Donation is a type of voluntary transfer of property (movable and immovable). The parties draw up an agreement, indicating the subject of the agreement, the form of the transaction and other nuances. Property rights will come into force from the moment of registration. If the donor dies while the documents are being prepared, the donation process will not be completed. The recipient will have to resolve the issue in court. In turn, the heirs of the deceased have the right to challenge the deed of gift. Such moments are regulated by the norms of the Civil Code of the Russian Federation.

Definitions of the concept of “gift”

The word “donation” means the transfer of certain property free of charge. Property rights are confirmed by drawing up an agreement and passing state registration. Real estate and movable property are transferred by deed of gift.

Capable people who have reached the age of majority or their representatives have the right to carry out gift transactions. It is not necessary to contact a notary office to draw up an agreement. The parties can independently collect documents and write down all the conditions, focusing on examples of agreements posted on the Internet. The deal is terminated only with mutual consent. It is enough to write a deed of cancellation of the donation. A deed of gift is unilaterally recognized as invalid or void only on compelling grounds given in the Civil Code of the Russian Federation.

The legislative framework

Issues related to the entry into force, writing and challenging of a gift agreement are regulated by the provisions of the Civil Code:

| Article number | Description |

| 572 | Definition of the concept of “donation” and features of the procedure. |

| 573 | The recipient has the right to refuse the gift. |

| 574 | Forms of agreement on the transfer of property as a gift. |

| 575 | Cases when it is unlawful to donate property. |

| 576 | Grounds for restricting the rights to manage donated property. |

| 577 | Reasons for the donor’s refusal to fulfill the terms of the agreement. |

| 578 | Features of the procedure for canceling a donation. |

| 579 | Situations when you cannot refuse the terms of a deed of gift or cancel it. |

| 580 | Consequences of harm to the citizen being gifted by the property of the donor. |

| 581 | Succession in drawing up a consensual form of agreement. |

| 582 | Features of the transfer of property in the form of donation. |

Reasons for choosing a deed of gift instead of a will

A will determines the order of inheritance of property after the death of its owner. The deed of gift becomes relevant already at the time of registration in Rosreestr and has two main advantages:

- Transactions involving the transfer of property as a gift are often carried out between family members, so the risk of being deceived is minimal.

- Close relatives are exempt from paying taxes when drawing up a deed of gift. For example, the transfer of an apartment between husband and wife, brother and sister, or grandmother and grandson will be free of charge. In other situations, you will have to pay 13% of the value of the gift.

Whether it is necessary to enter into an inheritance if there is a deed of gift also depends on the desire to specify other terms of the transaction. A will can be drawn up in detail, indicating all aspects relating to property rights passing into other hands after the death of the testator. In turn, the gift agreement must be drawn up in a generally accepted form. The donor has no right to supplement the document with terms and conditions for the transfer of property. The deed of gift has other advantages:

- The owner has the right to independently draw up the document.

- Registration is considered the moment the deed of gift comes into force.

- The received property belongs to the “personal” category, therefore, it will belong only to the citizen being gifted and will be inherited by his relatives. Spouses have no right to claim it.

- It is unlikely to challenge the transaction, since the property passes into new hands during the lifetime of the former owner.

- The notary does not have any special requirements for certification of the document.

The general list of shortcomings of a deed of gift is as follows:

- On the legal grounds described in the Civil Code, interested parties have the right to challenge the transaction and sue the property for themselves.

- The owner of the property loses property rights at the time the transaction is concluded. If we are talking about transferring an apartment, then the former owner will no longer be able to live in it or otherwise dispose of it at will.

- Gifts between non-related parties are taxable.

- An agreement is recognized by the court as sham if it is concluded for the purpose of concealing other frauds with the participation of distant relatives or third parties.

In the case of drawing up a will, the owner can use the property until death. Inheritance rights will come into force only six months after the death of the previous owner.

Focusing on the pros and cons of contracts, the conclusion suggests itself that a deed of gift is more useful to the heirs, and a will is more useful to the heirs.

Transfer of ownership

The key moment when concluding a deed of gift is the moment of transfer of ownership of the object. By giving an apartment as a gift, the owner loses all rights to this property. At what point does this happen? And when will the new owner be able to dispose of the apartment? To answer these questions, let us turn to the Civil Code.

Article 223 of the Civil Code states that the recipient’s right of ownership arises at the moment of transfer of property. However, if the property requires state registration, then the recipient will become the full rights holder after it is completed. In fact, the deed of gift comes into force after its registration.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

There are situations when the donor dies during registration. Will there be any problems during registration? In fact, it is difficult to say unambiguously how events will develop. But there is a risk that the relatives of the deceased may appeal the deal.

Types of agreement

You can issue one of the following forms of deed of gift:

| Document type | Description |

| Real | The essence of the document is the transfer of property rights at the time of completion of the transaction. |

| Consensual | Property will pass into other hands only under certain conditions specified in the contract, for example, you can write that the recipient will receive the apartment 3 years from the date of drawing up this document. |

| Donation | The donation is for general benefit purposes. The recipient of the property must be a legal entity. The donor has the right to monitor the use of the transferred property, based on the purpose and purpose written in the agreement. |

The agreement is drawn up in writing. According to Article 574 of the Civil Code of the Russian Federation, oral donation is permissible under certain conditions:

- Only movable property is donated;

- the role of the donor is played by an individual;

- the gift should not cost more than 3 thousand rubles;

- the transfer of the gift takes place at the time of conclusion of the transaction.

Promise of Giving

In legal practice, a distinction is made between contracts of promise of gift. The meaning of such an agreement is that the owner promises to donate the property after the occurrence of a certain event. Moreover, it should not bring benefits to the donor. This could be the recipient’s wedding, graduation from a university, etc.

It is not uncommon for the owner to die after promising a donation. The obligations of donation are transferred to his heirs (Article 581 of the Civil Code of the Russian Federation). The heirs must carry out the will of the deceased. But if the donee dies first, then the donee’s deed of gift does not pass to his heirs. His successors cannot accept a gift in place of the recipient.

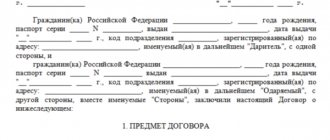

Features of compilation and design

A gift agreement is drawn up between the donor (owner of the property) and the recipient. Contacting a notary is not necessary, but lawyers still recommend having the document certified to avoid controversial issues:

- The notary has the right to act as a witness confirming the legality of the deed of gift.

- Any inaccuracy in drawing up a document leads to disastrous consequences. The notary is not interested in challenging the agreement he has certified, so he will immediately point out controversial issues and advise on options for changing the text.

- The registration authority will refuse to accept a document if the form of writing has been violated. The parties will have to start all over again, which will delay the donation process for another 2-3 months. In turn, the notary would not certify an incorrectly completed agreement.

Depending on the price of the property and the degree of relationship between the parties, the state duty varies from 3 to 20 thousand rubles. Other services (text writing, consultations) are paid separately. The algorithm for writing and registering an agreement on the transfer of property as a gift is as follows:

- Preparation of documentation: Identity card (donor and recipient).

- Certificate of marriage, if one of the parties has one.

- A power of attorney to act on behalf of the owner of the property or the recipient.

- Title papers.

- A document confirming the absence of encumbrances on the property.

- information about the parties;

- property: apartment;

- death of one of the parties;

Separately, you can write down clauses regarding inheritance by gift and death of one of the parties to the agreement.

What is the difference between a gift and a will?

Quite often people want to gift their property to their immediate family, but only after their death. In such a situation, it is necessary to draw up not a deed of gift, but a will. All aspects relating to a will are regulated by the Civil Code of Russia in Chapter 62.

A person should go to a notary and make a will in writing. Where to indicate everyone to whom he leaves his property. The notary will certify this application and, after the death of the testator, will issue a certificate of inheritance to the persons specified in the will.

The main nuance when drawing up a will is that the property that the heirs will receive must be owned by the testator. It is also taken into account that the testator is legally capable and an adult. If these points are not met, the will becomes invalid. The person who owns the property can change the will he has written. Both in full and in part, when he considers it necessary.

There are differences between a deed of gift and a will:

- Under a deed of gift, the recipient receives the right to use and own an apartment or land plot after signing the appropriate documentation. According to the will, the heirs can begin to fully use the property only after the death of the testator.

- The will must be certified by a lawyer; this is not necessary for a deed of gift.

- In the will, the testator must allocate shares to some of the heirs, this is regulated by Article 1149 of the Civil Code. When signing a gift agreement, the donor gives all his property to one person.

- When registering a deed of gift, the consent of other owners may be required. When a will is made, the testator does not ask permission from third parties.

- The testator can rewrite the will at any time and an indefinite number of times. During the donation procedure, the contract is drawn up once and cannot be challenged.

Another nuance for both procedures is the payment of the state fee.

When deeding property between immediate relatives, no fees are paid.

When making a will, the heirs in any case must pay a state fee for the service provided to them.

List of circumstances preventing the registration of a deed of gift

The parties do not have the right to draw up a gift agreement in the following cases:

- The donor is an official who is unable to transfer property due to his official position.

- The property is transferred by a person declared incompetent during court proceedings, or a child under 18 years of age. Such persons do not have the right to dispose of property independently.

- The parties to the agreement are the owners of commercial organizations.

- A guardian or trustee is trying to formalize a gift agreement in order to receive the property of the ward.

- The recipient of the gift is an employee of a government institution (educational, medical), and the donor is his client.

- The property being donated has several owners, one of whom is against the transaction.

- The donor has not yet become an heir. Initially, you can only draw up an agreement. It will be possible to register it after completing the process of obtaining property rights.

Prohibition of donation

According to the law, in some circumstances you cannot give a gift.

These include:

- The owner's age is less than 18 years;

- The donor is declared incompetent;

- If a person who was educated or treated in a special institution wants to give a gift - to an employee of such an organization;

- If they want to give in favor of civil servants for the performance of their functional duties;

- If the donation is planned to be made between commercial enterprises.

Main points of fulfillment of the contract after the death of the donor

Two scenarios for the development of disputes regarding the relevance of the deed of gift after the death of the donor stand out:

| Situation | Description |

| The document contains a clause on the transfer of property after the death of the donor. | According to the legislation of the Russian Federation, a deed of gift containing a condition on the transfer of property rights to movable or immovable property after the death of the donor is considered void. Such a clause is valid only for a will. |

| The agreement was signed, but the donor died before going to Rosreestr. | It will be possible to prove the intention of the deceased owner of the property who signed the necessary documents only in court, since Rosreestr employees will not be able to register the agreement in the absence of one of the parties. Relatives of the deceased also have the right to file a claim to invalidate the deed of gift. The likelihood of a positive outcome for the recipient is extremely low. In most cases, property passes to the heirs of the deceased on a general basis. |

Is spousal consent required when donating property during marriage?

According to the law of the Russian Federation, if the donated property was owned by a person before marriage, then the consent of the other spouse to such a transaction is not required. (There are cases when, when registering with RosReestr, even if there was property before marriage, the consent of the spouse is still required).

If - the donated property appeared after the registration of marriage, or is jointly acquired. In this case, the consent of the second spouse is mandatory.

Inheritance of property received as a gift after the death of the donee

Inheritance of an apartment or other donated property under a deed of gift occurs on a general basis. An exception is the indication in the contract of a clause on the return of property in the event of the death of its recipient. The giver will receive the gift back. Including a condition for the return of the gift in the contract will not help to return the property if the recipient managed to dispose of the gift before his death:

- sold;

- bequeathed;

- pawned;

- gave;

- rented out.

It is unlawful to demand the cancellation of the transaction and the return of the donated apartment after the death of the donee in the above-mentioned situations. According to the law, the recipient of the property can carry out any actions with the gift, except for causing intentional harm. Going to court will not bring results.

✨ Summary

To sum it up:

- It is possible to cancel a donation in the event of the death of the donee only if the corresponding condition is specified in the deed of gift.

- If the donated property was not sold, alienated, inherited, etc., then the cancellation of the donation occurs through Rosreestr.

- In other cases, you will have to go to court.

- The law does not give a deadline for canceling a gift, but as a general rule it is better to keep it within 3 years, and if the deceased donee has heirs, then within 6 months.

Can the owner sell the apartment he bequeathed? Information for heirs

Read

What does a person registered in an apartment have the right to? Reminder for those who are not homeowners

More details

Can they collect my rent debt if I am not the owner, but am registered in the apartment?

Look

Registration of a gift agreement by an heir

The heirs have full right to dispose of the property inherited under the will. To write a deed of gift, you need to follow the given algorithm of actions:

| Stage | What should the heir do? |

| Entry into inheritance | • Contact a notary office. • Present to the notary documents confirming the right of inheritance: - papers proving the existence of a connection between the deceased and the presumptive heir; - identification; - death certificate; - cadastral passport. |

| Registration of property rights | • Visit the notary's office again. • Provide the following documents to the specialist: - passport; — documents on the basis of which the client has the right to dispose of inherited property; - a check confirming the transfer of money towards the state duty. |

A citizen can dispose of property received under a will from the moment of registration of property rights. The process is complicated by the presence of several heirs. Each of them owns a certain share, therefore, the gift agreement is drawn up only with the consent of all co-owners.

Options for challenging a document

When registering a deed of gift in accordance with all the rules described in the Civil Code, the donor has the right to challenge it in the following cases:

| Causes | Description |

| The recipient has died | The document contains a clause on the return of property in the event of the death of the recipient. |

| The donated property is not taken care of. | A citizen who received property as a gift does not comply with sanitary standards and causes intentional damage to property. |

| The donor receives threats from the new owner of the property | The recipient carries out actions that threaten the life of the donor. |

| A pensioner donated his only home | The conditions for the person who decides to make a gift are clearly unfavorable. The legal authority may step in and declare the contract invalid. |

The procedure for revoking a contract takes place in court. If the donor died due to the actions of the recipient, then his relatives have the right to act as initiators of the proceedings.

Inheritance of a donated apartment, to whom the donated apartment is inherited

1

During his life, a citizen becomes the owner of various property.

The grounds for acquiring property are contracts of gift, exchange, purchase and sale, and certificates of inheritance rights.

In the event of the death of the owner, the order of inheritance of various objects directly depends on the basis for the creation of rights to them by the testator. Let's consider the features of inheriting a donated apartment.

Is it possible to donate an apartment received by inheritance?

After registration of ownership, the recipient becomes the full owner of the apartment. The owner can sell, donate or transfer the property by inheritance. Typically, inheritance is accepted without any restrictions.

However, there are exceptions to the law. For example, if the testator made a testamentary refusal (Article 1137 of the Civil Code of the Russian Federation). One of the conditions of the will may be the provision of living space to the legatee.

The order may contain a clause for a specific period or may remain in effect for the life of the beneficiary. Under such circumstances, alienation of the apartment may become impossible.

Few people would agree to live under the same roof with a stranger. After all, the right of use remains with the legatee even if the owner of the apartment changes. To solve the problem, the heir will have to negotiate with such a person on mutually beneficial terms. For example, offer him something in return for renouncing his rights.

Possible problems

Let's consider several life situations:

- The recipient did not have time to re-register ownership. If the beneficiary has not taken actions that indicate his reluctance to accept the gift, then his heirs can register ownership. The right is retained if more than 12 months . Otherwise, ownership remains with the donor. The basis for including an apartment in the inheritance is a donation agreement signed by both parties (donor, recipient).

- The donor survives the beneficiary. If the gift agreement contains a clause on the cancellation of the agreement in the event of the death of the recipient, the donor may file a corresponding claim in court.

- The gift has not yet passed into the possession of the beneficiary. A gift agreement may contain an obligation to transfer property by a certain date. But if one of the parties to the transaction dies earlier, it will certainly remain unfulfilled. If the donor dies, the responsibility to transfer the property passes to his heirs. In the event of the death of the recipient, the contract terminates by default.

Inheritance of a donated apartment occurs in accordance with the general procedure. You need to register ownership. After which you can dispose of the property as you wish. At first glance, everything is simple.

However, often the heirs cannot provide the necessary papers or conflicts arise between them. Such problems are usually resolved in court. You can get legal advice on our website.

You can submit an application through a special form. The lawyer will call you back at the specified time.

- Due to constant changes in legislation, regulations and judicial practice, sometimes we do not have time to update the information on the site

- In 90% of cases, your legal problem is individual, so independent protection of rights and basic options for resolving the situation may often not be suitable and will only lead to a more complicated process!

Therefore, contact our lawyer for a FREE consultation right now and get rid of problems in the future!

Save the link or share with friends

Source: //allo-urist.com/nasledovanie-podarennoj-kvartiry/

General points for invalidating deeds of gift

Interested parties may apply to have the gift agreement declared illegal in the following situations:

- the deed of gift contains additional conditions;

- property is transferred to a certain category of persons.

When contacting notaries or realtors, problems with drawing up a document and registering it usually do not arise. Experts know that it is unacceptable to indicate additional conditions prohibited by law:

| Conditions | Description |

| The property is transferred into the hands of the recipient after the death of the donor. | Property is transferred posthumously only to the heirs under a will. The deed of gift is concluded during the lifetime of both parties. |

| The recipient of the property will be obliged to support the donor until the end of his days. | A document containing a requirement to care for and maintain the other party is called an annuity agreement. The deed of gift must reflect a voluntary and gratuitous desire to transfer property to another person. |

| The donor has the right to live in the transferred apartment until his death. | The registration authority will not pass the document. Such conditions are elements of the annuity contract. Exceptions are made only to single pensioners who are donating their only home. The parties must insist on the document being accepted by Rosreestr. |

Interested parties have the right to apply to the court to have the gift agreement declared void if the following categories of citizens act as the donor or recipient of the property:

| Donor | Giftee |

| Civil servants | Other persons |

| Clients | Employees of social institutions |

| Wards | Guardians and trustees |

| A legal entity wishing to preserve property during bankruptcy | Any citizen by prior agreement with the initiator of the transaction |

Parties

- Donor. This is the owner of the property, the person transferring it. This party to the agreement can be a citizen or organization. The main thing is that these subjects of law must have the gift planned for transfer on the right of ownership.

- The donee. This is the person who is ready to accept a gift. This can be a citizen or an organization

The agreement can be drawn up between close relatives. It is also possible to give property to those who are not related by blood. The only differences will be in the taxation of the transaction.

Not all entities have the right to issue a deed of gift for real estate, for example, for an apartment. In some situations, conducting a transaction is against the law. In particular:

- its conclusion between commercial legal entities;

- gift from the patient to the attending physician, social worker;

- a gift to a government official if the transaction is related to the official’s duties;

- a gift from a student to his teacher.

The law allows you to give an item as a gift without a written contract, but provided that its price is no more than 3,000 rubles.

Signs of a contract indicating its validity:

- Gratuitous. There is no payment for the item being given as a gift.

- Participation in the transaction of 2 parties.

- Lack of conditions for the donee.

- Transfer by gift of not only things, but also property rights.

Download: Apartment donation agreement (sample)

Grounds for challenging a gift agreement by relatives

According to the law, it is impossible to challenge a document confirming the transfer of property if the donor is still alive and capable. For example, grandchildren do not have the right to sue a grandmother who wanted to give her house to a friend. In this situation, the owner of the property acted at his own discretion and has the right to do so. You can challenge a decision only in court if there are compelling reasons:

- The gift agreement violates the law.

- An imaginary or feigned transaction was made under the guise of writing a deed of gift.

- The donor is fully capable, but did not direct his actions at the time of signing the documents.

- The donee misled the owner of the property.

The deed of gift was issued illegally

The court recognizes the contract as invalid if it is registered illegally:

| Base | Description |

| The donor did not have the right to carry out any actions with the property | The initiator of the proceedings will have to find evidence and present it to the court: • A certificate of absence of property, issued by the BTI. • An act recognizing the documents on the basis of which the donor received the right of disposal as invalid. |

| The person who wished to donate the property did not obtain the consent of the second spouse | Property purchased by a husband and wife during marriage is joint property. One of the spouses has the right to enter into alienation transactions only with the consent of the other. If approval is not received, the contract may be considered invalid. The rule does not apply to personal property. |

| The donated property has several owners, one of whom did not approve the transaction. | Co-owners have the right to carry out transactions for donation, sale and rental of property only with mutual consent. An independent decision is unlawful. The degree of guilt of the recipient is assessed depending on his awareness. If the recipient of the property was aware of the events, then he is an accomplice to the crime. Otherwise, the citizen who received the gift is considered a misled victim. In the first option, the agreement is subject to cancellation, and in the second, there is a possibility that the court will recognize the new co-owner of the property share. |

| The transaction is carried out for the purpose of deception | Fraudsters can fraudulently take possession of the donor's property. For example, offering certain services in exchange for housing and other property. In court, you will have to prove the fact of deception by presenting correspondence, audio and video materials, and witness testimony. |

The likelihood of a positive outcome will increase in the following cases:

- The initiator of the proceedings is the interested person.

- Evidence is presented of the donor's unsuccessful actions to cancel the deed of gift.

The gift agreement is only a cover for other actions of the donor

According to Article 170 of the Civil Code, an imaginary or feigned transaction for the transfer of property as a gift will be canceled for the following reasons:

- The definition of “imaginary transaction” means the commission of actions that did not actually take place. For example, a man was ordered to pay debts on alimony obligations. His apartment was subject to foreclosure. Instead of transferring the property to the bailiffs, the defendant executed an imaginary transaction with his relative. According to the documents, the housing no longer belongs to the debtor, but he continues to use it. The court will invalidate such a transaction by comparing the date of drawing up the gift agreement and the date of the decision to collect the debt.

- Writing a feigned deed of gift means that another transaction is being carried out under the guise of transferring property as a gift. Such fraud is carried out due to the impossibility of including other conditions in the deed of gift, for example, the maintenance of the donor or his care. The parties secretly discuss all the nuances and draw up an agreement. Under the guise of transferring property as a gift, a sale or rent transaction is carried out, which is illegal.

The donor was not aware of his actions when drawing up the agreement

A transaction is considered void if the donor did not control his actions. The moment is regulated by Article 177 of the Civil Code of the Russian Federation:

- The citizen who donated the property is legally capable, but at the time of the transaction was not able to understand what was happening, for example, due to alcohol or drug intoxication. The donor or an interested person has the right to file a claim. The role of the latter may be a relative or a stranger who suffered as a result of the transaction.

- A gift agreement concluded shortly before the donor was declared incompetent can be legally annulled. A guardian caring for a citizen who has transferred property as a gift to a third party must file a claim in court. When considering the case, it will be necessary to prove that the ward was already incapacitated at the time the transaction was concluded. Medical examination and witness testimony will help.

The property owner was misled

Issues related to misleading the donor are regulated by Article 178 of the Civil Code. A transaction can be declared invalid if the recipient deliberately distorted information or did not provide all the information. The claim must be filed by the donor or interested party. The requirements will be satisfied only if there is evidence of a significant mistake by the owner of the property. The judge takes into account the following nuances:

- Reasons for carrying out the transaction, taking into account the financial situation and age of the property owner.

- Availability of other housing if the only apartment was donated.

- Clarification of the rights of the property owner when certifying a document at a notary office.

- The presence of a clause on the donor’s lifelong residence in the donated housing.

Donated apartment to whom is inherited - Legal advice

After the death of an individual, his property goes to his heirs. When distributing assets, a key role is played by the method of accepting the inheritance, the ownership regime and the composition of beneficiaries. The procedure for registering property is determined by law. Let's consider the features of inheriting a donated apartment.

What does a gift agreement provide?

One of the methods of alienation of property is a deed of gift. This type of transaction has its advantages and disadvantages. The gift agreement is beneficial, first of all, to the beneficiary.

He becomes the owner of the property immediately after the transaction is concluded and the transfer of ownership is registered. Whereas the donor loses property rights in relation to the property.

Such transactions are concluded exclusively in writing. Notarization of the gift agreement is optional.

The donated apartment is the personal property of the recipient. The rule applies both before the marriage is registered and in the event of its divorce. The property does not fall under the definition of joint property of spouses (Article 36 of the Civil Code of the Russian Federation).

An exception is that during the marriage, major repairs or reconstruction of the property were carried out at the expense of common funds or personal money of the second spouse.

Under such circumstances, property may be recognized as the joint property of the spouses by a court decision.

After the death of the donee, the property becomes part of the inheritance. The marital share is not separated from the inheritance mass. The donated apartment is divided between relatives of the same line in equal shares.

You can change things by making a will. The testator can assign personal property to anyone. For example, a wife, a child from a first marriage, or a cousin.

The law does not limit the freedom of expression of the apartment owner if the interests of the compulsory heirs are not infringed (Article 1149 of the Civil Code of the Russian Federation).

The donor's heirs cannot claim the donated apartment. The exception is cases of intentional deprivation of life of the donor by the beneficiary. Under such circumstances, the heirs may raise the issue of canceling the gift agreement through the court (Article 578 of the Civil Code of the Russian Federation).

Who will inherit the donated apartment?

The first in line are the family members of the deceased citizen (Article 1142 of the Civil Code of the Russian Federation). This includes parents, children, and the spouse of the testator. The donated apartment does not fall under the regime of joint ownership of spouses. Consequently, the wife cannot claim half of the living space. The property is divided equally between the applicants.

However, the testator can make a will and deprive relatives of their inheritance. The beneficiary of the property will be the person specified in the order. If the will applies only to part of the property, then the intestate property goes to the heirs by law. Applicants will accept property on two grounds simultaneously.

If the heirs include the testator's dependents, then their interest is satisfied at the expense of the property that has not been assigned. If there is no such property, then the shares of the heirs under the will are subject to reduction. An exception is that the heir used the apartment during the life of its owner.

Whereas the dependent has nothing to do with her. The allocation of a mandatory share will make it impossible to transfer the property to the heir under the will. Such issues are resolved in court. If there is evidence of the stated facts, the court may refuse to award a compulsory share to the heir (Art.

1149 of the Civil Code of the Russian Federation).

Is it possible to donate an apartment received by inheritance?

After registration of ownership, the recipient becomes the full owner of the apartment. The owner can sell, donate or transfer the property by inheritance. Usually the inheritance is accepted without any restrictions.

However, there are exceptions to the law. For example, if the testator made a testamentary refusal (Article 1137 of the Civil Code of the Russian Federation). One of the conditions of the will may be the provision of living space to the legatee.

The order may contain a clause for a specific period or may remain in effect for the life of the beneficiary. Under such circumstances, alienation of the apartment may become impossible.

To solve the problem, the heir will have to negotiate with such a person on mutually beneficial terms. For example, offer him something in return for renouncing his rights.

Procedure for inheriting a donated apartment

The procedure for registering an inheritance is determined by various legal acts. The order of inheritance of property is fixed by the provisions of the Civil Code of the Russian Federation.

The powers of a notary are regulated by the Fundamentals of the legislation of the Russian Federation on notaries. The rights and obligations of spouses are established by the norms of the RF IC. At the same time, judicial practice must be taken into account.

Explanations on the application of legislation by courts are set out in Resolution of the Plenum of the Supreme Court No. 9.

Procedure

Heirs need to contact a notary office. You must have with you documents confirming your involvement with the testator and his property.

The papers are submitted at the place of residence of the deceased subject.

If the citizen’s residential address is unknown, then the application is submitted at the location of the real estate he owns (Article 1115 of the Civil Code of the Russian Federation).

The notary checks the documents and establishes the applicant’s legal capacity. Then the heir is explained his rights and obligations. If the property is accepted, the applicant submits a written application. The notary issues a supporting document to the applicant.

Repeated application to the notary's office occurs after six months. You must have your ID and assessment report with you. The state duty is calculated based on the value of the property.

After payment, the notary issues a certificate of inheritance to the applicants.

The final stage is registration of property rights. The heir needs to prepare papers and submit them to Rosreestr. One of the documents is a receipt for payment of state duty. After 7–12 days, the copyright holder will be given an extract from the Unified State Register. After which he becomes the full owner of the home.

Statement

To enter into inheritance, the applicant must submit an application. The document contains the following information:

- name of the notary office;

- information about the beneficiary (full name, place of residence);

- reference to the presence of a relationship with a deceased citizen;

- mention of a will;

- the essence of the heir's request;

- date of application;

- applicant's signature.

Download the application for acceptance of inheritance

Documentation

An inheritance case is opened upon the application of an applicant for the property of the testator. The following documents must be attached to it:

- Passport of a citizen of the Russian Federation (of another country).

- Evidence of the death of the testator. This fact is usually confirmed by a death certificate. If a citizen is declared dead in court, then a court decision will be additionally required.

- Original will (if available).

- Documents confirming relationship with the testator.

- Papers for identified property.

- Certificate from the place of residence of the testator.

- Evidence of property valuation (report, extract from Rosreestr).

- Bank receipt for payment of the fee.

Expenses

The heirs will have to pay a state fee for performing notarial acts. Basic rates:

- 0.3% - at this rate, close relatives of the deceased citizen (spouse, children, parents, brothers) accept the inheritance. The limit amount of tax is 100 thousand rubles;

- 0.6% – the rate is set for all other applicants. The duty limit is 1 million rubles.

The tax amount is calculated based on expert assessment. It must be ordered before contacting the notary again. You can order the service from a specialized organization (private/public). The cost of appraiser services depends on the type of property, city, and popularity of the appraisal company.

Notary services are paid separately. They are not included in the fee. The average cost of notary services is 500–1000 rubles. In large cities the amount may be different.

The last expense item is registering ownership. Registration of an apartment costs citizens 2,000 rubles. If only part of the apartment in common shared ownership is subject to registration, then the amount of the state duty is 200 rubles.

Disputes between heirs are resolved in court. The amount of costs depends on the volume of claims, the availability of a lawyer, and the participation of witnesses. Claims of a material nature are more expensive.

Deadlines

First-line applicants are given 6 months . If such persons have not been identified, refused or were eliminated from the inheritance, then the next-ranking applicants take over the rights of inheritance. There are two options here.

If the heirs of the previous stage simply did not accept the property, then the next successors can declare their rights within 3 months .

Source: //comfortsymphony.ru/darstvennaya-kvartira-komu-perehodit-po-nasledstvu/

Time limits for challenging

The statute of limitations for claims to invalidate gift agreements is 3 years. The report begins from the moment of state registration. An exception is cases where circumstances of unlawful transfer of property are identified:

| Situation | Statute of limitations |

| The initiator of the proceedings was not aware of the gift agreement. | The statute of limitations begins from the moment the plaintiff learns about the gift. |

| Relatives of the donor are asking to extend the period for consideration of the case. | Extension is possible for up to 10 years. |

| The donor wants to revoke the deed of gift, but the recipient is against such a decision | The limitation period is 5 years from the date of registration of the contract. |

Third parties can submit an application to a legal authority only within one year from the moment the circumstances are identified on the basis of which it is possible to challenge the deed of gift. The following evidence is weighty for the court:

- Conclusion of a medical examination.

- Documents confirming the presence of alcohol or drug addiction.

- Certificate from law enforcement agencies.

- Receipts containing information about the date of receipt of money by the donor and their amount.

- A court decision declaring the owner of the property incompetent.

- Testimony of witnesses.

Paying tax

I would like to note in more detail what tax must be paid for the registration and exercise of rights under a deed of gift.

According to Russian law, donated property is considered income. (Article 41 of the Tax Code of the Russian Federation).

Consequently, after concluding a gift agreement, mandatory payment of personal income tax (Personal Income Tax) is required in the amount of 13 percent of the amount of the donated property. This condition applies only if the recipient is not a close relative. (exceptions are regulated by clause 18.1 of Article 217 of the Tax Code).

According to the Family Code of the Russian Federation, below is a list of relationships in which the obligation to pay personal income tax is removed. (according to paragraph two of clause 18.1 of Article 217 of the Tax Code of the Russian Federation)

- Children (including adopted ones).

- Parents.

- Spouses.

- Brothers and sisters.

- Grandfathers and grandmothers.

This list of kinship is “closed” - that is, it is not subject to expanded interpretation. The remaining relatives (not included in this list), as well as the rest of the donees, will be required to pay a 13 percent tax.

In fact, the amount of gift tax is calculated from the amount of real estate specified in the agreement. In theory, if the value of an object is not determined, the tax should be calculated based on the market price of the object.

How to avoid problems

To avoid litigation, participants in the transaction must remember the main points directly related to the gift agreement:

- Independently drawing up a deed of gift in writing, especially in the absence of a relationship between the parties, often leads to litigation. The initiators of the claims are close relatives of the donor.

- When filing an application to challenge a gift agreement, the recipient does not have the right to enter into transactions to alienate property received from the donor.

- Unlike a will, a gift deed becomes effective during the lifetime of the owner of the property. The document comes into force after registration is completed and the state fee is paid.

- After the death of the donor, the deed of gift for an apartment remains valid only if it undergoes state registration. If the procedure has not been fully completed, then according to inheritance law, the relatives of the deceased can lay claim to the property.

- Intentional infliction of irreparable damage to the donated property may become grounds for cancellation of the deed of gift.

- Property tax is paid if there is no relationship between the parties. If the recipient is a resident of the Russian Federation, then you will have to pay 13%. Foreigners are subject to a tax equal to 30% of the total value of the gift.

- The donated apartment is not the subject of a dispute in the event of a divorce, since it is personal property. The exception is cases of investing money in repairs from the family budget. Property will be divided according to the amounts spent.

A deed of gift for an apartment and other property is drawn up during the life of the donor. If desired, the document can be certified by a notary to avoid controversial issues in the future. If the owner of the property dies before the contract is registered, the transaction will not be completed. The death of the donee will not be a reason for the return of property. The gift will be inherited. To challenge the deed of gift, you can go to court. The claim will be satisfied only if there are compelling reasons.

Who owns the donated property?

The subject of the donation is personal property. He will not share in case of divorce. This is explained by the fact that no funds are spent on the acquisition of such property. Property is transferred to a specific person, which means his spouse cannot claim it. Only if something happens to the recipient will you have to enter into an inheritance. Then the donated apartment can go to the spouse - as the first-priority heir, as well as to other first-priority heirs.