Mortgage is a targeted credit banking product that is firmly entrenched in the real estate market.

Based on his organizational and financial capabilities, each borrower himself determines for how long to borrow a loan.

The minimum and maximum mortgage term depend on the bank’s conditions, the age of the borrower, the loan program and the amount of payments. There are other factors that determine loan terms.

A mortgage with a minimum time frame has a lower overpayment amount. A mortgage for a maximum period reduces the burden on the family budget and allows you to count on inflation.

Let's look at different options and determine for what period is most profitable for you.

Mortgage terms

The mortgage can be issued for a period from 1 year to 30 years . Russian banks offer minimum and maximum terms for repayment of funds.

The term of a mortgage loan is determined not only by the age of the borrower and the level of his solvency. The state has the right to limit the period of use of loan funds within the framework of special programs.

The main conditions for granting a mortgage are the term, interest rate and loan size . Separate bank requirements relate to age, length of service, income of the borrower and collateral.

The minimum lending term starts from 1, 2,3 or even 5 years, but the maximum term, designed for more than 30 years, is unlikely to be found in Russian banks.

One of the most important conditions for obtaining a mortgage is obtaining compulsory insurance for the collateralized property. This cannot be refused, since the requirement is determined at the federal level.

Interest rates on mortgages are significantly lower than on consumer loans, and they also tend to decrease.

By June 2021, Sberbank offered mortgages for young families at 8.6% per annum, and with state support for families with 2 or more children - even at 6%. Otkritie banks, Gazprombank and Alfa-Bank also offer favorable offers.

If you have already taken out a mortgage with a higher interest rate, contact the refinancing program and re-issue your loan obligations with another bank.

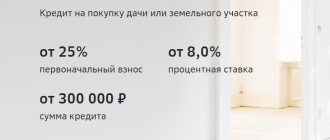

Amount Options

The size of the loan that the bank is willing to make available to the borrower is determined by the following parameters:

- restrictions on the minimum and maximum amount for the target program - for example, at Sberbank you can get from 300 thousand to 30 million rubles;

- the value of the property - the bank issues a loan up to 90% of the appraised value;

- income of the borrower - the amount of monthly payments should not exceed 30-40% of total income.

When determining the amount, the bank also takes into account the age of the borrower, family expenses, including other loan obligations, a list of documents, and the presence of guarantors.

Minor Conditions

Banks tend to use reinsurance, so when issuing long-term loans they impose additional requirements that are not defined at the legislative level, but if they are not met, you will be given a loan on unfavorable terms or even denied.

One of these conditions is life and health insurance . You don’t have to agree to it, but if you refuse, the annual interest rate will increase from 0.5 to 1%. A more reasonable decision would be to accept the bank’s terms and take out personal insurance.

Another important condition is the down payment. You can choose a mortgage program without it, but the conditions are unlikely to be very favorable. By paying the down payment, the borrower demonstrates to the bank his solvency and responsibility.

Typically, the contribution is from 15 to 25% of the cost of housing, and this is a considerable amount. You can pay more, then the bank will offer a more favorable interest rate, but not necessarily.

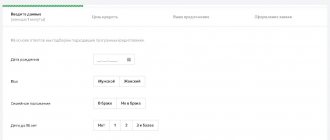

The standard borrower age requirement is 1 year . There is no upper limit, but there are restrictions on the age of the borrower at the time of retirement.

You should also pay attention to the conditions for early repayment . Even if you did not immediately plan for such an item, circumstances may change after a few years, and you will benefit from early repayment. Not all banks provide the opportunity to repay a loan earlier than the due date without charging commissions.

You may also need mortgage holidays - it is also better to find out the conditions for their provision in advance.

Best bank offers

Let's consider where the mortgage will be better, which banks offer optimal terms for concluding a contract. For example, we will not analyze new buildings, because partner rates usually apply to them. But interest on the purchase of secondary market objects is an objective indicator of the profitability of the offer.

Advantageous mortgage options from banks:

| Bank | Base rate | Increasing coefficients |

| Sberbank | 7,7% | 0.3% when submitting an application through the office, 0.4% when the PV is less than 20%, 1% when refusing insurance, 0.5% for non-salary clients 0.8% without certificates |

| VTB | 7.9%, 7.4% with PV from 50% | 0.5% for housing less than 65 sq m, 0.5% for PV less than 20% |

| Opening | 7,6% | 0.5% when submitting an application through the office, 1% with PV up to 20%; 0.4% with a PV of 20-30%, 2% if the borrower refuses insurance; 2% if title insurance is waived. |

| Transcapitalbank | 8% | 0.5% for individual entrepreneurs and business owners, 0.5% for a simplified package of documents, 2.5% for refusal of borrower insurance, 1% for refusal of title insurance. |

As you can see, each bank applies coefficients, so it is simply impossible to say for sure which mortgage will be the most profitable.

It’s better to choose 2-3 banks with the best offers for you and submit applications to them at the same time. If there are several approvals, you will be able to choose the best option in terms of rates and overpayments.

Length of mortgage and age of borrower

The average term for which a mortgage is usually granted is 15 years. During this time, most borrowers manage to pay the bank.

Debt obligations based on the maturity of the loan are divided into three types:

- short-term mortgage - up to 10 years;

- medium-term - from 10 to 20 years;

- long-term - from 20 to 30 years.

Most Russian banks set minimum and maximum age thresholds for borrowers. The requirements are determined by taking into account solvency and reducing the number of risks.

The standard age limit is from 21 to 65 years - the start and end of working age . For a 47-year-old woman, the maximum permitted loan period will be 18 years. A man aged 23 to 35 has the opportunity to apply for a loan for a maximum period.

Pensioners can increase the mortgage term if they have a stable income and pledge their existing real estate.

Some banks are moving away from standard requirements and issuing mortgages with completely different approaches to age. Otkritie Bank and Ak Bars Bank issue mortgage loans from the age of 18. Transcapitalbank and Sberbank lend to non-working pensioners and provide mortgages up to 75 years of age.

This approach allows you to get a mortgage loan for the maximum term, reduce your monthly payment and increase your chances of approval on a modest income.

Who can get a profitable mortgage?

The bank sets extremely favorable conditions for those borrowers who can be trusted. The rate is a direct indicator of trust. If it is low, there are some negative factors, the bank will increase the interest rate. This is standard practice.

Which mortgage borrowers do banks trust most?

- with a positive credit history. It’s good if the borrower has 2-3 debt obligations to banks paid on time. But the presence in your credit history of information about previously issued loans will become a negative factor;

- citizens who work officially and can confirm all declared sources of income. This is not only 2-NDFL or an electronic account statement from the Pension Fund, but also a copy of the work book certified by the employer;

- with decent experience at the current place of work. Banks indicate a minimum limit of 3 months, but they place maximum trust in those who work in one place for several years;

- working in large enterprises. If the employer is a small company or individual entrepreneur, the risks of being left without work are higher, and therefore the degree of trust is reduced;

- with a sufficient level of income. There should be enough money to live on, to pay off the mortgage, and to cover other obligations, if any. The higher the borrower’s income, the greater the chance of concluding a profitable mortgage agreement.

Each bank specifies requirements for the borrower, but these are simply certain frameworks or minimum parameters. This does not mean that a loan will be approved for everyone who meets these criteria.

Validity periods of mortgage loans under special programs

Mortgage for young families

A certificate for a certain amount is provided to one of the spouses aged 21 to 35 years . The document can be issued as a down payment. Determining the loan term depends on the conditions of a particular bank.

Military mortgage

The savings mortgage system in accordance with Federal Law No. 117 allows military personnel to accumulate funds in a special account.

The total amount will be used to purchase housing.

The activities of military personnel are dangerous, and retirement occurs earlier than for other categories of citizens.

The upper age limit for borrowers has been reduced to 45 years.

Military mortgages are available from 22 to 45 years of age. The maximum loan term is 23 years.

Is a mortgage profitable in general?

In terms of interest rates, a mortgage is the most profitable bank loan. It is secured by collateral; the bank does not risk being left with nothing, so it can afford to establish good service conditions.

But it is important to understand that this is a large loan, which is often taken out for 10-20 years. And the longer the return period, the more significant the overpayment becomes. People who enter into contracts for 15-20 years or more often state the fact that with the same money they could buy two or even 3 similar apartments.

How to reduce overpayment:

- initially choose a favorable mortgage term. For example, if you planned to take out a loan for 15 years, try to make it 12. In any case, the level of income will increase in relation to the monthly payment; over the years, payments will become less and less burdensome;

- use refinancing programs. If in the future banks begin to issue mortgages cheaper by 1-2% or more, apply for refinancing and reduce the current interest rate;

- take advantage of all required subsidy programs. Even if the mortgage is valid, it can be partially covered by maternal capital, re-issued under the Family Mortgage program, etc.;

- choose to buy a new building, a housing loan will be cheaper.

And remember that when buying a home with a mortgage, you can receive a tax deduction, which is 13% of the cost of the property and interest paid to the bank. The maximum payment is 390,000. Once received, this money can be used to partially repay the mortgage, which will significantly reduce the overpayment.

For what period is it more profitable to take out a mortgage loan?

In 2021, Sberbank occupies a leading position in the mortgage lending market. The minimum mortgage term in Sberbank starts from 1 year, and the maximum mortgage term in Sberbank is 30 years.

At the same time, interest rates and the total amount of overpayments have more advantageous positions than in other financial organizations.

If you are wondering what is the minimum term for which you can take out a mortgage, it is usually 1 year. However, a very small number of citizens, who have their own reasons for this, enjoy this right.

For example, in a year you are expected to receive an inheritance, transfer funds, receive financial assistance from relatives, and pay off a debt. Not everyone will be able to obtain the minimum mortgage term for a large amount .

If the age limits and monthly income do not meet, you will most likely be refused, but may be offered a mortgage for a longer period.

If you are still confident in your capabilities, choose a bank with the possibility of early repayment without paying commissions and agree to the loan term that they offer you. And you will make the decision on when to pay off the debt yourself.

Which bank will have the most profitable mortgage?

Let's start not with the names of specific banks, but with advice on choosing a financial institution. The potential profitability of a future transaction directly depends on this. One bank may approve you for a loan at 7.5%, and another at 8.5% or even higher.

A mortgage is a large loan that is taken out for a long period of time. And a difference of even 0.5% plays a role. For example, if you take 3,000,000 for 10 years at 7.5%, the monthly payment will be 35,611 and the overpayment will be 1.237 million. And if the rate is 8.5%, then the payment will be 37,200 and the overpayment will be 1.463 million.

Where will a mortgage be more profitable for you:

- First of all, always pay attention to the bank through which you receive your salary. It is these banks that usually create the best conditions, do not require a bunch of documents and approve transactions without any problems. All banks are improving lending conditions to their salary clients.

- If you are not satisfied with the conditions of the salary bank, find out from your organization which banks have accredited it. Employees of accredited companies are often given special, preferential terms for concluding a contract.

- If the first two options are not relevant, then ask for conditions from the bank where you previously took out a loan. Regular, high-quality borrowers also often receive improved contract terms.

The most profitable home mortgages are usually issued to salary clients. This is both profitable and convenient. The loan is linked to your salary account, you can directly transfer money from it or set up an automatic payment.