What kind of subsidy is this for housing and communal services?

Subsidizing housing and utility bills is a partial refund of funds to citizens who spend significant amounts on housing and communal services. Do you spend more than 10% of your family's total income on utilities? In this case, prepare an application for a housing and communal services subsidy and submit it to the City Center for Housing Subsidies (in Moscow) or other social authorities (in other cities of Russia).

IMPORTANT!

You will find new rules for receiving housing and communal services subsidies in Government Decree No. 420 dated 04/02/2020 (as amended on 04/29/2020).

Here's how it works: you pay monthly utility bills and have no utility debts. If these costs exceed the regionally established percentage of your family's total income, you have the right to reimburse part of the costs. The state pays compensation for housing and communal services to the applicant’s bank card or current account. To obtain such financial assistance, citizens need to submit an application for subsidies for utility services - the application must be sent once every six months.

IMPORTANT!

If the subsidy expires between March and September 2020, it will be extended automatically. For this period, a no-declaration procedure has been established - there is no need to contact social authorities to extend payments.

Updated list of affected industries for subsidy recipients

The new edition of the List of sectors of the Russian economy that require support in the context of a worsening situation as a result of the spread of a new coronavirus infection is presented in Appendix No. 5 to the Rules, approved. Government Decree No. 1513 dated 09/07/2021 (as amended by Government Decree No. 1849 dated 10/28/2021).

Here's what the updated list looks like:

Who is eligible to receive housing and communal services subsidies and under what conditions

Compensation is due not only to Russian citizens, but to foreigners permanently residing in the Russian Federation and registered in any Russian housing. Who has the right to apply for a housing subsidy to the State Center for Housing and Housing:

- owners of residential real estate - apartments, houses or any part of the housing;

- tenants of residential space under a lease (rental) agreement in a private housing stock;

- members of housing, housing and construction cooperatives;

- users of residential premises in state/municipal housing funds.

If you contact the State Center for Housing or another agency through a representative, prepare a power of attorney to perform actions on your behalf. Online submission of a request is possible only from the direct applicant; the involvement of representatives is not allowed.

How to apply for a subsidy for utilities in 2021

Applying for a subsidy to pay for housing and communal services can be done in various ways:

- By personal meeting with a specialist (in the housing subsidies department of the relevant district);

- By registration via the Internet (online).

Due to the large number of legislative acts regulating the issues of obtaining subsidies, the package of documents required for each specific case may have some differences, which are best clarified by a specialist. You can also send questions and requests that interest you by mail; this request is registered by a specialist indicating the date of receipt, and is also subject to consideration and consultation.

Loan secured by PTS CashDrive, Person. No. 18-034-75-009039

from 0.05%

rate per day

up to 1 million

90 – 2,555 days

Take out a loan

First of all, when applying for a subsidy, you need to calculate whether your family is low-income, and what share in the income structure is paid for housing and communal services. In the first case, the total family income is compared with the cost of living in your region, in the second, the share should not exceed 22%.

What documents will be needed

You will have to apply to social authorities for compensation to pay for housing and communal services once every six months. In addition to the application, you will have to provide supporting documents. Here is their list:

- applicant's passport;

- title papers for residential premises;

- a complete list of persons living in the apartment (house) and the legal grounds for their residence;

- documents on payment of housing and communal services and contributions for major repairs for the last month before submitting the application and separately for the entire subsidy period;

- a certificate confirming the presence or absence of utility debt;

- certificate of income of all family members (including the applicant);

- for foreign citizens - documentation confirming the foreigner’s citizenship of the state with which Russia has concluded an agreement on the provision of such subsidies (for example, Belarus, Kyrgyzstan).

Only after scanning/providing all these documents is an application for a subsidy made through the State Services online or the MFC. Those citizens who do not have a personal account on the government services portal have the right to contact the State Center for Housing and Civil Services in person (through a representative) or send documentation by mail.

Who will give the money - 5 main conditions

Companies and individual entrepreneurs - small businesses, as well as socially oriented NPOs that meet five criteria can count on the subsidy.

For socially oriented NPOs the criteria are different. They are listed in clause 4 of the Rules for the provision of subsidies, approved. Government Decree No. 1513 dated 09/07/2021 (as amended by Government Decree No. 1849 dated 10/28/2021).

How to apply for a housing and communal services subsidy through the government services portal

The fastest way to apply for compensation is to submit an application on the government services portal. Brief instructions on how to send an application for a subsidy through State Services to the regional department implementing the preferential project:

- Log in to your personal account on the government services portal.

- Select the type of service received - electronic request or personal appointment.

- Determine the type of appeal - filling out an application.

- Fill out an application.

- Attach supporting documents and send a request to the department.

And now - step-by-step instructions on how to fill out an application for a housing and communal services subsidy through State Services for a registered user.

Step 1. Go to the main page of the service, then go to your personal account.

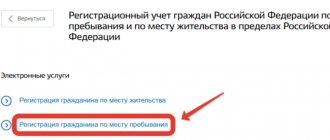

Step 2. Select a category and name, click “Get a service”.

IMPORTANT!

In each region, the service has different names, and various social departments are involved in its provision.

Step 3. Determine the type of request.

Step 4. We enter information about the applicant - his full name, gender, SNILS, date of birth, registration address, contacts and passport details.

Here we indicate information about the representation of interests.

Step 5. Answer the question about cohabitation and fill out information about all family members living with the applicant.

That's it, the application is completed. We attach the necessary documents and send a request to the social authority. If necessary, we can make an appointment for a personal appointment.

Amount of subsidy for non-working days

The amount of the subsidy is calculated by the tax inspectorate based on the federal minimum wage as of 01/01/2021 (RUB 12,792) and the number of employees reflected in the DAM (section 3).

Formulas for calculating subsidies:

The subsidy for non-working days is provided to its recipient once (clause 5.1 of the Rules, approved by Resolution No. 1513).

Who will receive the subsidy?

The subsidy is provided subject to the following conditions.

1. An organization or entrepreneur is included in the unified register of small and medium-sized businesses as of July 10, 2021.

2. The main activity of the subsidy recipient relates to one of the industries most affected by the spread of coronavirus.

Reference

The list of affected industries is given in Appendix No. 3 to the resolution. It included, in particular, such areas of activity as trade, furniture, transport, culture, etc. The recipient of the subsidy will be determined by the main type of economic activity (OKVED code), information about which is contained in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs as of July 10, 2021.

Check the OKVED codes of “your” individual entrepreneur and his contractors

3. The organization is not in the process of liquidation, bankruptcy proceedings have not been introduced against the recipient of the subsidy, and no decision has been made on the upcoming exclusion of the recipient of the subsidy from the Unified State Register of Legal Entities (the individual entrepreneur has not ceased operations).

4. As of July 1, 2021, the recipient of the subsidy has no arrears in taxes and insurance premiums, in total exceeding 3,000 rubles. When calculating the amount of arrears, information about its repayment as of the date of sending the application is used.

5. The location (place of residence and (or) place of activity in connection with the use of PSN) of the subsidy recipient and its separate divisions is in the region where “coronavirus” restrictions have been introduced.

How to apply

You can submit an application through online reporting systems, the taxpayer’s personal account on the Federal Tax Service website, or by mail (see the form in Appendix No. 2 to the Subsidy Rules).

If you use Extern, go to the “Federal Tax Service” section, find the “Application for a subsidy” form through the search and fill it out.

Here are detailed instructions.

After sending, Extern will receive a notification of acceptance or refusal to consider the application. When the treasury transfers the money, another message will be received from the tax office. If it is decided not to provide a subsidy, the Federal Tax Service will refuse.

Application and payment deadlines

Subsidies will be paid for April and May. To receive a subsidy for both months, the application must be submitted twice:

- for April - from May 1 to June 1, 2021;

- for May - from June 1 to July 1, 2021.

Tax authorities will take information about the number of employees from the SZV-M report. If you submit an application, the Federal Tax Service will not consider it until it receives data from SZV-M for April or May. Therefore, in order to receive a subsidy faster, submit the SZV-M ahead of schedule, as recommended by the Pension Fund.

If the tax office finds errors or inaccurate data in the application, it will send a message about the refusal of the subsidy - within three working days from the date of sending the application, but not earlier than the 18th day of the month following the calculation month: for April - no earlier than May 18, for May - no earlier than June 18.

If all the information about the subsidy recipient is correct, then the tax office will calculate the amount of the subsidy, create a register and send it to the Federal Treasury. Money from the treasury will be transferred to the applicant’s current account within three working days from the day the register is received by the treasury. Within three days, the Federal Tax Service will notify the recipient that the subsidy has been transferred.

Payments for April will begin on May 18, for May - on June 18.