Here is an application form for property, social, standard and investment tax deductions when filing a 3-NDFL declaration with the inspectorate.

To fill out the payment details fields for the correct transfer of funds, the article on how to find out your account number and bank details will help you.

The relevant articles will help you with the remaining columns of the application, such as the Federal Tax Service number (which you will contact) and the TIN number, which you can read by following the links.

New application rules from 2021

According to the current rules, in order to receive a deduction to the Federal Tax Service at your place of residence, you need to submit a 3-NDFL declaration with a calculation of the tax base, taking into account the deduction and the amount of personal income tax to be returned from the budget. An application for a personal income tax refund can be submitted within 3 years from the date of payment of the tax.

An application for a personal income tax refund is an official request from the recipient of the deduction to return to him the overpaid amount of personal income tax on the basis of Art. 78 Tax Code of the Russian Federation.

Until 2021, the application was submitted as a separate document and this was the only way to submit it. Since 2021, the rules have changed, and an application for a personal income tax refund can be submitted in one of two ways:

- as part of the 3-NDFL declaration (the new declaration form was approved by Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/615);

- separately from the 3-NDFL declaration (the application form was approved by Order of the Federal Tax Service of Russia dated February 14, 2017 No. MMB-7-8 / [email protected] ).

Including a tax refund application as part of the 3-NDFL declaration allows you to shorten the time frame for tax refunds from the budget.

Tax refund application: how to submit it to the inspectorate

The application can be submitted to the inspection in person or sent by mail. When sending by mail, the day of submission of the application is considered the date of its transfer to the post office employee for dispatch. Please attach all documents confirming overpayment of tax to your application. For example, paid receipts for its transfer.

In the first case (when transferring in person), make an application in two copies. Give the first one to the inspectorate. The second one will remain with you. Request that the tax inspector accepting the tax refund application put a stamp on the second (your) copy indicating acceptance of the application indicating the current date. They MUST do this.

In the second case (when sending by mail), send the application in a certified letter with a list of attachments. Letter rating - 1 rub. Be sure to keep the postal receipt and inventory certified by the postal employee. These documents will confirm the fact that the application was sent to the tax office (receipt of dispatch). The fact that it was received by the inspection can be confirmed by a printout from the Russian Post website. The number indicated on the receipt (mail identifier) will help you track your letter. This is 14 digits. For the Russian Post service for tracking letters, see the link. There you will find out when this letter was delivered to the tax office.

The tax must be returned to you within one month from the date of receipt of your application. If the tax inspectorate misses this deadline, they are required to pay interest (penalties) for each day the return is late. Interest is calculated based on the refinancing rate of the Bank of Russia (key or discount rate) for each calendar day of delay in repayment. For more information about tax refund deadlines, see the link.

Example The amount of tax to be refunded is 150,000 rubles. Delay in return is 48 calendar days. The refinancing rate that was in effect on the days when the tax refund was overdue is 5% per annum.

Amount of interest that the inspection is obliged to pay: RUB 150,000. x 5%: 365 days. x 48 days = 986 rub. 30 kopecks

Statement as part of the 3-NDFL declaration

An application for a personal income tax refund from reporting for 2021 can be filled out directly in the 3-personal income tax declaration - in the Appendix to section 1 (clause 5.1 of the Procedure, approved by Order of the Federal Tax Service of Russia dated August 28, 2020 No. ED-7-11 / [email protected] ) .

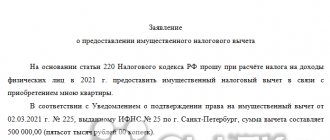

Sample application for personal income tax deduction (as part of 3-personal income tax)

The procedure for filling out the lines of the application:

| Line | How to fill |

| 095 | Indicate the unique (serial) number of the application for the current year. For the first application, enter “1”. Each subsequent application in the same year has a corresponding serial number: 2, 3, etc. |

| 100 | Reflect the amount of personal income tax to be returned according to the declaration |

| 110 | Enter the KBK from which the refund is made - 182 1 0100 110 (Appendix No. 2 to the Order of the Ministry of Finance dated 06/08/2020 No. 99n, Appendix 1 to the Order of the Ministry of Finance dated 06/06/2019 No. 85n) |

| 120 | Transfer the OKTMO code from line 030 of section 1 of the declaration |

| 130 | Enter the tax period code. If the declaration is for 2021, fill out this way: GD.00.2020. The year value must match the value specified in the “Reporting year” field on the title page of the 3-NDFL declaration |

| 140 | Enter the name of the bank where the tax will be transferred |

| 150 | Enter your bank identification code (BIC) |

| 160 | Reflect the account code:

|

| 170 | Enter your bank account number |

| 180 | Indicate your last name, first name, patronymic in full, without abbreviations, in accordance with your identification document. The information on this line must be identical to the information indicated on the title page of the declaration |

The application must be signed and dated.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Deduction amount

One of the most popular tax deductions is the housing purchase deduction, which consists of three parts and applies to expenses for:

- new construction or acquisition on the territory of the Russian Federation of housing (shares in it), land plots for it;

- to repay interest on targeted loans (credits) received from Russian organizations or individual entrepreneurs, actually spent on new construction or the acquisition of housing (share(s) in it) in the territory of the Russian Federation, a land plot for it;

- to repay interest on loans received from Russian banks, for refinancing (on-lending) loans (credits) for the construction or acquisition of housing (share(s) in it) in the territory of the Russian Federation, a land plot for it.

However, it is impossible to apply this deduction if residential real estate or land was purchased with the funds of the employer (other persons), maternity capital or at the expense of budgetary funds, or from a citizen who is interdependent in relation to the taxpayer (relatives, spouses, etc.). )

The maximum amount for new construction or purchase of housing is 2 million rubles.

At the same time, since 2014, the taxpayer has the opportunity to receive a tax deduction not from one, but from several residential real estate properties, but the maximum amount of expenses will remain unchanged - 2 million rubles. according to paragraphs. 1 clause 3 art. 220 Tax Code of the Russian Federation. This can also include the cost of repairing an apartment if, under the contract, residential real estate was purchased without finishing (clause 5, clause 3, article 220 of the Tax Code of the Russian Federation). Since the sphere of mortgage lending for real estate is now actively developing, the government body also did not ignore the costs of repaying interest on loans or targeted loans and determined the maximum amount for such expenses - 3 million rubles. This is regulated by clauses 4 and 8 of Art. 220 Tax Code of the Russian Federation. In other words, the taxpayer has the opportunity to receive 13% on expenses of 2 million rubles. (260,000 rubles), and by 3 million rubles. (390,000 rubles) and thus the maximum amount of property deduction that a taxpayer can receive will be 650,000 rubles.

You can apply for a tax deduction when there is an act of transfer of rights to residential real estate (clause 6, clause 3, article 220 of the Tax Code of the Russian Federation). In other words, if a taxpayer purchased an apartment in a building under construction in 2021, and in 2021 the house was commissioned, then a tax deduction can only be received starting from 2021 (since the transfer and acceptance certificate can only be obtained after the house is put into operation ).

How to submit an application separately from the declaration

An application for a personal income tax refund can be submitted in the same manner - separately from the 3-personal income tax declaration. Its form was approved by Order of the Federal Tax Service of Russia dated February 14, 2017 No. MMB-7-8/ [email protected]

The content of this statement is in many ways similar to the statement submitted as part of the declaration, but in terms of the number of pages it is more voluminous. The application has 3 pages:

- Page 1 “Application for refund of the amount...” - it reflects the application number, tax authority code, payer status, article of the Tax Code of the Russian Federation, amount of the refunded amount, etc.

- Page 2 “Account information” - here the name and BIC of the bank, type of account, its number, BCC, personal account number are indicated.

- Page 3 “Information about an individual (not an individual entrepreneur)” - the sheet is not filled out if the TIN is indicated in the application.

How to fill out page 1

| Field | How to fill |

| TIN | Indicate the TIN in accordance with the Certificate of Registration with the tax authority. If there is no TIN, Sheet 3 of the application is filled out |

| checkpoint | No need to fill out (strike through) |

| Application number | Indicate the unique (serial) number of the application for the current year. For the first application, enter “1”. Each subsequent application in the same year has a corresponding serial number: 2, 3, etc. |

| Submitted to the tax authority (code) | Enter the code of the tax authority to which the application is being submitted. The application is usually submitted to the tax authority at the place of residence (clause 7 of article 78, clause 3 of article 80, clause 1 of article 83 of the Tax Code of the Russian Federation). You can find out the inspection code on the official website of the Federal Tax Service through the service “Address and payment details of your inspection” |

| Full name of the organization (responsible participant...)/last name, first name, patronymic of an individual | Enter your last name, first name and patronymic. The patronymic name is indicated if available. Enter each letter in a separate cell |

| Payer status | Enter “1”, which means the taxpayer submitted the application |

| Based on the article | Specify Article 78 of the Tax Code of the Russian Federation - refunds are made on the basis of this article |

| Payer status | When applying for a deduction, you must indicate “1” |

| Please return | Enter the number 1 (this means the amount of tax overpaid) |

| At the rate of | Reflect the amount of tax to be refunded from the budget for the reporting year. Move it from section 1 of the 3-NDFL declaration |

| Tax (settlement) period (code) | Fill in format ГД.00. YYYY, where YYYY is the year for which the refundable amount of personal income tax was paid |

| OKTMO code | Take the code from the income certificate issued by your employer, on the basis of which the 3-NDFL declaration was completed |

| Budget classification code | BCC for tax refund: 18210102010011000110 (Appendix No. 2 to Order of the Ministry of Finance dated 06/08/2020 No. 99n, Appendix 1 to Order of the Ministry of Finance dated 06/06/2019 No. 85n). |

| The application has been drawn up | Indicate the number of pages of the application and documents attached to it. If an application for a personal income tax refund is submitted by a representative, then you must attach the appropriate power of attorney and indicate the number of its sheets in this field |

| I confirm the accuracy and completeness of the information specified in this application | Enter “1” if you personally contact the Federal Tax Service. In this case, the next three lines are not filled in. If the application is submitted by a representative, his data should be indicated in these lines and the code “2” should be entered. Then provide your phone number, signature and date. |

The section “To be completed by a tax authority employee” does not need to be filled out.

Procedure for filling out page 2

On this page you must enter your TIN and full name (middle name is indicated if available). In a separate field, information about the bank account to which the tax amount will be transferred (name of bank, type of account, BIC) is entered.

In the “Account number” field, enter code “1” (taxpayer) and account number. In the “Recipient” field, enter the value “2” (individual) and your full name.

How to fill out page 3

Page 3 is completed only if the TIN is not indicated on the previous pages of the application.

Here the personal data of the applicant is indicated: full name, identification document code (21 - citizen’s passport, 07 - military ID) and his details (series number, date of issue and who issued it).

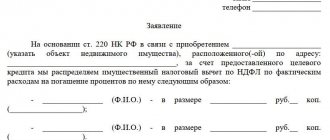

Sample application for personal income tax deduction (separate from 3-personal income tax)

Application for tax refund: sample filling

All pages of the tax refund application can be completed as shown below.