The annual increase in electricity prices raises many questions among residents of apartment buildings. To answer them, the management organization, being the provider of the utility service for energy supply, must know about the groups of tariffs and their components that affect price increases. Let's talk about this today.

Concluding an energy supply agreement based on the one-stop-shop principle

89760

The essence of the reform of RAO UES

Before moving on to a description of the components of the electricity tariff, we will briefly outline the essence of the RAO UES reform. The company that operated until 2002 (RAO) was actually a monopolist in the Russian Federation, because combined all types of activities: from the production and transmission of electricity to its distribution and sale. Accordingly, the cost of the electricity tariff was set by the state, represented by the Federal Tariff Service, which was the main prerequisite for the reform, because private investors did not invest money in this industry, and it required serious modernization.

The essence of the reform was to gradually move from tariff regulation to tariff formation using a market method, and for this it was necessary to get away from the monopoly by creating this very market. As a result of the reform, generating companies (electricity production), electric grid companies (electricity transmission), a system operator of the unified energy system (centralized control of the energy system), and energy sales companies with the status of guaranteed suppliers (sale of electricity to consumers) were created.

Customs rate in the Russian Federation

On the territory of the Russian Federation, until 2010, the customs rate was applied, introduced by government decree of November 26, 2006. Information about it was in Order No. 718, but currently it is not in effect.

01/01/2010 is the date from which resolutions corresponding to the provisions of the Interstate Council of the EurAsEC on:

- a unified product nomenclature applicable within the customs union (TN VED CU);

- unified customs tariff of the CU.

In other words, from the beginning of 2010, the Unified Customs Tariff of the Customs Union came into force on the territory of the Russian Federation. The previous Russian customs tariff ceased to exist.

Electricity tariff components

Thus, the cost of electricity (tariff) consists of the following four components: the cost of producing electricity (power) + the cost of transmitting electricity (power) + infrastructure payments + sales markup. The cost of electricity transmission (m) is otherwise called the boiler transmission tariff.

Consumers who have an energy supply agreement pay electricity to the guaranteeing supplier (in one window), and the guaranteeing supplier distributes and transfers the funds received to generating and network companies, as well as to the system operator.

The consumer also has the right to enter into two agreements: an electricity purchase and sale agreement, the tariff of which will include the cost of electricity (capacity) production + infrastructure payments + sales premium, as well as a separate agreement with the network company to pay for electricity transmission services.

In accordance with the Russian Federation Regulations dated 05/04/12, electricity tariffs for the current month are published by last resort suppliers with a delay of 15 days. For example, tariffs for August are published until September 15, etc., so it is impossible to find out the value of tariffs in the current month.

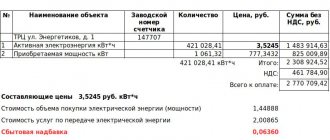

Below is a table that approximately indicates the percentage of each component in the total tariff share.

| Cost of electricity production (m) | Boiler transmission tariff | Sales allowance of the guaranteeing supplier | Infrastructure payments |

| 40% | 55% | 4,9% | 0,1% |

Responsibility for late payment for owners

Every citizen is responsible for paying utility bills. The grounds for turning off electricity in non-residential premises are specified in RF Government Decrees No. 354 and No. 442.

One of the grounds is violation of consumer obligations. At the same time, electricity can be turned off if payment has not been made within two months. Also, the consumer must be notified of the upcoming power outage in any way:

- personally against signature;

- by registered mail;

- on the receipt;

- by phone or email;

- in the payer’s personal account.

Attention. For legal entities, such notification is sent 10 days before the planned termination of electricity supply.

After receiving the notification, you must pay the outstanding debt within 20 days. It is also possible to pay the debt in installments. Please contact your electricity supplier with the relevant documents.

Owners of non-residential premises in apartment buildings may have questions not only about paying for electricity, but also other utilities, as well as about the requirements for the use and maintenance of such real estate. The following publications can answer some of them:

- Maintenance of such premises and what communications are allowed to be connected to them?

- What is operational management and what are its methods?

- How to organize heating in such premises, temperature requirements and tariffs.

- Who in the apartment building should pay for major repairs and one-room service?

- How to connect to the Internet?

- Drawing up an agreement with the cleaner.

- What should an owner do in case of flooding?

First component: cost of electricity (power) production

It is this component of the tariff that is determined by the market, i.e. depends on supply and demand in the electricity market. A simplified scheme of work is as follows: in accordance with the reform, in each region of the Russian Federation there are several generating companies that, through the bidding process, compete for the volumes of electricity that need to be produced according to requests from large consumers, gradually reducing the cost of their proposals. Thus, the winning company produces electricity for a specific application, for example, for a supplier of last resort, and this cost component is then translated into a tariff.

It should be noted that in addition to the electricity market, there is also a capacity market. If we draw an analogy with another energy resource - water, then electricity is water, and power is its pressure. Those. the tariff contains a component to pay for the production of electricity, as well as a component to provide the appropriate power.

Total: the cost of electricity (power) production is a value that changes monthly or monthly depending on the selected electricity tariff plan (price category). On average, it is growing smoothly by 6-8% per year.

How are tariffs determined?

INFORMATION ON THE FORMATION OF TARIFFS FOR DRINKING WATER (DRINKING WATER SUPPLY), INDUSTRIAL WATER, WATER SUPPLY AND WATER DISPOSAL FOR CONSUMERS OF THE KHABAROVSK MUP "VODOKANAL"

Tariffs are formed on the basis of the enterprise’s production programs in accordance with the following regulatory documents:

- Federal Law of December 7, 2011 No. 416-FZ “On water supply and sanitation”,

- Decree of the Government of the Russian Federation dated May 13, 2013 No. 406 “On state regulation of tariffs in the field of water supply and sanitation”,

- Order of the Federal Tariff Service of Russia dated December 27, 2013 No. 1746-e “On approval of the Methodological Instructions for calculating regulated tariffs in the field of water supply and sanitation”,

- Decree of the Government of the Russian Federation dated July 29, 2013 No. 641 “On investment and production programs of organizations operating in the field of water supply and sanitation”,

- Order of the Ministry of Regional Development of the Russian Federation dated October 10, 2007 No. 101 “On approval of methodological recommendations for the development of production programs for organizations of the public utilities complex”,

- Order of the Federal Tariff Service of Russia dated July 16, 2014 No. 1154-e “On approval of the Regulations for establishing regulated tariffs in the field of water supply and sanitation.”

Every year, before May 1 of the year preceding the next regulation period, the municipal unitary enterprise of the city of Khabarovsk "Vodokanal" develops and submits to the Committee on Prices and Tariffs of the Government of the Khabarovsk Territory (hereinafter referred to as the Committee) a draft production program and proposals for establishing tariffs that meet the financial needs of the enterprise for implementation of its activities and achievement of target indicators. The production program is developed for the duration of the regulated tariffs. Tariffs in the field of water supply and sanitation are calculated in accordance with the “Methodological guidelines for calculating regulated tariffs in the field of water supply and sanitation”, approved by Order of the Federal Tariff Service of Russia dated December 27, 2013 No. 1746-e.

By Resolution of the Khabarovsk City Administration dated July 1, 2013 No. 2424, the Khabarovsk City Municipal Unitary Enterprise “Vodokanal” was designated as the guaranteeing organization for the centralized cold water supply and sanitation system of the Khabarovsk City district. In this connection, the Committee establishes the following tariffs for the enterprise, included in the regulated system:

- Tariff for drinking water (drinking water supply)

- Tariff for industrial water

- Tariff for water supply

- Tariff for water disposal.

The tariff for water supply is considered by the Committee in the event of an appeal from local governments that have decided on the need to establish such a tariff.

Tariffs are established through the opening and consideration of tariff cases. The Committee conducts an examination of proposals for setting tariffs in terms of the validity of the costs taken into account when calculating tariffs, the correctness of determining the parameters for calculating tariffs, and reflects its results in its expert opinion.

The decision to set tariffs is made by the Committee following a meeting of the board no later than December 20 of the year preceding the start of the regulatory period for which tariffs are set.

Until January 1, 2016, tariffs in the field of water supply and sanitation were set for the enterprise for one year with a calendar breakdown in accordance with the maximum indices established by the Federal Tariff Service.

From January 1, 2016, the enterprise switched to long-term tariff regulation. This allows the enterprise to conduct balanced current financial and economic activities, as well as formulate its investment programs for a long period, depending on the approved tariffs.

Calculation of tariffs is based on determining the required gross revenue (GRR) of the enterprise for the planned period. The NRR is determined on the basis of economically justified expenses necessary to carry out regulated activities and ensure the achievement of target performance indicators of the enterprise provided for by investment and production programs during the regulation period.

IRR and long-term tariffs are adjusted annually taking into account the deviation of the actual values of tariff regulation parameters taken into account when calculating tariffs from the planned values.

When calculating the water consumption, water losses and water consumption by the enterprise for its own needs are taken into account.

Volumes of water supply (wastewater disposal) are determined based on the actual volumes and dynamics of water supply (wastewater disposal) over the past three years.

NGR is defined as the amount of planned:

- Production costs;

- Repair costs, including costs for current and major repairs;

- Administrative expenses;

- Sales expenses;

- Expenses for depreciation of fixed assets;

- Rent expenses;

- Expenses related to the payment of taxes and fees;

- Standard profit.

When calculating the NVV, the costs of operating ownerless centralized cold water supply and sanitation systems transferred to the enterprise in the prescribed manner are taken into account.

Planned indicators for each cost item are determined based on an analysis of actual costs, taking into account their changes in the planning period by:

- assessing the level of affordability of tariffs for subscribers;

- taking into account the impact on costs of changes in the volume of services sold as a result of the installation of metering devices;

- taking into account additional costs for the implementation of the enterprise’s production program, while assessing the need for investment resources to finance planned activities for the development of production, repair of fixed assets, introduction of new technologies and equipment;

- taking into account the level of inflation for the planned period.

Cost planning is preceded by work on developing the production program of the enterprise. The basis of this program is a plan for the implementation of services in kind, taking into account the forecast for the implementation of systems for accounting for consumed resources from subscribers, as well as measures to improve technologies that will reduce the amount of wasteful consumption of clean water during its production and delivery to the consumer.

Production costs include:

- expenses for the purchase of raw materials and materials and their storage;

- expenses for purchased electrical and thermal energy;

- expenses for purchased cold water;

- expenses for payment for work and services performed by third parties related to the operation of centralized water supply and sanitation systems;

- labor costs and deductions for insurance premiums of key production personnel;

- general running costs;

- other production costs directly related to the maintenance and operation of centralized water supply and sewerage systems, including costs for industrial control of water quality and industrial control of the composition and properties of wastewater, including costs for laboratory equipment, purchase of instruments and reagents used for analysis water quality, composition and properties of wastewater.

of raw materials and materials used by it for production needs , as well as for their storage, are calculated as the sum of expenses for each type of raw materials and materials, which are the product of planned (calculated) prices for raw materials and materials, and economically justified volumes of consumption of raw materials and materials .

Expenses for purchased electrical and thermal energy are determined as the sum of the products of the estimated volumes of purchased electrical and thermal energy and the corresponding planned (calculated) tariffs for electrical and thermal energy.

Labor costs are formed based on headcount standards after their analysis and adjustment. The actual average monthly wage at the enterprise, the increase in the tariff rate of a first-class worker in accordance with the Agreement on Amendments and Additions to the Industry Tariff Agreement in the Housing and Communal Services of the Russian Federation for the corresponding period, as well as the staffing table and organizational structure of the enterprise are taken into account.

Depreciation charges for the complete restoration of fixed assets are determined based on the current method of calculating depreciation and the book value of fixed assets

The costs of repairs and maintenance are determined from the annual repair plan and are confirmed by estimates for their implementation. The repair work plan indicates the source of the work, highlighting the work performed on an economic basis and under contracts with contractor organizations.

The costs of carrying out AVR are planned based on the actual costs incurred in the previous year. This item is comprehensive, including costs for materials, fuels and lubricants used by emergency vehicles during emergency response.

Costs for purchased water are calculated based on the need for purchased water in physical terms and the tariff for this water. To supply CHPP No. 3 of PJSC "DGK" with purified water, the enterprise purchases cold water coming from the first lift pumping station of CHPP No. 3, purifies it and supplies it to CHPP No. 3, which is subsequently used for hot water supply to the city. Expenses under this item directly depend on the water needs of the divisions of PJSC DGK.

General business expenses include costs associated with the management and maintenance of business units. This:

- heating and lighting of buildings and structures,

- remuneration of shop floor and administrative and managerial personnel, taking into account insurance premiums,

- remuneration of laboratory workers, taking into account insurance premiums,

- costs for the protection of water and waste facilities,

- labor protection and safety expenses,

- travel and transportation expenses,

- payment for services of third-party organizations (consulting, information, communication services, licensing and other services),

- auditing services,

- entertainment expenses,

- property insurance,

- costs associated with training and retraining of personnel.

- other expenses.

When determining the amount of expenses associated with the payment of taxes and fees , the following are taken into account:

- income tax;

- corporate property tax;

- water tax and fee for the use of water bodies;

- transport tax;

- payment for negative impact on the environment within established standards and limits, including in accordance with discharge reduction plans.

When determining the required gross revenue, standard profit includes:

- funds for repayment of loans and credits, interest on loans and credits attracted for the implementation of the investment program and replenishment of working capital;

- expenses for capital investments (investments) for the period of regulation, determined on the basis of approved investment programs;

- expenses for social needs provided for by collective agreements.

Production costs must cover the costs of implementing the enterprise's production program.

In order to reduce costs and reduce the cost of services, the enterprise has developed and operates a Resource Saving Program, which provides for the introduction of advanced technologies into production, installation and use of new equipment, technology, and modernization of existing equipment. In accordance with this program, pumping stations are switched to automatic operation, energy metering devices are installed, new technologies are being introduced for water and wastewater treatment, network repairs, and water consumption for own needs.

In connection with the crisis in the country's economy, the company has developed and is implementing anti-crisis measures, measures to reduce costs and increase production efficiency.

Tariffs for drinking water (drinking water supply), for process water, and wastewater disposal are established on the basis of the required gross revenue and the estimated volume of water supply and the volume of wastewater received.

Tariffs are determined in rubles per unit of service:

- for water supply – per 1 m3 of water sold,

- for water disposal - per 1 m3 of discharged waste liquid.

After conducting an examination of the economic feasibility of tariffs for drinking water and process water, sewerage, and water supply, the Committee, by its resolution, establishes tariffs for consumers of the Khabarovsk municipal unitary enterprise Vodokanal.

To familiarize yourself with the approved tariffs of the municipal unitary enterprise of the city of Khabarovsk "Vodokanal" follow the link https://vodocanal.tauta.ru/for-subscribers/tarify/

Second component: boiler tariff for electricity transmission (m)

This component of the tariff is regulated by government bodies (REC, FST, Tariff Committee). The boiler tariff is approved at the end of each year two months in advance. At the same time, in the second half of the year the tariff, as a rule, increases by 2-4% compared to the first half of the year.

The boiler tariff is applied in the tariff depending on the voltage level to the consumer's electrical network. For example, the boiler tariff at the SN-2 voltage level (20-1 kV) will be lower than the tariff at the LV voltage level (0.4 kV). This is explained by the fact that having connected at the CH-2 level, the consumer will need to independently build a substation that will lower the voltage level from 1 kV to the operating voltage of the equipment - 0.4 kV, as well as service it. Connecting a consumer to the network at the LV voltage level (0.4 kV) means that the substation has already been built by the network company, however, the tariff at this voltage level will be the highest, because The network company will ensure the transport of electricity from the power plant to the consumer, gradually lowering it to the operating voltage and, accordingly, will bear the costs of maintaining the network.

Total: cost of electricity transmission (m) - the boiler tariff for electricity is fixed for two half-years, on average increases by 2-4% in the second half of the year relative to the first and depends on the voltage level at which the consumer is connected to the network. The higher the voltage at the connection point, the lower the transmission tariff.

Introduction

Tariffs are certain rates or their system intended to pay for a variety of production and non-production services provided by a company, organization, firm, institution. The category of tariffs also includes a system designed to remunerate labor through the application of rates. A customs tariff is a tax applicable to the import and export of goods or services internationally in trade.

You will be interested in: “Near Estate”, a cottage community in Izhevsk, an excellent solution when choosing a place to live

As a lexical unit of the Russian language, the term “tariff” began to be used more than two hundred years ago, and its first mention was found in the Naval Charter of 1724. This word came from German or French, but these countries also borrowed it. Initially, the term was created by the Arabs, and it meant various duties, messages to the people of the country or settlements, announcements.

Third component: sales markup of the guaranteeing supplier

The sales allowance is similarly regulated by government agencies for two semesters. The sales value also grows on average by 2-4% in the second half of the year relative to the first, but its value depends on the maximum capacity of the enterprise (enterprise facility). There are three levels of maximum power: up to 670 kW, from 670 kW to 10 MW and over 10 MW. The higher the capacity of the enterprise, the lower the value of the sales premium.

Total: the sales premium is fixed for two half-years, on average it grows by 2-4% in the second half of the year relative to the first and depends on the maximum capacity of the enterprise. The higher the maximum capacity of the enterprise, the lower the sales premium.