What is a certificate of inheritance?

The legislator does not provide an exact definition of this term, but we can say that a certificate of inheritance is an official document issued by a notary and confirming the inheritance rights of a person to the property of a deceased citizen.

Here it is necessary to emphasize that the certificate itself does not relate to legal documents, but is legal confirming. In simple terms, such a certificate only confirms the fact of inheritance of property and the transfer to the heir of the rights and obligations belonging to the testator.

However, the law does not provide for the obligation of heirs to obtain such a certificate. The Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9 (hereinafter referred to as the Plenum No. 9) supplemented this thesis, indicating that obtaining a certificate of the right to inheritance is a right and not an obligation of the heir, therefore the absence of such a certificate cannot serve as a basis for refusal to accept statement of claim in an inheritance dispute, return of such a statement of claim or leaving it without movement.

But in no case should we belittle the significance of this document and let the procedure of universal succession take its course.

Why is it important to obtain a certificate of inheritance?

Firstly, such a certificate in itself is evidence of the transfer of the right to the property of the testator to the heirs, and secondly, it may be needed in the following cases:

- when issuing funds held in the bank in the presence of a testamentary disposition (Part 3 of Article 1128 of the Civil Code of the Russian Federation);

- implementation of state cadastral registration and (or) state registration of rights (Article 14 of the Federal Law “On State Registration of Real Estate” No. 218-FZ);

- the need to confirm the acquisition of a share in the authorized capital of the LLC (Part 13.1, Article 21 of the Federal Law “On Limited Liability Companies” No. 14-FZ);

- the need to prove the fact of acquiring the status of an heir in court (Resolution of the Presidium of the Court for Intellectual Rights of April 24, 2015 N C01-208/2015 in case N SIP-734/2014).

Is it possible to calculate the amount of duty without conducting an assessment?

There are 4 criteria for assessing real estate. All of them are legal, and assignees have the right to use any of them. The cost may be:

- inventory;

- nominal;

- market;

- cadastral

The notary issues documentary evidence of inheritance rights based on any conclusion. If several estimates differ from each other, the minimum price is taken into account.

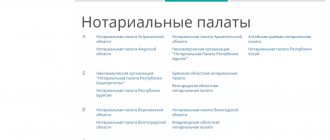

Place of issue of the certificate of inheritance

According to Art. 1162 of the Civil Code of the Russian Federation and Art. 70 Fundamentals of legislation on notaries, the certificate is issued by a notary at the place of opening of the inheritance.

First of all, this rule was introduced in order to prevent notaries from allowing several inheritance cases under one opened inheritance based on applications from several heirs submitted to different notaries.

At the moment, the “Inheritance Without Borders” program is operating in the Russian Federation, which allows heirs to submit an application to any notary within the notary district at the place where the inheritance was opened. Simply put, if the testator died, for example, in St. Petersburg, then the heirs can choose any notary who operates in the territory of the city of St. Petersburg. This program can be applied to inheritance cases of persons who died after December 31, 2014.

Conducting a hereditary matter by one notary is ensured by the presence of an electronic register of inheritance affairs, uniform for all notaries. Such a register makes it possible to exclude the re-opening of inheritance cases on the territory of the Russian Federation.

Article 1115 of the Civil Code of the Russian Federation establishes that the place of opening of the inheritance is the last place of residence of the testator. Article 17 of Plenum No. 9 states that the place of residence of the testator can be confirmed by documents certifying his corresponding registration with the registration authorities of citizens of the Russian Federation at the place of stay and at the place of residence within the Russian Federation.

This year, by the decision of the board of the Federal Notary Chamber dated March 25, 2019, Methodological recommendations for registration of inheritance rights were approved, according to which the last place of residence of a citizen can be recognized as:

- House;

- apartment;

- room;

- residential premises of a specialized housing stock;

- other residential premises.

These recommendations also determine the places of opening of inheritance for certain categories of citizens.

But in practice, controversial issues may arise when there is no documentary evidence of place of residence. As an example, we can cite the Appeal Ruling of the Sverdlovsk Regional Court dated October 2, 2021 in case No. 33-17023/2018, when the court, based on the spirit and letter of Art. 1115 of the Civil Code of the Russian Federation, taking into account the testimony of a witness, decided that, despite the fact that the deceased citizen lived in an apartment without registration, since he had recently served a sentence in prison and did not have time to register, the place of opening of the inheritance will still be this apartment.

To summarize this section, I would especially like to note that the topic of determining the place of opening of an inheritance is too broad to fit into the scope of this article. At the same time, determining the place of opening of the inheritance is one of the most important procedures for registering inheritance rights, and therefore, if in doubt, it is recommended to contact an experienced lawyer.

What to do after receiving the certificate?

After receiving the certificate, the copyright holder must register ownership of the property. Registration of an apartment, house or land plot is carried out at the territorial branch of Rosreestr. The application and documents can also be submitted through an intermediary - the State Budgetary Institution “My Documents” (formerly MFC).

Registration of the car is carried out at the local traffic police office. The papers are submitted at the place of residence of the heir. You must submit an application for vehicle registration within 10 days . Otherwise, the copyright holder faces a fine - from 1,500 to 10,000 rubles (Parts 1 and 1.1 of Article 12.1 of the Code of Administrative Offenses of the Russian Federation).

Registration of a share in the authorized capital of an enterprise is carried out by the Federal Tax Service (FTS). The papers are submitted to the registrar within 3 days from the moment of receiving the consent of the company participants to accept the heir as a co-owner (Article 16 of the Federal Law No. 14-FZ).

Read more about the procedure in our article at the link.

Deadline for issuing a certificate of inheritance

According to the general rule established by Article 1163 of the Civil Code of the Russian Federation, a certificate of the right to inheritance is issued to the heirs at any time after six months from the date of opening of the inheritance.

It is worth paying attention to the fact that the law does not establish time limits that would oblige a notary to issue a certificate of the right to inheritance after a six-month period, since each inheritance case is individual and the timing of issuing a certificate may depend on a variety of circumstances, such as, for example, the composition and location of the inherited property, circle of heirs and other legal features. The notary determines the specific deadline for issuing the certificate independently after researching and clarifying all legal issues within the framework of the inheritance case.

It is also necessary to take into account that the maximum period for receiving such a certificate by the heirs is not limited, that is, if in the inheritance file there is an application from the heirs submitted within 6 months for acceptance of the inheritance and all the necessary documents, the heir can contact the notary at least after 5 years.

At the same time, clause 2 of Art. 1163 of the Civil Code of the Russian Federation allows heirs to obtain a certificate before the expiration of the six-month period, provided that there is reliable information that, apart from the persons who applied for such a certificate, there are no other intended heirs. The legislator has not established reliability criteria, so the notary independently evaluates such data.

At the moment, the practice of early issuance of certificates of the right to inheritance is carried out quite rarely, since even if there is sufficient and convincing evidence of the absence of other heirs by law who could claim the inheritance, the fact that the testator made a will can never be ruled out.

The legislator in paragraph 3 of Article 1163 of the Civil Code established cases when the issuance of a certificate may be suspended:

- By the tribunal's decision;

- in the presence of a conceived but unborn heir.

Conditions for restoring the certificate, obtaining a duplicate

If the certificate of inheritance is lost or damaged, the notary who issued the document restores it and issues a duplicate that looks identical to the original source. A duplicate can be issued by one of the heirs in whose name the certificate of the right to inheritance, which is subject to restoration, was issued.

The basis for restoring a document is a corresponding statement on behalf of the person who lost it. All you need to do is apply for a duplicate and pay the tax.

Author of the article

The procedure for obtaining a certificate of inheritance

The entire procedure for obtaining a certificate of inheritance can be divided into several stages:

Stage 1. Applying to a notary with an application to accept the inheritance

Initially, you must submit an application to the notary

Legislator in Art. 1153 of the Civil Code of the Russian Federation established methods for accepting an inheritance:

- submission of an application from the heir to the notary to accept the inheritance;

- Submitting an application from the heir to a notary for the issuance of a certificate of right to inheritance.

The said article also mentions that the inheritance can be accepted in fact, that is, take measures to protect the property, continue to live in the inherited apartment, etc. At the same time, it is highly recommended to complete all notarial actions in order to avoid the occurrence of controversial situations.

Clause 5.15 of the Methodological Recommendations for Registration of Inheritance Rights specifically notes that submitting an application to a notary for the issuance of a certificate of the right to inheritance is also considered acceptance of the inheritance, even if an application directly for acceptance of the inheritance was not submitted.

The application is submitted to the notary within six months from the date of opening of the inheritance at the last place of residence of the testator in writing. It is very important to try to submit the application within the specified period, since its further restoration is carried out exclusively through the courts and is often a lengthy process.

The application must indicate the following information:

- Full name and place of residence of the heir;

- Full name of the testator, date of death and address of the testator’s last place of residence;

- basis of inheritance (will, law), family and other relationships;

- the will of the heir is to accept the inheritance.

The Federal Chamber of Notaries also recommends that such an application include information about other heirs known to the applicant, or indicate that the applicant does not have such information.

The heir is not deprived of the right to indicate other information, for example, about the composition and location of the inheritance, of which the heir is aware.

If you have difficulty completing your application, it is recommended that you contact a specialist in the field of inheritance law.

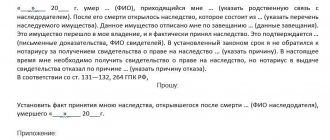

Application for acceptance of inheritance

Stage 2. Preparation of necessary documents

To perform further notarial actions, one application will not be enough; you need to prepare a certain set of documents and also provide them to the notary:

- Identification document of the heir;

- Death certificate;

- Documents confirming the basis of inheritance. Such documents may be a will or documents confirming family and marriage ties (extracts from registries, marriage certificate, etc.);

- Documents confirming the ownership of the property by the testator. Here the list of documents may vary depending on whether the property was movable or immovable; - Certificate from the Unified Information and Settlement Center (EIRC) about cohabitation with the deceased on the day of death.

It is important to note here that the notary cannot require the applicant to provide information that the notary can obtain independently, including from state registers.

The above list of documents is not complete and final and depends on the degree of complexity of the inheritance case.

Stage 3. Obtaining a certificate of inheritance

The issuance of a certificate of inheritance is the final stage after completing all the steps indicated above.

As already mentioned, a certificate of inheritance, as a general rule, can be obtained after six months from the date of death of the testator.

In the case of inheritance by will, the applicant is issued a certificate of the right to inheritance by will, and in the case of inheritance by law, a certificate of the right to inherit by law.

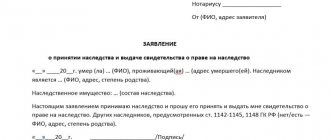

Certificate of right to inheritance

In a situation where there are several heirs, each of them has the right to demand that he be issued a certificate of the right to inheritance for the share due to him, regardless of whether the other heirs have received such a certificate or not.

Registration cost

Before applying for inheritance rights, consider whether it makes sense to spend money on re-registration of property. Remember that debts are transferred along with the inheritance. For some, a certificate is a desired document, for others it is a source of responsibility. You will have to pay the debts of the testator, transfer utility bills and taxes. To this must be added the costs of paperwork.

Issue a certificate - pay the state fee. Other expenses may apply. Therefore, before issuing a certificate, weigh all the material factors. And the right to choose remains yours. The law does not oblige you to accept an inheritance.

Amounts of state duty for relatives and other persons

Fee – payment for notary services provided as part of establishing the right to inheritance. The tariff is fixed and depends on the specific service. But in different regions the amount to be paid varies. In the capital you will have to spend more. The state duty is paid one-time. How long it takes a notary to formalize the right to receive an inheritance does not matter. The receipt is kept and attached to the application for a certificate.

In most cases, these are not the only costs. You will have to transfer finances when re-registering ownership rights. The peculiarity is that when inheriting real estate, vehicles and deposits, registration of the right of inheritance under a will and by law is paid based on a percentage of the price of the property. Third parties pay 0.6% of the value indicated in the appraisal report. Close relatives (first priority) contribute half as much - 0.3%. Do not confuse the duty with the tax that is paid when selling an inheritance.

Cost of property assessment work

You will have to pay for the appraisal company's work. If it is not possible to fit a car that is being inherited, you will have to spend money on calling a specialist who will assess the current condition of the car and determine its market value. Wear and tear of the engine, chassis, body, and damage is taken into account. After an accident, a car costs less. The price does not affect the rights of the successor, but the fee is calculated depending on it and you can understand how expedient it is to obtain a certificate and enter into an inheritance from a notary.

The situation is similar with apartments. They call an appraiser and get an opinion. The valuation of a country house will cost more, as will a dacha with a plot of land in a remote area of the region. The certificate of inheritance cannot contain an indication of these costs. And before issuing the document, the notary will check whether the fees have been paid in full. There is no need to appeal the assessed value. Hire other appraisers if you think the first ones did not work correctly.

But don’t think that the amount will be large. It does not matter when the duty is paid, since there are certain limits. The state will take no more than 100 thousand rubles. from close relatives and no more than 1 million from other heirs. The only way to avoid paying is to renounce the inheritance.

There are coefficients that allow you to reduce the cost of housing in the appraisal report. If it is not possible to evaluate the property using a specialized company, the cadastral price is taken to issue a certificate. It is then multiplied by a factor of 0.7. This will be the estimated value of the inheritance. There are other coefficients, which you can find out from lawyers. There is a right to involve proxies. This is convenient, especially if someone must represent the interests of the heir in another city.

Notarial services

Standard services require depositing funds according to the tariff. If you need to seek additional help, you will have to pay extra. Additional services include certification of a power of attorney, preparation of documents for filing an application for a certificate, etc. The notary may refuse to perform any actions. It is not always justified. But in most cases no one refuses.

Categories of beneficiaries for payment of state duty

The notary is obliged to carry out the procedure for entering into an inheritance in relation to persons belonging to preferential categories. The cost of services will be reduced in the following cases:

- If the heir brought a certificate of disability of the first or second group. The benefit involves paying 1/2 of the tariff.

- If persons lived together with the owner of the property, they inherit this housing. They have the right to enter into rights without a notary (in fact).

In addition, contributions, royalties, and insurance received as an heir are not subject to duty.

A separate category of persons are the heirs of people who died in the line of duty while performing their civic duty. And, if the notary does not issue a certificate, immediately go to court, file a claim, and defend your rights.

Certificate of right to inheritance by law and by will, what is the difference?

The difference between these two documents follows from the name itself, but there are some nuances that are worth examining in more detail.

Certificate of right to inheritance by law

Inheritance by law is inheritance on the terms and in the manner specified in the law and not changed by the testator in the will.

Inheritance by law is permissible in the following cases:

- the will was not drawn up by the testator, or was drawn up but subsequently revoked;

- not all property is bequeathed, but only part of it (the untested part of the property is inherited by law);

- the heir under the will refused the inheritance or was recognized as an unworthy heir.

The circle of heirs by law and the procedure for calling them to inheritance are determined by law in the order of priority provided for in Art. Art. 1142 - 1145 and 1148 of the Civil Code of the Russian Federation. At the moment, the legislator has established eight lines of heirs.

The conditions for issuing a certificate of the right to inheritance are determined by law in Art. 72 Fundamentals of legislation on notaries.

Since in this type of legal relationship there is no will, a very important point is the process of proving kinship with the deceased. Since the circle of heirs on this basis is quite extensive, the process of proving the presence of kinship can sometimes present some difficulties.

Thus, the plaintiff appealed to the court with a demand to oblige the notary to issue a certificate of the right to inheritance according to the law for the property of her deceased aunt. From the case materials, it appears that the notary refused to issue such a certificate to the plaintiff, indicating that it was not possible to establish the fact of relationship between the plaintiff and the testator. Meanwhile, the court did not agree with the notary, pointing out that the case materials included:

- death certificate of the testator;

- birth certificate of the testator;

- birth certificate of the plaintiff's mother;

- death certificate of the plaintiff's mother.

The court rightly pointed out that in both birth certificates the same person was indicated as the mother, from which it follows that the plaintiff’s mother and the testator were sisters, as a result of which the plaintiff is the heir of the second priority, and declared the notary’s refusal illegal (Appeal Determination of the St. Petersburg City Court dated January 29, 2018 No. 33-2126/2018 in case No. 2-4999/2017).

Certificate of right to inheritance under a will

When inheriting by will, property from the inheritance mass is distributed according to the will (the expression of the will of the citizen in the event of death). Under such circumstances, the testator is free to dispose of the property at his own discretion and bequeath it to any persons, as well as deprive the heir by law of the right to inheritance.

At the same time, the legislator determined the circle of persons who in any case will receive a share of the inherited property, even if they were not included in the will. Art. 1149 of the Civil Code of the Russian Federation refers to the following persons:

- minor or disabled children of the testator;

- the disabled spouse of the testator;

- disabled parents of the testator;

- disabled dependents of the testator.

As a general rule, the obligatory share in the inheritance is at least half of what the heir could receive by inheriting by law.

The issuance of a certificate of inheritance is regulated by Art. 73 Fundamentals of legislation on notaries.

At the stage of issuing a certificate, one of the most important actions performed by a notary is checking the will, namely:

- the notary must establish that the will was drawn up in writing, in accordance with the requirements of the law;

- the will must be certified by a notary.

After passing all stages of document verification, the notary issues a certificate of the right to inheritance in the shares specified by the testator. If the testator has not specified the shares of the heirs in the will, then the inheritance is considered bequeathed in equal shares.

In a situation where the heir does not have a will, but he knows or assumes that it exists, he should contact the notary who is handling the inheritance matter. The notary will check the presence of the will in the unified information system of the notary, and determine its content, if any.

In case the heir does not know the information about the notary who opened the inheritance case, there is a “Search for Inheritance Case” service, which allows you to find out information about the notary who opened the inheritance case using the testator’s last name.

Procedure for issuing a certificate

The execution and issuance of the document is carried out only upon the application of the interested heir to the notary office at the place of the opened inheritance within the established period limited by law. The procedure for issuing these documents is the same for all heirs - legal entities and individuals, and even the state.

The issuance procedure is regulated by Art. 70-71 “Fundamentals of the legislation of the Russian Federation on notaries.”

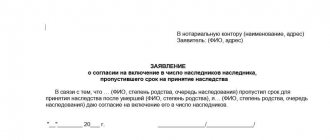

The conditions for issuing a certificate provide for the notary to verify the fact of the death of the testator, the place/time of the opened inheritance, the volume of inherited property and the point of its physical location. When inheriting by law, the employee is obliged to request documents proving that the persons who submitted the applications have the right to do so. If one of the relatives does not have such evidence, they can be included in the composition of the heirs with the consent of the remaining successors (Article 72 of the Legislation). If inheritance occurs according to a will , the notary checks the presence of a will document and finds out the presence of applicants for the obligatory share (Article 73 of the Legislation).

It is necessary to submit documents that clearly confirm: the time and fact of opening of the inheritance (death certificate of the testator), place of opening (his certificate of last registration), the identity of the applicant heirs (their passports), special documents (certificate of disability, etc.) . Real estate documentation is provided (the list is provided by a notary). When transferring inheritance of property (birth/marriage/divorce/change of surname), if there is a will, you must provide it to a notary.

If among the successors there are minors and incompetents , then after drawing up the document the notary is obliged to report it to the guardianship authorities.

Amount of state duty for issuing a certificate of inheritance

In 2005, the State Duma of the Russian Federation adopted Law No. 78-FZ, which exempts heirs from the obligation to pay tax on inherited property.

However, this does not mean that the heir will be able to enter into the inheritance and become the owner of a certificate of right to it completely free of charge, since it is the heirs who are responsible for paying the state duty.

This fee is collected by the notary, and the amount of the fee is established by the Tax Code of the Russian Federation.

The amount of state duty is not clearly defined by the legislator and depends on such circumstances as:

- degree of relationship between the heir and the testator;

- the value of the inherited property.

pp. 22 clause 1 art. 333.24 of the Tax Code of the Russian Federation establishes that:

- heirs of the first and second priority (children, spouses, parents, full brothers and sisters) must pay a state fee in the amount of 0.3% of the value of the inherited property. In this case, the amount of the duty cannot exceed 100,000 rubles.

- other relatives of the testator, as well as heirs who are not relatives but inherit under a will, must pay 0.6% of the value of the inherited property. In this case, the amount of the duty cannot exceed 1,000,000 rubles.

It follows from this that the assessment of inherited property is one of the most important stages in conducting an inheritance case, because without it it seems very difficult to correctly calculate the duty.

Objects that may need an appraisal include real estate, vehicles, art, and others. It also depends on the type of inheritance object and who has the right to carry out such an assessment. For example, the assessment of the value of real estate can be carried out both by organizations involved in such assessment and by government agencies for recording real estate objects.

In order to calculate the fee, the heirs must provide the notary with appraisal documents indicating the value of the inherited property.

Additionally, it is worth noting that the Ministry of Finance of the Russian Federation in letter 03-05-06-03/19714 dated 04/04/2017 explained that since since 01/01/2013 in our country the inventory value of housing facilities has not been calculated, the inventory value for real estate valuation is no longer applicable. To calculate the state duty, the heirs have the right to present a document indicating the market or cadastral value of the inherited property.

In practice, the most widespread is the market valuation of real estate, since experts note that the cadastral value often exceeds the market value, which significantly increases the amount of state duty. In order to provide the notary with a documented calculation of the market value of the property, the heir must contact an organization licensed to carry out appraisal activities.

It is important to correctly determine the value of inherited property

It is important to understand that the heir has the right to refuse notary services, which are of a technical and legal nature (copies of documents, etc.). In 2021, the Supreme Court considered a rather high-profile case in which the plaintiff appealed the notary’s refusal to issue a certificate of inheritance due to the fact that the plaintiff did not pay for additional notary services in the amount of 11,000 rubles. The plaintiff refused to pay for these services, indicating that he did not ask for them to be provided and prepared all the required documents himself. The court indicated that refusal to pay for technical services of a notary is not included in the list of reasons for refusal to perform notarial acts, since such services are not notarial, but only optional and their imposition is unacceptable.

When calculating the duty, it is important to know that its size is not determined by whether the inheritance procedure is carried out by law or by will.

The Tax Code establishes a list of citizens who are exempt from paying state taxes in full. These include, in particular:

- citizens when inheriting the property of persons who died in connection with the performance of state or public duties;

- citizens, when inheriting finances in bank accounts;

- minor heirs;

- incapacitated heirs over whom guardianship or guardianship has been established.

Grounds for cancellation of a document

A notary has the right to annul or cancel a certificate issued by him without going to court under the following conditions:

- the presence in the document of errors regarding the property (real estate, vehicles, weapons) and means of the deceased, clerical errors;

- The consent of the heirs to perform this notarial act is of great importance. Consent must be in written form only.

After canceling the certificate of inheritance, the notary must make a corresponding decision, on the basis of which he will subsequently make a new sample of the document.

Recognition of a certificate of inheritance as invalid

Disputes between heirs are a common situation.

All heirs who have become owners of a certificate of inheritance should remember that in certain cases such a certificate can be challenged.

The most common situations in which it becomes necessary to challenge evidence are:

- issuing a certificate without taking into account the legal rights and interests of all heirs;

- issuing a certificate to an unworthy heir;

- invalidation of the will on the basis of which the certificate was issued.

An inheritance that includes valuable property often becomes the subject of disputes between heirs and an attempt to appropriate as large a share of the inheritance as possible. There are often situations when relatives who have not communicated for many years begin to lay claim to the property of a suddenly deceased common relative.

Thus, two sisters went to court with a demand to restore the deadline for accepting the inheritance and invalidate the certificate of inheritance issued to the wife of their deceased father. In support of their claims, the plaintiffs indicated that they were heirs by law, and the deadline for accepting the inheritance was missed due to the fact that no one informed them about the death of their father. The plaintiffs noted that after their parents’ divorce, they did not maintain a relationship with their father. The court, having studied the case materials, indicated that the plaintiffs were not deprived of the opportunity to maintain a relationship with their father, take an interest in his life, and did not communicate with him solely of their own free will. The court especially emphasized that family relations represent not only an opportunity to make claims for inheritance, but also the manifestation of the necessary attention to the testator during his life, because with due attention, the plaintiffs could and should have learned about the death of their father in a timely manner. Lack of interest in the life of the testator cannot be considered a valid reason for missing the deadline for accepting the inheritance. Based on the above, the court refused to satisfy the plaintiffs' demands in full. (Determination of the Supreme Court of the Russian Federation No. 86-KG19-1 dated March 19, 2019).

At the same time, an analysis of judicial practice shows that courts quite rarely satisfy claims to declare an heir unworthy and are often guided by formal grounds. In order to recognize an heir as unworthy, significant evidence is required.

For example, the court of the Voronezh region, by ruling No. 33-3614 dated September 26, 2017, refused to recognize the testator’s wife as an unworthy heir, indicating that failure to visit the testator during his illness, as well as refusal of moral and financial support, cannot be grounds for recognition unworthy heir.

How to get a?

So, in order to inherit under a will, the applicant must fill out and submit an application. The papers are submitted to the notary at the place of the last place of registration/residence of the deceased owner.

The issuance of certificates depends on various factors - the validity of the will, the death of one of the heirs, the presence of a conceived but unborn successor, a mandatory share, the indication of a sub-heir, a property manager, etc.

Procedure

Let's imagine that the applicant is among the candidates to receive an inheritance under a will. Therefore, you need to declare your rights and obtain a certificate of inheritance.

General algorithm of actions:

- Find out about opening an inheritance case.

- Prepare for inheritance under a will.

- Contact a notary who keeps the written will of the deceased citizen.

- Draw up, sign and submit an application for a certificate of inheritance.

- Prepare the initial package of documents.

- Assess the assets due: real estate, car, jewelry, antiques, household items, shares, etc.

- Contact the notary a second time - provide the missing documents + an appraisal report for the property.

- Pay the state fee and attach the receipt.

- Obtain a certificate of inheritance - a document of title to ownership of shares or assets.

For other nuances, deadlines, documents, expenses and examples, read the article - “Entering an inheritance after death under a will.”

Try not to delay entering into an inheritance - missing the 6-month deadline is fraught with lengthy proceedings and the risk of losing your chances of inheriting.

Procedure

Initially, the heir needs to determine two things: is the inheritance case under the will open and which notary is handling it?

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The primary link is to the place of registration of the deceased citizen. If there are several offices in the area, call any notary and find out where exactly the documents should be submitted.

If the registration address is unknown, the heir has the right to submit an application at the location of the property (for example, an apartment or house). If there is only movable property, the application is submitted at the location of its most valuable part (for example, a foreign car or a collection of paintings).

The applicant must declare his rights within 6 months. The starting point is the date of death of the testator - it is indicated on the citizen’s death certificate.

The document is issued by the civil registration authority (registry office) on the basis of a medical report or by decision of a judicial authority. If you do not have a death certificate, you will have to restore it - for information on how to do this, read the article “How to restore a death certificate.”

An inheritance certificate is issued 6 months after the death of a citizen. The applicant needs to have a passport and a report on the value of the share for inheritance. The notary calculates the amount of the tax, gives the applicants the details for paying it - the heirs go to the bank, pay the state fee and return to the notary. The final step is to issue a certificate of inheritance - an official document with which ownership can be registered.

Application to a notary

The basis for issuing a certificate of inheritance is an application. The notary usually has the document form - a specialist can offer his services in filling out applications. The candidate will only have to read the text and put his personal signature.

If a personal visit to a notary is not possible, citizens can send an application by mail - by registered mail. The countdown starts from the date of the postmark. Be sure to keep the postal receipt-notification - in which case it will prove that the heir met the deadlines for entering into the inheritance.

The application must provide the following information:

- name of the notary office;

- personal data of the applicant (full name, place of registration, contact telephone number);

- description of the fact of death of the testator;

- reference to the will (required);

- the purpose of filing an application is to enter into an inheritance under a will + issue a certificate of inheritance;

- link to availability of additional applicants;

- date, signature of the applicant.

By signing the application, the heir agrees to accept the property under the terms of the will. It is not a fact that the inheritance includes only valuables - it is quite possible that the testator will also leave a less pleasant inheritance: debts, obligations, encumbrances, testamentary entrustments, etc.

Documentation

When submitting an application, the notary checks the available documents for entering into inheritance under a will. The list of papers usually depends on the type of property and the method of accepting the property.

This includes:

- ID card of a citizen of the Russian Federation;

- evidence of the testator's death - a death certificate from the registry office;

- a certificate from the place of registration of the deceased person - issued at the migration department;

- evidence of the property rights of the testator - purchase and sale agreement, certificate of inheritance, deed of gift, exchange agreement, etc.;

- report on cadastral/inventory/market price of identified assets;

- confirmation of tax payment - receipt.

If the heir under the will actually enters into an inheritance, he will need to inform the notary about this. Prepare checks for payment, invoices, receipts for the repayment of debts, witness statements, certificates from the housing office and the Tax Office... In a word, confirmation of the actual entry into the inheritance of the deceased.

Price

The issuance of a certificate of inheritance is carried out after payment of tax. The amount of the state duty is determined by law - the final rate depends on a number of factors. Among them are the line of kinship and the value of the inheritance.

State duty amounts in 2021:

| State duty amount | Who is the payer? |

| 0,3% | Tax payers at a reduced rate are family members and close relatives of the testator. This includes parents, children and living spouse. The legislator also included the brothers and sisters of the deceased subject as close relatives. The maximum tax amount is limited by law - it cannot exceed 100,000 rubles. |

| 0,6% | Tax payers at this rate are the remaining beneficiaries (individuals and organizations). The method of inheritance does not matter. The maximum collection amount is set at 1 million rubles. |

Tax relief is provided for a preferential category of citizens. To exercise their rights, heirs must provide supporting documents (for example, a disability certificate or a pension document).

Notary services are a separate expense item. The cost of services depends on the city of residence of the testator. If the notary has appointed a trustee, then the heirs will have to pay for his services. The amount of remuneration is usually specified in the contract. The cost of services should not exceed 3% of the value of the assets entrusted to the manager.

The last expense item is state registration of property rights. The total amount depends on the type of property (for example, registering ownership of a real estate property costs 2,000 rubles per person; if there are several applicants, each pays in accordance with their share in the property).

Dates of issue

You can obtain a certificate only six months after the death of the testator (Article 1163 of the Civil Code of the Russian Federation). The document is issued to all heirs at the same time or to each one separately, depending on the wishes. The certificate indicates the share of each heir, which is expressed as a percentage (for example, ¼ of the privatized apartment).

If after a while the unaccounted property of the testator is revealed, the notary issues an additional certificate to the heirs.

A delay in the issuance of a document may be caused by the following reasons:

- The presence of a conceived but not born successor.

- Death of one of the heirs during the process of paperwork.

- Actual acceptance of ownership.

- Court proceedings on a claim to challenge a will (for example, for an apartment).

- Refusal or non-acceptance of inheritance by first-line claimants.