Electronic services and housing and communal services on mos.ru are constantly updated and improved for the convenience of citizens. Now portal users have the opportunity to set up automatic payment for a single payment document (UPD) and the Moscow City Telephone Network (MGTS) for issued invoices. The new feature is available in the “My Payments” service.

“Thanks to the new function, Muscovites will be able to easily control their bills and be confident in timely payment of housing and communal services. You can set up automatic payments for specific dates of the month or on the day the invoice is issued. Payment confirmations these days will be sent to users by email and SMS,” said the press service of the Moscow Department of Information Technologies.

Automatic payment for housing and communal services from Sberbank. What it is?

Sberbank allows you to pay the bank client's utility bills automatically on a regular basis (including on weekends and holidays). You only need to spend a few minutes connecting it, and the bank “shifts” the responsibility for monthly payments for services such as gas, electricity, housing, landline telephone, Internet, and so on.

This saves a lot of your time and is, one might say, a nod from the largest bank in the Russian Federation towards its client. Accordingly, this creates additional convenience and makes a person more loyal to the credit institution, which is the main goal of any bank. And if we take into account the free nature of the service, and the fact that utility bills are generally paid without a commission (not always, it is necessary to clarify further), then there would seem to be no doubt about the advisability of connecting it. But it has its own nuances, which we will talk about later.

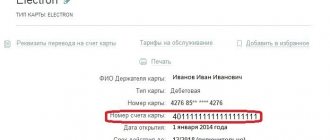

To transfer funds, a non-cash transfer is used, which is carried out from the client’s bank card to the accounts of the necessary organizations; it is to this card that Sberbank’s auto payment for housing and communal services is connected. Thus, a prerequisite for connecting to this service is that you have a Sberbank card.

Let's look at how the autopayment scheme works (automatic payment has already been activated by you). It includes several stages:

1. The bank checks the availability of bills issued to you by utility services. This happens 1 day before your scheduled auto payment date, when the required amount will be debited from your card account. If you have not received an invoice (or you have no debt), the bank will automatically check whether you have any debt every three days.

At the same time, the bank sends you a warning SMS that: “Autopayment for housing and communal services in the amount of such and such will be executed tomorrow. To cancel a payment, send code such and such to number 900.” As you can see, at this stage you have the option to cancel the payment. To refuse the operation, you must send an SMS message to number 900. In the SMS you must indicate the code sent to you by which the operation should be performed. Those. The bank gives you the opportunity to control the fact of execution of the payment and find out its amount.

The absence of such a message from you means your consent to payment.

2. The next day the bank makes payment. The commission is lower than for the corresponding operation in a branch, and often there is none at all (as, for example, in large cities - it all depends on how the bank negotiates with the utility service provider). In some cases, the payment may not go through:

- if there are no funds on the card;

- if the card is blocked (the reasons for this may be different);

- if the invoice issued to you exceeded (at least by one ruble) the maximum auto payment amount you specified (see below);

- if you sent a refusal SMS the day before.

3. The client receives an SMS message that a certain amount has been withdrawn from his account and transferred to the account of an organization specified (by you). Example SMS: “Autopayment for housing and communal services from MasterCard 1234... for such and such an amount was successfully made.” But this does not mean that the debt has been paid. The payment will be processed from 9-00 Moscow time on weekdays, and the transfer will take on average 3 days. The bank will not be able to notify you when the money arrives at the “address”, nor will it give a guarantee of this - its task is to send it to its destination.

More about auto payment

Every month, a modern person makes many payments. Some of them are permanent expenses, others must be paid strictly on time, and late fees are charged. In order to avoid unpleasant consequences due to delays or untimely replenishment of the phone balance, Sberbank offers. When connected, the system will automatically debit the required amount from the card balance to pay bills, fines, and credit payments.

Hide

- More about auto payment

- How does the service work?

- How to connect Sberbank auto payment?

- Advantages and disadvantages

- Types of auto payments

- Sberbank autopayments for cellular communications

- Automatic payment for housing and communal services

- Automatic payment for telecommunications services

- Automatic payment for repayment of loans from other banks

- Automatic payment service for traffic police fines

- Automatic payment for telephone in Sberbank

- Autopayment for MTS

- Autopayment Megafon

- Autopayment Beeline

- Autopayment Tele2

- Other types of auto payments

- How to disable Sberbank auto payment?

- Nuances and limitations

- Security and privacy rules

How to enable/disable auto payment from a Sberbank card for housing and communal services?

You can activate this service both in self-service devices (terminals or ATMs) and through the Sberbank-Online Internet banking system (abbreviated as SbOl). And, of course, this can be done at any bank branch. Let's focus on the first two methods.

Connecting the service at terminals (ATMs) step by step

Step 1. Insert the card into the card compartment and enter its PIN code.

Step2. In the main menu, go to the “Payments and Transfers” section, and then to “My Payments”, where we click on the “Autopayments” menu.

Step 3. Select the required service (in our case, housing and communal services and home telephone) and follow the instructions on the screen

Step 4. We confirm the correctness of the entered data and then receive a receipt confirming that Sberbank has successfully accepted the application to connect the required service.

Step 5. We receive an SMS with the corresponding notification.

You can see the sequence of necessary actions in more detail in the video.

Connecting the service through Sberbank Online (in the bank client’s personal account) step by step

Here you can go in slightly different ways, but the result will be the same. The classic way is through the “My Auto Payments” section and a faster way is through the transaction history. Let's consider the first method.

Step 1. Go to Sberbank Online in the “My Autopayments” section and click the “Connect autopayment” button

Step 2. Select the service and service provider we need.

Step 3. Select the card from which funds will be debited and fill out all the necessary fields of the form. In particular, we indicate the type of payment (fixed or actual), the expected date of payment of the invoice, the maximum payment amount per month and the name of the payment itself (for convenience).

Step 4. We confirm the fact of creating an automatic payment with the one-time password received in the SMS message.

Step 5. We receive an SMS notification about successful (or unsuccessful) connection of the service.

Please note that for this connection method, your card must be connected, and it does not matter what tariff: paid (full package with SMS information) or free (economical package).

Details in the video.

You can also disable the service in terminals and in Sberbank Online (just select the appropriate “disable” command on the active service). This can also be done at a branch or by calling the Sberbank hotline.

Shutdown

How to disable auto payment for housing and communal services Sberbank?

If for any reason you need to disconnect, then use multiple paths:

- Disconnection in Sberbank Online. To deactivate, go to “My Auto Payments”. Here you can select the appropriate template, make adjustments or delete. Click “Disable” and confirm the deactivation using the code that will be sent to you via SMS.

- At a terminal or ATM. Insert the card and go to the “Service, information” section. Select the previously created auto payment and click “Disable”.

- In the Sberbank mobile application, in the “Payments” tab, find “Autopayments”. Near the previously created payment, find “Disable” and click. Autopayment can be completely removed, changed, or suspended for a while. Confirm your actions in the application. A message will be sent to your phone informing you that the payment status has changed.

The autopayment service is very promising, but at the moment its use gives rise to conflicting opinions.

We hope that this material was useful to you and you now have a clear idea of what autopayment for housing and communal services from Sberbank is and how to connect autopayment for housing and communal services through Sberbank online yourself.

Cost of service and commission

The service itself can be activated for free. Consider the benefits of your time saved by the bank; time is money.

The commission amount ranges from 0 to 1 percent (no more than 500 rubles), but in any case it is lower than when paying for utilities at a Sberbank branch (or any other). Often there is no commission (in large populated areas), but this depends on how the bank negotiates with a specific service provider.

You will see the size of the commission when connecting to the service, and if you already know how to pay through the Sberbank Personal Account (aka SbOl Internet Bank), and have done this, then you already know the commission. For automatic payments, the commission will be the same.

The principle of interaction with the bank when connecting automatic payments

In order to make the most efficient use of the advantages of the functionality, it is worth understanding how Autopayment for utilities from Sberbank works. With one method, a specified amount is transferred in advance on a specific day. This option is suitable for utility bills that do not change. For example, for the Internet or satellite TV.

In case of unpaid amounts, the bank generates a notification for the user about the need to transfer a certain amount

If the payment amount depends on consumption, the functionality works in this order:

- On the day specified by the individual, the bank will send a request to the company regarding the existence of debts.

- In case of unpaid amounts, the bank generates a notification for the user about the need to transfer a certain amount.

- The client has 24 hours to make a decision. If he ignores the message from the bank, the money will be debited.

- The user will be notified of the completion of the transfer via a message.

- If the client does not want to pay this obligation, he can send a response message with a cancellation.

- The user will receive a notification that the operation was not completed.

You might be interested in:

How to pay utility bills through Sberbank Online

Answers to some questions

We have already answered a number of questions in the service review, now let’s look at other questions.

1. What to do if there are insufficient funds in your card account?

During the next payment, you will receive an SMS message informing you that it is impossible to make it. After this, the bank will check the availability of the required amount in the account and make the payment. You just need to top up your card in a timely manner. There are no penalties for insufficient funds on your card.

2. Will I know when the payment is made?

After each payment, the bank will notify you via SMS.

3. Is it possible to receive a receipt for a completed payment (for example, as proof of payment for services)?

Yes, sure. You can print it in the Sberbank Online system in the “Automatic Payments” section or save it to your computer’s hard drive (or flash drive). You can also apply for a check at a bank branch.

4. Is there a limit on the number of bills paid per month automatically?

There are no restrictions; each invoice will be paid according to the usual scheme (the main thing is that there is money on the card).

What if there is not enough amount in the debit account? Will autopay work?

If on the appointed day there are no funds in the debit account or the balance is insufficient to fully pay for the service, then the automatic payment will not work.

A second attempt to debit funds will occur 3 business days after the first attempt. If this time there is not enough money, then the auto payment will not work. And the next write-off will occur only in the next specified period.

For example, a client has an auto payment for the Internet in the amount of 500 rubles every 5th day of the new month. If there are insufficient funds in the debit account on August 5, the next debit attempt will occur on August 8. If there is not enough money in the account on this day, then the next attempt will take place only on September 5.

Pros and cons

Despite the obvious advantages (convenience, time saving, ability to control the bank’s actions) of the service, not all clients who have connected it speak positively about it. Judging by the reviews, the system is automatic. payments does not always work as it should - it is still “raw”, but, by and large, problems do not always happen through the fault of Sberbank.

- Get a Raiffeisenbank credit card “110 days without interest” in 2 minutes with free service and withdrawal of 50 thousand ₽ without commission monthly

- Apply for a free Tinkoff Black debit card and receive profitable cashback from the bank under the standard loyalty program and promotions (5% on purchases over 5,000 in retail chains)

- Apply for a free Polza Home Credit Bank debit card with 10% per annum on the promotional balance

- Apply for a credit card “100 days without interest” from Alfa-Bank and withdraw 50 thousand rubles every month for free

Therefore, we recommend that you first test the system with some provider of housing and communal services, whose payments are low. And if everything works fine, why not enable automatic payments for all other services?

Share your thoughts on this matter; perhaps you have already had positive/negative experience using this relatively new and interesting service.