Features of registering real estate during marriage

As mentioned earlier, all real estate purchased from the moment of registration of the marriage until the divorce is considered the joint property of the spouses. If the husband bought an apartment and registered it in his name, this does not matter: during the division, the wife will be able to receive her part.

Even if the second spouse was not working at the time of purchasing the apartment, the court will divide everything equally (Article 39 of the RF IC). They can allocate a larger share, acting in the interests of the child if he remains with him.

Conclusion: some people are offended if only one person tried to do everything for the family and earn money, and the second spouse did not make any efforts, but upon division receives half of the property. By law, it is considered public property. But there are several ways that will allow you not to divide and preserve your property after a divorce.

Tax deduction for purchases during marriage

If a husband and wife buy an apartment, a refund of 13% personal income tax depends on the mode of ownership:

- purchase of housing in joint ownership - a tax deduction is received by one of the couple, or the payment is distributed equally between husband and wife;

- buying an apartment in shares involves distributing the deduction strictly in accordance with the size of the part of the property;

- purchasing real estate with a mortgage - the tax deduction is calculated from the cost of the apartment and the interest paid on the loan.

The process of applying for a deduction in the case of shared ownership is somewhat different from joint property - in the first situation, the spouses must submit an application for the distribution of expenses between them.

Buying an apartment while married: how to protect yourself

It is advisable to take care of your own safety even before purchasing real estate during marriage. There are several ways to protect yourself:

- Draw up a marriage contract.

- Buy an apartment through a third party.

- Pay for real estate with personal money accumulated before marriage.

There are other ways, but they are less secure. Let's look at each of them in detail.

Registration of a marriage contract

Art. 40 of the RF IC allows you to conclude a marriage contract, and then instead of the legal regime of property in the family, contractual property will operate. The contract is concluded before registration or during marriage. In the first case, it comes into force only after the marriage is concluded in the registry office.

Important! A prenuptial agreement is relevant if the apartment is purchased with a mortgage and the spouse wants to keep it in the event of a divorce. The second spouse will not be able to claim the property, but he will not have to repay the debt to the bank, as he will not be involved as a co-borrower. The agreement must be certified by a notary.

How to conclude a marriage contract?

To draw up a marriage contract, you need to agree in advance what information it will contain. It is advisable to first draw up a draft, agree with each other, and only after that draw up the final version of the contract. It indicates only the specifics of financial and property legal relations in the family. He cannot regulate personal relationships.

How to draw up an agreement:

- Agree on the contents of the document, draw up the final version in triplicate.

- Contact a notary and sign the contract in his presence. He must sign and seal.

- Submit the agreement to the bank if the apartment is purchased with a mortgage.

A fee is paid for notarization in accordance with Art. 333.24 Tax Code of the Russian Federation – 500 rubles. If the notary independently draws up a contract and provides other technical services, this is paid separately.

Important! The agreement cannot contain provisions that limit legal capacity, regulate non-property relations, or worsen the position of one of the parties.

Purchase through a third party

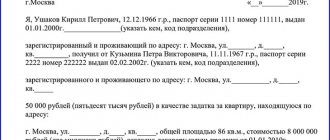

Housing purchased during marriage by one of the spouses with personal funds can be registered in the name of a close relative or other trusted person. In fact it looks like this:

- The spouse chooses an apartment and negotiates with a relative or friend who will act as the buyer.

- A purchase and sale agreement is concluded, where a friend appears as the buyer. The spouse allocates money for the purchase.

- The property is registered in the name of a friend, but the spouses live in the apartment.

Legal advice: this option is unsafe, it’s better not to risk it. The friend can kick the spouses out of the apartment at any time, since according to the documents he will be the owner.

There is another option. A friend can buy an apartment, the money will be allocated by one of the spouses, for whom a gift deed will subsequently be drawn up. According to Art. 36 of the RF IC, property received during marriage under a deed of gift is not subject to division. There is also a danger here: if during marriage the value of real estate is significantly increased at the expense of common funds, it may be recognized as joint property and divided (Article 37 of the RF IC).

How to draw up a gift agreement?

To register a deed of gift you need:

- Draw up an agreement and sign it.

- Submit the agreement and other documents for registration to Rosreestr or MFC.

- Receive a new extract from the Unified State Register and an agreement with a registration mark in 7-9 business days.

Notarization is required only if a share is being donated or one of the parties to the transaction is incapacitated. But the parties can turn to a notary at their own request if they want the transaction to be carried out as correctly as possible.

Buying an apartment in marriage with personal money

If a spouse has money saved before marriage or given by someone during marriage, he can buy an apartment with it. In the event of a divorce, she will not share. Even if the second spouse wants to divide, it is possible to prove that the purchase was made with premarital or gift funds.

Mortgage and joint ownership

The most common way to purchase real estate is on credit. In this case, the apartment is pledged to the bank until the debt is fully repaid. And if the agreement with the creditor is executed for only one of the spouses, the object will still belong to both in equal parts.

For loan obligations, husband and wife are co-borrowers, even if one of them has no income. An exception is paying for the loan with personal funds - money received as a gift or from the sale of one’s own property acquired before marriage.

If housing was purchased with funds received as a result of labor/business activity, the property is divided in equal shares between the spouses.

By a notarized agreement, the husband and wife are allocated specified parts of the premises. At the request of the parties to the loan agreement or the bank, the mortgage agreement can be renegotiated separately with each of the spouses and debt obligations can be divided in proportion to their shares.

Until the debt is fully repaid, property can only be sold with the consent of the bank (Article 37 of the Law of the Russian Federation of July 16, 1998). Therefore, when allocating shares and dividing loan obligations, the ownership of housing is re-registered with a note of collateral. After repaying the loan, the spouses acquire the right to dispose of the premises.

Documents required to prove ownership of housing

When selling a home, you will need passports and title documents for the property, which include:

- certificate of state registration of rights or an extract from the unified state register of real estate;

- a document, but on the basis of which the ownership right was registered (agreement on the gratuitous transfer of apartments into the ownership of citizens, a purchase and sale agreement, a gift agreement, a certificate of inheritance, etc.).

Reference! If the apartment is sold for cash, then these documents are quite enough to formalize and register the transaction with the MFC. You will also need a certificate from the Housing Office about registered persons.

How to register only for yourself and not share?

By buying an apartment with your own funds, you can protect yourself from the claims of your other half. In this case, there are certain schemes for purchasing housing so that it does not go to the husband or wife after a divorce.

Buying a home through third parties

The apartment is registered in the name of the closest relative (mother, father, brother, sister).

After registration and receipt of ownership of the apartment, a gift agreement is drawn up. The transaction is registered with the MFC and ownership of the object passes to you. Such registration will require some time and money. In this case, your other half has no legal basis to claim living space.

Donation

By registering an apartment through a gift deed, you will protect yourself from the claims of your other half in the event of a divorce, but you can pay tax. After receiving a deed of gift for residential premises, you must draw up a declaration and submit it to the tax office for verification. If the apartment was received from an outsider, you will have to pay a tax in the amount of 13% of the cadastral value of the property.

When registering a gift agreement, no tax is paid if the apartment was donated by a close relative:

- mother;

- father;

- Brother;

- sister.

In this case, it is necessary to prove family ties.

Inheritance

If you are an only child, then the apartment can be registered in the name of one of the parents. Sooner or later the apartment will become your property, but the husband or wife will not be able to claim it.

Personal funds

When buying an apartment with your own personal funds, you cannot guarantee yourself complete security in preserving the property. By law, an apartment acquired during marriage is considered joint property and upon divorce is divided between spouses in equal shares .

If you fail to reach an agreement with your other half, you will have to prove your right in court. And it’s not a fact that the court will side with you. Most likely, you will have to pay monetary compensation.

Acquisition of property by one of the spouses during separation

If you are officially married, but live separately, then the purchased housing is not subject to division (Article 38 Part 4 of the Family Code). To do this, it is necessary to confirm in court the fact of separation (registration, testimony of neighbors, etc.).

How are rights distributed?

- Own. If the apartment was registered as ownership before marriage or in a civil marriage, then it is sole property and does not require any additional permits for sale. When purchased in an official marriage, the apartment is considered joint property and upon sale the notarized consent of the other half will be required.

- Common joint property. It can only be registered in an official marriage and the presence of both owners will be required during the sale. If one of the spouses cannot be present at the transaction, then a notarized power of attorney for the sale is issued. Spouses have equal rights and in case of divorce the apartment is divided equally.

- Common shared ownership. It can be formalized in both official and civil marriage. In this case, ownership arises for a certain share in the apartment, according to an agreement that is stated in the main agreement. During the sale, the presence of all participants in the transaction will be required and, according to Federal Law No. 172 of June 2, 2016, it falls under the notarial category.

Regulatory framework

According to the Civil Code (Article 256), all property acquired by spouses during an official marriage is considered joint property and is divided equally upon divorce, unless this is stipulated in a separate written agreement (nuptial agreement). In this case, the property is divided according to the algorithm prescribed in it.

If an apartment purchased during marriage is registered in the name of one of the spouses, then it is still considered common joint property and you will not be able to sell it without the notarial consent of the wife (husband) (Article 35, paragraph 3 of the Family Code). The consent of the spouse is not required if more than three years have passed since the divorce.

When is a share in someone else's real estate due?

The most common cases:

- Inheritance. The closest relatives of the deceased may claim a share in the apartment.

- Will. Persons included in the will can count on a legal share in the apartment.

- Mortgage. If the apartment was purchased with a mortgage, but the husband or wife is registered as a co-borrower, they can be included in the number of owners of the residential premises.

- General farming. When running a joint farm for a long time (more than 3 years).

- Repair. If you spent your own money on expensive repairs.

- Marriage contract. If the marriage contract contains a clause on including a person among the owners.

- Sale of an apartment. When selling a privatized apartment and purchasing other real estate, all citizens must be included in the number of owners of the new home.

What can the second spouse claim if the transaction took place before the wedding?

Help: If the apartment was purchased before marriage, then it belongs to the person to whom it was registered or registered.

Let's consider cases when one of the spouses can claim a share in an apartment or monetary compensation:

- if one of the spouses invested their own funds and can prove this in court;

- maintaining a common joint household and living in the same area for a long time;

- if a person is a co-borrower in a mortgage loan, he can claim a share in the apartment even without being officially married.

Video review of the premarital apartment section: