Russians who find themselves in a difficult financial situation will receive help with mortgage payments. A year ago, an updated state program to assist mortgage borrowers began operating in Russia. It is aimed at providing support to certain categories of citizens who have financial problems that have led to them being unable to cope with the mortgage burden. Applicants for participation in the program must have a total family income not exceeding two subsistence levels. And the monthly payment on their mortgage must increase by at least 30% from the moment the mortgage contract is signed.

What is AHML?

The abbreviation AIZHK stands for Housing Mortgage Lending Agency. The agency is well known to borrowers whose financial well-being has deteriorated to such an extent that they can no longer pay their mortgage in full. The agency was created in 1997 by government order No. 1010. Since its establishment, it has been providing assistance to citizens who took out foreign currency or ruble mortgages and whose monthly payments increased by more than 30% due to the crisis in the real estate market and the collapse of the ruble exchange rate. The government has allocated two billion rubles for mortgage support.

Site Review

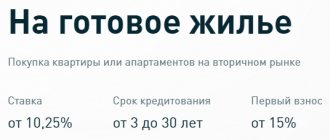

The main page is the place where all the structure's proposals are presented. Here the user can inquire about the terms and conditions of the program. Thus, the mortgage rate is indicated there.

Public-private companies have the right to offer mortgages to clients on the following terms:

Also on the landing page there is a small information about the company, inflation for the past month is indicated (April - 2.4%) and the volume of mortgages issued for the previous month (March - 235 billion rubles). The header of the site contains the following sections: “Mortgage” - “Rent” " - "Land" - "Partners" - "Investors" - "About the company." First things first. The AHML website for borrowers in the “Mortgage” section allows the user to learn more about mortgage programs, review the rates again, fill out an application and use a mortgage calculator. Here you can also find out about the companies servicing the loan, about the Agency’s partners, in whose branches a citizen will be able to apply for a mortgage (later it will be redirected to AHML), what documents are needed at the OJSC. Inside the page there are many subsections: military mortgage, refinancing, finished housing, etc. The next section is “Rent”. This is a page entirely dedicated to the rental housing program, designed to improve the living conditions of citizens and ensure the affordability of housing itself.

Here are the advantages, including:

On the same page the user can leave his request. Section “Land” also describes the program for selecting a land plot for development. The territory may meet certain parameters and be used for the buyer’s purposes. The “Partners” page, as the name suggests, is intended for potential partners of the program. There are various conditions and proposals regarding cooperation with DOM.RF.

In particular, the AHML website implies work on the following programs for partners:

The “Investors” section is a page with a report on the company’s activities and financial results. It presents the volume of bonds, ratings and other related information useful for potential investors. On the “About the Company” page you can find additional information, certificates, contacts, etc. An additional part of the site is “Personal Account”. Here the user can register and log into his own account. According to the company’s slogan, the goal of the activity is to provide the population of Russia with affordable and high-quality housing (apartment, reliable house, etc.). AHML invites all partners throughout Russia (different regions are served, for example, Nizhny Novgorod, Astrakhan, Moscow, etc.) to join the program if they share similar views.

What does the AHML and Sberbank program include?

>

The program implemented by AHML jointly with Sberbank is aimed primarily at restructuring mortgage debts. If the client’s monthly mortgage payment has increased so much that he can no longer pay the payment on time and in full, or if the citizen’s financial situation has significantly worsened for reasons beyond his control, he can contact AHML and Sberbank with a written application for refinancing debts

If the application is approved, the agency will compensate the lender, that is, Sberbank, for part of the funds that it did not receive from the client. The maximum amount of compensation is 30% of the amount not yet paid, but not more than one and a half million rubles. The amount of assistance can be increased, but not more than doubled and only by decision of a special interdepartmental commission.

In addition, participation in the program will allow the client to take advantage of the following privileges:

- writing off fines;

- repayment of penalties;

- reduction of the mortgage rate to the minimum (9.23%);

- reducing regular payments by half for a year and a half;

- increasing the loan term, thereby reducing the monthly installment;

- deferment of payments;

- conversion of foreign currency mortgages into rubles at the most favorable rate;

- payment of compensation to the borrower - no more than 600 thousand rubles.

Important!

- Conversion of mortgages from foreign currency to rubles is carried out in any case, since AHML conducts all calculations only in Russian currency.

- We recommend using an online loan calculator.

How to get help in a difficult life situation?

Many citizens do not know how to get government support in repaying their mortgage. This leads to a number of questions and difficulties.

It is recommended to adhere to the following algorithm of actions:

- find out compliance with all requirements and the possibility of debt restructuring;

- clarify whether the lender is a participant in the state program;

- visit the bank where the loan was issued. You must contact the Overdue Debt Department. Inform the specialist of your desire to exercise the right to state assistance;

- Get advice from a bank employee. The specialist will tell you what documents will need to be prepared and will issue a form and sample for writing an application;

- create a set of papers;

- come to the bank and provide the lender with a written application and prepared documents;

- wait for the decision of the authorized body;

- receive financial assistance.

The financial institution sends the application with the attached documents to JSC DOM.RF (AHML) for consideration and a decision on the advisability of providing support. The commission studies the received materials for about a month.

A citizen can find out about the decision made through his bank. Money is not issued in person.

Criteria for borrowers

Individuals applying for the mortgage restructuring program must meet strict requirements. Firstly, the family’s monthly income cannot exceed two subsistence minimums ( the value is set separately for each region of the Russian Federation ). Secondly, the mortgage payment must increase by more than 30% from the moment the contract is signed. By the way, the mortgage agreement itself must be concluded at least a year ago, and the apartment indicated on the paper must be the only home for the family.

In addition, applicants for AHML assistance must fall into one of the following categories:

- families with children, including disabled people;

- adults with disabilities;

- veterans of various wars;

- citizens supporting full-time schoolchildren, students or graduate students not older than 24 years.

Even those who have already participated in a similar program before 2017 can apply to refinance a Sberbank mortgage with AHML. To do this, you just need to collect a complete set of documents confirming your right to participate in the program.

Who is eligible for the benefit?

The following may apply for state assistance in repaying a mortgage:

- parents of one or more minor children;

- combat veterans;

- disabled people or parents of disabled children (more information about mortgages for disabled people can be found here);

- those who support students under the age of 24.

Important! The assistance program for mortgage borrowers is a real way to significantly reduce the cost of paying a loan. However, it is available only to a very narrow circle of borrowers.

Requirements for mortgage housing

>

Strict requirements for participation in the program apply not only to borrowers, but also to housing. The area of the property on which the mortgage is taken cannot exceed:

- for one-room housing – 45 m2;

- for a two-room apartment – 65 m2;

- for a three-room apartment – 85 m2.

List of required documents

| Participant requirements | Supporting documents |

| 1. The client is a Russian citizen falling into one of the following categories: | Russian passport. |

| 1.1. families with children; | Birth or adoption certificates for all children (under 18 years of age). |

| 1.2. guardians of children; | A decision of the guardianship authorities or court confirming guardianship. |

| 1.3. veterans of various wars; | Veteran's ID. |

| 1.4. families whose members have disabilities; | Certificates of disability issued by VTEC or medical and social examination. |

| 1.5. citizens who support schoolchildren, students or full-time graduate students not older than 24 years of age. |

|

| 2. The average monthly family income for 90 days does not exceed two subsistence minimums (minus the mortgage payment). |

|

| 3. The mortgage payment has increased by at least 30% since the contract was signed. | |

| 4. The total area of mortgaged housing does not exceed the established norm. | Documents on registration or assessment of housing |

| 5. The mortgage contract was signed at least one year before submitting the application for restructuring. | Mortgage contract |

| 6. Application for restructuring in free form | |

| 7. Consent to the processing of personal data | |

| 8. Questionnaire according to the bank form | |

| 9. Insurance documents for mortgage housing | |

How to become a participant in the program and restructure your mortgage debt?

To become a participant in the mortgage refinancing program from AHML and Sberbank, you must write the appropriate application at any bank branch where lending specialists work. You can clarify the conditions at the housing mortgage lending agency by phone or on the official website dom.rf.

We recommend reading:

- Mortgage loan from Sberbank today: current information on current programs for borrowers;

- How to fix your credit history;

- Extension of an application with Sberbank for a mortgage: can they refuse?

Where to apply for financial assistance

Despite the fact that the program is implemented through the EIRA, and it also provides financing, interaction with the borrower is carried out exclusively through the lending bank .

An application for financial assistance must be submitted to the bank where the loan was issued , or to the successor bank that has assumed the appropriate rights as a creditor. The latter is possible if, for example, the bank where the mortgage was issued was deprived of its license and its rights were transferred to another bank. A prerequisite is the participation of the creditor bank in the program. It is important to take into account here that out of more than half a thousand operating credit institutions, only about 85 banks are currently participants in the program.

The program places within the competence of banks the independent establishment of deadlines and a specific package of documents for borrowers wishing to take advantage of state support for mortgages. The exception is mandatory documents, the requirement for submission of which is established at the state level. Their list can be expanded, but cannot be reduced.