Who can count on inheritance

Inheritance refers to the transfer of a person's assets and property rights to his heirs. The general procedure is regulated by Section V of the third part of the Civil Code of the Russian Federation. In accordance with the provisions of this legislative act, events after the death of the testator develop according to one of two scenarios - depending on whether he left a will or not.

If there is no will

In this situation, inheritance occurs by law, when the rights to the property of a deceased person are determined taking into account the degree of relationship. According to this criterion, the heirs are divided into seven or lines. The first group includes the closest relatives, including:

- children;

- parents;

- spouses.

The second priority includes brothers and sisters, as well as grandparents. The principle of distribution of assets and property rights of the deceased is extremely simple.

The first priority heirs first receive the right to inheritance. Only in case of their absence does it come to the next one. Within one queue, all heirs have equal rights.

To this it is necessary to add three legally important points. The first concerns dependents who are entitled to inheritance and join any of the queues.

The second is related to the so-called inheritance by right of representation. This is a complex situation from a legal point of view when grandchildren and other descendants of the first priority heirs participate in the division of property in the case where the latter died after the death of the testator.

The third legal nuance concerns the common property of the spouses. In this case, the wife or husband of the deceased person receives the right to half of the assets acquired during the marriage in addition to the rights of the first priority heir. In other words, in this situation, not only inheritance law, but also family law, which is regulated by the provisions of the Family Code of the Russian Federation, applies.

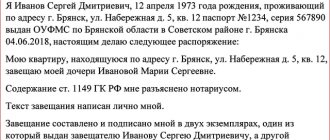

If there is a will

A will is a document in which the testator himself establishes a list of heirs and the procedure for distributing property between them. Notarization becomes a mandatory requirement for the document. It is important to note that the number of heirs can include not only relatives, but also any other people, for example, friends or colleagues, and even organizations - both commercial, social or charitable.

The execution of a will does not mean the loss of the rights of the so-called compulsory heirs. These include disabled or minor close relatives (spouse, children, parents), as well as dependents. Their rights are additionally protected by law, which is expressed in the distribution of property first between them and only then in accordance with the text of the will.

Obligatory relatives are entitled to half of what they would have received if they had inherited in order of priority.

Another situation deserves special mention - when not all property is distributed in the will. The remaining assets are inherited by law, that is, in accordance with the order of heirs.

Inheritance queues

The order of inheritance is determined by Article 63 of the Civil Code (Articles 1141 – 1151). The legislation establishes that close kinship is a priority in the matter of receiving property after the death of a citizen.

In the absence of a will, the queue is distributed:

- first - husbands, wives, children, mothers and fathers of the deceased person;

- the second – sisters and brothers, grandfathers and grandmothers;

- third - aunts and uncles;

- fourth - great-grandparents;

- fifth - cousins' granddaughters and grandchildren, great-aunts and grandfathers;

- sixth - cousins' granddaughters and grandchildren, cousins' nieces and nephews, cousins' aunts and uncles.

Important ! If one of the heirs died at the same time as the testator or before entering into the procedure, the right to the property is received by his successors by right of representation, if any. This rule applies to relatives unless they are unworthy heirs.

This category includes:

- relatives whose actions were aimed at the detriment of the testator, so that his property would be distributed after death taking into account their personal benefit (this fact must be proven in court);

- the applicant was entrusted with responsibility for the maintenance of the deceased, which he maliciously avoided;

- persons who do not have the right to inherit or are excluded from this event.

Adoptive parents and adopted children are considered to be blood relatives, and therefore have the right to expect to receive ownership of property legally along with other family members. This category of citizens has a court decision indicating adoption.

Inheritance contract

The will is drawn up by the testator independently. Only he himself will decide whether to inform his heirs about him or not. The information contained in the will is considered secret.

But the legislation also provides for another format of a document similar in meaning, which is called an inheritance agreement. It is concluded between the testator and any of the heirs (or several of them) and contains the conditions for receiving the inheritance.

An inheritance agreement, like a will, is certified by a notary and can be canceled at the request of the testator at any time.

The legislation does not provide for strict requirements for its content. Typically the contract includes the following information:

- rules for determining heirs;

- the procedure for transferring rights to property;

- conditions for appointing an executor;

- responsibilities of heirs, the fulfillment of which is necessary to receive an inheritance (not in conflict with the law);

- other circumstances and conditions affecting the distribution of the testator's assets.

It is important to note that an inheritance agreement has greater legal force than a will. In other words, if both documents are available, the first one is valid.

Cost: taxes and duties

When applying to the notary chamber, the applicant, in case of planning expenses, should take into account the payment for the services of a state representative who accepts documents and draws up a certificate of inheritance according to the law. The cost is formed in accordance with the internal established prices of the organization.

A mandatory payment to obtain the right to become the owner of real estate is a state duty, which is commensurate with the valuation of the property. Clause 22 of Article 333.24 of the Tax Code determines its size:

- heirs of the first and second stages are set at 0.3% of the value of the property, the amount does not exceed 100 thousand rubles;

- recipients of the remaining queues pay 0.6% of the property price, which does not exceed 1 million rubles, to the state treasury.

The main costs when carrying out the inheritance procedure are contained in property valuation (from 5 thousand rubles), state duty (0.3 or 0.6% of the cost of an apartment or house), notary services (from 2000 rubles).

Who cannot receive an inheritance

The legislation, and specifically Article 1117 of the Civil Code of the Russian Federation, contains the term “unworthy heirs”. It denotes persons who have committed unlawful acts against other heirs or the testator himself. A mandatory additional requirement is confirmation of the fact of the offense in the form of a court decision.

The following persons are recognized as dishonest heirs:

- parents who are officially deprived of parental rights and therefore cannot inherit property after the death of their children;

- heirs who, by force of law, were obliged to support the testator, but avoided doing so;

- heirs who tried to increase their own share of the inheritance or created obstacles in front of other heirs.

The order of two events is important for assigning an heir the status of an unscrupulous one—the adoption of an appropriate decision and the drawing up of a will. Each such situation is considered individually, and only a competent lawyer who specializes in inheritance law can give it a legal assessment.

Indivisible property

Article 133 of the Civil Code regulates the concept of an indivisible thing, which in kind cannot be divided between potential candidates without destruction or damage, or a change in purpose. In relation to such property when divided between heirs, Article 1168 of the Civil Code applies. It establishes a priority right to become the owner of the recipient who jointly owned the property with the deceased person over other claimants.

If the estate includes residential premises, indivisible in kind, citizens who are relatives, living and registered in the apartment or house at the time of death, their right to receive ownership of the object is regarded as priority.

What can be included in inheritance and what not?

The inheritance is formed from the things and other property of the deceased person, as well as the property rights and obligations belonging to him. In other words, not only assets are subject to inheritance, but also the debts of the testator, which are distributed in a similar way among the heirs.

The exception is those property rights and debts that are directly related to the personality of the deceased person. These include alimony, payments as compensation for harm or damage caused to the health and life of the testator or third parties. Intangible benefits, including non-property rights, are not subject to inclusion in the inheritance.

Is it necessary to enter into an inheritance after the death of a husband?

Spouses living in an official marriage jointly use property that is the personal property of the husband or wife and the joint property of the spouses. In the event of the death of her husband, a woman may not know that she must register an inheritance in the general manner.

Only a woman who is officially married to him has the right to inherit from her husband. The exception is not situations where the spouses did not actually live together or the man had a de facto marital relationship with another woman.

Important! Only the official wife has the right to inherit from her husband.

To do this, you must submit an application to the notary office at the place of last registration of the spouse. To prove the existence of an official marriage union, you must present a marriage certificate.

How to find out about a will

Usually the testator does not hide the fact of drawing up a will, since only the contents of the document are considered secret. The compiler has the right to provide potential heirs with a copy of the orders regarding his own property drawn up at the notary.

The lack of information from the heirs about the execution of the will, and especially its contents, does not lead to a violation of their rights. The fact is that a notary who opens an inheritance case in accordance with established rules is obliged to verify the existence of a will within 24 hours. This is not difficult to do, since any such documents are entered into a federal database maintained by a notary.

If a will is drawn up, the notary carefully examines its contents, after which he notifies all the people mentioned in it. If their contacts are unknown to him, it is permissible to inform interested parties through an announcement in the media.

This does not mean that the potential heir should wait to hear from the notary. The easiest way to obtain the information he is interested in is to contact a notary office, which should handle the inheritance case. The notary is obliged to provide the requested information in the manner prescribed by law.

Entry procedure

To inherit an apartment, house, vehicle, or other valuable things, it is necessary to follow the legal order. The sequence of actions includes:

- after receiving information about the death of a relative, a potential candidate should contact a notary office (regardless of the place of residence of the deceased);

- when visiting a specialist, he needs to have a package of documents that are required to establish the grounds for entering into an inheritance;

- Conduct a property assessment by contacting the appropriate organization (market, cadastral or inventory);

- pay the state fee (calculation of the cost depends on the valuation of the property);

- after 6 months from the date of death, you should contact the notary again in order to obtain a certificate confirming the right to inheritance.

Important ! If the relative who received it plans to privatize the property and make transactions with it in the future, an obligatory step is to contact the registration chamber to enter information into the state real estate register.

From this moment on, it will include a new owner who, at his own request, has the right to dispose of it - sell, exchange, donate, bequeath, rent.

How to inherit

The inheritance case is opened by a notary in accordance with the rules of territorial affiliation, which are established by local authorities. In general, we are talking about the last place of official or temporary registration of the deceased. The main thing that the heir needs to do to enter into the inheritance is to contact the notary who opened the inheritance case before six months have passed after the death of the testator.

Stage No. 1. Contacting a notary

Determining which notary office you need to contact is extremely simple. To do this, just contact the regional notary chamber, the coordinates of which can be found on the official website of the Federal Department.

All that is required from the heir to open a case is to present a passport proving his identity. By law, you don't even need a death certificate, although some notaries are reluctant to request one themselves, which is their responsibility. The result of such a controversial policy from a legal point of view of the notary staff is a refusal to open an inheritance case. Therefore, it is better, simpler and more correct to provide the death certificate of the testator along with the passport.

During a visit to a notary, you must fill out two applications - to open a business and to accept an inheritance. Samples of both documents are provided on site.

The duties of the notary include informing the heir in detail about what additional documents will be required to enter into the inheritance. If the inheritance case was opened by another relative, and there is no information about the notary who did this, you can obtain such information on the official online resource, which is also managed by the Federal Notary Chamber. To search, it is enough to indicate the full name of the deceased, as well as two dates - the day of birth and the day of death.

Another Internet resource deserves special mention, which reflects data on the search for heirs announced by notaries in the framework of open inheritance cases. It is posted on the official website of the FNP at the following address. The search is conducted using the full name of the deceased person who left an inheritance.

It is important to remember that you need to contact a notary before six months have passed from the death of the testator. The consequence of this rule is the impossibility of entering into an inheritance before the end of these six months.

The only exception is receipts within 100 thousand rubles. from the bank account of the testator with mandatory targeted spending on organizing the funeral. Permission to withdraw money is given by a notary, to whom the heir applies with a reasoned statement.

Stage No. 2. Providing the necessary documents

Entering into an inheritance involves collecting and submitting a set of documents to the notary. With some degree of convention, they are divided into two categories. The first includes those that are mandatory in any situation, the second includes those that are required to be filed depending on the type of inherited property.

Mandatory documentation

Two main documents - applications for opening an inheritance case and entering into an inheritance - are mentioned above. They must be accompanied by:

- death certificate of the testator;

- documents confirming relationship with the deceased (one of the birth or marriage certificates) - when entering into inheritance by law;

- an alternative option - a will - when entering into an inheritance under this document;

- a document about the last place of registration of the deceased, for example, an extract from the house register or personal account.

Additional Documentation

Depending on the method of inheritance and the type of inherited property, several most typical situations can be identified. When each of them arises in practice, several additional documents are required:

- House, apartment or other real estate . In this case, it is necessary to prove that the real estate - residential or non-residential - is part of the inheritance. The easiest way to do this is by presenting title documents, for example, a purchase and sale agreement, exchange or donation agreement, DDU, etc.

An alternative option is to provide a certificate of registration of property rights or, as has been issued in recent years, extracts from the Unified State Register of Real Estate. Although usually the notary independently sends a request to the regional division of Rosreestr to confirm ownership rights. In some cases - when registering property rights before the end of January 1998 - it is additionally necessary to obtain from the BTI and submit to the notary a certificate drawn up in Form No. 2.

- Land plot. From a legal point of view, land also refers to real estate. Therefore, in this situation, you will again need to present title documents. The notary carries out a request to Rosreestr to obtain information from the Unified State Register of Real Estate on his own. Although nothing prevents the applicant from providing the extract himself.

- Vehicle. To inherit a car, you must provide the notary with a title, registration certificate, title documents and the results of an independent assessment of the value of the car.

- Inheritance through court. This method of inheritance is practiced in two cases. The first is if the heir did not contact the notary within the established six-month period (an additional condition is a valid reason, for example, illness). The second is inheritance of unregistered property rights. In both cases, you will need to provide to the court:

- statement of claim;

- documentary evidence of payment of the state fee;

- documents confirming the applicant's position.

Stage No. 3. Payment of state duty

Notarial actions for registering an inheritance are paid in the form of a state fee. Its value is determined depending on two factors - the status of the heir and the market value of the inherited assets. The latter is determined on the basis of an independent examination, which is carried out by an accredited specialized organization.

| Heir status | State duty amount | |

| Calculation formula | Maximum value | |

| Spouse Children (including adopted children) Parents Siblings (both paternal and maternal) | 0.3% of the market price of assets | 100 thousand rubles. |

| Other | 0.6% of the market price of assets | 1 million rub. |

The following categories of heirs are exempt from paying state duty:

- incompetent;

- minors and their representatives;

- living in the same apartment or house and registered.

Step #4. Obtaining a certificate of inheritance and registering property

After the expiration of the established period, the notary issues a certificate to the heirs. The received property must be registered accordingly - real estate in Rosreestr, car - in the traffic police.

If the deadline for registering an inheritance has expired

If you did not manage to enter into an inheritance within six months, you will have to go to court. The only way to resolve the matter without litigation is to obtain written consent from all other heirs who have already accepted the inheritance to recognize your right. This happens very rarely. In order to restore your rights through the court, you need to prove that you missed the deadline for a good reason. For example:

- were abroad for some reason and could not return;

- were seriously ill and were unable to move;

- were in prison or colony without the opportunity to contact a notary;

- did not know about the relative/inheritance;

- did not know about the death of a relative.

There is no exact list; situations can be very different, but these are the most common reasons. Evidence of a valid absence can include, for example:

- medical certificates;

- documents from work, if we are talking about a long business trip.

The documents depend on the situation and the reason for the absence. After considering your case, the court makes a decision either to refuse due to insufficiently valid reasons/lack of evidence, or grants the request and restores the term, or allows you to enter into the inheritance immediately.

- Lawyers for inheritance issues

FAQ

What is meant by inheritance?

Inheritance is the property and property rights or obligations of a deceased person that are subject to distribution among the heirs.

What methods of inheritance exist in Russia?

Today, inheritance is carried out in one of two ways: by will (if such a document is officially executed and certified by a notary, an inheritance agreement is equivalent to it) or by law (in all other cases).

Which heirs are in the first line?

Closest relatives – spouses, children, parents.

Who is included in the list of compulsory heirs?

Minor or incapacitated children, disabled or incompetent spouses and parents, and disabled dependents.

How long does it take to contact a notary?

The law establishes the need to contact a notary within six months. If the deadline is missed, it can be restored, but only with the consent of other heirs or by court.

What documents are needed to enter into an inheritance after the death of a husband?

List of documentation when registering an inheritance with a notary

| No. | Title of the document | Comments |

| Passport | The document must include all the necessary notes (record of children, marriage stamp) | |

| Owner's death certificate | Issued by the district registry office at the place of last registration of the deceased or at the place of death | |

| Certificate of last place of registration | Can be issued at the passport office, MFC, housing department | |

| Certificate of registration of marriage union | Issued by the district registry office at the place of registration of the union | |

| Document on removal from the place of registration | Issued by the passport office | |

| Title documentation | For property that is subject to inheritance | |

| Legal documentation | Extract from the Unified State Register of Real Estate (issued by Rosreestr) | |

| Cadastral passport for an apartment | Issued by BTI | |

| Property Valuation Report | For real estate you can get it from Rosreestr, for other property you need to order it from a specialized company |

The list of documents may vary depending on what property is included in the inheritance mass.

Conclusion

- In Russia, there are two options for inheritance - by will or by law.

- The first option involves the execution and notarization of a will or inheritance agreement. It does not abolish the rights of compulsory heirs.

- The second option is used in all other cases and in relation to property not included in the will. In this case, inheritance occurs in the order of priority established by law.

- The first and main condition for receiving an inheritance is to contact a notary - to open an inheritance case or (if it is already open) to be included in it.

- You must contact a notary within six months. After this, you need to collect and provide the necessary package of documents, obtain the appropriate certificate and register ownership of the property.

Required documents

Without providing this procedure with documents, the notary has no right to give advice to a specific person regarding property transferred to relatives after the death of a person.

In 2021, the following are required to be provided:

- an application from the heir, executed in person or by a representative under a power of attorney (with a copy and the original provided for verification);

- a copy of the applicant’s passport with presentation of the original (the front part and registration information are required);

- a certificate confirming that the citizen has died (issued by the civil registry office within 3 days after death);

- a copy of documents that indicate relationship with the deceased (birth certificates of spouses, children, change of surname, marriage, certificate of vital records) with presentation of the originals;

- a registration certificate issued at the passport office, which contains information about registration at the place of residence of the deceased; if living in a rural area - an extract from the house register;

- certificates confirming ownership of real estate, or extracts from the Unified State Register of Real Estate;

- cadastral passport;

- information about the acquisition of property by a deceased person (donation agreement, purchase and sale agreement, certificate of receipt of inheritance);

- statements of personal accounts, if the inheritance is money in the bank;

- conclusion on property valuation.

They are issued by different organizations - registration and cadastral chambers, passport office, civil registry offices, credit institutions. To carry out the procedure, it is important that the documents are correctly prepared, with seals, stamps and signatures.

An important aspect is drawing up an application and submitting it to a notary office. It reflects:

- personal information about the testator and his successor (last names, first names, patronymics, passport details);

- place and date of death;

- property objects included in the property;

- indication of the status of the applicant relative to the deceased (close relationship);

- information about other close people (if available);

- request for acceptance of inheritance;

- date and signature.

The best option for submitting the application and documents is personal presence, so the applicant will have information about the date and incoming number when the specialist accepts the information. If the candidate does not have the opportunity to apply, he has the right to send them by mail, but the application will need to be notarized. Transfer through a representative with a power of attorney to carry out these actions is also available to the successor.

How is jointly acquired property inherited after the death of one of the spouses?

Lawyer Antonov A.P.

Property acquired by spouses during marriage is their joint property, except in cases where other provisions are specified in the marriage contract or the spouses entered into an agreement on the division of property (Articles 33, 34, 38 of the RF IC; Article 256 of the RF Civil Code). As a general rule, the common property of spouses includes: the income of each spouse from labor, entrepreneurial activity and the results of intellectual activity, as well as pensions, benefits and other monetary payments that are received by the spouses and do not have a special purpose, for example, amounts of financial assistance; movable and immovable things, securities, shares, deposits, shares in capital contributed to credit institutions and other commercial organizations, which were acquired from the common income of the spouses; any other property that the spouses acquired during the marriage. In this case, it does not matter in the name of which spouse it was purchased, in the name of which or by which of the spouses the funds were deposited. At the same time, property received by one of the spouses during marriage by inheritance or as a gift, as well as personal items, except for jewelry and other luxury items, are not jointly acquired property (Article 36 of the RF IC). The surviving spouse retains the right to part of the common property acquired during the marriage with the testator. The deceased spouse's share in such property is included in the inheritance and passes to the heirs. As a general rule, when determining shares in the common property of spouses, their shares are recognized as equal. Otherwise, it may be provided by a marriage contract, a joint will of the spouses, an inheritance agreement or a court decision (clause 4 of article 256, article 1150 of the Civil Code of the Russian Federation; clause 1 of article 39 of the RF IC). For example, if spouses have an apartment in joint ownership, only a share equal to 1/2 of the deceased spouse’s apartment is included in the inheritance estate. The remaining 1/2 share in the ownership of the apartment remains with the surviving spouse. In this case, the surviving spouse has the right to file an application for the absence of his share in the property acquired during the marriage. Then all this property will be included in the inheritance (clause 33 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9; clause 9 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on July 4, 2018). In general, to accept inheritance of jointly acquired property after the death of one of the spouses, we recommend following the following algorithm.

Step 1. Find out whether there is a will or inheritance agreement. If there is a will certified by a notary or other authorized person, the share in the joint property of the spouses is distributed in accordance with the order of the testator. Thus, a will may provide for the creation of an inheritance fund that carries out activities to manage the property of the deceased spouse received through inheritance in accordance with the conditions for managing the inheritance fund. Let us note that the spouses (testators) can make orders regarding the inheritance of common property and the determination of the shares of the heirs in a joint will. They can also enter into an inheritance agreement, including the appropriate conditions (clause 1 of Article 123.20-1, Articles 1118, 1119, clauses 1, 5 of Article 1140.1 of the Civil Code of the Russian Federation). An exception to the principle of freedom of will is the rule on compulsory share in the inheritance. In accordance with it, the testator(s) or the testator under an inheritance agreement cannot deprive the right to inherit from their minor or disabled children, disabled spouse and parents, as well as their disabled dependents, that is, all persons supported by the testator. Regardless of the contents of the will, they have the right to receive at least half of the share that would be due to each of them upon inheritance by law (clause 4 of article 1118, clause 6 of article 1140.1, clause 1 of article 1149 of the Civil Code of the Russian Federation).

Reference. Disabled persons When determining inheritance rights, the disabled include (Article 8.2 of the Law of November 26, 2001 N 147-FZ; clause 31 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of May 29, 2012 N 9): minors; women over 55 years old and men over 60 years old; citizens recognized as disabled people of groups I, II or III (regardless of the assignment of a disability pension to them).

In this case, the above-mentioned persons lose the right to an obligatory share if they are also beneficiaries of an inheritance fund established in pursuance of the testator’s will, and during the period established for acceptance of the inheritance, they did not inform the notary leading the inheritance case about the renunciation of all rights of the beneficiary (Art. 123.20-3, paragraph 5 of Article 1149 of the Civil Code of the Russian Federation). The obligatory share includes everything that the heir, who has the right to such a share, receives from the inheritance for any reason (clause 3 of Article 1149 of the Civil Code of the Russian Federation).

Step 2. Consider the peculiarities of inheritance by law (if there is no will or inheritance agreement) If the deceased spouse did not draw up a will or did not enter into an inheritance agreement, inheritance is carried out according to the law (Part 1 of Article 1111 of the Civil Code of the Russian Federation). Heirs by law are called upon to inherit in order of priority. Persons indicated in the same order inherit in equal shares, with the exception of heirs by right of representation. If there are no heirs in one line, heirs in the next line are called upon to inherit. The heirs of the first stage are the children, spouse and parents of the testator, who most often inherit property (Articles 1141, 1142 of the Civil Code of the Russian Federation). If there is no dispute between the heirs, there is no court decision and there is no marriage contract, half of all property jointly acquired by the spouses is included in the inheritance mass. Further, this half is inherited by the surviving spouse alone or by the surviving spouse and other first-degree heirs. In this case, the inheritance is distributed between them in equal shares (Article 39 of the RF IC; Article 1141 of the RF Civil Code). When one of the legal heirs died before the opening of the inheritance or at the same time as the testator, the share passes to the descendants and is divided equally. For example, after the death of a mother and son, the son’s children will each receive 1/2 of the inheritance mass (Clause 1 of Article 1146 of the Civil Code of the Russian Federation).

Step 3. Accept the inheritance To accept the inheritance, you must submit an application for acceptance of the inheritance or an application for the issuance of a certificate of inheritance to the notary at the last place of residence of the testator. The heir chooses the type of application at his own discretion (clause 1 of Article 1153 of the Civil Code of the Russian Federation). Usually, in an application for acceptance of an inheritance, a request is written to issue a certificate of the right to inheritance. In this case, there will be no need to submit a separate application for the issuance of a certificate, provided that in such an application the composition of the inherited property for which the heir requests to issue a certificate is indicated. If you submit an application for a certificate of right to inheritance, then the inheritance is considered accepted by you even in the absence of a separate application for acceptance of the inheritance (clause 5.15, 13.1 of the Methodological Recommendations, approved by the decision of the FNP Board of March 25, 2019, protocol N 03/ 19). You can clarify the contact details of the notary of the notarial district in which the deceased was registered in the notary chamber of the corresponding territorial entity (Article 123.16-3 of the Civil Code of the Russian Federation). As a general rule, you can accept an inheritance within six months from the date of opening of the inheritance. The time of opening of the inheritance is the moment of death of the citizen. Accordingly, the day of opening of the inheritance should be considered the date on which the moment of death of the testator falls, that is, the date of his death (clause 1 of Article 1114, clause 1 of Article 1154 of the Civil Code of the Russian Federation). If this deadline is missed, other options for acquiring an inheritance are possible: restoration of the missed deadline or recognition of the right to inherited property in court, as well as recognition of the heir as having entered into the inheritance by all other heirs by submitting an appropriate application to a notary (Article 1155 of the Civil Code of the Russian Federation).

Step 4. Prepare the necessary documents and submit them to the notary. The notary may require documents and information confirming (Articles 72, 73 of the Fundamentals of the Legislation of the Russian Federation on Notaries; clauses 46 - 49, 56, 57 of the Regulations, approved by Order of the Ministry of Justice Russia dated August 30, 2017 N 156; clause 13.11 of the Methodological Recommendations): fact, moment and place of death of the testator (for example, a death certificate issued by the civil registry office); grounds for calling to inheritance: in particular, this is a will (in case of inheritance by will) or, for example, a marriage certificate (in case of inheritance by law); ownership of the property by the testator (for example, a certificate of ownership of real estate, an extract from the Unified State Register of Real Estate (USRN, until 01/01/2017 - USRE)). It should be taken into account that information from the Unified State Register of Real Estate, containing, in particular, data on the rights of the testator and his surviving spouse to inherited property, is requested by the notary himself within three working days from the date of your application. At the same time, the notary has no right to require you to provide such information (Article 47.1 of the Fundamentals of the Legislation of the Russian Federation on Notaries; Part 14, Article 62 of the Law of July 13, 2015 N 218-FZ); the value of the property, which can be confirmed by an independent assessment of relevant organizations. However, this does not mean that the notary has the right to demand from the heirs documents issued by such organizations. For example, the cost of an apartment can be confirmed by an extract from the Unified State Register of Cadastral Value. In addition, for the issuance of a certificate of inheritance rights, it is necessary to pay a state fee (or a notary fee - when contacting a private notary), the amount of which depends on the share in the ownership of the apartment (clause 22, clause 1, article 333.24, clause 3 p 1, Article 333.25 of the Tax Code of the Russian Federation; Parts 1, 2, Article 22 of the Fundamentals of the Legislation of the Russian Federation on Notaries).

Reference. Amount of state duty (tariff) The amount of state duty (notarial tariff) for issuing a certificate of inheritance by a notary to: natural and adopted children, spouse, parents, full brothers and sisters of the testator - 0.3% of the value of the inherited property, but not more than 100,000 rubles. ; other heirs - 0.6% of the value of the inherited property, but not more than 1,000,000 rubles. In particular, heirs who have not reached the age of majority on the day of opening of the inheritance, as well as persons inheriting an apartment if they lived together with the testator on the day of his death and continue to live in this apartment after his death are exempt from paying the state duty (clause 22 p. 1 Article 333.24, paragraph 5 Article 333.38 of the Tax Code of the Russian Federation).

The notary has the right to require other documents, since there is no exhaustive list of required documents.

Step 5. Obtain a certificate of the right to inheritance You can receive a certificate of the right to inheritance after six months from the date of death of the testator. The notary issues it if you have submitted all the necessary documents. He can issue a certificate before the expiration of the specified period if there is no doubt about the number of persons who applied for a certificate of the right to inheritance and other possible heirs (clauses 1, 2 of Article 1163 of the Civil Code of the Russian Federation). A certificate of the right to inheritance issued on paper by a notary since December 29, 2020 must have machine-readable markings with which you can check its accuracy (Article 5.1, Part 2, Article 45.1 of the Fundamentals of the Legislation of the Russian Federation on Notaries; Part 1, Article 6 of the Law dated December 27, 2019 N 480-FZ). The given procedure for registering inheritance rights to a share in the common property of spouses is the same for all types of property - from real estate to cash deposits. However, to inherit certain types of property, for example, shares in the authorized capital of organizations, you need to follow the rules that take into account the specifics of a particular type of property (Methodological recommendations on the topic “On the inheritance of shares in the authorized capital of limited liability companies” (approved at a meeting of the Coordination methodological council of notary chambers of the Southern Federal District, North-Kazakhstan Federal District, Central Federal District of the Russian Federation 28 - 29.05.2010)).

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!