02.01.2021

When purchasing real estate in 2013 (2012, 2011, 2010 and earlier), a property deduction is provided to buyers of an apartment, room, house or shares in them (for more information about what a deduction is and how it is applied, see the link). Having received a property deduction when purchasing an apartment, house, room (share in them), you can return the tax in the amount of 260,000 rubles. (or not pay it in the future). This is the income tax you have already paid or will be required to pay. For the procedure for providing a property deduction for real estate purchased after 2013 (for example, in 2021, 2020 and 2021), see the link.

How does property deduction work?

The amount of property deduction is equal to the cost of the purchased property. However, the maximum deduction amount is limited. Regardless of how much you paid, the deduction when purchasing an apartment (or other real estate) cannot exceed RUB 2,000,000. (excluding mortgage interest, if any). But we won’t stop there for now. Details below.

Let us illustrate the mechanism of how the deduction works. But first of all, you need to remember that income tax is calculated only at the end of the year. That is, at the end of each year you sum up all the income received, reduce them by deductions and calculate the tax amount. Then you compare it with the amount that you personally paid (or your employer paid for you). You either pay the difference to the budget (if you paid less than necessary), or return it from the budget (if you paid more than necessary).

Example Let's assume that your salary is 35,000 rubles. per month. The income tax that will be withheld from her will be: 35,000 rubles. x 13% = 4550 rub.

The company you work for will pay this amount to the budget monthly. Consequently, you will receive your salary in your hands minus tax, that is, only in the amount of 35,000 rubles. — 4550 rub. = 30,450 rub.

Accordingly, for the year you will receive a salary in the amount of: 35,000 rubles. x 12 months = 420,000 rub.

Tax will be withheld from her in the amount of: 420,000 rubles. x 13% = 54,600 rub.

So, the company where you work has withheld a tax from you in the amount of 54,600 rubles for the year. and paid it to the budget.

This year you received the right to a deduction when purchasing an apartment in the amount of 380,000 rubles. At the end of the year, your annual taxable income will be: RUB 420,000. (salary for the year) - 380,000 rubles. (deduction) = 40,000 rub. (taxable income)

Tax must be withheld from him in the amount of: RUB 40,000. (taxable income) x 13% = 5200 rub.

However, you have already been deducted 54,600 rubles. After all, the company that paid the tax for you calculated your income without this deduction. Consequently, you have the right to return part of the overpaid tax for you from the budget in “real” money. This part will be: 54,600 rubles. (tax already withheld) - 5200 rub. (tax to be paid) = RUB 49,400. (tax that the budget will have to return)

Accordingly, you have the right to claim a tax refund on this amount.

Read more about how to apply tax deductions by following the link.

Limitations and features of payments for deductions

The second important point is that multiple deductions for income tax apply only to real estate that was purchased before 01/01/14.

If real estate was purchased before the new legislation came into force, then the old rules apply to it.

They are displayed in paragraph 27 of subparagraph 2, paragraph 1 of Article No. 220 of the Tax Code of Russia.

According to the old legislation, income tax deductions applied to one piece of real estate in an amount not exceeding 2 million rubles. This means that the deduction could not be more than 260 thousand rubles.

In cases where the amount received was less than the maximum established limit, it was impossible to receive the difference on subsequent purchases.

For example, in 2007, a citizen purchased an apartment worth 1,100 thousand rubles. and received a deduction equal to 143 thousand rubles. In 2015, he purchased a house, but after reviewing his application, he was denied the deduction. This is due to the fact that until 2014 a one-time deduction was in effect, and according to the current legislation, multiple receipt of a deduction applies only to contractual relationships that were concluded after 01/01/14. This means that the citizen has already exercised his right to an income tax refund and cannot apply for its secondary receipt.

Tax refund on mortgage interest on housing purchased before 2014.

Those who purchased housing for the second time with a mortgage before 2014 will face the same difficulty. During that period, there were no restrictions on deductions for credit interest.

This meant that the citizen had the right to return 13% of the entire mortgage loan amount, but it could only be obtained for the real estate object for which the main property deduction was received.

In the old version of the law, income tax refunds for ordinary purchases and acquisitions of real estate using loans (loans, mortgages) were considered a single type of deduction.

For example, if a citizen purchased housing in 2012 and received an income tax deduction for this property, then he will not be able to claim a refund of the 13% tax for the second time on housing that he purchased with a mortgage in 2013.

Tax refund on mortgage interest on housing purchased after 2014.

Another feature is that you can use the right to deduction a second time if real estate is purchased on credit (mortgage), when the main deduction was received for an apartment purchased before 2014, and the second property was purchased after the new edition of the Tax Code came into force Russia.

In 2014, when the new law first came into force, this issue caused a lot of controversy, but a decision was soon made allowing the second use of the right to receive a deduction in such situations.

This was confirmed by letter of the Federal Tax Service of the Russian Federation No. BS-4-11/8666 dated 05.21.15. In accordance with this document, citizens have the right to claim an income tax refund when purchasing a residential property on credit (mortgage) acquired after 2014, if the main deduction was received before 2014.

This clarification applies only to interest on loans if, before 2014, the citizen did not purchase real estate on credit (mortgage) and did not receive (or plans to receive) a tax refund on it.

Income tax refund until 01/01/01.

The last feature is the receipt of deductions in cases where a citizen purchased housing before January 1, 2001 and received a deduction for it. However, he did not purchase real estate and did not exercise the right to deduction in the period from 2001 to 2014. At that time, the payment of deductions was made in accordance with Federal Law No. 1998-1 dated December 7, 1991, which became invalid at the beginning of 2001.

The right to multiple tax refunds when purchasing real estate after 2014, when the main deduction was received before 01/01/01, is secured by letter of the Ministry of Finance of Russia No. 03-04-05/5889 dated 02/13/14.

You will find out why piecework wages are beneficial in our article. Find out more about floating salaries, their pros and cons in our material.

What is the child tax deduction and how can you use it to your advantage? Our article is devoted to this issue.

Property deduction: when is there a right to it?

The right to a property deduction arises in the year when you bought real estate (house, apartment, room, etc.) and received ownership of it. Moreover, it does not matter what month of the year this happened. It is important that this happens no later than December 31st. Otherwise, the right to deduction will arise next year.

Please note that ownership of real estate appears after state registration of a transaction (for example, sale or purchase). State registration is the making of the necessary entries in the State Register of Rights to Real Estate and Transactions with It. Typically, the date of entry into the register and the date of issue of the Certificate of Registration of Property Rights do not coincide (the certificate, as a rule, is issued “in hand” a little later). So the date of issue of the certificate itself does not matter. If the transaction was registered, for example, on December 30, 2013, and the certificate was issued in January 2014, then ownership was received in 2013, not 2014. The date on which the transaction was registered is usually indicated on the Certificate of Title.

Example: You bought an apartment under a sales contract. The corresponding entry was made in the state register on December 25, 2013. You became eligible for the deduction in 2013. Accordingly, all income for 2013 (from January 1 to December 31) can be reduced by deduction.

An exception to this procedure is provided only for apartments purchased under an agreement of shared participation in construction (DDU). A deduction for such apartments can be obtained after concluding a DDU agreement, paying for it and issuing an acceptance certificate for the apartment from the developer to the buyer. Accordingly, you can count on the deduction before registering ownership of the apartment.

The period during which you can apply for a property deduction is not limited by law. For example, having bought an apartment in 2013, you can claim a deduction and reduce your income received in 2013, 2014, 2015, 2021, 2021. And it doesn’t matter how many years have passed since the purchase of the apartment. There are only two nuances.

First , the deduction will be provided according to the rules that were in force in the year the apartment was purchased.

Second , you can claim a refund of taxes that have not passed three years since payment.

For example, you bought an apartment in 2013. However, after the deduction, you applied only in 2021. In such a situation, you can claim a refund of taxes paid in 2021, 2021 and 2021. Tax transferred in 2021 and earlier years will not be returned to you (more than three years have passed since it was paid).

You also do not have the right to claim a refund of taxes that were paid in the years preceding the year you purchased the apartment. So, if you buy an apartment in 2021, you will not be able to return taxes for 2021, 2021 or 2018. An exception to this procedure is provided only for pensioners. They have such a right.

Amount of property deduction

The amount of property deduction when purchasing an apartment is equal to the purchase price of the apartment or other real estate (house, room). This may include other purchase costs (more on these below). However, the maximum amount of property deduction is limited by law. Regardless of the cost of the apartment (other real estate), its amount cannot exceed 2,000,000 rubles.

For example, an apartment costs 1,300,000 rubles. Then the deduction when purchasing this apartment will be the same amount (it does not exceed the maximum). Another variant. The apartment costs 6,000,000 rubles. In such a situation, you will receive a deduction in its maximum amount - 2,000,000 rubles. The difference is 4,000,000 rubles. will not affect the amount of the property deduction.

The amount of property deduction when purchasing an apartment may exceed RUB 2,000,000. The fact is that it is subject to increase by the amount of interest on the mortgage loan that you received to purchase the real estate for which you receive a deduction (if, of course, you had such a loan). Moreover, the amount of these interests, which increases the amount of the deduction, is not limited by law.

For example, if you bought an apartment for 3,400,000 rubles. and paid interest on a mortgage loan in the amount of RUB 330,000, then you will be given a deduction:

- for the apartment itself within its maximum amount - 2,000,000 rubles;

- for interest in the amount of their actual amount - 330,000 rubles.

The total deduction amount will be: 2,000,000 + 330,000 = 2,330,000 rubles.

The amount of interest on targeted loans, which can increase the amount of the deduction, is not limited by law. You will receive a deduction on interest as long as you pay it to the bank. But this procedure only applies to real estate purchased before January 1, 2014.

Some basic information

- Who can receive a tax deduction? Tax resident of the Russian Federation who pays personal income tax. That is, unemployed students or individual entrepreneurs on a simplified basis cannot take advantage of the benefit.

- The following aspect follows from this: the amount of deduction cannot be more than the amount of calculated personal income tax for the year.

For example, Roman earns 40 thousand rubles a month, 480 thousand rubles a year, he has no other income. From this amount the employer withholds personal income tax in the amount of 62.4 thousand rubles. Roman bought an apartment for 1 million rubles and wants to receive a deduction in the amount of 130 thousand rubles (13%). Since he transferred only 62.4 thousand rubles during the year, he will be able to return this amount. The rest will have to be postponed to next year, but more on that later.

- The tax deduction can be obtained through the employer or directly through the tax office. Through the employer, you can reimburse expenses that were incurred in the current year. Through the tax office - for the past three years.

What expenses are taken into account when providing a property deduction?

Such expenses can be divided into three groups. The first is for construction or purchase:

- residential building (shares in it);

- apartments (shares in it);

- rooms (shares in it);

- a plot of land provided for housing construction or a plot on which a residential building is located (share in it).

The second is to pay interest on loans and credits that were provided for the construction and purchase of the above-mentioned objects (residential building, apartment, room, etc.). The third is interest on bank loans received for on-lending of the mentioned loans and credits.

The costs of constructing or purchasing a residential building (share in it) include your costs:

- for the purchase of the residential building itself (including unfinished construction);

- for the development of design and estimate documentation;

- for the purchase of construction and finishing materials;

- for construction work or services (completion of a house that has not been completed) and finishing;

- for connection to electricity, water, gas supply and sewerage networks or the creation of autonomous sources of electricity, water, gas supply and sewerage.

The costs of purchasing an apartment or room (share in them) include your costs:

- to purchase the apartment, room or share itself, or the rights to them in a house under construction;

- for the purchase of finishing materials;

- for work related to the finishing of this property

- for the development of design and estimate documentation for finishing work.

Attention! As you can see, these expenses include not only the direct cost of the house or apartment itself, but also the costs of completing or finishing them. So, such costs can be included in the deduction provided that you are purchasing, for example, a house that has not been completed with capital construction (that is, unfinished). And for such objects they issue a special certificate of state registration. Therefore, if you bought a house that has been completed, you will be prohibited from including these expenses in the deduction.

Regarding the apartment, it must be purchased in a new building (preferably under an agreement of shared participation in construction). If the apartment was purchased on the secondary housing market, then it will not be possible to include the costs of finishing it in the deduction (see letter of the Federal Tax Service of Russia dated August 15, 2013 No. AS-4-11/14910). One more requirement. If you are buying a house or apartment that needs finishing, this should be clearly stated in the purchase and sale agreement or DDU. At the same time, we remind you once again that regardless of the amount of such expenses, the deduction cannot exceed 2,000,000 rubles.

Example A person purchases an apartment and applies for a property deduction.

Situation 1 The apartment costs 2,400,000 rubles. It needs finishing. Finishing costs amounted to 340,000 rubles. In this case, the deduction will be provided in the maximum amount - 2,000,000 rubles. Moreover, finishing costs do not need to be documented. They will not be included in the deduction amount anyway.

Situation 2 The apartment costs 1,800,000 rubles. It needs finishing. Finishing costs amounted to 560,000 rubles. In this case, the deduction will be provided again in the maximum amount - 2,000,000 rubles. Finishing costs must be documented in a minimum amount of 200,000 rubles.

Situation 3 The apartment costs 1,250,000 rubles. It needs finishing. Finishing costs amounted to 480,000 rubles. In this case, the deduction will be provided in the amount of: 1,250,000 + 480,000 = 1,730,000 rubles.

Finishing costs must be documented for the full amount included in the deduction in the amount of 480,000 rubles.

Attention! Interest on the mortgage loan taken out to purchase this apartment will increase the amount of the property deduction.

What documents are needed to obtain a property deduction?

To receive a property deduction when purchasing an apartment (other real estate), you must provide the tax authorities with a declaration of Form 3-NDFL and a special application for the deduction. You can view the application form for property deduction by following the link. All expenses that you include in the property deduction amount must be supported by documents. The Form 3-NDFL declaration is accompanied by all documents that confirm the costs of paying for real estate (or interest on a mortgage loan) and your right to a tax refund. For more information on how the 3-NDFL declaration should be submitted, see the link.

Such documents include copies of:

— property deduction when purchasing an apartment or room on the secondary market:

- agreement for the purchase of an apartment (room) with all additional agreements and annexes to it;

- documents confirming the fact of payment for an apartment or room (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- certificates of ownership of the apartment (room);

- agreements on the distribution of deductions if an apartment or room was purchased as joint property (original!).

— property deduction when purchasing an apartment or room in a new building under an agreement on shared participation in construction or an agreement on the assignment of rights:

- an agreement for shared participation in construction (investment) or an agreement for the assignment of the right of claim with all additional agreements and appendices thereto;

- a document confirming the fact of transfer of an apartment or room (for example, an acceptance certificate);

- documents confirming the fact of payment for an apartment or room (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- agreements on the distribution of deductions if an apartment or room was purchased as joint property (original!).

— property deduction when purchasing a residential building and land plot:

- agreement for the purchase of a residential building and land plot with all additional agreements and annexes thereto;

- documents confirming the fact of payment for a residential building and land plot (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- certificates of ownership of a residential building and land plot;

- agreements on the distribution of deductions if a residential building and a land plot were purchased as joint property (original!).

- property deduction when paying interest on a mortgage loan spent on purchasing real estate:

- loan agreement with all additional agreements and appendices thereto;

- documents confirming the fact of payment of interest on the loan (for example, a bank certificate, account statement, etc.).

Attention! The specified list of documents is given in the letter of the Federal Tax Service of Russia dated November 22, 2012 No. ED-4-3/19630. It is comprehensive. This means that tax authorities have no right to demand documents not named in this list. This letter is mandatory for use by all Russian tax inspectorates.

If, in addition to the costs of purchasing the apartment or house itself, you include in the deduction the costs of finishing it (completing the house), then you will also need documents that confirm them. These may be contract agreements with builders for finishing work, cash register receipts confirming payment for these works, sales receipts for the purchase of building materials and cash register receipts confirming their payment. If there are no documents, then the amount of such expenses cannot be included in the deduction.

Restrictions on property deduction

There are few such restrictions. But they exist.

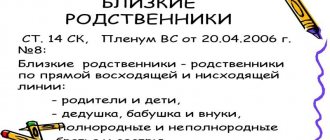

First , a property deduction is not provided if the property was purchased from a related party. Those persons listed in Article 105.1 of the Tax Code are recognized as interdependent. For example, these are your close relatives. Therefore, if you bought an apartment from your wife/husband (parents, brother, sister), then you will be denied the deduction.

Secondly , property deductions are not provided if the property was paid for by other persons for you and you have no obligations to them. For example, you were so liked at work that your employer bought you an apartment. There is an apartment - there are no obligations. Your deduction will be denied. However, if the same employer gave you money to buy an apartment on credit, then you will receive a deduction. You will also retain the right to it if you buy an apartment using a bank loan. After all, you still have the obligation to return the money in both the first and second cases.

Third , the property deduction cannot include expenses for the purchase of an apartment (other real estate) that were paid from maternal (family) capital or through payments from the federal, regional or local budget. Accordingly, if, for example, an apartment costs 1,800,000 rubles. and an amount of 250,000 rubles. paid from maternity capital, the deduction will be only 1,550,000 rubles. (1,800,000 - 250,000).

I bought an apartment from my parents/brother/sister/son/daughter. Can I get a tax deduction?

No, you cannot receive a tax deduction in this case. According to the Tax Code of the Russian Federation (paragraph 26, paragraph 2, clause 1, article 220 of the Tax Code of the Russian Federation), a property deduction is not provided if the purchase and sale of property is carried out by interdependent individuals. Parents/brother/sister/son/daughter are interdependent persons both under the old legislation (until 2012, interdependent persons were determined according to the Family Code of the Russian Federation), and according to new changes (since 2012, interdependent persons are determined according to clause 1 of article 105.1 of the Tax Code of the Russian Federation ).

Property deduction for joint purchase of an apartment (house)

The best option if you are the sole buyer of the property and all documents are issued in your name. But, as a rule, apartments are bought by families (for everyone). In this situation, there are two options:

- the first - into joint ownership (that is, the apartment becomes the common property of all buyers and shares in it are not distributed between them);

- the second - in shared ownership, indicating in the documents to whom and in what amount this or that share belongs.

In both options, the total amount of the property deduction remains unchanged (RUB 2,000,000 plus interest on the mortgage). At the same time, it is distributed among all buyers. In the first case (joint ownership), buyers decide independently how to distribute it. They write statements to the tax office and indicate in what proportion and to whom the deduction is due. For a sample application for distribution of deductions, see the link.

Example A wife and husband bought an apartment worth RUB 1,900,000. into joint ownership.

Situation 1 According to the spouses, the deduction is distributed as follows:

- wife - 50%;

- husband - 50%.

Accordingly, each buyer has the right to claim a deduction in the amount of 950,000 rubles. (1,900,000 x 50%).

Situation 2 According to the spouses, the deduction is distributed as follows:

- wife - 30%;

- husband - 70%.

Accordingly, each buyer has the right to claim a deduction in the amount of:

- wife 570,000 rub. (1,900,000 x 30%);

- husband 1,330,000 rub. (1,900,000 x 70%).

Situation 3 According to the spouses, the deduction is distributed as follows:

- wife - 0%;

- husband - 100%.

Accordingly, the entire deduction amount in the amount of RUB 1,900,000. declared by the husband. The wife has no right to deduction.

In the second case (shared ownership), the deduction is distributed among the co-owners in proportion to their shares. Moreover, if the apartment becomes the property of not only the spouses, but also their minor children, their parents have the right to receive a deduction for children (that is, they can increase their expenses by the amount of costs for purchasing shares for children).

Example An apartment worth RUB 1,900,000 was purchased. into shared ownership.

Situation 1 An apartment was purchased by a husband and wife in equal ownership (1/2 each). In this case, each spouse has the right to claim a deduction in the amount of 950,000 rubles. (1,900,000 x 1/2).

Situation 2 An apartment was bought by a husband and wife, while the husband owns 3/4 and the wife 1/4 of the apartment. Accordingly, each buyer has the right to claim a deduction in the amount of:

- husband 1,425,000 rub. (1,900,000 x 3/4);

- wife 475,000 rub. (1,900,000 x 1/4).

Situation 3 An apartment was purchased by a husband, wife and minor child in equal ownership (1/3 each). In this case, each buyer has the right to claim a deduction in the amount of 633,333 rubles. (1,900,000 x 1/3). In this case, one of the spouses can receive a deduction for the child themselves.

In this situation, he will receive a deduction in the amount of: 633,333 (his deduction) + 633,333 (deduction for the child) = 1,266,666 rubles.

FAQ:

Can I transfer my right to a deduction to my spouse?

No you can not. You can only distribute expenses according to the deduction, but no one can get it for you.

What to do if the apartment was sold, but an application for deduction was not submitted?

If you bought the apartment and have documents confirming payments and ownership, then you can apply for a deduction. The fact that the apartment has already been actually sold is not a basis for refusal, since you have incurred the costs of purchase.

We bought an apartment, the spouse distributed all the expenses on himself and receives a deduction. Can I get a deduction for myself when buying another apartment?

Yes, you can, since in fact you did not incur expenses and you still have the right to deduct.

How to get a property deduction

There are two ways to get a deduction. The first provides that the amount of tax that was withheld from you, for example, at work, is returned to you from the budget. The second provides that no tax is withheld from you at work.

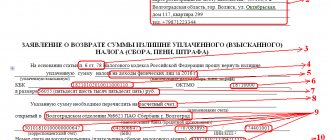

The first method is the simplest. To use it at the end of the calendar year in which the apartment was purchased (or subsequent years), you need to submit to the tax office:

- Personal income tax return (form 3-NDFL) for the corresponding year. You can download the 3-NDFL declaration for 2011, the 3-NDFL declaration for 2012 and the 3-NDFL declaration for 2013 using the links. For more information on how the 3-NDFL declaration should be submitted, see the link.;

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- application for property deduction and tax refund. You can download the deduction application in a convenient format, recommended by tax authorities, from our website (see link);

The second method requires that you receive a special notification from the tax office. It confirms the fact that you purchased the property and are entitled to the deduction. The notification also indicates its amount. You submit this notification to the accounting department of the company where you work. Based on this document, income taxes are simply stopped being withheld from you. You can apply for notification after purchasing an apartment. To do this, you need to provide the inspection:

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- an application to issue you a notice to receive a property deduction at your place of work.

Portal "Your taxes" 2021