System functions and capabilities

To gain access to the functions of the DomClick portal, you must register

. The registration procedure consists of sequentially performing simple steps:

Submitting an application is not a loan. To do this, click on the link “Calculate your mortgage and send an application to the bank.”

A page will open on which you can use a calculator to calculate the loan size, its cost, the amount of the monthly payment, and also register in the system.

After filling out the form, you need to click on the “Create personal account” button. In the pop-up window, you must enter the code from the SMS message that will be sent to the number specified during registration, and click “Confirm.”

Next, to enter your Personal Account, the specified phone number and password received via SMS will be used.

Online mortgage application submissions provide the opportunity to fill out the required information online and attach required documents to your application. Review of the application does not take much time. The maximum period for consideration does not exceed 2 days, although in practice approval or refusal comes on the same day that the application is sent.

After the bank approves the online application, the following options become available

:

- applying for a mortgage loan

- familiarization with the status of the application

- receiving advice at every stage of the lending procedure

- search for housing according to specified parameters

- viewing real estate properties offered for sale by real estate agencies and Sberbank partners among developers

- search for housing among confiscated or mortgaged properties

- receiving online advice from bank specialists in the field of mortgage lending

- provision of electronic copies of documents, which significantly speeds up and simplifies the procedure for lending and registration of housing rights

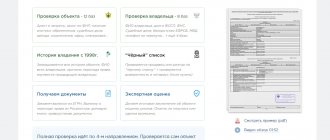

You can start searching for real estate in DomClick as soon as the bank has approved the application and designated the maximum possible loan amount for a specific borrower. After the property has been selected, you need to upload documents in your DomClick personal account and wait for the bank to approve the selected property.

After this, to conclude a deal, you will have to visit the Sberbank mortgage lending center

. A suitable date can also be selected on the website. If the borrower is looking for housing on his own, using the portal, you can carry out an examination of the property in order to establish the legal transparency of the transaction. As practice shows, most transactions on the secondary market can be challenged in court. Expertise helps protect the buyer from the following risks:

- acquisition of an apartment by the previous owner in violation of the law

- the child living in the apartment did not participate in privatization

- the interests of all heirs are not taken into account when inheriting real estate

- crazy salesman

- presence of a temporarily discharged resident

- the owner of the apartment is bankrupt

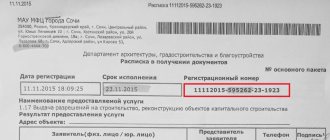

Registration of a purchase in Rosreestr is the last stage of the process of obtaining a mortgage from Sberbank through the DomClick portal.

More information about electronic transaction registration is described in a short video.

What is electronic registration of a real estate transaction and why is it needed?

The electronic service from Sberbank is a set of measures for registering agreements via the Internet when interacting with the DomClick online portal.

This means that in order to register in the Unified State Register of Real Estate a transaction for the purchase of housing using a mortgage or their own funds, the borrower will not have to collect documents and personally visit the Registration Chamber. Sberbank takes care of everything.

The remote real estate registration service includes:

- payment of the state duty for entering data on the completed purchase and sale transaction into the Rosreestr database;

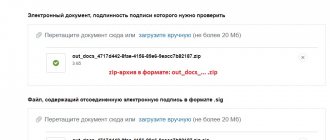

- production of a qualified electronic signature (CES) for the seller and buyer of real estate;

- sending documents electronically for registration in the Unified State Register of Real Estate;

- direct communication with the Registration Chamber before receiving the finished extract;

- support of the procedure at all stages.

When applying for a mortgage loan to purchase an apartment, the borrower will have to repeatedly deal with the need for state registration: when concluding a purchase and sale agreement, signing a mortgage agreement with the bank and drawing up a mortgage on the property being financed. Electronic service allows you to save time, money and effort, which is especially important for buyers from other regions.

Thanks to this approach, the time it takes to complete a transaction at Sberbank is significantly reduced, and the procedure itself is simplified. The borrower only needs to go to the bank once and provide the required package of documents. The manager himself will scan them and send them for registration to the justice authority. The completed extract will be sent to the applicant’s e-mail address.

More details about the service:

Features of a mortgage for secondary housing in DomKlik

Through DomClick from Sberbank you can purchase a house in a new building or on the secondary market. When deciding in favor of the secondary market, it is worth considering some features:

- The interest rate on a loan for an apartment on the secondary market is usually higher, and the maximum amount is almost half as low

- in a resale property you can immediately register and move into an apartment immediately after purchase, while in a new building a lengthy procedure for registering property rights cannot be ruled out; there may be an undeveloped infrastructure of the area and insufficiently streamlined engineering systems

- the transaction requires attentiveness from the buyer, since it does not exclude unaccounted claims from previous owners

- on the secondary market it is easier to choose suitable housing, since not only the condition of an individual apartment is taken into account, but also the condition of the house, the developed infrastructure of a residential area and other nuances

Is electronic registration of a transaction through Sberbank required?

Electronic registration of the transfer of ownership of a residential property is not mandatory at Sberbank when applying for a mortgage loan. Clients independently decide whether it is profitable for them to resort to this service or not.

Many people prefer to personally prepare the necessary documents and submit them directly to the territorial body of Rosreestr or the MFC (acts as an intermediary). Some are trying to save money, others don’t trust various innovations.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

Customers who use this online service can expect a reduction in the annual mortgage rate by 0.1% (applies only to new buildings and finished housing).

Online mortgage calculator in DomClick

You can calculate the required loan amount at DomClick using a loan calculator. For calculations you will need to enter the following parameters:

- purpose of the loan

- you must select a purpose from the drop-down menu (apartment in a new building, an apartment on the secondary market, building a house, a country house, refinancing, military mortgage, mortgage with state support for families with children) - cost of real estate

(minimum amount 300 thousand rubles, maximum is not limited) - down payment amount

– the minimum payment amount is calculated automatically and depends on the type of property - credit term

After entering the specified parameters, the built-in program will calculate the loan amount

, monthly payment amount and interest rate.

The interest rate may be affected by additional conditions, for example, having a Sberbank salary card, making a transaction through the DomClick portal, taking out insurance in companies accredited by Sberbank PJSC.

You can activate this or that option using the slider on the right.

Mobile application DomClick from Sberbank

To make the service even more convenient, Sberbank has developed a DomClick mobile application for mobile devices running on the iOS or Android platform.

The program can be downloaded for free on the App Store or Google Play. DomClick for iOS

DomClick for Android

Using a mobile application, you can choose a future apartment among more than 400 thousand objects, communicate with participants in the transaction via chat, exchange electronic documents, and receive prompt advice from specialists.

The application has received a high rating from users, which tends to reach 5 points on a five-point scale.

How to register in the system?

How to register in the DomClick system was discussed above. To do this, you must submit an application for a loan, enter the requested information and wait for the preliminary approval of the application.

Registration in the system is useful primarily for the loan applicant, as it opens up certain opportunities. After the application, online consultations become available, personal data is saved, it becomes possible to communicate with the manager, and transfer to the bank electronic copies of documents that are necessary to make a positive decision for issuing a mortgage loan.

I'm ruining the DomClick mortgage system

The curse of any scientific thinking is that its bearer evaluates an ordinary transaction not from the point of view of the business risk it carries, but much more broadly, discussing any difficulties, even unlikely ones. This takes much more time and effort, and the benefits are usually small. However, there are situations where scientific thinking saves you from mistakes, a kind of pleasant excess. And, of course, it is impossible to do without it in lawmaking, when any structure has to be shaken from all sides. But closer to the point...

I'm talking about the same sale of the apartment I inherited. The real estate market now is not what it was in the 90s or even in the 2000s. Few people have free money, so they take out bank loans coupled with a mortgage. Sber even created its own specialized product - DomClick, and many people go there. My buyer also contacted me and offered to pay me the purchase price using a mortgage loan through an irrevocable letter of credit. I don’t expect crazy fluctuations in the exchange rate, I have a tax benefit, why not.

And I propose to conclude an agreement with payment within 5 days after registration of the transfer of rights, from a letter of credit, relying on clause 5 of Art. 488 Civil Code. They say that until I receive the money, I will have a mortgage on the apartment to ensure payment of the purchase price, quite reasonable expectations. But it was not there. A prerequisite for Sber to provide a loan is that the seller waives this legal mortgage so that the property is transferred to the buyer without encumbrance and then becomes pledged to the bank. A quick search for other banks that would take into account the interests of the real estate seller did not lead to anything. Everyone demands that the Seller waive the legal mortgage.

I understand buyers: many of them have nowhere to get money except on credit from the bank. Therefore, they agree to any conditions. The rules of Art. work to protect their rights. 428 of the Civil Code on the agreement of adhesion. If the bank goes too far in its favor, the court will correct it. Perhaps these same rules will protect my rights, since I was forced to agree to abandon the legal mortgage in my favor. But it was not there. I am not a party to the accession agreement: my counterparty is the same citizen. The bank also forces him to accept the corresponding condition, but unlike him, I, as a seller, cannot refer to the rules on adhesion agreements.

And here the scientific brain sees a defect in our Civil Code: the adhesion agreement often has a reflected effect on the rights of third parties who are forced to agree to the terms of the agreement imposed on their counterparty, simply because market conditions force it to be concluded. However, third parties do not have any protection measures in this case, although it is clear that Sber dominates here. The only alternative for third parties is to refuse to sell using the DomClick system and look for a buyer with free money, which has been dying out as a class in recent years. But I want to sell the apartment. No one lives there and you have to waste money on utilities.

Since it is impossible to maintain a legal mortgage, you need to look for other ways to get rid of the risk that the purchase and sale agreement contains. Otherwise, ownership of the apartment will be transferred, but there will still be no money. I found several such methods. Firstly, there is a significant penalty for late payment (non-payment). But it makes sense if the buyer has money, because foreclosure on the apartment will not be possible. She is mortgaged by the bank, which has first-party rights. And in general, the apartment may turn out to be the buyer’s only living space, and foreclosure on it will be refused.

Secondly, the transfer of ownership of the apartment at the time of payment. This option is unlikely to suit the bank, which wants the encumbrance in the form of a mortgage to arise immediately upon registration of the transfer of rights. In addition, after refusing to register transactions with residential premises, it is impossible to separate the moments of transfer of rights to real estate and registration. They happen simultaneously. Therefore, the agreement that ownership of the apartment is transferred at the time of payment, which occurs after registration, has no practical meaning. There are simply no legal mechanisms for this.

Thirdly, a possible “reversal” of ownership rights in the event of non-payment of real estate within a certain period. Yes, the contract will have to be terminated through the court, this will take time. And even if ownership can be returned, the apartment will still be burdened with a bank mortgage. And in general, the problem of “rotation” of ownership in relation to real estate is very vague: it does not fit well with registration and is very vaguely spelled out in the rules of the Civil Code on purchase and sale. However, this is a topic for another discussion.

These three methods exist in the relationship between the seller and the buyer, and none of them is suitable. Maybe try to get into the relationship between the buyer and the bank, for example, enter into the agreement as a third party - the recipient of the money. DomClick excludes this option, directly indicating that the bank does not interfere in the relationships of clients who resolve claims on their own. It seems that if the letter of credit is irrevocable, the buyer cannot independently, without the consent of the seller, change the conditions or refuse the letter of credit, “unless the bank establishes otherwise,” as stated in the banking conditions of the letter of credit, contrary to paragraph 1 of Art. 869 Civil Code.

What is “other” is not said. It is possible that, with the consent of the bank, the buyer may not ask the seller, and instead of a letter of credit, receive a loan in cash, spending it on other purposes, or simply replace the recipient. And the apartment will already be burdened with a bank mortgage. Then sue the buyer, and the bank must be involved in the process if there is his fault (as stated in the notorious terms of the letter of credit). There is not a word about liability in the same banking conditions, although by changing the terms of the letter of credit or refusing it, the bank and the buyer are acting in bad faith, and according to the Civil Code they must bear responsibility.

However, the seller, if he has not received the price for the apartment, will be forced to first sue the buyer, and not the bank. Yes, the bank bears responsibility, but, most likely, separately with the buyer (Article 872 of the Civil Code states that only banks are jointly and severally liable). The bank does not have a direct contractual relationship with the seller. The maximum that is possible here is an agreement in favor of a third party. And the buyer’s responsibility to the seller is purely contractual. And whether the bank and the buyer (not an entrepreneur) under such circumstances can be considered to have jointly caused harm is a difficult question. And if the responsibility is separate, then you will first have to sue the buyer to determine the extent of the bank’s responsibility. It's long and inconvenient.

Of course, the huge Sberbank will not follow the lead of a small client and change the terms of payment through a letter of credit, so the seller can be relatively calm. What if the bank is smaller and the buyer is larger!? In a word, in the DomClick system the balance of interests of the real estate seller and the bank is clearly shifted in favor of the latter, which, however, is not surprising, and the Civil Code does not provide reasonable options for restoring this balance. Most salespeople don't even think about this, but scientists should. I see a simple mechanism here - to extend the rules of the Civil Code on adhesion agreements to third parties - counterparties of the weaker party, who are now deprived of such an opportunity.