Lazy Investor Blog > Collaboration

Author Yaroslav Klimov

I, as an active reader of a lazy blog, decided to also participate in writing useful information. We'll talk about real estate. I must admit right away that the entire practical part of this article was tested on my own skin; instead of reasoning and assumptions, a huge amount of work was done in studying this topic.

Each of us, to one degree or another, faces the housing problem. Some people want to acquire their own square meters for living, while others want to improve their living conditions or ensure a comfortable retirement by renting out residential premises. Unfortunately, everyone knows that the necessary expenses for “living” are often equal to the “average” salary. And as a result, the bank needs to spend a lot of time to accumulate a down payment. And by using the mortgage lending program, a person agrees to make monthly payments to the bank for many years. And in such a situation, it is necessary to try very hard to maintain an acceptable standard of living.

I spent a long time studying the possibilities of purchasing real estate, repeatedly calculated the proposed mortgage programs, read gigabytes of information, talked with people who have some experience in the real estate field (realtors, businessmen, property owners). The time was well spent... I found a reasonable alternative - housing cooperatives! Every day such organizations are gaining more and more popularity in society due to the fact that this option for solving the housing problem has many advantages compared to a mortgage. In addition, there is less paperwork, because... the client’s credit history and budget component play a lesser role than in banks.

Why did you choose ZhNK out of all the options?

In 2015, I inherited about 1.5 million rubles.

At that time, the daughter lived in rented apartments, and at the family council they decided to invest money in her housing. With this amount we could buy a small family on the outskirts of Kazan or a one-room apartment in the suburbs. Neither option suited us. We couldn’t get a mortgage because my husband and I are both freelancers, we work under civil law contracts (CLA) with different customers, and we don’t have a permanent job. My daughter just got a new job, so she couldn’t count on a mortgage either. We didn’t want to delay the purchase - in a year, due to inflation, this money would not be enough for even half of a one-room apartment - so we turned to a realtor. We agreed that he would monitor advertisements for sale, and if an inexpensive apartment appeared, he would immediately inform us. The realtor warned that the amount was small and finding a suitable option would be difficult. He suggested that we consider buying an apartment in installments through a housing and savings cooperative: there is no overpayment for interest and documents from work are not needed.

Responsibility

Legislative projects, on the basis of which the full legitimacy of the functioning of housing savings cooperatives is regulated, establish two fundamental points for which responsibility is assigned to the housing cooperative or removed from it.

These points can be found in Law No. 215 “On Housing Savings Cooperatives”, Chapter 1, Article 4.

This article states that if individual members of a housing cooperative have accounts payable and obligations, these obligations are not transferred to the whole association . That is, in simple terms, each member of the cooperative bears individual responsibility for those debts that are assigned exclusively to him due to his own financial activities. The second paragraph of this article states that for the general obligations of the cooperative, its members are liable with all property belonging to the housing cooperative in question , and responsibility in this case is distributed accordingly equally.

If we move away from the exclusively documentary and legal conventions of this topic, it should be noted that the fundamental responsibility of the housing cooperative is to maintain an appropriate level of provision of services provided and the overall quality of all work performed, in case of non-compliance with the standard, the shareholder members have the opportunity during the meeting challenge the results of the work carried out by the enterprise.

The capital and functioning of the cooperative are supported by funds contributed monthly by members of the cooperative, as well as contributions from new members.

How does ZhNK work?

I had a general idea of how a cooperative works. Members of the cooperative contribute a certain amount monthly to the common pot, and with this money they buy housing first for one member of the cooperative, then for the second, third, and then in turn. But there were still many questions, and I went with my husband to the first meeting with the manager of the ZhNK.

Kazan ZhNK works on the basis of a local developer and sells apartments only from this developer. You can choose any apartment: one-, two- or three-room. To join the cooperative, you need to pay an entrance fee of 10 thousand rubles. While you remain a member of the cooperative, you pay membership fees of 1 thousand rubles per month.

ZhNK has two accounts. One receives membership and entrance fees; the cooperative spends this money on its needs: employee salaries, taxes, rent, and business needs. The second account receives the initial and monthly payments for the apartment. This account is called a mutual fund. The cooperative can spend money from the mutual fund only on the purchase of housing and nothing else.

The minimum amount of the initial contribution to the mutual fund is 30% of the cost of housing. If the shareholder has contributed 30%, the cooperative reserves an apartment for him from the developer, and it is removed from sale. In order for a housing cooperative to buy housing for a shareholder, you need to contribute at least 50% of the cost of the apartment. After purchasing the apartment, the shareholder continues to pay shares and membership fees until he pays the entire cost. In November 2015, when I joined the cooperative, installment plans could be issued for 10 years, but now the period has been reduced to 7 years.

The Central Bank, tax authorities and shareholders monitor the targeted spending of funds. Every year, an independent auditing company checks the financial documents of the cooperative and draws up a report: how much money went into the accounts of housing cooperatives, where it was spent, how many apartments were purchased, whether the cooperative has debts to shareholders or other creditors. The cooperative sends the auditors' report to the Central Bank, the tax service and posts it on its website. Anyone can download the report and look at it themselves or show it to a specialist.

When a shareholder joins a ZhNK, the shareholder’s last name, first name, patronymic, his INN are entered into the Unified State Register of Legal Entities (USRLE), and the number and date when changes were made to the Unified State Register of Legal Entities are indicated. These changes are registered with the tax office. Extract from the Unified State Register of Legal Entities and check whether information about you is included.

Organizational and legal form

The Housing Code of the Russian Federation defines housing cooperatives (housing construction cooperatives) as non-profit organizations, and all because the purpose of uniting citizens and organizations is not to obtain benefits or profits, but to obtain a finished product, in our case - housing.

The organizational and legal form of housing cooperatives is a consumer cooperative, which is regulated on the basis of the Housing Code, namely Chapter Eleven. Both citizens and legal entities can join such cooperatives.

Sources

- https://svoe.guru/mnogokvartirnye-doma/upravlenie/zhnk.html

- https://svoe.guru/mnogokvartirnye-doma/upravlenie/zhsk/chto-takoe-z.html

- https://law-divorce.ru/pokupka-kvartiry-cherez-zhilishhnyj-kooperativ/

- https://kapremont.expert/kvartira/zhsk/chto-takoe.html

- https://101urist.com/nedvizhimost/upravlenie/mkd/zhk/chem-otlichaetsya-zhsk.html

- https://zhivemvrossii.com/kvartira/zhsk/chto-eto-takoe.html

- https://rosreestr.net/info/pokupka-kvartiry-cherez-jilishchnyy-kooperativ

- https://101urist.com/nedvizhimost/uprav-mkd/zhsk/chto-takoe-zhnk.html

How is the cost of an apartment calculated?

I know about two types of ZhNK. Some cooperatives give shareholders loans in installments at 2–3% per annum. All calculations are the same as in a mortgage, only the interest rate is low. An attractive scheme works in a stable housing market. If the cost of an apartment rises by 4% or more, housing and communal services begin to operate at a loss. The second cooperatives give in installments not money, but square meters. Our cooperative belongs to the second type, and I will tell you, using the example of my apartment, how the cost of the monthly contribution is calculated.

We chose a one-room apartment with an area of 34.51 m2. In order for the cooperative to buy the apartment from the developer, I need to pay half, that is, 17,255 m2. The cooperative divides the remaining 17,255 m2 into 120 months of installments. It turns out that every month I need to contribute money for a share contribution for 0.144 m2. While the house is being built, the price is set by the developer, and after the house is delivered - by an independent appraisal company.

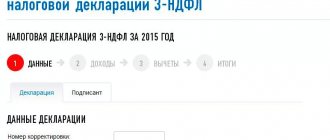

This is what the calculations of the monthly contribution look like in the shareholder’s “Personal Account”

Is it necessary?

Is a housing cooperative required at all? Housing cooperatives have been very popular in recent years. Its necessity is due to the fact that such an organization allows not only to profitably maintain the building, but also deals with all issues of construction.

Owners, that is, members of housing cooperatives, have the right to see how their real estate is being built from scratch, take part and control this process.

Thus, we can conclude that the housing cooperative allows owners to fully participate in the construction and maintenance of the building. Thus, the most trusting relationships develop between the management organization and the owners.

How it really happened

At first, we wanted to spend all the money we inherited on a down payment, and our daughter would pay monthly payments from her salary. But for a whole year, while the house was being built, my daughter would have to pay, in addition to the share contributions, for the rent of the apartment. Not counting other mandatory expenses, she would spend more than 30 thousand rubles on housing alone. Therefore, we decided to buy a minimum 50% of the area, and from the remaining money to pay monthly installments for a year and a half. During this time, the house will be rented out, my daughter will renovate the apartment, move into it, and there will be no rental costs.

To join a cooperative, a passport and TIN certificate are enough. I wrote an application to join the housing cooperative, signed an apartment reservation agreement and received details for paying entrance, membership and share fees. ZhNK does not accept cash; all payments are made only through the bank.

In the application for joining the housing cooperative, I indicated the parameters of the selected apartment and its cost

When I signed the documents, the developer’s price was 64,600 rubles per square meter, and the down payment was 1,114,673 rubles. I didn’t delay in paying. The next day I went to the bank, but it turned out that on that day the developer raised the price by 760 rubles per square meter. My payment was enough to buy 17.0544 m2, and I still owed 17.4556 m2.

While the house was being built, the developer increased the price six more times, but this did not greatly affect the monthly payment. For example, I buy 0.144 m2 per month. If the price of a meter is 64,600 rubles, then the payment is 9,302.4 rubles; if the price is 67,742 ₽, then you need to deposit 9,754.85 ₽.

After the building is completed, apartments are revalued every three months. The appraisal company focuses on the location of the house and the average market value. If the price of real estate falls in the market, then the share contribution is reduced. But in fact, the price is constantly rising. For 2021, the increase in price amounted to 3175 rubles per square meter, and the monthly payment increased by 457 rubles.

The house has underground parking, so you can access the courtyard by stairs or elevator

How is the apartment documented?

The developer, as promised, completed the house within a year, and we were invited to accept the apartment. The procedure is the same as for equity holders: the owner and the foreman inspect the apartment. If there are no complaints, the owner signs the apartment acceptance certificate. If there are any comments, the owner writes a complaint in the report. The foreman estimates how much time is needed to eliminate the defect and sets another day for a re-inspection. There were no serious deficiencies in our apartment; we only asked to replace the handle on one window. The workers changed the handle right in front of us, and we signed the document.

A month later we received the keys to the apartment. I myself or my family members can register in the apartment and live in it. But until I pay the money in full, the apartment remains the property of the cooperative, so ownership is registered with the housing cooperative. The cooperative is a legal entity, and the state duty is 22,000 rubles. I paid this money when the cooperative registered the apartment after the house was handed over. When I pay off my debt to the cooperative, the apartment will be re-registered in my name, and I will have to pay the state fee again, but only 2000 ₽ for a private person.

We received the keys to the apartment

Reorganization and liquidation of a housing and savings cooperative

ZhNK as a legal entity can be reorganized or liquidated. Reorganization is provided if:

- merger of companies;

- division of the organization;

- joining another cooperative;

- conversion to another form, for example, HOA.

Liquidation can be forced, that is, by court decision. This is possible if ZhNK violates the law or goes bankrupt. Voluntary liquidation is usually carried out if the cooperative has fulfilled its objectives.

In this case, one should take into account the risks borne by the participants of the cooperative:

- collective responsibility;

- loss of funds upon liquidation of the association;

- additional expenses.

If a housing cooperative is created for fraudulent purposes, participants are unlikely to be able to receive apartments or return the invested funds.

What difficulties may arise and how can they be solved?

Now I have to buy a little more than 10 square meters from the cooperative or pay 774,260 rubles at prices for January 2020. Over four years, our family’s financial situation has improved: our daughter works abroad, my husband and I began to earn 2 times more. Therefore, we are not afraid of a sharp jump in real estate prices. Even if the minimum payment doubles, it will not be burdensome for us. The apartment is currently empty, but if necessary we can rent it out. Rent money can be used to cover monthly payments.

A much greater danger is the bankruptcy of the cooperative. The apartment remains the property of the housing cooperative; in the event of bankruptcy, it will be sold to pay off debts. By law, shareholders are fifth-degree creditors, so I’m unlikely to receive the full amount of money paid into the mutual fund.

So far the cooperative has not raised any concerns. It is developing successfully and attracting new shareholders. If alarming facts appear, I will take out a consumer loan, pay off the debt to the cooperative and transfer the apartment to myself.

What happens if the shareholder delays the next payment?

The order of obtaining an apartment for such a member is changing (Part 5 of Article 28 of the Law on Housing and Housing Communities). In case of systematic violation of the payment schedule (more than three times during the year) or after one delay of more than three months, the shareholder may be expelled from the cooperative (Articles 8 and 9 of the Law on Housing and Communal Services). If the debtor has already been given an apartment for use, he will have to vacate it within two months.

A member expelled from a cooperative is required to return the value of his share. But there are no entrance and membership fees.

Is it possible to use matkapital to buy an apartment through ZhNK

Yes, you can, and maternity capital can be used both as an entrance fee and as a share contribution.

To do this, you need to provide the Pension Fund:

- an extract from the register of members of the cooperative confirming membership in the housing cooperative;

- a certificate of the contributed amount of the share contribution and the remaining unpaid amount necessary to acquire ownership rights;

- a copy of the cooperative's charter;

- a notarized written obligation of a member of the cooperative to allocate a share to the child within 6 months after making the last payment.

What are the risks when buying an apartment through ZhNK

The cooperative has the right to invest in construction, so shareholders may face bankruptcy of the developer or long-term construction.

Agreements with housing cooperatives are not registered by the state, which means fraud is possible when the same apartment is given to several people.

While the apartment is being purchased, its value may rise. And the legislation does not establish a framework for indexing. To avoid a sharp increase in the cost of housing, it is worth stipulating in the contract reasonable limits for changing this indicator.

One of the most important points is that you can become a homeowner only after the share has been paid in full. Until this moment, the cooperative has only monetary obligations. If a cooperative goes bankrupt, the shareholder risks being left without housing.

In this case, the main thing for a member of the cooperative is not to miss the deadline for filing an application to include his claims (recovery of the paid share contribution) in the register of creditor claims. The shareholder has only three months to do this (a month at the observation stage and two months at the bankruptcy stage).

There are three ways to track information about a debtor’s bankruptcy:

1. Through the file cabinet of arbitration cases

To search, enter the name of the debtor or his INN or OGRN, select the arbitration court of the region where the debtor is registered. Then, using the “case filter” column, select only bankruptcy cases from the list.

2. Using the Unified Federal Register of Bankruptcy Information (EFRS)

Please provide a name.

3. Through the “bankruptcy” section on the website of the Kommersant newspaper

To search for bankruptcy announcements, enter TIN, OGRN or other company identifiers. From the date of publication in the newspaper of messages about the introduction of supervision or bankruptcy proceedings, the deadlines for presenting claims of creditors are counted.

primary goal

The main goal for which the introduction of a new legislative project was originally intended is the possibility of offering citizens a new type of services and increasing the independence of citizens in self-government . That is why the initiative to create a new housing complex is given to the citizens themselves on the basis of certain conditions, which will be discussed in subsequent chapters.

Thus, the list of tasks of this type of association, according to the legislative intent, may include providing citizen-shareholders with the opportunity to conveniently purchase housing both within a specific site within the competence of consideration, and in other cities of Russia.