Temporary use of real estate, including for commercial purposes, is permitted both for a fee and for free. At the same time, free rent of non-residential premises intended for business activities has its own characteristics.

If you don’t know them, there is a high probability of filing claims from the tax authorities. Therefore, in this article you will learn the features of leasing commercial non-residential premises free of charge between legal entities, as well as when the owner is an individual.

And also, we will tell you about all the important nuances, in addition you can, which contains all the necessary and essential conditions. In general, we will try to help understand this issue as much as possible.

When does an agreement for the gratuitous use of non-residential premises apply?

Many business representatives have a question about whether a lease agreement can be free of charge. Let us answer right away - no. The fact is that, from a legal point of view, rent involves paying a fee for the use of property, no matter for how long it is provided.

The use of property on a free basis is formalized by a loan agreement, which, however, has much in common with a lease agreement. In such a transaction, the parties are referred to as the lender and the borrower. However, throughout this material we will continue to use the word “rent”.

Between legal entities, a loan agreement (free lease) is used in cases where the enterprises are closely related to each other. And also, property is often provided free of charge for use by public organizations.

For example, we offer.

A gratuitous use agreement is also used when an object of cultural heritage is transferred in order to maintain it in proper condition.

Attention is important! Be sure to specify responsibility in the event of negative situations. We also recommend that you write down conditions regarding possible damage due to fire.

If we are talking about legal entities, then they are prohibited from transferring property free of charge to the founders (shareholders), as well as to citizens included in the management team of the company.

For example, it is impossible to conclude a loan agreement between an enterprise and its director (Part 2 of Article 690 of the Civil Code of the Russian Federation). There are no other prohibitions regarding free rent for companies by law.

Essential terms of the lease agreement for commercial premises and the possibility of free use

Naturally, first there should be a preamble, which indicates information about the owner and user of the property. The subject of the contract should provide detailed characteristics of the premises and the period for which it is transferred for use.

We recommend! For maximum comfort, it is advisable to insure your property.

Although the transfer of commercial premises for rent free of charge does not imply charging a fee for its use, the tenant (borrower) will still have to bear certain costs.

Thus, the tenant may be required at his own expense to:

- maintain the occupied property in proper condition;

- carry out routine repairs;

- bear or compensate the lessor for all operating costs.

All of these points must also be specified in the loan agreement (free rental).

Lessor legal entity

We have already noted above that an enterprise cannot transfer its property for free use to a certain circle of persons. In all other cases, free rental of non-residential premises between legal entities is completely legal.

The preamble to the agreement should indicate information about the official who acts on behalf of the company.

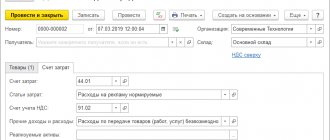

If the lender is a legal entity, then primary accounting documents must be drawn up for the agreement. Along with the acceptance certificate, the lessor must issue an invoice (regarding the collection of VAT).

If the owner is an individual

The contract will need to indicate the citizen’s passport details. In addition, you should refer to the details of the documents on the basis of which the property belongs to the person (certificate of ownership, registration certificate, and so on).

If premises in a residential building are transferred for use, then you should be prepared for the fact that you will have to resolve various issues both with the residents and with the management company. It is possible that the consent of the landlord’s spouse may be required to transfer the property for free rent.

Therefore, free rent of non-residential premises from an individual requires preliminary consideration of a number of issues.

Regardless of who the lessor will be, the agreement should include clauses regarding the financial responsibility of the borrower (tenant) for damage to property, the procedure for early termination of the relationship and the procedure for returning property.

Agreement for free use of non-residential premises: contents

In order to give the agreement for the gratuitous use of unoccupied premises legal significance, before execution it is worth carefully studying its contents. Before filling out the form, it is important for the parties to familiarize themselves with the main sections of the document, without which it will not have legal force. Without what information a legal contract cannot be formed?

- Parties indicating data from the passport or registration data from the Unified State Register of Legal Entities. Participants can be both citizens and legal entities;

IMPORTANT: there are a number of restrictions for a commercial organization that acts as a lender. According to Art. 690 of the Civil Code of the Russian Federation, it cannot transfer the premises under such an agreement to the founder, participant, manager, as well as to persons who are members of the management and control bodies over the activities of the organization.

- Description of the property (its exact address, area, purpose, plan);

- Signing date and validity period;

REFERENCE: Based on Art. 610 of the Civil Code of the Russian Federation, if the validity period is not specified in the contract, it is considered concluded for an indefinite period.

Applications and related documents when drawing up an agreement

In some cases, a free use agreement alone is not enough. You will also need attachments to the lease agreement for the free use of non-residential premises.

This will include such data.

First of all, you will need a graphic diagram (explication), because the tenant must know which part of the property he has every right to use.

Further, the attachments may include copies of the technical and cadastral passport, as well as other title documents.

If consent is provided from the landlord's spouse, then this is also included. A representative can sign the agreement on behalf of any of the parties. In this case, the enclosures must include a copy of the relevant power of attorney.

We've sorted out the applications. Now let's move on to the composition of the documents that are drawn up along with the contract.

Regardless of who is the lessor (lender), the transfer and return of property is formalized by an acceptance certificate. It describes the condition of the property at the corresponding point in time, and also records data from utility meters.

If property is transferred between legal entities, the lessor provides the lessee with an invoice. It is necessary for maintaining tax accounting for VAT.

Features of a contract for the free use of non-residential premises

The distinctive features of the document are:

- Gratuitous nature. In other words, the parties do not have any financial obligations to each other under this agreement;

- Limited rights of the borrower. According to Art. 689 of the Civil Code of the Russian Federation, the terms of the contract provide for the possibility of transferring real estate only for temporary use, while, for example, when renting, the right of ownership also arises;

- The rights of third parties are preserved. The conclusion of an agreement for the gratuitous use of non-residential premises between the lender and the borrower does not entail the termination of the rights of third parties, for example, to use the premises. The lender is obliged to notify the second party to the agreement about the rights of third parties before the parties sign a copy of the agreement;

- As a general rule, the borrower bears the costs of maintaining the property and makes major and current repairs at his own expense.

Is registration required?

As is known, a real estate lease agreement requires state registration (see paragraph 2 of Articles 609, 651 of the Civil Code of the Russian Federation).

Let's figure out whether these rules apply to a loan agreement (free use).

The loan agreement is given attention in Chapter 36 of the Civil Code of the Russian Federation. Article 689 makes reference to some legal norms on leasing, but they do not talk about state registration of the transaction.

Therefore, as a general rule, a free lease agreement does not require additional state registration.

An exception is made for cultural heritage sites. For an agreement in relation to them, state registration is required regardless of the period for which the agreement is signed.

In accordance with paragraph 3 of Art. 3 of the Land Code of the Russian Federation, property relations regarding the ownership, use and disposal of land plots, as well as transactions with them, are regulated by civil legislation, unless otherwise provided by land, forestry, water legislation, legislation on subsoil, on environmental protection, and special federal laws.

According to clause 1.1 of Art. 24 of the Land Code of the Russian Federation, an agreement for the gratuitous use of a land plot is concluded in accordance with the Civil Code of the Russian Federation and the Land Code of the Russian Federation. By virtue of Art. 153 of the Civil Code of the Russian Federation, transactions are recognized as actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations. Clause 1 of Art. 131 of the Civil Code of the Russian Federation provides that the right of ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by the bodies carrying out state registration of rights to real estate and transactions with it. The following are subject to registration: the right of ownership, the right of economic management, the right of operational management, the right of lifelong inheritable possession, the right of permanent use, mortgage, easements, as well as other rights in cases provided for by the Civil Code of the Russian Federation and other laws. The procedure for state registration of rights to real estate and the grounds for refusal to register these rights are established in accordance with this Code by the law on registration of rights to real estate (clause 6 of Article 131 of the Civil Code of the Russian Federation). Based on paragraph 1 of Art. 164 of the Civil Code of the Russian Federation, in cases where the law provides for state registration of transactions, the legal consequences of the transaction occur after its registration. Clause 2 of Art. 26 of the Land Code of the Russian Federation provides that agreements for the lease of a land plot, sublease of a land plot, gratuitous use of a land plot, concluded for a period of less than one year, are not subject to state registration, except in cases established by federal laws. Thus, if a fixed-term agreement for the free use of a land plot is concluded between organizations for one year or more, this agreement is subject to registration. Accordingly, if such a period is established by the contract for less than one year, the contract is not subject to registration. This position is also confirmed by the explanation by the Plenum of the Supreme Arbitration Court of the Russian Federation of the provisions of paragraph 2 of Art. 26 of the Land Code of the Russian Federation (clause 9 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 17, 2011 N 73 “On certain issues in the practice of applying the rules of the Civil Code of the Russian Federation on a lease agreement”, clause 21 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 24, 2005 N 11 “On some issues related to the application of land legislation"). Based on clause 2 of Art. 610, paragraph 2 of Art. 689 of the Civil Code of the Russian Federation, if the period is not specified in the agreement, the agreement for gratuitous use is considered concluded for an indefinite period. The legislation (Clause 2 of Article 26 of the Land Code of the Russian Federation) directly provides for the obligation to register only fixed-term contracts concluded for at least one year. The uncertainty of the term does not imply the extension to the relevant legal relations of the rules governing the consequences arising from a certain term of the contract. This conclusion is also confirmed by clause 11 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 16, 2001 N 59 “Review of the practice of resolving disputes related to the application of the Federal Law “On State Registration of Rights to Real Estate and Transactions with It”, according to which the building lease agreement , renewed for an indefinite period, does not require state registration, since according to clause 2 of Art. 651 of the Civil Code of the Russian Federation, a building lease agreement concluded only for a period of at least one year is subject to state registration. This position was expressed by the court in relation to legal relations regarding the renewal of the lease of the building. However, due to the absence in the practice of courts of a different opinion regarding the legal relationship of gratuitous use of a land plot, we consider this position on the absence of the need to register a perpetual agreement to be applicable in relation to the case under consideration. Thus, an agreement for the gratuitous use of a land plot, concluded by organizations for one year or more, is subject to state registration. If the period is less than one year, the agreement is not subject to registration. In our opinion, an open-ended contract is not subject to registration, since the legislation directly provides for the obligation to register only fixed-term contracts concluded for at least one year.

Taxes and tax risks

Practice shows that transactions involving the transfer of property for free rent are the object of close attention from tax inspectors. The legislation currently does not contain clear rules for taxation of “gratuitous” transactions.

Let's take, for example, VAT for enterprises that provide property for use free of charge. The Federal Tax Service and some courts consider such an operation as a gratuitous provision of services. And if so, then VAT should be calculated based on the market value of the rental of such property.

At the same time, there is judicial practice according to which a loan agreement is considered as a transfer of property rights. In this case, VAT does not arise.

In the same way, there are many problems with income tax and personal income tax (if the lessor is a citizen). Therefore, if an enterprise plans to provide its property for free use, then it is necessary to consult not only a lawyer, but also an auditor.

At the same time, the most recent judicial practice should be studied. Then, for free rental of non-residential premises, taxation will be structured according to the optimal scheme. You should also be prepared for the fact that you will have to defend your rights in the courts.

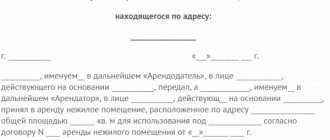

Standard contract for free rental of non-residential premises

To make it easier to get an idea of what a free lease (loan) agreement should look like, we provide a sample agreement.

It can be used as a basis for preparing the text of your own deal. When editing, add your own points or exclude unnecessary ones.

We hope that this material has helped you understand the features of free rental of commercial real estate.

Agreement for free use of non-residential premises