All the lines of heirs according to the law What is the line of inheritance for grandchildren How do disabled dependents inherit

Inheritance by law is the most common in our country. It is carried out in an order strictly defined by law.

There are the following principles of inheritance by law :

- Inheritance is based on family and marital relationships with the testator

- The list of persons who are included in the circle of heirs by law is strictly defined by law and is exhaustive

- The inheritance is divided only between the heirs of one line called to inherit, and in equal shares

- The right of inheritance passes from one line of inheritance to the next only if there are no heirs belonging to the previous line. That is, in the absence of heirs of the first stage, heirs of the second stage are called upon to inherit, and so on. Accordingly, heirs of the fourth and subsequent orders receive the right to inheritance only in the absence of heirs of the first three orders.

Lawyer on inheritance issues in St. Petersburg. Tel.+7 (812) 989-47-47 Telephone consultation

Nephews are the heirs of what order?

As a general rule, inheritance can be transferred by making a will or concluding an inheritance agreement. If the testator has not expressed his last will in the will, as well as in other cases established by the Civil Code of the Russian Federation, inheritance by law takes place (Article 1111 of the Civil Code of the Russian Federation).

Heirs by law are called upon to inherit in the order of priority provided for in Articles 1142-1145 and 1148 of the Civil Code of the Russian Federation. The heirs of the first priority according to the law are the children, spouse and parents of the testator.

Heirs of the second stage are the full and half-siblings of the testator, his grandparents on the parents’ side.

Nephews of the testator

The circle of second-order heirs includes the testator’s nephews and nieces (Article 1142 of the Civil Code of the Russian Federation)

The children of the testator's siblings are nephews. Nephews inherit by right of representation. They can claim inheritance in the event of the death of their parents, who are siblings of the deceased testator. The share of the heir of the deceased, together with the testator or before him, must pass to the descendants of the heir who did not have time to accept the part due to him.

Example: Citizen Smolin still had an apartment after his death. There were no first-line heirs. The heirs of the second stage, the brother and sister of the deceased, are called to inherit. A year earlier, Smolin’s brother died suddenly and left him with a ten-year-old daughter. Since the brother died earlier, his share goes to his daughter, who is Smolin’s niece. The minor niece will receive the share that would have been due to her father, that is, half of the apartment. The notary was provided with documents confirming the relationship with the deceased. Based on the documents, the notary issued a certificate of ownership, according to which Smolin’s minor niece and sister each receive 1/2 shares of the apartment.

Cousins of the testator

Children of cousins will be considered cousins of the testator (Article 1145 of the Civil Code of the Russian Federation).

Heirs of the sixth order are called upon to inherit in cases where the heirs of the previous orders:

- absent;

- refused the inheritance;

- found unworthy;

- excluded from the list of heirs by the testator's will.

Responsibilities for debts and responsibility for accepted inheritance

Inheritance is not always represented only by values. Often, along with material goods, debt obligations are included. The distribution of financial obligations can occur as follows:

- equal distribution among all heirs;

- entrustment only to those candidates who receive property encumbered with monetary debts and loans.

Important! Inheritance is allowed only for all property due. You cannot refuse financial obligations and receive only valuables.

If the heir has become the owner of an apartment that is under a mortgage or has received the obligation to repay a separate consumer loan, then after assuming the rights of inheritance, the citizen must inform the creditor about this. The borrower draws up a new agreement, which states that further payments fall on the shoulders of the newly-minted heir.

In case of late payments or evasion of their execution, the heir will be subject to sanctions provided for in the contract. Therefore, you need to be prepared to strictly comply with the signed contract.

Nephews' right to inheritance

Inheritance is the transfer of property, rights and obligations of the testator to the heirs. The inheritance passes to the heirs in the order of universal succession in an unchanged form, as a single whole at the same moment.

Can nephews inherit? Nephews are called upon to inherit after confirming their relationship with the testator and providing the necessary documents, according to the law, will, testamentary disposition.

Nephews' rights under the law

According to Article 1143 of the Civil Code of the Russian Federation, children of the testator's full and half-siblings (nephews and nieces of the testator) inherit by right of representation.

If the testator's brother or sister dies before or at the same time as him, the right of inheritance passes to their descendants - the testator's nephews or nieces. Nephews are entitled only to the share that their parents were entitled to. If the testator's brother or sister has two or more children, then the share of their deceased parent is divided equally between them.

Rights of nephews under a will

Property can be disposed of by making a will. The testator, at his own discretion, can bequeath property to any persons, determine their shares, or disinherit without giving reasons.

If the will makes a provision for a nephew without specifying an interest in the estate or a specific item, the nephew is entitled to receive a full share of the estate. Persons not specified in the will, but entitled to an obligatory share in the inheritance, inherit, regardless of the contents of the will, at least half of the share that would be due to each of them if inherited by law.

Example: Citizen Korbmacher bequeathed his apartment to his nephew. The common-law spouse declared her right to an obligatory share in the inheritance. She provided documentary evidence that at the time of citizen Korbmacher’s death she was disabled, had lived with him for more than three years and was his dependent. As a result, the nephew inherited 3/4 shares, and the common-law spouse inherited 1/4 shares in the apartment.

The rights of nephews to an obligatory share in the inheritance

Nephews can claim a compulsory share in the inheritance if they are disabled dependents and lived together with the testator for at least a year before his death.

Example: After the death of one of the sisters, the second took her children to live together and care for them, but in a testamentary document she bequeathed her property to her cohabitant. After her death, the inheritance was received by her cohabitant with a 3/4 share and her nephew (one of her sister’s children), who at the time of the testator’s death was a group 1 disabled person. He inherited 1/4 share of the inheritance. The second nephew did not receive anything, since he was of age and able to work.

Transfer of the right to accept inheritance (hereditary transmission)

If the testator's brother or sister died after his death, the nephews can apply to the notary, regardless of whether their parents entered into the inheritance or not, and receive a share in the inherited property.

Adoptive parents and adopted children

- The Civil Code of the Russian Federation states that an adopted person with his offspring and his adoptive mother and father with their relatives are actually identified with relatives by blood.

- At the same time, family ties with genetic parents are severed, and mutual inheritance is excluded (except for cases of maintaining contacts between these persons, specified in paragraph 3 of Article 1147).

- If an adopted son, daughter, or their children have a relationship with one or two parents or other genetic relatives, then they can inherit after each other’s death, and this does not exclude the possibility of receiving their share from the inheritance of the adoptive parent/adoptee.

How can nephews prove their relationship with the deceased?

Documents confirming the relationship between the nephew and the testator:

- nephew's passport;

- the nephew’s birth certificate, which contains the details of his parents;

- passport of the deceased;

- birth certificate of the testator;

- birth certificate of the nephew's parent who is the testator's brother or sister;

- marriage certificate of the testator's parents and brother (sister).

In the absence of documents confirming the relationship, it will not be possible to enter into property rights to inheritance.

Material costs

You won't be able to avoid spending. A complete list of expenses associated with receiving an inheritance by nephews:

- State duty. It is calculated based on the value of the accepted values, the degree of relationship, and the conditions for the transfer of owner rights.

- Registration of a power of attorney. When transferring powers to a lawyer, the services of a notary who certifies the power of attorney are paid.

- Re-registration of inheritance. The nephew independently pays all expenses associated with registration and registration with Rosreestr.

- Debts of the testator. Receiving an inheritance automatically implies accepting the duties and responsibilities that come with the property.

Debt obligations must be repaid. If the amount is large, more than the price of the inheritance, the nephew has the right to refuse the property, for which another application is written. The procedure is described in the relevant publications.

How to inherit an inheritance for nephews

Step-by-step instructions for entering into an inheritance:

- availability of grounds for inheritance;

- preparation of necessary documents;

- submitting an application and documents to a notary;

- obtaining a certificate of inheritance;

- registration of property rights.

An inheritance can be accepted within six months from the date of opening of the inheritance (clause 1 of Article 1154 of the Civil Code of the Russian Federation).

What to do if the deadline for accepting an inheritance has been missed, read → here

Required documents

To acquire an inheritance, the heir must accept it. To do this, you need to contact a notary and submit the following package of documents:

- application for acceptance of inheritance and issuance of a certificate of right to inheritance;

- heir's passport;

- death certificate of the testator;

- a certificate from the testator’s last place of residence;

- a document confirming the relationship;

- title documents for property;

- property valuation act.

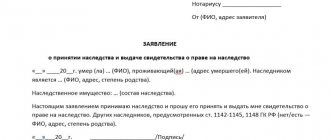

Sample application for acceptance of inheritance and issuance of a certificate of right to inheritance

| Application for acceptance of inheritance and issuance of a certificate of inheritance |

State fee for obtaining a certificate of inheritance

For the issuance of a certificate of the right to inheritance by law and by will, nephews pay a state duty in the amount of 0.6% of the value of the inherited property, but not more than one million rubles.

Nephews also bear the costs of notary services of a legal or technical nature.

When nephews do not inherit property

Situations when acceptance of inheritance by nephews is impossible:

- recognition of the nephew as an unworthy heir. If the relatives of the testator prove in court that the applicant has unlawfully acted in relation to the deceased and the court finds him unworthy, the property will pass to the relatives by law.

- recognition of the nephew's parents as unworthy heirs (in case of inheritance by law). If the nephew is an heir under the will, he will receive his share, regardless of this circumstance.

- if the nephew’s parents are recipients of a mandatory share in the inheritance.

Disabled dependents

Disabled legal successors who are not included in the list of representatives of the second stage can count on their share on an equal basis with them, if at least a year before the death of the testator they were supported by him. The fact of living together does not matter here - they could live in another place. But if such a dependent is not an official heir, but lived with the deceased in the same living space for a year or more and was in his care, then he is called up on a par with second-order heirs. If there are no heirs of the second or other orders, then the listed persons receive their part of the property as heirs of the 8th order.