In short, no, even on the basis of a bailiff's order. Collection of money placed in a special account of the debtor in the interests of a third party affects the interests of the owners of premises in the apartment building and can have socially significant negative consequences. Details are in today's article.

Capital repair fund and methods of its formation

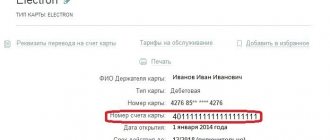

4031410

Features of making payment

There are several ways to avoid the queue when paying for the Kyrgyz Republic. The simplest and most comfortable alternative is the official smartphone application, remote access, through a terminal or ATM, in which the tenant makes the payment himself. Each region has specific operators. When changing the owner of property or making changes to registration data, the following documents must be provided to the fund or management company: a passport of a citizen of the Russian Federation, a certificate confirming ownership of real estate.

Since 2014, residents of apartment buildings have been required to pay for major repairs. Many people do not make payments at all due to a lack of understanding of the payment mechanism. But failure to pay may result in fines. The personal account of the management company has information about receipts to the account. These data indicate the amount that individual residents contributed. The receipt for the Kyrgyz Republic includes the following data:

- Full name of the property owner;

- the number of people registered and actually living;

- territorial location of the apartment;

- area and total number of rooms;

- number of storeys;

- home improvement and so on.

Information

A small number of owners understand the mechanism of payment and accruals under the Kyrgyz Republic. This is the basis for not accumulating debt. Timely payment becomes the key to prosperous living in your own territory. Payments for major repairs refer to utility costs allocated to maintain the house in a comfortable condition.

Obligation to pay contributions for major repairs

The need for payments is explained by the privatization of residential and non-residential premises. The public part of the property, without the normal functioning of which it is impossible to live comfortably in MKD apartments, requires care and restoration.

The Housing Code defines capital repairs, which includes:

- Replacement of parts of structural elements of an apartment building: roof;

- basement;

- facade;

- stairs;

- utility rooms.

- water supply;

The legislative framework on the basis of which it is necessary to transfer contributions for the restoration of residential buildings is the residential complex. Its articles provide direct instructions on the procedure for applying regulations.

On its basis, the utility service is obliged to issue an invoice to homeowners every month for major repairs of public property. The amount can be included in the receipt with utility obligations or have a separate document. The owner is required to pay it monthly. The received financial investments are accumulated in local specialized accounts.

According to the calculation method, the amount of payment for major repairs is determined as the product of the minimum cost of major repairs and the total occupied area.

The minimum size per square meter is approved by regulations of regional entities and municipalities of federal cities. For this reason, payment for major repairs is different everywhere. The highest is in Moscow and St. Petersburg.

Important! The obligation to pay applies to owners living in high-rise buildings included in the list for restoration.

3-8 months after the publication of the list of repair objects, owners of residential premises must receive notifications from management companies to conclude contracts.

The law exempts citizens living in new buildings (houses 3-5 years old) from making transfers for restoration work. The specific duration depends on the region of residence.

Collection of funds earlier than these deadlines is possible with the consent of all residents of the apartment building, fixed in the decision of the general meeting. To do this, management company employees must organize a meeting of at least 2/3 of the owners of apartment buildings (regardless of residence and registration) and collect signatures.

Consequences of failure to pay for capital repairs

To avoid consequences, residents must:

- check the amount of debt under the Kyrgyz Republic using the previously described methods;

- make payments on time;

- keep paid receipts, as they confirm the absence of debt;

- make payments using the correct details, be sure to check them before directly depositing the amount;

- pay for major repairs on specified dates and in a certain amount.

If the case goes to court, the tenant will be able to present paid receipts that will exonerate him and prove his case. Failure to pay may result in administrative liability (fine). The payment procedure is mandatory and is carried out once a month. Non-payment leads to:

- summons to court;

- the arrival of bailiffs who collect debts;

- seizure of property;

- arrest of the owner for an offense.

The Housing Code of the Russian Federation exempts from payment of these contributions in the following cases:

- the emergency condition of the house, which is confirmed by independent experts. This conclusion is issued by the administration;

- seizure of real estate or land by the state for certain reasons (sports events).

Warning

You can find out the amount of debt in the HOA or FKR, by checking previous and current receipts, as well as using Internet portals (Government Services). Via the Internet, this operation can be carried out through the website of the State Services, the Unified Center, which is responsible for the control and maintenance of an apartment building, as well as through a personal visit to the FKR or HOA. You can search for a home by address, receipt or invoice.

What are the consequences of non-payment?

The law provides penalties for property owners who ignore statutory payments. It is not fully regulated in the legal field, because there is a contradiction between the norms of the law. According to the Housing Code, owners of residential and non-residential premises are required to pay for restoration repairs. The Civil Code stipulates that transfers must be made on the basis of the voluntary consent of citizens.

Important! However, based on judicial practice, most decisions on lawsuits are made in favor of management companies and regional funds.

Accrual of penalties

Debt arises when payment is overdue by 1 month. Starting from the second month and until the end of the third, the management company and the fund have the right to charge a penalty in the amount of 1/300 of the refinancing rate. After 90 days of delay in payment, the fine increases to 1/130 of the Central Bank refinancing rate.

Inability to sell an apartment

When selling real estate, the buyer may require from the seller information on payment of utilities and contributions for major repairs. The presence of debt will affect the completion of the transaction: the buyer will either refuse it or demand a price reduction by this amount.

Fines

Penalties for non-payment of the mandatory contribution are determined by the court, upon the recommendation of the bailiff. The amount of the fine depends on the size of the debt and the reasons for the delay in payment.

Other consequences

The bailiff has the right, upon the recommendation of the Criminal Code about the debt that has arisen, to seize the owner’s bank account. If the debt exceeds 30 thousand rubles, the debtor will not be allowed to cross the border of the Russian Federation.

State Services Portal

This method is considered convenient and fast, since the process is carried out online. The tenant does not need to go anywhere, waste time, or collect documents. All you need is a registered personal account on the portal, an Internet connection and the address where the property is located.

In the personal account, the owner finds the section responsible for utilities, where payments are made. For convenience, you need to fill out your account with personal information and reliable data from documents, this will significantly reduce the time for processing data and searching for the desired section. In the future, you will be able to regularly monitor accruals or debts, as well as pay on the portal itself.

Is the debt for major repairs transferred to the new owner?

Unfortunately, the debt is transferred from the previous owner to the new owner of the property. This legal norm is enshrined in Article 158, Part 3 of the Housing Code of the Russian Federation. The confusion arises because, according to Art. 210 of the Civil Code of the Russian Federation, debts for utility bills are assigned to the citizen during whose period of ownership these debts appeared in the first place. However, Art. 158 part 3 of the Housing Code of the Russian Federation separates the concept of “contributions for major repairs”, therefore Art. 210 Civil Code of the Russian Federation.

Accordingly, there is no point in turning to law enforcement agencies and the courts - according to the law, it is you who are obliged to repay the debt. Therefore, we recommend that you always carefully read the purchase and sale agreement (it should reflect the status of your personal account), and also require a document from the seller confirming the absence of debt. Otherwise, in the absence of caution and attention, the buyer will only find himself an additional headache.

Other methods

All residents are required by law to pay the appropriate fees. Only certain categories of residents are exempt. Even if the owner pays for major repairs on an ongoing basis, he still sometimes needs to check the debts in order to avoid troubles in the future. Such information can protect the tenant and prevent the occurrence of an administrative offense. If there is a debt, then these manipulations are carried out before paying it or when buying or selling real estate.

The territorial branches of the Fund, which collects contributions for capital repairs, have information about debts. Employees at the address will be able to find all the information, but only the owner indicated in the documents has the right to provide it. Therefore, before visiting the regulatory authority, you should take supporting documents (passport, certificate of ownership, etc.).

Modern technologies have developed to such an extent that you can find out information about debt via the Internet, that is, without leaving your home. Now you don’t need to stand in queues or go through authorities to become the owner of the relevant information. To do this, you only need to create a reliable account on the website that regulates the payment of contributions for major repairs. The account must be linked to a personal account. The State Services portal will allow you to regularly monitor payments, debts and other account transactions, which will ensure the security of the property owner.

Information

Any management company that provides services to a large number of payers tries to create simplified accounting, so each tenant receives his own account. Under this personal account is the address of the owner. This account makes it easier to check debts at service centers. Today, some banks will allow you to use this information using the Internet.

Who is eligible for benefits?

The law defines categories of citizens entitled to a payment discount of 30%, 50%, 100%.

Homeowners aged 80 years and older (single and married) are exempt from contributions.

Payment reduced by half:

- disabled people of groups 1 and 2;

- owners aged 70 years and older (single and family);

- disabled children;

- guardians/parents of disabled children.

The following are eligible to receive a 30% subsidy:

- liquidators at the Chernobyl nuclear power plant;

- civilians from the exclusion zone affected by radiation;

- veterans of war and labor;

- disabled war veterans;

- large families;

- low-income people with a confirmed income level.

Receiving compensation is possible subject to confirmation of the federal decree at the regional level (relevant resolutions with budgetary justification have been adopted).

In the absence of a receipt

The easiest way to check your personal account is, of course, a receipt that arrives monthly. But it happens that the document did not arrive to the owner, or it is lost. A receipt for major repairs is not considered mandatory when visiting the relevant authorities. It is important to have with you documents confirming ownership and a passport of a citizen of the Russian Federation.

The fund's employees have all the necessary information on your account, so debt repayment is available without a monthly receipt. Monitoring the absence of debts for major repairs is the responsibility of every conscientious owner. Ignoring payment of dues will cause trouble.

In what cases is the owner exempt from contributions?

The conditions for exemption from the obligation to pay contributions for major repairs are regulated by the Housing Code of the Russian Federation. In particular, according to the provisions of the Housing Code of the Russian Federation, the owner does not have to pay in the following cases:

- If an apartment building, part of which the owner owns, is recognized as unsafe . A conclusion on its emergency status must be issued in writing by the municipal administration of your city;

- If the property of the owner of real estate is temporarily seized from him for the needs of municipal or federal authorities. This means that during the “alienation” of the property, its current owner is completely exempt from all types of contributions, including housing and communal services, contributions for major repairs, etc. As a rule, real estate is confiscated in the event of unforeseen situations - the resettlement of refugees in your region, an increase in tourists due to any events, etc. It should be noted that the authorities most often do not touch ordinary “private traders”. This clause of the RF Housing Code applies, first of all, to hotels, hostels, property of developers, etc.;

- If the owner bought a recently commissioned house (the so-called “new building”). In this case, he is exempt from contributions for a period of one to three years, depending on the laws and regulations of his region. This information needs to be clarified with the city or regional administration. Also, the developers from whom the property was purchased are required to provide information on benefits.

When purchasing a property with debt

It happens that the new owners purchased an apartment that has a debt for major repairs. This indicates that the previous owner did not pay the dues on time. Civil legislation does not imply that when purchasing real estate, all debts are automatically transferred to the new owner. But upon closer examination of the circumstances, it becomes clear that this is not the case. According to Article 158 of the Housing Code, the debt for major repairs is transferred to the new owner after registering the property in his name.

Therefore, the purchase of an apartment should be accompanied by a thorough check of the debts and the owner himself. It would be appropriate to enter into an agreement under which all existing debts become the responsibility of the new owner. With such agreement, all further troubles will be excluded, and the total cost of the apartment will decrease due to the presence of debts. If the buyer categorically refuses to assume the debts of the previous owner, then this is reflected in the documents in order to avoid various kinds of disagreements.

Execution by the bank of bailiffs' orders

The bank, in its defense, stated that it could not fail to comply with the bailiff's order. But the courts did not agree with this.

In issuing the order, the bailiff notified the bank that he did not know whether the HOA had funds that could not be foreclosed on, and asked the bank to notify him of this.

The bank reported that such funds were in a special account and invited the bailiff to confirm the possibility of writing off money from the specified account.

At the same time, without waiting for a response from the bailiff, the bank wrote off the funds from the special account of the partnership on the same day.

The courts found that there was no violation of the law in the actions of the bailiff, but the bank did not suspend the execution of the writ of execution and did not promptly tell the bailiff about the special nature of the disputed current account.

Failure to pay contributions for capital repairs

Knowledge of the payment mechanism does not guarantee that the owner will in good faith pay a certain amount within the specified period. But the law strictly regulates these issues, since payment of fees is an obligation, not a wish of the owner. Accumulated debts for this type of utility services will inevitably lead to undesirable consequences. The state has established the following penalties for this type of offense:

- penalties are charged, which are calculated from the thirty-first day the debt arose. They amount to one three hundredth of the total debt;

- If there is a debt for a period of six months, legal proceedings begin.

Information

It is worth understanding that bringing it to trial threatens not only the payment of the debt for major repairs, but also the reimbursement of legal expenses and payment for the activities of bailiffs.

What's happened

The homeowners' association entered into an agreement with the bank to create a special current account for the formation of a capital repair fund. According to the terms of the agreement, transactions with the account not provided for by the Housing Code of the Russian Federation and the agreement were not allowed.

Once, almost 290 thousand rubles were recovered from the HOA in favor of an individual. The bailiff sent a decree to the bank to foreclose on the funds of the HOA.

The bank complied with the order and wrote off the money from the special account. The partnership considered these actions to be contrary to current legislation and filed a claim first with the bank and then with the court.

The courts of first instance and the Supreme Court of the Russian Federation sided with the HOA and ordered the bank to compensate the partnership for its losses.

How to get personal account information?

The storage cell number can be obtained this way:

- First of all, you need to obtain information about who carried out the account registration process;

- Based on the information received, you can obtain data about the savings cell in various ways. When contacting a management organization, a regional operator, or when contacting an authorized person.

Let's look at different situations in more detail. In the case where the personal balance sheet was opened by an organization of a managing format, you can contact the office of this organization and ask for certain data. Please note that upon your application, not only a number must be provided, but also reporting that reveals all aspects of the expenditure of funds.

If the house has a joint account, which was opened by a regional operator, then in this case it is necessary for the resident or a group of owners to draw up an application in free form to provide data about the savings cell. This application can be taken personally to the administration, or can be sent by mail. After the regional operator receives such a request, it must notify residents within several weeks. That is, provide the necessary data for the storage cell.

If residents carried out the opening on their own, you can find out the cell number by contacting the initiative group of people. That is, to those who put forward the offer or to the official representative of your home. Based on your application, you must provide all the necessary information, including your number.

Benefits of opening an account for residents

In this situation, it becomes possible to independently carry out the procedure for controlling the costs of capital repairs. Residents can also use special banking programs to receive a percentage of the annual profit from the amount of money received. Thus, additional profit will be generated, which will generate a more intensive collection for subsequent repairs. But there are certain disadvantages in such a situation. Since among the owners it will be necessary to select a trusted person, and subsequently carry out the opening process in the name of this person.

As you understand, the trusted person will have full access to all funds. But other residents will not be able to have such access and will have to be content solely with the reporting documentation on the disposal.

Who is the account owner?

Money is credited to the account through payments made by residents of a particular building. Despite the fact that the savings come from the residents, they do not have the right to independently dispose of them. The owner - the regional operator or a representative of the management authority - has the full right to disposal and use . Residents at the same time have the right to use savings, but only if a specific decision on this issue was made at a meeting of owners, and this decision must be reflected in the appropriate minutes.