The owner is an individual or organization that has the right to use, own and dispose of it (Article 209 of the Civil Code of the Russian Federation). When selling property, this right passes to the buyer on the basis of a purchase and sale agreement. If the information in the contract is not true, the transaction may be considered void.

Before concluding a transaction, it is especially important to check whether the name of the owner and their number are correctly indicated in the contract. This will help avoid problems in the following cases:

- The apartment is being sold by a third party, and the contract indicates a false owner;

- The apartment is in shared ownership, but only one owner is mentioned in the contract;

- One of the owners is a minor/incapacitated citizen, but the contract does not say this. To sell such property, permission from the guardianship authorities is required.

To find out who is the owner of the apartment, you need to submit a request to the Unified State Register of Real Estate (USRN). The Unified State Register of Real Estate stores all information about real estate starting from 1998. Earlier data can be found in the BTI, but they are issued only to copyright holders.

Checking for collateral

Pitfalls await unwary real estate buyers. For example, if the previous owner pledged the apartment to the bank. It will be very difficult to re-register such real estate in your name - the bank simply will not allow you to do this. We will tell you further how to check real estate for encumbrances and pledges by force of law, and find out by the cadastral number of the restrictions.

What is collateral

Collateral is a way of securing loan obligations. A bank or other lenders, when issuing a loan, seek to protect themselves from non-repayment of money. To do this, the debtor pledges the property, and, in case of non-repayment of the loan, the bank takes it (real estate/movable property) for further sale. Checking real estate for collateral is an important condition for a safe purchase and sale transaction. The presence of a lien on the property indicates that third parties have rights to the property, who, not being the owners, can cause a lot of trouble for the future owner. Not only banks can pledge property The mortgagee can be individuals or legal entities and even the tax office.

We find out whether there is a “criminal trail” following the seller

First of all, you should make sure that his passport is not fake. We go to the website of the Main Directorate for Migration Issues of the Ministry of Internal Affairs of Russia, select the “Check against the list of invalid Russian passports” service, indicate the series and number of the seller’s passport and send a request.

The answer is given immediately. If the passport is “clean”, then it is not on the list of invalid ones. In addition, on the State Automated System “Justice” portal you can find out whether your seller was involved in a criminal case.

Select the “Federal courts of general jurisdiction” tab, then “Search by cases and judicial acts”, select a subject of the Russian Federation and indicate your full name. person you are interested in. The system will display all court cases in which your seller has recently participated, with the texts of the decisions made.

What are the risks of purchasing mortgaged property?

Buying a property with a lien is a headache.

- Firstly, you will not be able to re-register the property in your name. Therefore, without being its official owner, you will not be able to sell it to another person.

- Secondly, you will not be able to dispose of the collateral until the previous owner's debt is paid off. Typically, such owners disappear immediately after the transaction and obviously will not pay their debts - the burden of returning the money will fall on you. From now on, only legal proceedings will await you.

Buying mortgaged property is a risk. In such transactions, involve the mortgagee, as it is necessary to obtain permission from him before the purchase and sale transaction. Permission does not have to be verbal; document everything and have it certified. The best option is to involve specialists who have legal knowledge and skills to resolve issues regarding the transfer of rights to mortgaged property.

What to do if the apartment has debts?

If the seller honestly admitted that he did not pay the bills. Or you found out this during the inspection, but do not want to lose this apartment. Then we can come to an agreement. But be sure to include all actions in the purchase and sale agreement.

- The seller pays himself. The best decision would be to ask the owner to pay all debts before the transaction is completed. This is especially true for contributions for major repairs. You can conclude an agreement and indicate that both parties will wait for each other. The seller will not sell the property to third parties, and the buyer will not switch to other apartments. Or offer the owner to pay the debts with money from the advance payment. The main thing is to write everything down in the purchase and sale agreement or in the advance payment agreement .

- Debts pass to the buyer. In this case, the seller can make a discount on the amount that the buyer will pay for the debts of the former owner. Again, all these actions will need to be specified in the purchase and sale agreement.

Important! The discount amount must be indicated not as part of the total cost, but as a separate line. If suddenly the deal is challenged in court, then it will be easier to prove that it was the buyer who paid for the utilities and he will have to be reimbursed for the debts of others.

If you couldn’t come to an agreement with the seller, you should still refuse the purchase. Because, as already written above, utility payments will remain with the seller. And major repairs will legally go to the buyer. Moreover, some residents do not pay for this service for years and as a result, considerable sums accumulate.

Text: Ksenia Antonova, Elizaveta Pastukhova

How to check real estate for collateral in a bank

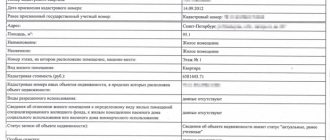

The question of how to check an apartment for collateral with a bank worries many. You can find out the restrictions by cadastral number through an extract from Rosreestr. A real estate pledge must be registered in the Unified State Register of Real Estate (without this, all agreements or agreements on the transfer of collateral have no legal force). Any interested person, including a potential buyer, can order an extract from the Unified State Register of Real Estate. From the document you can find out:

- cadastral number of the object;

- date of registration;

- information about past and present owners with ownership periods and shares;

- Address of the object;

- date of construction;

- total area, number of floors, number of rooms;

- purpose of use of real estate;

- the presence of encumbrances - from collateral to arrest and easement (the right to limited use of someone else's land plot).

From the extract from the Unified State Register of Real Estate you will receive the answer to the question - how to check the apartment for collateral and arrest . To do this, just look at the line “presence of encumbrances”. An empty line means the property is “clean.” If there are entries in the line, pay attention to the dates of encumbrances; perhaps they have already been exhausted. Otherwise, buying mortgaged real estate will not bring joy.

For apartments, a common option is to sell a mortgaged apartment. Know that the mortgaged apartment is pledged to the bank. You can buy it, but only with the permission of the mortgage bank.

When is a statement of absence of collateral required?

An extract from the Unified State Register of Real Estate will be of interest to future property owners. It is necessary when:

- concluding a purchase and sale agreement;

- receiving an inheritance;

- receiving real estate under a gift agreement;

- assignment of claims to an apartment or land;

- division of property;

- identification of legal owners and legal or notarial verifications.

Do not think that the presence of a deposit is important only when concluding a purchase and sale agreement. Even receiving a mortgaged apartment as a gift causes a number of difficulties in the future.

When is such information needed?

The need to obtain such information may arise for a variety of reasons. The most common ones include the following:

- Buying an apartment - in this case, obtaining information about the privatization of housing is of great importance for the buyer, since it is important to promptly identify persons entitled to lifelong residence in such real estate. It occurs when one of the residents renounced their share during privatization.

- The intention to carry out the privatization procedure in relation to a particular housing - in this case, it is necessary to first clarify whether it is already in private ownership.

- When renting real estate, the tenant may be interested in the question of what category the rental housing in which he lives belongs (municipal or private).

- Other reasons.

How to obtain an extract from the Unified State Register of Real Estate about the absence of collateral

Today, a certificate from the Unified State Register can be obtained in paper or electronic form. Both the first and second have equal legal force. The paper one is certified by a seal and signature, and the electronic one is certified by the digital signature of Rosreestr. Courts, banks and government agencies will accept any type of statement from you. There are 4 ways to get an extract from the Unified State Register of Real Estate:

- Personal application to Rosreestr or MFC. Take with you your passport, application and receipt of payment of the state fee, and for the representative - a power of attorney. The certificate will be prepared within 5 days. This is not the most convenient way. You will have to take time off from work and stand in lines. The asking price for individuals is from 400 rubles, for legal entities - from 1100 rubles.

- Contact Rosreestr by post. The procedure is the same as for personal appeal. The time it takes to receive statements will increase, since everything depends on the speed of the post office. The price tag is similar to the first method.

- Online request on the Rosreestr website. You need to know the property address or cadastral number, pay the fee and leave your passport details. The period for receiving an extract is from 6 hours to 3 days. The cost of the service is from 350 rubles.

- Online request in the EGRN.Reestr service. This method is simpler and faster than others. Indicate the address or cadastral number of the property and pay 200 rubles for a statement of characteristics and rights. You can order a statement with full information for 350 rubles. The period for obtaining a certificate is up to 6 hours. During this time, you will receive a pdf file certified by the digital signature of Rosreestr by email.

The online request form is not suitable for obtaining a paper statement. You will have to contact a specialist in person or by mail.

What can happen if you don’t check contracts?

If contractual risks are not detected in a timely manner, they may ultimately result in problems: the contract may be declared invalid by the court or will be terminated, the organization or individual may suffer losses, and the director of the organization may be held vicariously liable.

An agreement may be declared invalid for several reasons:

(1) there are no essential conditions;

(2) conditions are specified that are contrary to the law (often such an agreement is voidable, but if such a transaction encroaches on public interests or the interests of third parties that are protected by law, then the agreement is void);

(3) if signed by a citizen who was declared incompetent by the court, then such an agreement is void, and if it was signed by a person who is of limited legal capacity, then this agreement can be challenged in court;

(4) an agreement can be declared invalid by a court if at least one of the parties signed it under the influence of deception, violence, threat or unfavorable circumstances, etc.

If you signed an agreement with a shell company, this may lead to losses, since such a counterparty most likely did not intend to fulfill the agreement. And it will be almost impossible to recover damages in such a situation.

The agreement may indicate that disputes will be resolved in arbitration. The proceedings themselves in this case can cost a lot of money, and you simply cannot afford it.

The director of the company may be held personally liable if an agreement is concluded that is not approved by the general meeting of participants.

In general, this is only an approximate list of possible adverse consequences that may occur in the event of failure to conduct a legal examination of the contract.

The cost of a lawyer's services in Moscow for legal review of contracts can vary greatly, and depends primarily on the qualifications of specific specialists, the range of services provided and the complexity of conducting such a contract analysis.

Video about legal analysis of the contract

Advantages of an online request in the EGRN.Reestr service

In addition to the low cost of services, a key advantage is the speed of receiving an extract. The certificate does not have a clear validity period, however, encumbrances can appear on any day - even the next day after receiving the extract, let alone the 5-day period of the MFC and Rosreestr. And if you include the time for postal delivery here, then the received extract may no longer be relevant.

We recommend checking real estate for collateral through the Unified State Register. The service operates around the clock, prices are low, and the period for providing an extract is minimal. The extract is official and certified by the digital signature of Rosreestr - it will be accepted by banks, courts and government agencies.

Don't waste time and check the property for collateral right now!

We check to whom and how much this seller already owes

The more debt the seller has, the higher the risk that he will not be able to return the money if the deal is cancelled.

The most famous source of information about debtors is the website of the Federal Bailiff Service: in the section “Data Bank of Enforcement Proceedings” by full name. you can find out what outstanding debts a person currently has.

On the portal “Unified Federal Register of Bankruptcy Information” you can find out whether your seller has been declared bankrupt.

You can determine what debts he will have in the near future on the mentioned portal of the State Automated System “Justice”, as well as on the official websites of the arbitration court and courts of general jurisdiction at his place of residence (all decisions made against a particular citizen are now published there).