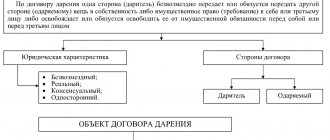

Types and essence of the contract

There are three types of contracts involving the transfer of property for maintenance and care:

- Lifetime annuity agreement . Involves the financial maintenance of the apartment owner. He is paid monthly until the amount specified in the contract is fully repaid. Often the payment amount is equal to the cost of the apartment. For example, the owner values the apartment at 1,000,000 rubles. This amount is divided over 5 years. It turns out that the renter must pay 17,000 rubles per month. If death occurs before the agreed date, then payments stop and the apartment becomes the property of the recipient.

- Perpetual annuity agreement . The idea is to pay the owner of the apartment a certain amount until death, regardless of the value of the property. The parties determine the amount of monthly or quarterly payment and the maintenance procedure. Upon the death of the annuitant, payments cease.

- Lifetime maintenance agreement with dependents . This type of contract involves an agreement between the property owner and a third party. Only instead of paying money, an elderly or sick person receives care: feeding, treatment, cleaning the apartment, etc. As a rule, such an agreement is concluded by elderly people with relatives, since a stranger can deceive by not providing proper care. A lifelong maintenance agreement is not always drawn up in relation to the owner of the property. The owner of the property may enter into such an agreement to provide care for another person. For example, a daughter enters into a rental agreement, providing her own apartment in exchange for caring for her elderly mother.

Each type of agreement has certain nuances and requirements for drafting. If the document is drawn up incorrectly, it will not have legal force, which is disadvantageous for both parties.

LIFETIME MAINTENANCE AGREEMENT WITH DEPENDENTS. SAMPLE

LIFETIME SUPPORT AGREEMENT WITH DEPENDENTS

Moscow city,

nineteenth January two thousand fifteen.

We, gr. A

, born June 12, 1990, citizenship: Russian Federation, gender: male, passport 12 12 123456, issued by the Department of the Federal Migration Service of Russia for the city.

Moscow in the Obruchevsky district on June 26, 1983, subdivision code 770-120, registered at the address: ___________________, hereinafter referred to as RENT RECIPIENT, on the one hand,

and gr. B

, born June 12, 1990, citizenship: Russian Federation, gender: male, passport 12 12 123456, issued by the Department of the Federal Migration Service of Russia for the city.

Moscow in the Obruchevsky district on June 26, 1983, subdivision code 770-120, registered at the address: ________________, hereinafter referred to as the RENT PAYER, on the other hand

,

Being of sound mind and sound memory, acting voluntarily, we have entered into this agreement as follows:

1. The RENT RECIPIENT under this agreement for lifelong maintenance with a dependent transferred into the ownership of the RENT PAYER the RESIDENTIAL HOUSE belonging to him by right of ownership, located at the address:

______________, consisting of a main brick building with an area including unheated premises of 68.3 (sixty-eight point three) square meters. m, including a total area of 60.2 (sixty point two) sq. m, of which residential is 32.4 (thirty-two point four) sq. m.

2.

The specified residential building belongs to the RENT RECIPIENT on the basis of registration certificate N _____ dated July 1, 1995, issued by the Lyubertsy Civil Registry Office for the city of Moscow, which is confirmed by a certificate of state registration of rights dated October 30, 2002, form 77-AO 9999999, entry in the Unified State Register rights to real estate and transactions with it 99-99-99/125/2013-935 dated October 30, 2002, issued by the Office of the Federal Service for State Registration, Cadastre and Cartography in Moscow.

3.

The inventory value of a residential building is 100 (one hundred) rubles 00 kopecks, which is confirmed by certificate N ______, issued on November 1, 2009 by the Office of the Federal Service for State Registration, Cadastre and Cartography for the Moscow Region.

4.

The specified residential building is transferred on the terms of lifelong maintenance with a dependent for 100 (one hundred) rubles 00 kopecks.

5.

The RENT PAYER purchased the specified residential building from the RENT RECIPIENT on the terms of lifelong maintenance with dependents for 100 (one hundred) rubles 00 kopecks.

The settlement between the parties is made in full before signing the contract.

6.

The notary explained to the parties that the agreement on the price is an essential condition of this contract and if they conceal the true price of a residential building and true intentions, they independently bear the risk of declaring the transaction invalid, as well as the risk of other negative consequences.

7.

Simultaneously with the payment of the above amount, the RENT PAYER undertakes to fully support the RENT RECIPIENT for life, providing him with food, clothing, care and necessary assistance and retaining his right to free lifetime use of the specified residential building.

8.

The cost of monthly material support (food, clothing, care and necessary assistance) is determined by the parties in the amount of 10,000 (ten thousand) rubles 00 kopecks.

9.

The RENT RECIPIENT guarantees that he does not enter into this agreement due to a combination of difficult circumstances on extremely unfavorable conditions for himself and this agreement is not an enslaving deal for him.

10.

The right of ownership to the specified residential building arises from the RENT PAYER from the moment of registration of this agreement and registration of the transfer of ownership in the compulsory state registration authorities.

11.

In accordance with Art. 35 of the Land Code of the Russian Federation, upon transfer of ownership of the specified residential building, the RENT PAYER acquires the right to use the corresponding part of the land plot occupied by the alienated residential building and necessary for its use, on the same terms and to the same extent as the previous owner.

12. The contents of

Articles 602

,

604

,

605

of the Civil Code of the Russian Federation and

Article 35

of the Land Code of the Russian Federation were explained to the parties by the notary.

13.

The specified residential building is alienated free from residence by third parties who, in accordance with the law, have the right to use this residential building.

14.

The RENT RECIPIENT guarantees that before signing this agreement, the specified residential building has not been sold to anyone else, not given as a gift, not mortgaged, not encumbered by the rights of third parties, and is not in dispute or under arrest (ban).

15.

The costs of concluding this agreement are paid by A.

16.

This agreement has been read aloud and contains the entire agreement between the parties with respect to the subject matter hereof and supersedes and renders null and void all other obligations or representations that may have been accepted or made by the parties, whether oral or written, prior to the execution of this agreement.

17.

This agreement has been drawn up in three copies, one of which is kept in the files of the notary of the city of Moscow Ivanov I.I. at the address: Moscow, Bobrov lane, 6, copies A and B are issued.

The contents of this agreement were read aloud to its participants.

_________________________ _____________________________

_________________________ _____________________________

Moscow city.

The nineteenth of January two thousand fifteen.

This agreement is certified by me, Ivan Ivanovich Ivanov, a notary of the city of Moscow.

The agreement was signed by the parties in my presence. The identity of the parties has been established, their legal capacity, as well as their affiliation with the group. And the alienated residential building has been checked.

This agreement is subject to state registration with mandatory state registration authorities.

Registered in the register for N 2

.

Charged at the rate: 00 rub. 00 kop.

Notary Ivanov I.I.

How to draw up a contract

Before concluding a deal, it is important to discuss all the details of the agreement. The payment procedure, amount of payments, methods of care, etc. are immediately agreed upon. All emerging nuances are also indicated in the contract.

It is recommended to draw up an agreement with a lawyer. It will help you avoid mistakes that could be disastrous for both parties. Thus, an incorrectly drawn up agreement will leave the owner without an apartment and maintenance, and the renter without property. Therefore, it is necessary to take a responsible and legally competent approach to drawing up contracts of this type.

A prerequisite is confirmation of the contract by a notary. This is necessary to assess the mental health of the future rentee, to check the absence of physical and psychological pressure on the owner. A certificate from a psychiatrist will also be required as documentary evidence.

Contract clauses, sample

An annuity agreement and a lifelong maintenance agreement have the same format. There are mandatory conditions that must be present in the document, and additional ones.

Download sample contracts:

- life annuity;

- perpetual annuity;

- dependent on maintenance.

First, let's look at the mandatory clauses of the contract. Without them, the document will be considered invalid.

Contract type

First of all, the type of contract must be indicated - annuity or lifelong maintenance. This clause provides the basic terms of the agreement, so the name of the agreement must be present.

Rent fee

There are several types of rent:

- Material support , implying monthly or quarterly payments of a certain amount.

- Caring for the rentee , including feeding, cleaning the apartment, providing assistance when visiting the clinic, etc.

- Caring for a dependent annuitant . It implies not only physical care for the owner of the apartment, but also payment of money for maintenance.

The type and amount of the rent payment is indicated. If the parties choose the second type, then the obligations of the lessor are described in detail.

Description of the property

This paragraph implies a description of the apartment that is the subject of the transaction. What information must be provided:

- address of the property (street name, house number, floor, apartment number);

- cadastral number;

- number of rooms, size of total area;

- number of the certificate of ownership of the apartment.

If other property (for example, furniture, household appliances) goes into ownership, an inventory is made. You can indicate in the contract, without details, that the apartment includes furniture and appliances. If this is not done, then the relatives who show up will be able to lay claim to the property (except for the living space itself).

Information about registered and resident persons

A very important clause of the contract, which requires information about persons who have the right to reside and be registered in the apartment. If members of his family live with the owner, then the full name, date of birth, and passport details must be entered.

It should also be stated that after the death of the owner, residents must leave the premises if the terms of the agreement provide for this. Sometimes tenants live with the owner under a lease agreement. If the future owner plans to rent out this property, then the tenants will be able to stay subject to renewing the contract with the new landlord.

Property value

After the death of the annuitant, the apartment can be sold or transferred free of charge:

- For money . It happens like this: the renter pays money for a certain time, and when the owner survives, the remainder of the amount is transferred to him. In this case, the rent recipient will have to leave the premises (for example, move to relatives or to a nursing home). In the event of death, the specified amount is paid to the heirs (you can specify who specifically to transfer the money to).

- For free . Most often, the apartment is transferred to the new owner free of charge. In this case, large sums of money are paid throughout the life of the owner. If death occurs, the balance is not paid.

An appraiser is called in to determine the value of the property. But the parties can agree on the price among themselves. Keep in mind that the owner will not be able to change the price!

Contract time

And here there are three options:

- Limited . Rent is paid for a certain time period, after which the rentee must leave the premises, if this is stipulated in the contract. Or payments stop, but the former owner can continue to use the apartment until death.

- Lifetime . The term of the annuity is determined by death. The person is dependent until his death, after which the transaction is automatically canceled, and the apartment passes into full ownership of the new owner. If the amount is paid and the owner is alive, then the transaction is also terminated, but the apartment becomes full possession only after the death of the rentee.

- Indefinite . It has no time limits and can be inherited. For example, the mother becomes the annuity recipient. After her death, the right to receive annuity passes to the direct heir - her daughter. The deal is valid until the entire amount specified in the contract is paid.

And now about additional clauses, which can be included in the contract at the discretion of the parties, but in their absence the contract does not lose its force.

Conditions and reasons for early termination of a transaction

Like any type of transaction, an annuity agreement can be terminated early. But there must be good reasons for this, which are indicated in the document. These include:

- Failure to fulfill obligations to pay rent . For example, if the payer delays payments or makes them incompletely.

- The payer is declared bankrupt or insolvent.

- The party interested in obtaining an apartment does not provide proper care for the elderly person.

- Physical and psychological pressure on the former owner, etc..

It is impossible to terminate such contracts without the participation of the court. And to achieve a positive decision from the authorities, evidence is needed.

Redemption of rent

In case of early termination of the contract and failure to fulfill obligations, the payer must buy back the annuity. This is done by paying the full cost of the apartment or the amount of rent. If the payer did not make payments at all, then the contract is terminated without subsequent alienation of the apartment.

The contract must indicate in what way and under what conditions the rent will be redeemed. This point is of interest to both parties, so it should not be neglected.

Responsibility of the parties

The next clause of the agreement is the responsibility of the parties for fulfilling the terms of the transaction. Parties may use liquidated damages as a penalty for failure to make payments or provide care services on time.

The parties can independently determine the amount of the penalty or rely on the current indicator of the Central Bank of the Russian Federation. Experts indicate that the optimal interest rate is 12-15% per annum.

The contract also provides for the possibility of causing material damage to the annuity recipient. In this case, the violator must pay the amount of actual damage, which is determined visually or with the involvement of a specialist.

Possibility of making changes to the terms of the contract

This part of the agreement provides for the possibility of making changes to the essential terms of the annuity agreement. This point concerns primarily the size of monthly payments and payment terms. For example, information can be adjusted if the dollar exchange rate changes, the value of real estate increases, the solvency of the renter deteriorates, etc. It is recommended to indicate each reason for making changes.

Chapter 34. Rent and lifelong maintenance with dependents

§ 1. General provisions on annuity and lifelong maintenance with dependents

Article 692. Rent agreement

1. Under a rent agreement, one party (rent recipient) transfers ownership of property to the other party (rent payer), and the rent payer undertakes, in exchange for the received property, to periodically pay rent to the recipient in the form of a certain amount of money or providing funds for its maintenance in another form.

2. Under an annuity agreement, it is possible to establish the obligation to pay annuity indefinitely (permanent annuity) or for the life of the annuity recipient (lifetime annuity). A life annuity can be established on the terms of the lifelong maintenance of an individual with a dependent.

Article 693. Form of rent agreement

A rent agreement is subject to notarization, and an agreement providing for the alienation of real estate for the payment of rent is also subject to state registration.

Article 694. Alienation of property for payment of rent

1. Property that is alienated for the payment of rent may be transferred by the recipient of the rent into the ownership of the rent payer for a fee or free of charge.

2. In the case when the annuity agreement provides for the transfer of property for a fee, the rules on purchase and sale (Chapter 31) are applied to the relations of the parties regarding the transfer and payment (Chapter 31), and in the case when such property is transferred free of charge, the rules on the gift agreement (Chapter 33) , unless otherwise established by the rules of this chapter and does not contradict the essence of the annuity agreement.

Article 695. Encumbrance of rent on real estate

1. Rent encumbers the land plot, enterprise, building, structure or other real estate transferred for its payment. In the event of alienation of such property by the rent payer, its obligations under the rent agreement are transferred to the acquirer of the property.

2. A person who has transferred real estate encumbered with rent into the ownership of another person shall bear subsidiary liability with him (Article 500) for the claims of the recipient of the rent arising in connection with a violation of the rent agreement, unless this Code, another law or agreement provides for joint and several liability for this obligation.

Article 696. Security for payment of rent

1. When transferring a plot of land or other real estate for payment of rent, the recipient of the rent, as security for the obligation of the rent payer, acquires the right of pledge over this property.

2. An essential condition of an agreement providing for the transfer of a sum of money or other movable property against the payment of rent is a condition establishing the obligation of the rent payer to provide security for the fulfillment of his obligations (Article 398) or to insure in favor of the annuity recipient the risk of liability for non-fulfillment or improper fulfillment of these obligations.

3. If the annuity payer fails to fulfill the obligations provided for in Part 2 of this article, as well as in the event of loss of security or deterioration of its conditions due to circumstances for which the annuity recipient is not responsible, the annuity recipient has the right to terminate the annuity contract and demand compensation for losses caused by termination of the contract.

Article 697. Liability for late payment of rent

For late payment of rent, the rent payer shall pay the rent recipient the interest provided for in Article 496 of this Code, unless a different amount of interest is established by the rent agreement.

§ 2. Constant rent

Article 698. Recipient of permanent annuity

1. Recipients of permanent annuity can only be individuals, as well as non-profit organizations, if this does not contradict the law and corresponds to the goals of their activities.

2. The rights of the annuity recipient under a permanent annuity agreement may be transferred to the persons specified in Part 1 of this article by assigning a claim and transferred by inheritance or by succession during the reorganization of legal entities, unless otherwise provided by law or agreement.

Article 699. Form and amount of permanent annuity

1. Permanent annuity is paid in money in the amount established by the contract.

A permanent annuity agreement may provide for the payment of annuity by providing things, performing work or providing services corresponding in value to the monetary amount of the annuity.

2. The amount of permanent annuity paid, established by the permanent annuity agreement, per month must be no less than the established minimum wage.

Article 700. Terms for payment of permanent annuity

Unless otherwise provided by the permanent annuity agreement, permanent annuity is paid at the end of each calendar quarter.

Article 701. The payer’s right to repurchase permanent annuity

1. The payer of a permanent annuity has the right to refuse further payment of annuity by repurchasing it.

2. Such a refusal is valid provided that it is declared by the annuity payer in writing no later than three months before the termination of annuity payment or for a longer period provided for in the permanent annuity agreement. In this case, the obligation to pay rent does not terminate until the entire redemption amount is received by the annuity recipient, unless a different procedure for redemption is provided for in the contract.

3. The condition of the permanent annuity agreement regarding the refusal of the permanent annuity payer from the right to repurchase it is void.

The contract may provide that the right to repurchase a permanent annuity cannot be exercised during the life of the annuity recipient or for another period not exceeding thirty years from the date of conclusion of the contract.

Article 702. Redemption of permanent annuity at the request of the annuity recipient

The recipient of a permanent annuity has the right to demand redemption of the annuity by the payer if:

1) the annuity payer is overdue for payment by more than one year, unless otherwise provided by the permanent annuity agreement;

2) the rent payer violated its obligations to ensure payment of rent (Article 696);

3) the rent payer is declared insolvent or other circumstances have arisen that clearly indicate that the rent will not be paid to him in the amount and within the time limits established by the agreement;

4) the real estate transferred for the payment of rent came into common ownership or was divided between several persons;

5) in other cases provided for by the agreement.

Article 703. Redemption price of permanent annuity

1. The redemption of a permanent annuity in the cases provided for in Articles 701 and 702 of this Code is made at the price determined by the permanent annuity agreement.

2. In the absence of a condition on the redemption price in the permanent annuity agreement, under which the property is transferred for a fee for the payment of a constant annuity, the redemption is carried out at a price corresponding to the annual amount of annuity payable.

3. In the absence of a condition on the redemption price in a permanent annuity agreement, under which the property is transferred for the payment of rent free of charge, the redemption price, along with the annual amount of rent payments, includes the price of the transferred property, determined according to the rules provided for in Part 3 of Article 526 of this Code.

Article 704. Risk of accidental destruction of property transferred for payment of permanent annuity

1. The risk of accidental loss or accidental damage to property transferred free of charge for the payment of permanent rent is borne by the rent payer.

2. In the event of accidental destruction or accidental damage to property transferred for payment for the payment of permanent annuity, the payer has the right to demand, accordingly, termination of the obligation to pay annuity or change the terms of its payment.

§ 3. Lifetime annuity

Article 705. Recipient of life annuity

1. A lifelong annuity may be established for the period of life of the individual transferring property for payment of annuity, or for the period of life of another individual specified by him.

2. It is allowed to establish a life annuity in favor of several individuals, whose shares in the right to receive annuity are considered equal, unless otherwise provided by the life annuity agreement.

In the event of the death of one of the annuity recipients, his share in the right to receive annuity passes to the surviving annuity recipients, unless otherwise provided by the life annuity agreement, and in the event of the death of the last annuity recipient, the obligation to pay the annuity is terminated.

3. An agreement establishing a life annuity in favor of an individual who has died at the time of conclusion of the agreement is void.

Article 706. Amount of life annuity

1. Lifetime annuity is defined in the contract as a sum of money periodically paid to the annuity recipient during his life.

2. The amount of life annuity established by a life annuity agreement, which provides for the alienation of property free of charge, per month must be no less than the established amount of the minimum wage.

Article 707. Terms of payment of life annuity

Unless otherwise provided in the life annuity agreement, the life annuity is paid at the end of each calendar month.

Article 708. Termination of a life annuity contract at the request of the annuity recipient

1. In the event of a significant violation of the life annuity agreement by the annuity payer, the annuity recipient has the right to demand from the annuity payer the redemption of the annuity on the terms provided for in Article 703 of this Code, or termination of the agreement and compensation for losses.

2. If an apartment, residential building or other property is alienated free of charge for the payment of a lifelong annuity, the annuity recipient has the right, in the event of a significant violation of the contract by the annuity payer, to demand the return of this property with its value offset against the redemption price of the annuity.

Article 709. Risk of accidental destruction of property transferred for payment of life annuity

Accidental destruction or accidental damage to property transferred for the payment of a life annuity does not relieve the annuity payer from the obligation to pay it on the terms provided for in the life annuity agreement.

§ 4. Lifetime maintenance with dependents

Article 710. Lifetime maintenance agreement with dependents

1. Under an agreement of lifelong maintenance with a dependent, the annuity recipient - an individual transfers a residential house, apartment, land plot or other real estate belonging to him into the ownership of the rent payer, who undertakes to provide lifelong maintenance with the dependent of an individual and (or) a third party (persons) specified by him ).

2. The rules on life annuity apply to a lifelong maintenance agreement with a dependent, unless otherwise provided by the rules of this paragraph.

Article 711. Obligation to provide maintenance for dependents

1. The obligation of the annuity payer to provide dependent maintenance may include providing for the needs for housing, food and clothing, and if the health condition of an individual requires this, also caring for him. A lifelong maintenance agreement with dependents may also provide for payment by the annuity payer for funeral services.

2. The contract for lifelong maintenance with dependents must determine the cost of the entire amount of maintenance with dependents. At the same time, the cost of the total amount of maintenance per month under a lifelong maintenance agreement with dependents, which provides for the alienation of property free of charge, cannot be less than two established amounts of the minimum wage.

3. When resolving a dispute between the parties about the scope of content that is provided or should be provided to an individual, the court must be guided by the principles of good faith and reasonableness.

Article 712. Replacement of lifelong maintenance with periodic payments

An agreement on lifelong maintenance with dependents may provide for the possibility of replacing the provision of maintenance with dependents in kind by payment of periodic payments in money during the life of an individual.

Article 713 Alienation and use of property transferred to ensure lifelong maintenance

The annuity payer has the right to alienate, pledge or otherwise encumber real estate transferred to him to ensure lifelong maintenance, only with the prior consent of the annuity recipient. The annuity payer is obliged to take the necessary measures to ensure that during the period of provision of lifelong maintenance with a dependent, the use of the specified property does not lead to a decrease in the value of this property.

Article 714. Termination of lifelong maintenance with dependents

1. The obligation of lifelong maintenance with a dependent shall be terminated by the death of the annuitant.

2. In the event of a significant violation by the annuity payer of its obligations, the annuity recipient has the right to demand the return of real estate transferred to ensure lifelong maintenance, or payment of the redemption price to him under the conditions established by Article 703 of this Code. In this case, the rent payer has no right to demand compensation for expenses incurred in connection with the maintenance of the rent recipient.

Nuances of the agreement

When drawing up a contract, it is recommended to carefully consider several points:

- payment procedure - in cash or by transfer to a card or bank account;

- actions in case of incapacity of the payer - whether the transaction will be terminated or the payment of annuity will be postponed;

- deadline for making payments - it is worth indicating by what day of the month the rent must be paid (or write that from the 1st to the 10th of each month, for example);

- accurately describe the services that the payer will provide - it is best to describe each service separately (for example, not just “cleaning”, but “cleaning the kitchen, cleaning the bedrooms, cleaning the bathroom, cleaning the toilet, etc.);

- time and frequency of walks;

- names of permitted and prohibited products , frequency of their purchase;

- conditions for preparing and serving food , times of breakfast, lunch and dinner;

- daily routine by the hour.

The contract may also contain a clause providing for rules of conduct for the payer in the event of illness of the apartment owner. List what services must be provided:

- purchase of medicines;

- accompaniment to the clinic and transfer;

- care when prescribed bed rest;

- pet care responsibilities;

- frequency of visits to clinics, etc.

It is especially important to write down all the smallest details when concluding a transaction with a stranger. But even when drawing up an agreement with relatives, there is no need to be afraid of seeming like a hypocrite, writing down each condition with particular meticulousness.

Subject of the agreement

The subject of a lifelong maintenance agreement with dependents is property that is alienated for the maintenance with the dependents of the annuity recipient, which includes ensuring the daily living needs of the annuity recipient in food, housing, medical care, clothing, payment for medicines and care for him when necessary due to his condition health of the annuity recipient. It is also possible to provide for payment of funeral services by the rent payer.

Under this agreement, only real estate (both non-residential and residential) can be alienated - a residential building, apartment, land plot, and so on, both free of charge and for a fee.

What terms of the contract cannot be changed?

There are several terms of the annuity agreement that cannot be changed. These include:

- Amount of rent . The monthly payment should not be lower than the subsistence level, and if the former owner is a dependent - two subsistence minimums. And since this indicator tends to change, the amount of payment is also subject to adjustment.

- Real estate pledge . When the rent agreement comes into force, the apartment automatically becomes the property of the payer, and the recipient becomes the mortgagee. But he cannot dispose of it at his own discretion - sell, give, etc.

- Damage or destruction of housing . Responsibility for the safety of property rests with the tenant. But if the property is destroyed for reasons beyond the control of the owner, the contract does not lose its force. The payer must continue to pay the due amount. If the property is destroyed as a result of the actions of the pledgee, then the contract is terminated.

How to find a rent payer?

Rent is a kind of loan for an apartment, only he will be able to use the property after the death of the former owner. But, unlike a bank, you won’t have to pay interest. For these reasons, there are quite a lot of people who want to care for or financially provide for elderly people in exchange for property, but among them there are also scammers, if you encounter them, you can be left without housing and means of subsistence. Therefore, you need to choose a rental provider carefully, taking into account several important points:

- It is not always profitable to make a deal with close relatives, but it is safer than with strangers;

- before concluding a transaction, you need to ask for a certificate of no criminal record;

- If a potential renter has already concluded rental agreements, then it is better to refuse the services of this person.

If you have no choice and need to contact strangers, you can find a renter through advertisements, acquaintances, and social networks. There are quite a lot of people willing to complete this type of transaction, so there shouldn’t be any problems finding one.

Required documents

To draw up a rental agreement, you will need a package of documents:

- passports of both parties;

- certificate of ownership of the apartment;

- a certificate of family composition indicating all persons registered in the apartment;

- certificate of cadastral value of real estate.

Lawyers recommend additionally requesting a certificate from a psychiatrist confirming the absence of deviations. If, after the conclusion of the agreement, the owner of the apartment is declared incompetent, the agreement will be declared invalid. Moreover, unscrupulous relatives, in order to receive an inheritance, can buy a certificate from a psychiatrist in order to invalidate the annuity agreement. In this case, it will be almost impossible to prove your case.

The annuity recipient is recommended to request a number of certificates from the person in whose name the property is planned to be alienated:

- certificate of no criminal record;

- a certificate from a narcologist confirming the absence of drug and alcohol addiction;

- a certificate of income from the employer as proof of solvency.

You can draw up an agreement yourself, but then it must be certified by a notary and submitted to Rosreestr for official registration. An encumbrance is placed on the property that prevents the further sale of the property.

Notary services are paid . For drawing up a rental agreement, you will have to pay 0.5% of the cadastral value of the property, but not more than 20,000 rubles. Registration of the document in Rosreestr is also paid. In 2021, the state duty is 2,000 rubles. A receipt confirming payment is attached to the contract.

Tax obligations of transaction participants

According to Art. 585 of the Civil Code of the Russian Federation, the rent payer receives ownership of the property immediately after state registration of the agreement. From this moment on, he becomes responsible for the timely payment of property and land taxes.

The payer has the right to a tax deduction, which is provided to employed citizens at the end of the tax period. You can count on it provided that the apartment is transferred into ownership on a paid basis. If the rent implies the transfer of the right to property free of charge, then a tax deduction is not provided.

The annuity recipient pays a tax of 13% on the income of an individual. The tax amount is determined depending on the monthly amount.

The calculation is carried out using the formula: monthly payment amount × 12 (months) × 13%. For example, a payment of 12,000 rubles is made per month. It turns out: 12,000 × 12 × 13% = 18,720 rubles. This amount must be paid according to a self-drafted declaration.

.

If the transaction is terminated early and the rent is redeemed, you will also need to pay a tax of 13% on the amount received.

Civil Code of the Russian Federation Part 2

| Previous chapter | Content | Next chapter |

| SECTION IV. SPECIFIC TYPES OF OBLIGATIONS |

CHAPTER 33. RENT AND LIFETIME DEPENDENT SUPPORT

GENERAL PROVISIONS ABOUT ANNUITY AND LIFETIME DEPENDENT SUPPORT

Article 583. Rent agreement

1. Under a rent agreement, one party (rent recipient) transfers ownership of property to the other party (rent payer), and the rent payer undertakes, in exchange for the received property, to periodically pay rent to the recipient in the form of a certain amount of money or the provision of funds for its maintenance in another form.

. Under an annuity agreement, it is possible to establish the obligation to pay annuity indefinitely (permanent annuity) or for the life of the annuity recipient (lifetime annuity). Lifetime annuity can be established on the terms of lifelong maintenance of a citizen with a dependent.

Article 584. Form of rent agreement

A rent agreement is subject to notarization, and an agreement providing for the alienation of real estate for the payment of rent is also subject to state registration.

Article 585. Alienation of property for payment of rent

1. Property that is alienated for the payment of rent may be transferred by the recipient of the rent into the ownership of the rent payer for a fee or free of charge.

. In the case where the annuity agreement provides for the transfer of property for a fee, the rules on purchase and sale (Chapter 30) are applied to the relations of the parties regarding the transfer and payment, and in the case when such property is transferred free of charge, the rules on the gift agreement (Chapter 32) to the extent since otherwise is not established by the rules of this chapter and does not contradict the essence of the annuity agreement.

Article 586. Encumbrance of rent on real estate

1. Rent encumbers the land plot, enterprise, building, structure or other real estate transferred for its payment. In the event of alienation of such property by the rent payer, its obligations under the rent agreement are transferred to the acquirer of the property.

. A person who has transferred real estate encumbered with rent into the ownership of another person bears subsidiary liability with him (Article 399) for the claims of the rent recipient arising in connection with a violation of the rent agreement, unless this Code, another law or agreement provides for joint liability for this obligation.

Article 587. Security for payment of rent

1. When transferring a plot of land or other real estate for payment of rent, the recipient of the rent, as security for the obligation of the rent payer, acquires the right of pledge over this property.

. An essential condition of an agreement providing for the transfer of a sum of money or other movable property against the payment of rent is a condition establishing the obligation of the rent payer to provide security for the fulfillment of his obligations (Article 329) or to insure in favor of the annuity recipient the risk of liability for non-fulfillment or improper fulfillment of these obligations.

. If the annuity payer fails to fulfill the obligations provided for in paragraph 2 of this article, as well as in the event of loss of security or deterioration of its conditions due to circumstances for which the annuity recipient is not responsible, the annuity recipient has the right to terminate the annuity contract and demand compensation for losses caused by termination of the contract.

Article 588. Liability for late payment of rent

For late payment of rent, the rent payer shall pay the rent recipient the interest provided for in Article 395 of this Code, unless a different amount of interest is established by the rent agreement.

PERMANENT RENT

Article 589. Recipient of permanent annuity

1. Recipients of permanent annuity can only be citizens, as well as non-profit organizations, if this does not contradict the law and corresponds to the goals of their activities.

. The rights of the annuity recipient under a permanent annuity agreement may be transferred to the persons specified in paragraph 1 of this article by assigning a claim and transferred by inheritance or by succession during the reorganization of legal entities, unless otherwise provided by law or agreement.

Article 590. Form and amount of permanent annuity

1. Permanent annuity is paid in money in the amount established by the contract.

A permanent annuity agreement may provide for the payment of annuity by providing things, performing work or providing services corresponding in value to the monetary amount of the annuity.

. The amount of the permanent annuity paid, established by the permanent annuity contract, per month must be no less than the minimum subsistence level per capita established in accordance with the law in the relevant constituent entity of the Russian Federation at the location of the property that is the subject of the permanent annuity contract, and if not in the corresponding subject of the Russian Federation of the specified value is not less than the minimum subsistence level per capita established in accordance with the law for the Russian Federation as a whole.

The amount of permanent annuity established by a permanent annuity contract at the level of the per capita subsistence minimum specified in paragraph one of this paragraph is subject to increase taking into account the increase in the corresponding per capita subsistence minimum. (clause 2 as amended by Federal Law dated November 30, 2011 N 363-FZ)

Article 591. Terms for payment of permanent annuity

Unless otherwise provided by the permanent annuity agreement, permanent annuity is paid at the end of each calendar quarter.

Article 592. The right of the payer to repurchase permanent annuity

1. The payer of a permanent annuity has the right to refuse further payment of annuity by repurchasing it.

. Such a refusal is valid provided that it is declared by the annuity payer in writing no later than three months before the termination of annuity payment or for a longer period provided for in the permanent annuity agreement. In this case, the obligation to pay rent does not terminate until the entire redemption amount is received by the annuity recipient, unless a different procedure for redemption is provided for in the contract.

. The provision of a permanent annuity agreement regarding the renunciation of the permanent annuity payer’s right to repurchase it is void.

The contract may provide that the right to repurchase a permanent annuity cannot be exercised during the life of the annuity recipient or for another period not exceeding thirty years from the date of conclusion of the contract.

Article 593. Redemption of permanent annuity at the request of the annuity recipient

The recipient of a permanent annuity has the right to demand redemption of the annuity by the payer in cases where:

the annuity payer is overdue for payment by more than one year, unless otherwise provided by the permanent annuity agreement;

the rent payer violated his obligations to ensure the payment of rent (Article 587);

the rent payer has been declared insolvent or other circumstances have arisen that clearly indicate that the rent will not be paid to him in the amount and within the terms established by the agreement;

real estate transferred for payment of rent came into common ownership or was divided between several persons;

in other cases provided for by the contract.

Article 594. Redemption price of permanent annuity

1. The redemption of a permanent annuity in the cases provided for in Articles 592 and 593 of this Code is made at the price determined by the permanent annuity agreement.

. In the absence of a condition on the redemption price in a permanent annuity agreement, under which the property is transferred for a fee against the payment of a constant annuity, the redemption is carried out at a price corresponding to the annual amount of annuity payable.

. In the absence of a condition on the redemption price in a permanent annuity agreement, under which the property is transferred for payment of rent free of charge, the redemption price, along with the annual amount of rent payments, includes the price of the transferred property, determined according to the rules provided for in paragraph 3 of Article 424 of this Code.

Article 595. Risk of accidental destruction of property transferred for payment of permanent annuity

1. The risk of accidental loss or accidental damage to property transferred free of charge for the payment of permanent rent is borne by the rent payer.

. In the event of accidental destruction or accidental damage to property transferred for payment under the payment of permanent annuity, the payer has the right to demand, accordingly, termination of the obligation to pay annuity or change the terms of its payment.

LIFE RENT

Article 596. Recipient of life annuity

1. Lifetime annuity can be established for the life of the citizen transferring property for payment of annuity, or for the life of another citizen specified by him.

. It is allowed to establish a life annuity in favor of several citizens, whose shares in the right to receive annuity are considered equal, unless otherwise provided by the life annuity agreement.

In the event of the death of one of the annuity recipients, his share in the right to receive annuity passes to the surviving annuity recipients, unless otherwise provided by the life annuity agreement, and in the event of the death of the last annuity recipient, the obligation to pay the annuity is terminated.

. An agreement establishing a life annuity in favor of a citizen who has died at the time of conclusion of the agreement is void.

Article 597. Amount of life annuity

1. Lifetime annuity is defined in the contract as a sum of money periodically paid to the annuity recipient during his life.

. The amount of life annuity established by a life annuity agreement providing for the alienation of property free of charge, per month, must be no less than the minimum subsistence level per capita established in accordance with the law in the relevant constituent entity of the Russian Federation at the location of the property that is the subject of the life annuity agreement, and in the absence of the specified value in the relevant subject of the Russian Federation, it is not less than the minimum subsistence level per capita established in accordance with the law for the Russian Federation as a whole.

The amount of the life annuity established by the life annuity agreement at the level of the per capita subsistence level specified in paragraph one of this paragraph is subject to increase taking into account the increase in the corresponding per capita subsistence level.

(clause 2 as amended by Federal Law dated November 30, 2011 N 363-FZ)

Article 598. Terms of payment of life annuity

Unless otherwise provided in the life annuity agreement, the life annuity is paid at the end of each calendar month.

Article 599. Termination of a life annuity contract at the request of the annuity recipient

1. In the event of a significant violation of the life annuity agreement by the annuity payer, the annuity recipient has the right to demand from the annuity payer the redemption of the annuity on the terms provided for in Article 594 of this Code, or termination of the agreement and compensation for losses.

. If an apartment, residential building or other property is alienated free of charge for the payment of a lifelong annuity, the annuity recipient has the right, in the event of a significant violation of the contract by the annuity payer, to demand the return of this property with its value offset against the redemption price of the annuity.

Article 600. Risk of accidental destruction of property transferred for payment of life annuity

Accidental destruction or accidental damage to property transferred for the payment of a life annuity does not relieve the annuity payer from the obligation to pay it on the terms provided for in the life annuity agreement.

LIFETIME SUPPORT WITH DEPENDENTS

Article 601. Lifetime maintenance agreement with dependents

1. Under an agreement of lifelong maintenance with a dependent, the annuity recipient—a citizen—transfers a residential house, apartment, land plot or other real estate belonging to him into the ownership of the rent payer, who undertakes to provide lifelong maintenance with the dependent of the citizen and (or) a third party (persons) indicated by him.

. The rules on life annuity apply to a lifelong maintenance agreement with a dependent, unless otherwise provided by the rules of this paragraph.

Article 602. Obligation to provide maintenance for dependents

1. The obligation of the rent payer to provide dependent maintenance may include providing for the needs for housing, food and clothing, and if the citizen’s health requires this, also caring for him. A lifelong maintenance agreement with dependents may also provide for payment by the annuity payer for funeral services.

. The lifelong support agreement must define the cost of the entire amount of dependent support. At the same time, the cost of the total amount of maintenance per month under a lifelong maintenance agreement with dependents, which provides for the alienation of property free of charge, cannot be less than two values of the subsistence level per capita established in accordance with the law in the corresponding constituent entity of the Russian Federation at the location of the property that is the subject of the lifelong maintenance agreement maintenance with dependents, and in the absence of the specified value in the relevant subject of the Russian Federation, at least two values of the subsistence minimum per capita established in accordance with the law for the Russian Federation as a whole. (as amended by Federal Law dated November 30, 2011 N 363-FZ)

. When resolving a dispute between the parties about the amount of content that is provided or should be provided to a citizen, the court must be guided by the principles of good faith and reasonableness.

Article 603. Replacement of lifelong maintenance with periodic payments

An agreement on lifelong maintenance with dependents may provide for the possibility of replacing the provision of maintenance with dependents in kind by payment of periodic payments in money during the life of the citizen.

Article 604. Alienation and use of property transferred to ensure lifelong maintenance

The annuity payer has the right to alienate, pledge or otherwise encumber real estate transferred to him to ensure lifelong maintenance, only with the prior consent of the annuity recipient.

The annuity payer is obliged to take the necessary measures to ensure that during the period of provision of lifelong maintenance with a dependent, the use of the specified property does not lead to a decrease in the value of this property.

Article 605. Termination of lifelong maintenance with a dependent

1. The obligation of lifelong maintenance with a dependent shall be terminated by the death of the annuitant.

. If the annuity payer significantly violates its obligations, the annuity recipient has the right to demand the return of real estate transferred to ensure lifelong maintenance, or payment of the redemption price to him under the conditions established by Article 594 of this Code. In this case, the rent payer has no right to demand compensation for expenses incurred in connection with the maintenance of the rent recipient.

| Previous chapter | Content | Next chapter |

Procedure for terminating the contract

Termination of an annuity or lifelong maintenance agreement is possible by agreement of the parties or in court. In the first case, the issue is resolved peacefully when the payer, for example, is no longer able to pay rent. But most often such contracts are terminated in court.

There are two reasons for termination of a transaction:

- Failure to fulfill the terms of the contract . Elderly people complain of lack of attention, poor maintenance and delayed payments.

- The tenant is declared incompetent . The relatives received a certificate of incapacity of the elderly person at the time of the transaction. The rent agreement is terminated, the payer is left without property and money paid.

But the payer can also terminate the contract if the rent recipient does not take care of the safety of the property, damages the apartment, etc. In this case, the payer has the right to return the amount paid or receive a share of the property.

There are situations when grandparents become suspicious or resort to deception in order not to give up the apartment. Fables are made up about lack of payment for two or more months, leaving, or failure to fulfill other terms of the deal. But the court satisfies the requirements only after presenting evidence of a violation.

Lifetime annuity agreement

Lifetime annuity AGREEMENT No.

g.

"" g.

Citizen, passport (series, number, issued), residing at the address, hereinafter referred to as the “

Rent Recipient

,” on the one hand, and citizen, passport (series, number, issued), residing at the address, hereinafter referred to as the “

Rent Payer

” , on the other hand, hereinafter referred to as the “

Parties

”, have entered into this agreement, hereinafter the “Agreement”, as follows:

SUBJECT OF THE AGREEMENT

1.1. The parties undertake to enter into a future life annuity agreement (hereinafter referred to as the “Main Agreement”), the terms of which the parties determine in this preliminary Agreement.

1.2. The main Agreement will be concluded by the parties within days after the privatization by the Rental Recipient of apartment No. located at the address: , and the registration of a certificate of ownership on this basis by the authorized body.

BASIC TERMS OF THE BASIC AGREEMENT

2.1. The rent recipient transfers to the rent payer the ownership of a room apartment with a total area of sq.m., a living area of sq.m., located at the address: , hereinafter referred to as the “premises”, and the rent payer, in exchange for the received premises, undertakes to pay the rent recipient a lifelong annuity , and also provides the Rent Recipient with the right to lifelong residence in the transferred premises. Lifetime rent in this Agreement means the payment during the life of the Rent Recipient of periodic payments in money in the amount established in this Agreement.

2.2. The characteristics of the transferred premises are in accordance with certificate No. dated "" of the year, which is an integral part of this agreement.

2.3. Lifetime annuity is established in the form of monthly payments in the amount of rubles.

2.4. For the period of validity of the Main Agreement, the rent payer is obliged to:

- provide the Rent Recipient with the premises specified in clause 2.1 of the Agreement for living for the period of the Rent Recipient's life;

- monthly, no later than the date of the month, pay the annuity recipient a life annuity in the amount specified in clause 2.3 of the Agreement.

2.4.1. For the period of validity of this preliminary Agreement, the rent payer undertakes to take all necessary actions for the privatization of the apartment specified in clause 2.1 of the Agreement.

2.5. The annuity recipient under the Main Agreement is obliged to:

- transfer the apartment under the terms of clause 2.1 of the Agreement no later than “” after the conclusion of the Main Agreement.

2.5.1. The annuity recipient under this preliminary Agreement undertakes:

- not to register (permanently, temporarily) any citizens in the apartment specified in clause 2.1 for any reason;

- issue to the Rent Payer, as well as to the citizens indicated by the Rent Payer, the necessary documents and powers of attorney for the Rent Payer to fulfill its obligations specified in clause 2.4.1 of this Agreement;

- provide the Rent Payer with other necessary assistance in fulfilling his obligations provided for in clause 2.4.1 of this Agreement.

2.6. The rent recipient, in order to secure the obligations of the rent payer under the Main Agreement, receives the right of pledge on the transferred premises.

2.7. All expenses for state registration and notarization of the Rent Agreement and transactions provided for by this Agreement, state registration of rights to real estate transferred under this Agreement are charged to or reimbursed by the Rent Payer.

2.8. The risk of accidental destruction of the premises transferred by the Rent Recipient lies with the Rent Payer. In case of accidental destruction of the apartment, all obligations of the Rent Payer are preserved.

2.9. The party that fails to fulfill or improperly fulfills its obligations under this Agreement is obliged to compensate the other party for losses caused by such failure.

2.10. In the event of a significant violation of the Agreement by the Rent Payer, the Rent Recipient has the right to demand redemption of the annuity or termination of the Agreement and compensation for losses. A significant violation of the Agreement is recognized as:

- delay by the Rent Payer in paying rent for more than one year (other period).

2.11. A life annuity agreement is subject to mandatory registration and notarization.

RESPONSIBILITY OF THE PARTIES

3.1. If one of the parties evades concluding the main Agreement (clause 1.1) provided for in this Agreement, the evading party will have to compensate the bona fide party for losses caused by such evasion.

3.2. If one of the parties avoids concluding the Main Agreement, the other party, by virtue of clause 4 of Art. 445 of the Civil Code of the Russian Federation, has the right to go to court with a demand to compel the conclusion of an agreement.

3.3. If the Rent Recipient, in violation of the obligation provided for in clause 2.5.1 of the Agreement, registers any citizen for any reason in the apartment specified in clause 2.1 of this Agreement, the Rent Payer acquires the right to refuse to conclude the Basic Agreement, and the Rent Recipient is obliged will reimburse the Rent Payer for all expenses incurred in fulfilling the terms of this Agreement, as well as pay a fine in the amount of rubles.

DISPUTE RESOLUTION

4.1. All disputes and disagreements that may arise between the parties on issues that are not resolved in the text of this Agreement will be resolved through negotiations based on the current legislation of the Russian Federation.

4.2. If controversial issues are not resolved during negotiations, the disputes are resolved in court in the manner established by the current legislation of the Russian Federation.

FINAL PROVISIONS

5.1. This Agreement is subject to notarization and state registration in the manner prescribed by law and comes into force from the moment of state registration.

5.2. This Agreement is drawn up in 4 copies, one copy for each party, one copy is kept in the notary’s files and one copy for the registering authority. Each copy of the Agreement has equal legal force.

ADDRESSES AND PAYMENT DETAILS OF THE PARTIES

Annuity recipient

- Registration address:

- Mailing address:

- Phone fax:

- Passport series, number:

- Issued by:

- When issued:

- Signature:

Rent payer

- Registration address:

- Mailing address:

- Phone fax:

- Passport series, number:

- Issued by:

- When issued:

- Signature:

Risks of the parties

A well-drafted agreement involving a lawyer and a notary will help protect against fraud and dishonesty on the part of the rent payer. If the basic and additional conditions are specified, then payers will not evict the tenant or refuse care and financial support.

But still, each party risks suffering losses associated with unfair treatment. Let's consider the existing risks.

- Error in choosing a payer

. When choosing a partner, older adults are advised to take personal preferences into account. For the rest of your life, a stranger will be present in the apartment or you will have to pay maintenance. And personal hostility will negatively affect relationships and the nervous system. - An unbearable burden

. The payer risks finding himself in a difficult financial situation, because he will have to pay a monthly amount exceeding 10,000 rubles. Considering that there are basic expenses (paying rent, taxes, buying food for your family), the burden can be overwhelming. - Long wait for an apartment

. By drawing up a rent agreement, the payer expects to receive the property soon. But old people can live for decades more. There have been cases when the annuity recipient lived longer than the payer. It is recommended to provide for this point in the agreement, allowing the inheritance of the apartment and obligations under the agreement. - Relocation of an old man

. After registration of the agreement, the apartment becomes the property of the payer. And unscrupulous persons evict the elderly. If this point is not provided for by the terms of the transaction, then the annuity recipient needs to go to court. - Loss of property

. The actions of the elderly are often reckless due to age and mental illness. And property damage is one of the most common situations. Old people flood their neighbors, forget to turn off the burners, etc. If the property is destroyed, the payer will be left without real estate, but with a valid rental agreement. - The old man wants to terminate the contract.

Fraudsters are found not only among rent payers, but also among grandmothers. They go to court with a demand to declare the contract invalid due to failure to comply with the terms of the deal. - Heirs.

After the death of the old man, you should wait for the relatives to find out about the inherited apartment. But their attempts to regain their property are rarely crowned with success, especially if there is a certificate of the old man’s legal capacity at the time of the transaction. - Causing harm to health

. To hasten the death of the old man and quickly get an apartment, medicines are given in large doses, meals are prepared with prohibited products. Such acts are subject to criminal liability. - Family difficulties.

Caring for an elderly person is difficult for families. And if difficulties arise, the old man has the right to terminate the deal.

Unfortunately , even a deal concluded in the presence of a lawyer is risky for both parties. But you can reduce the likelihood of deception with a detailed analysis of the terms of the agreement.

Termination of a lifelong maintenance agreement

Termination of a lifelong maintenance agreement with a dependent can be carried out both on general grounds, which are provided for by the rules of Chapter 26 of the Civil Code, and on special grounds, which are specified in paragraph 3 of Chapter 33 of the Civil Code of the Russian Federation.

Obligations that arise from the contract can be terminated by the payer only on a general basis. The recipient may terminate the relationship ahead of schedule if the payer materially violates the terms of the agreement. In this situation, he has the right to demand from the payer the redemption of the rent on the terms provided for in Article 594 of the Civil Code of the Russian Federation, or compensation for losses and termination of the contract.

The rent payer for late payment of rent to the annuity recipient pays interest, which is provided for in Article 395 of the Civil Code of the Russian Federation, when a different amount is not established by the agreement (Article 588 of the Civil Code of the Russian Federation).

When a contract with the recovery of losses is terminated, the annuitant has the right to claim compensation for all losses, which include the value of the transferred property minus the compensation received from the annuity payments and the payer for the property.

The procedure for transferring property from the recipient to the payer is not regulated by the Civil Code of the Russian Federation, but it is in the interests of both parties to formalize such transfer with an acceptance certificate.

In a sample life support agreement with dependents, you can use the following applications:

- Description of the property.

- Property specification.

- Cadastral passport.

- Certificate of state registration of rights.

- Surety agreement (original).

- Pledge agreement (original).

- Insurance contract (copy).

- Bank guarantee agreement (original).

- Title documents for real estate.

In a lifelong maintenance agreement with dependents, the following accompanying documents are used:

- The act of accepting the transfer of real estate.

- The act of accepting the transfer of property.

- Protocol of disagreements.

- Additional agreement.

- Protocol for reconciliation of disagreements.

Differences between annuity contracts

In order not to make a mistake in choosing the type of contract, it is worth considering the differences between them.

Condition | Life annuity | Perpetual annuity | Maintenance and dependency |

| Annuity recipient | Individuals | Individuals and non-profit organizations | Individuals |

| Type of property | Cash, real estate, cars | Cash, real estate, cars | Residential Properties |

| Rent term | Limited by the life of the annuitant | Is not limited | Until the death of the recipient |

| Transfer of obligations by inheritance | Not getting through | Transmitted | Not getting through |

| Change of annuity recipient | Impossible | Allowed | Not allowed |

| Rent payment method | Cash, food, care, maintenance, apartment cleaning services | Cash and bank transfers, care services, cooking | Care and service for an elderly person: cleaning the apartment, cooking, feeding, accompanying to the hospital, care during illness |

| Frequency of rent payment | Monthly | Quarterly | Monthly or daily |

Sample life annuity agreement

AGREEMENT N _____ life annuity

g.__________ "___"_________ ____ g.

Citizen __________________, hereinafter referred to as the “Rent Recipient”, passport ___________, ____________, date of birth, registered at the address: __________________, on the one hand, and citizen ____________, hereinafter referred to as the “Rent Payer”, passport ____________, __________ date of birth, registered at the address: _______________________________, on the other hand, we have entered into this Agreement as follows:

1. THE SUBJECT OF THE AGREEMENT

1.1. Under this Agreement, the Rent Recipient transfers to the Rent Payer a two-room apartment located at the address: _____________________________________, hereinafter referred to as “property”, and the Rent Payer, in exchange for the property, undertakes to periodically pay the Rent Recipient during his life (lifetime) rent in the form of a certain amount of money. the amount established by this Agreement. 1.2. The property belongs to the Rent Receiver on the right of ownership, which is confirmed by the Certificate of State Registration of Rights, series ______, N __________, issued by the Main Directorate of the Federal Registration Service for Moscow, and an entry in the Unified State Register of Rights to Real Estate and Transactions with It N _________________ dated __________ g. 1.3. The characteristics of the transferred property are indicated in the Technical Data Sheet and the attached BTI certificate. 1.4. The property is transferred to the Rent Payer free of charge within the period agreed upon by the parties, after the state registration of this Agreement and the transfer of ownership of it. 1.5. The rent recipient guarantees that until the moment of transfer the real estate is not encumbered by the rights of third parties, is not under arrest, and his rights to the real estate are not disputed in court. 1.6. The following documents are transferred along with the apartment: - technical passport; - extract from the house register; — certificate of state registration of rights.

2. RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The rent payer undertakes to pay the rent recipient monthly (or annually) in payment of rent in the amount of _______ rubles (but not less than 1 minimum wage per month). The rent is paid within the period agreed upon by the parties by transferring funds to the account of the Rent Recipient, notified by him to the Rent Payer. 2.2. The rent payer has the right to early transfer funds in payment of rent to the account of the rent recipient both for one period and for several periods. 2.3. The rent paid to the Rent Recipient by the Rent Payer encumbers the property transferred under this Agreement. In the event of alienation of property by the Rent Payer, its obligations under the Rent Agreement are transferred to the acquirer of the property. When the Rent Payer transfers property encumbered with rent into the ownership of another person, this person bears subsidiary liability with the Rent Payer for the claims of the Rent Recipient arising in connection with the violation of this Agreement. 2.4. The rent recipient is obliged to warn the rent payer about hidden defects in the transferred property. 2.5. The rent recipient, in order to secure the obligations of the rent payer, receives the right of pledge on the transferred property. 2.6. Accidental destruction or accidental damage to property transferred for payment of rent in accordance with this Agreement does not relieve the Rent Payer from the obligation to pay it on the terms provided for in this Agreement. 2.7. All costs for state registration and notarization of this Agreement, as well as for state registration of rights to property transferred under this Agreement, are paid by the Rent Payer. 2.8. This Agreement may be terminated in cases provided for by the current legislation of the Russian Federation.

3. RESPONSIBILITY OF THE PARTIES AND ENSURING FULFILLMENT OF THE OBLIGATIONS OF THE RENT PAYER

3.1. The party that fails to fulfill or improperly fulfills its obligations under this Agreement is obliged to compensate the other party for losses caused by such failure. 3.2. In case of non-fulfillment or improper fulfillment by the Rent Payer of clause 2.1 of this Agreement, he shall pay the Rent Recipient a penalty in the amount of ___% of the unpaid or late paid amount for each day of delay.

4. DISPUTE RESOLUTION

4.1. All disputes and disagreements that may arise between the parties on issues that are not resolved in the text of this Agreement will be resolved through negotiations based on the current legislation of the Russian Federation. 4.2. If settlements are not resolved during negotiations, disputes are resolved in court in the manner established by the current legislation of the Russian Federation.

5. FINAL PROVISIONS

5.1. This Agreement is subject to notarization, comes into force from the moment of its state registration and is valid during the life of the Rent Recipient. 5.2. The transfer of ownership of the property transferred under this Agreement by the Rent Recipient to the Rent Payer is subject to state registration. 5.3. This Agreement has been drawn up in 4 copies, one for each party, for the notary and for the institution for registering rights to real estate and transactions with it. Each copy of the Agreement has equal legal force. 5.4. Addresses and payment details of the parties:

Rent payer: _____________________________________________________ _____________________________________________________________________ _____________________________________________________________________

Rent recipient: _____________________________________________________ _____________________________________________________________________ _____________________________________________________________________

SIGNATURES OF THE PARTIES:

Rent payer: _________________/_________________

Rent recipient: _________________/_________________

City (village, town, district, region, region, republic).

Date (day, month, year) in words.

This agreement is certified by me, (last name, first name, patronymic), a notary (name of the state notary office or notary district). The agreement was signed by the parties in my presence. The identity of the parties has been established and their legal capacity has been verified.

Registered in the register for N ________.

State duties collected (at the rate) ________.

Seal Notary Signature

conclusions

- The rent agreement implies the receipt of money in an amount equal to the cost of the apartment, which becomes the property of the payer.

- A lifelong maintenance agreement involves caring for an elderly or sick person instead of paying for an apartment.

- The annuity recipient pays 13% tax on the amount received.

- Obligations under the contract terminate with a life annuity. In the case of an unlimited term, the transaction is valid until the payment of the cost of the apartment.

- Responsibilities under the transaction are inherited, as is the subject of the agreement.

- A lawyer will help you draft a contract correctly.

- The agreement is subject to registration with Rosreestr. After this, ownership rights pass to the rent payer.

Often pensioners, elderly residents, and people with poor health are in dire need of self-care and constant care. Their pension or benefits are not enough to cover their living expenses and pay for housing and utilities. However, they are the owners of expensive property, an apartment or a house.