Last update: 02/16/2021

No matter how a person gets used to his own home, sooner or later he has to change it. Few people spend their entire lives in one place. The reasons may be different - I changed jobs, started a family, children grew up, or I grew above myself and my capabilities. There is only one result - the old living space is no good, a new one is needed. So it's time to change. How does the exchange of apartments ? How to exchange your apartment for another? What is the procedure here?

Now we will figure out how all this is done.

First of all, we find out what type of housing we are talking about - public or privately owned . The method of processing the exchange depends on this:

- state apartment - exchange with the permission of the relevant government agency;

- private apartment - exchange by agreement of the parties or sale with simultaneous purchase (alternative transaction).

Now - in order.

Extract from the Unified State Register (EGRN) for an apartment - what is it, what information does it contain, where and how to get it? See the Glossary at the link.

About legislation - in a nutshell

The exchange agreement is provided for in Article 567 of the Civil Code of the Russian Federation. The same conditions apply to it as to the purchase and sale agreement. In other words, the parties need to decide on two important points:

- Accurately identify the objects to be exchanged (locality, address, area, inventory number and other significant points);

- Agree on the cost. If necessary, the obligation of additional payment for a specific party is determined, as well as the amount and procedure for depositing funds.

Requirements for an apartment for exchange:

- Being in private ownership (the party to the contract must have the right to own and dispose of the object);

- No encumbrances (the apartment is not pledged, mortgaged, and is not the subject of claims from third parties).

Important

! According to Article 72 of the Housing Code of the Russian Federation, users of an apartment under a social tenancy agreement also have the right to exchange the object. They can do this with the user of the same property. In practice, such transactions occur rarely.

The exchange took place. What to do next?

Of course, repairs. It is necessary to remove memories of the previous owner from the walls, ceiling and floor. You can glue the wallpaper yourself and take master classes on applying Venetian plaster. Or you can do it easier and turn to professionals - order a turnkey overhaul service. Professionals will take on the renovation of your new living space: they will draw up an estimate, develop an architectural design, purchase materials, remove construction waste and even carry out clean-up after the renovation is completed. And all this for a fixed time and cost. All that remains for you to do is choose a design, get a finished apartment and invite guests to your housewarming party

Making a deal

To exchange an apartment you will need the same documents as for sale:

- registration certificate for the apartment, extracts from the Unified State Register;

- a document confirming the method of acquisition (sale and purchase agreement, shared construction, etc.);

- identification of each party to the transaction;

- consent of the spouse if the object was acquired during marriage;

- consent of the guardianship authorities if children live in the apartment;

- other documents (information about the absence of debt, information about residents registered in the apartment).

Features of the transaction:

- The agreement is drawn up in writing in 3 copies (one for the parties, the third for Rosreestr);

- Before signing, the procedure and conditions for additional payment are determined;

- The transaction is subject to registration in Rosreestr (the most convenient way is through the MFC).

Attention!

As a general rule, notarization of the exchange agreement is not necessary, but it is better to use it.

Exchange options

As mentioned earlier, the process of exchanging municipal housing is quite complex. There are several possible exchange options:

- By consent. One of the mandatory conditions under which it is possible to exchange municipal housing is the consent of all adults registered and living in the area. If children, incapacitated people or citizens with disabilities live in the living space, it is in no case possible to do without the consent of the social protection authorities to the exchange process. It is possible that consent will not be obtained. A refusal may be received due to the fact that living conditions in the living space chosen as an exchange option are much worse than in a municipal apartment. The final decision must be made by the OSOiP no later than 2 weeks after the employers have submitted the application letter.

- Forcibly. An exchange of a municipal apartment through the court is possible if anyone living or registered in a municipal apartment does not want to carry out an exchange or is not satisfied with the exchange option proposed by the party initiating the exchange. In this case, the initializer is forced to demand a forced exchange by going to court. When going to court, according to the rules of the housing code, the plaintiff must have not only compelling arguments that are the reason for the exchange, but also several possible exchange options. Only in this case can the court take his side. Otherwise, it is almost impossible to count on a positive decision.

If you cannot avoid a lawsuit, it is recommended to seek the help of a lawyer. He will help you correctly draw up a statement of claim to the court. This document must contain the following information:

- Name of the judicial organization.

- Plaintiff's passport details.

- Data about the residential premises (its status).

- Information about minors or incapacitated citizens registered in the apartment.

- The reason that became the main reason for exchanging housing.

- Previously taken steps in this process.

- Reasons why mutual agreement was not reached.

- Consent of the board of trustees to carry out the exchange process.

In addition to the claim, the plaintiff must have the following documents:

- Consent of the compulsory medical insurance to carry out an exchange transaction.

- Documents that confirm the consent of all citizens registered in the apartment.

- Certificate from the registry office about family composition.

- A document confirming payment of the state duty.

- Copies of passports of everyone assigned to the apartment.

There are a number of reasons why a judicial organization may not give permission to exchange a municipal apartment. Among the most common are the following:

- The residential premises are controversial, are in disrepair or the house is planned to be demolished in the near future.

- As an exchange option, a room in a communal apartment was chosen, where an incapacitated or disabled person cannot live.

- The tenancy agreement is changing or is scheduled to be terminated.

- One of the premises selected as an exchange option may not be suitable for habitation.

As for the time that the whole process will take, it is very difficult to talk about it. It depends on many factors. First of all, it depends on how quickly you can find suitable exchange options. As a rule, realtors practically do not do this, which means you will have to look for options on your own. If a lawyer and a notary are involved in the procedure or in the event of a trial, this will require additional costs, but will make the transaction as safe as possible.

If we talk about where to start exchanging a municipal apartment, you should contact an experienced lawyer, which will help avoid many of the difficulties of the process and significantly speed up the exchange process.

Counter-sale of apartments: does this make sense?

There is a lot of advice on the Internet that it is better to arrange the exchange through two sales contracts. I do not recommend using this scheme for the following reasons:

- In fact, there is not a purchase and sale, but an exchange; money is not transferred;

- If the transaction is cancelled, it will not be possible to return the previous apartment;

- Each contract specifies a price, so the opportunity to “reduce the tax burden” disappears.

Where did the idea of hiding the exchange behind a double purchase and sale even come from?

I think realtors came up with this to charge double rates to clients. There is no problem stipulating in the real estate exchange agreement the need for additional payment, leaving the furniture and other conditions. Moreover: there is no legal prohibition to exchange one apartment for two others (especially of equal value), for a country house or even for a plot.

Note!

An exchange agreement for a mortgaged apartment is theoretically possible, but in practice banks do not give consent to such transactions.

How can I change my apartment?

Apartment exchange is carried out according to one of the following options:

- On the secondary market. Owners, at their discretion, sign one exchange agreement or two purchase and sale agreements. The parties to the transaction consider the issue of additional payment independently, depending on the quality of the transferred housing.

- On the market of new buildings using the trade-in system. The developer and the buyer also enter into a contract of agreement. The proceeds are counted towards the new apartment.

- In the municipal housing market. The procedure is possible only with the permission of the municipality. It will not be possible to exchange privatized space for municipal space.

Let's take a closer look at the first two options. The third can be carried out only after consultation with your housing committee or another structure in charge of the apartment.

Complete turnkey apartment renovation

- Everything is included The cost of repairs includes everything: work, materials, documents.

- Without your participation After agreeing on the project, we only bother the owners when the repairs are completed.

- The price is known in advance. The cost of repairs is fixed in the contract.

- Fixed repair period Turnkey apartment renovation in 3.5 months. The term is fixed in the contract.

Read more about Done

Do I need to pay tax when exchanging an apartment?

When selling real estate at a profit more than once every 5 years, you need to pay income tax - 13 percent of net income

. That is, if A. bought an apartment in 2021 for 5 million rubles, and sold it in 2021 for 10 million, he will have to file a declaration and transfer to the state 13% of the difference of 5 million, or 650 thousand rubles .

Since, according to Article 567 of the Civil Code of the Russian Federation, the rules of a purchase and sale transaction apply to the exchange agreement, then tax will have to be paid in a similar situation. But there is a nuance!

For example, two apartments of equal value are subject to exchange, the market value of which has increased.

In contracts, you can specify a figure that suits both parties (for example, the price upon acquisition/creation). In this case, you will not have to pay tax. There is no direct violation of the law, since participants have the right to determine any price

.

One apartment for two

How to exchange one living space for two? In practice, less often, but still there are situations when it comes to exchanging one living space for two. This is called "exchange" .

Often such situations arise when it comes to dividing inherited housing between several heirs or when spouses separate from each other as a result of divorce.

How to make an exchange? To complete a transaction, you need to perform several sequential actions:

- sale of a large apartment (purchase and sale);

- purchase of 2 smaller footage (purchase and sale).

Can furniture, appliances and repairs be specified as an additional payment for the property?

An interesting tip is to “balance” the cost of an apartment with furniture and appliances

. The problem is that in this case you need to individually identify each item and indicate its value. Repairs generally cannot be an “option” when selling an apartment, since the property is sold either with finishing or without.

How to get out of the situation? Indicate in the contract only expensive things (if they really act as an additional payment). For example, a kitchen set, an oven, a refrigerator. Another option is to draw up an annex to the contract, which will list the furniture. But it is better to specify in the agreement an additional payment in rubles, which, by agreement, will be accepted by the furniture.

State duty

Don't forget to pay the state fee. Its size, according to the Civil Code, is exactly the same as when making a transaction for the purchase and sale of residential premises. The one who makes the decision to exchange a municipal apartment acts as a seller, and the residents who live in apartments acting as an exchange act as buyers. According to the Law, state duty is not paid if the owner of the apartment has lived in it for more than 3 years.

A receipt for payment of the state duty is required when making a transaction for the exchange of a municipal apartment.

Verification of encumbrances

It may seem that an exchange is safer than a pure purchase

. Indeed, if the transaction is cancelled, the parties will return to their original state. But after the exchange, the apartment can be sold - another interested person will appear. Theoretically, the chain of transactions risks becoming impressive. This is why it is worth checking the counterparty through registries:

- enforcement proceedings;

- bankrupt;

- pledges.

Ideally, ask the seller for a credit history statement

. If the counterparty has no debts, then the risks are also minimal. When registering with Rosreestr, it will not be possible to alienate an apartment with encumbrances. But, I repeat, in this case the parties return to their original state - this is easier than trying to return money for real estate.

If one of the owners is against

When conducting a transaction, it is important to obtain the consent of all co-owners of the property. If the child is under 14 years old and does not have a passport, consent is given by the parents. After overcoming the age of 14, the child gives consent independently, but with the approval of the parents. If there is no agreement, the initiator of the exchange can only dispose of his share.

If one of the co-owners wishes to exchange the property, he must notify the other co-owners about this. If there is no agreement, he sends written notice of the upcoming transaction and offers to buy out the share for a certain amount. If the share is not redeemed within 30 days or he receives a written refusal, you can look for an exchange option. In this case, he can exchange the share for the same in another apartment, an apartment with an additional payment, a house or other real estate.

If we are talking about municipal housing, you must submit an application to the municipality, which will make a decision based on the application. In order not to be refused, it is advisable to provide an exchange option in advance.

Summary. The contract is more complicated than a purchase and sale, but not very much

So, if you need to sell and buy an apartment at the same time, an exchange will do. The transaction is not prohibited by law; no special requirements are imposed on it. The key nuance is the correct execution of the contract. You will have to fork out for legal assistance, at least for notary services.

By the way, I have my advantages, the main one being safety.

. Both parties will not deal with cash or a bank account (or at least with a minimum amount). Such a deal is not held in high esteem by scammers, so the risk of being deceived is small.

Grounds and reasons

As a rule, the reasons for exchanging a non-privatized apartment through the court are: domestic disagreements, systematic quarrels between residents.

Also, if one of the cohabitants deliberately harms others - he acts as a hooligan or leads an antisocial lifestyle, making the lives of others unbearable (or even jeopardizing them).

At the same time, a compromise regarding travel in the household has not been reached and someone is actively opposed (or the landlord has already vetoed it).

You can learn from our articles about whether it is possible to exchange an old home for a new building, a room for a house and a plot of land, and how to do the exchange correctly with an additional payment.

Options with and without surcharge

For one and two 1-room apartments

You can exchange a two-room apartment for a one-room apartment, but an additional payment will be made in favor of the owner of the two-room living space. The following factors contribute to this:

- availability of an additional room;

- large living area.

But you need to take into account that if a one-room property is superior in characteristics to a two-room property, for example, a new and an old house with the same apartment area, then it can be exchanged at the same price or even with an additional payment to the owner of the one-room property.

The real estate market has its own pricing laws. For example, in the vast majority of cases it is impossible to exchange a two-room apartment for two one-room apartments without additional payment. But there are exceptions:

- If a 1-room property is for small families, and a 2-room property is spacious and located in an elite building.

- If both apartments belong to the owners under a social rental agreement, and the tenants agree to such conditions.

Apartments that have not been registered in ownership can be changed only after receiving approval from the housing department of the administration of a particular locality.

Change to two-room

When exchanging 2-room apartments with identical characteristics, the transaction is considered equal. This procedure may be beneficial in the following cases:

- exchange of housing between relatives;

- moving to another city or region.

An exchange without additional payment is also possible if the advantages of one object are compensated by the advantages of a different order belonging to the second object. For example, one apartment may be more spacious, but the second one is located in the center. In such a situation, owners can agree on an equivalent exchange or provide an additional payment.

Finances need to be paid extra only if there are clear advantages of one of the objects: significant differences in footage, proximity to the metro or the center of the village.

For a 3-room apartment

Without attracting additional funds, it is possible to exchange a three-room Khrushchev apartment for a two-room apartment with an improved layout (with or without additional payment). A similar transaction is possible if the two-room property has significant advantages:

- the presence of a large loggia;

- located in an area where infrastructure is more developed;

- closer to a bus stop, metro station or center;

- the building is new or after major renovation.

In addition, the presence of family ties between the parties to the transaction and the status of the settlements in which the buildings are located are important. In some cases, the lack of additional payment is explained by the presence of expensive plumbing, good repairs and other improvements in smaller housing.

If the contractors do not like the repair, they have the right to refuse to pay extra for it, in which case the efforts expended will be in vain.

To exchange two- to three-room apartments located in equivalent buildings erected at approximately the same time, an additional payment is required. When calculating the amount, additional footage and the market value of this category of real estate are taken into account.

For a 4-room apartment

An exchange for a four-room apartment without additional payment is possible only if there is a significant advantage in two-room housing. It can be expressed in the following features:

- the quality of the house, including the year it was built;

- geography of the settlement;

- distance of the building from the center;

- innovative equipment for a smaller facility, in the absence of amenities in the second apartment.

If the characteristics of the property can be called similar, an additional payment is made proportional to the difference in footage. also be requested for an additional room.

For a private house

In this case, understanding the intricacies of pricing is most difficult. It may be necessary to calculate the costs of building a similar house and subtract the amount of depreciation over the years of operation of the structure.

The degree of infrastructure development, the presence of basic utilities, etc. are also taken into account. If the adjacent territory is privatized, the price of the territory is also added here.

If a plot of land is leased from the municipality, its value should not be taken into account.

Having found out the cost of an apartment and a house, you should subtract the smaller from the larger value. This will be the amount of additional payment that the owner whose property turns out to be more expensive will receive. If the indicators are approximately equal, a direct exchange is carried out.

Exchange on the secondary market

It is quite possible to exchange an apartment for another on the secondary market. The most difficult stage is finding a suitable housing option, and registration is quite simple, with the help of one exchange agreement or two DCTs.

Exchange is possible:

- for equivalent housing - then the cost of the apartments is completely the same, down to the last penny;

- for larger and more expensive real estate - then you need to make an additional payment;

- for smaller and less expensive real estate - then the other party makes an additional payment.

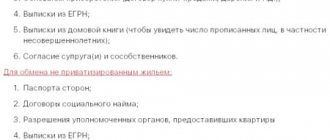

List of documents

The list of documents is similar to a regular sale and purchase, only both parties collect:

- passports of exchange participants;

- extract from the Unified State Register of Real Estate – order a current one, no older than a month, to check arrests/bans/encumbrances;

- document-basis - for a deeper analysis of legal purity;

- technical passport - to check the redevelopment;

- a certificate of absence of debts for housing and communal services - in order not to receive an apartment with debt;

- certificate of registration - close the risk of getting an apartment with a registered person;

- notarized consent of the spouse to the transaction;

- permission for guardianship if an apartment belonging to a child is alienated;

- a receipt for payment of the state fee of 2,000 rubles for each apartment - for the MFC.

When the documents are collected, you can draw up an agreement for exchange.

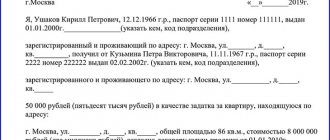

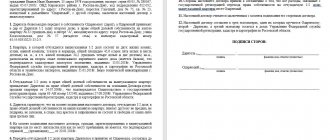

Agreement form

In the agreement for the exchange of an apartment with or without additional payment, you must specify:

- Full name, passports and addresses of the parties;

- description of apartments with address, cadastral number, area, number of rooms;

- general legal formula: “The parties exchange the apartments belonging to them”;

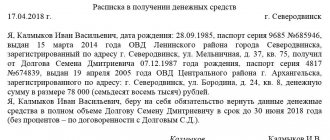

- cost of apartments, size and procedure for additional payment;

- transfer procedure (under a deed or under an agreement);

- other conditions that the parties deem necessary.

The cost must be indicated. The parties can base it on any numbers - market, cadastral or inventory value. There is no need to attach any special reports; you just need to evaluate the property at your own discretion. The amount of the surcharge is also required.

If no additional payment is planned, this is also stated in the agreement. The prices in this case are equal.

ATTENTION! Download the exchange agreement form to fill out. The transaction does not require notarization if there are no minor owners and shares in the right are not alienated.

Procedure

Let's look at how an apartment is exchanged on the secondary market step by step:

- Search for options for exchange, preliminary inspection of housing and preliminary agreements.

- Collecting documents for apartments according to the list above.

- Drawing up an agreement.

- Submitting an agreement to the MFC for registration of rights. You must come to submit in person with your passports and transaction documents. The application will be completed by an MFC employee at the reception.

- Registration takes 3-14 days, after which the parties are issued statements indicating their rights to housing.

- Additional payment and actual transfer can be done at any stage.

If the transaction is carried out using two DCTs, then you will need to take two coupons to the MFC - since two sets of documents will be submitted.

Additional payment can be made using any method named in the article at this link.

Tax issue

Since an exchange with or without surcharge is equivalent to a sale and purchase, as a result of the transaction, the parties must pay a 13% tax to the budget if the property was in their ownership for less than 3 (5) years. When exchanging with an additional payment under one contract, citizens often make the mistake of calculating personal income tax on the amount of the additional payment. This is incorrect - the tax base in this case will be equal to the price of the transferred apartment.

Example. Sidelnikov A.P. and Palochkin G.V. We entered into an agreement to exchange our apartments with an additional payment. Palochkin’s housing is not subject to tax, because was in his possession for more than 5 years. Sidelnikov’s real estate is valued by the parties at 3,500,000 rubles, of which 3 million is paid for by Palochkin’s apartment, and 500 thousand goes as an additional payment. The tax must be calculated on the full cost - 3.5 million, and not on the amount of the surcharge.

Moreover, each of the “sellers” has the right to a tax deduction on sales and a tax deduction on purchases. The scheme is as follows:

- first of all, the tax base is reduced by a fixed deduction from the seller - 1 million rubles;

- then this point is reduced by the buyer’s deduction, since both transactions were made in the same tax period - by a maximum of 2 million rubles;

- 13% is taken from the amount received - this is the amount of tax to be paid.

Example. Vasyutina L.A. exchanged her apartment worth 3,000,000 rubles for another apartment worth 2,700,000 rubles and received an additional payment of 300,000 rubles. The tax base in her case was 3,000,000 rubles. By applying the seller’s tax deduction, Vasyutina received a base amount of 2,000,000 rubles. As a buyer of another home, she is entitled to a maximum deduction of 2,000,000 rubles. By applying it, Vasyutina will receive a tax base of 0 rubles - she will not have to pay tax.

Thus, the maximum deduction can reach 3 million rubles (1 million deduction from the seller + 2 million deduction from the buyer when tax is offset). All transactions are reflected in the 3rd personal income tax declaration. Read more about paying tax here.