The complexity of the procedure that is associated with the re-registration of ownership of a land plot is to collect all the documents necessary for this in the shortest possible time and in accordance with all established rules, which include the general procedure. In addition, various difficulties may arise that are not dependent on government agencies, but arise in connection with the individual circumstances of citizens. Not to mention how important the procedure is to re-register land, that is, the ownership of another person. Without it, it will simply be impossible to confirm your rights, and if any conflict situations or legal proceedings arise, you may face considerable troubles, including the loss of your own property.

Before re-registering a land plot when purchasing it or obtaining it in another way, you should determine the documents that are necessary in a particular case. When re-registration becomes the result of a transaction between close relatives, it is advisable to consider several options in order to choose the most optimal and mutually beneficial, since each option has its own nuances.

Forms of land ownership

Land ownership is realized through:

- use when the owner has a confirmed right, which makes it possible to carry out work on the site to process and obtain ownership of the results of labor;

- orders when the owner receives property rights to his plot, and with it the opportunity to exploit the land at his own discretion: sell it, donate it, use it as collateral, change it. To obtain such an advantage, the land user needs to re-register ownership of the land plot.

Currently, our compatriots are increasingly interested in the opportunity to dispose of land. Moreover, such property transactions are so diverse that the owner can re-register his own documents for the acquisition of property rights, but also has the right to alienate rights in favor of third parties.

We will talk about the procedure for re-registration of land plots and how to do it correctly. But first, about the legal basis.

The procedure for transferring land rights

To transfer ownership, you can make one of the types of civil transactions. Conditions for this:

- the cadastral chamber must contain information about the alienated land plot;

- Regardless of whether the transaction is planned for compensation or gratuitously, the agreement on it is registered in Rosreestr. Only from the moment of registration and the appearance of information in the cadastre about the new owner, the rights to the object are considered transferred;

- the lease agreement will be registered in Rosreestr only if the lease relationship is of a long-term nature - at least a year;

- any transaction must be a voluntary decision of the owner. This principle is enshrined in his personal signature in all documents.

When do you need a cadastral engineer?

Geodetic organizations carry out work on the ground and draw up a boundary plan for the site. It is required:

- if there is no record in the cadastral chamber;

- before any transaction, if the boundary plan has not been prepared earlier;

- during demarcation;

- in case of disputes and questions regarding the boundaries of the site.

The cadastral engineer carries out geodetic work in the presence of the following persons:

- the owner, long-term tenant or authorized person if there is a notarized power of attorney for the plot itself;

- the same persons representing neighboring areas bordering the study area;

- representative of the municipality, if necessary.

The result of the work is a boundary plan. He contains:

- technical information about the land plot;

- drawing-plan of the area;

- signatures of all those present. In this way, all owners confirm their agreement with the measurements and certain boundaries. If there is no signature, there must be an explanation (for example, notification of delivery of a registered letter with an invitation to attend the land survey). It can be extremely difficult to transfer the right to a plot without the necessary signatures on the boundary plan.

The legislative framework

The procedure for re-registration of land ownership rights in Russia is regulated by three main regulations: the Civil and Land Codes and Law No. 218-FZ “On State Registration of Real Estate”. Subjects of the Federation have the right to adopt normative documents at their level that establish more detailed regulations.

When is it necessary to re-register land ownership?

The need to re-register a land plot may arise if there is a need to change the type of right. There are several of them:

- own;

- rent;

- free term use;

- unlimited use.

The main condition for re-registration is the presence of a title document confirming the fact that the site has been allocated by the local administration. It has no statute of limitations. It should be submitted to the authorized body (this may be the administration of a district, city, settlement) along with the application and other documentation. It is precisely his decision that will serve as the basis for re-registration, as well as a court ruling.

The procedure for re-registration of a land plot as a property

Persons who own an allotment, but are not the owners, can restore their property rights by directly contacting the local executive committee with a request to re-register the land plot. This is permissible if possession occurs on the basis of:

- permanent (unlimited) use;

- rent from the municipality;

- lifelong inheritable ownership.

Grounds and conditions

The basis and condition for re-registration is the presence of documentary evidence of the allocation of the site by the local administration. Such documents are defined as title documents and have no statute of limitations. They should be submitted to the authorized person when submitting the application, enclosing them in the package of other documentation.

More information about the grounds for the emergence of property rights can be found here.

Documentation

The documents submitted to the administration are as follows:

- title document;

- cadastral passport of the land plot;

- applicant's passport;

- or power of attorney for a representative and passport;

- statement.

What to do if there are no documents? - all the details are in our article.

The review period is up to one to one and a half months. After which a decision is made on the admissibility of re-registration of the form of law.

If the decision is positive , issued in the form of an administrative act, the landowner continues the procedure in Rosreestr.

There are no fees for administrative work. But in Rosreestr you must pay a fee of 350 rubles, attaching a receipt of payment to the package of listed documentation, including the administrative act.

The Federal Law of June 30, 2006, No. 93-FZ, which came into force in 2006, is considered a good help in registration It gained popularity as a “dacha amnesty,” that is, a simplified procedure for re-registering a land plot. Today it continues to operate, but at the discretion of regional leadership. Those regions that continue to rely on it allow changes to the form of ownership by direct re-registration in Rosreestr, bypassing the bureaucratic procedure of an administrative decision.

Please note that some situations do not allow gratuitous re-registration . Such legal precedents arise when interested parties have previously exercised the right to privatization. In this case, it is necessary to register the purchase of the land plot at the cadastral value. This rule suspended the effect of the “dacha amnesty”, giving way to a regulatory check of the admissibility of gratuitous re-registration.

How it all happens

After the transaction has been completed, you can begin re-registration. Any purchase, gift or lease transaction requires a written agreement. If you plan to buy or rent a plot, you will also have to sign a preliminary agreement, after which you will pay part of the money. The main agreement requires registration with Rosreestr. By the way, this can be done by contacting the nearest MFC.

It is allowed to buy out land plots that were previously provided for indefinite use or lease, or if the category of land for them has changed. True, the acquisition of a plot will become possible if the owner has ownership rights to the buildings erected on it. So, for example, the ownership of the land under an apartment building will be issued by the Management Company.

But the plot can also be accepted as an inheritance and used as a way to collect the borrower’s debt. This requires a court order. The debtor himself can cede the land to pay off the debt. And then they draw up a compensation agreement.

There is even a certain algorithm that will allow you to quickly collect the necessary documents so that registration of a land plot as private property goes without problems:

- concluding a preliminary agreement and making an advance payment;

- preparation of a package of documents;

- conclusion of the main agreement;

- payment of the remaining money for the land;

- registration of the main agreement.

And you have a legal document in your hands.

Consequences of not re-registering a land plot

A common and common practice is when citizens do not deal with property issues in a timely manner. Then re-registration of the land plot may be impossible.

The allotment can:

- not to participate in property transactions;

- will not be the subject of collateral value;

- will not be able to be included in wills;

- will not be inherited.

If there are no capital developments on the territory of the land plot, the local administration has every right to take the land plot and put it up for auction and obtain ownership rights to it.

If there is a building on the territory of the plot, then the municipality can legally cut off that part of the land where this building is not located, since it is the legal actual and legal owner of the land plot. The only exception is land, which is in inheritable possession for life. This type allows the transfer of land by inheritance and secures dominance by the new owner.

Required Documentation

Now we will talk in more detail about what documents are needed to re-register a land plot. But, before you start collecting them, you will have to clarify what rights you personally have in order to count on re-registration. And they arise if the area:

- has already been used before - it could be gratuitous use or lifetime ownership, which is inherited;

- acquired by purchase;

- received as a gift;

- received as an inheritance.

Each such case requires the following set of papers:

- a statement indicating the basis for possessing property rights;

- cadastral passport and copies of the cadastral plan of the plot;

- deed of gift, purchase and sale agreement, decision of the authorized body on the transfer of ownership of the plot and other document on the completed transaction;

- receipt of payment of the duty;

- document on acceptance and transfer signed by the parties to the transaction (this does not apply to land inheritance).

In special cases, this list may be supplemented.

| purchase and sale | the seller must confirm his ownership of the land being sold; present a civil passport (for an authorized person - a notarized power of attorney) |

| gift transaction | The donor will be required to provide a document confirming that he has ownership of the donated plot. |

| if the donor is married, his spouse must confirm his consent to the transaction | |

| inheritance | certificate of the testator's ownership of the inherited land |

| a will, and if there is no will, confirmation of close family ties with the deceased, and therefore of your right by law to inherit the entire plot or part of it | |

| change of land category | The owner of the land plot should prepare:

|

If the decision to receive a plot is made by an authorized body, all that is required is a basic set of documentation and the passport of the citizen in whose name the land is registered.

However, the registration procedure may well not be so simple. And this is due, first of all, to errors made in the documents. And if they were discovered in land surveying or shared property (of a large family or dozens of shareholders), then the dispute risks dragging on, and passions literally “boil” at court hearings.

So you will have to try to ensure that all documents are in order and completed in a timely manner.

Transfer of land subject to right of use

Plots that are not owned, but have the right to use, are transferred to other persons in other ways:

- lease agreement – registered with the municipality that owns the land;

- You can inherit a plot of land while preserving the form of the right. In this case, it is enough to simply notify the municipality that the right of use has passed to the heir;

- lease agreement after the auction - rights can be transferred only to participants of the same auction who took second, third and subsequent places. Transfer to third parties who did not participate in the auction is not possible.

To transfer the right to land, you need to contact the municipality with the following documents:

- application from the owner of the plot;

- statement from the receiving party;

- indication of the basis for the transfer of rights;

- confirmation of the absence of debts for the land.

This type of transfer of rights cannot be compensated.

How to re-register a land plot to a third party

The first and very important rule is that re-registration is allowed only on the condition that the ownership of the property has already been registered previously.

In other cases, when there is a transfer of property rights, it is only possible to re-register the plot under the house. And the transfer of property will be carried out only if the property transaction is completed.

Re-registration of rights to another person (relative or not) takes place in several stages:

- Draw up a document that will become the basis for the transfer of ownership. If we are talking about immediate relatives or minor children, a deed of gift turns out to be the most suitable option.

- Have it certified by a notary to confirm the legality of the paper and the voluntary nature of its execution. During the procedure, in addition to the donor himself, the recipient must also be present (for a child under 14 years old, his parents or guardians).

- Make adjustments to the earlier information contained in the Unified State Register of Real Estate – thereby re-registering ownership rights.

If the inheritance was accepted by court order, because the six-month period allotted by law for entering into the inheritance turned out to be overdue for some reason, it is necessary to present both the court decision and a stamp indicating its entry into force. This is what the step-by-step instructions for land users look like.

What are the methods of re-registration?

There are two forms of ownership: ownership and right of use. In the first case, the owner of the land plot can enter into any transactions; they only need to be registered with Rosreestr. The right of use imposes some restrictions on re-registration: when making transactions, the participation of the legal owner – the municipality – is required.

Methods of alienation of rights:

- complete transfer of rights to the allotment to another person: sale, exchange, donation;

- temporary transfer: the plot can be rented out, including for a long term;

- transfer of the right of use or ownership to the heirs;

- court decision;

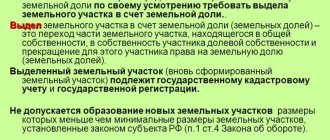

- delimitation - that is, the distribution of one plot between several new owners (usually relatives).

Design features

In the event of the owner's death

Re-registration of property rights has certain specifics, since it occurs through the inheritance procedure.

The successor must, within 6 months after the death of the owner, confirm with a notary his intention to enter into the inheritance. And when submitting documents for registration, do not forget the certificate of inheritance. To re-register a previously existing property right, you will have to wait until six months have passed from the date of death of the testator.

Purchase and sale

Sometimes re-registration is carried out by deeding a deed to a close relative. But then the new owner will not receive the 13% return on the cost of the land plot specified in the contract.

Other Features

The legislator insists that the re-registration of land separately from the residential and non-residential buildings located on it is not allowed. The transaction is uniform and applies to all real estate.

A plot of land transferred to a spouse is associated with the use of joint property. And this implies some difficulties in transferring property rights to the other spouse.

A little about privatization

The privatization of land plots has become a free chance for many landowners to transfer their holdings to personal use. This opportunity has once again been extended, now until 2018. Only this will allow you to own your lands in SNT without restrictions.

The “dacha amnesty” program allows you to do this according to a simplified scheme with a minimum of documents. Thus, it is possible to do without a permit to build a country house; there is no need to legalize the construction.

If your lands do not fall under protected areas, are not reserved for the needs of the state, or privatization is directly prohibited, collect papers and transfer the land into ownership.

Useful tips from a lawyer

At the end of our conversation, the expert shared with us a couple of useful tips that will help you properly re-register the site and avoid stupid mistakes. According to her, when re-registering land to a stranger, it is best to formalize the transfer by drawing up a purchase and sale agreement.

It is also very important to check and re-read all important papers and documents. This will avoid confusion and prevent unpleasant surprises in the future. In addition, the lawyer drew attention to the fact that the conclusion of a purchase and sale agreement does not in fact mean a complete transfer of property rights to the buyer. Therefore, after concluding a transaction with the new owner, it is necessary to register the changes with the MFC, otherwise in this case the risk of being left without land and without money increases.

What are the consequences if ownership is not re-registered?

If the procedure for re-registration of ownership of the plot has not been carried out, then the immovable object has no legal force. It cannot be sold or given away.

- An individual, even as an insolvent owner, will retain the right to exploit the land. But if his alienation happens, regardless of the reason, he will not receive compensation, and he has no right to count on it.

- A legal entity will be penalized for the illegal use of a land plot, since there is a strict requirement for it - if a lease agreement is not signed with a local or regional government body, and the ownership is not properly re-registered, the use of the plot is illegal.

When a plot changes owner, re-registration of ownership becomes an inevitable procedure. It is possible to re-register the right to yourself or to another person, even a minor. This procedure cannot be avoided when a piece of land is inherited.

What does the right to permanent, unlimited use of a land plot mean?

The right to permanent use of an allotment is a privilege that is granted to the allocated land for an unlimited time. At the moment, this is the prerogative of only municipal and state authorities.

Ordinary citizens are not granted such rights. But since the times of the USSR, some people may have had them. They can use the land entrusted to them, but they do not have documents for it that record the rights and ability to dispose of it. Let's try to understand in more detail what the indefinite use of an allotment is.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Show content

What it is?

The name of this right already largely reflects its basic essence. Permanent indefinite use of the site gives the right to use the allocated plot for an indefinite period of time.

At the same time, it will officially be in the possession of a state or municipal body. Because of this, citizens and legal entities are deprived of the privilege to dispose of entrusted squares of land .

The mentioned restrictions are in effect from the date of implementation of the updated Land Code of the Russian Federation. Persons who have the opportunity to use land free of charge without time restrictions previously had the right to give agricultural holdings for free use or lease .

At the moment, only ownership and operation for your own purposes are available, but not sale.

Reference! As already mentioned, some citizens received the right to permanent, unlimited use of plots before the start of the updated version of the Land Code of the Russian Federation. Technically, the designated privilege remains with them, but it would be preferable for them to register the specified territory in Rosreestr for themselves.

The object of the right associated with the territory entrusted free of charge and for a long period of time is the land fund. And relationships of a land nature are already determined for him. A specific object will be a specified plot lying within fixed boundaries.

Taxation of a dacha donation agreement in 2021

Based on the information contained in Article 207 of the Tax Code of the Russian Federation, real estate donation transactions are subject to tax, the amount of which currently amounts to 13% of the total value of the transaction, that is, the cost of the dacha.

The cadastral value of real estate, in accordance with paragraph 1 of Article 402 of the Tax Code of the Russian Federation, is included in the tax base for the mandatory payment of personal income tax. At the same time, this value cannot differ greatly from the real market value of the same object (or the gift itself after an appropriate assessment) and be lower than it by more than 20%!

ARTICLE RECOMMENDED FOR YOU:

Prohibition on giving and receiving gifts

Also, it is worth noting that if a close relative, exempt from taxation, decides to sell the dacha within three years from the date of transfer of ownership to him, he will have to pay 13% of the cost of the property .

Donees who are distant relatives, like strangers acting in this role, must pay personal income tax in full, without any special deductions. The Tax Code of the Russian Federation establishes the deadlines within which such recipients should prepare and submit a declaration to the tax office (until April 30 and until July 15 of the following year, which follows the year of the donation transaction).

An example from the practice of lawyers on the website “Legal Ambulance”

Citizen Ryzhikova O. wanted to give her nephew a dacha - a small house with a plot of land, the cadastral value of which was 1,500,000 Russian rubles . Since the aunt and nephew, according to the above rule, are not considered close relatives, the donee had to pay income tax according to the following formula:

1,500,000 Russian rubles x 13% = 195 Russian rubles

Moreover, if these citizens formalize the purchase and sale (provided that the dacha has been owned by the donor for more than 3 years), there will be no need to pay personal income tax. If this property was owned by Ryzhikova for less than three years, you will have to pay an amount that will still be less than when registering a deed of gift:

1,500,000 Russian rubles - 1,000,000 Russian rubles (tax deduction) = 500,000 Russian rubles x 13% = 65,000 Russian rubles

The procedure for drawing up a contract for the donation of a dacha in 2021

As we have repeatedly noted in previous articles on the Legal Ambulance website, since an agreement of this type requires mandatory state registration - the agreement must be drawn up in writing! At the same time, the legislator allows the donor and the recipient to notarize the document drawn up by the parties, recommending that transactions be notarized due to their high cost.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Since the deed of gift regulates the conditions and procedure for the actual transfer of a country house and land, the success of the transaction, in general, will depend on the correctness of the agreement. Therefore, the parties must specifically, clearly and unambiguously state each point of the document!

However, lawyers note that an agreement can be challenged in 95% of cases if its content does not contain the following information:

- The intention expressed by the donor to transfer the dacha free of charge into the ownership of the donee or group of persons;

- the expressed consent of the recipient to accept the gift and assume all responsibilities associated with it;

- information about the parties to the transaction, including their passport details and actual residential addresses at the time of drawing up the dacha donation agreement;

- a detailed description of the properties and characteristics of the object of the donation, including data on the land plot, the address of the dacha, cadastral numbers of the house and plot, as well as the technical characteristics of all premises that distinguish the gift from among similar objects;

- list of grounds for termination of the deed of gift;

- instructions on the current legal capacity of the donee and the donor;

- indicating the period for transferring the object into ownership of the new owner;

- a list of obligations and rights of the parties, as well as their responsibility for violating the terms of the agreement;

- information about the absence of encumbrances or similar restrictions on the use of real estate;

- signatures of the parties.

ARTICLE RECOMMENDED FOR YOU:

Pretentious gift agreement - legal advice

The next step in concluding a dacha donation agreement after drawing up and proofreading the main agreement is its mandatory state registration, or more precisely, the re-registration of ownership from the donor to the donee. All the parties need to do is go together to the registration authority, where they will have to write a corresponding application (from both the donor and the donee), hand over a package of necessary documents and receive a receipt from the organization’s employees with an approximate completion date of the procedure.

The procedure for re-registration: when is it better to make a will, and when is it better to make a deed of gift?

The second option on how to officially transfer a dacha to another person is to make a will.

It is necessary to compare all the pros and cons to make the right decision.

3 advantages of deed of gift:

- There will be no grounds for disputes between heirs regarding the division of property. The property is removed from the estate when a will is made.

- The country house will go to the person the owner chooses.

- The risk of challenge is minimized. If the owner understood the essence of his actions when signing the contract, then there will be no reason to challenge it.

But the gift transaction also has a drawback - it is the need to pay tax. You can try to circumvent the law by registering the property first in the name of a close relative, and then again in the name of the person to whom the property is ultimately transferred. But you will still have to bear the associated costs: you will need to pay for notarization of documents and registration of ownership rights in Rosreestr.

When you need to transfer real estate to someone other than a close relative or a stranger, it makes sense to draw up a will.

The fundamental difference between a will is that the property goes to the heir only after the death (death) of the testator. That is, drawing up an inheritance is a transfer of property not right now, but in the future.

The cost of drawing up a will is 1 thousand rubles. Plus, there will be expenses for further registration for the heirs (2 thousand rubles - duty to Rosreestr, payment of notary fees, depending on the degree of relationship).

Drawing up a gift agreement - 3.8 thousand rubles. plus 2 thousand rubles. – fee for registration of ownership rights. Besides this, you won't have to pay anything.

It is necessary to take into account the circumstances in advance in order to choose the right option.