To confirm the fulfillment of obligations under the contract, a certificate of completion of work is drawn up. download the 2021 sample and form for free below.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

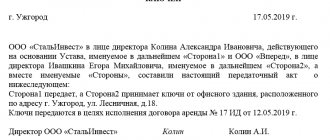

The act is an annex to the contract. The document guarantees that the customer has no complaints about the work performed. It must be drawn up in two copies - one for each side. A sample act of completion of work is further on the page.

The document is the basis for settlements under the contract between the customer and the contractor, so it is important to draw it up and execute it correctly. Download our example of a work completion certificate - it’s free, fill in your data and use the document as a template.

Is there a special form for the acceptance certificate for completed work, and where can I download it?

The acceptance certificate for completed work is the final document with which the parties to the contract (you can download the 2020 sample for free in this article) approve the completion of the work upon completion.

In addition to the final acts, interim acts can be drawn up. Read about them in the article “Certificate of Interim Acceptance of Completed Work - Sample” .

There is no special form for the act of acceptance and transfer of the result of work (with the exception of activities in which it is necessary to draw up an act in the KS-2 form, which we will discuss below). When concluding a contract, the partners (customer and contractor) develop and agree on the form or sample of the work completion certificate themselves. Moreover, it is important for an accountant that it contains those details that are established by law for the primary document. That is, the details from Art. 9 of the law of December 6, 2011 No. 402-FZ. After all, based on the certificate of completion of work, the contractor company will record revenue, and the customer will record expenses. In particular, the acceptance certificate for completed work must contain:

- Name;

- date of compilation;

- name of the person who prepared the document (contractor);

- characteristics of the work, including its types, unit of measurement (if any) and cost indicators;

- positions and signatures of persons carrying out delivery and acceptance.

For more information about correcting primary documents, see the article “How to make corrections to primary documents.”

You can view the acceptance certificate for completed work on our website using the link below:

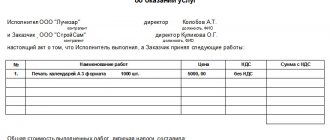

Certificate of services rendered

There is no unified form of this document; you can develop it yourself. It is most convenient to agree on a version of the act as an annex to the agreement, and use only it. If the requirements for the form of the document are not provided for in the contract, then usually the executor draws it up and offers it to the customer for signing.

The legislation does not require the mandatory execution of an act confirming the provision of services. But the parties can independently foresee its necessity, determine its form and deadlines for its preparation. Typically the document contains the following information:

- name indicating the contract number and the date of its conclusion;

- information about the parties;

- number and date of signing;

- list of services, their type and volume;

- total cost;

- period of provision;

- the presence or absence of complaints about the quality of the service and the timing of its provision;

- number of copies;

- signatures of the parties.

The certificate of services rendered is drawn up in two copies. Seal impressions are placed if they are available in the organization, since they are not a mandatory requisite of the primary accounting document. The parties have the right to include any additional conditions at their discretion and add a section to describe the identified deficiencies. You can also indicate in the act that it is the basis for the final settlement under the contract.

Free accounting services from 1C

What details are most important?

Despite the fact that the law does not provide for mandatory details for acts, indicating certain information in them will avoid disagreements and disputes between the parties.

- Number and date of conclusion of the contract. It is especially important to indicate them if several contracts for different types of services have been concluded between the customer and the contractor. Without these details, it is impossible to determine which specific agreement this act relates to; in the event of a legal dispute, it will not be accepted as evidence of the provision of a service.

- Information about identified deficiencies. If during acceptance the customer has any complaints about quality or deadlines, he should indicate this in the report. If there is no corresponding section in the document, the customer may refuse to sign it and put a mark stating that the services were not accepted due to detected deficiencies. Information about them is presented in a separate document, for example, a claim, and sent to the contractor. If such a mark is not made, then in the event of a dispute, the contractor may declare that the refusal to sign was unmotivated, and the services will have to be paid.

- Information about the transfer to the customer of the result of the provision of the service, for example, a draft contract, assessment report, etc.

Signing period

When concluding a contract for the provision of services, it is necessary to determine the date of signing the act. This is due to the fact that often the service is used already during its provision. In this case, the signing period is determined according to the rules of Art. 190-194 Civil Code of the Russian Federation. This could be a specific date, an upcoming event, or the end of a certain period. If the term is not agreed upon in the contract, then the certificate of services rendered must be signed within 7 days from the moment the customer or contractor submits the corresponding request.

If the customer does not sign the act

When performing work, the performer can present its final result. When providing services, it is sometimes difficult to prove that they were provided. Therefore, the customer may refuse to sign the act and pay for the service without reason. To exclude this possibility, it is advisable to provide the following conditions in the contract:

- the contractor has the right to draw up a unilateral act if the customer evades or unmotivatedly refuses to sign;

- a unilateral act confirms the fact of receipt of services and is considered the basis for payment.

Thus, drawing up a final document after completing work or providing services is an optional, but highly desirable action. The presence of the act and its correct execution will allow you to avoid disputes and disagreements between the parties to the agreement.

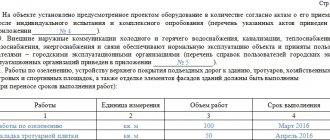

When is the KS-2 form applied?

The unified form KS-2 is used in capital construction. The current legislation does not provide for the mandatory use of unified forms, including such documents as the act of acceptance and transfer of the result of work in the KS-2 form. However, in practice, the implementation of construction and installation work for industrial, housing, civil and other purposes is formalized by an act in the KS-2 form, which, if necessary, is modified to suit the needs of the organization. The basis for its preparation is the journal of work performed (form No. KS-6a). And the act itself is used to generate a certificate of the cost of work performed and expenses (form No. KS-3).

A sample act of acceptance of completed work in form KS-2 and explanations for its preparation can be found in the article .

Is it necessary to use forms KS-2 and KS-3 when accepting/transferring repair work performed under a construction contract if a UPD is drawn up? You will find an expert answer to this question in ConsultantPlus. Trial access to the legal system is free.

Procedure for signing the act

Acceptance of work performed is carried out in accordance with Art. 720 GK . According to established standards, the customer must check the quality of the services provided within the specified period, which is specified in the contract. Only after signing the document can you count on payments.

The most difficulties arise when the contractor deviates from the signed agreement. All identified deficiencies must be officially documented.

If a seal and signature have been placed at the bottom of the form, the work is considered accepted. After this, the customer cannot demand that defects be eliminated, regardless of their nature.

Additionally, if deficiencies are identified, a report of deficiencies is drawn up. A certain period of time is allotted for solving problems, after which an intake form is drawn up again.

Reference! If disputes arise between two parties, an expert examination is appointed. It is carried out by third parties or specialists. If the contractor’s fault is proven, in accordance with established standards, work to eliminate deficiencies is carried out at the contractor’s expense. In the case where the problem is resolved by two parties, a different payment amount is agreed upon.

Where to find a sample contract for 2021

A contract with an individual of the 2021 model (or a civil contract) is quite often used by businessmen if it is necessary to hire an employee to perform a certain amount of work, but there is no need to conclude an employment contract with him.

When concluding a GPC agreement with a “physicist”, do not forget about the risks of his retraining for labor. Explanations from ConsultantPlus experts, for example, an analytical review of recent judicial practice, will help you minimize these risks. If you do not already have access to this legal system, a full access trial is available for free.

Particular attention should be paid when drawing up a contract with a foreign citizen of the 2021 model - it is important to take into account all the nuances. To make the task easier, we present you with a form for such a document.

Look for the nuances of a contract with an individual in the article “Civil contract with an individual.”

Read about the specifics of taxing payments to individuals under contract agreements with insurance premiums in the articles “Contract agreement and insurance premiums: nuances of taxation” and “Insurance premiums under the GPA”.

These types of agreements are also widely in demand among entrepreneurs; you can download samples of them by clicking on the link:

- contract for the provision of services, sample 2021;

- construction contract sample 2021.

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Results

The acceptance certificate for completed work does not have a legally established form; it can be developed by the organization independently, in compliance with the requirements for primary documents.

In construction, as a work acceptance certificate, as a rule, an act of form KS-2 is used, which, if necessary, includes details to reflect additional information.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changes in contractual terms

During the implementation process or as a result of the customer filing a claim at a number of stages, the cost may change relative to the previously signed copy of the document.

For this purpose, an adjustment report for the work performed is drawn up indicating:

- number and date of the document to which the adjustment is being made;

- changes in the pricing policy upward or downward with reference to circumstances, including a defect identified by the customer after signing the main act and accepted by the contractor;

- new total cost according to the changes made.

The date of signing by the customer is the basis for recording and adjusting the VAT amounts relative to what was previously accepted and reflected in the accounting registers by both parties to the transaction.

Explanations on the topic

| Main points | Requisites | Download |

| If you make payment minus a penalty, then in the certificate of services performed indicate the amount of payment under the terms of the contract, the amount of the penalty collected, the procedure for its calculation and the basis for its application, and the total amount payable to the supplier | Letter of the Federal Antimonopoly Service dated December 10, 2015 No. ATs/70978/15 | |

| In case of termination of the contract by agreement of the parties, the customer pays only for the work that is confirmed by the document | Letter of the Ministry of Finance of Russia dated November 10, 2017 No. 24-03-07/74487 | |

| For activation, the form of a universal transfer deed is also used. Additional indicators are added to it | Letter of the Federal Tax Service of Russia dated December 23, 2015 No. ED-4-15/22619 |

About the author of this article

Alexandra ZadorozhnevaAccountant, project expert Practicing accountant. I have been working since the beginning of my studies at the university. I have experience in both commerce and budgeting. From 2006 to 2012 she worked as an accountant-cashier and personnel officer. From 2012 to the present - chief accountant in a budgetary institution. In addition to direct accounting, I am involved in purchasing and economic planning activities. I have been writing feature articles for specialized publications for 4 years.

Other publications by the author

- 2021.12.27State Defense OrderRoscosmos approved a new procedure for reporting on the execution of government contracts for state defense orders

- 2021.12.24 EIS Instructions for placing a schedule in the EIS according to 44-FZ

- 2021.12.24 Customer documents How to draw up procurement regulations under 223-FZ

- 2021.12.23 Procurement control How to reflect savings in planning documents

Additional design requirements

To create an act, you need either a company form or a special form with standard text. This document must comply with the standards of GOST R 6.30-2003. In particular, the act must contain these provisions:

- Company name.

- Name of the document (act).

- Number.

- Name of the act, title (for example, “about truancy”).

- Signatures.

- In some cases, an approval column must be present.

FOR YOUR INFORMATION! The title of the document must be consistent with the name (“act”). That is, it must be placed in the genitive or prepositional case.

Key characteristics of acts

An act is a document used to confirm certain operations or events. It is formed, for example, during these operations:

- Audits and various studies.

- Inventory.

- Testing new technology.

- Transfer of goods and materials.

- Transfer of affairs to a new manager.

- Direction of completed construction projects into operation.

Usually the act is drawn up by a commission or other group of persons. It can document the results of the work of both temporary and permanent commissions.

![Bank Zenit mortgage and refinancing [credit][sale]](https://bgrielt.ru/wp-content/uploads/bank-zenit-ipoteka-i-refinansirovanie-credit-sale4-330x140.jpg)