The term mortgage insurance by its nature applies to the insurance of credit risks. This type of insurance should not be confused with types such as property insurance or title insurance. Real estate or title insurance may be included in apartment mortgage insurance as additional types of insurance services. They can be included in the mortgage insurance contract as additional risks, for example, title insurance, destruction of property.

Why do you need to take out mortgage insurance?

Purchasing an insurance policy incurs additional costs, making your mortgage even more expensive. It is no coincidence that the overwhelming number of clients are thinking about the question of whether life insurance is necessary for a mortgage. If you refer to the legislative act, you can find out that in order to obtain a mortgage, only the collateral must be insured. However, this does not prevent banks from setting their own conditions, failure to comply with which entails an increase in the interest rate on the loan, which makes it less profitable, and may even result in a refusal to accept the application for processing.

Preferential mortgage Gazprombank, Persons. No. 354

from 5.99%

per annum

up to 3 million

up to 30 years old

Get a loan

In addition, over a long mortgage term, anything can happen, including health and work problems. Of course, you always want to believe in the best, but in this case the risks are too high. Taking out an insurance policy for the entire loan term will help to avoid problems, because in a critical situation the insurance company will take over the repayment of the debt. Therefore, you retain ownership of the property.

Myth 4: It is profitable to take out mortgage insurance from a bank

First of all, each bank will offer favorable conditions for them and will be extremely reluctant to compromise when registering with other companies.

It is best to check the list of accredited companies online in advance at Sberbank and select the necessary conditions. And after that go to the bank.

The borrower can choose organizations not accredited by Sberbank, but in order to agree on a discount on the mortgage, the bank will have to check the company for financial stability. Often employees don't want to do this and get into conflict that only senior managers can resolve. Even if they make concessions to clients and check the insurance system, they must be prepared that this will take some time.

The main advantages of Sberbank Insurance are an expanded list of insurance risks, but their policy is twice as expensive. So, they pay even if the damage occurred as a result of the actions of the insured person; in a state of intoxication; suicide, etc.

Most insurance companies refuse to pay in such cases. But if a person is sure that such risks can be eliminated, then there is no point in paying the insurance company twice as much.

In addition, by selecting different insurance companies, you will be able to take advantage of personal discounts, individual offers, etc. When registering through a bank, all this is not available.

What types of mortgage insurance are offered?

Due to the fact that mortgages have a long loan term and a minimum interest rate, such precautions are completely justified. Banks are primarily a commercial structure that is primarily interested in making a profit. Therefore, they require the issuance of several insurance policies at once:

- in relation to collateral;

- life and health of the borrower;

- legal transparency of the transaction.

If the need for the first paragraph is determined by the law, then the second is introduced in the interests of not only the bank, but also the client. There are practically no refusals of such services as life and health insurance for a mortgage. This is due not only to the desire to reduce their loan costs by obtaining more favorable conditions, but also to an objective assessment of the situation. Borrowers are aware that life is extremely unpredictable. And the purchase of housing is designed, among other things, to leave it to the children. Therefore, we can say with confidence that it makes no sense to refuse such a service. You just need to make inquiries in advance; you can take out life insurance for a mortgage where it is cheaper. As a rule, the bank has its partners among insurance companies or is part of a group of companies, one of which is engaged in this type of [Sberbank[/anchor], VTB, Renaissance, and so on), However, nothing prevents you from finding a suitable option for cooperation on your own.

Loan “Collateral Loan+” Norvik Bank (Vyatka Bank), Person. No. 902

from 8.8%

per annum

up to 8 million

up to 20 years

Get a loan

As for title insurance, it is necessary for the first three years. This is how long the statute of limitations on a real estate transaction lasts, during which it can be challenged. This is done in order to avoid the possibility of participating in so-called double sales, which can occur either through negligence or intentionally for the purpose of fraud.

What can you save on?

Banks provide their clients with different insurance options to choose from, offering to buy insurance from a partner. But if you are not satisfied with these conditions, you can refuse and choose another company. The full package from different insurers costs from 0.77 to 2% of the loan amount. The number is deceptively small.

If you took out a loan of 2,500,000 rubles, then per year you will have to pay the company more than 20,000 rubles, and in 15 years you will pay back more than 200,000 rubles. And this already makes you think, is it possible to save money somehow? Our answer: you can.

- Firstly, there are companies that do not require co-borrower insurance. That is, if the mortgage is issued to the husband, then there is no need to insure the life of the wife.

- Secondly, insurance is calculated based on the age and gender of the borrower. Thus, women aged 30–45 years can receive a substantial discount. Therefore, it is more profitable to issue a policy for your spouse.

- Thirdly, the shares of co-borrowers are taken into account. If the majority of the loan is issued to a pensioner, insuring his life and share of his property will cost much more.

To make the right decision, do not immediately agree to the bank’s offer. It’s better to use a calculator to calculate insurance, choose the conditions that are most suitable for you and conclude a contract to your advantage.

Subject of mortgage insurance

The subject is mortgage risk insurance. A loan for the purchase of housing, carried out within the framework of mortgage lending programs, involves the issuance/receipt of significant amounts. A change in the market situation for both parties to the contract. In other words, both the bank and the client can cease to exist, and financial risks cannot be excluded.

In general, all mortgage risks can be divided into systematic and unsystematic. The majority of risks are systematic. There are non-systematic ones, characteristic of a particular economy.

Thus, there are quite a lot of risks in mortgage lending; they depend on the course of inflation, economic development or crisis phenomena, the state of the real estate market and many other risk factors that are interdependent and influence each other.

Loan “New building with state support” TransCapitalBank, Lt. No. 2210

from 5.34%

per annum

up to 12 million

up to 25 years

Get a loan

Myth 3: You can only get insurance from a bank

Most clients are sure that they can only take out mortgage insurance from the company offered by the bank, but this is not the case. The borrower has the right to choose any organization independently, but in order not to pay additional interest for increasing the mortgage rate, it is better to choose organizations accredited by the bank.

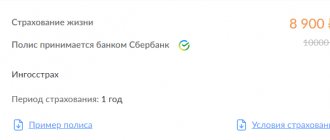

Sberbank has about 20 companies. The most common are Sberbank Insurance, Absolut Insurance, AlfaStrakhovanie, VSK and others.

Any bank offers insurance companies that are beneficial to it (for Sberbank this is SberStrakhovanie), but this does not mean that the client does not have the right to choose an organization that is profitable for himself.

Cost issues and calculations

The responsibility to insure the mortgage loan and the mortgaged property rests with the borrower himself. At the same time, he pays the insurance amounts from his own, not loan funds. During the mortgage lending boom, the cost of insurance for such contracts, as well as their conditions, changed significantly. The price of insurance has increased, and insurance companies, in pursuit of profits, have complicated insurance products, dividing them according to the principle of 1 risk - 1 insurance. By 2021, when the excitement subsided and policyholders began to take a more rational approach to choosing insurance products, universal insurance programs appeared that combined several possible risks. So, today the calculator allows you to calculate several insurance programs at the same time.

Mortgage with state support for families with children Raiffeisenbank, Lit. No. 3292

from 5.19%

per annum

up to 12 million

up to 30 years old

Get a loan

When purchasing housing, borrowers are forced to simultaneously enter into several or at least two insurance contracts:

- compulsory mortgage insurance

- property insurance, that is, purchased real estate.

Additionally, it is proposed to obtain title insurance. In addition, a number of banks require life insurance for borrowers and co-borrowers in favor of the bank. Thus, all types of insurance contracts are aimed, first of all, at protecting banking interests, since the beneficiary of all insurance products is the bank that issued the mortgage loan.

What are the benefits of mortgage life insurance?

LC is the most significant expense that a borrower faces when applying for a mortgage. Payment amounts for the year range from 7-18 thousand rubles. At the same time, the greater the risk of illness and death of the borrower, the higher the tariff. But life insurance gives the borrower good bonuses:

- Increasing the likelihood of issuing a mortgage loan;

- Low interest rates (without personal insurance, the bank increases the interest rate for using a loan by 1-2 points);

- In case of temporary disability, it is easier to reach an agreement with the lender - to refinance the loan or revise the repayment schedule;

- If an insured event occurs, the insurance company will pay the debts, the family budget will not suffer;

- If the borrower becomes ill, treatment and recovery will be paid for by the insurance company.

The lower the amount of mortgage debt, the lower the insurance payment. In case of early repayment of the loan, the insurance company returns part of the paid contributions to the insured person (if there are no restrictions in the contract). In addition, insurers are interested in attracting customers, so they often offer promotions that allow them to reduce premiums by 0.5-0.8%.

Insurance is issued to the recipient of the mortgage loan, co-borrowers, guarantors and other persons specified in the mortgage agreement. Each company approves a list of persons whose lives cannot be insured:

- Under 18 years old, over 55-60 years old;

- Registered in narcology, psychoneurological, anti-tuberculosis dispensaries and other specialized medical institutions;

- Having suffered a stroke, heart attack;

- With serious diseases (oncology, diabetes, liver cirrhosis, heart disease, AIDS, HIV and other diseases).

There are insurers who do not refuse to enter into a contract for such persons, but increase the rate due to the riskiness of the insurance.

The life insurance program of the insurance company may include the risk of harm due to emergency situations, involuntary loss of work (reduction in the number of employees, liquidation of the company).

Miser pays twice

Let's say you are young and self-confident, and do not want to pay the abstract risk of a “brick on your head.” Let's also make the assumption that you found a bank that doesn't care, who appreciated your excellent health and safe profession and agreed to issue a mortgage loan without insuring your life. Will this mean that you have won on all boards? Not at all.

Firstly, the bank, realizing that it has increased the risk of non-repayment, will most likely simply raise your mortgage rate, where it will “pledge” losses in the event of your illness, injury or even death. Secondly, you, wittingly or unwittingly, are exposing your relatives to the blow: after all, if you lose the opportunity to repay the loan, then most likely they will have to pay off the debt, otherwise the question of forced eviction from the apartment will arise... Thirdly, in the event of a serious illness Medical expenses will inevitably be added to the mortgage burden. And in these circumstances, an insurance premium that will save your home will not be at all superfluous...

Even if you prudently save for a rainy day, they may not be enough: inflation and other risks of financial loss cannot be discounted.

Where is life insurance cheaper?

Let's look at the example of the cost of life insurance offered by the largest insurers in the Russian Federation.

- A healthy 38-year-old woman with no bad habits or risky hobbies, working in a relatively safe job.

- A 35-year-old man with no bad habits or risky hobbies, with a relatively safe job.

The mortgage loan for both respondents is 2 million rubles. Prices are current as of August 2021, results are presented in percentage and monetary terms.

| № | Insurance company name | Amount of insurance for a woman (rubles) | Amount of insurance for a man (rubles) |

| 2 | Reso-Garantiya | 5820 | 12 300 |

| 3 | SOGAZ | 3815 | 7319 |

| 4 | Rosgosstrakh | 1900 | 1900 |

| 5 | VSK | 1665 | 1665 |

| 6 | Alpha insurance | 2000 | 2000 |

| 8 | Insurance group "UralSIB" | 3080 | 6600 |

| 9 | Russian standard | From 3500 | From 3500 |

| 10 | Ingosstrakh | 1376 | 1376 |

Where is the cheapest mortgage life insurance? Calculators on insurance company websites will help you calculate costs and rates. You can quickly choose the most profitable solution.

Insurance – what does the borrower get?

When taking out insurance, borrowers protect themselves and their loved ones from unforeseen circumstances due to which the mortgage will not be repaid on time. Insurance allows you to avoid consequences such as death or disability of the borrower. After all, if there is no policy, the burden of payments will fall on loved ones. The burden of insurance is quite significant, so you should pay attention to cheap mortgage insurance , which can save you a lot. Now on many websites you can use a mortgage insurance calculator , which allows you to immediately calculate the cost.

Myth 10: It is more profitable to issue a policy on the official website

It is much more profitable to take out insurance on Polis812:

- It is possible to select insurance from the required list of insurance companies accredited by the bank;

- The conditions are briefly described;

- There are additional discounts and extended policy terms (compared to Sberbank);

- All insurance issued online through Polis812 is accepted by Sberbank;

- When using the promo code, an additional 15% discount.

Take out mortgage insurance

Myth 9: I took out insurance at the bank, and I’ll sort out the problems there

If problems, questions or insured events arise, contact the insurance company. Even if the agreement was concluded at a bank branch, it is only an intermediary of services.

Before applying for a policy, you must carefully read the list of insurance services and the procedure for resolving issues. This will help you avoid having to resolve problems in another city, receive payments and be confident in the legality of the policy.

There are no problems with well-known companies (VSK, Reso-insurance, AlfaStrakhovanie), because offices are located in Moscow and they have transparent conditions. With start-up and unknown companies, everything can be much more complicated.

Documents for real estate insurance

Since insurance of an apartment with a mortgage (or other purchased housing) is mandatory by law, let’s start considering the issue with it and find out what documents are needed to obtain insurance.

Standard home insurance includes the following insured events resulting in damage or destruction of collateral:

- earthquake;

- tornado, storm;

- fire;

- rain and flood;

- hitting a vehicle object or crashing an aircraft;

- illegal actions of third parties.

In different insurance companies, the requirements for the package of documents provided for obtaining insurance may differ. But there are also general requirements. The main package includes the following list of documents:

- document assessing the market value of the purchased property;

- cadastral passport;

- document confirming ownership;

- act of acceptance and transfer of an object.

If an apartment is purchased on the primary market, then the basic package will be sufficient. When purchasing an apartment on the secondary market, the bank may additionally require:

- current extract from the house register;

- documents confirming the absence of debt on utility bills;

- house plan (floor plan);

- confirmation of the legality of the redevelopments carried out (if any).

A package of documents directly according to the borrower’s identity is also provided:

- copy of passport (all completed pages);

- insurance application;

- mortgage loan agreement;

- documents confirming the sources and amount of income;

- marriage certificate and spouse’s consent to enter into a transaction (notarized);

- children's birth certificates.