The state fee is paid for the performance of legally significant actions, for which companies apply constantly and without fail, starting with the registration of their own activities. Individuals also quite often make such payments for certain services of government bodies. In some cases, specifically specified in regulations, organizations or individuals are faced with the need to return the paid amount of state duty in full or in part.

Question: By a court decision, the state duty was recovered from the losing party. Should the plaintiff - LLC (USN, “income”) include in income the amount of state duty received from the defendant? Is state duty returned from the budget included in income when the defendant is the tax authority? View answer

When and how can this be done? In what situations can a state duty refund not take place? What do taxpayers need to do to achieve this? How to correctly record these amounts in accounting? Let's figure it out together.

What state fees do legal entities and individuals pay?

The budget receives certain amounts through the appeal of organizations and individuals to government agencies for carrying out actions with legal consequences.

Question: Is it possible to return the state fee in case of refusal to register a lease agreement? How is this duty reflected in tax accounting depending on the result of registration of the agreement? View answer

Basic fees for organizations

Organizations constantly contribute certain funds to the budget as state duties. The amounts and timing of these deductions vary and depend on the type of activity of the company and the nuances of its functioning. Conventionally, duties paid by legal entities can be divided into 3 groups:

- Organizational expenses:

- registration of activities;

- amendments to the Charter;

- issuance of licenses;

- applying for permits;

- registration of certificates;

- ordering an urgent extract from the Unified State Register of Legal Entities;

- certification of contracts, etc.

- Registration of acquired assets and/or rights.

- Interaction with courts.

In what order and amount is the state fee returned to the plaintiff if the claim is abandoned in the arbitration process ?

What fees can an individual pay?

Throughout their lives, Russian citizens often turn to government agencies when they require any legal action. For this, according to the Tax Code of the Russian Federation, they must pay a state duty. The most common requests are:

- to courts of various levels;

- to the police;

- to notaries;

- to the registry office;

- registration of services for obtaining Russian citizenship or renunciation of it;

- documentary support for entry and exit from the country, etc.

In what cases is it possible to refund (offset) the state duty ?

Deadline for refund of state duty payment

The possibility of returning payment of the state fee is relevant only for three years from the date of its payment. In this case, the payer has the opportunity to restore the missed deadline. To do this, he needs to file a claim in court.

However, most often payers do not lose the opportunity to return their funds within a 3-year period. During this period, the payer can quite legally contact the tax authorities with a demand to return funds that were mistakenly paid in favor of any government agency.

Refunds of overpaid funds are usually made within one month after submitting the relevant application. Moreover, the decision on the feasibility and possibility of performing such an operation is made within 10 days after receiving the application from the payer.

It must be said that tax authorities usually comply with these deadlines. This is due to the fact that failure to comply with the deadlines required by the legislation of our country provides for the return of funds from the budget with accrued interest. This situation cannot suit the tax authorities, so payers can count on a prompt decision to return payment of state duties.

Fees that are allowed to be refunded

Tax Code of the Russian Federation in paragraph 1 of Art. 333.40 of the Tax Code of the Russian Federation regulates situations when citizens or organizations can be refunded (in whole or in part) the state duty they previously transferred. This can be done not with any payment, but only if:

- the company or individual transferred the amount of state duty higher than necessary;

- the document for which the state fee was paid was not accepted or was returned;

- the court left the claim, for the filing of which a fee was transferred, without consideration;

- the legal proceedings were terminated;

- the notary refused to perform actions paid for by the state fee;

- the required document (passport, identity card, etc.) was refused;

- the person who paid the state duty renounces the intention to commit actions with legal consequences.

Is a court ruling on the return of state fees ?

NOTE! The last reason will be relevant only if, having paid the state fee, the citizen or company has not yet contacted the authorized bodies. That is, if there was an appeal, and then the application was withdrawn, it will no longer be possible to return the amount of the fee.

Erroneous state duties

You can also return a state fee transferred by mistake, that is, that went to the wrong bank account due to inaccuracies in payment details. This happens due to errors by the cashier or the payer himself. A common reason is the use of irrelevant (outdated) details.

Naturally, the state duty transferred for services for which it is not provided for by the Tax Code of the Russian Federation will be refunded.

Required documents for refund of state duty payment

A refund of state duty payment is possible only if the payer has all the necessary documents in hand. First of all, the payer must provide a statement indicating the grounds and reasons for the refund. This point is extremely important, since its success will depend on the validity of the applicant’s claims. Therefore, the application must be drawn up as competently as possible. The applicant must clearly state the reasons for the refund. In addition, the reasons for the return must be current at the moment.

The applicant may provide several reasons why he is requesting a refund of the funds paid. However, you should not turn your statement into a novel of several pages. This may lead to a delay in making a decision on this issue. The application must be dated and signed by the payer. Due to this, employees of the government agency to which it is sent will not waste time searching for the necessary information.

To confirm the validity of his claims, the payer must attach a check or receipt for payment. In general, the more documents are submitted, the greater the chances of a positive outcome of this process.

When the state duty cannot be returned

The law stipulates several special exception cases, in the event of which it is unlawful to ask for a refund of the state duty:

- The fee was transferred for registering a marriage, but the wedding did not take place for some reason. The same applies when filing a divorce.

- An application was submitted to change the first or last name, for which a state fee was paid, but the applicant changed his mind and did not do this.

- After filing a claim in court, the defendant at some stage before the end of the process agreed to fulfill the claims.

- The state fee was paid, but government agencies refused to register the applicant:

- driver's license;

- legal entity;

- restrictions on real estate rights (encumbrances);

- real estate transactions.

In all these cases, the state duty will not be returned to the payer, either fully or partially.

IMPORTANT! The only exception is the registration of termination of registration of real estate transactions and the imposition of encumbrances on it. If the parties confirm their will with appropriate statements, they will be able to return 50% of the state duty.

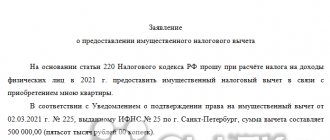

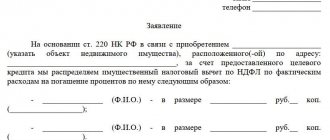

How to write

A unified form for submitting an appeal has not been developed. The form approved by Order of the Federal Tax Service of Russia No. ММВ-7-8/ [email protected] dated November 30, 2018, has the force of a recommendation and is used for electronic applications.

In accordance with tax legislation, the requirements are as follows:

- compliance with written form (or electronic using a single electronic portal of state and municipal services);

- attachment of the original receipt, payment order;

- attachment of court rulings or certificates (for court fees).

It is recommended to include standard document details:

- a header indicating the tax office, other government agency, and the applicant’s data;

- Title of the document;

- the main part with a request to return funds due to specific circumstances;

- list of applications;

- signature and date.

In order to issue a refund of the state duty when returning a statement of claim, abandoning the intention to go to court, under Art. 333.40 of the Tax Code of the Russian Federation, it will be necessary to obtain a certificate from the court confirming the circumstances of the court case. In the same appeal, it is recommended to request the original, the original document on the payment of funds, since the tax office will refuse payment without it. In practice, courts satisfy such requests by filing copies in files. It is also possible to contact credit institutions to obtain the original. The sample for filling out an application for a certificate for refund of state duty has not been developed; it is drawn up using standard details in free form. The court issues a certificate within three days after the application, on the fourth day - in the office.

How to proceed to return the transferred state duty

The algorithm of actions of a legal entity or individual to return the amount of state duty includes a number of actions stipulated by the legislation of the Russian Federation:

- Collection of necessary documentation:

- to return the entire amount of the duty - originals of checks, receipts, bills or other documents confirming payment;

- to return part of the fee - copies of these documents.

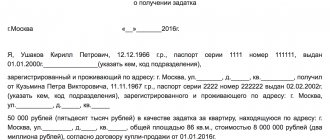

- Writing an application. There is no strict form for it, but some organizations recommend their own forms, which can be obtained directly from their institutions or taken from their websites on the Internet. If the application is drawn up at your own discretion, it must include:

- data of the state duty payer;

- purpose of payment;

- reasons for return;

- account details for transferring state duty back.

- Submitting an application. You need to hand it over to the boss of the tax office that accepted payment of the state duty. For personal delivery, a receipt will be required. You can send the document by mail with notification. Online submission is not permitted.

- Waiting times. The official body makes a decision on return or non-return within ten days. And the money will be credited to the account specified by the payer within 1 month - the payment is made by the Federal Treasury.

ATTENTION! If you need to return the fee for ship applications, you will need a court decision or certificate giving the go-ahead for the return of all or part of the state fee.

State fee refund procedure

First of all, you should find out for what reasons a refund of state duty payment may be made. It should be said that the state duty is not always refunded. Therefore, payers who want to get their money back must meet a number of requirements.

Firstly, a full or partial refund of the state duty can only be carried out if the payer sends an application for the return of the paid amount of the state duty to the body that is authorized to carry out legally significant actions. This means that the payer also needs to send an application to the Federal Migration Service (in the case of issuing a passport or international passport), the State Traffic Safety Inspectorate (in the case of issuing a driver’s license), the Civil Registry Office (in the case of marriage), etc.

Secondly, documents must be attached to the application that confirm the fact of the overpaid amount. In order to receive a full refund, you must provide original payment documents. If a partial refund is required, the payer can make do with providing copies of documents confirming the payment. Such documents are receipts and payment checks.

Refund of state duty in accounting entries

To account for state duties, the PBU provides for a special account 68 “Calculations for taxes and fees”, a subaccount “Calculations for state duties”. Since the money returned as state duty is income for the organization, it must be taken into account in subaccount 91 “Other expenses”. The postings will look like this:

- debit 68, credit 51 “Current accounts” - payment of funds on account of state duties;

- debit 68, subaccount “Calculations for state duty”, credit 91, subaccount “Other income” - state duty subject to refund is included in other income;

- debit 51, credit 68 – the state duty has been returned in full (or part of the state duty has been received back).

FOR YOUR INFORMATION! If the costs of paying the state duty have already been written off, and the funds were returned, these entries must be reversed.

Application for refund of state duty payment

Speaking about the application for a refund of state fees, it is necessary to return to the topic of reasons and grounds for making a refund. The following cases may serve as grounds for filing an application:

- payment of state duty in an amount greater than necessary;

- refusal to apply to this government body;

- termination of office work;

- leaving the application unattended.

An application for the return of funds from the Federal Treasury should be sent precisely to the government agency where the service was provided to the payer. As mentioned above, this could be a traffic police department, a regional branch of the Federal Migration Service, a district registry office, etc. Proper filing of an application requires the attachment of a number of documents. In particular, a payer planning to return part or all of the money must be provided with a court decision that describes the circumstances that serve as the basis for the return of the state duty. All available receipts must also be provided. As for the statement itself, it can be written either manually or printed. The application must contain the full name and address of the applicant, as well as details of the institution to which it is being submitted.

The procedure for filing an application for the return of state duty to the court

If a citizen decides to return the paid amount, then he needs to correctly write an application for a refund of the state duty to the court. In addition to this, you need to perform a number of other actions in a certain order established by law:

- apply to the court with a request to confirm that the person has not used the duty receipt (for example, in cases where no one has ever applied to the court with a receipt for the state duty paid);

- wait for the court's decision, if everything is still not decided, the return depends on the judicial act (the final decision in the case or the court's ruling);

- write an appeal to the tax office, see the sample at the end of this material (when a judicial act is adopted and it establishes a refund of duties, when in principle no duty was used, etc.).

If at least one action is performed incorrectly, there is a possibility that the court will refuse to return the state duty. Even the slightest mistake in an application can cost a citizen a refusal, so you should approach this with sufficient care; get advice from our lawyer in civil cases to avoid mistakes.

What happens to the duty that was overpaid? This type of duty can be quickly returned without any problems. In this case, the court is obliged to return the entire amount paid if the case has already been closed or it has been refused consideration. If you are interested in a positive result, you must take into account the information we provide. If you are interested in refunding state fees in an arbitration court or a court of general jurisdiction with our help, contact specialists who have proven themselves to be good. We will solve everything professionally and on time.

USEFUL : watch the VIDEO about reducing the state fee to the court and write your question in the comments to be able to get advice from a lawyer (for more information about reducing the state fee, follow the link on the main part of the site).

When and where to contact

The payer has the right to refund the state duty and submit an application for the transfer of overpaid amounts to the intended destination - to the tax office, court, traffic police or the Ministry of Internal Affairs, Rosreestr.

The money will be returned under certain conditions established in the Tax Code of the Russian Federation. For example, you can request a refund of the fee when filing a claim after receiving a special certificate from the court. They apply to the territorial tax office to receive compensation, but only after they have documented grounds.

IMPORTANT!

If the judicial authority rejected the claim or partially satisfied it, the fee cannot be returned. The same rule applies to a settlement agreement: a refund of the state duty when concluding a settlement agreement in an arbitration court is impossible.

Here are the cases in which the tax office will return the money:

- the payer independently decided not to file a claim;

- the court returned the claim to the applicant (Article 135 of the Code of Civil Procedure of the Russian Federation);

- the proceedings in the case were terminated (Article 220 of the Code of Civil Procedure of the Russian Federation);

- the claim was left without consideration (Article 222 of the Code of Civil Procedure of the Russian Federation);

- The plaintiff paid the fee once again.

To return the money, there must be a specific legal basis, which must be referred to in the appeal and supported by documents. You must apply for compensation to the same judicial body to which the original claim was filed and which heard the case.

The payer has the right to apply for overpaid money within 3 years from the date of transfer of the state fee. If this period has expired, update it according to the rules for restoring the procedural period (Article 112 of the Code of Civil Procedure of the Russian Federation).

To correctly fill out the state duty payment form, use free instructions and samples from ConsultantPlus experts.

to read.