It is rare that a young family in modern realities does not face such a problem as the lack of their own housing. If previously the only option was long-term accumulation, often with the help of relatives, today mortgage lending is coming to the fore. By turning to the bank for help, you will quickly receive the missing amount and be able to purchase an apartment or house in which you can live now. You will need to pay much later. However, it should be noted that a loan such as a mortgage has a number of serious features. First of all, we mean its large size and duration. It is no coincidence that most citizens prefer to cooperate with large banks, in whose reliability they are confident. In connection with these factors, the question of what documents will be required for a mortgage at SberBank does not lose its relevance.

What requirements does Sberbank put forward to borrowers?

Registration of a transaction for the purchase of real estate with a mortgage encumbrance through Sberbank is available only to citizens of the Russian Federation. The following requirements are established for Russians:

- Age. Applicants who have reached 21 years of age are eligible to apply. The age limit at the time of contract closure is 75 years. If a mortgage is issued without income/employment information, the loan must be closed before age 65 inclusive.

- Work experience – from 3 months at the current place of work. The requirement for having a total work experience of 1 year over the previous 5 years has been cancelled.

- Co-borrowers. Any individuals up to 3 people. Their income is taken into account in calculating the loan amount. Spouses of title borrowers must become co-borrowers (with the exception of the lack of citizenship of the second spouse or division of property under a marriage contract).

To approve a mortgage, the bank requires collecting certificates about the financial solvency of co-borrowers. Age requirements are similar to those for borrowers.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The decision to attract third parties to mortgage lending is made by the bank client, but with a low income it is impossible to do without them. The bank views such support positively, because it is evidence of the client’s social well-being.

You can submit an application with a package of documents at one of the Sberbank branches at the place of permanent registration of the client or co-borrower, the location of the property being purchased, or the accreditation of the employer of the borrower (co-borrower). The choice is up to the mortgage applicant.

What needs to be prepared for non-residential premises

In order to issue a loan for non-residential premises, for such real estate you need to submit the following documents to the bank for a Sberbank mortgage:

- if a land plot is rented - a lease agreement;

- technical passport or description of the floor where the premises are located;

- evidence that there are rights to the premises;

- a plan of the entire building, where the area being purchased is indicated;

- project and estimate, if the object has not yet been put into use;

- confirmation of the profitability of the premises.

The last point applies to commercial real estate, when the non-residential premises are planned to be used as a gas station, warehouse, store, etc.

Standard package of documents that will be requested in each bank

The financial stability and social status of the borrower for any lender are decisive in the decision. Banks call this an “initial approval” for a mortgage. It is logical that its issuance is impossible without establishing the credit rating, nature of employment, income and solvency of the client. Interaction with the financial structure begins with verification of such facts.

Based on the information provided by the client, the bank approves the mortgage, sets the maximum loan amount and provides time to search for real estate for the transaction (90 days). Once the object is selected, you can collect the papers. A standard list of documents is required by almost all financiers who provide loans to the population with collateral.

What documents will the bank need at the stage of submitting an application and its consideration?

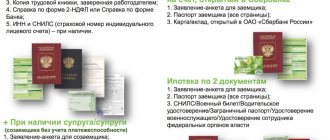

Before submitting an application to the lender, you must prepare confirmation of the financial solvency and identity of the borrower:

- a general passport with a valid expiration date and a registration mark at the place of residence;

- second confirmation of identity (at the client’s choice) – military ID, international passport, driver’s license, service ID of municipal/federal authorities;

- SNILS, INN;

- confirmation of work activity – a certificate from the place of work according to the organization form, a copy or extract from the work book, a lawyer’s certificate, a copy of the agreement/contract, a certificate of registration of individual entrepreneurs or self-employed status are allowed;

- marriage certificate for the registered relationship of the potential borrower;

- 2-NDFL certificate for employees, bank account statements for individual entrepreneurs (it is possible to provide information about income using a bank form);

- certificates on the amount and terms of payment of pensions for pensioners for old age, disability, loss of a breadwinner, length of service (for this document the standard of the agency providing pensions is acceptable).

Sometimes, at the time of submitting an application, it turns out that the applicant’s income allows him to take out a mortgage, but his financial stability is in doubt. In this case, Sberbank offers to find guarantors. These individuals assume financial responsibility in the event the client becomes insolvent. Guarantors provide the bank with the same package of documents as the borrower.

What needs to be provided after the application is approved

You can select real estate immediately after receiving a positive decision on your application. As soon as the buyer decides on the property, the collection of basic documents for obtaining a mortgage at Sberbank begins.

Depending on the program and the bank’s credit policy, the complete package may vary. At the same time, there are always standard papers, without which not a single mortgage transaction will go through:

- confirmation of ownership (for secondary real estate) - an extract from the Unified State Register of Property, the presence of encumbrances and restrictions;

- documents on the provided collateral for a mortgage loan;

- assessment of the market value of a secondary property;

- confirmation of the availability of a down payment from the borrower (statement of the account balance or payment documents for payment of part of the cost of the object);

- documents on the loaned property (provided by the developer or private owner);

- notarized consent of the borrower's spouse to sign the encumbrance agreement;

- documents from the developer for new buildings - escrow agreement with Sberbank, title documents for land (ownership, lease of land), statutory documents of the construction organization, DDU or Project Financing Agreement;

- details of the escrow account where funds will be stored until the facility under construction is put into operation (opened in Sberbank).

Any real estate owned by the borrower (including non-residential premises and land), vehicles, securities, and precious metal bars can be used as collateral for a mortgage. Moreover, their estimated value must be no less than the apartment purchased on loan.

The list of documents for an object directly depends on its type.

What documents do you need to take from the seller?

In the primary market, Sberbank works with accredited properties (the list of approved new buildings can be found on the DomClick portal). Project declarations and construction permits for such real estate have already been verified by the bank, and the buyer remains to provide the purchase and sale agreement concluded with the seller company.

You will have to work hard to collect documents for a mortgage on a secondary home. It is the seller who is obliged to document the legal purity of the transaction, collect papers for the assessment and technical characteristics of the object.

Package from the owner:

- copy of passport with registration marks;

- marriage or divorce certificate;

- notarization of the single/divorced seller that at the time of the sale he was not in a marital relationship;

- notarized consent of the spouse for the alienation of real estate (if acquired during marriage);

- the basis for the emergence of the right to the object: agreement of exchange, purchase and sale, deed of gift, documents of inheritance, rental transfer of rights;

- permission to sell guardianship authorities if minors and/or incapacitated persons are registered in the apartment or have shares in the property;

- cadastral passport, technical passport, extract from the house register about registered persons;

- if there is redevelopment - permission from regulatory authorities;

- certificates from the housing department confirming the absence of debts on utility bills.

If this is shared ownership, you will need:

- notarized notification to other owners of the seller’s alienation of his share;

- notarized waiver of the pre-emptive right of purchase by other owners;

- permission from the guardianship authorities to notarize the minor’s renunciation of his share

The seller initiates an appraisal of his property. The total amount of the submitted report determines the size of the loan issued to the borrower, the down payment and the insured amount of the object.

When a third party acts on behalf of the owner, a notarized power of attorney is required. The validity period and documentary terms of reference of the attorney must be specified.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The so-called general power of attorney is not provided for in Russian law. In practice, such a document implies the ability to conduct purchase/sale transactions on behalf of the principal, represent his interests in departments, open/close bank accounts, carry out settlements, receive money due to the principal and other legal possibilities. In order for an attorney to carry out a specific action with real estate, the power of attorney must contain the appropriate permission.

Results

If you decide to use a mortgage lending service, do not rush to collect the entire package. For the first part of the design, you will only need the initial list. After the credit institution approves the amount of the available credit limit, the borrower will have no more than 120 days to find suitable housing. Collect everything else after you decide on the property.

When you first contact, clarify all questions that are unclear to you, ask the manager to make an approximate calculation of the monthly payment to assess your solvency. To calculate monthly installments, the borrower can independently visit the official website, where a mortgage calculator is presented in accordance with the terms of the loan.

Features of obtaining a mortgage using two documents

The “light version” of the mortgage loan is available to salary clients. A simplified scheme applies at the stage of submitting an application form. The applicant provides his passport and a second identification card (driver’s license, SNILS, international passport). 2-NDFL certificates, copies of employment records and employer confirmation of length of service are not needed (the bank already has access to such information from “salaries”).

The disadvantages of a mortgage based on two documents include a lower age threshold for closing a loan (65 years) and an increase in the client’s personal rate by 0.8%, due to which the monthly loan payment will be higher.

After receiving approval, the registration algorithm does not differ from conventional programs. To obtain a mortgage loan from Sberbank, you will have to prepare a complete package for the property, submit certificates from the seller, insure life and the encumbrance.

Total

When going to the bank for a home loan, do not rush to collect all the necessary documents at once. To approve a loan, the bank only needs a basic package of documents, which concerns your personal data, employment and earnings. You will have time for everything else later, after the bank approves the transaction. In addition, many documents have an expiration date, after which you will have to collect everything again.

At the first consultation, provide the loan specialist with the information necessary at the first stage and find out all the points that interest you. When you first visit, ask a bank employee to calculate the approximate amount of monthly payments to assess your financial capabilities.

Additional documentation on special mortgage programs

Sberbank operates about 15 collateral housing lending programs aimed at solving citizens’ housing problems and refinancing other loans. You can buy popular types of real estate with a mortgage: a property under construction or a finished property, a country cottage with a plot of land or an apartment in an apartment building, a private house within the city, in the countryside, a garage or a parking space.

At the same time, the lender offers profitable lending programs, including loans with a reduced or refundable rate using maternal capital. Special conditions are provided by the state by subsidizing banking costs. The client’s compliance with the requirements is confirmed by additional documents on social mortgage.

Papers for mortgages with maternity capital

In addition to the standard papers discussed above, the borrower must submit:

- a certificate from the regional branch of the Pension Fund about the balance of maternity capital;

- state certificate for MSK (original and copy).

A notification from the Pension Fund may be submitted to Sberbank during the entire period of approval of the mortgage loan. But you shouldn’t delay: the certificate is valid for 30 days from the date of issue.

With a Sberbank mortgage using MSK, parents will be able to buy a finished home or an apartment in a building under construction from a developer. Within 6 months after the loan is issued, the borrower applies to the Pension Fund branch at the place of residence to submit an application for debt repayment using MSK funds.

Secured lending for the purchase of housing

The program is called “Loan for any purpose secured by real estate.”

It is not the apartment being purchased that is registered as an encumbrance, but any real estate owned by the borrower. Since the loan is non-targeted, documents on the purchased object are not needed.

The following can serve as collateral:

- housing in apartment buildings, block sections of town houses, rooms in apartments;

- private houses of the individual housing construction category together with a plot;

- garages and garage premises with land allotment.

In addition to identity documents, confirmation of employment and solvency, the client additionally prepares papers on the collateral object.

The list is extensive:

- certificate of ownership on paper (if issued);

- documents providing the basis for the emergence of the right to real estate;

- extended extract from the Unified State Register of Real Estate;

- cadastral and technical passports, floor plan and explication;

- report on assessing the value of the object;

- notarized consent of the spouse for the pledge;

- marriage contract (if any);

- certificate from the housing department, extract from the house register about registered persons;

- consent of the guardianship authorities, if children and incapacitated persons are registered in the residential premises;

- boundary plan and other documents for the land plot (if the encumbrance is placed on a house or private plot).

The program is available to citizens with temporary registration in the Russian Federation (Russian citizenship is required). From such persons, Sberbank will require a document confirming registration at the place of residence.

Young Family Program

It would be more correct to call the program a promotion, since special conditions for citizens apply “within” the limited list of Sberbank mortgage programs. For a family to be included in the preferential category, at least one of the spouses must be under 35 years of age. Both full and single-parent families will be able to take advantage of the offer.

Under the terms of the program, a mortgage can be issued for housing under construction or a finished secondary market apartment.

In addition to standard documents, you will need:

- marriage certificate (not required for borrowers from single-parent families);

- child's birth certificate;

- confirmation of relationship with the parents of the borrower/co-borrower, if the income of these persons is taken into account in the calculation of solvency.

Family ties will be confirmed by the borrower’s birth certificate (parents are indicated there), registry office certificates about the change of surname, name, patronymic, and the borrower’s marriage certificate.

Military mortgage

The program is designed for military personnel participating in the military savings and mortgage system (NIS). Providing military housing is carried out by the department at the place of service, the procedure is regulated by a separate law (No. 117-FZ).

The essence of a military mortgage is as follows:

- credit debt is repaid by the state for the borrower throughout his service;

- it is the military department that determines whether the candidate is eligible for preferential conditions;

- The bank’s task is to verify the applicant’s right to a military loan and carry out all standard procedures for obtaining a mortgage.

The list of documents provided is not very different from other mortgage programs. Additionally, you will need a certificate of the right of a participant in the NIS of housing provision for military personnel to receive a targeted housing loan. Standard papers include a passport, a certificate from the place of service, documents on the loaned object and confirmation of the seller’s identity.

Mortgage with government support

The list of objects acceptable for purchase is limited to new buildings under construction and finished ones. To approve the application, it is enough to meet the standard requirements for the borrower discussed above, but the seller must be a legal entity (developer).

The package of documents includes confirmation of the borrower’s identity, employment, solvency, availability of a down payment, paperwork on the loaned property and the collateral.

Payments between the parties can be made through the secure transactions service of the DomClick portal.

The algorithm is as follows:

- The borrower transfers money for the property to a special account of the Sberbank Real Estate Center.

- The lender makes a request to Rosreestr to register the purchase and sale transaction.

- After receiving confirmation, funds are transferred to the seller's account.

Package of documents for registration of the service:

- passport, TIN of the buyer;

- passport and details for crediting the seller’s funds (legal entities provide only bank account information);

- purchase and sale agreement for the property.

Buying a home in a building under construction

The seller of such an object is the developer, so all registration falls on the borrower. Documents for mortgage approval and transaction are provided according to the usual list of Sberbank.

The additional kit required by the buyer depends on the situation:

- maternity capital is used - a state certificate and a certificate from the Pension Fund of the Russian Federation on the balance of funds in the MSK account;

- the loan is issued under the “Young Family” program - documents for children, marriage;

- if guarantors are brought in to secure the borrower's obligations or other real estate is pledged - papers on the object, confirmation of the solvency of the guarantors.

As an interim measure, it is more convenient to formalize a pledge of the right of claim under an equity participation agreement (PAA) between the buyer and the developer.

What documentation package to collect for registration of a new building

The standard list includes evidence of rights to a specific apartment or residential building, information from the register and the consent of the second spouse to the transaction. You will also need:

- results of expert cost assessment;

- cadastral passport of living space;

- technical documentation;

- certificate of registered persons;

- marriage contract, if any.

If you have dependents registered in the mortgaged living space, you need to obtain paperwork from the guardianship department. This list must be collected before 90 days have passed after the money is issued.

Buying a new building with a mortgage: instructions

What to do after accepting an apartment with a mortgage in a new building

Nuances and difficulties faced by borrowers when collecting documents and certificates

Not only clients, but also sellers must collect the necessary information. If the owner turns out to be a slow person, he can ruin the deal. This is the first nuance that a potential borrower will encounter. Here it is enough to control the process of collecting documents, but there are situations that will require endurance and caution:

- If the apartment has been put up for sale several times, and the periods of ownership of each owner are insignificant (within a year, sometimes less), someone’s violated rights, fraud with inheritance, shared ownership, and maternal capital may “come to light.” In such a situation, it is better to independently order an extended extract from the Unified State Register and make sure that there are no arrests (even those lifted).

- Sellers generally don't like mortgages. There is always a risk that during the registration process a buyer with real money will appear and the owner will refuse the mortgage transaction. A preliminary purchase/sale agreement will help to avoid such troubles.

- Obtaining certificates is time-consuming. An application for permission from the guardianship authorities is processed within 14 days, a certificate from the passport office about registered persons or an extract from the Unified State Register is produced from 2 to 5 days. At the same time, the validity period of the set of documents for the apartment is limited. For supporting information, it is 14-30 days, so it is better to order such papers shortly before the mortgage transaction (taking into account the preparation time).

- The sale of an apartment (house, cottage) will be complicated by the presence of minors among the owners or registered residents. You will have to not only obtain permission, but also confirm the continued provision of living conditions for these citizens at a similar level, and this is additional paperwork.

- There are many pitfalls in a shared real estate transaction. The seller is obliged to obtain consent for the sale from the owner of the share. And if communication with the owner is lost (or he is against the sale), the issue will have to be resolved through the court, but during the litigation the mortgage approval period will end.

- At the stage of preparing documents, it is not common, but there are errors and unreliable information in certificates (this is what the Unified State Register of Real Estate extracts are “sinful of”). Such papers will have to be redone.

A mortgage acts as a guarantee of the legality of the transaction. Banks check the property against closed databases and will not approve the premises with the likelihood of loss of ownership. But this circumstance does not exempt the buyer from carefully studying all documents.

Why requirements may differ for different borrowers

The reason is obvious: borrowers from different social groups have different sources of income, financial and social stability. And even for one group, the conditions differ depending on age, the method of confirming solvency, the ratio of income to expenses, participation as guarantors/co-borrowers with other persons, and credit load.

It is unrealistic to get a mortgage from Sberbank for an unemployed person without a confirmed income. Violations of the law in the past, too frequent litigation (even as a plaintiff), health problems, debts for housing and communal services and alimony may well serve as a reason for refusal of a mortgage or negatively affect the terms of lending.

What package of papers does an individual entrepreneur need to get a loan?

To receive funds to purchase housing, an entrepreneur will need to collect a more impressive package of certificates and statements. They are designed to confirm the borrower’s reliability and financial stability. However, the procedure is simplified if the entrepreneur conducts monetary transactions through this bank.

Together with an identification document and an application, a sample of which will be issued by the managers of the financial institution, the following individual entrepreneur documents will be required for a mortgage at Sberbank:

- extract on availability of registration in the state. register of entrepreneurs;

- a license or certificate giving the right to entrepreneurial activity;

- report on taxes paid for a year or 24 months;

- certificate of income/expenses received ();

- certificate of property status and current obligations ()

- papers for a mortgaged house or apartment.

Tax reports for simplified taxation are provided for 12 months. A two-year report will be required for the general method of paying taxes.

Other certificates may be required (). They are mainly related to confirmation of income level (long-term commitment agreement, office rental agreement, etc.). Sometimes it is necessary to confirm marital status, salary of the second spouse, etc.

Current samples of applications and certificates for obtaining a mortgage

Today, many mortgage transactions are concluded electronically. The DomClick portal, associated with Sberbank, helps with this. The site contains a huge database of real estate for purchase/sale, checked for legal purity by Sberbank specialists. The portal offers many useful services.

In fact, the platform allows you to conduct real estate transactions from filing an application to registering the right to an object.

Step-by-step algorithm for submitting a mortgage application to Sberbank through the DomClick portal:

- Log in to your “Personal Account” using your mobile phone number, Sberbank-Online service ID or login/password from the “Personal Account” of the “State Services” portal.

- Select the "Mortgage" tab.

- Go to the “Mortgage Calculator” section and in the “Loan Purpose” menu, select the appropriate program and set the necessary conditions.

- Click “Submit an application” (“Update calculation” if you need to change the lending parameters) and go to the page with the application form. Filling out begins with entering information about the identity and income level of the borrower.

- In the data verification section you will need to enter your passport details, registration and actual residence information.

- Indicate information about your spouse (upon official registration of marriage); if co-borrowers are involved, the information about these persons.

- At the final stage, the candidate selects a Sberbank office where it is convenient for him to conclude a deal and sends the application form for verification.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

When purchasing real estate remotely, the buyer and seller will have to visit the Sberbank office to sign an apartment purchase and sale agreement (in 3 copies: for the bank and the parties to the transaction). If the owner is from another region, all 3 draft agreements are sent by mail or special mail. by courier to the branch at the person’s place of residence for signing.

Like most lenders, Sberbank has retained the ability to submit a paper mortgage application in the office. The borrower's questionnaire looks like this:

What papers should be prepared for a garage loan?

This type of building is also often purchased through a loan. There is a separate list of documents for obtaining a mortgage from Sberbank for a permanent garage and a portable building. In the first case you will need:

- confirmation of the absence of encumbrances;

- information about the owner of the land under the garage;

- object assessment results;

- registration certificate and consent of co-owners, if any;

- certificate from the cooperative for the owner of the garage;

- a certificate proving that the object will not be demolished.

Some certificates are requested from the municipality. The cooperative needs to clarify that the seller is the sole owner of the garage. If the building is located on the territory of an apartment building, additional clarification will be required from the management company.

When purchasing a portable structure, you will also need documents to take out a mortgage from Sberbank. This list includes:

- land lease agreement for a garage;

- or a certificate for the site;

- conditions for transporting the structure;

- confirmation of rights to the design.

These papers are collected specifically for the loan object. Additionally, you will need a package for applying to a financial institution.