The decision to sell an apartment is always accompanied by serious financial and emotional troubles. This is felt to a greater extent by those who complete the transaction on their own. But even if paid consultants are involved in the process, the property owner will still have to take part in the preparation of papers for purchase and sale. This is due to the fact that a financial personal account from the place of residence is accessible only to the owner of the property or his official representative with a notarized power of attorney in hand.

Briefly about the concept of “financial personal account”

Most owners know quite accurately the parameters of their house or apartment: total area, number of rooms, availability of “conveniences”. But for a potential buyer to trust the owner, a simple word is not enough. In fact, when a person thinks about what a financial personal account from the place of residence is, it is easiest to imagine this paper as a “passport of the house.”

This comparison accurately reflects the data contained in this document:

- number of floors of the building, location of the apartment, number of rooms and their purpose;

- technical improvement, that is, water, heat, gas and electricity supply, presence/absence of an elevator, garbage chute and other devices;

- form of ownership of real estate;

- Full name of everyone registered in the residential area in question;

- information about the benefits provided.

Contrary to popular belief, the unified financial account form does not contain a column about debt for housing and communal services. Representatives of the management company have the right to add this information solely at their own request. Such a position will likely upset those who do not know what a copy of a financial personal account is and believe that the issued certificate will be similar to a rent reconciliation report. Information about utility bills (or rather, debt) usually needs to be requested separately.

Purpose of a financial personal account

Based on the information contained in the extract, the document can be used in the following situations:

- registration of real estate transactions (purchase and sale, donation, inheritance, division of property in kind);

- registration of a new tenant;

- privatization or resettlement of communal housing;

- receiving benefits and allowances;

- documentation of the redevelopment.

For example, when selling an apartment, a potential buyer needs to make sure not only that there is no debt for housing and communal services, but also carefully study the list of persons registered in this residential area. A situation often arises when, at the time of the conclusion of the transaction, there are still registered residents in the property being sold, among whom there may be a minor child. Since children are under special protection of the law, it will be difficult to discharge them after purchasing an apartment.

More prosaic cases of contacting management companies are when a person needs a certificate about family composition or living conditions. This task is successfully solved by a copy of a financial personal account. As an experiment, Moscow developed and began to implement a single housing document that can replace 12 types of certificates for various purposes.

Structure of a personal account statement

The document does not have a set format; the most important thing is that it contains all the information about the home ownership.

Conventionally, the contents of a financial personal account can be divided into several blocks:

- identification of the applicant - address, full name of the responsible tenant, contacts;

- technical equipment of housing - a list of connected communications, accounting and control equipment (meters), availability of “conveniences”;

- general information and characteristics of the object - type, area (total and residential by room);

- data on the form of ownership and disposal - documents on ownership or municipal lease rights;

- composition of persons registered in the residential area.

Information about charges for services, current payments and debt at the time of receipt of the certificate may also be indicated in the document.

Why is FLS needed?

A number is assigned to the premises to track all property or technical changes associated with the living space. A copy of the FLS, i.e. An account statement is always taken for a certain period - for example, for a period of 1 month before the date of application. A copy of the FLS is required in the following situations:

- Checking debts for housing and communal services;

- Confirmation of apartment ownership (the document always indicates who owns the property and who is registered in the premises);

- To check the characteristics of the status of housing and communal services accounts;

- To check the condition of the housing, as well as material amenities: whether the house is in the queue for major repairs, whether it is going to be demolished, whether there is gas/water wiring, etc.;

- Distribution of shares when dividing property - for example, during a divorce or inheritance.

In all these cases, a copy of the FLS is required. The personal account itself in this case serves as a repository of information, a kind of register of all key information about housing. In simple, one might say, everyday use, the document is useful primarily for paying for housing and communal services. Technical and legal aspects are of secondary importance in this case.

Organizations authorized to issue an extract

Due to the fact that information about the housing stock and the people registered in it is collected in a single database of the region, a person does not need to search for a long time where to get a copy of the financial personal account from the place of residence.

You can apply to receive it:

- to a management company or HOA;

- to a unified information and settlement center (UIRC), authorized to collect payments for housing and communal services;

- to the local administration, if there is no EIRC in the locality;

- at the MFC at your place of residence or registration.

Wherever the homeowner turns, he will be given a document with the same set of data, and the important thing is not where to get the certificate, but how long it will take. Thus, when contacting the management company directly, the document can be ready on the same day, and when ordering through the MFC, it will take up to 5 days to complete it, excluding the time for postal mailing of the original, if the applicant is in another locality.

Which country would you rather live in? ⚡ Take the test in 2 minutes

Package of necessary documents

An extract from a financial personal account for home ownership is issued on the basis of an application from the person in whose name this account is issued.

When contacting any of the authorized organizations, you must present:

- a passport or a notarized power of attorney to represent the legal interests of the applicant (it must contain a clause on the right to request such information about the principal);

- document on the right of ownership or use of housing;

- other papers, if the owner or his representative wants to make changes to the data.

After presenting the originals, an employee of the management company or MFC must verify the validity of the application and register it. The fact of receipt of the certificate is confirmed by the recipient’s signature in a special journal or by postal notification of delivery.

Place of application and receipt of extract

Situations when a person is registered in one locality, but actually lives in another, occur at every step. And the distance between cities can be hundreds of kilometers. Therefore, today every person, even being far from home, can obtain information on a personal account, for example, order a service through any MFC or online.

If a foreigner applies for an extract or changes to it, then Form 9 about registration at this address will need to be attached to the standard package of documents.

In the event that a foreigner has temporarily left his place of permanent residence or does not have one at all, he must go through the registration procedure at his actual location.

Why this is necessary, how it happens and what threatens a foreign guest who violates the requirements of migration legislation is described in the material on the topic “Registration of foreign citizens at the place of stay.”

Where can I get an extract?

To get an extract, you need to go one of the ways - contact the multifunctional center or district administration, visit the portal www.gosuslugi.ru. Let's look at these options next.

MFC and district administration

If you choose one of the first two ways to obtain a certificate, you will need:

- passport;

- a document confirming ownership (extract from the Unified State Register, social tenancy or purchase and sale agreement, etc.).

Everything is simple here: just visit the authority office and contact an employee. He will give you a form for entering information and a sample.

What data

indicate: last name, first name, patronymic, contacts (current telephone numbers, e-mail), residential address, type of title document.

The application and all documentation are transferred to the administration specialist or MFC. If there are no shortcomings in the information provided or the list of papers, the application is accepted for processing.

The period for producing an extract is from one to two days.

(meaning only workers).

Portal “Government Services”

In fact, the same thing is done through the State Services website. Only this way does not require office visits, and therefore saves time and effort.

Note 4.

To use the functionality of this resource, you need to be registered in the system. Registration requires the provision of passport data and confirmation of actions using a one-time code from an SMS message.

Procedure:

- open the portal;

- go to the “Personal Account” tab;

- log in (or register if you haven’t already);

- on the main profile page, open the “Services” tab;

- select the “Apartment, construction and land” block;

Government services. Personal Area. Category " - further – “Personal account” – “Get statement”.

Sometimes a difficulty arises: a site visitor does not find the desired option

. This happens when authorization has not been completed and the citizen’s identity has not been identified. Therefore, this moment needs to be monitored separately.

How long is the statement valid for?

The statement received once has a certain validity period. In essence, it simply reflects the state of the object at the time the certificate is issued. All information listed in it is valid only until a new change in one of the points, but no more than 30 days from the date of receipt of a copy of the financial personal account. This means that the certificate can be used within a month after receiving it. But if another tenant registers in the apartment the day after the document is issued, then the previously issued extract immediately becomes invalid.

Validity

The validity period of the document is limited to the period of accrual of utility bills and is equal to one month. After updating information about the apartment, the information on the statement becomes no longer relevant.

IMPORTANT! If an extract is needed when making real estate transactions, then it is better that the date of its execution be as close as possible to the date of drawing up the contract.

This way, the risk of loss of funds and property of buyers will be minimal if persons claiming to live in the apartment show up. You will not be able to extend the validity period of your statement; you will have to request a new one.

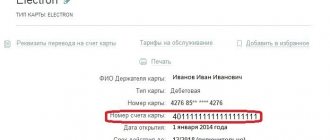

A personal account is an important document in which you can see data on living space. Its number is displayed on every utility bill, but you can find out its number in other ways.

When completing transactions, you always need information about the object, which can be found out from the extract. It’s easy to get an extract from the LS; you just need to come to the authorized body and write an application.

Opening and re-registration of a personal account

After registering ownership of an apartment in a new building or housing purchased on the secondary market, the new owner needs to open or re-register a financial personal account.

There are a number of nuances that you need to know before submitting your application:

- the account is assigned only for residential premises (apartment, house);

- the object may be owned or municipally leased;

- The responsible person is recognized exclusively as an adult with legal capacity.

In order for the name of the new owner to appear on the personal account statement, he must contact the management company or HOA with an application and the following package of documents:

- passport;

- document on ownership or right of disposal (agreement of purchase and sale, donation, lease of municipal housing, extract from the real estate register of the Unified State Register of Real Estate)

- a certificate of family composition - those of its members who are registered in the purchased living space;

- consent of the remaining adult residents that the applicant will become a responsible tenant.

If we are talking only about re-registration or making additions to the housing registry data, then to receive this service you can contact the MFC, the local administration, the Unified Settlement Center, or use the State Services website, for which you should select the appropriate region.

It is important to understand that a personal account is opened for each residential property only once; upon resale, it is not closed or created anew.

With each change of owner or tenant, changes are simply made to the financial and personal account data. Some adjustments can only be made when dividing the homeownership.

What is the content of the document?

The document displays all relevant information about the apartment in as much detail as possible:

- The name of the management company, if there is one, the name and surname of the recipient of the extract, the address of the management company and the address of the premises itself;

- Indication of the title document - purchase and sale agreement, equity participation agreement, cadastral passport, etc. Previously, certificates of ownership were always indicated, but after their abolition, any title paper is indicated;

- Characteristics of the house in which the premises are located: type of covering (wooden or reinforced concrete), year of construction, number of floors and type of heating (central or private);

- Detailed characteristics of housing: number of rooms, total residential and non-residential area in the premises, as well as area broken down into rooms, kitchen, bathroom, etc.; apartment number and floor on which the apartment is located;

- All amenities are listed, such as an elevator, the presence of a gas pipeline, satellite or cable TV, etc.;

- The section “Information about owners and tenants” lists all persons registered in the apartment, as well as those who have a share in this property. The type of registration, date of birth, presence or absence of an established fact of family relations, etc. are also indicated here.

From the above, it becomes clear that the FLS form actually lists the most important and up-to-date data on real estate. This document can be used when conducting transactions with an apartment, starting with its sale and ending with the imposition of an encumbrance on it when receiving a large loan.

conclusions

When buying a property, it's not enough to just look around the rooms and talk to the neighbors. A lot of interesting and useful things can be learned from a copy of the financial personal account for an apartment or house. In particular, about how technically equipped the new home really is, whether accounting tools are installed and verified. But the most important thing is insurance against unnecessary hassle on the part of former residents and a guarantee that they did not leave a “surprise” in the form of some forgotten large debt for housing and communal services.

Issuance procedure

When contacting one of the previously mentioned authorities, you must have a passport and a document confirming ownership.

Sample application for obtaining an extract from the Federal Tax Service

Chronologically, the procedure contains the following stages:

- filling out the application form;

- passing citizen identification;

- checking the actual powers of a person;

- checking the submitted documentation;

- determining the final purpose of the request;

- registration and assignment of a registration identifier (number) to the certificate.

Drawing up a copy of the FLS is a free event (the cost of the service is included in the cost of servicing the real estate).

Statement deadline

- about two days. Issuance occurs exclusively against the signature of the applicant-recipient. The document can be sent by mail if such a request is indicated by the citizen.

What is a bank statement

A bank statement is a register of account transactions over a certain period of time.

In this case, we mean any account: both a current account belonging to a legal entity or individual entrepreneur, and a personal bank account registered to an individual. Non-cash payments, as well as payments using bank cards, have become widespread not only among organizations, but also among individuals. People increasingly prefer cards to cash, especially during the coronavirus pandemic. Small businesses represented by the self-employed are moving to the Internet and massively receiving payments for their services on cards. Therefore, it is important to be able to obtain summary information on inflows and outflows made to a bank account. This is precisely the function that a bank statement performs.

Find out about the work of self-employed people with legal entities from the article .

Let's look at what a bank statement looks like and how the information in it is structured below.

Form T-54

A unified personal account card in the T-54 form is intended to reflect monthly information about accrued wages and other accruals for a particular employee, about all deductions made based on data from primary accounting documentation for production, about work performed, standards of time worked, as well as other orders for different types of payment.

This is what the T-54 form looks like:

The document is created separately for each specialist from the beginning of the calendar year or from the date of official employment. Information is entered monthly for one calendar year. The organization decides independently how to fill out the employee’s personal account form for the salary, enshrining the established procedure in the accounting policy. The nuances depend on the company’s field of activity and the number of employees. In separate departments, the rules may differ.

The accounting procedure is approved by the manager, and all pay slips and personal accounts are filled out exclusively by an accounting employee or another responsible person who is entrusted with accounting responsibilities in the company.

How to check template status

The status of the template can be checked by opening the “File Import/Export Result” tab in your personal account. You will see a list of all the templates that you have already uploaded to the site. Note that the status of the template can and should be checked, since the site only indicates whether the file has been processed or not, and only inside the downloaded document will it be indicated where you made the mistake.

Under the checkbox, the “Save processed file” function is offered; the document will be downloaded in Excel format. The status of the object is indicated in the last column of the table, which is called “Processing Status”. If the background is red, then there are errors. The program does not write how to correct them, so you will have to check the entire table again. If “Ok” is written in the “Processing status” column, then the table was processed successfully.