Early repayment options

Today, the entire banking sector allows for early repayment of loan obligations. But not every borrower knows all the nuances of such procedures, which leads to unpleasant situations. There are increasingly cases where a person, having completely covered his credit obligations, becomes a debtor. The following types of loan repayments ahead of schedule are distinguished:

- Full early repayment.

- Partial early repayment.

The borrower pays the balance of the borrowed amount and interest for the last period of time that he used the loan. This happens most often when refinancing a loan. When the borrower found an opportunity to borrow funds at a lower interest rate or increased the loan term.

That is, in a new loan, the borrower reduces either the overpayment on the loan or the monthly installment. In this situation, the first loan agreement is terminated, since the borrower’s obligations under it have been fulfilled.

Partial early repayment of the loan. This is also a very common situation. The borrower has the option to pay more than the monthly payment amount. And he pays more than the loan agreement suggests, while remaining a client of the bank. In this case, the amount in excess of the monthly payment should reduce the loan balance. This entails both a reduction in the amount of interest paid and a reduction in the term of the loan.

Conditions for early repayment

According to Russian laws, a bank cannot refuse a borrower to make an early payment of funds on a loan. Just as it does not have the right to impose any penalties or penalties for this. That is, any borrower, if he has the desire and opportunity, can repay the loan in full or in part ahead of time.

Subtleties of repayment

A prerequisite for early repayment of the loan, in full or in part, is the borrower’s application for this operation, signed by him personally at the bank. That is, this cannot be done remotely.

It would be a mistake to deposit the calculated amount into your account and expect that the bank will write it off as a loan repayment. The bank will write off monthly payments as long as there is enough money. That is, the actual early repayment will not happen. Only an application from the borrower can change the write-off amount upward.

If you do not take this subtlety into account, you can get into trouble. Considering that the loan has been repaid, skip the next payment, earn penalties and undermine your own credit rating.

Pros and cons of paying off your mortgage early

Not everyone is able to save enough money to purchase a home. A mortgage loan gives everyone the opportunity to buy their own apartment or house by paying off the debt over several years.

This is quite convenient, considering that each financial institution offers a variety of mortgage repayment terms:

- growing inflation does not in any way affect the amount of payments;

- regardless of the rise in real estate prices, the cost of an already purchased apartment will not change;

- people purchasing their first home are provided with benefits in the form of tax deductions, which are returned every month until the established amount is paid in full.

According to statistics, the average repayment period for a mortgage loan in Russia is on average 4-5 years. It is obvious that many borrowers are trying their best to pay off their mortgage early. However, there are both positive and negative aspects to paying off your mortgage early.

Pros of the solution:

- Few people can say with confidence that for the entire 20 years for which the mortgage is designed, they will have a stable income and the ability to make the necessary payments on time. Therefore, in order not to unexpectedly end up on the street due to unforeseen circumstances, citizens save on everything in order to get rid of the credit burden as early as possible.

- The need to constantly think about debt creates a certain psychological discomfort. A person cannot relax, thinking that for many years he will have to give part of his salary to the bank. Since childhood, our parents have taught us that debt is bad and we need to get rid of it as soon as possible.

- The most significant advantage of paying off your mortgage early is reducing the amount of overpayments by reducing interest on the loan. If you calculate all the interest that accrues over 10–20 years, the amount you get will be much larger than what you initially took.

- Until the mortgage is fully repaid, the apartment or house serves as collateral for the loan, that is, collateral, a guarantee that the bank will receive its money back. Therefore, throughout the entire credit period, the housing is under the control of the financial institution, and the person has no right to either sell it or rent it out. Early payment of the mortgage removes this encumbrance.

- It is possible that while repaying the mortgage, a person may want to purchase another home or invest in a new one to make a profit. By paying off the loan ahead of schedule, he will be able to fulfill his plans.

Disadvantages of the solution:

- The impact of inflation. It is possible that the constantly growing inflation in our country will negate all the efforts of the borrower. Citizens' incomes are constantly indexed; on average, they increase 2-3 times over 5–10 years. The size of the mortgage remains the same, but taking into account inflation it also decreases by 2-3 times. Money tends to depreciate. And it may happen that by denying everything to yourself and your family, a person, in fact, gains nothing. So does it make sense to rush to pay off your mortgage as soon as possible if you can pay it off later by adding up several salaries?

- You should not try to take every available cash to the bank to cover your mortgage debt. It makes sense to think about a profitable investment. For example, if you have been dreaming of a car for a long time, it may be better to spend this money on purchasing it, since the interest rate on a car loan is much higher than a mortgage loan. By buying a car now, you will remain in a small plus, eliminating the need to overpay at least for it.

In addition to major acquisitions, it is worth paying attention to profitable investments: business development, purchase of securities or additional real estate. If you look into the near future, you can see that these investments will rise in value and bring you a profit, while the amount of the mortgage will depreciate more and more over time. - For some, a significant argument against paying off your mortgage early may be the 13% income tax deduction available when purchasing a home for the first time. This benefit, often expressed in a decent amount, can be canceled if the mortgage is paid off early.

Thus, paying off your mortgage early may not bring the expected results. This can be beneficial in cases where the encumbrance placed on housing urgently needs to be removed or a change in the financial situation of the borrower is expected.

Is it worth paying off the loan early?

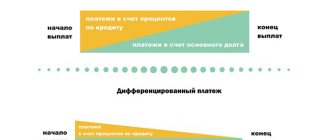

The answer to this question depends on the system for forming the monthly contribution. Most consumer loans today have annuity monthly payments. Their meaning is that the payment amount is the same throughout. That is, in the first months, most of the monthly payment consists of interest payments, while repayment of the loan amount itself occurs in a minimal amount.

An alternative is differentiated payments. With them, the repayment amount of the principal loan is constant, and the interest amount decreases as the loan balance decreases. That is, at the beginning of the loan period the payments will be larger, at the end – smaller.

With an annuity scheme, it is advantageous to repay the loan only at the beginning of the loan agreement, when, according to the terms, the body of the loan is not repaid. With differentiated payments, early repayment is always beneficial.

Treating lending as a financial instrument, you need to carefully study the terms of the loan, monitor changes in the market for loan products, and use any opportunities to reduce your own debt burden.

How to repay a loan early

To implement early repayment, credit departments may set a number of requirements. One of them is to notify the bank in advance of the desire to make an early payment.

The deadlines for filing a notification are set differently, from 10 days to a month, depending on the internal regulations of the institution. There are also creditors who agree to accept the entire amount for repayment without a preliminary application, but there are very few of them.

It is still recommended to inform the bank about early repayment through an application, as this will insure the client. The document must be sent in two copies. It is important to ensure that each of them has a bank visa indicating the date of delivery. One copy remains with the lender, the second is taken for yourself. In the future, an endorsed document will relieve the individual of bankers’ potential doubts and serve as proof of compliance with all conventions.

Recalculation of interest

You should pay attention to the accrual of interest - lenders have the right to calculate them only for the period of use of loan funds. The borrower is obliged to repay them in full upon early closure of the obligation, along with the body of the principal debt.

For what period is it better to take out a mortgage?

In Russia, a mortgage is taken out for an average of 10–15 years; people do their best to pay it off as early as possible. For comparison, in the United States they are much more relaxed about debt obligations, so mortgage loans are taken out for 20 years or more, often paid in full by the borrowers’ children.

This attitude of Russians towards mortgages is due to high interest rates, which entail significant overpayments. Western banks issue housing loans at 1-2% per annum, while in Russia rates reach 12-15%. It is not difficult to calculate what the overpayment will be over 20 years.

It is worth taking out a mortgage for a period of 10 years or less if there is absolute confidence in the ability to repay the loan ahead of schedule, for example, using maternity capital funds. If a housing loan was issued for a period of more than 10 years, but suddenly money appears to pay off the mortgage early, you have to repay a much larger amount.

The desire to quickly pay off your mortgage and save on interest is quite natural, but it must first of all be supported by a material base. Shortening the loan term invariably leads to higher monthly payments. And you need to realistically assess your capabilities so as not to switch to bread and water.

Bank commissions

The law directly prohibits the accrual and deduction of fees for early repayment of a loan. Organizations dissatisfied with this situation have veiled these amounts and present them, for example, as a commission for issuing a new payment schedule.

To avoid misunderstandings with commissions, you should find out in advance all the terms of the loan, and find out in detail from the institution’s employees about additional amounts in the form of commissions that will have to be paid in case of early fulfillment of the obligation.

Is it possible to pay off a mortgage early?

Every person wants to repay the debt as quickly as possible and forget about it. If we are talking about a loan, especially a long-term one, the need to pay a certain amount to the bank every month, as well as overpayment in the form of interest on the loan, can significantly spoil the mood.

Early repayment of a mortgage is not profitable for a credit institution.

Even if we take into account that if the entire loan amount is repaid before the end of the term specified in the loan agreement, the bank does not risk losing its money, it will still lose profit. The main income of any financial organization is interest on loans. Long-term loans are especially attractive in this regard, since a mortgage issued for 5–10–20 years will bring a stable profit throughout the entire period. Please note: repaying the loan ahead of schedule does not oblige you to repay the entire amount borrowed at once on one day.

Payments for early repayment of a mortgage can also be made every month, but in a larger amount. In this situation, interest on the loan is recalculated downwards. Many people wonder if it is possible to simply reduce the size of the monthly payments after recalculating the interest rate. However, the amount of payments is determined by the terms of servicing the loan and the repayment scheme specified in the agreement, so it is not always possible to reduce it. Banks often make the procedure for early mortgage repayment quite difficult in order to discourage the borrower from changing anything. So, in order to repay the debt earlier than the scheduled date, the client will be required to provide a pre-drafted application or pay a commission calculated according to the amount of the early payment.

[offerIp]

However, in order not to scare away potential clients, banks do not exclude the possibility of early repayment of a large loan. The policy of these organizations regarding mortgage repayment before the end of the loan period is quite flexible. If, already at the stage of drawing up the contract, the borrower discovers that it will not be possible to repay the mortgage ahead of schedule, he can refuse and contact another bank. Each financial institution strives to retain the client and create favorable conditions for continued cooperation, so in most cases banks are ready to give up part of the profit so that the person remains with them.

Certificate of fulfillment of loan obligations

Having sent the creditor a notice of early repayment in advance and deposited the required amount into the account, you need to perform one more action. Namely, make sure that the loan is closed. To do this, a couple of days after full payment, it is advisable to request the status of the credit account from the bank.

It happens that the final amount of the debt is recalculated taking into account interest and commissions, which creates a lack of funds in the account for complete closure. We can talk about 10 rubles, for example, which was not enough to complete the operation, but in a year there will be a larger amount due. Hence the importance of being vigilant and monitoring the entire operation to the end.

So, the debt is fully repaid, there is verbal confirmation from the bankers, but this is not enough. You will need to request a written document confirming the fact of payment. Typically, certificates are issued on the organization’s letterhead, indicating that the loan obligations have been fully fulfilled.

You will need to keep the received certificate for several years to prevent possible claims from creditors. Thus, having information on the nuances of early repayment, you can protect yourself from unnecessary worries and unpleasant situations with creditors. Consequently, recalculation of interest upon early repayment of the loan is mandatory.

5 / 5 ( 1 voice )

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 8

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Svetlana

07/21/2021 at 03:29 the loan balance was 102,978, I paid a partial repayment of 70,000, recalculated and 42,000 remained due for payment. In the statement for the month I saw that interest was deducted by 10,000. Is this legal,

Reply ↓ Anna Popovich

07/21/2021 at 15:23Dear Svetlana, without understanding the terms of the loan agreement, it is not possible to answer your question.

Reply ↓

07/15/2021 at 17:02

With annuity payments, isn’t the amount of interest paid in case of early repayment reduced and distributed to the amount of the body? With a 10-year loan with the same rate after 5 years, than early repayment of a loan with diff. Are payments more profitable than repaying the same loan with annuity payments? There is the full cost of the loan, there is an effective annual rate. What difference does it make to you whether the interest or the body ceases to exist and in what proportions? How does the cost of the loan change depending on the method of repayment according to the schedule?

Reply ↓

- Olga Pikhotskaya

07/15/2021 at 17:12

Ivan, good afternoon. You can calculate payment schedules for any debt repayment methods and the amount of overpayment using our loan calculator at this link.

Reply ↓

06/23/2021 at 16:46

Good afternoon. Can you please tell me when the bank commission is the smallest for early repayment? What is more profitable for early repayment, reducing the loan amount or reducing the repayment period? In the first year

Reply ↓

- Anna Popovich

06/23/2021 at 18:02

Dear Anna, an employee of the bank where the loan was issued will help you calculate the most profitable option.

Reply ↓

06/05/2021 at 03:35

If I pay off my mortgage early, that is, I close the year. How do I recalculate the table from top to bottom or bottom to top?

Reply ↓

- Anna Popovich

06/07/2021 at 17:01

Dear Victoria, check this point with your bank.

Reply ↓

Using the Sberbank Online service

The borrower must correctly process the payment for early repayment of the debt, otherwise the money may simply not be debited from his account or, due to inattention, a small amount will remain unpaid, on which interest will subsequently be charged.

Payment calculation

If the client decides to close the loan completely, then first you need to find out the exact amount of the debt. To do this, just call the bank's hotline number or personally contact one of its offices. On the bank’s pages there is a separate section “early repayment”, in which borrowers can familiarize themselves with the early repayment calculator of a mortgage loan.

It is necessary to repay the debt in full, since even on a balance of one kopeck interest will be charged, and then a penalty, which is why the loan will not be considered closed. After making the payment, it is better to make sure that there is no debt using your personal account. You can also contact the office of the financial company so that bank employees will issue a certificate confirming the closure of the loan and the absence of debt.

Statement

Before submitting an application, you must deposit funds into the account from which payment will be made. You also need to visit the nearest bank office and fill out an application (a company employee will give you a form and a sample to fill out). The client must indicate the current account from which the money should be debited. In case of partial repayment, you should also indicate what needs to be done:

- mortgage recalculation;

- reduction of payment terms.

The application can also be submitted on the official website of the credit institution. The size and number of payments for early repayment of a mortgage loan are not limited.

Making a payment

It is not possible to pay a mortgage loan using cash, so you can transfer money using any of the available methods:

- by bank transfer in your personal account on the financial company website;

- through the nearest ATM or terminal;

- through a cash desk at a bank office.

Transferring accumulated cash savings is quite simple, since this procedure is no different from making monthly payments.

Results

After making the payment and fully repaying the debt, the client will be issued a certificate confirming the closure of the loan and the absence of debt to the bank. If payment was partial, then employees must provide a new monthly payment schedule. If the application was sent via the Internet, then the new schedule will be displayed in the user’s personal account.

Thus, early repayment of a mortgage at Sberbank and a refund of interest paid is a real way to reduce debt and significantly save your own budget. Making additional payments is not at all difficult, since funds can be transferred at any convenient time, regardless of the amount.