From our article you will learn:

Organizations and individual entrepreneurs are required to report to government regulatory authorities. Based on clause 3 of Art. 40 No. 14-FZ, only the director of the company has the right to represent interests and make transactions on behalf of the company. Consequently, submitting reports to the tax and other departments is also his responsibility. What if the provision of documents to the departments is not carried out by the head of the enterprise, but by an authorized representative (employee). In such cases, a power of attorney is created to send information.

Let's consider what kind of power of attorney is needed to submit reports to the tax and statistical services, pension and insurance funds, as well as the procedure for preparing these documents.

How to format a handwritten version

A power of attorney for the transfer of powers can be executed in simple written form or in a notarized form. In the first case, you don’t need to go anywhere, just write the text on a piece of paper. In the second case, you need to visit a notary and pay a registration fee.

A simple power of attorney can be executed by hand or on a computer. The notary document is drawn up on a special numbered form and filled out on a computer.

If the principal decides to draw up a document by hand, this is his right, but with the exception of cases prescribed in the Civil Code of the Russian Federation! It is not legally prohibited to transfer part of the rights in the form of a simple written power of attorney. How to write a power of attorney by hand? There are no established rules for drawing up a handwritten trust document, but the principal must indicate:

- information about both parties to the relationship - full names of the principal and representative, passport details, addresses of residence and registration;

- a numbered list of powers that the principal transfers to the representative - the list must be complete, exhaustive, understandable, unambiguous;

- the exact calendar date of execution of the document – day, month, year;

- the name of the locality, subject of the federation in which the trust document is drawn up.

The text needs to be structured in such a way that an outsider can figure out who is the principal and who is the trustee, and what specific powers are being transferred. It is recommended to specify an expiration date.

Requirements for MChD

The format for presenting information and uniform requirements for machine-readable forms of documents on powers are published on the Federal portal of regulatory legal acts. Thus, Order No. 857 of the Ministry of Digital Development dated August 18, 2021 established that:

- to create a machine-readable power of attorney, the XML format must be used (PDF format is allowed if automated processing and visualization of document data is not available in the information system);

- the power of attorney must be signed by an enhanced qualified electronic signature in the XMLDSIG format or in accordance with the format approved by Order of the Ministry of Digital Development dated September 14, 2021 No. 472.

What are the types

Handwritten powers of attorney can be issued to transfer various powers. From here we can distinguish the following types:

- general or general;

- special.

According to one of the presented types, the trustee exercises the powers delegated to him by the principal. Depending on the type, the order of registration will differ. The range of transferred rights is determined by the principal. The representative may:

- be a trustee before a large number of individuals and legal entities;

- carry out actions in relation to the property of the principal;

- control the task assigned to him from the beginning of execution to the final result.

General or general

The principal transfers to the authorized person the right to exercise an unlimited range of powers. Specific transferred responsibilities are not specified in the “body” of the power of attorney. A general power of attorney gives the representative the right to perform actions in relation to the property of the principal and to perform certain actions for him.

For example, a person goes abroad to work for six months. Every month he needs to receive a pension, pay utilities, and pay off a loan. He also wants to rent out his apartment and lend his car to a driving school. He doesn’t have time to complete all the steps himself, so he issues a power of attorney for his brother, the realtor and the driving school. That is, you have to draw up 3 handwritten trust documents.

The brother is given the authority to pay utility bills, represent interests in possible disputes with the management company, and the right to receive a pension. The realtor is given the rights to rent out an apartment, sign an agreement on behalf of the owner, and the right to accept payment from tenants for the use of the property.

The driving school is given the authority to use the car for training purposes for six months. The responsibility to pay fines during this period, if they are received through the fault of students or instructors, also falls on the shoulders of the driving school.

That is, the owner of the property in each trust document prescribed specific responsibilities for each representative. The validity period of each power of attorney will be 6 months. If the principal does not know the exact date of his arrival from a business trip, he can indicate the event at which the transferred powers will lose force - “the return of the owner (full name) from the trip.”

Special

It is issued to perform the same type of actions during a specific period of time. An example could be a power of attorney to a forwarder to receive goods from a specific supplier within a month or from several suppliers. You can arrange the transfer of powers for 1 time. For example, a cashier to receive cash from a bank from a company’s account during a specific calendar date.

Basic writing cases

A power of attorney is issued when one person wishes to entrust a number of his powers to another. The reasons may be different:

- long business trip;

- long-term illness;

- inability to reach a government agency;

- others.

A simple written power of attorney can be issued to any public or private body:

- to a bank or post office;

- to the tax office or the Pension Fund;

- per car;

- to receive funds;

- other.

Depending on where and why the trust document is drawn up, there will be some nuances during registration.

To the bank

The depositor has the right to entrust the process of replenishing the deposit or withdrawing funds from it to a third party. You can write down the authority by hand, but it is recommended to issue a notarized power of attorney. Banks trust them more. There is no way to check a handwritten power of attorney, so there is a high probability of committing fraudulent actions with the depositor’s funds. The bank will not agree to this.

If it is not possible to visit a notary and draw up a trust document, you can go another way:

- visit the bank branch where the account or deposit is opened;

- ask the authorized employee to print out the power of attorney form - it will already contain the data of the principal;

- an employee of a credit institution to clarify the list of transferred rights, details of the account or deposit in respect of which they are transferred;

- The future representative must be present - the bank employee will enter his data on the form based on the passport.

An authorized employee of the credit institution will check the correctness of filling out the form and certify with his signature and seal of the credit institution.

To the tax office

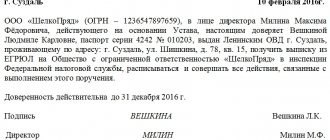

A power of attorney must be issued to the tax office to submit reports on behalf of a legal entity or entrepreneur, to resolve disputes that have arisen, and to receive documents addressed to a citizen. If powers are transferred from one person to another, a simple written form will not work in this case; tax authorities require a power of attorney to be issued by a notary. If powers are transferred from the enterprise to an employee, you can draw up the document on the letterhead of the principal company.

The trust document to the Federal Tax Service must contain the following information:

- full name of the organization, full name and position of the head;

- if authority is transferred by an individual, then full name and data from the passport;

- name of the document, series and number, date and place of execution;

- full name and passport details of the authorized person;

- an exact list of delegated powers;

- validity period – it is recommended to issue for one financial year.

The power of attorney is signed by both parties and sealed with the company seal.

For car

If the issue is only about driving someone else’s car, then there is no need to draw up a trust document. The new driver must be included in the MTPL policy. But if you need to perform other actions in relation to the vehicle, a power of attorney should be issued. For example, to remove a car from an impound lot. You can write a document by hand, or you can go to a notary and fill out a form.

It is necessary to correctly indicate the details of the vehicle; the information is taken from official documents:

- the name of the vehicle – as it is written in the PTS;

- state license plate;

- the year the car was produced;

- engine number;

- chassis;

- body number;

- VIN;

- details of the certificate of property rights;

- by whom it was issued and when;

- PTS details – series and number.

It is also necessary to indicate the details of both parties – the principal and the representative. The trust document is signed by both parties.

To receive funds

A trust document to receive funds can be issued by both legal entities and individuals. You need to know how to write a power of attorney to receive financial resources. You must specify:

- the name of the credit institution from which the attorney must receive money for the principal;

- what exactly needs to be done - withdraw cash or transfer to another account;

- the amount that can be disposed of;

- a request to issue cash or make a transfer to a third party.

The details of the principal and the attorney must be indicated. The power of attorney is signed by both parties.

A legal entity can act as a principal. For example, the general director trusts the chief accountant to withdraw cash from the company's account. A trust document is drawn up on the organization’s letterhead, indicating:

- full and abbreviated name of the legal entity;

- Full name and position of the manager;

- organization details;

- Full name and position of the attorney;

- date and place of compilation;

- delegated powers – receiving funds from the organization’s account (you must specify account details);

- amount receivable - it must be indicated if the transfer of authority is one-time in nature, if permanent (the chief accountant can periodically withdraw money from the account for various needs), it can be omitted;

- time period of reality;

- date of registration;

- signature of the head of the enterprise and a trusted employee;

- current seal of the organization.

The data must be written clearly, easy to read, without errors or blots. The print must be legible and not blurry.

To receive documents

Both a citizen and an enterprise can entrust the receipt of documents. The trust document can be drawn up by hand or in a notary office. Enterprises register on company letterhead.

It is imperative to indicate which documents and where the authorized person should receive. For example, “acts of hidden work for 2019 at Nepolis LLC.” A power of attorney is signed by both parties and can be one-time or permanent.

Are there any problems with new signatures from the Federal Tax Service?

A number of electronic platforms, for example, use special extensions for trading; the Federal Tax Service signature is not suitable for working with them. Before receiving and using a new signature, refusing to use EPCs issued by certification centers, check whether you can use the new signature on the selected site.

We recommend using signatures issued by the ACA for now until the system for working with new electronic powers of attorney is established and the functionality of various portals is prepared to work with them.

Order an Astral ET signature for 15 months: quick release, use on all major portals, for reporting, EDI, etc.

Validity and reassignment

The period of validity of the trust document is established by the principal. He can delegate powers for 1 day, or for 1 year or 10 years. There are no legal restrictions on the disposal of one’s obligations in favor of a third party.

What is transference? When a person signs a power of attorney, he assumes some of the powers from the principal. But a situation may arise when the trustee cannot fully fulfill the obligations assigned to him. He has the right of subrogation, that is, he entrusts the powers previously assigned to him to a third party.

A transfer of power can be issued in the following cases:

- the principal independently prescribed this possibility in the primary trust document;

- there are serious circumstances that prevent the attorney from fulfilling the obligations previously assigned to him - the primary document should not contain a clause prohibiting reassignment.

The validity period of the “secondary” trust document cannot exceed the period of validity of the primary one. After the first power of attorney expires, the sub-power of attorney also loses its legal force.

Who can be a confidant

As already written above, anyone can be a trustee, only he must be over 18 years old and have legal capacity. For an individual, this could be a friend, acquaintance, or simply a special person who can fully resolve certain issues and represent interests accordingly.

For legal entities, employees act as attorneys; it all depends on what specific papers need to be collected or signed. A permit document can be given to either one or a group of authorized persons. Lawyers, secretaries, accountants and managers act as attorneys in organizations.

(Video: “Power of attorney to receive documents”)

Types of powers of attorney for receiving documents

Trust documents can be classified according to the type of authority granted:

- One-time, created for one action, an example would be a secretary who took certain documents

- Special ones, which must be prescribed by law;

- General, they give the right not only to take and bring documents, but also to correct them if there is an error in them.

In our case, we will consider in detail these types of powers of attorney:

- from citizen to citizen;

- from the organization to the employee;

- from a citizen to a lawyer;

- from the organization to the lawyer;

Possible mistakes

When drawing up a power of attorney, mistakes may be made that will lead to the document being invalid and the attorney will not be able to fulfill the powers assigned to him. “Popular” mistakes when compiling:

- lack of information about the authorized person - the transferred powers will not be affected by this, but the authorized person will constantly prove that the power of attorney was issued in his name;

- dates, deadlines, amounts must be indicated not only in numbers, but also in words;

- information about the parties must be written down as they are indicated in official documents - it cannot be abbreviated or crossed out;

- be sure to indicate the date of registration - without it, the trust document will be void;

- the scope of delegated powers - imprecise or vague (for example, “and other powers associated with the power of attorney”) wording can lead to misunderstandings between the trustee and the organization in which the assigned duties are to be carried out;

- if a power of attorney is issued on behalf of an organization, then the signature of the head and a “living” seal are required;

- if the scope of delegated authority includes the receipt of inventory items or funds, the document must also be signed by the chief accountant;

- in paragraph 3 of Art. 187 of the Civil Code of the Russian Federation stipulates cases when it is necessary to have a document certified by a notary; without this, it will be invalid;

- the power of attorney must reflect the good will of the principal to transfer powers.

Where can it be used?

Conventionally, cases of issuing a power of attorney that does not require notarization can be divided into 2 groups:

- from a legal entity to receive:

- goods;

- cargo;

- goods and materials;

- correspondence, etc.

- from an individual to:

- machine control;

- receiving a salary, scholarship, pension, benefit;

- baggage claim, etc.

In addition, you should know that Art. 185.1 of the Civil Code of the Russian Federation provides for a number of cases when a document is already automatically considered certified by a notary. Here, additional contact with a specialist is not required. This category includes powers of attorney issued by:

- military personnel undergoing treatment in hospitals, sanatoriums and other medical institutions of a military nature, certified by the head of such organizations;

- military personnel and members of their families if they have this document issued by the commander;

- persons staying in prisons, with a power of attorney certified by the head of such institution;

- citizens (adults and capable) located in boarding schools, orphanages, shelters and other institutions of this kind, upon certification of the document by the head of such an organization.