

To enter into inheritance, applicants must complete the following steps:

- Prepare a package of required documents.

- Identify a notary office.

- Submit an application for acceptance of property.

- Conduct an assessment of the identified property.

- Pay the required fees.

- Obtain the appropriate certificate.

- Complete the transfer of ownership.

Statement

When registering an inheritance, the main document is the application of the successor. The form of the document is not fixed by law. However, the application must have several important sections. This includes:

- Name of the notary office.

- Personal data of the legal successor (full name, registration address).

- A brief description of the fact of the death of the testator.

- The essence of the appeal is acceptance of the inheritance.

- List of identified property.

- Mention of other applicants.

- Grounds for accepting inheritance (disposition/law).

- Date, signature.

If the heir is a co-owner of an object of inherited property, then he can indicate in the application a request for a share of this object.

Example. After the death of citizen M., the inherited property included ½ for an apartment, a car, and a land share. The heirs of citizen M. were his wife and daughter from his first marriage. The owner did not formalize the will. When submitting documents to a notary, the heiress assessed the property. The share in the apartment was 1,000,000 rubles, the car – 400,000 rubles, the land share – 800,000 rubles. The wife was a co-owner of the apartment. Therefore, she asked the notary to allocate the second share of the apartment as hereditary property. Since the second heiress owned the residential premises, and she did not object, the notary issued the widow a certificate for ½ share of the apartment and ¼ share of the land plot. The daughter received a car and ¾ of a plot of land. She paid her father's wife compensation in the amount of 200,000 rubles. and became the full owner of the land plot.

Sample application for issuance of a certificate of inheritance rights

Deadlines for accepting an inheritance

Primary heirs submit an application within 6 months . This includes applicants under the will and first-degree relatives (Article 1154 of the Civil Code of the Russian Federation).

Successors of the next stage submit documents six months after the death of the testator. They can claim their rights within 3–6 months.

A three-month period is given in case of non-acceptance of the inheritance by first-degree relatives. If the main applicants refuse or are removed from inheritance, the next legal successors are given six months.

Filing an application outside the established period is allowed in two cases - there is a court decision or the consent of the heirs to include another applicant in their composition (Article 1155 of the Civil Code of the Russian Federation). The first method is most often used.

Documentation

When submitting an application, the applicant must confirm his involvement in the property of the testator. The list of papers depends on the method of inheritance and the degree of relationship with the deceased citizen.

Minimum package of documents:

- civil passport of the recipient of the property;

- death certificate;

- certificate from the last place of registration of the property owner;

- document on deregistration;

- title deeds to real estate or other assets;

- report on the market value of the apartment;

- a will or documents confirming family ties;

- confirmation of payment of state duty.

The co-owner additionally provides evidence of his rights to a share in the objects of the inherited property. Such documents are not required from the spouse of the deceased, who allocated the marital share from the inherited property.

What about the actual method of inheritance? The successor will have to prepare a package of documents confirming the acceptance of the inheritance and its protection. Legally significant actions must be completed within a 6-month period .

Important! The residence of a co-owner in a residential premises in which the share belonged to the deceased owner is not considered actual acceptance of the inheritance.

Expenses

List of expenses when registering an inheritance

| Payment Description | Comments | Payment amount |

| State fee for a notary when entering into an inheritance | For spouses and close relatives | 0.3% of the amount of property received (no more than RUR 100,000) |

| For distant relatives and strangers | 0.6% of the amount of property received (no more than RUB 1,000,000) | |

| Technical work in a notary office | The list is established by methodological recommendations | The cost is set by the notary office. The maximum payment for the region is set by the Regional Notary Chamber. The cost of the service can be found on the website |

| Property valuation | Depends on the type of property | Real estate from 3000 rub. Car from 5000 rub. |

| State fee for registration of property rights | Depends on the type of property | Share in the apartment - 200 rubles. Apartment or house – 2000 rub. |

| Court expenses | Depends on the claims | State duty to court - from 300 rubles. Drawing up a claim - from 1500 rubles. Representation in court – from 10,000 rubles. |

Benefits when paying fees are granted to certain categories of heirs:

- disabled people of groups 1–2 (50% discount on the fee amount);

- citizens who lived with the testator on the day of his death;

- relatives of citizens who died in the performance of public duty;

- young children;

- incompetent citizens.

Deadlines for issuing a certificate of heir's rights

If the inheritance was accepted in a timely manner by applicants under a will or primary legal successors, then a certificate is issued to them after a 6-month period .

When registering an inheritance by second-degree relatives or as part of a transmission, the issuance of a certificate is shifted depending on the circumstances of the case.

Important! If the heirs can prove the fact that there are no other recipients of the property, then a certificate of the rights of the heirs can be issued earlier than the established period.

Registration

The final stage of inheriting an apartment that was in joint ownership should be its state registration. It is possible only if there is a certificate of inheritance, and requires the new owner to do the following:

- Collection of necessary documents.

- Writing an application for registration.

- Submitting a package of papers to the Rosreestr office at the location of the living space or MFC.

- Payment of state duty.

After successful registration, the applicant will receive a notification to his specified phone number or email address and will become the full owner of his part of the apartment.

If you need to confirm ownership of the living space in the future, you should again contact Rosreestr or the MFC to obtain an extract from the Unified State Register of Real Estate (certificates of state registration of real estate have not been issued since July 15, 2016).

Documentation

To register ownership of a joint apartment, the successor will need to collect a list of the following documents:

- Identification.

- Certificate of right to inheritance.

- Separation agreement (if drawn up).

A receipt for payment of the state fee is not required.

Expenses

For registration of a real estate property, the applicant will be charged a state fee of 2,000 rubles. But, if he submits an application and pays for the service through the portal https://www.gosuslugi.ru, he will receive a discount of 600 rubles (in this case, the amount of the state duty is subject to indexation taking into account a coefficient of 0.7).

Deadlines

The period within which you can apply for state registration is unlimited. The heir has the right to do this when he wants or when he decides to sell or donate a share of the apartment.

The period of the procedure, on the contrary, is quite strictly regulated by law and is: 3 days for Rosreestr and 5 for the MFC.

Mandatory share

A wife can make a will in which she does not name her husband as an heir. However, the law defines situations when he will receive his share in any case, since he belongs to the category that is entitled to a mandatory share.

For example, a husband is vested with such a right in ½ part of the due inheritance “by law” when he:

- disabled person;

- was fully dependent on his wife for a year;

- has reached retirement age.

If in the will the wife did not indicate the size of the obligatory share or determined it to be less than the required share, then the spouse has the right to challenge such a will in court.

How to become the sole owner of a shared living space

If the heir to several square meters of living space wants to become its full owner, he can contact the co-owners of the apartment with an offer to purchase their shares. With their prior consent, the potential buyer needs to implement the following action plan:

- Agree with the sellers on the transaction amount.

- Draw up a purchase and sale agreement.

- At the pre-agreed time, come to the notary to conclude the transaction.

- Make the payment in a previously agreed upon way (this can be done later, after registration is completed, or earlier, even before signing the contract).

- Register the transfer of ownership of the share in Rosreestr.

From the moment of state registration, the property is officially assigned to the new owner, although the acquirer acquires rights to it after the sale and purchase transaction has been certified.

Before purchasing shares, it is important to immediately find out whether there are minors or incapacitated citizens among the co-owners of the living space. If yes, then it is recommended to start the redemption process with them, since this is where difficulties can arise.

The thing is that they do not have the right to conclude an agreement on their own - their legal representatives (parents, guardians, trustees) are authorized to do this for them. But even their consent to the sale will not be decisive here, since the law establishes strict control over transactions involving the alienation of property of socially vulnerable citizens.

This is expressed in the need to obtain permission to sell part of the apartment from the guardianship and trusteeship authorities. And it, in turn, can be given only if the following circumstances are established:

- A shared apartment is not the only place of residence of a minor/incapacitated co-owner.

- The sale will not violate other legitimate interests and rights of the citizen, but, on the contrary, will serve to improve his financial condition.

It is almost impossible to predict or influence the decision of the guardianship and trusteeship authority. Therefore, if the heir wishes to become the sole owner of the apartment, he should wait for the consent required in this case, and only then proceed to acquire shares from the remaining, capable owners.

If the order is strictly observed, the inheritance process does not present any particular difficulty for the successor. However, it is not always possible to follow a well-coordinated algorithm; unforeseen circumstances often interfere with it, creating difficulties and sometimes almost insurmountable obstacles.

For those who have already encountered them or want to prevent them in advance, the help of our lawyers will be relevant. In order to receive useful advice from them free of charge and in the shortest possible time that can correct the current situation, just contact them through the online form or by calling the specified telephone numbers.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

46

Entry into inheritance after death under a will

The procedure and rules for entering into inheritance under a will are established by the chapter...

23

Lawsuit to restore the deadline for accepting an inheritance in 2021

The judicial hearing of the case on restoration of the period for accepting an inheritance begins with...

28

How to draw up a will for an apartment

The legislation of the Russian Federation establishes the right of every capable citizen to perform posthumous...

11

How to find out if there is an inheritance

The sudden death of the testator or lack of contact with other applicants may...

18

Mandatory share in the inheritance by will and by law (without a will)

The legislative act regulating civil law in the field of inheritance (section V...

15

Are loan debts inherited?

The short answer is YES, debts are inherited if the heir accepts the inheritance...

Common-law wife (cohabitant)

Has the right to the property of a deceased man only if the property belongs to him personally.

Legally, the cohabitants did not legalize their relationship and only actually lived together, running a common household. When one dies, the survivor can claim the inheritance of the second if recognized as a dependent in court. When drawing up a will, the rights of the cohabitant are protected in accordance with the law and, if properly executed, are not disputed by other successors.