In this case, the seller must pay income tax, since he owned the property for less than 5 (five) years, in the amount of 13%. However, the amount on which the tax is calculated is not the sale price, but the difference between the amount for which the seller himself bought the apartment and the amount of the current sale. That is, in this situation, the seller will have to pay 13% of 1 million, namely 130,000, instead of the 26,000 that he would have paid with the 200,000 that he added to the cost.

Risks for the seller

Obtaining an “overstated” mortgage involves indicating in the documents the value of the property higher than the actual amount received, and often the amount of overstatement can be quite significant. Of course, if the seller has owned the property being sold for more than 5 (five) years, this does not matter, and it will not matter at all what exactly the sales amount will be included in the contract.

Receipts are also a risk

Of course, in practice this occurs only in isolated cases, but to be on the safe side, two receipts are drawn up. One of them says that the buyer transferred a certain amount to the seller, and the other says that the seller transferred the necessary amount to the buyer. One receipt is attached to the purchase and sale agreement, and the second remains in hand as insurance.

Now let’s imagine a situation if suddenly the registration of the transaction does not go through for one reason or another and the buyer refuses to purchase the apartment. Of course, everyone, and the bank too, by the way, understand everything perfectly well, but the money was received upon signing the agreement. but what if?! Think carefully before taking such a risk.

Here's a hint: make a loan agreement in simple written form for the required amounts and for the required terms. If your buyer resorts to “tricks” and invites you to participate (take risks), then offer this risk to him. Agree?! Go for it.

Anna Smirnova

350 t.r. - this is a type of down payment that your buyer must have (these are the conditions for providing a mortgage loan). Sberbank's contract form is strict. According to the purchase and sale agreement, these 350 tr. will be transferred to the seller when signing the agreement, further in the text there will be a phrase with approximately the following content: “by signing this agreement, the seller confirms that he has received the specified amount” PLUS, to confirm the fact that the borrower has a down payment, he will ask the seller for a receipt for the money received. The receipt will be kept in the bank!

Cadastral value is an indicator that determines the tax burden on the owner of a particular property. It is always lower than the market price. When calculating it, the cost of one square meter of housing in a specific region is taken, using special coefficients.

Using a scheme to artificially inflate the value of real estate is accompanied by risks for both parties. In this case, the seller risks more. In this regard, it is recommended not to use the scheme under the following factors:

Second scheme

Next, with the help of a lawyer, two counter receipts are drawn up from the seller and the buyer. Accordingly, they indicate that no actual transfer of funds was made. This will protect both parties in the event of a deal failure.

This is where a scheme emerged involving inflating the cost of an apartment in order to get a mortgage approved by the bank. And given the difficult financial situation of most citizens, this scheme is not so rarely used in the real estate market (although it cannot be called absolutely legal). How does it work?

Seller's risks when the price of the apartment is inflated

The scheme is indecently simple - in order to get more money to buy an apartment, you need to show it that this apartment is worth more . That is, simply inflate the price for it (formal cost), which will be indicated in the Sales and purchase agreement. The real (real) price remains the same, that is, the one agreed upon by the Buyer and the Seller, and which the Seller will eventually receive in his hands. And that very excess (“markup”) remains only on paper, solely so that the bank will issue more money for the purchase of real estate, and the borrower would not have to make a down payment at all.

Receipt from the Buyer when the cost of the apartment is overstated

Such a sale of an apartment at an inflated price in the contract does carry some risks for the Seller. Sellers generally don’t really like Buyers with a mortgage , and even more so those who drag their problems with them and offer to solve them using the “gray schemes” method. But when there is tension in the market with Buyers, you have to put up with what you have.

- Initially, you will need to choose a suitable real estate option. It is recommended to look for an apartment with one owner. The presence of accompanying factors complicates the transaction procedure.

- At the next stage, it is necessary to agree with the seller on artificially inflating the cost. The amount must be identical to the amount required by the banking company under a specific mortgage lending program.

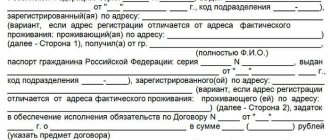

- The seller writes a receipt for the advance payment. Accordingly, its size is identical to the difference between the artificially completed cost and the desired price for the sale of the apartment.

- The next step is to appraise the property. Accordingly, if the first scheme of artificially inflating the cost of an apartment is used, then one can only hope that the results of the appraiser will allow one to obtain a loan. When using the second scheme, you will first need to agree with the appraisal company on the need to inflate the value. Difficulties may arise if the appraiser is appointed directly by the banking company. In this case, it is quite difficult to come to an agreement, since appraisal companies may lose the trust of the bank if they disclose knowingly false information.

- Next, a preliminary purchase and sale agreement is drawn up between the seller and the buyer. It states the cost of the apartment, which was the result of an artificially inflated price.

- The buyer prepares the necessary package of documentation to be submitted to the banking company. In particular, you need to provide a receipt for the transfer of the advance payment to the seller.

- After completing the registration procedure for the provided documentation package, the banking company transfers the remaining funds to the seller.

Registration of a receipt for the initial payment for the purchase of real estate with a mortgage

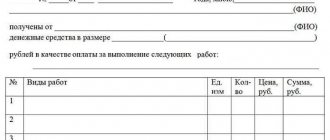

The receipt must have a clearly designed and completed structure in which important data and accurate information will be recorded. The document is filled out as follows:

- information about the buyer has been entered;

- all apartment owners are listed;

- passport details of each participant in the transaction are recorded;

- the full cost of housing, recorded both in numbers and in words to avoid misinterpretation of one of the entries;

- the amount of the deposit paid must be recorded in an identical way;

- detailed characteristics of the property being sold, including its area;

- lists the conditions under which the amount of the deposit will or will not be returned to one or another party;

- the final date for concluding the transaction and making the full payment;

- When paying in stages, it is important to fix the dates within which each amount will be paid and its volume.

If the seller or buyer wishes to implement additional clauses or rules, this decision should be discussed and, after unanimous agreement, added to the remaining clauses of the receipt for the transfer of the deposit. This document is drawn up in two copies, after which it is given to each party for storage.

Inflating the cost of an apartment with a mortgage is a seller's risk

As a result, if such a scheme is carried out, the former owner receives all the money for the apartment being sold non-cash in one payment from the bank after the transfer of ownership to the new owner.

Inflating the cost of an apartment with a mortgage risks the buyer

This scheme involves lies and deception of a financial organization, so everything committed remains on the conscience of the parties to the transaction. Possible consequences for both parties under Article 159.1 of the Criminal Code of the Russian Federation 1. Fraud in the field of lending

- A common situation of overestimation is that the borrower does not have money for the down payment on the loan. The contribution is equivalent to a significant amount of funds. There is a need to inflate the market value of housing. In this case, the price is fictitiously inflated so that the financial company allocates funds for the purchase of real estate in a larger volume. In a positive scenario, it is possible to get a loan without a down payment by applying an overstatement. The money simply goes to the seller non-cash.

- The apartment is not renovated, and that is why the buyer needs a considerable amount of money just to put the property in order. And in this case, an overestimation is required. There are properties where it is impossible to move into and live comfortably without the intervention of a repair team. To do this, the buyer wants to inflate the cost of the apartment under the mortgage.

- Many borrowers simply need cash for some other need. For example, buying a car or traveling. And in this case, the borrower needs to inflate the cost of the apartment on the mortgage.

Terms of market and cadastral value

- First of all, real estate valuation. The lender requires an appraisal report. The buyer may have to negotiate with the appraiser to inflate the price of the apartment. This scheme is associated with additional one-time financial payments, which overlap with the payment for the overvaluation of the appraiser’s services.

- Even if you managed to agree with the appraiser on the overstatement, do not forget that the credit company is aware of such schemes. A report that appears suspicious to the bank will be sent for additional verification. If the check reveals that the cost is overstated, the apartment will receive a refusal and the bank will not transfer the funds. And a refusal on an object means that you will have to look for another apartment to inflate the price.

- The situation of meeting with an unscrupulous seller cannot be ruled out. Do not forget that during the overvaluation transaction, the seller will have a promissory note. If you come across an unscrupulous person, nothing will stop him from going to court with this receipt, instead of breaking up after an overpriced deal.

- When purchasing an apartment without a down payment, the borrower bears the burden of paying off the debt for the full cost of the property and interest on it. This is a large amount of money.

- Criminal liability of both parties for fraud in overstatement cannot be ruled out.

What papers should you collect?

Buying an apartment on credit is issued for 10-30 years. This is a long term debt. During this period, the property will not belong to the buyer. Calculate the prospects before taking such a step. If you want to increase the price of the property you are purchasing, you should first negotiate with the seller. The seller will be an indispensable participant in the designated overpricing scheme. How does the overestimation procedure work?

In the conditions of fierce competition in the banking industry, today there are credit organizations (including some quite respected ones) that are more loyal to the characteristics and figures provided than other banks. We give a list of them below:

Preparing the appraisal is a concern and expense for the buyer that cannot be passed on to the seller. However, in some cases, by agreement of the parties, the issue with appraisers is assigned to the seller. This happens, in particular, when an apartment is purchased with an unapproved redevelopment or when the seller needs the purchase price in the appraisal album to be different from the real one.

When not to overestimate

You should also not discount the seller’s personality. If the documents are drawn up incorrectly - the advance payment agreement and the receipt - it will be very difficult for the buyer to prove that he does not owe the seller anything.

This scheme involves lies and deception of a financial organization, so everything committed remains on the conscience of the parties to the transaction. Possible consequences for both parties under Article 159.1 of the Criminal Code of the Russian Federation 1. Fraud in the field of lending

A down payment is a mandatory condition when purchasing housing using a mortgage loan. It ranges from 10 – 50% of the housing price. The seller receives the first payment before the transfer of ownership to the mortgagee, before or after signing the contract, by issuing a receipt.

If the case goes to court to consider the controversial issue

When there is a receipt, and the debtor only briefly delayed the payment of the amount of money, this does not mean that the case should be immediately transferred for consideration to the judicial authorities of the executive branch. It is best in this case to draw up a letter and send it to the debtor, outlining a reminder of his obligations. A registered letter will allow the sender to receive a receipt, which becomes an important document in case it is necessary to protect interests in court.

If the debtor does not cover his debt within a week, then this violation is grounds for going to court. Although it is very difficult to resolve controversial issues in the world even in court, it is important to make every effort on your part. When filing a case in court, you must attach a certificate of payment of state tax to the receipt, as well as, in addition to the original sample, a copy of it. The application is submitted to the branch of the court to which the plaintiff belongs at the address. A magistrate may take on cases where the amount of debt does not exceed 50,000 rubles.

Only the original receipt must be submitted to the court; a copy of the document and even the testimony of witnesses do not play any significance. The judge reserves the right to decide whether to submit a document for examination to determine its authenticity based on handwriting. If the claim period has expired and has come to the end of the three-year period, then the judge may reject the request for repayment of the debt. In order to have significant guarantees that the case will be resolved in favor of the plaintiff, it is best to enlist the help of an experienced and qualified specialist in these matters who has judicial practice.

When you shouldn’t inflate the price of an apartment

Next, with the help of a lawyer, two counter receipts are drawn up from the seller and the buyer. Accordingly, they indicate that no actual transfer of funds was made. This will protect both parties in the event of a deal failure.

How to reduce risks

The seller wants to sell the house for 5 million rubles. Accordingly, the buyer wants to use a mortgage, but there is no money for the down payment. At the same time, according to the mortgage lending program, a payment of 10% of the price of the purchased property is required, that is, 500 thousand rubles.

Banks, on the contrary, make payment of a down payment a mandatory condition of the mortgage. If a large amount has already been deposited into the seller’s account, and the apartment remains pledged to the bank until the housing loan is closed, the client is unlikely to want to lose the property. Thus, the down payment minimizes the risk of non-fulfillment of debt obligations on the part of the borrower.

Apartment valuation

Let's take a closer look at the risks that real estate sellers face when they inflate its value.

- If the bank becomes aware of the fraud, the transaction will not take place, since the buyer will not receive the necessary funds. Refusal to lend in this case will be the mildest possible consequence.

- In case of sale, income tax will have to be paid not on the actual income received, but on the higher amount that appears in the document.

- Upon termination of an already concluded transaction, the seller may owe the buyer the amount of the down payment, which he formally returns under the terms of the receipt.

Transaction with change in value

To obtain a mortgage and avoid paying a down payment, the client provides the bank with a receipt from the seller stating that the required amount has already been paid. The overpricing scheme does not always work flawlessly. Let's consider the buyer's risks and situations when it is better to provide documents on the real market value of real estate to the bank.

- The borrower does not have a stable income to repay the mortgage on time. The buyer's risk is the possible loss of the collateral property. If the apartment becomes the property of the bank and it turns out that its real market value is much lower than that indicated in the documents, the borrower even risks becoming involved in a criminal case.

- There is no trust relationship between the seller and the buyer. In this case, the bank may also find out about the fraud and refuse to lend.

- The property cannot be compared with similar properties on the market and its value is determined by its architectural value.

As you probably know, most transactions for the purchase of apartments in our time are carried out using borrowed funds allocated by mortgage banks for the targeted purchase of residential real estate. The mortgage loan amount approved by the bank is always based on the cost of the purchased home. However, there are several types of cost, including:

Dangers when drawing up a receipt

For fraudsters, receipts drawn up with errors, with blank fields or corrections are easy prey. That is why drawing up and checking a receipt is an important process that requires utmost care. Many people fall into the following common mistakes:

- The receipt contains data from only one party. Such a mistake can lead to the fact that the partner can completely pretend that he does not know the specified citizen and, moreover, has not entered into any financial transaction with him;

- the fact that the money was transferred is not stated;

- the parties forgot to indicate the date on which the receipt was drawn up, in which case, if the case goes to court, it will be extremely difficult to determine the statute of limitations;

- make a deal with a suspicious person who may promise to pay the full amount along with interest in the near future.

There are some precautions you can take to protect yourself from intruders. These helpful tips include:

- requesting documentation proving the owner's ownership rights;

- the contract must record all property owners and buyers who enter into ownership rights;

- It is important to have a certificate of persons; this document records those people who are currently discharged from the property being sold, but by and large are heirs and can return to receive their part of the inheritance;

- technical passport containing detailed characteristics of the apartment, its area, layout and other features;

- It is important to indicate the item with the date of signature of the receipt and the item of the expiration date of the receipt in close proximity to each other, which will prevent attackers from writing unnecessary information;

- empty spaces in the document should be filled in with dotted lines or crossed out;

- when the transfer of the full amount has taken place, the second copy of the receipt must be withdrawn.