All people living in the same living space are required to register at their place of residence. Moreover, they have an obligation to pay for utility services and to make payments for the use of the apartment. So that at any time you can check exactly what payments were made by the residents of the house, all payment actions are entered into a special database. From this article you will learn what a financial personal account is from your place of residence, where you can get an account statement or a copy, and how to open a financial personal account.

What is a financial personal account from the place of residence

Important! A financial personal account from the place of residence is opened for the entire residential premises.

A financial personal account from the place of residence is issued with the purpose of storing unified information about all financial transactions that took place within one residential premises in one place. It can be opened for an apartment or house that a person owns as property, social tenancy or lease. In this case, it does not matter whether the owner or the tenant pays for the maintenance and management of the residential premises, housing and communal services. The personal account contains the following information:

- about those who own the housing in question and who is registered in it (in the case where there are several owners, each is indicated in a financial personal account, and the share in the common property is also indicated);

- about the supplied communications (elevator, garbage chute, water disposal, gas supply, water supply, electricity supply), the degree of improvement;

- about the type of housing in question (individual apartments, communal apartment) and the characteristics of the apartment/house (number of rooms, area, floor, number of floors in an apartment building, level of wear and tear).

If an apartment or residential building has several owners, and a personal account was opened for only one of the owners, when dividing the property, each of them must take care of registering a separate account and making payment exclusively for their part of the premises. An extract from a financial personal account may be needed in the following cases:

- for the privatization of residential premises;

- for transfer of property by inheritance, execution of a gift agreement;

- to coordinate the redevelopment of the apartment;

- to sign a purchase and sale agreement (an extract from the house register will also be useful, which contains the entire history of sales of the apartment/house, the time of registration and check-out of residents).

How to pay for housing and communal services using ELS through State Services?

Many Russian citizens have long been using the State Services portal to pay utility bills. When entering the site, you must enter an ELS and a secret password (it cannot be shared with strangers).

On the site you can not only pay bills, but also carry out a number of other operations:

- find out when the deadline comes to transfer the IPU indicators. This must be done monthly from the 15th of the current month to the third of the next. If you submit meter readings later, the readings will be taken into account only after a month;

- Payments must be made by the 10th of the current month. Exceptions apply only to receipts that come under contracts that indicate a different payment interval;

- property owners can control the amount of charges and monitor changes in tariffs. The list of mandatory services has two main categories: housing and utilities. Utilities include payment for consumed resources (cold and hot water, electricity, gas, sewerage, heat). Housing – this includes maintenance, current and major repairs of residential and common premises, removal of solid waste, intercom, television antenna, etc.

Also, with the help of a single personal account of the housing and communal services payer, the owner can find out about the required benefits or subsidies.

It is very important to always pay for housing and communal services on time, because failure to pay can lead to the imposition of penalties, disconnection of an apartment or house from the distribution network, as well as debt collection through the court.

How to open a financial personal account from your place of residence - algorithm

Important! If you have become the new owner of an apartment by purchasing it, accepting it as a gift, receiving it by inheritance, etc., you need to re-register a financial personal account - it must be opened for the main tenant. The remaining owners must give their written consent.

The main tenant of housing can be a person who meets the following conditions:

- he must be of age;

- his legal capacity should not be limited;

- he must be registered in this housing and live in it.

To re-register a financial personal account, you need to contact the utility services and re-issue the contracts so that the new owner is indicated as the payer. Specifically, you need to go to the gas service, the water supply department, or the electricity supplier.

Next, you need to go to the management company and ask to add new information to the house register, and then open a financial personal account for the new owner. It is necessary to prove the existence of rights to own the premises. From now on, utility bills will be sent to the new owner.

Payment for housing and communal services using ELS

A single personal account allows you to pay for utilities in one click, without fees, queues and wasting personal time. Nowadays you rarely meet a person who does not have a bank card, and any reputable financial institution has a mobile application where you can register, make transfers between accounts, pay for purchases, services, including housing and communal services bills.

We have already looked at how to find out the ESL to pay for utilities. This is what you need to indicate, and then pay the bill quickly and conveniently. Also, many banks offer to enable an alert function. Here you will also need an ELS, which is entered in the “housing and communal services accruals” section. Each new accrual will come with a notification. Accruals are made automatically and displayed in the application on the main page.

The payment receipt can be sent by email or printed. If you urgently need a document and you cannot find it, you can look at the payment in the “made payments” section or request a copy.

Where can I get a financial personal account from my place of residence?

Important! If you apply in person, an extract from your personal account will be ready in 2-3 days; the MFC and employees of the State Services website will prepare the paper in 5 days.

A copy of a personal account can be issued in several institutions at once, and it makes no difference where to apply - it’s a matter of convenience:

- submit an electronic application through the State Services portal;

- send a request by mail (registered letter with acknowledgment of receipt);

- MFC (multifunctional center);

- municipal administration;

- Management Company.

In institutions where the applicant can apply in person, the person responsible for receiving and issuing documents is obliged to perform the following actions:

- check the applicant's passport;

- make sure that the applicant has the right to receive a copy or extract of the specified document;

- check the compliance of the submitted documents with the requirements of the law;

- check the completeness of the requested papers;

- ask about the purpose of the applicant’s application;

- register the application and assign it an individual number.

How to find out PM by residential address?

You can obtain information about the single drug number either remotely or during a visit to one or another authority.

Web banking

Banks today are actively modernizing the area related to payment for housing and communal services, because... Many users deposit money through bank cards. The functionality of their personal online banking account helps them with this.

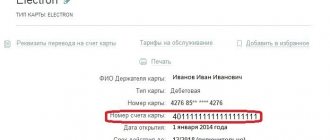

Let's consider a particular example with Sberbank Online. To find out the desired number, you should:

- log in to your account;

- go to the “Transfers and Payments” tab, then – “Housing and Public Utilities and Home Telephone” – “Rent”;

Section "Rent" in the housing and communal services tab. Personal account of Sberbank Online - select the item depending on the type of receipt you receive (for example, “Single payment document”).

If you have previously paid for housing and communal services and saved the transaction settings, the number will already be entered in the field for entering your personal account.

Another way:

Open the “Personal Accounts” tab. Enter your address in the search. The results will be displayed immediately - the number itself, the amount of the last payment, and the total amount of debt (if any).

Note 2.

The data provided by the banking system is synchronized with the database of the Unified Settlement and Information Center.

Please note:

in addition to the number, the amount required for payment is also shown - without any additional requests or checks. Although the payment amount is offered by default, the user can change it.

As you can see, it is very easy to find out PM through your personal account. You can immediately implement the transaction here if the citizen has not yet paid for housing and communal services for the current billing period.

Portal gosuslugi.ru

Government services are an equally convenient way to find out your LAN number. The advantages are efficiency and an intuitively understandable procedure. The downside is that in 2021 only Muscovites can use the function.

To obtain the necessary information, you need to register on the website www.gosuslugi.ru

in the “Personal Account” section: open the data entry window and click the “Register” link.

If you already have an account in the system, please log in. Further:

- open the “Services” category;

- open one by one the subcategories “Apartment, construction and land” – “Payment of housing and communal services” – “Account information”;

Portal “State and “Payment for housing and communal services” - enter the address (city, street, house, apartment);

- click the search icon.

Note 3.

You can simply enter your address into the information search bar. The effect will be similar to the result from the actions described above.

The condition for a successful search event is a verified account. To do this, you must indicate at least a phone number in your profile. If the requirement is met, the system issues a drug number attached to the living space.

Management companies

The method is available to residents of any subject of the Russian Federation. The main requirement is that maintenance of the apartment (house) must be carried out by a specific institution

.

To find out the number, you will have to visit the office of the management company. Two other options are the organization’s website and calling its hotline.

Where can I get the name of the authority, contact numbers, email or Internet resource address? All this is indicated on the receipt that the courier leaves in the mailbox.

Answers to common questions about why you need a financial personal account from your place of residence

Question No. 1: Did I understand correctly that a financial personal account from the place of residence establishes the right of ownership of the owner or tenant of the property?

Answer: No. A personal account only states the fact of ownership or hiring. The right of the owner or tenant is established by the following documents - a certificate of inheritance rights, a gift or sale agreement (for the owner) and a decision of the executive body, a municipal order (for the tenant).

Question No. 2: For how long is a financial personal account from the place of residence valid?

Answer: The validity period of an extract or copy of a financial personal account is 30 days from the date of its issue.

Rate the quality of the article. We want to be better for you:

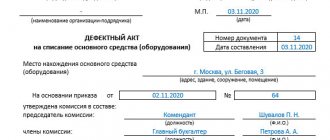

Procedure for closing a treasury account for a legal entity

When an account can be closed:

- As a result of the termination of the client's activities.

- After full execution of the government contract.

- If there have been no transactions on the account for 2 years.

- When changing the number structure.

To close the account, the client is notified of the need to submit an application along with supporting documents. It will be reviewed within 5 days.

The account will be closed after changes are made to the Consolidated Register if there is no cash balance on it.

So that everything is in a bundle

The consumer receives up to five payments, as happens, for example, with residents of houses No. 2, 3, 16 and 19 on Yuzhny Boulevard (Avtozavodsky district). And for each transaction in banks there is a commission of up to 25 rubles from each payment.

- One - I paid for everything, and it’s great! But this has to be paid in different places, and they also charge commissions,” local residents complain.

Meanwhile, the region has long created a mechanism that allows tying all utility payments into one “bundle”. “Economy of the Volga Region” described how to use the tool in the article “Billing to Help” (issued October 23, 2021).

Let us recall that utility service providers complained: management companies (MCs), having collected money from the population, often “forget” to transfer it to resource supply organizations (RSOs). A solution could be the transition of direct consumers of services to direct contracts with RSO - then management companies would lose the opportunity to “earn money” through intermediation. But when switching to direct contracts, in addition to increasing the number of settlement centers, an increase in the number of legal offices will be required to consider disputes.

“Today there are many homeowners’ associations that do not work with the interregional information and settlement system,” noted Roman Zharkov, financial director of Nizhnovteploenergo LLC, at the October meeting. — It’s more convenient for us when management companies cooperate with Headache LLC, which offers information and settlement services. As such, its experts recommend introducing the practice of issuing a single payment document (UPD) to consumers of housing and communal services. It includes both housing (“maintenance of residential premises”, including “maintenance of common property”) and most utilities, “sewage”, “heating” and others), as well as “contribution for major repairs”.

The practice of using EAP has been successfully used for many years in Nizhny Novgorod and many municipalities in the region. It has proven its effectiveness and convenience for residents. In addition to the obvious advantages for the consumer (convenience of payment, when all charges are tracked using one document and payment is made for the full package of housing and communal services), the ENP ensures almost one hundred percent collection of payments for RNO (97-99 percent is the annual average, and in December, as a rule, the collection rate is higher hundred percent, as people try to pay off the debts they have accumulated over the year).

According to experts, the cost of billing services for housing and communal services enterprises that are participants in the ENP is low: the costs of printing and delivering receipts are shared among everyone involved in the process. And automated processing of an array of payments using a consolidated bank account allows you to negotiate with collection banks on their minimum commission.

Another advantage is the unity of information about the premises and the subscriber, which ensures the availability of up-to-date source data for calculating fees for all housing and communal services, which minimizes accounting and calculation errors. Subscription services for residents based on the “one window” principle also speaks in favor of the EAP.

However, the obvious has not become probable: today, the actions of RSO related to the transition to direct contracts for the provision of utility services (and this has become a fashionable trend) lead to the disintegration of the EPD into many separate receipts. The main reason for such actions is the reluctance of the RSO to bear the costs of paying bank commissions. Previously, they were reimbursed by the management company, but the transition to direct contracts destroyed such relationships.

In practice, exit from the EPD system and its disintegration into several receipts for housing and communal services in Nizhny Novgorod has already occurred. Only Our House LLC:

— The utility consumer should be able to pay without a fee, including in accordance with the Consumer Protection Law. The existing scheme of mutual settlements allows you to easily maintain a single payment document for housing and communal services; the consumer will not incur any additional costs.

Yuri Dolgov, resident of Sormovo district:

— The practice of issuing EPDs for housing and communal services must be preserved. This is convenient for residents - we pay receipts without additional commission. There are many points of public service based on the “one window” principle. It is beneficial for all organizations in the housing and communal services sector, since the ENP provides them with high collection of payments. When switching to separate payment documents for the population, the convenience of payment, the transparency of calculations will disappear, and additional fees will arise when paying for each receipt. As a result, revenues to housing and communal services enterprises will also decrease. I think that all organizations in the housing and communal services sector understand this, but underestimate it.