The procedure for entering into inheritance in Russia

Russian legislation strictly relates to the transfer of rights to property and rights, therefore there are rules for identifying unworthy heirs. This is the name given to persons who influenced the deceased to act in their interests, ignoring the interests of other heirs or their own. This category may include relatives who did not provide care for the deceased or did not help in difficult times.

In the Russian Federation there is an effective procedure for registering an inheritance through a notary, which includes several points:

- Relatives are required to collect and submit documents. Draw up and submit a notarized application, bring a death certificate (copy or original), a document indicating the address of the deceased before his death.

- The case of acceptance is opened and character is established.

- A consultation is held with a notary, who will individually evaluate the case and determine what additional documents and manipulations should be prepared so as not to disrupt the procedure.

- Complete and pay the state fee to obtain a certificate.

- Document the fact that the owner of the inherited property has changed.

- Perform the actual transfer of rights to the heir.

- The notary issues a special certificate.

When a disposition of property has not been made, one must proceed within the prescribed legal provisions. Then factors such as the degree of relationship and the legality of inheritance are taken into account.

Inheritance contract

Registration of inheritance can take place not according to a will, but using an inheritance agreement. The will is unknown even to the participants, and the inheritance agreement provides for the knowledge of all interested parties. In addition, information is available about what conditions the heir must adhere to in order to enter into inheritance according to the law. An inheritance agreement is more authoritative than a will, and its terms will be followed first.

The agreement is concluded between the testator and the heir. This document must contain the following information:

- under what conditions the number of heirs is determined, and in what order the transfer of rights to inheritance will take place;

- executor and his terms;

- what obligations do the parties have in relation to property or non-property objects (they should not contradict the law);

- discuss the circumstances, depending on which different consequences may arise.

The inheritance agreement is limited by the provision on the allocation of a mandatory share. After drawing up the agreement, it is studied by the parties and signed. Next, the document is certified by a notary.

Even if one of the parties to the agreement renounces his share, this does not affect the rights of the other parties. The only one who can refuse the agreement is the testator, but the parties must receive notification of changes. In addition, participants can receive compensation for losses they incurred while fulfilling the terms of the contract. After the contract is terminated, the testator can fully dispose of the property, including by selling it.

Moment of inheritance

The moment of inheritance is considered to be the day when a person receives a notarial certificate confirming the transfer of property rights. Such a certificate is given to each heir no earlier than six months after the death of the testator.

Attention! The Civil Code provides for the possibility of issuing such a certificate earlier than the specified period, but only if the notary is completely confident that other people will not make their claims to the property. That is, after confirming that there is only one candidate for the property.

Despite the fact that the right to inheritance arises with the receipt of a notarial certificate, it will be possible to dispose of the property only after the re-registration of property rights to the object. And after the re-registration of property rights, a person will receive a confirming document allowing full use and disposal of the property. Including selling it, donating it, passing it on by inheritance, renting it out.

Types of inheritance

Entering into an inheritance after the death of the testator can take place taking into account several scenarios, depending on what is the prerequisite for receiving it - a will or the law. Each option requires detailed consideration.

Entry into inheritance according to law

According to the law, entry into inheritance after death occurs if the deceased did not create anything. The law prescribes the order of heirs. There are 8 steps. For example, children, husbands/wives, parents, and the state closes the list. A certain order is required - everyone is called to the notary, according to their place in the queue. If there are no main heirs, the second, third, etc. are called. queues.

Entry into inheritance under a will

A will is a document that indicates who the heir is without taking into account the degree of relationship and other circumstances. The document can be closed (when the notary does not know about the contents of the will, and the envelope is transferred sealed in front of witnesses) and open (the notary is familiar with the contents). Please note that a closed will may contain errors and inaccuracies, which sometimes affect the procedure. Although if the inaccuracies are minor, they will not affect the legality of the paper.

The document is usually drawn up by a notary, who checks, certifies and stores it. The specialist will ensure that everything goes correctly, without trying to challenge the document or invalidate it. In addition, the notary is obliged to confirm the legal capacity of the testator and make sure that he understands his actions. This applies to situations where people try to make a will while under the influence of alcohol or drugs.

There must be only one will that is legally binding. When there are several conflicting documents, the one drawn up last will be valid. However, the document can be canceled by making a new will or by writing an official cancellation of previous instructions.

The heirs do not need to be notified of the will. To verify the availability of a document, you should contact a notary office, where a search will be carried out in the register upon request. Then the essence of the will is conveyed to the heir. This information cannot be publicly available, as this violates the secrecy of the will. Registration of inheritance through a notary will make this procedure safer.

What can be included in the inheritance and what cannot?

Before you begin to enter into an inheritance according to the law, you should determine what is included in the category of “inheritance”. This is the property, rights and obligations that belonged to the testator at the time of his death. This also applies to debts that are transferred to the heir, along with the property on which they “hang.”

The personal rights and obligations of the testator are not transferred. For example, alimony, compensation for harm, etc. As well as non-property rights and benefits of an intangible nature.

Who can apply for an inheritance?

Before entering into an inheritance, you should find out who can claim it. The right to inheritance arises in the following cases:

- you were mentioned in the will as an heir;

- there is an agreement where you appear as the heir;

- you are a relative of the deceased (in the absence of a will or agreement);

- you have the right to a share in the inherited property, but are not an heir under a will or contract;

- your name appears in the charter of the inheritance fund.

It should be taken into account that an inheritance agreement takes precedence over a will, and a will has greater force than entering into an inheritance by law. But regardless of the situation, all heirs must contact a notary within 6 months after the case was opened.

Since it is not always known whether the testator left a will or agreement, potential heirs can make a request from a notary according to the requirements of the law. Registration of an inheritance through a notary obliges him to check in a special database the existence of an agreement or will.

You can find out which notary is holding the inheritance file (provided that it is open). To do this, you should use a special service on the Fed.not platform. chambers. To search, just enter the full name of the testator, date of birth and death.

Who does not have the right to inherit?

Entry into inheritance has restrictions by law, and some persons cannot claim inherited property:

- When the heir influenced the drawing up of the will using illegal methods. For example, he put pressure on the testator, persuaded or gave a bribe to the specialist who was involved in drawing up the document. But these facts need to be confirmed.

- If the parents were relieved of parental responsibilities. The exception is situations where parents have been restored to their rights.

- If the heir, who was obliged to support the testator until death, did not do so.

In these cases, it does not save, even if the person is mentioned in the will.

Inheritance by will

1. Currently, property can only be disposed of in the event of death by drawing up a will. In this case, the making of a will by two or more persons is not allowed. A will is always:

- personal order of a legally capable person

a citizen in case of death regarding his property rights and obligations;

- one-sided deal

;

— notarized

certified transaction or equivalent to such.

The will must be made in person. Making a will through a representative is not allowed.

A citizen who has not reached the age of 18, but is in a registered marriage, has the right to draw up a will. An emancipated citizen (Article 27 of the Civil Code) also has the right to make a will.

If a citizen is recognized as incompetent or with limited legal capacity (Articles 29 and 30 of the Civil Code), making a will is unacceptable.

2. The principle of freedom of will.

A citizen making a will has the right, at his own discretion, to bequeath property to any persons, to determine in any way the shares of heirs in the inheritance, to deprive one, several or all heirs of the inheritance by law, without specifying the reasons for such deprivation, and also to include other orders in the will. The testator has the right to cancel or change the completed will at any time. Freedom of testament is limited only by the rules on compulsory share in inheritance. The testator is not obliged to inform anyone about the contents, execution, change or cancellation of the will (Article 1119 of the Civil Code).

The principle of freedom of will gives maximum choice for the testator both regarding the inherited property and regarding the heirs.

The testator has the right:

— make a will in favor of one or more persons.

Moreover, he is not connected by family or other relationships - this is his choice. The will may indicate both individuals and legal entities, both Russian and foreign citizens;

— to appoint an heir as an heir under a will,

as well as to the heir by law in cases where the heir appointed by him in the will or the heir by law dies before the opening of the inheritance, or simultaneously with the testator, or after the opening of the inheritance, without having time to accept it, or does not accept the inheritance or refuses it, or will not have the right to inherit or will be excluded from inheritance as unworthy;

— appoint an executor,

those. executor of his will as expressed in the will. Currently this can only be a citizen;

— assign

for one or more heirs, both by will and by law, fulfillment

at the expense of the inheritance of obligations of a property nature

in favor of one or more persons

(testamentary refusal)

;

— assign to the heir

(heirs) by law or will, the commission of any

action of a property or non-property nature aimed at achieving a generally beneficial purpose (assignment);

- at any time cancel or change the will he has drawn up,

not explaining the reasons for your actions;

— “forgive” your unworthy heirs,

bequeathing property to them after they lost the right of inheritance, etc.

3. As a general rule, a will must be drawn up in writing and certified by a notary.

Failure to comply with this rule entails the invalidity of the will.

All wills can be divided into notarized wills, equivalent wills and wills drawn up in emergency conditions.

Notarized wills should be divided into simple and closed, with and without witnesses.

A will can be certified by any notary and does not depend on the place of residence of the testator.

Based on paragraph 1 of Art. 1125 a notarized will must be written by the testator or recorded from his words by a notary.

As a general rule, a will must be signed personally. The law makes it possible not to sign a will due to physical disabilities, serious illness, or illiteracy. In such cases, the will must indicate the reasons why the testator could not sign the will with his own hand, as well as the last name, first name, patronymic and place of residence of the citizen who signed the will at the request of the testator, in accordance with the identity document of this citizen.

4. The testator has the right to make a will without giving other persons, including a notary, the opportunity to familiarize themselves with its contents (closed will).

Such a will must be personally written and signed by the testator. Failure to comply with these rules entails the invalidity of the will.

The closed will in a sealed envelope is handed over by the testator to the notary in the presence of two witnesses who sign the envelope. The envelope signed by the witnesses is sealed in their presence by a notary in another envelope, on which the notary makes an inscription containing information about the testator from whom the closed will was accepted by the notary, the place and date of its acceptance, surname, first name, patronymic and place of residence of each witness in accordance with the identity document. When accepting an envelope with a closed will from the testator, the notary is obliged to explain to the testator the contents of the law and make an appropriate inscription about this on the second envelope, as well as issue the testator a document confirming the acceptance of the closed will (Article 1126 of the Civil Code).

5. Witnesses in inheritance law are citizens present during the drawing up and certification of a will.

Witnesses can be voluntary or mandatory.

Voluntary witnesses participate in the execution of a will at the request of the testator and with the consent of the relevant citizens, while mandatory witnesses are required by law and, of course, with the consent of both the testator and the citizen witnesses (transfer of a closed will to a notary (clause 2 of Article 1126 Civil Code); opening by a notary of an envelope with a closed will and reading out such a will (clause 4 of Article 1126); execution of a will equivalent to a notarized will (clause 2 of Article 1127 of the Civil Code)).

The following cannot be witnesses: a notary or other person certifying the will; the person in whose favor a will is drawn up or a testamentary refusal is made, the spouse of such a person, his children and parents; citizens who do not have full legal capacity; illiterate; citizens with physical disabilities that clearly do not allow them to fully understand the essence of what is happening; persons who do not sufficiently speak the language in which the will is drawn up, with the exception of the case when a closed will is drawn up (clause 2 of Article 1124 of the Civil Code).

If a will is drawn up and certified in the presence of a witness, it must be signed by him and the last name, first name, patronymic and place of residence of the witness must be indicated on the will. The notary warns the witness, as well as the citizen signing the will instead of the testator, about the need to maintain the secrecy of the will (clauses 4 and 5 of Article 1125 of the Civil Code).

6. The following are equivalent to notarized wills:

1) wills of citizens undergoing treatment

in hospitals, hospitals, other inpatient medical institutions or living in homes for the elderly and disabled, certified by the chief doctors, their deputies for medical care or the doctors on duty of these hospitals, hospitals and other inpatient medical institutions, as well as the heads of hospitals, directors or chief doctors of houses for the elderly and disabled;

2) wills of citizens who are on ships while sailing,

sailing under the State Flag of the Russian Federation, certified by the captains of these vessels;

3) wills of citizens who are

in exploration, Arctic, Antarctic or other similar expeditions, certified by the heads of these expeditions, Russian Antarctic stations or seasonal field bases;

4) wills of military personnel,

and at points of deployment of military units where there are no notaries, also wills of civilians working in these units, members of their families and family members of military personnel, certified by the commanders of military units;

5) wills of citizens in prison,

certified by the heads of places of deprivation of liberty.

Unlike a notarized will, equivalent wills must be signed not only by testators and persons certifying the will, but also by witnesses

.

The testamentary disposition of rights to funds in banks should also be considered equivalent to notarized wills. Thus, a testamentary disposition of rights to funds in a bank can be certified by an authorized bank employee (Articles 1127, 1128 of the Civil Code).

7.

Drawing up a will in simple written form is allowed only as an exception in the cases provided for in Art.

1129 Civil Code. A citizen who is in a situation that clearly threatens his life, and due to the current emergency circumstances, is deprived of the opportunity to make a will in accordance with the rules of Art.

Art. 1124 -

1128

of the Civil Code, can express his last will regarding his property in simple written form. The presentation of a citizen's last will in simple written form is recognized as his will if the testator, in the presence of two witnesses, personally wrote and signed a document, from the content of which it follows that this document constitutes a will. A will made in emergency circumstances is subject to execution only if the court, at the request of interested parties, confirms the fact that the will was made in emergency circumstances.

8. In case of violation of the provisions of

the Civil Code

, entailing the invalidity of a will, depending on the grounds for invalidity, the will is invalid due to its recognition as such by the court (disputable will) or regardless of such recognition (void will).

A will may be declared invalid by a court upon the claim of a person whose rights or legitimate interests are violated by this will. A will may be declared invalid on the general grounds established by law for recognizing transactions as invalid (Articles 168 - 179 of the Civil Code). It should be noted that challenging a will before the opening of the inheritance is not allowed. The law also defines some special grounds for invalidating a will. Thus, failure to comply with the rules regarding the written form of a will and its certification entails the invalidity of the will.

Misprints and other minor violations of the procedure for its preparation, signing or certification cannot serve as grounds for the invalidity of a will if the court has established that they do not affect the understanding of the will of the testator.

Both the will as a whole and the individual testamentary dispositions contained in it may be invalid. The invalidity of individual instructions contained in the will does not affect the rest of the will, if it can be assumed that it would have been included in the will in the absence of instructions that are invalid.

The invalidity of a will does not deprive the persons named therein as heirs or legatees of the right to inherit by law or on the basis of another valid will.

Drawing up a will in simple written form is allowed only as an exception in the cases provided for in Art. 1129 Civil Code. Particular grounds for the invalidity of the will are mentioned in paragraph 3 of Art. 1124 of the Civil Code and are associated with the fact of the presence of a witness when making a will. In the event that when drawing up, signing, certifying a will or when transferring it to a notary, the presence of a witness was mandatory, the absence of one when performing these actions entails the invalidity of the will, and the witness’s failure to comply with the requirements established by law (personal or other interest of the witness; incomplete legal capacity or illiteracy etc.) may be grounds for invalidating a will. In the first of the cases mentioned, the will is void, in the second it is voidable.

9.

One of the most important

principles

of inheritance by will is

the secrecy of the will

.

This principle is based on the constitutional right of a citizen to privacy (Part 1 of Article 23 of the Constitution). By virtue of Art. 1123 of the Civil Code , a notary, another

person certifying a will, a translator, an executor of a will, witnesses, notaries with access to information contained in the unified information system of the notary, and persons processing data of the unified information system of the notary, as well as a citizen signing the will instead of the testator,

does not have the right, before the opening of the inheritance, to disclose information concerning the contents of the will, its execution, modification or cancellation.

In case of violation of the secrecy of the will, the testator has the right to demand compensation for moral damage, as well as use other methods of protecting civil rights. At the same time, the submission by a notary or other person certifying the will of information about the certification of the will, the revocation of the will to the unified information system of the notary is not a disclosure of the will.

10. The testator has the right to assign to one or more heirs by will or by law the fulfillment at the expense of the inheritance of any obligation of a property nature in favor of one or more persons (legatees), who acquire the right to demand the fulfillment of this obligation (testamentary refusal).

The contents of the will may be limited to the testamentary refusal.

In accordance with paragraphs 2 - 4 of Art. 1137 of the Civil Code, the subject of a testamentary refusal may be the transfer to the legatee of ownership, possession on another property right or for the use of a thing included in the inheritance, transfer to the legatee of a property right included in the inheritance, acquisition for the legatee and transfer to him of other property, fulfillment for him of certain work or provision of a certain service to him or making periodic payments in favor of the legatee, etc. In particular, the testator may impose on the heir to whom a residential house, apartment or other residential premises is transferred the obligation to provide another person with the right to use this premises or a certain part of it for the period of this person’s life or for another period. Upon subsequent transfer of ownership of the property that was part of the inheritance to another person, the right to use this property granted by testamentary refusal remains in force.

The right to receive a testamentary refusal is valid for three years from the date of opening of the inheritance and does not pass to other persons. However, the legatee in the will may be assigned another legatee in the event that the legatee appointed in the will dies before the opening of the inheritance or at the same time as the testator, or refuses to accept the testamentary refusal or does not exercise his right to receive the testamentary refusal, or is deprived of the right to receive the testamentary refusal. The three-year period from the date of opening of the inheritance for filing a request for a testamentary refusal is preemptive and cannot be restored. The expiration of this period is grounds for refusal to satisfy these requirements.

It should be noted that the heir’s obligation to fulfill a testamentary refusal arises only if he accepts the inheritance. A testamentary refusal is executed within the limits of the value of the inheritance transferred to it. If the heir to whom the testamentary refusal is entrusted has the right to an obligatory share in the inheritance, his obligation to fulfill the refusal is limited to the value of the inheritance transferred to him, which exceeds the size of his obligatory share (clause 1 of Article 1138 of the Civil Code).

In cases where a testamentary refusal is assigned to several heirs, such refusal burdens the right of each of them to inheritance in proportion to his share in the inheritance insofar as the will does not provide otherwise.

If, due to circumstances provided for by the Civil Code, the share of the inheritance due to the heir, who was entrusted with the obligation to fulfill the testamentary refusal, passes to other heirs, the latter, insofar as it does not follow otherwise from the will or law, are obliged to fulfill such refusal (Article 1140 of the Civil Code).

If the legatee, by his deliberate unlawful actions directed against the testator or heirs or against the implementation of the testator’s last will expressed in the will, contributed or tried to facilitate the receipt of a testamentary refusal, he is excluded from receiving a testamentary refusal (clause 5 of Article 1117 of the Civil Code).

The legatee has the right to refuse to receive a testamentary refusal (Article 1137 of the Civil Code). In this case, refusal in favor of another person, refusal with reservations or under conditions is not allowed.

In the case where the legatee is also an heir, his right to refuse to receive a testamentary refusal does not depend on his right to accept or refuse the inheritance.

11. A testator may in a will impose on one or more heirs by will or by law the obligation to perform any action of a property or non-property nature aimed at achieving a generally beneficial purpose (testamentary assignment).

The same obligation may be assigned to the executor of a will, provided that a part of the inherited property is allocated in the will for the execution of the testamentary assignment.

Unlike a testamentary refusal, which is always of a property nature, an assignment can be of both a property and non-property nature. In the first case, the rules on the execution of a testamentary refusal are applied to the testamentary assignment.

In a testamentary refusal, the legal significance is precisely the generally beneficial goal, towards the achievement of which the actions of the person obligated to fulfill the assignment should be directed.

Interested persons, the executor of the will and any of the heirs have the right to demand execution of the testamentary assignment in court, unless otherwise provided by the will. The validity period of the right to demand the execution of a testamentary disposition is not directly defined by law, however, clause 2 of Art. 1139 of the Civil Code establishes that the rules provided for by the Code for testamentary disclaimers are applied to a testamentary assignment, the subject of which is actions of a property nature. Taking this into account, the right to demand the execution of such a testamentary assignment is valid for three years from the date of opening of the inheritance.

If, due to circumstances provided for by law, the share of the inheritance due to the heir who was entrusted with the obligation to fulfill the testamentary assignment passes to other heirs, the latter, insofar as the will or law does not indicate otherwise, are obliged to fulfill such assignment.

12.

In order to protect the rights and interests of citizens not specified in the will, but who were dependent on the testator due to incapacity, the law provides for the right of compulsory share of such heir.

This share, as the name suggests, is mandatory and therefore limits the rights of other persons, including the testator and heirs under the will. Such a share is at least half the share that would be due upon inheritance by law

.

The right to an obligatory share in an inheritance is satisfied first of all from the remaining untested part of the inheritance property, even if this leads to a reduction in the rights of other heirs under the law to this part of the property, and if the untested part of the property is insufficient to exercise the right to an obligatory share, from that part of the property , which is bequeathed.

The obligatory share includes everything that the heir entitled to such a share receives from the inheritance for any reason, including the cost of the testamentary disclaimer established in favor of such heir.

If the exercise of the right to an obligatory share in the inheritance entails the impossibility of transferring to the heir under the will property that the heir entitled to the obligatory share did not use during the life of the testator, but the heir under the will used for living (a residential building, apartment, other residential premises, dacha, etc.) or used as the main source of livelihood (tools, creative workshop, etc.), the court may, taking into account the property status of the heirs entitled to the obligatory share, reduce the size of the obligatory share or refuse in her award.

When determining the circle of heirs entitled to receive a mandatory share in the inheritance, as well as the rules for calculating it, it is necessary to take into account a number of provisions:

1) the right to an obligatory share cannot be made dependent on the consent of other heirs to receive it, since the law does not provide for the need for their consent;

2) heirs of the second and subsequent stages, as well as heirs by right of representation, whose parents died before the opening of the inheritance, do not have the right to an obligatory share in the inheritance, except in cases where these persons were dependent on the deceased;

3) Art. 1149 of the Civil Code does not connect the emergence of the right to an obligatory share in the inheritance of the persons listed in this norm with cohabitation with the testator, with the exception of the calling to inherit as obligatory heirs of the disabled dependents of the testator, named in paragraph 2 of Art. 1148 GK;

4) children adopted after the death of persons whose property they had the right to inherit do not lose the right either to a share in the inherited property as heirs at law, or to an obligatory share if the property was bequeathed to other persons, since by the time the inheritance was opened the legal relationship with the testator , being their parent, were not terminated;

5) children adopted during the lifetime of a parent do not have the right to inherit the property of this parent and his relatives, since upon adoption they lost their personal and property rights in relation to them, with the exception of the cases specified in paragraph 4 of Art. 137 of the Family Code, providing for the possibility of maintaining relations with one of the parents in the event of the death of the other or with the relatives of the deceased parent at their request, unless the adoptive parent objects to this;

6) when determining the size of the obligatory share in the inheritance, one should take into account all heirs by law who would be called to inherit (including heirs by right of representation to the share of their parents, who would have been heirs by law, but died before the day the inheritance was opened ), and proceed from the value of all inherited property (both bequeathed and untested parts), including items of ordinary home furnishings and household items. Therefore, when determining the size of the obligatory share in the inheritance allocated to the plaintiff, it is necessary to take into account the value of the property received by him by inheritance by law (or by another will of the same testator), including the value of property consisting of items of ordinary home furnishings and household items;

7) the obligatory share in the inheritance is determined in the amount of at least 1/2 of that which would be due to the heir entitled to it in case of inheritance by law, and is allocated to this heir in cases where he is not indicated in the will or a part of the inheritance is bequeathed to him less than the required share;

the right of the heir to accept part of the inheritance as a mandatory share does not pass to his heirs by way of hereditary transmission;

9) in cases established by law (clause 4 of Article 1149 of the Civil Code), the court may, taking into account the property status of the heirs entitled to the obligatory share, reduce the size of the obligatory share or refuse to award it;

10) rules on declaring an heir unworthy in accordance with Art. 1117 of the Civil Code applies to heirs who have the right to an obligatory share in the inheritance.

13. The execution of a will is carried out by the heirs under the will, with the exception of cases when its execution in full or in a certain part is carried out by the executor of the will. The testator may entrust the execution of the will to the citizen-executor (executor of the will) specified by him in the will, regardless of whether this citizen is an heir.

The consent of a citizen to be the executor of a will must be expressed in writing. A citizen is also recognized as having agreed to be the executor of a will if he, within a month from the date of opening of the inheritance, actually began to execute the will.

The testator may indicate in the will a list of actions that the executor has the right to perform. Unless otherwise provided in the will, the executor of the will must take the measures necessary for the execution of the will.

The executor of a will has the right, on his own behalf, to conduct affairs related to the execution of the will, including in court, other government bodies and government agencies. The executor of a will can perform a variety of functions: search for heirs in whose favor the will was made; notify them about the opened inheritance; contact the notary at the place of opening of the inheritance with an application to take measures to protect the inherited property; distribute inherited property among the heirs in cases where this is possible (for example, distribute items of ordinary household furnishings and household items between the heirs in the absence of a dispute between them), etc. The executor of the will has the right to compensation from the inheritance for the necessary expenses associated with the execution of the will, as well as to receive remuneration in excess of expenses from the inheritance, if this is provided for by the will.

The heirs have the right to demand from the executor of the will a report on its execution; in turn, the executor of the will has the right to compensation from the inheritance for the necessary expenses associated with the execution of the will, as well as to receive remuneration in excess of the expenses from the inheritance, if this is provided for by the will (Article 1136 Civil Code).

14. The principle of freedom of a will presupposes the possibility at any time to cancel or change a will drawn up by him, without indicating the reasons for its cancellation or change.

The testator has the right through a new will

revoke the previous will as a whole or change it by canceling or changing individual testamentary dispositions contained in it. Regardless of whether or not a subsequent will contains direct instructions to cancel the previous will or individual testamentary dispositions contained therein, it cancels the will in whole or in part in which it contradicts the subsequent will.

A will canceled in whole or in part by a subsequent will is not restored if the subsequent will is canceled by the testator in whole or in the relevant part. If a subsequent will is invalid, inheritance is carried out in accordance with the previous will.

A will can also be revoked by means of an order for its revocation

. An order to revoke a will must be made in the form prescribed for the execution of a will. The rules on the consequences of the invalidity of a subsequent will are accordingly applied to an order to revoke a will: in the event of the invalidity of an order to revoke a will, inheritance is carried out in accordance with this will.

A testamentary disposition in a bank (Article 1128 of the Civil Code) can only cancel or change a testamentary disposition of rights to funds placed in the corresponding bank.

Revoking a will, like the will itself, is a one-sided transaction.

Deadlines and documents for entering into inheritance

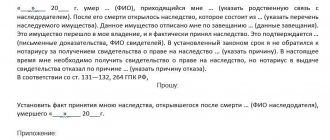

Within six months after the death of a person, all paperwork must be completed. The procedure begins with collecting papers. Documents for entering into an inheritance must be presented to a notary. Usually, this is a notary at the place of residence of the deceased. Having found this specialist, you need to draw up a statement expressing your readiness to accept the property. This will be the reason for opening an inheritance case.

The procedure begins with the collection of documents for registration of inheritance:

- passport;

- death certificate (can be obtained from the registry office);

- papers that confirm relationship (for example, a marriage certificate or birth certificate).

The notary may request additional documents for entering into inheritance.

The next stage is checking the availability of open inheritance cases. If everything is fine, a state fee must be paid. The state duty depends on the order of inheritance. If the first-priority applicants pay 0.3% of the value of the property (no more than one hundred thousand rubles), then the heirs of the third and subsequent stages are forced to pay 0.6% of the property (up to 1 million rubles). To correctly determine the value of the property, you should order an assessment from the BTI. This is a paid service, so the state fee is not the only financial expense that the heir will incur. Therefore, it is difficult to immediately say how much it costs to enter into an inheritance.

All we have to do is wait for the evidence. It will be received 6 months after the death of the testator. If you miss the registration procedure, the property will not be fully disposed of, sold or used in any other way. Real estate registration takes place through Rosreestr (contact the MFC), and the car is registered with the traffic police. But you can do this only after you find out how much it costs to enter into an inheritance, pay the state fee and write an application.

Inheritance of real estate

Real estate has its own characteristics. For example, you need to apply six months after the death of the deceased or the announcement of it. Sometimes deadlines are restored, but only by court decision.

If we are talking about real estate, often the heirs do not enter into inheritance, but simply live in the apartment, pay for it, but do not formalize everything using legal methods. They are actually its owners, but according to the documents this is not the case. It's better to formalize everything. In this case, the inheritance is registered through the MFC. After submitting the application, you need to wait six months and receive a certificate. With the certificate, you can go to Rosreestr and register the apartment in your name.

Entering into inheritance without a will: procedure

First-degree relatives have the right to inherit without a will:

- Children. It makes no difference whether the child is natural or adopted (the main thing is that the procedure is formalized). If the child is illegitimate, he needs to receive a document that will confirm his relationship with the parent. When the testator has an unborn child, the property cannot be distributed until the child is born.

- Spouses. The couple must officially legitimize their relationship, since wedding and actual marriage do not give the right to the property of the deceased. If the couple separated before the document was opened, the spouse also cannot be the primary heir. For such persons, a will is one of the most optimal solutions, since the answer to the question of how to enter into an inheritance without a will will be disappointing.

- Parents. This includes natural parents and adoptive parents, but excludes citizens deprived of authority over the child.

- Dependents. Provided that there is a confirmed fact of dependency during the year. The actual place of residence of a person does not play a fundamental role.

For these persons, the question of how to enter into an inheritance without a will does not arise, since they are heirs of the first priority.

Instructions for registering an inheritance through the MFC

Registration of inheritance through the MFC requires compliance with a certain procedure:

| Going to a notary | The specialist will clarify what documents you will need. The notary also writes an application requesting the issuance of a certificate. This certificate will confirm your rights. |

| Payment of state tax | Entering into an inheritance by law requires payment of a state fee, the amount of which is determined individually for each case. |

| Contact the MFC by selecting a branch, focusing on the place of residence of the heir | Bring a package of required documents. Find out what other documents may be needed to register an inheritance. Ask MFC employees about the date of production of the document. |

| Come to the MFC on time | Pick up a document on property rights |

| Contact a notary with ready-made documents | Finish registering your license. |

What happens if you do not enter into inheritance on time?

Terms are limited to six months. If you skip them, the property goes to the next heirs. If there are no such heirs, the property goes to the state. But missing a deadline is not a death sentence. It can be restored. Only the restoration procedure takes place in court. You can also request written permission to extend the period from other heirs. It is important that all interested parties give consent.

If we are talking about the consent of the heirs, in fact, they are already sharing their property with the right to which they received, because how to enter into an inheritance depends on them. The written permission is drawn up in the presence of a notary. After this, the notary will issue new certificates for each participant.

Restoration of rights can also be organized in court. There must be a good reason for this. You must go to court within 6 months after the delay. Then you won't be able to obtain your license. In this case, going to court involves filing a claim, as well as collecting documents confirming the validity of the reason for missing deadlines. The claim and documents should be copied and copies sent to other heirs. Registered mail with acknowledgment of receipt is used.

Entering into inheritance through court

In this article, we will consider the main cases when registration of the right to inheritance is possible only through the court, and we will also tell you about the procedure for registering an inheritance through the court, and answer the frequent question of heirs “How to enter into an inheritance through the court?”

In accordance with civil law, an inheritance can be accepted as a general rule within 6 months from the date of death of the testator or from the date of entry into legal force of a court decision recognizing a citizen as deceased.

Place and repayment of debts upon entry into inheritance according to the law

To clarify where to accept property, you need to study Article 115 of the Civil Code of the Russian Federation. Such a place could be:

- the place where the testator most recently lived;

- the address where the inherited property is located;

- the area where the most valuable part is located (if the values are distributed in more than one place).

If you are registering an inheritance through a notary, he can involve a manager to protect the property and ensure its preservation until the property passes to the heirs. Then the heir must repay the expenses spent to preserve the property. When all conditions are met, the citizen will officially be able to join.

You can get legal assistance on inheritance issues on our website.