Property insurance at VTB is a reliable and affordable way to avoid financial losses and protect valuable property from unforeseen incidents. LLC IC "VTB Insurance" offers a number of its services, thanks to which you can insure a house, apartment, cottage, equipment and furniture.

The company has developed 5 property insurance programs:

- “Advantage for an apartment” – insurance protection for apartments;

- "Hi, neighbor!" – to protect the apartment and property in it;

- “Advantage for Furniture” – furniture insurance;

- “Advantage for the home” – insurance of a dacha, country house;

- “Equipment Advantage/Portable+” – protects portable equipment.

- “Apartment Optimal” – Protection of civil liability from financial losses in case of damage caused to neighbors;

Property insurance for a mortgage from VTB is carried out according to 2 programs: the basic mortgage program and the “Advantage for Mortgage”.

- Important!

Company products

In addition to the online selection of insurance products, the company’s clients can purchase other insurance coverage options both at VTB Bank branches and on the organization’s website.

Quick policy “Hello, neighbor!”

An alternative to issuing a standard policy on the Internet or on a website is property protection with express registration “Hello, neighbor!” from VTB 24. The policy can be purchased both from the group and from partners , for example, in cellular communication, equipment and electronics stores Euroset, Svyaznoy, Eldorado, commercial banks JSC Raiffeisenbank, PJSC Post Bank , PJSC Sovcombank.

The advantages of the insurance product are registration without documents and inspection. All data is filled in “according to” the buyers of the product. The insured may be the owner of the property, but it is allowed to purchase the product in favor of third parties with another owner of the apartment indicated as the beneficiary.

Calculation of the policy price within the framework of the “Hello, Neighbor!” program – 5 thousand rubles (with insurance coverage of 1.1 million rubles) and 12 thousand rubles (insurance coverage – 2 million rubles). The program includes civil liability protection, interior decoration, and owner's property, including dishes, appliances, furniture and clothing.

"Apartment optimal"

This is a classic option for property insurance , which can be purchased at VTB Bank branches. It includes protection against fires, gas explosions, natural disasters, bays and floods, illegal actions of third parties (vandalism, theft, robbery), and terrorist acts. Additionally, clients are protected from civil liability to neighbors.

The policy is calculated taking into account the protection parameters chosen by the client at bank branches. The cost of insurance varies depending on the amount of insurance compensation: the higher the amount of insurance protection, the more expensive the cost of the policy. A passport is required to register the product.

For detailed information about the policy, please call the Contact Center at 8-800-100-4400.

What is an insurance policy and why is it needed?

A mortgage insurance policy from VTB gives confidence in the future to those who purchased it. Its design allows you to feel protected from troubles with your apartment and save money if something really happens.

The contract can provide for the event of loss of work, capacity and even life. Anything can happen while paying off a mortgage that can last decades.

What is included in the basic VTB insurance program? These are the main risks: 1. Damage, destruction, loss of real estate. Here you can foresee the occurrence of:

- fire;

- explosion of gas or steam;

- flooding;

- destruction from military operations;

- natural disaster;

- terrorist act.

2. Loss of property rights to housing of former owners as a result of litigation.

3. Loss of health or life of the borrower as a result of:

- illness;

- accident;

- of death.

It is advisable to include additional conditions in the policy that may prevent loan repayment.

It can be:

- loss of permanent income due to liquidation of the organization, staff reduction;

- stay on long-term treatment;

- theft.

There is also an addition to the policy called “Mortgage Benefit”. It is needed in order to accumulate a reserve amount for the purchase of a new property if the apartment cannot be restored. That is, the client will not lose the funds already invested and will not be left without a roof over his head even as a result of the complete destruction of property.

How does apartment insurance work? For example, if there is a fire in an apartment, the damage from it is assessed, and this amount is paid to the residents for repairs. If something happens to the client, he becomes disabled or, God forbid, dies, his remaining debt to the bank will be paid off for him. He will also be paid compensation for the loss of the owner's title if someone challenges the property rights of past residents in court. If the borrower pays off the loan in advance, he will receive his money back for the remaining time until the end of the mortgage agreement.

Insure risks

offers protection against the following types of risks:

- Bays, floods of third parties. This may be robbery, theft, robbery, vandalism and other actions aimed at destroying the property and property of the beneficiary.

- Civil responsibility to neighbors. If the owner unintentionally caused harm to the health of neighbors or their property, his interests will be protected by a financial company. For example, VTB 24 insurance will help against the risk of flooding of neighbors due to a burst water pipe.

- Fire and the consequences of its extinguishing, exposure to smoke from combustion products. Damage is indemnified if, after extinguishing a fire, the insured object was damaged by water, foam or sand (for example, from the actions of a fire brigade).

- Gas explosion and consequences, including damage to property from fragments and other objects.

- Natural Disasters. Adverse natural phenomena that negatively affect the condition of the insured property, for example, floods, hurricanes, landslides, are included in the list of risks subject to compulsory insurance.

- Other actions and phenomena included in the insurance contract.

At the request of the client, the list of insured services can be expanded, or vice versa, reduced to the required level. The number of risks is reflected in the final cost of the insurance premium, which also depends on the availability of a lease agreement, the region of registration and the total area of the premises.

FAQ

How does theft insurance coverage work?

Two factors are key in this case. The first is the specific terms of the contract concluded with the insurance company. Theft must be included in the list of insured events.

The second factor is documentary evidence of the theft and the amount of damage suffered by the insured. This type of documentation is usually obtained from the department of the Ministry of Internal Affairs or the investigative committee that is investigating the incident.

Does disaster insurance protect me?

A policy issued by an insurance company becomes protection against a specific natural disaster if the contract contains a clause on its inclusion in the number of insured events. It is important to understand that in this situation we are talking about listing all possible natural and man-made disasters. This will allow you to receive insurance compensation even if the insurance company tries to refuse to pay compensation. Services for this type of insurance are provided by almost all serious participants in the Russian insurance market.

Tariffs for services

, "Comfort" and "Premium". The packages differ in the cost of the insurance premium and the number of risks included. The client independently chooses which protection option is suitable for him .

Additionally, the buyer can use individual selection of parameters; in this case, the size of the policy will cost more than standard home insurance services.

The final cost of the tariff from VTB 24 for property insurance is set after the client selects all the parameters, which automatically includes the risks of power outages in the apartment and the consequences of freezing water pipes. These types of risks are common to all insurance packages.

Rules of property insurance "VTB Insurance"

According to the rules of the insurance contract, VTB can insure:

- Private residential buildings (house, dacha);

- Apartments and even rooms in apartment buildings;

- Private land plots;

- Any outbuildings and household buildings such as garages, bathhouses, greenhouses, decorative buildings, fences;

- Movable property (furniture, portable equipment).

The owner can also separately insure his civil liability or activate a compensation service against the actions of terrorists.

The validity period of the property insurance contract is strictly one year, and the cost of insurance is calculated for the same period. For additional customer convenience, there is a calculator on the official website. There you can also arrange insurance yourself, saving your time. For example, post offices have ready-made insurance packages.

How to calculate the cost?

The calculation of insurance at VTB is influenced by several factors:

- Total area of the property . Starting from 50 sq.m. and above, the insurance premium automatically increases.

- Registration . Residents of the capital and region will pay more under Comfort and Premium policies than buyers from other regions.

- Renting out premises . If there is a rental agreement, the cost of the policy increases.

Additionally, clients can order a policy with an individual choice of parameters. The insurance premium for such a product will be 20-30% higher than the classic insurance option due to the inclusion of additional property protection functions.

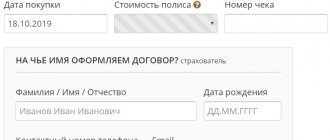

Algorithm for online purchasing

- Go to the official page of the company (section on property protection) “VTB Insurance” https://www.vtb24.ru/promo/insurance/apartment.html.

- The “Policy Cost Calculation” service will appear on the screen. Several parameters should be entered: area (in numbers), region (Moscow and St. Petersburg or another), ownership (yes/no), whether the premises are for rent (yes/no).

- View the calculation results. When the specified selections are automatically changed, the system will calculate the new premium amount for the proposed insurance options.

EXAMPLE: a client wishes to purchase a “Comfort” level policy. Apartment area – 68 sq.m. Region – Voronezh region. The apartment is owned and there is a lease agreement. The cost of the policy will be 2831 rubles. For residents of capital cities, the cost of a policy under similar conditions would be 3,326 rubles. The presence of a rental agreement also increases the cost of the insurance premium (without it, the premium will be 2256 rubles under primary conditions and 2751 for certain regions).

If you want to protect certain types of services, it is recommended to use the “At your choice” tab with the selection of parameters based on the client’s wishes.

Features of the “Advantage for Apartment” program

If you want to decide for yourself what will be insured and for what amount, give preference to the “Advantage for Apartment” program.

The company offers four insurance options – “Standard”, “Comfort”, “Premium” and “At your choice” (with individual parameters).

For each item of insurance, a certain amount of the insured amount is provided:

- from 1,000,000 to 10,000,000 rubles – for structural elements;

- from 300,000 to 1,500,000 rubles – for utility networks and finishing;

- from 100,000 to 800,000 rubles – for indoor items (furniture, shoes, clothing and equipment);

- from 3,000,000 to 6,000,000 rubles – for the “Safe Apartment” option (that is, when insuring people in the premises against the risk of an accident);

- from 250,000 to 1,000,000 rubles – for civil liability.

To conclude a contract, you do not need to provide housing and property for inspection by a specialist. The calculation procedure is determined personally. When making monthly payments, the company allows you to receive interest-free installments for a maximum of four months.

Required documents

Depending on the type of policy purchased, a different set of documents is required . Minimum requirements for purchasing the “Hello, Neighbor!” insurance product. – you just need to indicate the full name of the insurance beneficiary and the exact address of the property. If the client takes out collateral insurance for an apartment as part of a mortgage agreement, he will need to take with him an identification document, information about the amount of the remaining debt under the mortgage agreement, fill out an application and indicate the type of protection.

Insurance is issued for a year, and depending on the type of protection, they may additionally require information about the employer (if insurance against job loss is implied), information about the transfer of rights to property (if there is a change of owner).

When purchasing an online policy, the client fills out all the data independently, indicating the address of the property and information about the owner of the apartment. It is not required to send certified copies of documents. It is necessary to indicate the owner of the property as the beneficiary, since payments are made only to the owner of the property.

Insured event on property at VTB Insurance

In what cases is damage compensated? The insured events for each of the poles were mentioned above, upon the occurrence of which compensation occurs.

Algorithm for receiving compensation:

- The owner must take all possible actions to minimize the damage and be sure to contact the competent authorities, police, firefighters, gas service and others;

- Within 3 days, you must notify VTB Insurance Company by calling the toll-free hotline, applying on the official website, or visiting the office;

- After this, a company representative will come to the site to evaluate and inspect the property;

- She will also draw up a list of documents that must be submitted to the bank;

- If the parties come to an agreement, then within 10 days the money will be transferred to the owner’s account.

You will find all the necessary documents for writing a statement about the occurrence of an event on the official VTB website in the section of your program.

Which package should I choose?

To choose the right insurance coverage option, it is recommended to exclude unnecessary parameters from the insurance . Clients living in the southern regions may not insure their property against freezing of water pipes, since this type of risk practically does not occur in the region due to certain climatic conditions.

Standard – an economical option for property protection

Type of insurance with a minimum premium. The package insures interior decoration and movable property.

Protection is provided against interruptions in electricity and related equipment in the apartment , as well as insurance against the consequences of freezing water in pipes and its thawing in the spring.

The amount of insurance coverage for all regions is 400 thousand rubles.

Comfort – classic level

The Comfort insurance policy offers property protection services that include all the parameters of the Standard policy and protection against liquid spills. Clients in Moscow and St. Petersburg (+regions) can insure property for up to 600 thousand rubles. An increased limit is available for Comfort and Premium policies. Residents of other regions can only count on the standard 400 thousand rubles of insurance premium.

Premium – maximum protection

The increased level of protection includes all the parameters of the Comfort level, as well as the Luxury Service package. Clients can take advantage of a unique type of protection and service - compensation for expenses for staying in a hotel (outside an apartment) after an accident insured, room cleaning, luggage transportation. The amount of coverage in case of damage is identical to the “Comfort” policy (with differences for buyers in the Moscow Region and Leningrad Region and other regions).

Individual approach

If the selected protection options do not meet the client’s needs, the buyer can order insurance on individual terms. Unlike classical protection options, this type of insurance can include structural elements worth up to 10 million rubles.

The client can choose several insurance options, for example, protection of structural elements and the “Lux” package, which provides support for the client in the event of an accident with the apartment.

Any of the included risks automatically increases the cost of the insurance premium. Its size is also influenced by what amount of coverage the policy buyer wants to choose.