Home » Inheritance » State duty when entering into an inheritance in 2020

123

According to the legislation of the Russian Federation on taxes and fees, when entering into the right to inheritance, it is necessary to pay a state fee. Payers are both citizens and organizations that perform legally important actions (executing a purchase and sale agreement, donation, inheritance).

Stages of inheritance

First of all, in order to formalize inheritance rights, the successor must go to a specialist within six months from the date of death and life of the testator. This must be done with a death certificate (issued without payment), a passport, and other documents. A lawyer in an office located at the location of the property will accept the application and open an inheritance case. The cost of this operation is about 1100 rubles.

The step-by-step procedure for accepting an inheritance is as follows:

- obtain a death certificate from the registry office;

- collect a package of documents;

- no later than 6 months, go to a specialist.

During the procedure, the notary accepts applications from other legal successors and creates a list of property recipients and their parts. As the deadline for closing the case approaches, legal successors pay state fees and notary expenses upon entering into an inheritance.

After 6 months, and not earlier, the successor receives a certificate of inheritance. Next, he applies the document to the State Register or the State Traffic Safety Inspectorate, where he registers ownership of the apartment, dacha or transport. You will have to pay 2,000 rubles for entering information into the Unified State Register in Moscow. For a change of car owner – about 2800.

What is included in the list of documents required to obtain rights?

- death certificate;

- certificate from the residential address of the deceased;

- will, if any;

- birth certificate, other documents certifying relationship;

- a fragment from the house register, if the successor lived with the deceased;

- documents for real estate: certificate of ownership, purchase and sale agreement, deed of gift;

- certificate from the BTI about the price of the apartment.

If a vehicle is inherited, the successor should be provided with:

- vehicle registration certificate;

- PTS;

- gift or sale agreement;

- property valuation act.

When inheriting other property, for example, deposits or shares, you will need a savings book, an extract from the register of shareholders, as well as other documents confirming property rights.

Note! According to the law, lawyers do not have the right to demand from successors an extract from the Unified State Register on the legal purity of the property. From October 12, 2015, information is requested by the lawyer independently.

Lawyer's answers to citizens' questions

She was married for 10 years. They lived together in the same apartment until the death of their spouse. Now I have started registering my inheritance. Do I have to pay a state fee for issuing a certificate of ownership of an apartment?

If you document the fact of living together in this apartment before death and living together after death, you are exempt from paying the state fee for issuing the certificate. You can provide a certificate stating that you are registered at the testator's address and testimony of witnesses confirming cohabitation.

Should minor heirs pay state fees?

Heirs who have not reached the age of majority by the day the inheritance is opened are exempt from paying state duty.

My husband and I were divorced, but were able to maintain a good relationship. The eldest son lived with his father for 23 years. My youngest son, 9 years old, is with me. In August, her ex-husband died suddenly. What remained was the apartment in which he lived with his son. Will children pay a state fee to obtain a certificate of inheritance?

Your children will be exempt from paying state fees for issuing a certificate of inheritance. The younger son had not reached the age of majority on the day the inheritance was opened, and the eldest lived with his father on the day of death and continues to live in this apartment after death. You need to provide documents confirming these circumstances.

Mom died. I am the only heiress, I live in another city. There is no will. Will I have to pay state duty for an inheritance?

Regardless of the method of obtaining property, you must pay a state fee for issuing a certificate of inheritance. For close relatives (parents, spouse, children, full brothers and sisters) – 03.% of the value of the property.

To calculate the amount of the state duty, an assessment of the property and confirmation of your relationship with the testator is required.

State duty upon entering into inheritance

According to Article 333.24 of the Tax Code of the Russian Federation, state duty rates in 2021 are:

- 0.3% of the price of the property if the heirs are relatives of the deceased in the first two lines of inheritance, but not more than 100 thousand rubles;

- 0.6% of the property price for other legal successors. In this case, the payment to the state does not exceed 1 million rubles.

According to the law, the basis for calculating the price of property is its market or cadastral value. To find out the market value when registering an inheritance, you need to order the procedure and receive an appraisal report. You can see how much the property is worth according to cadastral value on the Rosreestr website.

Note! The amount of the state duty does not depend on the order of inheritance. It is determined only by share and closeness of relationship. If there is more than one heir, the amount of the fee is divided among all legal successors in proportion to the share of the property received.

The cost of notary services when registering an inheritance is determined by the scope of the specialist’s technical services. These include the production and certification of documents, issuance of copies, execution of powers of attorney, and consultations. If the state duty is required to be paid, then obtaining UPTC is free: if the client disagrees with the form and content, he has the right to order them elsewhere.

The price list for notary technical services when registering an inheritance is explained by the Federal Notary Chamber, which sets tariffs for each region. However, Article 333.38 of the Tax Code of the Russian Federation exempts privileged categories of citizens from paying money for related services. Their exhaustive list is specified in the legislative act.

Here is an example of some technical fees of a notary:

- announcement of the will – 300 rubles;

- services for legal confirmation of a will – 100 rubles;

- confirmation of the application for entry into rights - 100 rubles;

- certification of the revocation of the will by the testator – 500 rubles;

- confirmation of property abandonment – 500 rubles;

- issuing copies of documents – 100 rubles;

- notary request – 50 rub.

Important! If you have difficulties calculating the price for registration of rights, you can use the online calculator on our resource. With its help, you can find out in a few seconds how much it costs to enter into an inheritance this year. To do this, you need to know the estimated or cadastral value of the property.

Categories of citizens exempt from paying state duties and technical services

Articles 333.35, 333.38 of the Tax Code of the Russian Federation determine the list of persons who are completely exempt from paying state duties or who are entitled to discounts when entering into an inheritance. These include:

- heroes of Russia or the Soviet Union;

- participants or disabled people of the Second World War;

- former prisoners of war, prisoners of the Nazis;

- disabled people of groups I and II (50% discount on all notary services);

- people receiving real estate or a share where they lived with the deceased;

- people acting in the interests of wards and minor children;

- citizens registering rights to deposits, insurance payments, royalties;

- persons whose successors are people who died during public service, political repression, or while saving people.

Discounts are provided based on documents presented at the notary's office. Moreover, if the property is inherited by several persons, and one of them is exempt from payment, the state duty is reduced in proportion to the number of heirs.

Payment order

The function of a tax agent is assigned to a notary, since according to paragraph 1 of Art. 333.18 of the Tax Code of the Russian Federation, the tax is paid before any notarial acts are performed. You can pay the state duty when entering into an inheritance either in cash or in non-cash form. When paying through a bank cash desk, form No. PD-4sb (tax) is issued. The details are issued by the notary.

The payment confirmation receipt is presented to the notary along with the rest of the documents for inheritance.

Sample payment form for payment of state duty upon inheritance

What is the difference between entering into an inheritance by law and a will?

Entry into inheritance according to law

The procedures for registering inheritance rights by law and by will differ. It happens that the deceased owner of the property does not leave a will regarding the inherited persons. In this case, inheritance is carried out in order of priority regarding the proximity of the relationship.

According to the law, the line of inheritance looks like this:

All children of the deceased, born in an official or unofficial marriage, adopted, born after his death, as well as unborn heirs, have the right to accept the inheritance of their parents. If the legal successor is just preparing to be born, according to the law, it is impossible to divide his share before birth.

Note! The property is distributed equally among the first-degree heirs. At the same time, apartments, deposits and other property, according to Article 1117 of the Civil Code of the Russian Federation, cannot be inherited by unworthy persons, as well as by parents deprived of their rights.

Also, dependents - disabled people who lived with the testator and were supported by him for at least a year - can become successors in order of priority. Dependents have the right to receive no more than ¼ of its amount. To do this, they, as well as the successors of any of the lines, when entering into an inheritance, need to go to the notary's office in the city where the deceased lived and declare their right.

In the absence of a will, the law allows the heirs to agree on the division of shares. This can be done legally correctly by drawing up an agreement in writing.

Entry into inheritance under a will

The state grants the right to every citizen of the Russian Federation to dispose of property at their own discretion. A person has the right to transfer for use what belongs to him to any person, even if he is not his relative. Legally, the will of a citizen is reflected in a will - a document defining the rights and obligations of the recipients of the inheritance from the moment of its opening. He can assign shares in property in an arbitrary amount to a notary.

However, the owner of the property will not be able to disinherit people from the following four categories:

- minor children;

- children who have reached adulthood but are unable to work;

- a retired or disabled spouse;

- father and mother who have lost their ability to work.

One way or another, they will receive a share of the inheritance, regardless of who is indicated in the will as the beneficiary.

Entry into inheritance under a will is carried out in the following order:

- the notary announces the contents of the testamentary document (if it was transferred in an envelope);

- the heirs write an application to enter into inheritance rights;

- beneficiaries provide a package of documents: passport, death certificate, certificate from the house register, inheritance data (location, cadastral number of the apartment, area, etc.);

- the state duty is paid, a certificate of title to the property is obtained;

- the acquired property right is registered with government agencies.

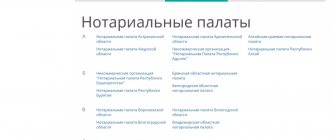

If the heir does not have a copy of the will, and he cannot take it from his relatives for good reasons, he must obtain the document from the lawyer who carried out the certification. The specialist does not have the right to refuse service to the recipient: by law, he must issue a copy within 10 days. If there is no information about the inheritance, the applicant can seek help from the notary chamber.

Benefits for paying for notary services

When accepting a certain inheritance, heirs with 1 or 2 disability groups pay 50% of the specific tariff for notary services. This benefit is provided to all similar categories of citizen applicants, regardless of the following parameters:

- degree of relationship;

- established share in the inheritance;

- line of official inheritance.

Important! Pensioners of the Russian Federation who do not have 1 or 2 disability groups are not provided with such benefits. In this situation, the state fee for issuing a new certificate of title to a car, private house, communal room or other inheritance is paid in full.

What is the difference between receiving an inheritance by will and by law?

As you can see, the deadlines, list of documents and the procedure for their provision are unchanged in both cases. The difference between legal procedures lies in the specifics of inheritance. The circle of persons entering into inheritance under a will is much wider: it is not limited to the first priority beneficiaries. Not only blood relatives, but also people completely alien to the family can inherit by testament. They can be individuals, enterprises and even states, including foreign ones.

At his own discretion, the testator determines the inheritable shares in the property. He can leave half of the apartment to one relative, and divide the rest between three others. When inheriting by law, property will be distributed without taking into account the will of the deceased - equally between all representatives of the first and subsequent orders.

The testamentary order of inheritance takes precedence over the legal one. According to Article 1111 of the Code, the latter comes into force only if the deceased did not write a will or it was declared invalid. Also, property is divided in equal shares according to the law if the successors specified in the document renounced their rights. One of the main requirements for the testator is that at the time of drawing up the will he must be legally competent. Otherwise, interested parties may challenge the validity of the document in court.

The nuances of paying state duty by several recipients of an inheritance

The state fee is paid by all heirs. This rule is not followed when receiving a specific property share by inheritance.

Example

Petrov G.V. left all his own property as an inheritance to several heirs: a car to his son B.G. Petrov, a two-room apartment to his daughter D.G. Petrova, and a dacha to his neighbor L.V. Krasnov. In this case, all heirs pay a state fee of specific in full.

If Petrov had left his son both his car and half of the two-room apartment, then his daughter would have become the heir to 1⁄2 of the share, and not the entire apartment, and would have paid only 1⁄2 of the duty.

If it is impossible to determine the value of the inheritance: valuation of the inherited property

Payment of the state fee for entering into an inheritance is a necessary legal requirement for the successor. As far as we know, the amount of the contribution depends on the price of the property, amounting to 0.3% and 0.6% of its value. To correctly calculate the amount of the fee, the notary needs to know the value of the property. This is the only reason why a property valuation should be carried out upon taking possession.

Heirs have the right to independently choose the method of property valuation: at market or cadastral value. You can find out the value of real estate from the state’s point of view on the State Register website without paying - any specialist can enter the resource and obtain information. Obtaining a market valuation involves expenses. To carry out the procedure, you must use the help of independent appraisers or authorized government bodies who will charge a fee for their services.

Depending on the region, the real estate valuation procedure costs 5-10 thousand rubles. It can be economically justified only if the cadastral value of the property significantly exceeds the market value.

Note! In addition to real estate, all types of property of the deceased that require registration are subject to assessment: transport, shares, bonds, business, weapons. Items must be appraised within six months after the death of the testator.

You can find out how much they pay for the valuation of various inheritance objects in the table:

| An object | Amount, rub |

| House, apartment, garage | from 5000 |

| Land plot | from 8000 |

| Freight car | from 5000 |

| A car | from 4500 |

Examples of calculating state duty

When officially accepting a specific property as an inheritance, you need to know how the state duty is calculated in this situation.

Below are two examples. Read also: Acquisitive prescription

Initial conditions: according to the will, the heir was left a one-room apartment and a dacha. The cadastral value of the first property is 1,000,000 rubles, and the second - 500,000 rubles.

Example #1

According to the will, the husband left his own apartment and dacha to his wife, who was with him until his death. In this situation, the following fee is paid for inheriting a dacha - 1,500 rubles. = 0.3% * 500,000 rub.

When re-registering legal rights to inherited real estate, the widow must go to Rosreestr and pay the following state fees to the budget: 2,000 rubles. - for a one-room apartment and 350 rubles. - to a dacha with an allotment. Total, in this situation, the heiress will pay 3,850 rubles for registration of specific inherited property. = 1,500 rub. + 2000 rub. + 350 rub.

Example No. 2

The deceased testator-grandfather bequeathed his apartment and dacha to his granddaughter, who lives in another city. In this situation, for the re-registration of property, the heiress must pay the following amount of state duty = 9,000 rubles. (to a notary) + 2,000 rub. + 350 rub. (to Rosreestr) = 11,350 rub.

Formulas and examples of calculating the costs of inheritance

Example 1. After his death, a man left his heirs (his wife and two daughters) a homeownership that he inherited from his parents. Such property is not recognized as jointly acquired property, so it was divided in equal shares between each family member.

The cadastral value of the house was 5 million rubles. Due to the fact that the heirs were close relatives of the deceased, the state duty was calculated at a rate of 0.3%:

5,000,000 *0.3/100 = 15,000 rubles.

Payment of the notary fee was made by each legal successor in the amount of 5,000 rubles. In addition, the heirs reimbursed the expenses of the notary's office in the amount of 4,000 rubles.

Example 2. After the death of a single citizen, a car worth 2 million rubles was left behind. The man had no children and divorced his wife. The only relative who could inherit was the nephew. He began to register the rights to the property. Since the heir was not a close relative of the deceased, the state duty is calculated using the following formula:

2,000,000*0.6/100 = 12,000 rubles.

In addition, the testator's nephew reimbursed the appraiser's expenses in the amount of 5,000 rubles and the technical services of a notary. The total amount spent by the assignee was 21,000 rubles.

Example 3. A girl inherited from her father an apartment worth 3 million rubles and was indicated in the will. Besides her, the man had a 30-year-old son from his first marriage, about whom there were no documentary orders. There were no minors or dependents in the family.

According to the law, the girl has the right to real estate in the amount of 100. The registration fee is calculated as follows:

3000 000 *0.3/100=9000 rubles.

In addition, the heiress paid the notary's expenses in the amount of 5,000 rubles. It does not include the fee for registering property in the Unified State Register of Real Estate - 2,000 rubles, which the girl gave to the territorial body of Rosreestr.

State duty calculator

To correctly calculate the amount of state duty, the notary divides everything into shares assigned to each participant (according to legal order, according to the will). Each person then pays the price of only his or her share of the property. For example, if you received 1/2 share in the right to real estate, then you will pay only half of the total amount of state duty.

State duty calculator when receiving an inheritance

Cost of inherited property:

rub.

I am a hero of the Russian Federation, the USSR, a WWII veteran or a full holder of the Order of Glory

The state duty will be: 0 rub.