Buying a home remains a priority for many Russians. Not everyone will be able to do this without borrowing money. Contacting the bank will help solve this problem and implement existing plans. Mortgage lending has become more accessible, as various banks offer favorable services. Citizens are especially interested in proposals from Sberbank, which has once again reduced interest rates on mortgage loans and also expanded the list of mortgage schemes for various categories of the population. Extended mortgages, with their rates and conditions, can attract a record number of Russians and help them solve their housing problems.

You can submit an application in two ways:

- By contacting a bank branch, where an experienced specialist will help the client fill out a form, give recommendations, and also advise on existing programs. In each individual case, the bank individually determines the interest rate on the loan. But there are a number of features that can affect its reduction.

- You can fill out the application yourself and submit it electronically via the Internet. Using an online calculator, you can calculate the various nuances of lending and choose the best option. But the borrower should be prepared for the fact that the bank branch will offer a different loan rate. After reviewing the application and receiving approval, the criteria chosen by the client and the interest on the loan may change.

Features of mortgage lending

The bank can offer its clients mortgage lending under several programs. First of all, the type of property being purchased will affect the drafting of the contract. A loan can be obtained to purchase an apartment on the secondary market or in a building under construction, to purchase a country house, to build or purchase a summer house, as well as to independently build a residential building. The main differences here will affect the down payment and interest on the loan. There are especially favorable offers on shares from the bank and the developer, which any borrower can take advantage of. They are characterized by a reduced loan rate.

There will be differences for different categories of citizens. Preferential offers are provided for families with small children, where the rate is reduced to 6%; loans for military personnel also have a reduced interest rate and allow you to make a down payment using a military certificate. The effect of the preferential lending program is limited in time. For example, a child mortgage will work until the end of 2022, and is available to those families in which a second or third child was born in 2021. Another interesting opportunity is to refinance a mortgage loan from another bank, as a result of which the client will be able to take advantage of more favorable offers.

Secure payment service

Another product from Sberbank designed to increase the comfort of transaction participants:

- The parties to the agreement open a special account to which the buyer’s money is transferred.

- Documents are submitted for registration.

- The bank requests information from Rosreestr about the registration progress.

- After registration, the bank transfers the money to the seller.

Calculations are carried out without the participation of the parties. Compared to escrow, for example, the seller does not need to present ownership documents to the bank. Unlike a safe deposit box (2,000 rubles), the bank is responsible for the safety of funds in the account, plus it independently prepares all the documents. The cost of the service is 3,400 rubles.

Quickly jump to sections

- Sberbank Mortgage: official website

- Sberbank mortgage phone number

- Interest rates and mortgage terms at Sberbank

- Conditions for borrowers

- Mortgage interest rates

- Requirements for the borrower and real estate

- Mortgage insurance at Sberbank

- Required documents

- Applying for a mortgage: Dom.Click service

- Electronic registration service

- Secure payment service

- Sberbank mortgage programs for 2021

- State support 2021: valid until July 1, 2022

- Mortgage for a new building

- Finished housing on the secondary market

- State support for families with children

- Mortgage plus maternity capital

- Mortgage for building a house

- Cottage on mortgage - country property and land

- For renovation participants - (program suspended)

- Military mortgage

- Garage or parking space with mortgage

- Loan secured by real estate for any purpose

- Sberbank - mortgage refinancing

- Expert opinion on mortgages at Sberbank

- Reviews from real borrowers

- Problems with repaying your mortgage

- Loan restructuring

- Mortgage holidays

- Finally

- Calculate your mortgage online

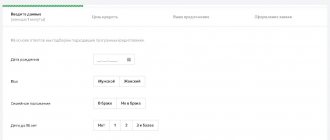

Requirements for the borrower

The bank is quite loyal to its clients and does not make excessive demands:

- Persons who are at least 21 years old can take out a loan for residential real estate. The maximum age for mortgage lending is 75 years. However, it must be taken into account that at the time of full repayment of the loan by the borrower, according to the payment schedule, he should not be more than 75 years old.

- Work experience at the last job exceeds 6 months without a break. In total, worked for more than 1 year.

- The client must be able to confirm his regular income with a document. For this, a 2-NDFL certificate for 6 months or a document in the form proposed by the financial institution is suitable. Such confirmation is not required if the potential borrower receives a salary or pension on a bank card.

- The income received by the client must ensure the ability to pay the monthly loan payment amount and other living expenses. After paying the mortgage payment, at least 40% must remain.

- A good credit history will be the basis for the bank to make a positive decision on the application.

Obviously, meeting such requirements is not so difficult. Many citizens who decide to purchase their own square meters can apply for affordable mortgage lending on favorable terms.

Mortgage under the program “Purchase of finished housing”

The “Product” was developed for participants in the Housing Renovation Program in Moscow. You have the opportunity to obtain a mortgage loan and improve living conditions during relocation for owners and tenants under a social rental agreement for apartments in houses included in the Renovation Program.

Stages of obtaining a mortgage under the Renovation Program:

- Choose an apartment. You are allowed to choose an apartment only in the area in which the property transferred to the Renovation Fund is located;

- Submit your application. Contact a Sberbank branch, fill out an application for a mortgage, and if necessary, get advice from a specialist;

- Wait for Sberbank's decision. In a few days you will receive a bank decision on your application;

- Gather the necessary documents. Collect the required documents for the property and submit them to the bank manager;

- Come for a deal. If the property is approved, you will need to sign an agreement at the Sberbank Mortgage Lending Center;

- Sign the agreement at the Renovation Fund office. Here you need to sign a purchase and sale agreement or an agreement for the exchange of residential premises;

- Registration of property rights. Submit a copy of the loan agreement to the Renovation Fund for registration of the exchange agreement or purchase and sale agreement in Rosreestr.

Interest rates:

- For salary clients of Sberbank – from 9.1% per annum;

- Base interest rate – from 9.6% per annum;

- If you do not confirm income – from 9.9% per annum;

- If you refuse insurance, 1% per annum is added to the rate.

Calculate mortgage payments from Sberbank online:

Are loans available for the purchase of real estate for pensioners?

People of retirement age can also buy an apartment, house or cottage using a mortgage loan. For pensioners, the rules for issuing a loan differ slightly from the general requirements. But there is a main limitation: the client’s age should not exceed 75 years by the time the loan is closed. Both working and non-working pensioners can borrow rubles to purchase real estate. This category of citizens is characterized by a certain stability, a responsible attitude towards obligations, and the presence of a guaranteed income - a pension.

The main nuances of mortgage lending for this category of people:

- Pensioners can count on a loan at 7.4%. But the final figure may be higher, since experts take into account a number of nuances. Specifically, canceling life insurance will increase the rate by 1 percent.

- The loan term is no more than 30 years.

- Sufficient income to pay fees. Only pension income or the pension and salary of a working pensioner can be indicated here.

- The down payment is at least 15 percent from your own money.

- The loan amount must be at least 300 thousand rubles.

- Borrowed funds are issued in Russian rubles.

Mortgage plus maternity capital

By purchasing finished or under construction housing with a mortgage from Sberbank, you have the right to use maternity capital funds to pay the down payment or part of it. Borrowers who have taken advantage of the mortgage lending programs: “Purchase of finished housing - flat rate” and “Purchase of housing under construction” will be able to obtain a mortgage using maternity capital. The minimum down payment is at least 20% of the value of the loaned property.

Benefits of a loan

- Very favorable mortgage interest rates;

- There are absolutely no commissions;

- Preferential loan terms for young families;

- Individual approach to consideration of a loan application;

- Special conditions for salary clients;

- To increase the amount of the mortgage loan, you can attract co-borrowers;

- Possibility of obtaining a credit card from Sberbank.

In addition to the required documents for the “Purchase of housing under construction” and “Purchase of finished housing” programs, you will need: A state certificate for maternity capital and a document from the territorial body of the Pension Fund of Russia on the balance of maternity capital. You must insure the property pledged as collateral (with the exception of the land plot) against the risk of loss for the entire term of the loan agreement.

Will interest rates on the loan decrease?

When deciding to apply for a mortgage loan, many people are concerned about whether the interest on the loan will be reduced during the year. This is due to the fact that everyone would like to receive funds to purchase their own home on more favorable terms. It is difficult to answer this question unequivocally. But analysts predict an improvement in lending conditions. The decrease in interest is associated with a decrease in the level of inflation in the country and an increase in interest in mortgage lending on the part of citizens. The number of transactions involving borrowed funds is growing steadily. This, in turn, may indicate that the real incomes of citizens have stabilized and are trending upward. There was confidence in the future.

Against the backdrop of all this, it is possible that interest rates on loans for certain categories of citizens, as well as on mortgages on a general basis, will continue to decline, just as they did in 2021. There are no direct statements from the bank's management in this regard yet. The influx of clients buying real estate on credit contributes to the development of the construction industry. A reduction in loan interest will attract even more citizens. All participants in the process will benefit from this: citizens, banks, construction organizations.

Minimum loan size for a non-targeted loan secured by real estate and how it is calculated

The lender offers to obtain a non-targeted loan secured by real estate. The meaning of the loan is that the client pledges an apartment, townhouse or country house of which he is the owner. In this case, the borrower receives a large amount and for a long period - up to 20 years.

The minimum value is set at 500,000 rubles. Sberbank employees do not disclose exactly how the minimum loan amount is calculated. But the client’s monthly income and credit history play a key role. The recommended loan payment should be no more than 40% of the applicant's income.

Important! If the borrower is legally married, then the income of the spouses is summed up. The income of attracted co-borrowers is also considered.

The cost of real estate is also important. Therefore, a prerequisite for mortgage lending is a property assessment by a specialist. Sberbank makes a decision based on an assessment of the apartment made by a specialist from an accredited company, and not from the seller. Considering that the prices indicated by the appraiser and the seller may differ, Sberbank’s offer may differ from the applicant’s requests.

Interest rates

You can take out a mortgage loan using a simplified option, which allows you to obtain borrowed funds using just two documents. In order to submit an application you will need:

- Passport of a citizen of the Russian Federation.

- Another identification document.

The client will have to fill out an application in which he must provide reliable information. This will speed up the procedure. Errors in the application may lead to refusal by the bank.

Loan interest will depend on various factors. The borrower can additionally take advantage of promotions and special offers. The difference from the general conditions for the rate will be 0.5% if the client does not receive wages or other income on the bank card. At the same time, to calculate the maximum amount, the bank accepts information about income that the borrower cannot document.

After the application is approved, you will need to submit documents for the property that is subject to lending (60 days are allotted for this), as well as a certificate confirming the availability of funds for the down payment.

country estate

The loan is provided for:

- Purchase or construction of a summer house (garden house) and other buildings for consumer purposes;

- Acquisition of land;

- Mortgage loan amount: from 300,000 rubles;

- Mortgage rate: 9.50% per annum;

- Loan term: up to 30 years;

- Down payment: 25%;

- Loan collateral: pledge of the loaned or other residential premises or guarantee of individuals;

- Commission for issuing a loan: not charged.

How to get a “Country Real Estate” loan?

- Provide a package of documents for consideration of the loan application;

- Receive a decision on your application;

- If the decision is positive, present the documents on the property to the bank;

- Sign the mortgage loan documents;

- Register your rights to the property in Rosreestr.

Applying for a secondary loan: interest and conditions

Despite the fact that today developers offer apartments in high-rise buildings under construction on favorable terms, many citizens are more interested in purchasing ready-made housing. Here the bank meets its clients halfway, providing favorable conditions when purchasing an apartment on the secondary market:

- A loan at 9.4% is available provided that you have a bank salary card, life insurance is in place, and the apartment is registered electronically.

- Borrowed funds can be provided for a period from 1 year to 30 years.

- The borrower must be at least 21 years old and no more than 75 years old at the time of loan closure.

- The total work experience must be at least 1 year. You must have worked in your last job for at least 6 months at the time of application.

- The down payment for a finished apartment is the same as for new buildings - only 15 percent.

Thus, the bank expands the boundaries of housing choice for clients using borrowed funds, allowing them to look for a good option among ready-made apartments. Review of the application by managers will not take much time. If the borrower meets the requirements and has sufficient income, then you can safely submit the collected documents for consideration.

Mortgage for the construction of a private house

Sberbank provides its clients with the opportunity to obtain a mortgage product not only for new buildings or finished housing, but also for the purchase of land for individual housing construction. This type of lending is quite risky for the bank. If the construction of the house is not completed, the bank may suffer significant losses. Therefore, the main requirements of this program are the provision of another property to secure collateral obligations.

The borrower can receive loan funds in several stages. After confirming the intended use of funds, he can count on receiving the next tranche.

It is important to understand that building a house and spending funds is possible only after the project has been agreed upon with bank representatives. No change can be made without the participation of a credit institution.

Despite the fact that the interest rate for this program is higher than for other mortgage products, there are several distinctive features that make this product quite profitable:

- The bank allows you to use maternity capital as a down payment or partial repayment of debt. You can also take advantage of the preferential program for young families within the framework of this project;

- if the client is a participant in the Sberbank salary program, he will receive a discount on the interest rate;

- The terms of this program do not provide for restrictions on the loan amount. Attracting co-borrowers will significantly increase this indicator;

- As a result of approval, the client receives a personalized card with a certain limit.

Construction is a long process, so at the stage of applying for a loan it is worth wisely assessing your capabilities. You also need to know whether the selected land plot meets Sberbank’s requirements for obtaining a mortgage loan.

Bank requirements for the site:

- Location of the object. The land plot can be located both within the city and outside it. However, this mortgage program does not provide for issuing loans for construction in villages.

- Quality of the land. The purpose of the land plot can only be individual housing construction. Also, a representative of the credit institution checks the quality of the soil on which the construction project is planned to be built.

- Materials for construction. A house under construction can only be a capital construction project. The bank does not consider the construction of wooden structures.

- Communications. The object under construction must be equipped with all necessary communications.

A number of additional requirements may apply. It all depends on the loan object and the individual capabilities of the borrower.

Conditions for providing a mortgage loan:

- minimum amount - 300,000 rubles;

- The term of the mortgage loan is up to 30 years;

- down payment - at least 25%;

- the maximum amount is no more than 75% of the value of the property registered as collateral.

The interest rate when using this program will be 11.6%. The requirements for the borrower are the same as for other mortgage programs.

Important! A mandatory condition will be insurance of the facility under construction.

These mortgage lending programs are the most popular among Sberbank clients. However, the bank also has other profitable projects that can be used under the terms of a mortgage loan.

How to reduce the percentage

When taking out a long-term loan, you should take into account that even the slightest reduction in interest will save a significant amount. Therefore, you should not neglect the opportunity to reduce your monthly expense item. Let's look at what affects loan interest:

- Real estate properties sold at a promotion from a bank and developer will reduce the rate by approximately 2 percent.

- Life insurance will add another 1% savings.

- If the client receives wages on a bank card, then the rate will be reduced by another 0.5%.

- A child mortgage will allow you to pay off the loan at a rate of 6% upon the birth of your second and/or third child.

- Confirmation of income with an official certificate will allow you to count on more profitable loans.

- Registering a property electronically gives an advantage of 0.1%.

- A real estate loan taken for a short period will also allow you to save on interest payments to the bank. But early repayment of debt with a long loan term will not provide the same savings.

Problems with repaying your mortgage

If the borrower has problems repaying the debt, it makes sense not to delay, but to contact Sberbank for help. At the moment, there are at least two options: restructuring according to bank rules and credit holidays according to the law.

Loan restructuring

Restructuring allows:

- defer loan repayment;

- increase the mortgage term to reduce the monthly payment amount;

- if the mortgage is in foreign currency, it can be converted into rubles.

Restructuring is provided at the request of the borrower, if he can confirm his difficult financial situation. For example, if he lost his job or became seriously ill.

Mortgage holidays

A difficult life situation is a reason to ask for a mortgage holiday. Now there are two reasons for this:

- according to Art. 6.1-1 Federal Law “On Consumer Credit”;

- according to the law on credit holidays due to the pandemic.

The application can be submitted electronically through your mortgage manager.

Military mortgage from Sberbank

The rules for applying for a loan to purchase housing for military personnel have improved somewhat. To receive a loan, a citizen must meet certain requirements and submit a regulated package of documents to the bank. Borrowed funds are issued on the following conditions:

- Loan amount up to 2.33 million rubles. In 2021, it could not exceed 2.12 million rubles. Thanks to the bank's innovations, the choice of residential real estate has expanded.

- The loan term is no more than 20 years.

- The down payment is at least 15% of the cost of the purchased apartment.

- The interest rate is within 9.5%.

- A stable income allows you to regularly pay correctly calculated monthly payments.

To apply for a loan to purchase real estate, military personnel must prepare the following documents:

- Passport or other identification document.

- Borrower's questionnaire.

- Documents about the property being purchased.

- Certificate confirming the possibility of participation in the preferential lending system.

- Certificate of income for the last 6 months.

Since the bank approaches each client individually, other documents may be requested.

Purchase of finished housing

A mortgage loan is approved for the purchase of real estate on the secondary housing market. The interest rate on the mortgage is from 8.80% per annum. Borrowers who bought a finished apartment on the DomClick.ru Service will receive a 0.30% discount on the mortgage rate. You can also get a discount on the percentage by taking out life insurance (-1%). Discount for young families – 0.40% per annum. The application can be submitted online from the official website of Sberbank. You will receive a loan decision within 24 hours (also online).

How to apply and receive a decision?

- Calculate your mortgage loan online (there is an excellent calculator on the bank’s website);

- Complete and submit the application online;

- Choose an apartment;

- Complete the transaction (electronic registration).

- Loan currency: Russian rubles;

- Minimum loan amount: 300,000 rubles;

- Maximum loan amount: should not exceed the lesser of 85% of the contractual value of the housing being financed or 85% of the estimated value of another property being pledged as collateral (90% for clients receiving salaries into an account with Sberbank);

- Loan term: up to 30 years (up to 12 years under the program for subsidizing rates by developers);

- Down payment: from 10% for salary clients of the bank (receiving wages from 09/17/2019 to 01/20/2020 as part of the down payment promotion). From 15% – for other borrowers (from 50% – for borrowers who have not confirmed their income and employment);

- Commission for issuing a loan: not charged;

- Loan collateral: collateral for the loaned or other premises;

- Insurance: mandatory insurance of the property pledged as collateral (except for land) against the risks of loss or destruction, damage in favor of the bank for the full term of the loan agreement;

- Geography: the entire Russian Federation.

Interest rates:

- Base rate: 9.20% per annum;

- Rate within the framework of the “Promotion for Young Families”: 8.80% per annum.

Mortgages for young families

Young families need special help, which is why the bank’s experts have provided special offers for them. Young families include citizens who got married before the age of 35, as well as single parents with the same age restrictions. For this category, loan approval is provided at 8.6%. The duration of the loan can be up to 30 years, but cannot be less than one year. If a second or third child is born in the family from January 1, 2021, then lending at a rate of 6% will be an advantageous offer. These conditions are now relevant not only to young families, since older parents can also take advantage of them.

The program was created to motivate citizens to start a family and promote demographic growth by encouraging families to have more than one child. After all, many parents were stopped by the fact that it was not possible to buy a spacious property when expanding their family. Now it is possible to provide decent living for families who decide to have two, three or more children during the program period. The bank set a time limit for the program - the end of 2022.

Mortgage for secondary housing and its features in 2021

The loan funds that the bank issues to the client for the purchase of secondary real estate are called mortgages for secondary housing. In this case, the object for which ownership is registered is recognized as secondary. It must be ready to move in. The apartment can be located in an old or newly completed building. Only in the case of obtaining a primary mortgage, the borrower purchases the property from the developer, and when obtaining a secondary mortgage, from an individual (owner). The period for consideration of a loan application is no more than 8 working days.

Advantages of a mortgage for secondary housing

- Obtaining a secondary mortgage makes it possible to buy a finished home and move into it immediately. If you buy a primary home, a “new building” or a “construction option”, you will need to wait until construction or renovation is completed.

- For secondary housing, loans are issued at a lower interest rate, because... The bank's risk is significantly lower than when issuing a loan for the purchase of housing under construction, an apartment, a residential building or other residential premises on the primary real estate market. With the exception of promotions under the subsidy program and discounts from developers and bank partners.

- The borrower also takes less risk because he sees finished housing, rather than construction prospects outlined by the developer. Another advantage is that resale properties tend to be cheaper. However, the resale value of real estate will also be lower than in the case of primary housing.

Mortgage refinancing

The credit burden has become an unbearable burden for many citizens today. A mortgage loan previously taken out on less favorable terms can become a serious burden if the family’s income has decreased, children have appeared, or additional loans have been issued. Refinancing a mortgage loan can help in this situation. You can refinance both the mortgage of Sberbank and other banks by choosing more favorable offers.

Additionally, the refinancing program allows you to combine mortgage lending with other loans in order to pay them off in one place, at one time. The requirements for borrowers applying for refinancing are the same as when applying for a mortgage loan on a general basis: age 21-75 years, total work experience of at least 1 year, proof of income from the current place of work for at least 6 months. The borrower must not have serious delays in payments.

The bank is considering refinancing in an amount of at least 500 thousand rubles, the maximum amount should not exceed 80% of the value of the property being pledged. When refinancing, you can expect to receive up to 1 million rubles for personal purposes at the mortgage rate.

Additional opportunities for mortgage borrowers

A mortgage loan is a long-term commitment. Therefore, even if the borrower currently has a stable financial position, the situation may change in the future. If the user realizes that the financial burden is becoming burdensome, the credit institution must be notified immediately.

If the cause of financial instability is significant, then in such a situation Sberbank offers its clients a refinancing program. This will help not only reduce your debt burden, but also maintain a positive credit history, avoiding violations of the loan agreement.

Today, applying for a mortgage with Sberbank can be a very profitable solution for the borrower. However, it is extremely important to think over and calculate all possible options that will allow you to receive a loan on terms favorable to the client. If you use all available tools wisely, you can significantly reduce your mortgage loan costs.

The most favorable rate in Sberbank

To determine which of the proposed programs is most acceptable for the client, it is necessary to compare how much interest per annum is offered by certain mortgage loans from Sberbank.

| Program | Standard | Promotional | Minimum |

| Buying a home in a new building | 10,7% | 10% | 8% |

| Buying a finished apartment | 11,5% | 11% | 10,5% |

| Plus maternity capital | According to the main mortgage program | 11% | 10,5% |

| Housing construction | 12% | — | 12% |

| Country housing | 11,5% | — | 11,5% |

| Military mortgage | 10,9% | — | 10,9% |

Prerequisites

It is important to know some mandatory conditions for a mortgage from Sberbank:

- real estate is purchased on the territory of the Russian Federation;

- lending currency – Russian rubles;

- The property is pledged and insured by the borrower for the entire loan term. Mortgage insurance at Sberbank was discussed in detail earlier, here we remind readers that there are two types of insurance: mandatory for property and voluntary for the title of the apartment and the life of the borrower;

- The requirements for a co-borrower on a Sberbank mortgage are the same as for the loan recipient: age restrictions apply, proof of employment and income is required.

We will talk about the types of loans and the features of their processing in the next section.

How can you increase the maximum loan amount?

To obtain a larger loan, it is necessary to offer the bank more favorable conditions - collateral in the form of other real estate, attract guarantors or provide documents confirming the presence of additional sources of income.

Solvency is the main criterion in this matter. The higher the salary, the more money the bank will be able to offer. However, only official income is taken into account. Those that you can confirm with a 2-NDFL certificate, a deposit statement, a document on the rental of real estate, etc.

If the income is not enough, payments can be divided over a longer period - for example, not 15, but 20-25 years. Thus, the amount of the required monthly payment will decrease and you will have the opportunity to take out a larger loan. It is worth considering that overpayment will result in higher interest rates and to avoid this, it is recommended to make payments ahead of schedule.

The loan amount is calculated for each client separately. Using an online calculator you can only get approximate data. You can find out the exact information by visiting a bank branch in person and providing a company employee with all the necessary documents.

Advice for practical borrowers

Mortgage conditions at Sberbank in 2022 are attractive, and many clients use the bank’s calculators to calculate payments and tariffs. Simple rules will help you choose the optimal lending conditions and get benefits:

- use all budget and bank subsidies provided to your family (military certificate, maternity capital, conditions of the “Young Family” state program, benefits for public sector employees and corporate clients of the bank). Reducing the rate by 1-1.5% per annum will provide tangible benefits when taking out a large loan for a long term;

- Give the bank as much information as possible about your financial situation. This will help you get loan approval on standard and special conditions;

- apply for a property tax deduction when purchasing real estate. The money received can be used for early settlements with the creditor or for the improvement of new housing;

- choose the terms of a Sberbank mortgage, assessing your capabilities in 2022 and the prospects for changes in income. Preliminary calculation and a conservative approach to lending is the best strategy!

- Don't be afraid of electronic registration. It will allow you to save significant money.

- submit an application through bank partners. This will increase the chances of approval and receive certain preferences on the rate.

You can learn what documents are needed for a mortgage in Sberbank and how to apply for a mortgage in Sberbank step by step from our previous posts. Also be sure to look at the post about how a mortgage is issued without a down payment at Sberbank of Russia.

You can apply for a mortgage online through our service directly on the website.

We are waiting for your questions about working with Sberbank mortgages below. We would be grateful for reposting and rating the article.