January 25, 2021 Nikita Umerenkov All authors

- Civil servant status and entrepreneurial activity are incompatible concepts

- Investment property and rental business. What is possible and what is not?

Working for the state means great powers, but also great responsibility. Therefore, legislation regulates in detail the activities and status of civil servants, including establishing numerous prohibitions and restrictions for them. Many of these prohibitions and restrictions relate to the field of finance and investment. We have already written about this on our website (Investments for civil servants: limitations and opportunities). With this article we begin a series of publications where we will consider in detail the impact of prohibitions and restrictions related to the civil service on the investment opportunities of civil servants.

Prohibitions and restrictions for civil servants in the field of finance and investment can be divided into the following large groups: (1) ban on business activities; (2) prohibition on foreign accounts and financial instruments; and (3) a prohibition on holding securities that results (or may result) in a conflict of interest.

Is renting out housing a business activity?

When renting out real estate, a citizen, as a rule, hopes to make a profit. This is what the whole procedure is aimed at. Every month the tenant pays money to the owner of the property. Often this type of activity becomes a permanent income for citizens.

The state ensures that citizens inform authorities about the progress of their activities. This is necessary to accumulate a future pension, as well as to ensure that the tax authority has the opportunity to receive income to the state treasury.

Renting out premises can be equated to a business, which means that the owner of the property must register accordingly so that his activities are not considered prohibited on the territory of the Russian Federation.

Is it necessary to register?

A description of individuals as subjects of law carrying out activities within the framework of Civil Law is contained in Chapter 3 of the Civil Code. But special attention within this chapter should be paid to Article 23, which draws attention to the entrepreneurial activities of citizens.

In accordance with Article 23 of the Civil Code, a person has the right to engage in entrepreneurial activities, but for this he only needs to register as an individual entrepreneur. At the same time, an individual entrepreneur is not the same thing as a legal entity, because he continues to remain a citizen, but with some features of his legal status.

Based on practice, it is mandatory for a citizen to register as an entrepreneur in order to rent out an apartment. After all, the state prefers to consider rental activities as entrepreneurial ones. But on the other hand, renting out an apartment is the right of the owner. And it is not always possible for him to receive income from such activities.

In accordance with subparagraph 3, paragraph 1 of Article 67 of the Housing Code, residents of a social rented apartment also have the right to sublease it, however, the law does not require them to register as an individual entrepreneur. However, there are many cases of holding citizens accountable for lack of registration in the form of an individual entrepreneur.

Some could prove their right to not want to go through such a state procedure, others could not. Today there is no clearly formulated legislation, which means that every citizen has the right to decide for himself what to do, while being guided by considerations of his personal benefit and convenience.

Prohibition on business activities

The Civil Service Law and the Anti-Corruption Law prohibit civil servants from engaging in entrepreneurial activities and participating in the management of a commercial organization.

The Civil Code defines entrepreneurial activity as “independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services . It also requires that persons carrying out entrepreneurial activities must be registered in this capacity (i.e. as an individual entrepreneur, individual entrepreneur) in the prescribed manner. For conducting such activities without state registration, administrative and tax liability is provided, and, under certain circumstances, even criminal liability.

Despite the direct requirement for this (and the corresponding administrative and criminal liability), many individuals are engaged in activities that fit the definition of entrepreneurial, without registering even as an individual entrepreneur.

Advantages

It is a mistake to believe that registering as an individual entrepreneur will add hassle to you. There are also positive aspects to this situation.

- The money that will be deducted as tax will be deposited into your pension savings, which means that in old age you will have the right to count on a larger amount of money.

- You will carry out the activity of leasing real estate, without fear that the state will hold you accountable.

- The third advantage of the current situation is related to the trust of tenants. Having learned that you have the status of an individual entrepreneur, applicants for living in your apartment will realize the seriousness of your intentions, so the level of trust in you will be greater.

Entrepreneurship and real estate investment

Let's look at whether a government employee can engage in entrepreneurial activity using the example of real estate investment.

Investment property

The second most popular (after bank deposits) investment instrument in the Russian Federation is real estate. It can be argued that simply purchasing investment property in the hope that its value will increase is not a business activity. With such an investment, the use of property (i.e., the extraction of its useful properties) does not occur, because the owner only owns the asset. Similarly, investments in construction at the excavation stage under the DDU agreement will also not be recognized as entrepreneurial activity.

Consequently, such a method of investment as purchasing or investing in real estate, subject to other restrictions and prohibitions, is fully available to government employees , since neither the purchase of real estate nor investments in its construction are entrepreneurial activities. The only thing worth keeping in mind when considering the possibilities of investing in such assets is the obligation of civil servants to report on their property in the prescribed manner, and also, for some categories of civil servants, on their expenses.

Rental business

Another type of investment in real estate is the acquisition, as a rule, of ready-made real estate for the purpose of renting it out. Business rante actually consists of the targeted purchase of real estate and its immediate rental. “Professional” rante are registered as individual entrepreneurs, which allows them to legally save on taxes, since the tax rate for individual entrepreneurs can be below 13%.

Can an official engage in the rental business? Will such activity be considered entrepreneurial (and, therefore, prohibited)?

Based on the ban on entrepreneurial activity, civil service and individual entrepreneur status are incompatible, and registration as an individual entrepreneur is not available to civil servants. However, many individual landlords also do not register as individual entrepreneurs.

The signs of entrepreneurial activity specified in the Code are of an evaluative nature and do not allow an unambiguous answer as to whether the activity of leasing real estate is entrepreneurial. The answer to this question can be given by judicial practice in administrative and criminal cases, where court decisions on specific cases provide criteria, signs of entrepreneurial activity and its differences from other activities.

Taxation methods

simplified tax system

The simplified taxation system is beneficial for small businesses and is suitable for various categories of activity. This taxation system is most common among beginning private entrepreneurs. Its main benefit is that instead of three general taxes, individual entrepreneurs will pay only one tax. It is transferred once every 3 months, that is, a quarter, and you only need to submit a report to the Tax Inspectorate once a year.

Having chosen such a system, you need to decide on the object of your taxation. It can be income or income minus expenses. The tax rate on income ranges from 1 to 6%, while the tax rate on the second indicator can reach up to 15%. It all depends on the region and the type of your activity.

The simplified taxation system is convenient in that you can deal with all the reporting and draw up the necessary papers even without the involvement of accounting.

Tax patent

A tax patent also refers to a simplified taxation system. It is notable for the fact that there is no complicated reporting procedure or record keeping. Practically the only regime in which a tax return is not submitted; the tax is calculated only in case of payment for a patent.

The essence of this regime is to obtain a patent, which gives the right to carry out certain activities. A patent is issued for a strictly designated period; upon its expiration, a new one is issued.

The advantages of this method of taxation are the relatively low cost of this patent, the ability to choose the validity period, the acquisition of several patents at once, and the lack of tax reporting. It is unlikely that a person who rents out real estate will have his own full-time accountant to draw up documentation for submission to the Tax Inspectorate. A tax patent frees you from such a need.

The permitted types of activities under the patent system include leasing real estate and making a profit for it. Therefore, very often persons registering themselves as individual entrepreneurs resort to this method of paying taxes.

Arbitrage practice

From existing judicial practice, as well as available explanations from tax authorities, it follows that the presence of only one lease agreement is not enough to recognize a citizen landlord as an entrepreneur. In order to draw such a conclusion, it is necessary to establish facts of systematic profit-making from the transfer of property for rent. Therefore, in order to resolve the issue of the presence or absence of signs of entrepreneurial activity, law enforcement and tax authorities first of all analyze the purposes for which a citizen acquired this or that property, as well as the systematic nature of his transactions, both for the acquisition of real estate and for its rental rent By “systematic” business conduct, tax authorities understand that a citizen carries out at least two transactions during the year.

A conclusion about the presence of signs of entrepreneurial activity in a citizen’s actions can only be made if there is complete and comprehensive information about all the circumstances of such activity. In this case, entrepreneurial activity may be indicated, in particular:

- Acquisition of real estate for the purpose of subsequent profit

- Keeping records of transactions related to the implementation of transactions (i.e. “accounting”)

- The interconnectedness of all transactions made by a citizen in a certain period of time, etc.

If these signs are absent, for example, when an individual makes a one-time rental transaction, then the activity is not entrepreneurial and the citizen does not have the obligation to register as an individual entrepreneur. Thus, in one of the decisions, the Supreme Court indicated that an individual who was not registered as an individual entrepreneur, who acquired for personal needs or received real estate by inheritance or under a gift agreement, but due to the lack of need to use this property, temporarily rented it out to rent or lease and as a result of such a transaction received income, is not subject to criminal liability for illegal entrepreneurship.

Registration process

Before completing the steps for direct registration, choose a method for registering an individual entrepreneur. This can be done using two of the methods described below. Register yourself or with the help of professional registrars.

- Select the name of your individual entrepreneur.

- The place of residence of the individual entrepreneur must be indicated as the registration address.

- You need to select activity codes. You can get acquainted with them in the OK 029 2014 classifier.

- Then, based on the data received, you need to fill out an application for individual entrepreneur registration using form p21001.

- Pay the state fee that follows registration. This can be done using electronic payment, as well as with the help of financial credit organizations.

- Appear at the Tax Inspectorate with a completed package of documents.

- Choose the tax system that suits you best.

- Sign all documents that you have.

- Check them and go to registration, having first made photocopies.

- Obtain a receipt from the employee indicating that you have submitted the papers.

- After 3 business days you should receive your registration documents back.

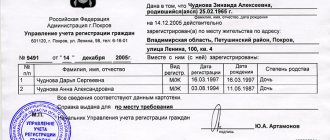

- You are given a record sheet of the Unified State Register of Individual Entrepreneurs, which has form P 60009, as well as a certificate of registration with a tax institution.

- After registration, you need to register as an employer with the Russian Pension Fund, obtain statistics codes, make your own stamp, open a current account, and obtain a license.

Sanctions for payment evasion

Illegal rental of an apartment is dangerous due to unexpected financial losses. An example is that the tax authority, having received information that the owner is making a profit while evading paying taxes to the federal budget, can bring the citizen to civil liability and summon him to court.

As statistics show, sanctions for many people turn out to be very burdensome and, in addition to the amount of debt, penalties and various fines accumulate for failure to submit a tax return and other documents. In extreme situations, a person may be brought to criminal liability, which may become the basis for a criminal record and a fine of up to 200 thousand rubles. Imprisonment for up to one year is also possible in accordance with Article 198 of the Criminal Code.

The danger is that the tenants who have moved into your apartment may also turn out to be scammers and use the property, for example, to house illegal migrants. In this case, the apartment owner unwittingly becomes a defendant in a criminal case related to the illegal stay of citizens on the territory of the Russian Federation in accordance with Article 322.1 of the Criminal Code.

Of course, the owner will not be brought to real criminal liability, but will spend many unpleasant minutes in the courtroom.

But, unfortunately, despite such strict sanctions, only a few people respect the law.

As practice shows, only 20% of citizens register as an individual entrepreneur. Others prefer to receive income without notifying the state.

Officials have the right to rent out property belonging to them (hire)

July 3, 2019

Civil servants who own apartments and other real estate have the right to rent or lease them.

At the same time, according to clause 3, part 1, article 17 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation”, in connection with the civil service, a civil servant is prohibited from engaging in entrepreneurial activities personally or through proxies .

Entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services (Article 2, paragraph 1 of Article 23 of the Civil Code of the Russian Federation). If a civil servant receives systematic profit from renting out property owned by him, the employer or law enforcement agencies may have a question about classifying this activity as entrepreneurial.

One of the signs of entrepreneurial activity is its focus on systematically obtaining profit from the use of property. At the same time, the lack of profit in itself does not affect the qualification of an activity as entrepreneurial, since making a profit is the goal, and not the obligatory result of such activity (clause 13. Resolution of the Plenum of the Supreme Court of the Russian Federation dated October 24, 2006 N 18).

If property (for example, an apartment) is acquired by a civil servant not for personal needs, but is used only for renting (renting) and these actions are performed repeatedly, then there is a possibility that such activity will be recognized as entrepreneurial (clause 1.1 of the Letter of the Federal Tax Service of Russia dated 07.05 .2019 No. SA-4-7/8614).

In addition, civil servants need to reflect the presence of such property in their ownership and the receipt of income from it in the annually submitted information on income, expenses, property and property-related liabilities.

Income from leasing or leasing property is subject to personal income tax. When receiving income, a civil servant must also submit to the tax authority no later than April 30 of the year following the expired one, a tax return in form 3-NDFL and pay income tax no later than July 15 of the year following the expired one.

Thus, as a result of the systematic conclusion by public servants of transactions with property and receipt of income, it may lead to a violation of established anti-corruption prohibitions or failure to fulfill obligations established by anti-corruption legislation and tax legislation.

For these violations, a civil servant may be subject to disciplinary action, up to and including dismissal due to loss of confidence.

Prepared by the Department for Supervision

of Anti-Corruption

Legislation Return to list

Some features

When renting out an apartment by an individual entrepreneur, the presence of a lease agreement is simply necessary and is a prerequisite. In order to make a competent representation of expenses and calculations of the corresponding taxes, it is necessary to indicate in the contract exactly how payment will be made. We also strongly recommend that you open your own current account or simply a separate bank account, into which funds from tenants will be credited.

Ask the residents of your property to pay for their accommodation on time and through a financial and credit organization. Keep the receipts, which may later be required by the tax authority to verify the accuracy of the data you provided.