For a long time, the owners of shares in the property of previously existing rural collective farms could not fully dispose of them. This was due to the imperfection of laws and registration: in fact, participants only received compensation in the form of “in kind” - grain, sunflower oil, flour, etc.

With the replacement of collective farms by joint-stock companies and other modern forms of ownership, shareholders now have the opportunity to fully decide what to do with their shared property - cultivate it themselves, rent it out, sell it, give it as a gift, or inherit it. In order to avoid mistakes that will later lead to losses, it is important to understand the nuances.

What is a land share?

This concept is often used by residents of rural areas, because... in fact, the terminology is a “relic” of the collective economy, which appeared after the revolution, during Soviet times. Then the land was taken from the private property of wealthy peasants and landowners, after which it was transferred to common property and conditionally divided among the residents of villages and hamlets.

Now, in addition to his personal plot, where he has his own residential building, outbuildings, garden and vegetable garden, each peasant has a share in the field, which is cultivated by a joint-stock company (formerly a collective farm). Land shares of collective farmers are not the real estate itself, but only the right to it, and according to modern laws it can be realized in different ways:

- Receive compensation for the use of shares by the former collective farm.

- Register as private property and cultivate the territory yourself - run a personal subsidiary plot or engage in farming.

- Sell a segment to another person - individual or legal entity.

- Rent to farmers.

- Set up as an inheritance.

- Transfer as a gift, for free and for life.

Many land shareholders do not know their rights - in fact, the land can be used more efficiently than receiving a ton of grain annually, or less (depending on the share size). If you need money for family needs, you can, for example, organize a sale.

Likewise, rent will bring additional money. Some have enough experience to start their own farm and make a living that way.

Peculiarities

A share on a collective farm is a type of property right that has the following features:

- Territorially refers to rural settlements; The purpose of the plots is agricultural (growing cereals, fruits and other crops).

- The purpose of its issuance by the state is to organize lands that have become ownerless after the liquidation of collective farms. Since not everyone was ready to organize activities on several hectares of land, most collective farmers began to rent out their shares to modern joint-stock companies. There were frequent cases when people practically lost their property - territories were bought from them for next to nothing by entrepreneurs.

- It was issued only to collective farmers - persons who were not employed in collective farm organizations did not receive it. The latter include, for example, rural doctors and nurses, teachers in village schools, kindergarten workers, librarians and others.

- It is not land, but a right to it, therefore it does not have technical characteristics (cadastral number, address, boundaries, area). You can transfer your share to a physical object only after a well-organized allocation procedure.

- When separating, it is necessary to take into account the property interests of other shareholders, so during the process you need to have a good understanding of not only the terminology, but also the nuances of the design.

- The share cannot remain ownerless. It is either used by its owner - the shareholder, or is leased by him to a local organization that was previously a collective farm or state farm. In the latter case, the shareholder receives a profit in kind or in cash.

- Shares of land are measured in ballo-hectares. This is a relative value that allows you to have an idea of what size segment can be obtained when allocating, and also determines the rent.

Differences between property and land shares

These two concepts are different from each other. The first option involves the allocation of property privileges for certain services to the local administration - the specific benefit that it brings to the collective economy and labor contribution. It is allocated from the general property, the size depends on the degree of contribution to the common cause.

The second option concerns only land and was issued to every villager who was a member of the organization, no matter what position he held, what his working day was, the degree of workload and labor hours spent.

Who was given a land share on the collective farm:

- Members of collective and Soviet farms.

- Employees of agricultural organizations.

- To the legal heirs of collective farmers.

Property and shares of agricultural land can be combined into one - in this case the total value will be formed. Ownership will be confirmed by shares or a special certificate. After the merger, the property can be privatized and used at your discretion. The distinctive features of the concepts are contained in Federal Law No. 101, Article 12.

Advantages and disadvantages

The main advantage of share ownership is the opportunity to receive income, in kind or in cash. The latter depends on how the shareholder decides to dispose of the property - lease or sell.

Rent by former collective farms is overwhelmingly paid in kind. Its content depends on the nature of the enterprise’s activities and the crops it sows. This can be feed, sunflower seeds, oats, flour, straw, hay, etc. Quantitative indicators are established by the organization.

Minuses:

- Low harvest, as a result of which the annual payment in kind may be reduced by the administration.

- Obligation to pay property taxes.

- Unfair actions of the tenant - underestimation of share payments, failure to fulfill obligations, improper handling of land.

Violation of laws, soil and environmental pollution and other illegal actions may lead to the seizure of territory into state ownership. In this case, the main responsibility for the condition of the land lies with the owner, i.e. shareholder.

Who buys them

Land shares have the right to receive:

- Members of collective or state farms.

- Residents of rural areas - once.

- Heir of a member of an agricultural enterprise.

- Social workers working in agricultural enterprises.

Important! If, after three years of ownership of the share plot, it has not been used for its intended purpose, then the local municipality authorities have the right to seize it and recognize the share as ownerless.

The process of issuing shares was completed in 1998 , but it is possible to become its owner through a civil transaction.

Land share is the law

The definition of “land share” first appeared in 1991. The previous reform of land collectivization was considered ineffective.

By decree of the president of the country, collective farms were reorganized, and the land was distributed into private ownership in the form of allocations from general agricultural real estate. The reform was carried out with the aim of improving the system and preventing bankruptcy of rural settlements.

All collective and state farms, declared insolvent in 1992-1993 and on the waiting list for bankruptcy, divided their fields into share plots. The procedure for their receipt, possession, disposal and transfer by inheritance is regulated by the law “On Land Shares”.

Acts that also define legal relations in the field of land law:

- The Land Code of the Russian Federation contains general recommendations on the ownership, use and disposal of land plots.

- Federal Law No. 101 “On the turnover of agricultural land” regulates the procedure for transferring a share in land and disposing of it at the discretion of the owner. The act was issued in 2002.

- Federal Law No. 218 “On State Registration of Real Estate” establishes the procedure for assigning a cadastral number and recording plots in Rosreestr. Adopted in 2015.

- Federal Law No. 251 of 2015 obligated everyone who owns shared lands to register with the Unified State Register. This had to be done before the beginning of 2021. According to the document, objects not included in Rosreestr become municipal. After this, the local administration manages them independently.

- Federal Law No. 221 “On the State Cadastre” - the procedure for resolving issues in local Cadastral services. Released in 221.

- Federal Law No. 218 regulates property transactions and state registration of real estate, dated 2015.

The latest legislation was issued for the purpose of identifying agricultural lands. The fact is that after state distribution, a large number of territories turned out to be ownerless, for reasons:

- An agricultural share initially does not have an established holder.

- The owner died and did not make a will, he has no heirs or they do not want to accept the inheritance.

- After death, heirs for certain reasons do not have the right to register property.

- The shareholder does not control the fate of his share. This may be due to a change of place of residence, ignorance of the laws, reluctance to register the territory as property and register it with Rosreestr, etc.

The fact of lack of demand can be protested by the owner - to do this, you need to contact the local municipality and write a corresponding statement. If an allotment is declared ownerless at a general meeting of shareholders, this decision can only be challenged in court.

Is it possible to get a share of land today?

More than twenty years have passed since the reform of the transfer of collective farming to private farming. The question arises: is it possible to get a share in a former collective farm today - if, for example, you move to live in the countryside and get a job in a local joint-stock company?

Who received the land share previously:

- Agronomists.

- Tractor drivers.

- Combiners.

- Machine operators.

- Livestock breeders.

- Milkmaids.

- Veterinarians.

- Shepherds.

As you can see, the professions related directly to farming. One of these specialties can still be obtained today, subject to availability. The difference is that the transformation reform has ended, the plots have been distributed and today it is no longer possible to obtain a share of a land plot.

This cannot be done by distribution, but it is quite possible to buy a share from one of the participants, or even several, again, if there are owners willing to participate in the sale. Free options may also exist in a joint stock company.

This will give certain privileges in receiving in-kind compensation for renting it out. This is what existing shareholders do who want to receive more grain, which will be used for raising livestock or poultry. A share can also be received as a gift or by will.

Do I need to pay tax when allocating a share?

The question of whether it is necessary to pay tax for a land share is regulated by Article 389 of the Tax Code of the Russian Federation. Individuals and organizations having the right of ownership, possession and perpetual use pay a tax, the amount of which is determined by the cadastral value of the land plot.

When concluding a lease or purchase and sale agreement, an independent calculation of income is made, the taxes on which are transferred to the state treasury within the prescribed period. The amount of income is indicated in the 3-NDFL tax return.

Share price

The share price was established when they were allocated, but at present it has lost its relevance. In order to determine today how much your part is worth, you can use the following characteristics:

- The size of the share, which is established in hectares. From it you can determine the approximate area of the territory.

- The cost of similar objects that belong to a given rural settlement - with the same category and intended purpose.

- What is the demand - how many offers have been received regarding the acquisition.

- Characteristics of the land within which the specified part is located: fertility, climate, infrastructure features, etc.

- The presence of burdensome factors – liens and arrests.

It is possible to determine the price not only of the share, which in essence is rather virtual, but also of the allotment itself. To do this, it is necessary to physically isolate it from the general field, i.e. carry out land surveying: determine the boundaries and area. After this, you can take as a basis:

- Cadastral value.

- Market price.

- Order an independent assessment.

To carry out the latter, you must have an Extract from the Unified State Register, a certificate of ownership and a technical passport for the site. Modern prices for agricultural shares vary from 50 to 300 thousand rubles. The right to set the final price remains with the direct owner.

Allocation and privatization

Since an agricultural land share is only a right, in order to privatize an object, it must first be separated from the general agricultural territory into an independent one. Therefore, the registration procedure will be more complex and lengthy than the usual registration of land ownership. You can do this either independently or with the help of a lawyer.

Announcement in local media

You need to start the event by submitting an advertisement in the local newspaper. The text must contain information about yourself and the purpose of highlighting your land share from the general territory. It is important that the newspaper is distributed throughout the entire area where the village is located. You need to contact the editorial office - it is located in the regional center.

The same announcement must be duplicated on the Internet resource of the local government body. To do this, you need to send a written notification to the administration, which contains the date, time, place of collection and its purpose.

Meeting of shareholders

A month must pass after the announcement is released. The next stage will be organizing a meeting where the remaining shareholders of the territorial unit (village) must be present.

Stages:

- You can gather residents using a notification on the local bulletin board. The purpose of the meeting is to determine the boundaries and area of the future land plot. The venue can be the building of the local rural administration (village council).

- A representative of the local administration must be present at the gathering - he checks the registration procedure (everyone must have their passports and certificates of shares with them). He is also the chairman of the meeting.

- It is necessary to appoint a secretary who will register the participants and draw up a protocol.

- Next, a proposal on the parameters of the site is submitted for general discussion. After this, a vote is held, during which the secretary counts the number of those who agree and those who protest. The advantage remains with the answer accepted by the majority.

- The result is calculated in two ways - by comparing shares or by ordinary counting of votes (if the first option is not possible).

- At the end of the event, minutes of the commission meeting are drawn up.

- The decision must be signed by all those present and the chairman. This document will be the basis for the selection. The paper is considered valid if at least half of all shareholders have participated. If not enough villagers came, a repeat quorum is organized - according to a similar scheme.

The protocol must contain the following mandatory points:

- Date and venue.

- The agenda is the subject of discussion.

- Result of the meeting.

- An application that contains a list of participants, their passport details and details of share documents. Signatures are placed here, opposite the data.

- Signatures of the chairman, organizer of the meeting and secretary.

The document is drawn up in two copies - one remains in the archives of the village council, the other is transferred to the initiator of the event. The paper is kept in the village council - anyone interested can apply for it within three days after the vote. An authorized person issues a copy or an extract; the cost of printing is paid by the recipient.

Loading…

Too long?

Reload document

| Open in new tab

Surveying

The next stage, which is the most expensive, is the land surveying procedure. Order of conduct:

- With the signed minutes of the meeting and a certificate of share rights, you need to contact the local Cadastral Service to call an engineer for measuring work.

- A contract agreement is concluded with the executive, which specifies the nature of the service, the object and the final cost of the work. The latter is also stated in the estimate, which is attached to the document.

- To perform the service, a specialist needs to visit the site - based on the results of satellite imagery, he determines the coordinates of the characteristic points of the site. Next, the boundaries are designated and the area is calculated.

- Based on the results of measurements, a boundary plan is drawn up, where the physical characteristics of the plot are recorded. Based on it, a cadastral plan is drawn up - the final display of the territory’s data.

In most cases, in rural areas there is one specialized surveying company. If there are several of them, the quality of the work may be different, so when choosing a contractor you must be guided by recommendations and reviews.

It is important to check that the company has a special license for land surveying. The procedure is paid - tariffs for each locality are different and are clarified by the authorized organization. Documents confirming payment must be retained.

Coordination and cadastral plan

The resulting boundary plan must be agreed upon with other shareholders of the local settlement, because they are potential neighbors. For this purpose, a general meeting will be organized again, where the agenda will be the approval of the survey project. Peculiarities:

- In order for the quorum decision to have legal force, the presence of at least 20 percent of the total number of shareholders must be present.

- If everyone’s shares are different, the number of those present is determined by calculating the share size - at least 50 percent of the total territory must participate.

- The course of the meeting is similar to the gathering, where the owners express their consent to the allocation of land.

- The protocol will be valid if, in addition to the participants, a representative of the local government and the secretary of the meeting put their signatures. The list of voters is drawn up in the form of an appendix indicating their passport data.

- The previously generated boundary plan and other documents collected so far are attached.

Copies of documents are kept in the local village council; interested parties can receive them for review within three days after the meeting.

With the land management file (package of documentation), you must contact the Land Committee - an authorized person will approve the boundaries of the territory on the ground, create a boundary file and issue a cadastral plan with a detailed drawing. The result of the survey can be appealed to the same authority.

Registration in Rosreestr and obtaining a certificate

The final stage is registration of the formed allotment in the Russian Register. Before you write an application and submit documents, you need to pay a state fee. You can contact Rosreestr through the Multifunctional Center. Papers that must be submitted for registration:

- Passport of a citizen of the Russian Federation.

- A statement according to which the right to a land share must be formalized as land ownership.

- Cadastral plan.

- Protocol of agreement with shareholders.

- Certificates confirming the absence of debt to the tax authorities and seizure of property rights.

- An appraisal document establishing the value of the plot.

- Receipt for payment of state duty.

After submitting copies of documents, you must obtain a receipt from the MFC employee. Before this, he checks the copies with the originals. The period for issuing a certificate of ownership is about a month.

It is possible to send documents by mail - the recipient will be the local branch of Rosreestr. In this case, it is necessary to draw up a registered letter with an inventory. Compared to MFC, the method is much less popular.

Owner's rights

The received document gives full right to use and dispose of real estate at your own discretion - sell, give, inherit. It is worth noting that the type of permitted use in this case will be farming, but not individual residential construction.

The latter is possible only when changing the VRI - for this you need to contact the local administration with a corresponding application, to which either a positive or negative answer can be given.

Therefore, the land can only be used for planting or raising animals. Article 78 of the Land Code of the Russian Federation also allows the creation of artificial ponds for fish breeding or forest plantations on such plots.

Responsibilities

In addition to the rights, the owner of the allocated territory has the following responsibilities:

- Pay land tax annually. This issue is regulated by Chapter 31 of the Tax Code of the Russian Federation.

- Operate the plot within the framework of the land category and type of permitted use.

- Prevent its desolation, damage to the quality of the soil, its depletion and destruction.

- Do not pollute the environment.

- Maintain boundary signs placed on the square.

- Observe fire safety measures.

- If you have neighbors, respect their rights.

In case of violation of duties, the owner may be fined or the property may be confiscated for the benefit of the local municipality.

How to sell a share of land?

Selling a share is one of the ways to generate income from this property right. Compared to separation, the procedure is somewhat simpler and consists of two main stages.

Contract of sale

After a price has been set for the object and a buyer has been found, a contract is concluded between the parties. The difference from a regular deed of sale here is the subject, namely, the transfer of a land share, and not a plot of land.

The paper must refer to the certificate authorizing the disposal of the share - indicating the date of issue, identification number and name of the issuing authority.

The remaining clauses are the same as a regular sales contract, including the price the buyer pays to the seller and how it will be paid.

Loading…

Too long?

Reload document

| Open in new tab

Registration

The process is similar to the method of registering ownership when allocating land. At the same time, the package of documents submitted to Rosreestr is slightly different - instead of the minutes of the meeting of shareholders, a purchase and sale agreement is submitted. After receiving the documentation, the act is assigned a state number, and it becomes the main basis for property rights. Transfer of rights through sale makes it possible for the owner to dispose of them in full.

In order to begin direct use of the plot - farming - it is necessary to go through the allotment procedure.

Owner rights

If the allotment is part of the common property of the shareholders, then the owner’s rights are limited:

- will;

- waiver of property rights;

- adding land to the share capital of an agricultural organization;

- transfer to trust management to another shareholder;

- sale or gift to a shareholder.

If the owner allocates land from the general area, then the range of his rights expands and he has the right:

- Conclude purchase and sale transactions of land.

- Exchange for other real estate.

- Rent out.

- Pass on by inheritance or as a gift.

- Pawn it in a bank.

- Donate.

Registration of inheritance

A share in a plot of land is a full-fledged property, so it can be bequeathed to heirs. According to civil law, a will is drawn up in two ways:

- Will. The document is drawn up by the testator and notarized. Six months after his death, the heirs have the right to contact a notary with this paper and receive a certificate of right to inheritance.

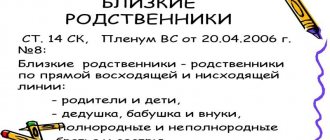

- In law. If a will is not drawn up, only immediate relatives can claim the property of the deceased. The procedure is similar - receiving a document and its further registration in Rosreestr.

In the latter case, you must notify the authorized person about your relationship with the deceased - provide a marriage or birth certificate, or a court decision (if the fact of relationship was determined in court). You need to have a death certificate and documents confirming the absence of debts with you.

Instructions for registration

Allocation of a land share begins with drawing up a plan:

- Approval of the boundary plan at the general meeting of owners.

- Obtaining an opinion from the administration on the compliance of the boundary plan with the norms of land legislation.

- Registration of a cadastral passport.

How to register a land share:

- Collect the necessary list of documents.

- Contact your local administration.

- Carry out boundary surveying.

- Organize a meeting of the participants of the array - when allocating the territory.

- Contact the cadastral chamber for approval of the share as property.

- Contact Rosreestr to complete the property registration process.

In case of an approving decision, the shareholder receives a certificate of grant of share, which indicates :

- Share area.

- Type of ownership: arable land/pasture.

List of documents

To register a land share you need:

- Passport.

- Application (sample).

- Cadastral passport for a plot of land.

- Permission from the administration to receive a land share.

- Receipt for payment of state duty.

- Extract from the land registry.